Merchant One Review 2026

Merchant One Merchant Services Plans & Pricing

Merchant One Comparison

Expert Review

Pros

Cons

Merchant One Merchant Services's Offerings

Merchant One offers a flexible pricing structure tailored to individual business needs. The company provides plans starting at $13.95 per month, with transaction fees ranging from 0.29% to 1.55% for swiped transactions and 0.29% to 1.99% for keyed-in transactions.

This approach allows businesses to select a plan that aligns with their specific requirements, making Merchant One a viable option for those seeking customizable online payment solutions.

Customer Support

When I evaluated Merchant One’s customer support, I found that they offer 24/7 assistance via phone and email. Notably, their support is provided by actual human representatives, which makes resolving issues significantly more manageable compared to dealing with chatbots or navigating web support articles. However, I noticed the absence of a live chat feature, which is a standard expectation for many users seeking immediate assistance.

Phone Support

Merchant One provides a dedicated customer support hotline. During my testing, I contacted their support line and experienced varying wait times. Some users have reported extended hold periods, while others have praised the helpfulness of the representatives once connected.

Email Support

I reached out to Merchant One via email to assess their responsiveness. Despite their claim of 24/7 support, I did not receive a prompt response, which could be a concern for businesses needing timely assistance.

Live Chat Support

When I utilized the live chat option, I was promptly connected to a support agent who efficiently addressed my queries. This real-time interaction is beneficial for businesses seeking immediate assistance without the delays often associated with email support.

Online Resources

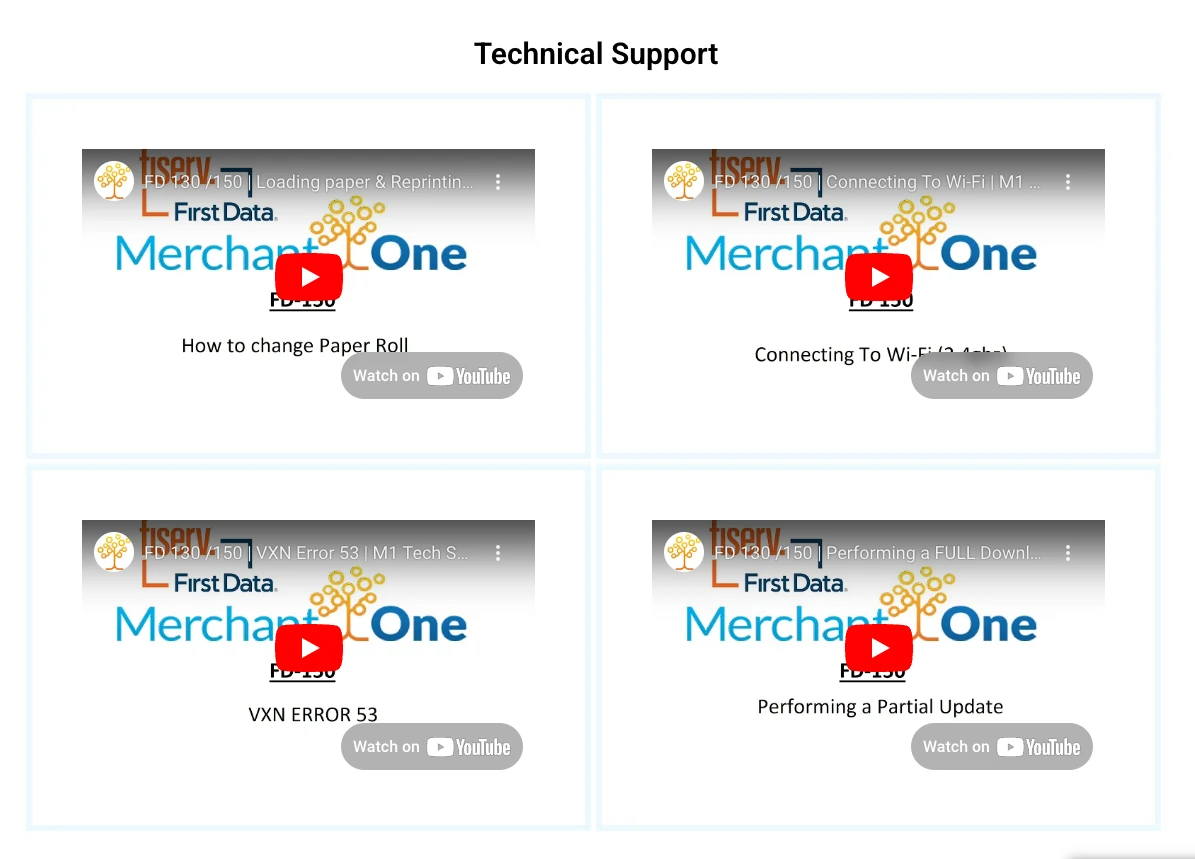

Merchant One’s help portal includes technical support videos designed to assist users with common issues and setup processes at HELP.MERCHANTONE.COM

However, I noticed that their website lacks a comprehensive FAQ section and blog, which are valuable resources for users seeking self-help solutions and insights into best practices.

