PaySafe Review 2026

PaySafe Merchant Services Plans & Pricing

PaySafe Comparison

Expert Review

Pros

Cons

PaySafe Merchant Services's Offerings

I found that, in contrast to many of its competitors, PaySafe does not offer open pricing structures.

Rather, it develops customized quotes depending on various factors. Although this approach might pose a challenge for smaller businesses, it could be advantageous for larger enterprises, offering potentially competitive rates tailored to their specific needs.

As PaySafe operates on a quote-based system, your final cost will likely depend on the services required, your monthly transaction volume, the average value of individual transactions, among other factors.

PaySafe claims to provide “exceptionally competitive processing rates” on its website. Nevertheless, the lack of transparent pricing makes it difficult to ascertain whether PaySafe will be a cost-effective solution for your business upfront.

Customer Support

When I explored Paysafe’s customer support, I found a variety of channels available to assist users:

Phone Support

Paysafe offers dedicated phone support for both U.S. and European merchants. U.S. merchants can reach customer service at 800-324-9825, available Monday through Friday, 9 AM to 7 PM CST.

When I tested Paysafe’s phone support, I found response times to be reasonable. I called during business hours and was connected within a few minutes. The support agent was knowledgeable about online payment processing services, answering my questions about transaction delays and account setup. However, phone support is only available on weekdays, which could be a limitation for businesses needing assistance over the weekend.

Email Support

For non-urgent inquiries, Paysafe provides email support. U.S. merchants can reach out to merchantsupport@merchants-help.com. Technical support is available at technicalsupport@merchants-help.com.

I tried reaching Paysafe’s email support, and while I received a response, it took more than a day. For less urgent issues, this is fine, but businesses needing quick resolutions might prefer phone or chat options. Online merchant services often require fast troubleshooting, so a quicker email response would improve the experience, but then again, you can always call.

Account Manager Assistance

For more complex issues, Paysafe advises contacting an account manager.

I reached out and found this approach useful, as the manager provided tailored guidance on integrating e-commerce payment methods into my system.

You can also reach out via the website:

Online Resources

The Paysafe website features a comprehensive Help & Support section, including FAQs and guides covering various topics related to their merchant services software. Additionally, the site offers access to the Developer Center for technical documentation and resources.

The FAQ section and knowledge base cover a wide range of topics. I found answers to common questions about electronic check processing and virtual card for online payment, making it a useful self-help tool. However, some sections could be more detailed. They also offer a great set of webinars to learn from:

In summary, Paysafe provides multiple support avenues, including phone, email, and online resources, to assist businesses in effectively utilizing their online payment solutions.

Features & Functionality

General Features

Here’s a list of payment solutions offered by PaySafe Merchant Service providers:

- Comprehensive payment solutions

- Security measures

- Global reach

- Seamless integration

- Advanced analytics and reporting

- Subscription billing and recurring payments

- Multi-currency processing support

- Real-time fraud detection and prevention tools

- Digital wallet integrations (e.g., Skrill, Neteller)

- Prepaid card solutions

- Accept cash payments online

- API and SDK support for custom integrations

- Scalable payment platform for high-growth businesses

- Access to over 120 global markets

- Cash-based online payment methods (e.g., Paysafecard)

- Point-of-sale and virtual terminal options

- Support for high-risk industries

- Integrations

Comprehensive Payment Solutions

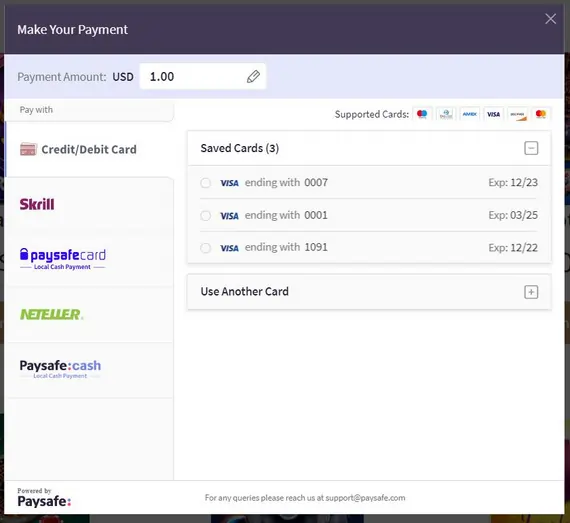

When I tested Paysafe’s payment solutions, I found the platform highly versatile. Businesses can accept credit and debit cards, digital wallets like Skrill and Neteller, and even prepaid card payments. This flexibility is essential for merchants catering to diverse customer preferences. The inclusion of cash-based online payment methods such as Paysafecard expands accessibility for businesses operating globally.

