FreshBooks Review 2026

FreshBooks Accounts Receivable Plans & Pricing

FreshBooks Comparison

Expert Review

Pros

Cons

FreshBooks Accounts Receivable's Offerings

FreshBooks offers four different pricing plans: Lite, Plus, Premium, and Let’s Talk. The prices for each plan are $22/month, $35/month, $60/month, and Let’s Talk respectively. All plans offer a 30-day free trial.

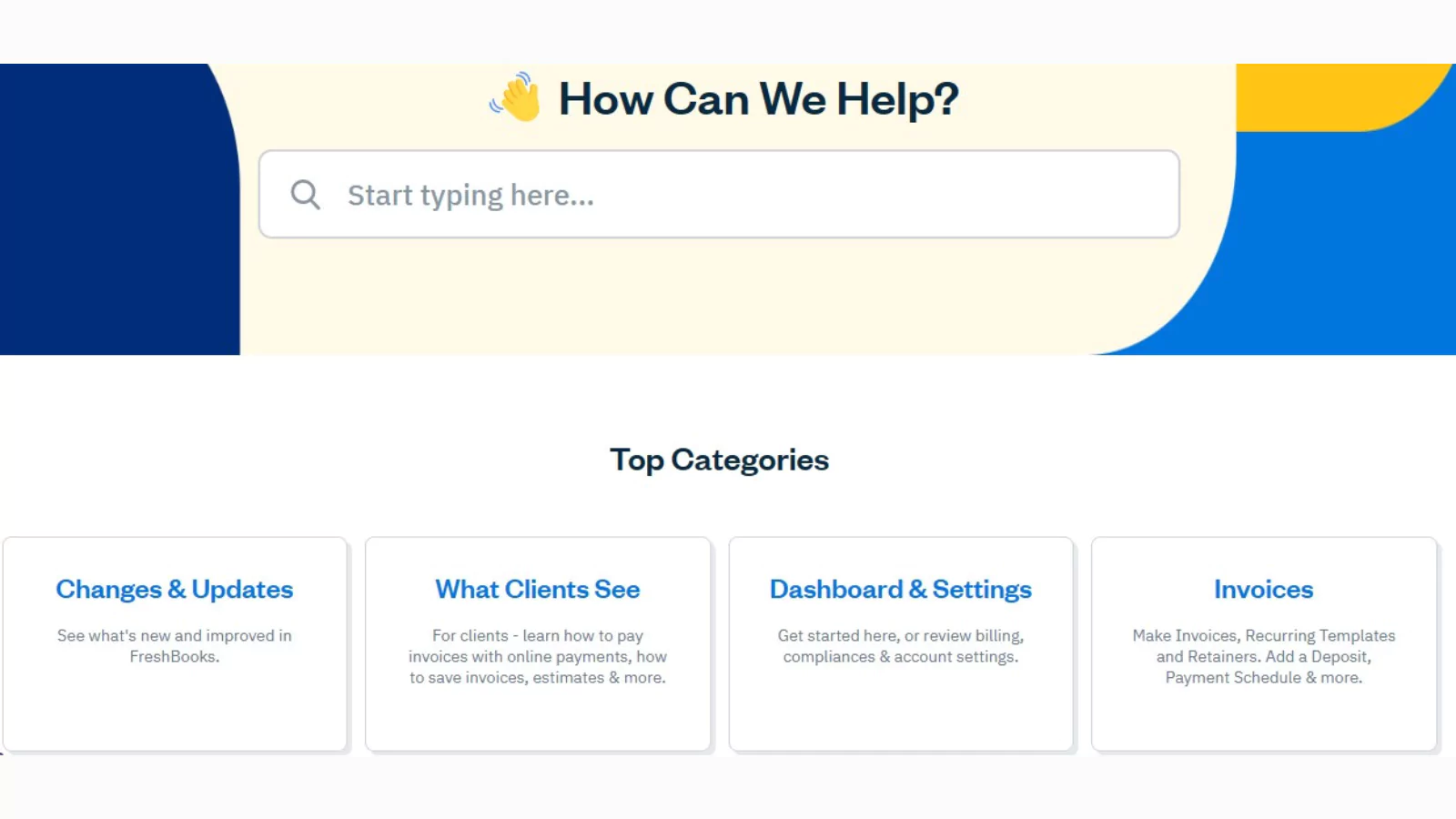

Customer Support

FreshBooks offers phone and email support, live chat, knowledge base and a help center. Support is free and available by phone and by email during office hours. Self-serve support is available globally and 24/7 through the Help Centre and through the chatbot, FreshBot.

Phone Support

FreshBooks can be reached by phone at 1-888-231-6707 for support. I waited on hold for approximately two minutes. While on hold, I was given the option to check the help section of the FreshBooks website, wait in the queue, request a callback, or email client support. The agent I spoke with was very friendly. I inquired about the various plans available and was given information about changing plans after my 30 day free trial that echoed the information on the website. In terms of phone support, this is as ideal as a customer could expect.