In summary, while Merchant One offers continuous support through multiple channels, the addition of more extensive online resources such as a detailed FAQ and informative blog could enhance the overall user experience for businesses utilizing their Merchant Services software and Online payment solutions.

Features & Functionality

General Features

I found the wide range of features to be very impressive. I’ll go into detail below:

- State-of-the-art terminal systems

- High-speed payment processing

- Gift and loyalty card programs

- Text message marketing campaigns

- Customer management database

- Check processing services

- Mobile payment solutions for smartphones and tablets

- Signature capture and card swiper add-ons

- Free e-commerce shopping cart integration

- Online account management and remote accessibility

- 24/7 customer support

- Integration support for seamless setup

- POS system solutions

- Cash advance services

- Clover point-of-sale (POS) system

- Payment gateway

- Mobile credit card terminals

- Invoice generator

- Merchant One shop

Dashboard

State-of-the-Art Terminal Systems

Merchant One’s state-of-the-art terminal systems are designed to meet the needs of businesses of all sizes, offering high-speed and reliable online payment processing services. These terminals seamlessly integrate with online merchant services, enabling secure transactions for both in-store and e-commerce payment methods. Equipped with the latest technology, these systems provide flexibility, allowing businesses to accept traditional credit cards, virtual cards for online payment, and digital wallets, ensuring a smooth and efficient checkout experience.

Gift and Loyalty Card Programs

Merchant One’s Merchant Services software includes built-in gift and loyalty card programs designed to boost customer engagement. I explored these features and found them particularly useful for increasing repeat business. They integrate directly with e-commerce payment platforms and in-store systems, making it easy to track and manage rewards programs. Businesses looking to enhance brand loyalty will appreciate the seamless integration with the payment gateway.

Text Message Marketing Campaigns

I also tested Merchant One’s text message marketing feature, which allows businesses to send promotions, reminders, and updates directly to customers. Integrated with online payment platforms and e-commerce payment methods, this tool ensures businesses can drive sales and engagement with real-time messaging. The ability to connect marketing efforts to transaction data enhances its effectiveness.

Customer Management Database

Merchant One provides a customer management database within its online payment solutions. I found this database helpful in organizing and analyzing customer data, tracking purchase history, and developing targeted marketing strategies. The integration with e-commerce payment platforms allows businesses to personalize their approach, whether they operate online or in-store.

Check Processing Services

With Merchant One’s electronic check processing, businesses can offer flexible payment options while maintaining security and speed. I tested this feature, and it worked smoothly alongside other payment processing tools. Whether processing checks online or in-store, businesses benefit from streamlined transactions that align with their broader e-commerce payment method strategy.

Free E-Commerce Shopping Cart Integration

Merchant One offers free e-commerce shopping cart integration, enabling businesses to easily set up online stores and start accepting payments. This feature is fully compatible with online merchant services and payment gateways, supporting a variety of e-commerce payment methods for seamless transactions. By streamlining the checkout process, businesses can enhance customer satisfaction and drive online sales.

Online Account Management and Remote Accessibility

Stay in control of your operations with online account management and remote accessibility features. Merchant One’s online payment solutions allow businesses to monitor sales, manage inventory, and track transactions from anywhere. These tools integrate with online payment platforms and e-commerce payment systems, offering a centralized hub for real-time business oversight.

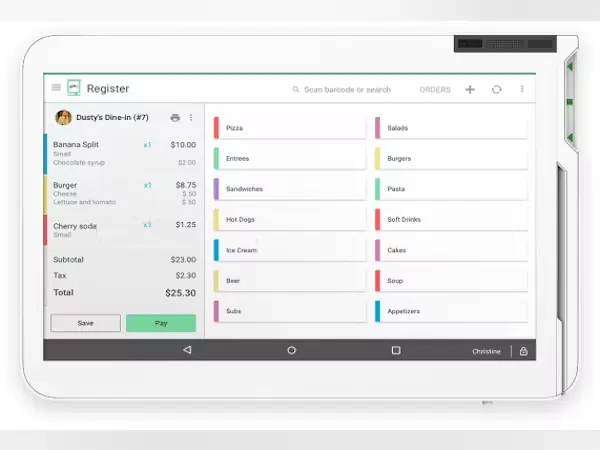

POS System Solutions

When I explored Merchant One’s POS system solutions, I found them to be a comprehensive tool for businesses looking to streamline payment processing. These systems integrate with online payment processing services, enabling businesses to manage both in-store transactions and e-commerce payment methods from a single platform.