Security Measures

Security is a standout feature of Paysafe’s merchant services software. I explored its fraud prevention tools, which monitor transactions in real-time to detect suspicious activity. Tokenization and encryption ensure that customer payment data remains protected. These safeguards help businesses maintain compliance while reducing chargebacks and fraudulent transactions.

Global Reach

With a presence in over 40 countries and support for more than 120 currencies, the merchant service provider offers a truly global payment solution. This allows businesses to expand their operations internationally and cater to customers around the world. Paysafe’s global reach facilitates seamless cross-border transactions and enables businesses to tap into new markets without significant hurdles.

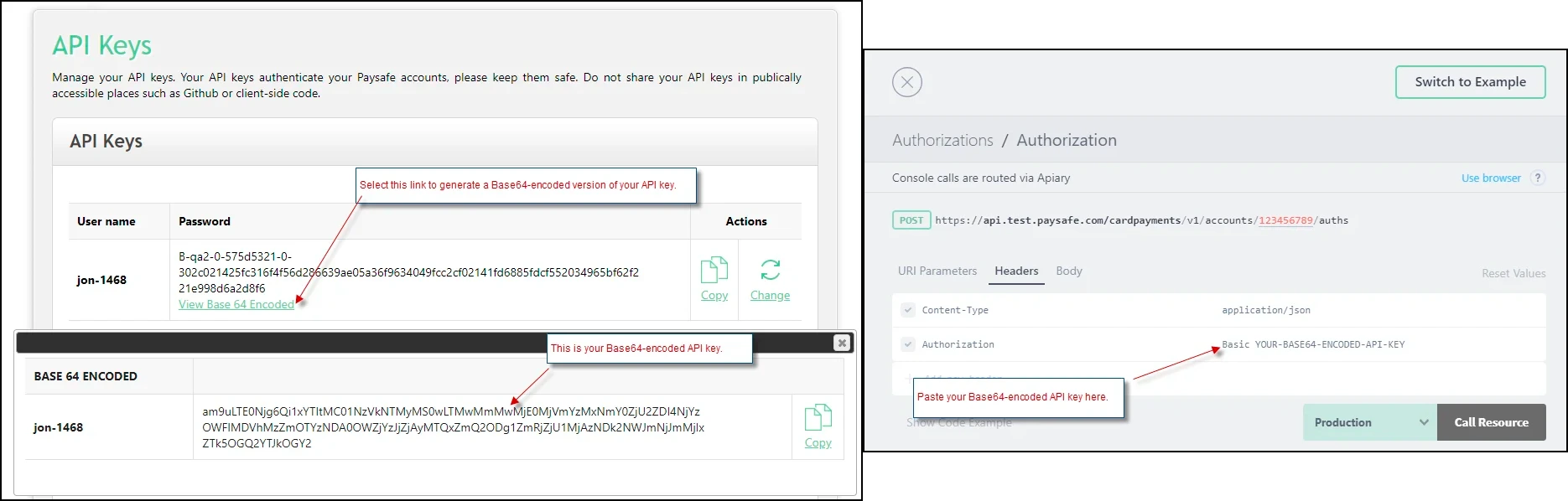

Seamless Integration

I tried integrating Paysafe’s API and SDKs with an e-commerce platform, and the process was straightforward. The platform provides prebuilt plugins for popular shopping carts, reducing development time. For businesses needing custom payment workflows, Paysafe’s merchant services software offers extensive integration options to streamline online payment solutions.