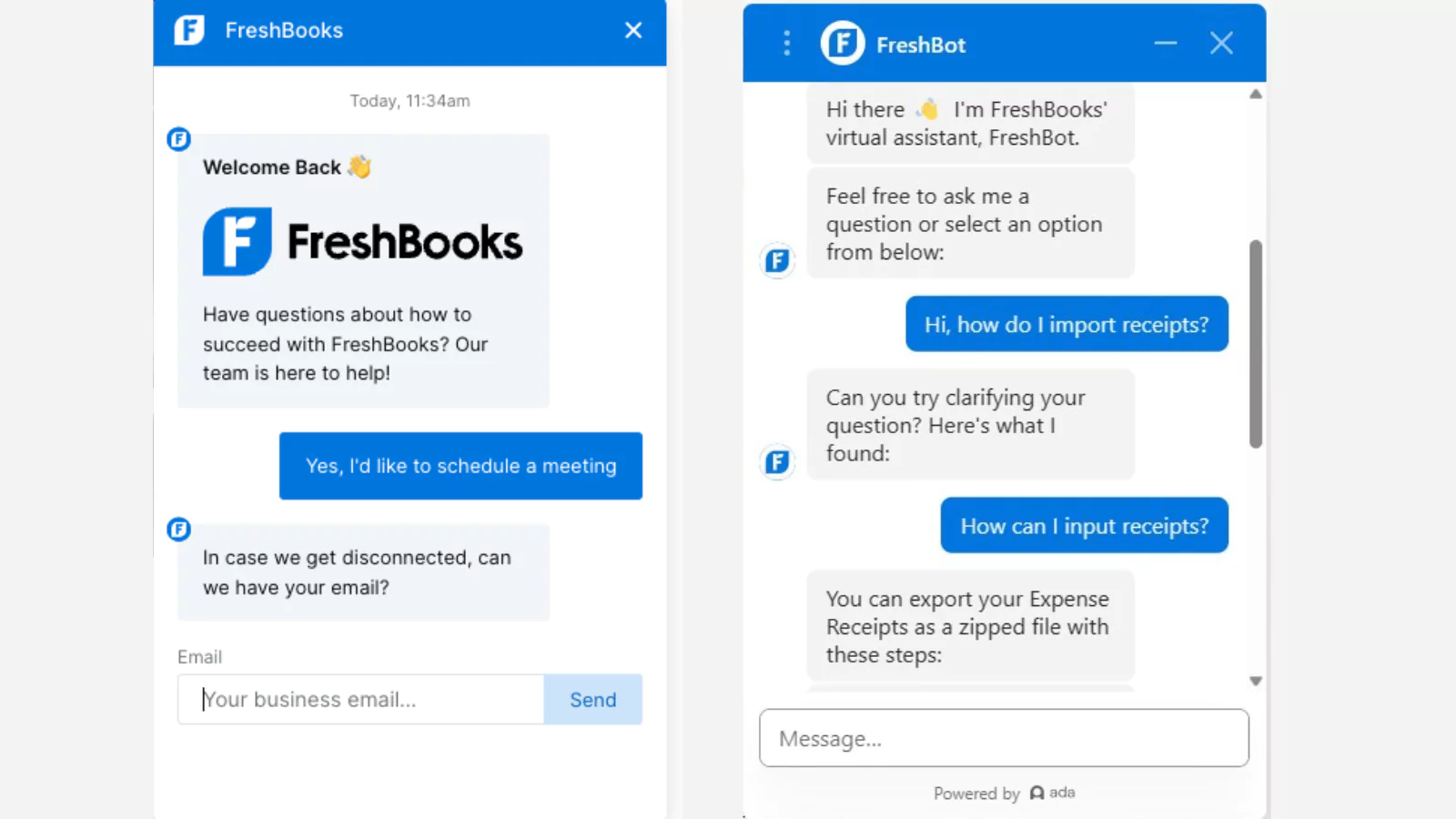

Live Chatbot

FreshBooks offers an online live chat, with their chatbot, FreshBot. The service was very fast, however I did need to rephrase my question since FreshBot didn’t immediately understand my query.