With built-in compatibility for payment gateways and customer management tools, the POS system offers a unified experience that simplifies transactions and enhances operational efficiency. Whether accepting credit cards, virtual cards for online payment, or mobile wallet transactions, these systems deliver the reliability businesses need.

Cash Advance Services

Merchant One also offers cash advance services, a valuable financial option for businesses requiring immediate funding. I looked into this feature and found it particularly useful for companies leveraging online merchant services and e-commerce payment platforms. The fast approval process allows businesses to access funds quickly, whether for expansion, covering unexpected expenses, or managing cash flow.

Since the service is integrated into Merchant Services software, repayment is seamless and aligned with business revenue, making it a flexible and accessible financial solution.

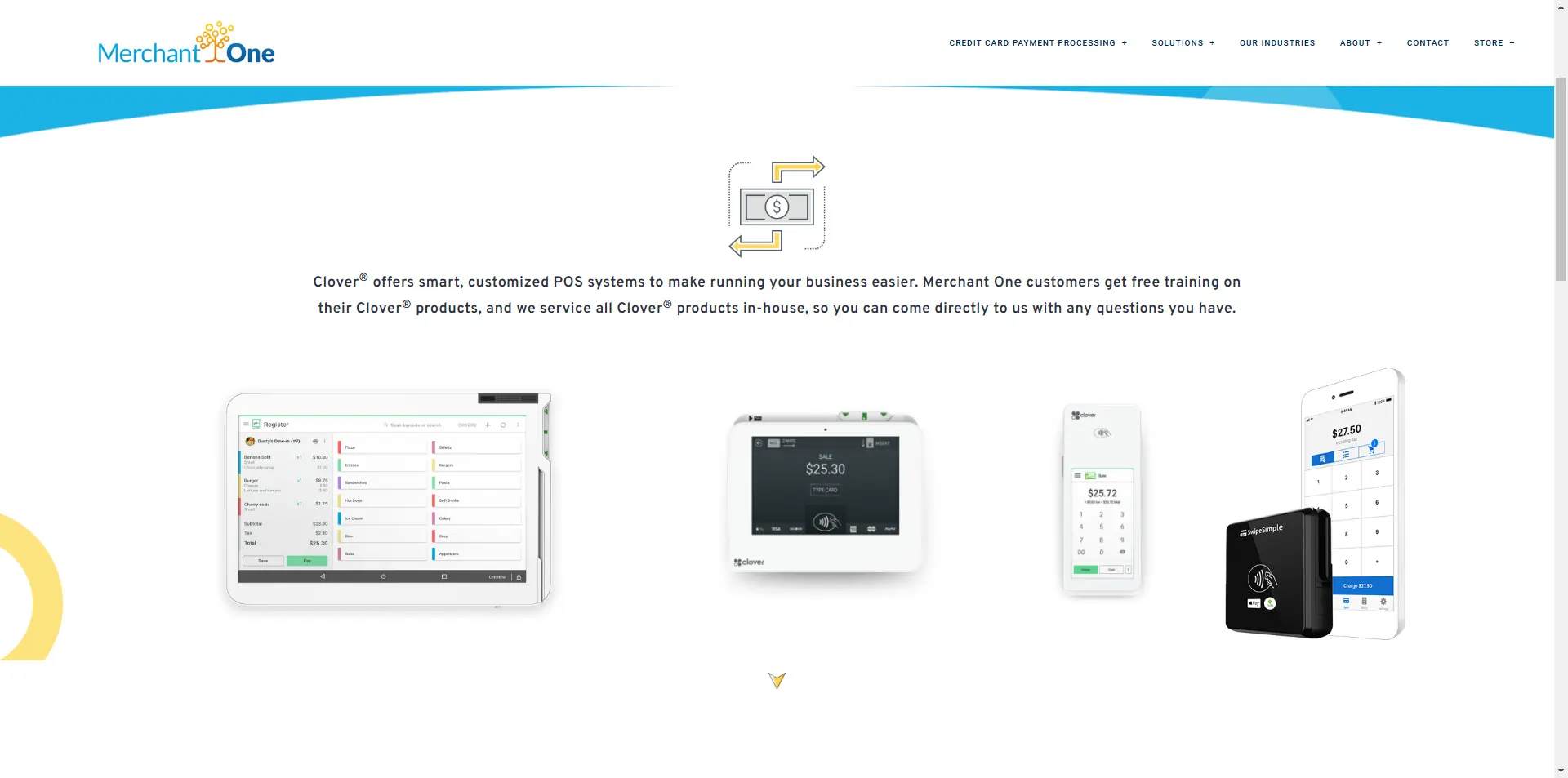

Clover Point-of-Sale (POS) System

Merchant One provides a variety of credit card processing options for small businesses, including comprehensive payment gateways and virtual terminals.