Advanced Analytics and Reporting

I found Paysafe’s reporting tools to be highly detailed and useful for tracking transaction trends and customer behavior. The dashboard provides real-time insights, helping businesses optimize e-commerce payment methods and reduce inefficiencies. With access to in-depth analytics, merchants can refine their online payment solutions and improve revenue forecasting.

Subscription Billing and Recurring Payments

Paysafe enables businesses to manage subscription billing and recurring payments seamlessly. Its automated system ensures that recurring transactions are processed on time, reducing manual intervention and enhancing customer convenience. This feature is ideal for businesses offering subscription-based services or products.

Multi-Currency Processing Support

The merchant services software provides multi-currency processing, allowing businesses to accept payments in over 40 currencies. This feature helps merchants expand globally by providing customers with the option to pay in their local currency, improving the customer experience and reducing conversion friction.

Real-Time Fraud Detection and Prevention Tools

Paysafe employs advanced fraud detection technologies to ensure the security of transactions. Its tools monitor transactions in real-time to detect and prevent fraudulent activities, safeguarding both merchants and customers and fostering trust in the payment process.

Digital Wallet Integrations (e.g., Skrill, Neteller)

When I tested Paysafe’s digital wallet integrations, I found that accepting payments through Skrill and Neteller was seamless. These options provide customers with faster, more flexible e-commerce payment methods, especially for high-risk industries. Businesses benefit from reduced chargeback risks and instant fund transfers, making it a reliable online payment platform for digital commerce.

Prepaid Card Solutions

I explored Paysafe’s prepaid card solutions, and they add real value for businesses. Merchants can issue branded prepaid cards, ideal for loyalty programs, corporate disbursements, or consumer incentives. These cards create an additional revenue stream while enhancing customer retention. The setup process is smooth, and businesses can customize branding to align with their marketing efforts, making it a flexible merchant services software solution.

