Square Review 2025

Square Accounts Receivable Plans & Pricing

Square Comparison

Expert Review

Pros

Cons

Square Accounts Receivable's Offerings

Square’s payment processing platform simplifies payment processing for businesses by consolidating the fees charged by card companies, banks, and compliance standards.

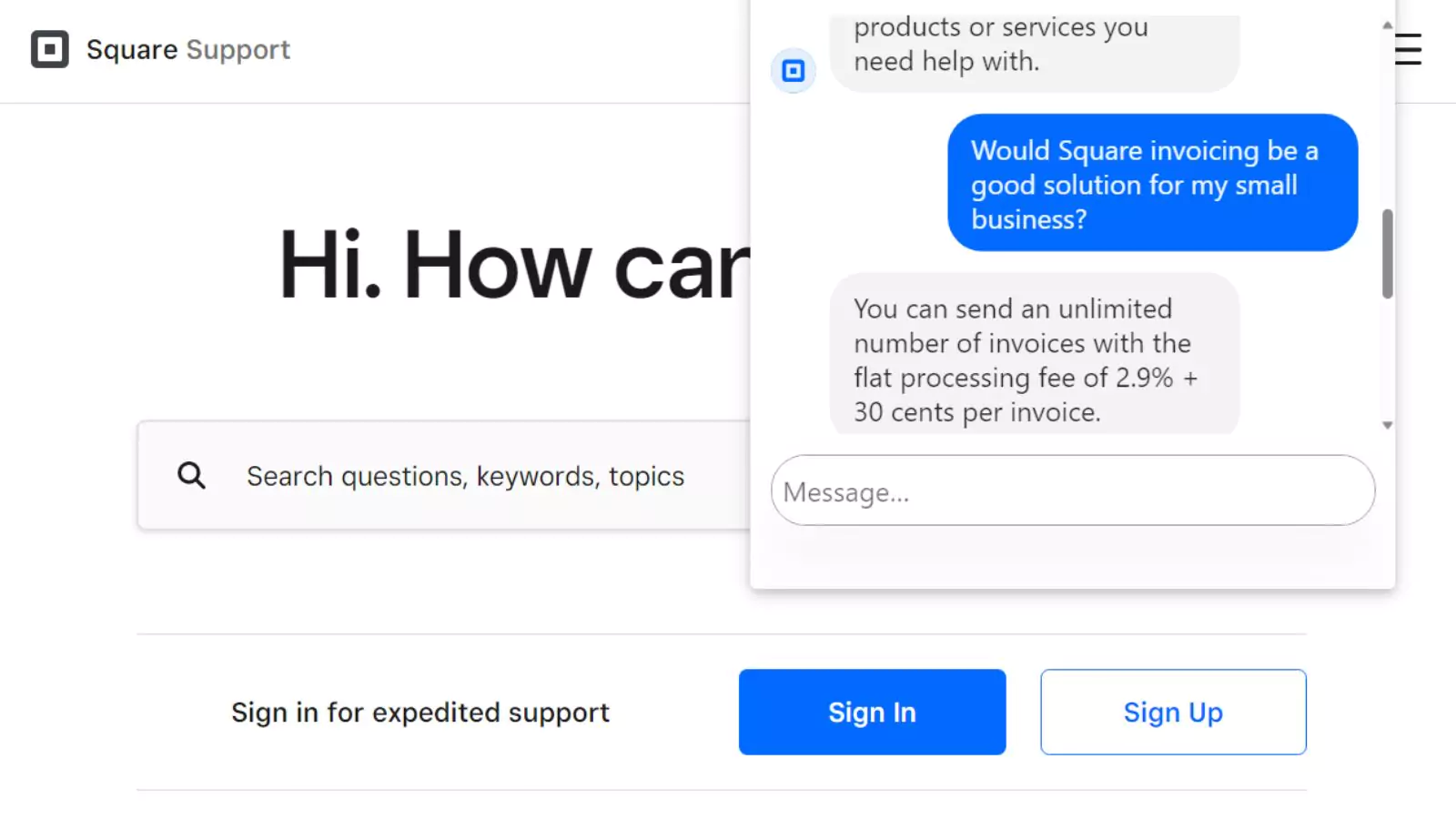

The platform charges a small fee for each transaction based on the payment method used. For card-present payments made using Square hardware, the fee is 2.6% plus 10 cents per transaction. For keyed payments, the fee is 3.5% plus 15 cents per transaction. For online payments made through Square’s eCommerce API, Square Online Store, Square Online Checkout, or online invoicing, the fee is 2.9% plus 30 cents per transaction for cards, or 1% with a minimum of $1 per transaction for ACH bank transfers (via invoices only).