The Clover Station is a comprehensive system that allows for inventory and staff management. The Clover Mini, while compact, can grow with your business. Clover Go is an ideal solution for processing payments on the go, while the Clover Flex serves as an all-in-one device, replacing the printer, terminal, and register. Learn more in our in-depth review of Clover’s POS system.

Since Clover equipment and other credit card readers are compatible with various credit card processors, you have flexibility once you own the equipment, unlike with proprietary POS systems that lack portability.

Payment Gateway

Merchant One offers a payment gateway service with essential features like a virtual terminal, a customer vault for securely saving card details, an invoice generator, and the ability to set up recurring payments. The payment gateway also includes a QuickBooks plugin for seamless integration.

Mobile Credit Card Terminals

Merchant One offers multiple mobile credit card terminals that cater to businesses requiring a flexible and portable solution for accepting credit card payments.

Its mobile payment options are:

- Clover Go

- BBPOS Chipper

- Swift B250 SwipeSimple

- iProcess (either MagTek or Dynamo)

Invoice Generator

Merchant One’s user-friendly invoice generator allows for the easy creation of new and recurring invoices for customers.

Merchant One Shop

Merchant One also has an online store where you can easily order terminals, receipt paper, supplies, and decals for your business.

Hardware & Software

Merchant One is compatible with all devices and operating systems. For hardware, the Clover equipment is fully supported in-house by Merchant One and is easy to use. This system also works with both iPhone and Android devices. Merchant One will help you pick the best mobile payment solution for your business.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

You can expand business reach with diverse sales channels.

Performance:

Merchant One offers a great suite of features designed to enhance payment processing for businesses.

Integration Capabilities

Merchant One’s payment gateway provides access to e-commerce solutions, including payer authentication, hosted checkout, advanced fraud tools, “buy now” buttons, and compatibility with over 175 shopping cart integrations, such as Shopify. Additionally, it enables merchants to integrate their payment system with over 300 software applications, including accounting apps and CRM programs like Salesforce, Zoho, and HubSpot. This extensive integration capability allows businesses to create custom workflows between the Merchant One system and multiple third-party apps.

Performance and Reliability

In terms of performance, Merchant One is known for providing high-speed payment processing, ensuring that transactions are completed swiftly and efficiently. The system is designed to handle high transaction volumes, making it suitable for businesses of various sizes. Additionally, Merchant One offers next-day funding on all card types, which is crucial for maintaining cash flow in fast-paced business environments.

Security Features

Security is a paramount concern for Merchant One. The payment gateway includes advanced fraud detection tools and payer authentication to verify the cardholder’s identity, reducing the risk of chargebacks. The system is also PCI compliant, ensuring that all transactions meet industry security standards.

In summary, Merchant One’s combination of extensive integration options, reliable performance, and robust security features makes it a compelling choice for businesses seeking comprehensive online payment solutions.

Ease Of Use:

The platform is user-friendly and straightforward to navigate. Businesses can easily log in to access virtual terminals, reporting data, customer management tools, and invoices.

Merchant One’s payment processing and merchant services are incredibly easy to use, even for those who are not familiar with payment processing systems. Their user-friendly interface and intuitive design make it simple for merchants to accept payments, manage transactions, and access data in real-time.

With a range of payment options available, including mobile payments, EMV chip card processing, and contactless payments, merchants can provide their customers with a seamless payment experience. Additionally, Merchant One’s 24/7 customer support and advanced security features, such as tokenization and fraud detection, ensure that merchants can process payments with confidence and peace of mind.

Overall, Merchant One’s payment processing and merchant services are a great option for businesses of all sizes looking for a reliable, secure, and easy-to-use payment processing solution.

Verdict:

Merchant One distinguishes itself in the credit card processing industry through its flexible pricing model. Unlike providers that enforce uniform rates, Merchant One collaborates with each business to develop a customized pricing plan tailored to its unique requirements.

This personalized approach ensures that businesses, regardless of size or industry, receive a payment processing solution that aligns with their specific needs. By offering such adaptability, Merchant One positions itself as a compelling choice for businesses seeking tailored Merchant Services software and Online payment solutions. I recommend considering Merchant One to evaluate whether it’s the right fit for your company.

User Review

- RATES RATES RATES