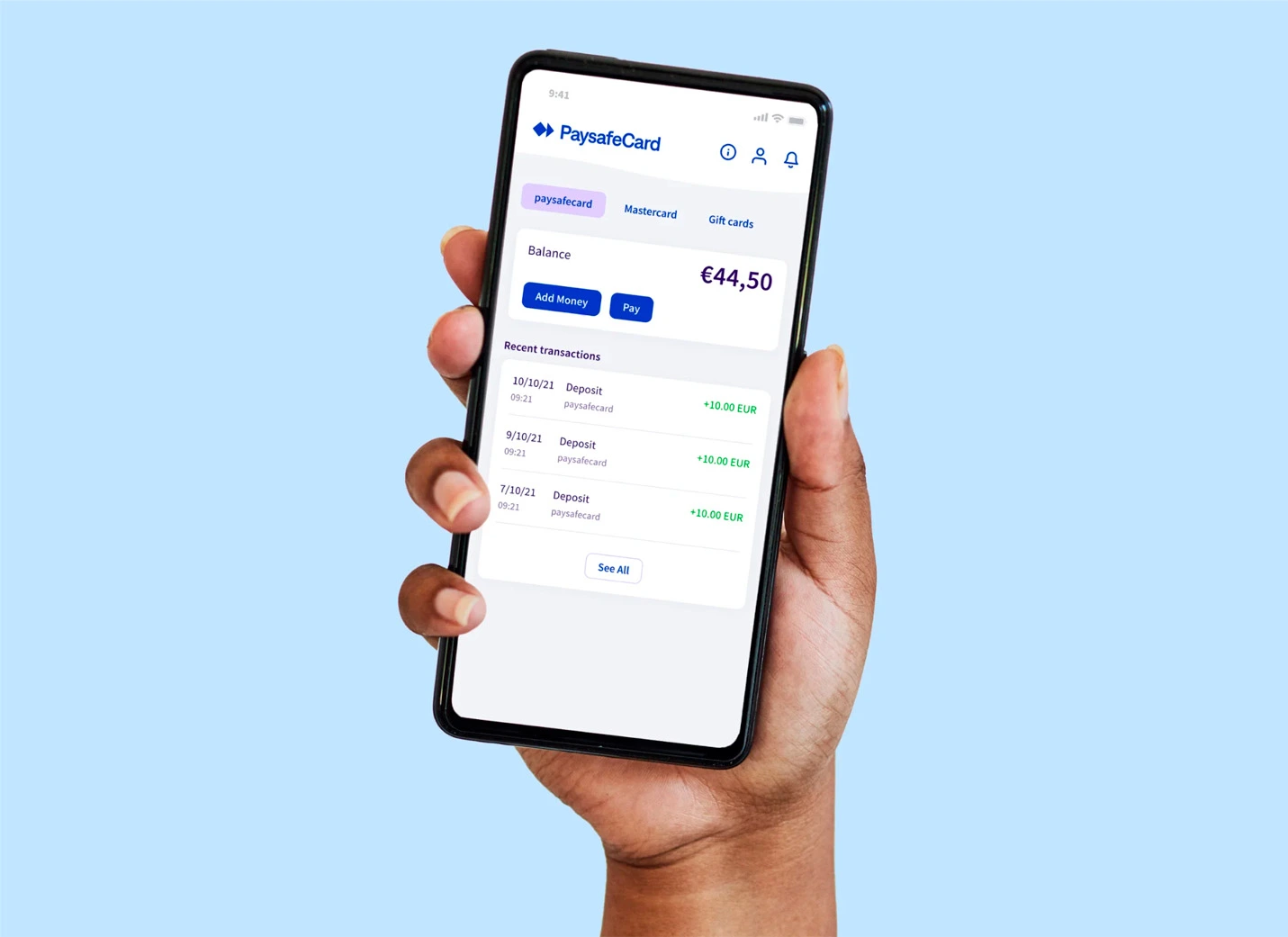

Accept Cash Payments Online

When I tested Paysafe’s cash-based payment options, I found Paysafecard to be a secure way for customers to pay online without a bank account or credit card. This feature is great for unbanked users or those prioritizing privacy. Businesses benefit from reduced fraud risks while expanding their reach to a wider customer base.

Access to Over 120 Global Markets

The Paysafe merchant solutions connect businesses to over 120 global markets, enabling seamless cross-border transactions. Its merchant service platform supports a wide array of payment types and regulatory requirements, making international commerce more accessible for businesses of all sizes.

Cash-Based Online Payment Methods (e.g., Paysafecard)

I tried Paysafecard, and it’s a great option for customers who prefer cash-based online payment methods. This feature allows businesses to accept payments from unbanked customers or those concerned about privacy. Transactions are secure, and businesses benefit from lower fraud risks compared to credit card payments. It’s an excellent addition for companies looking to expand their online merchant services and reach a broader audience.

Point-of-Sale and Virtual Terminal Options

The merchant service provider offers point-of-sale (POS) systems and virtual terminals to cater to both physical and remote payment needs. These solutions are versatile, supporting card-present and card-not-present transactions, ensuring businesses can accept payments in various scenarios.

Support for High-Risk Industries

Paysafe specializes in providing payment solutions for high-risk industries, such as gaming, travel, and e-commerce. Its expertise in compliance and risk management ensures that businesses in these sectors can operate smoothly while maintaining secure and reliable payment processing.

Integrations

Paysafe provides various software integrations and partnerships with third-party apps to enhance payment capabilities and offer a seamless experience to businesses and consumers. While the specific integrations may vary over time, here are some examples of popular and major third-party apps that have integrated with Paysafe:

- WooCommerce – Paysafe’s plugin allows businesses to accept payments directly within WooCommerce-powered stores.

- Shopify – Paysafe integrates as a payment gateway, enabling Shopify merchants to process transactions seamlessly.

- Magento – Paysafe’s payment extension lets Magento store owners integrate secure payment processing.

- Salesforce – Paysafe offers a payment solution within Salesforce for managing transactions and customer payments.

- QuickBooks – Paysafe syncs payment data with QuickBooks for streamlined financial management.

These are just a few examples of third-party apps that have integrated with Paysafe’s software solutions. Paysafe continuously expands its partnerships and integrations to cater to the evolving needs of businesses and provide seamless payment experiences across various platforms. For the most up-to-date information on specific integrations, it is recommended to consult Paysafe’s official documentation or contact their support.