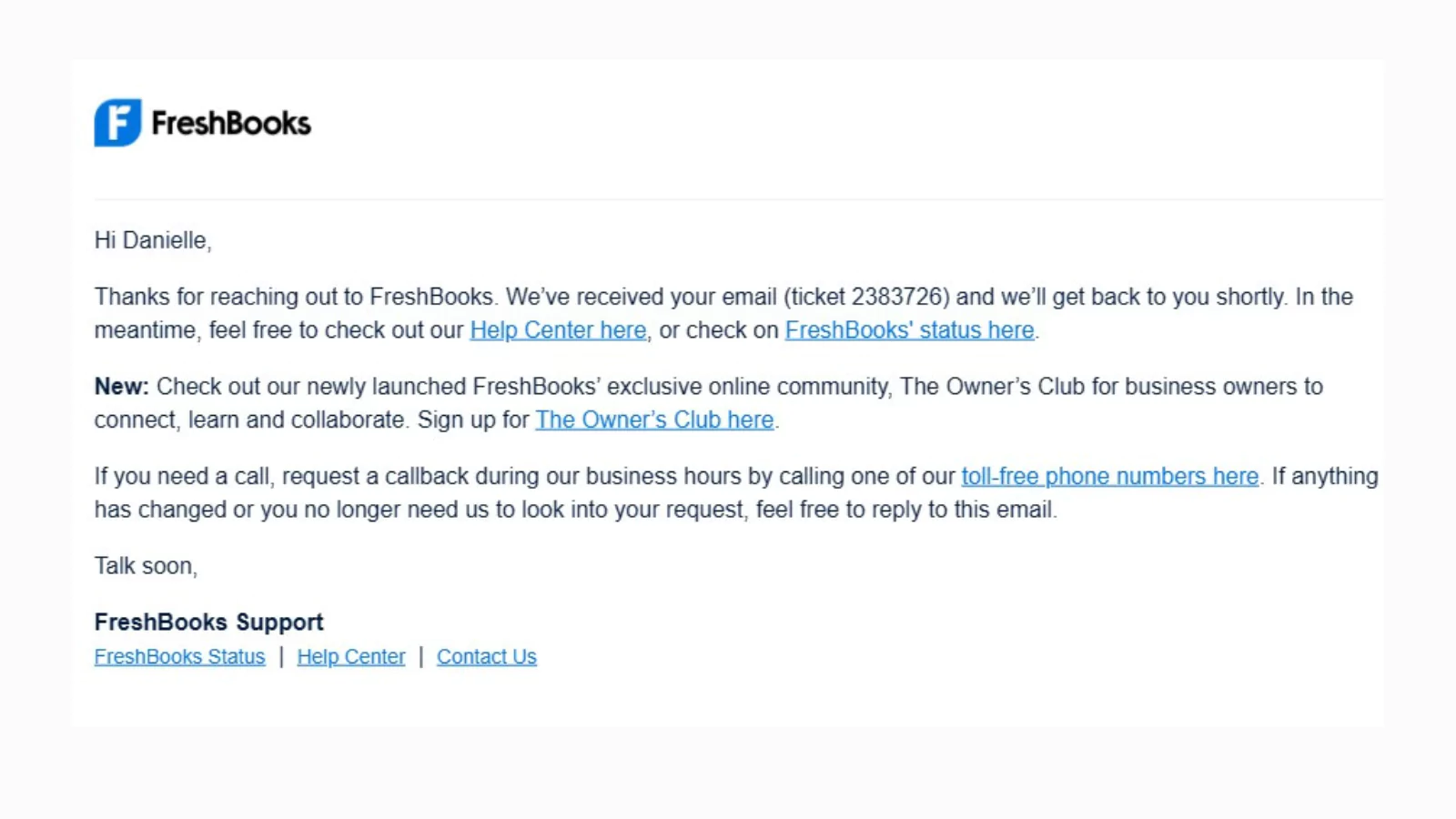

Email Support

FreshBooks does have an email support option, at support@freshbooks.com. I emailed a query regarding plans for my small business, and received a notification immediately that my inquiry was in the queue, waiting for response. The email address can actually be replied to, which is not common, in the event of a change or additional questions.

FAQ

FreshBooks has an intuitive and highly organized FAQ section, with specific information grouped into broad sections allowing the user to drill down and refine their query. When I drilled down looking for information (on how to track additional income), I was provided with detailed screenshots and step-by-step instructions.

Features & Functionality

General Features

Comprehensive tools for capturing, editing, recording, sharing, and collaborating to efficiently manage financial workflows.

Automation Features

FreshBooks offers various automation features such as creating invoices and receiving payments through multiple methods including credit and debit cards, ACH transfers, Stripe, and PayPal. The industry-standard credit card processing fee is 2.9% plus 30 cents per transaction.

