U.S. Bank Review 2026

U.S. Bank Merchant Services Plans & Pricing

U.S. Bank Comparison

Expert Review

Pros

Cons

U.S. Bank Merchant Services's Offerings

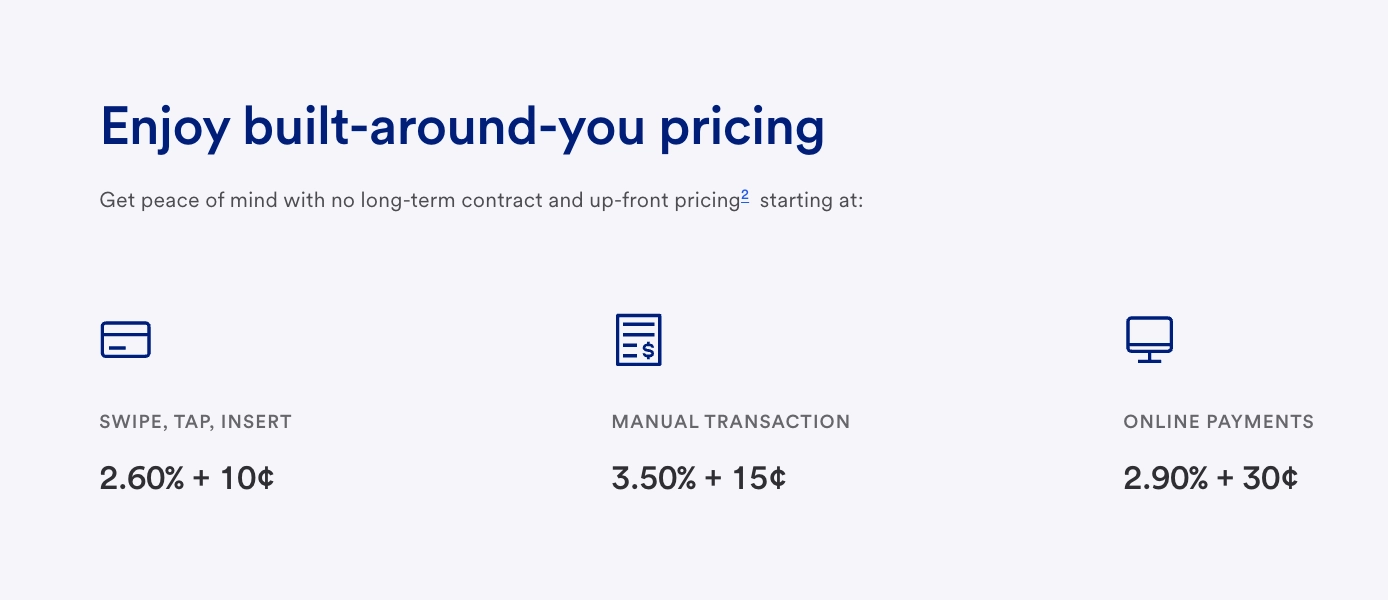

Their Built Around You Pricing Includes the following:

SWIPE, TAP, DIP: 2.6% + 10¢

KEY-IN TRANSACTION: 3.5% + 15¢

ONLINE PAYMENTS: 2.9% + 30¢

Customer Support

24/7/365 Customer Support

When I tested U.S. Bank Payment Solutions’ support, I appreciated the 24/7/365 availability. I contacted them outside standard business hours, and their team was quick to respond. Having round-the-clock access is a huge benefit, especially for businesses that operate late nights or weekends.

They also have a great Smart Assistant on the website:

Multilingual In-House Support

The multilingual support is a great feature for businesses with diverse staff or international customers. The team provided clear, professional assistance, ensuring I fully understood the solutions available. This is a major plus for businesses that need seamless communication.

Dedicated Relationship Management

For more in-depth support, U.S. Bank assigns relationship managers. I reached out to mine, and they provided tailored advice on optimizing my online payment solutions. Having a direct point of contact made it easier to resolve complex issues.

Multiple Contact Channels

I tested their phone support (800-777-7240), and my wait time was minimal. While there’s no live chat, their email support and contact forms were responsive. A chat feature would improve accessibility.

Blog & FAQ Resources

I explored their blog and FAQs, and they provide solid insights into merchant services software and e-commerce payment methods. While helpful, I found some articles could be more detailed.

Overall, U.S. Bank Merchant Services delivers strong support, but adding live chat would enhance accessibility.

Features & Functionality

General Features

U.S. Bank Payment Solutions is designed to be simple enough for beginners to use but powerful enough to support business growth.

Here are some of the features you can leverage:

- POS Integration

- ACH Payment Processing

- Billing & Invoicing

- Data Security

- Debit/Credit Card Processing

- Everyday Funding

- Electronic Signature

- In-Person Payments

- Mobile Payments

- Multiple Payment Gateways

- Online payment processing

- PCI Compliance

- Payment Fraud Prevention

- Payment Processing Services Integration

- Recurring Billing

- Reporting/Analytics

- Mobile Credit card processing

- Cash Transactions

- Contactless NFC

- Electronic Receipts

- Mobile Card Reader

- Statement analysis

- 3rd-Party Integrations

Point of Sale (POS)

U.S. Bank Payment Solutions offers a service called talech, which is a feature-rich, affordable, cloud-based point-of-sale (POS) solution tailored to the retail, restaurant, and service industries. It is easy to use and can scale seamlessly across multiple locations to support business expansion.