Hardware & Software

The specific hardware requirements for using Paysafe may vary depending on the specific product or service you are referring to. However, these are some general guidelines regarding the hardware requirements for common Paysafe solutions:

Point-of-Sale (POS) Systems

If you are using Paysafe’s POS systems, such as their card readers or terminals, the hardware requirements typically involve having a compatible device with the necessary connectivity options. This could include a computer, tablet, or smartphone with features like USB, Bluetooth, or NFC capabilities, depending on the specific POS device you are using.

Online Payment Integration

For integrating Paysafe’s online payment solutions into your website or online platform, the hardware requirements are typically minimal. You would need a computer or server capable of hosting your website or application and meeting the software requirements specified by Paysafe.

Mobile Applications

If you are developing a mobile application that utilizes Paysafe’s payment services, the hardware requirements would depend on the platform you are targeting (e.g., iOS or Android). You would need a device capable of running the respective mobile operating system and meeting the development environment requirements for building mobile apps.

It’s important to note that Paysafe primarily operates through software interfaces, and the hardware requirements are generally associated with the devices used to interface with their services, such as POS devices or development environments. To get precise hardware requirements for a specific Paysafe product or service, it is recommended to consult Paysafe’s official documentation or reach out to their support for the most up-to-date information.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

Paysafe delivers a swift, reliable, and feature-rich solution for businesses seeking efficient online payment platforms and merchant services software. When I evaluated Paysafe’s performance, here’s what I looked at:

Speed

Paysafe offers instant fund transfers, ensuring that businesses receive payments promptly, which is crucial for maintaining cash flow. The platform’s MobilePay app allows for quick transactions via smartphones or tablets, enhancing payment flexibility.

Reliability

In my experience, Paysafe’s system is dependable, handling transactions with precision and maintaining consistent uptime. The platform’s advanced security measures, including fraud detection and prevention tools, ensure safe transactions, providing peace of mind for businesses and their customers.

Feature Set

Paysafe provides a great array of features beyond basic payment processing. These include support for over 250 payment methods, digital wallets like Skrill and Neteller, and cash-based transactions through Paysafecard. The platform also offers advanced analytics and reporting tools, enabling businesses to monitor transactions and gain insights into customer behavior.

Ease Of Use:

Easy Account Setup

When I tested Paysafe, I found that opening an account was quick and straightforward. The platform guides you through the setup, and businesses can start accepting online payments almost immediately. Instant fund transfers ensure businesses receive payments quickly, reducing cash flow concerns.

Intuitive Back Office

Paysafe’s back-office dashboard is designed for efficiency. I found it easy to navigate, with extensive data access that allows businesses to monitor transactions, generate reports, and track real-time sales. For merchants handling e-commerce payments, this feature streamlines financial management.

Mobile App Convenience

I tried the Paysafe mobile app, and it enhances payment flexibility. Businesses can accept online payment processing services from anywhere, making it ideal for mobile transactions. Users can also access reports and transaction history on the go.

User Experience

I also did some research online. While many users find Paysafe’s merchant services software intuitive, some mention a learning curve. However, its payment gateway and reporting tools simplify transactions for businesses looking for reliable online merchant services.

Uniqueness:

Paysafe sets itself apart with instant fund transfers, multi-currency support, and seamless integration with digital wallets like Skrill and Neteller. It supports over 250 payment methods, including electronic check processing and virtual card for online payment, making it a powerful online payment platform for global businesses and high-risk industries.

Verdict:

In summary, Paysafe is a payment platform with some distinctive strengths and weaknesses. The service offers tailored, quote-based pricing, allowing customers to avoid paying for unnecessary features. This model potentially favors businesses with high monthly transaction volumes, who may be able to negotiate lower rates. However, Paysafe doesn’t sufficiently detail certain features, making it difficult for average merchants to understand the system without direct interaction with a representative.

This ambiguity extends to its pricing, making it challenging for potential users to assess its suitability without a formal quotation. Additionally, some Paysafe payment methods are not available in the U.S., restricting the operations of U.S.-based businesses.