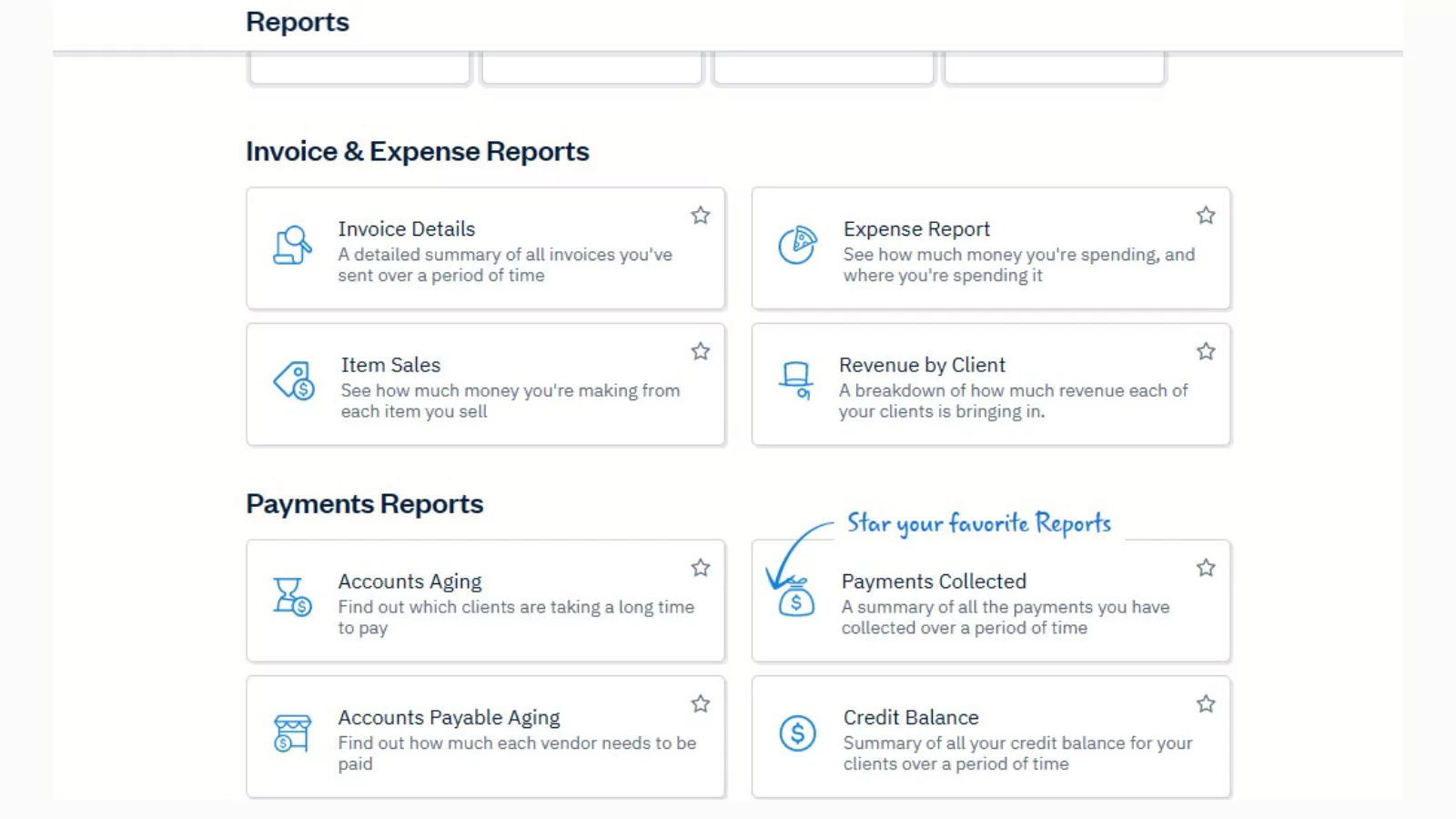

Reporting & Analytics

FreshBooks provides double-entry accounting reports, the option to invite an accountant, and the ability to establish recurring billing and client retainers.

Cash Flow Features

FreshBooks helps users monitor their business operations by providing detailed reports, timely, cloud-based invoicing services, while accepting multiple forms of payment. The software utilizes automation and online payments which can also increase profitability as a long-term strategy.

Integrations & Add-Ons

FreshBooks has various add-on capabilities, such as FreshBook Payments (allowing users to get paid faster through credit card payments), FreshBook Select, which is designed for growing businesses that can benefit from specialized services, and FreshBook Teams which allows for more functionality when managing people and projects. It also has integrations such Gusto for a fully integrated payroll and Bench for bookkeeping.

Performance:

The Premium level offers the ability to personalize email templates and signatures, along with automated client emails that contain dynamic fields. Additionally, this tier enables you to monitor bills, payments, and vendors through Accounts Payable, as well as track project profitability.