Customer Support

Phone Support

Square does provide a support hotline; the service is available from 6am – 6pm PDT Monday through Friday. When I phoned, there were several options to navigate, but I was able to speak to someone within one minute. The customer service representative was very pleasant, verified my information quickly, and clarified my question before answering.

Email Support

Email support is available to users, with an estimated wait time of 24 to 48 hours; however I didn’t receive any reply to my message.

Live Chat

Automated chat is the first line of customer support, aside from online resources. It works effectively and questions are answered accurately and quickly.

Video Tutorials

Square has an extensive YouTube channel with dedicated playlists on various business topics including accounts receivable.

Overall Experience

Square has numerous channels for customer support, which are effective ways to get information and answer specific questions. I appreciated that the various channels were visible, and included clear hours of operation.

Features & Functionality

General Features

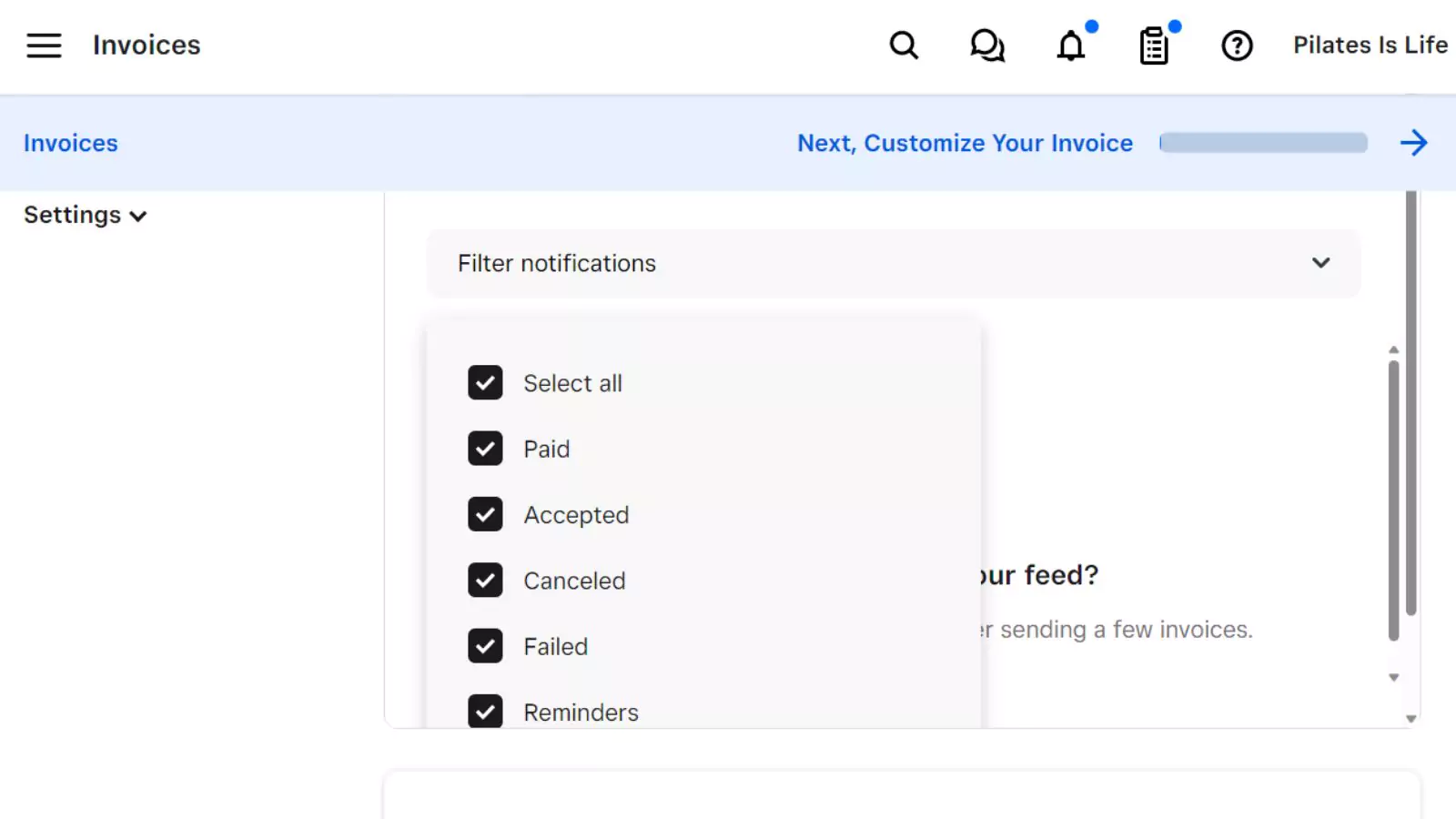

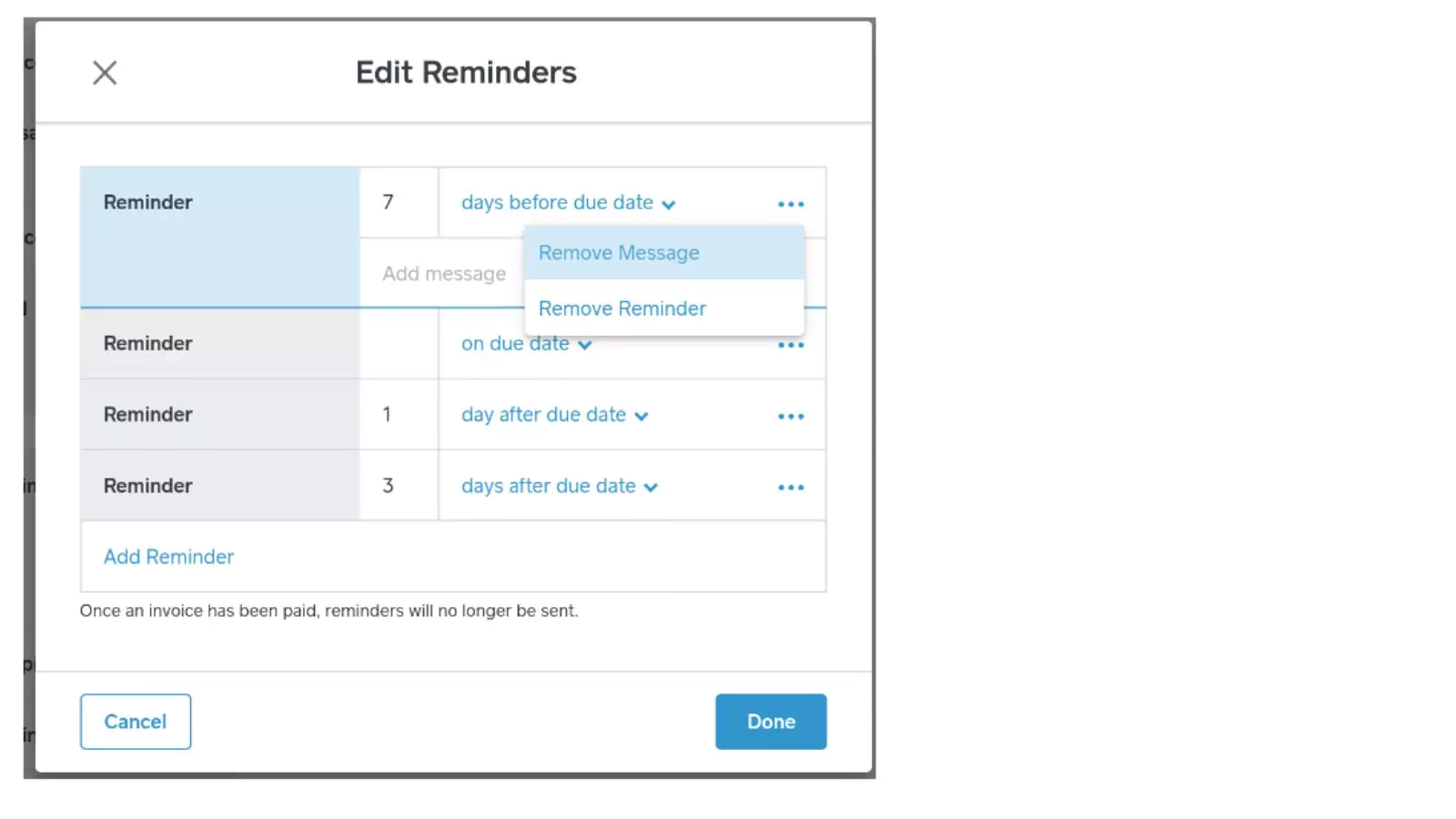

Square allows automation of invoice reminders such as email, text messages, or phone calls. For those using Square Invoices, there is an option to schedule follow-up reminders for overdue invoices, accept partial payments, attach contracts, and filter invoices based on payment status (pending, outstanding, or paid).