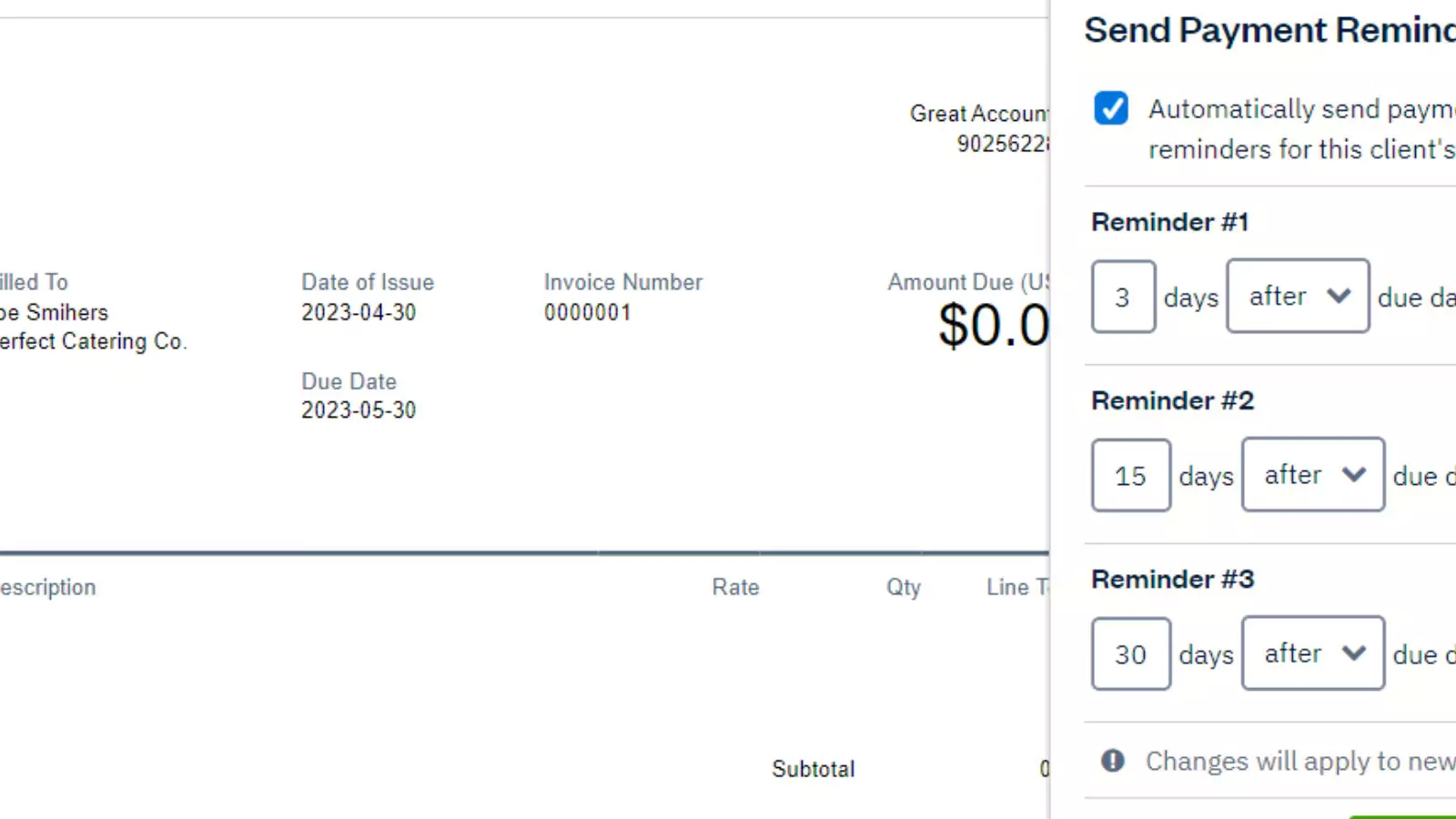

Develop a recurring template that can automatically generate invoices according to the frequency selected, providing a convenient solution for subscription-based work or ongoing, work that repeats at regular intervals. Recurring payments and advanced payments can also be utilized to facilitate automatic payment of recurring invoices.

Email Notifications

Email Notifications allow Owners and Admins to stay up to date on account activity by surfacing important information when they’re needed. In-app notifications appear for Owners and Team Members, and new notifications will appear as a number inside a red circle over the bell icon.

Payment Notifications

Using FreshBooks simplifies the process of monitoring outstanding payments and expenses.

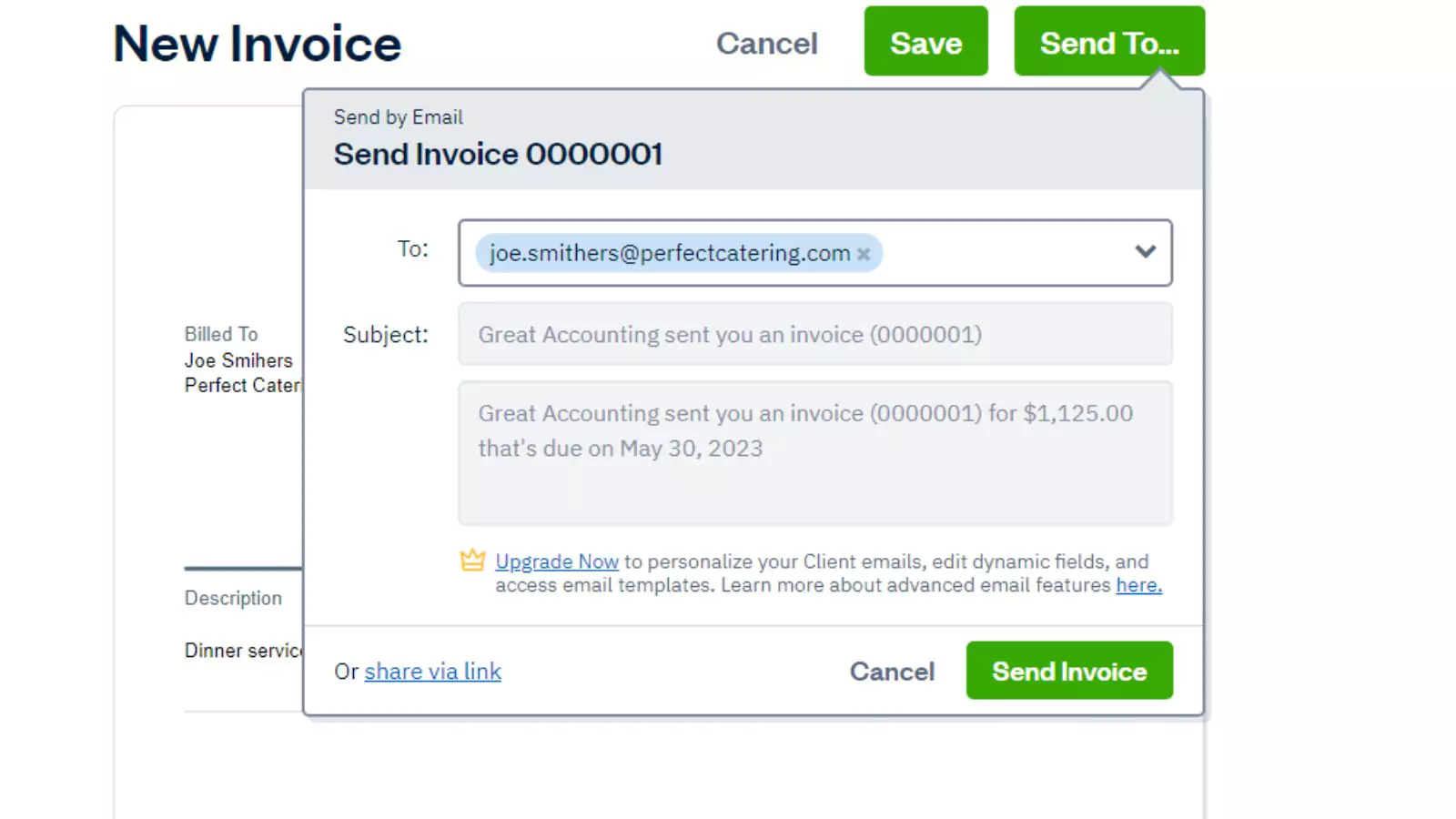

Sending Emails

Users can effortlessly send invoices via email, ensuring a smooth and hassle-free delivery process.