Automation Features

By using Square Invoices, business owners can schedule reminders for overdue invoices, accept partial payments, attach contracts, and easily filter invoices by their payment status. Automating invoice reminders not only facilitates faster payments but also frees up time and attention for business owners to focus on other tasks.

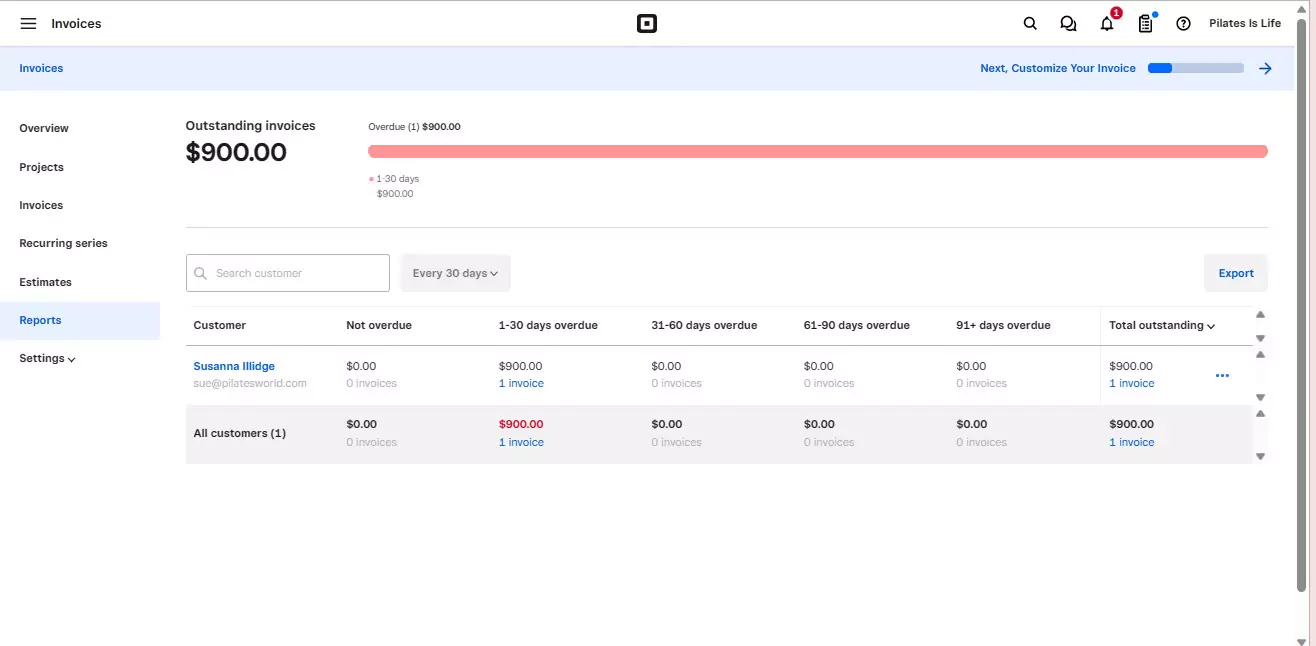

Reporting & Analytics

The advanced reporting options provided by Square enable users to gain a more comprehensive understanding of their business operations. In order to access these advanced features, individuals can navigate to their Square Dashboard online and utilize the available Filter By and Display By options. By utilizing these features, users can obtain more in-depth insights into the inner workings of their business.

Cash Flow Features

Square’s cash flow monitoring can help businesses avoid mistakes, which can negatively impact their cash flow. Automating invoice reminders through email, text messages, or phone calls can be an effective solution to reduce errors and save time. This approach not only speeds up payments, but also helps streamline business operations. Square Invoices offers features such as scheduling follow-up reminders, accepting partial payments, attaching contracts, and filtering invoices based on payment status.

Integrations & Add-Ons

Square integrates with multiple third-party apps, which are available and categorized by industry (or other requirements) on their website, on the Square App Marketplace.

Performance:

Payment notifications

Square allows users to turn notifications on and off, according to the module they want to receive notifications from.

Reminders

Square allows users to set reminders for payments, to avoid any oversights.

Sending Emails

Square allows users to send invoices via email, allowing for easy and seamless delivery.

Invoice Creation

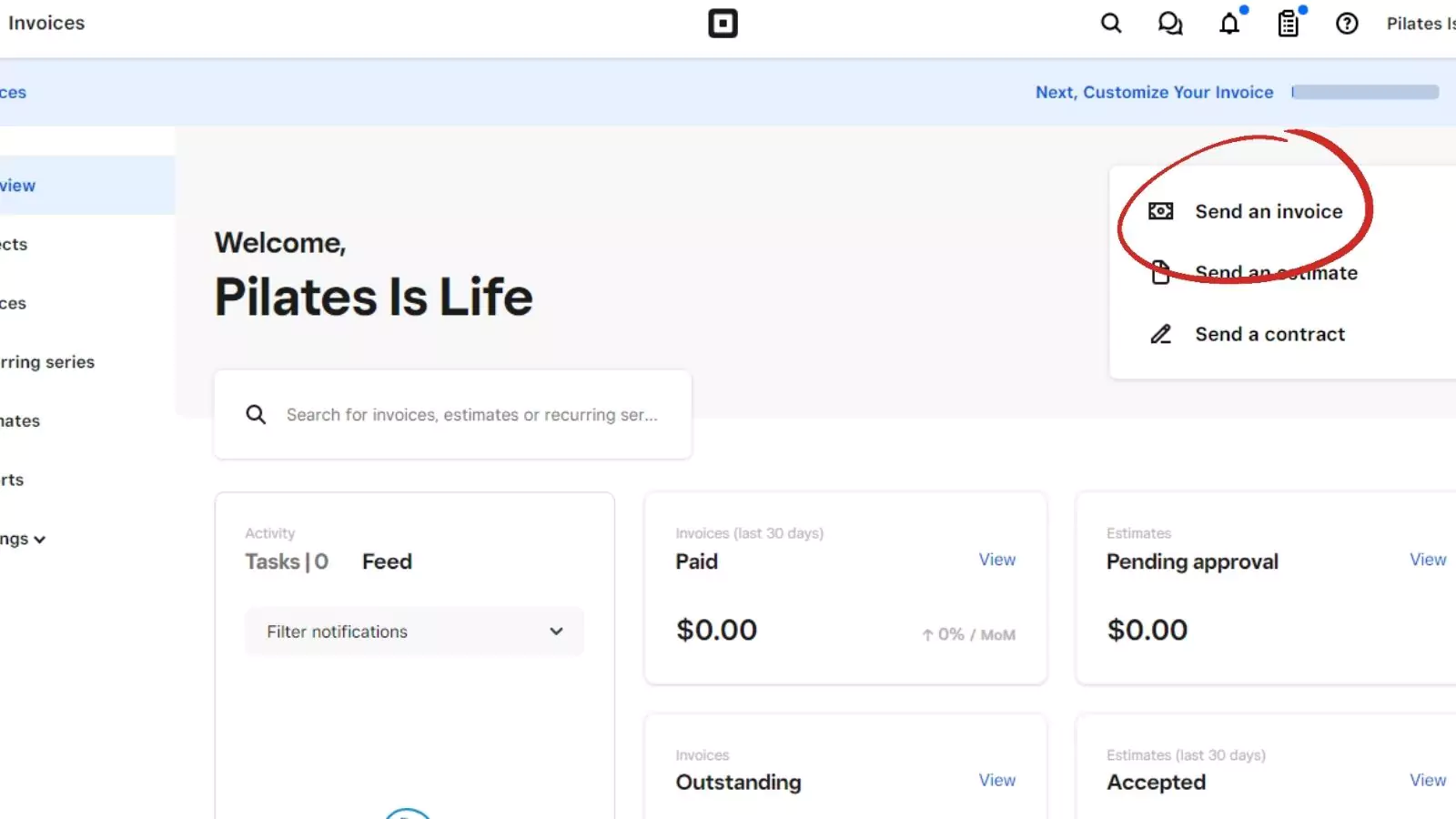

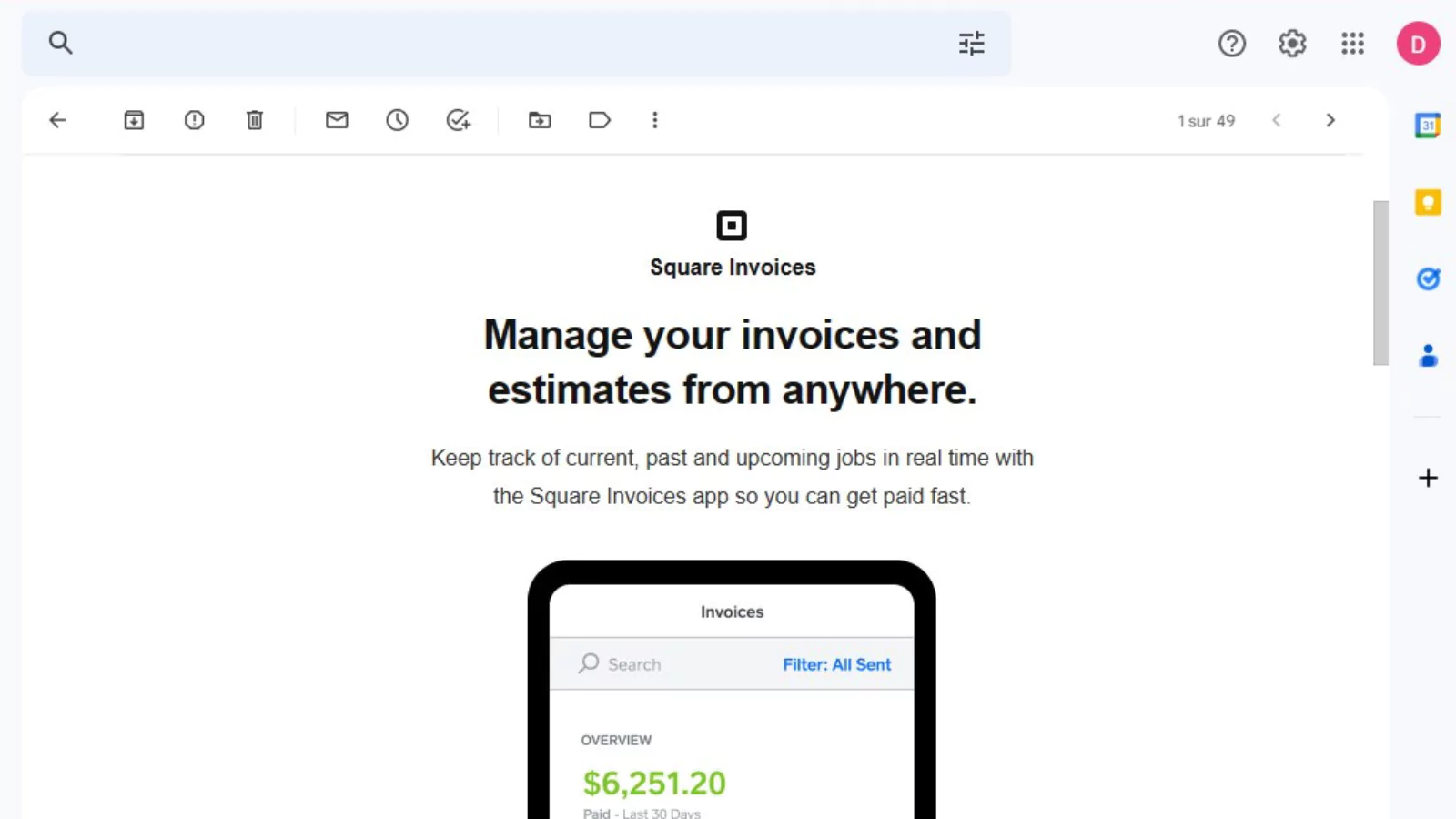

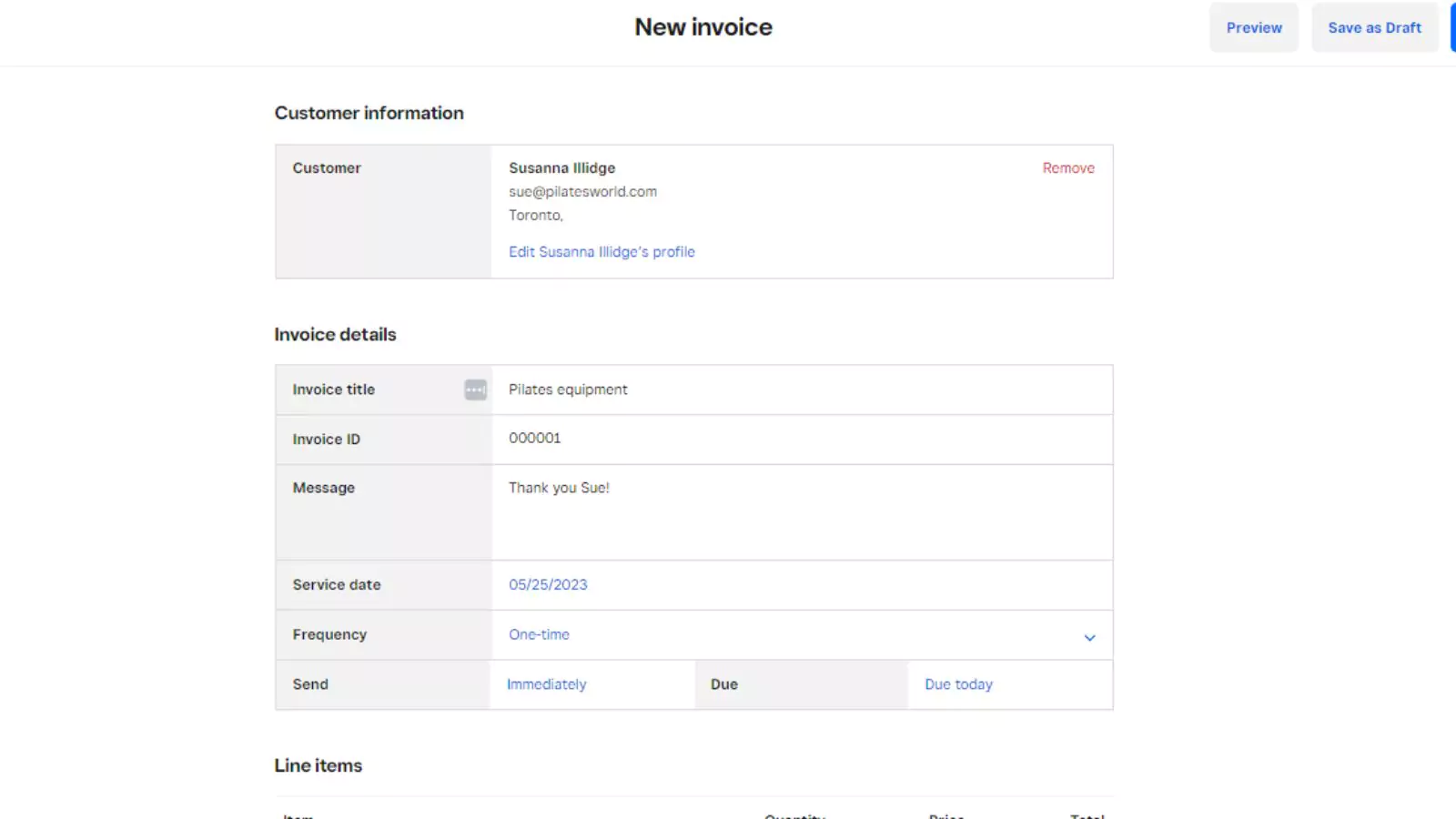