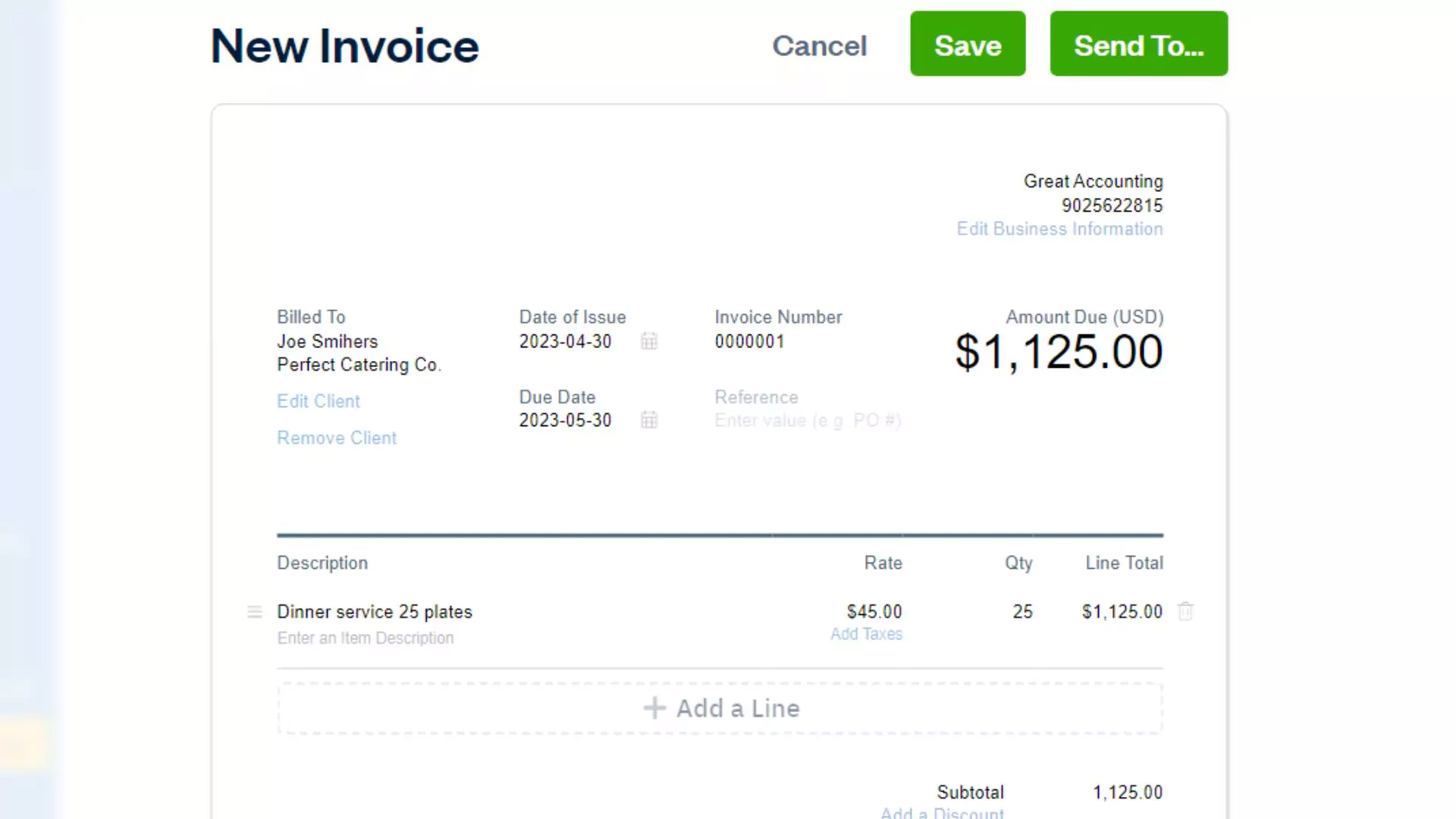

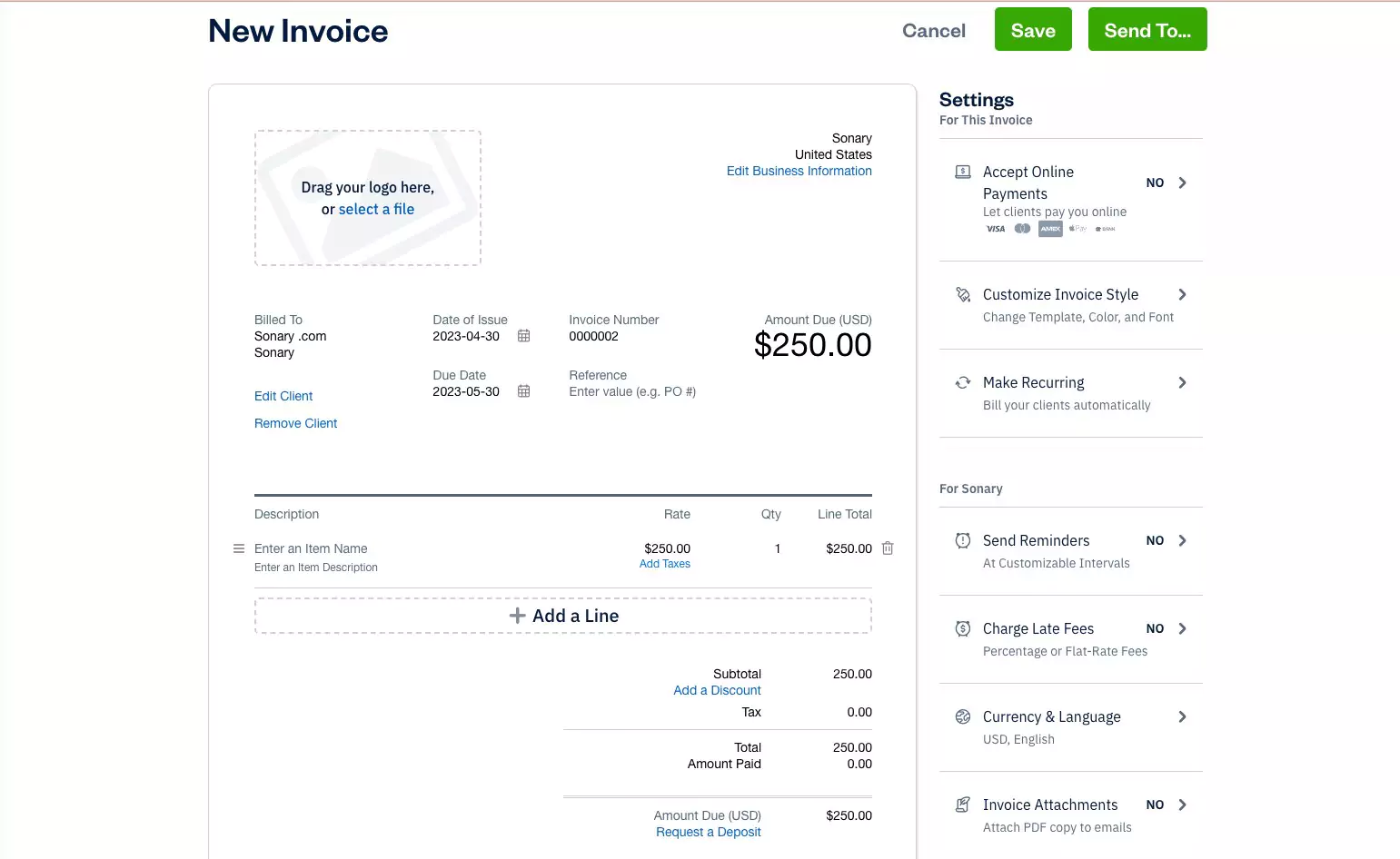

Invoice Creation

Users can effortlessly generate customized, professional invoices that incorporate their business branding.