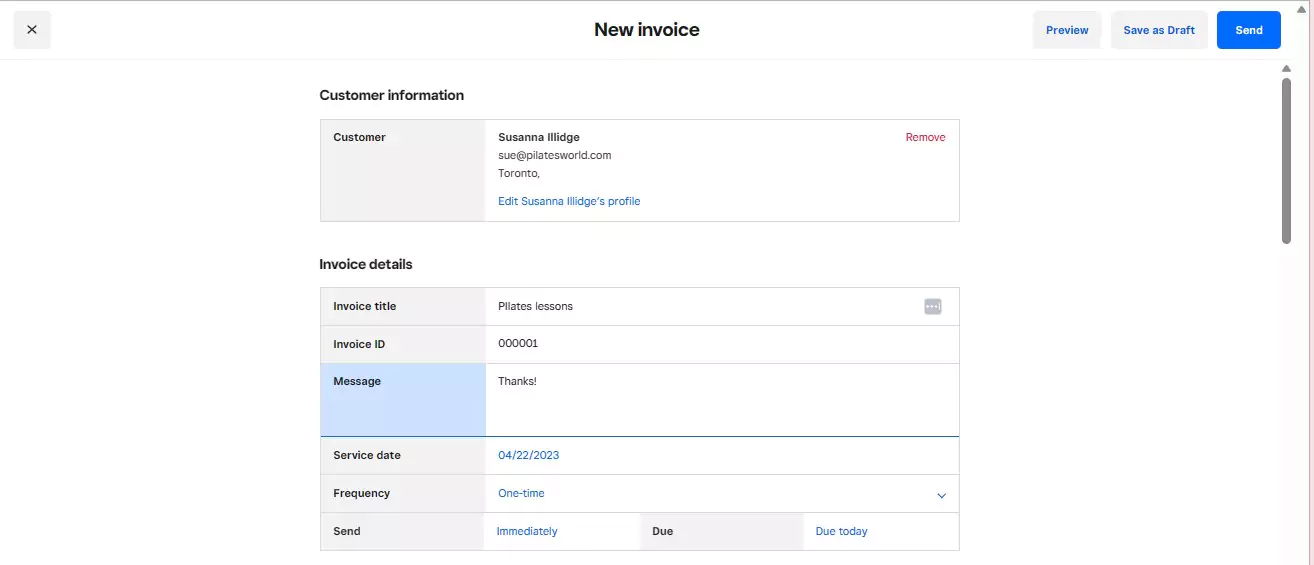

Square Invoices enable users to send estimates and invoices digitally from any location, track payment statuses in real-time, and accept payments through card or ACH bank transfer continuously. Square Invoices have a payment rate of over 75% within a day.