Ease Of Use:

Overall Experience

Overall, the software was very easy to set up and use. Even as a new user, it was very straightforward to navigate and locate specific functions.

Create Invoices

It was very simple to determine how to create a new invoice. The dashboard allowed me to navigate directly to this screen, and I could easily customize the look and feel of my invoices if I wanted to.

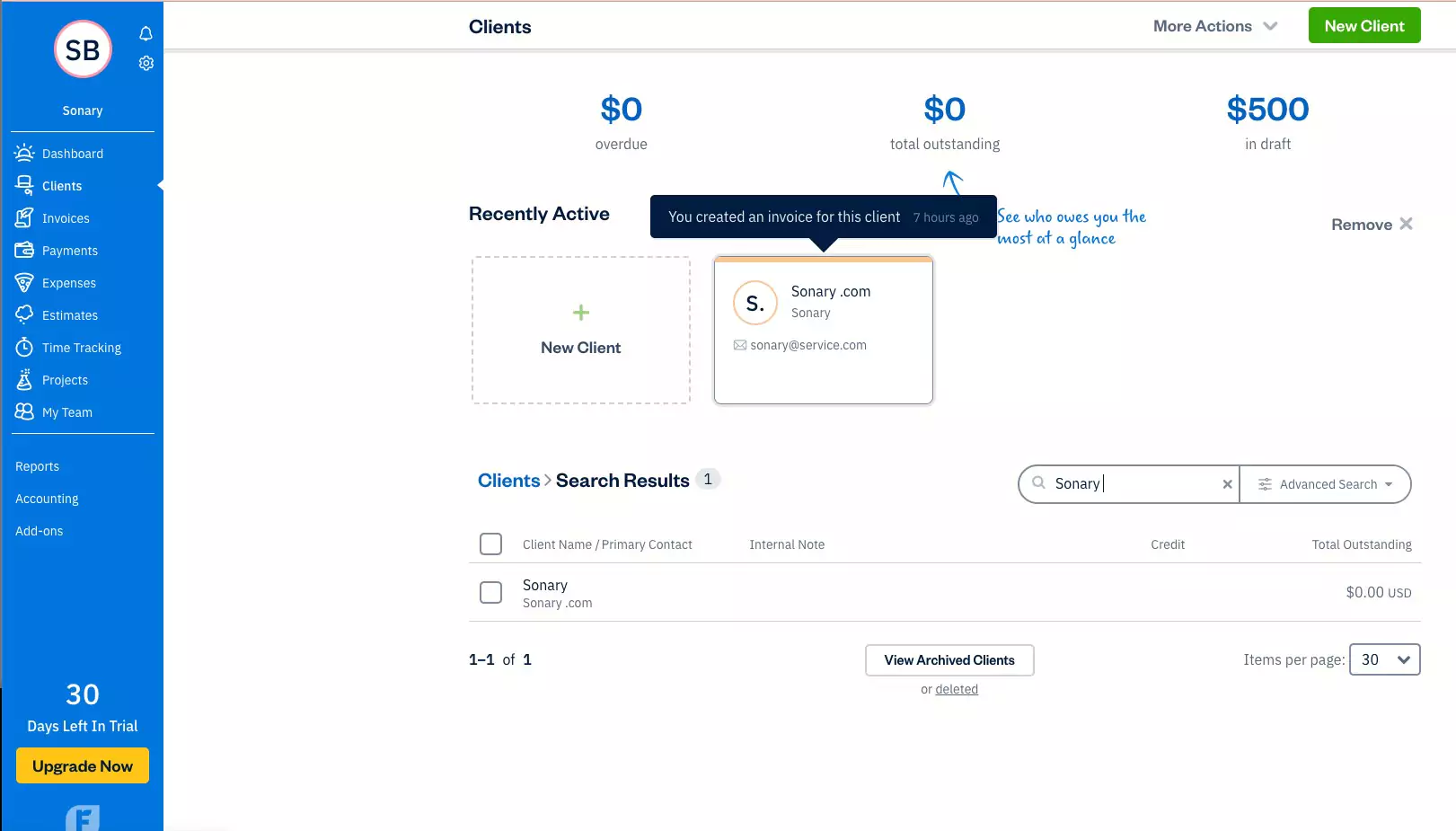

Find Client

Detailed customer records can be created by FreshBooks users, and these records can be easily retrieved either by name or customer ID.

Customize Reports

Navigating to and selecting reports is very straightforward. FreshBooks allows the user to choose the type of report, and also to add their most frequently used report types to favorites, which is convenient.

Verdict:

FreshBooks is an excellent choice for individuals such as freelancers, small business proprietors, or anyone who requires invoicing and payment acceptance as part of their business operations. Its interface and layout are very intuitive and attractive. However, if you belong to a larger team, desire greater flexibility in terms of customization, or want multiple account users, you may want to explore alternative options.