Ease Of Use:

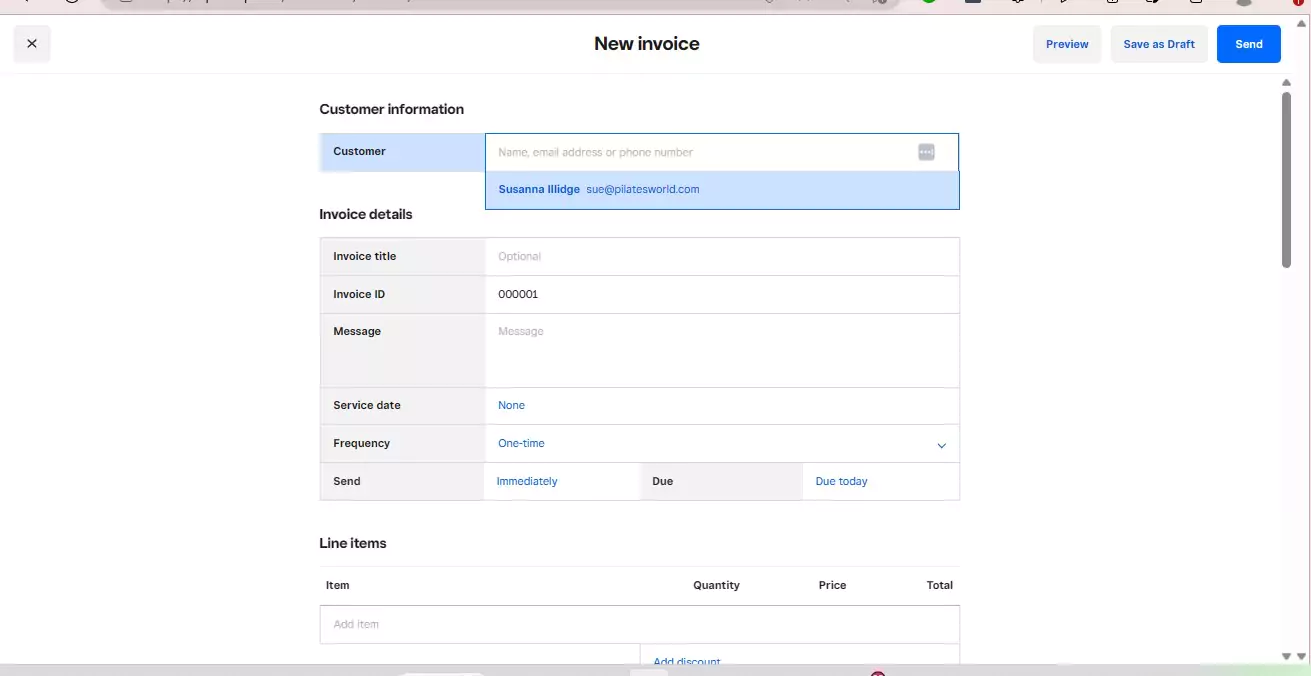

It was easy and straightforward to register for Square invoicing; I was finished in only a few minutes. The dashboard has an intuitive layout that makes it easy to navigate, and the features are conveniently accessible. Adding new customers and creating invoices, and learning how to send them, was very simple.

This video will show the easy setup process for Square:

Create invoice

Creating invoices is very intuitive, thanks to the user-friendly interface. The fields are laid out in a logical manner.

Find Clients

Invoiced users can create detailed customer records, which can be retrieved easily by name or customer ID.

Customize Reports

The user-friendly interface makes the process of creating reports very intuitive, and the options available are clearly indicated.

Verdict:

For those who are starting their business and unsure of their potential revenue, Square may be a suitable option. It has no monthly fees, making it a cost-effective way to start. This feature makes it easy for users to begin using Square immediately. It has a high degree of functionality and integration with third party apps, as well.

For businesses with low or fluctuating transaction volumes, Square can be a practical choice. It guarantees that processing charges are only applicable to the amount earned, ensuring that the user pays only for what they use.