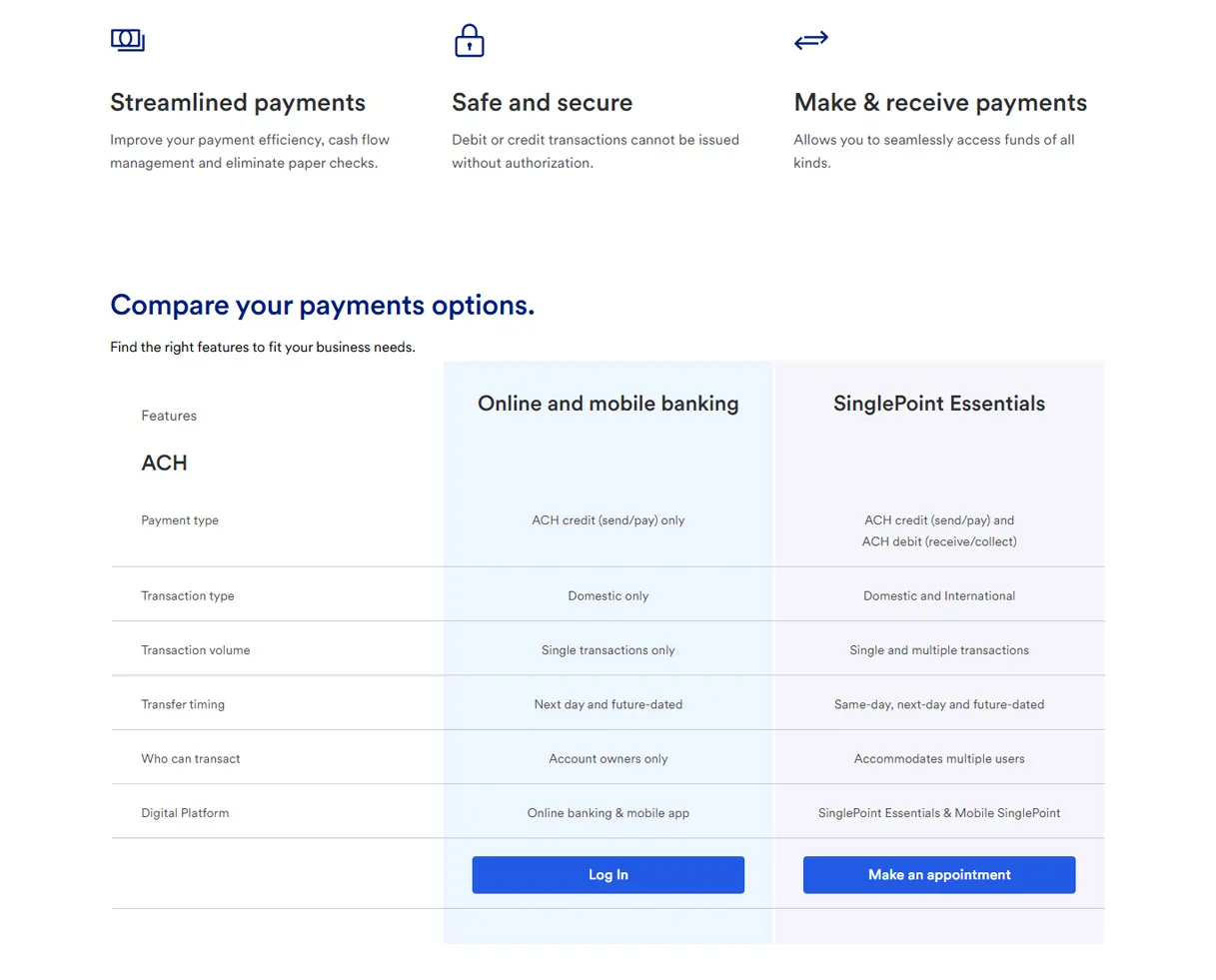

ACH Payment Processing

When I tested U.S. Bank Payment Solutions’ ACH payment processing, I found it to be a highly efficient way to manage direct bank transfers. This feature is perfect for businesses that rely on recurring billing, such as subscription services, membership programs, and invoicing.

The process eliminates paper checks, reducing transaction costs and increasing reliability. Payments are securely processed, minimizing fraud risks.

I also noticed that settlement times were quick, ensuring predictable cash flow management. For businesses looking to optimize their electronic check processing, U.S. Bank provides a reliable and cost-effective solution.

Billing & Invoicing

The platform’s billing and invoicing tools allow for the creation and management of professional invoices. I found the customizable templates and automated reminders particularly useful, as they expedited payment collection and minimized overdue accounts. This feature enhances the overall efficiency of accounts receivable processes.

Data Security

Data security is paramount in payment processing, and U.S. Bank employs advanced encryption and tokenization to protect sensitive information. When I assessed their security measures, I felt confident in the platform’s ability to safeguard customer data, ensuring compliance with industry standards and fostering trust with clients.

Debit/Credit Card Processing

The solution supports comprehensive debit and credit card processing, accepting all major card brands. During my evaluation, transactions were processed swiftly, and funds were deposited promptly. This capability is essential for businesses aiming to offer flexible payment options to their customers.

Electronic Signature

The electronic signature feature facilitates the secure signing of documents online. I utilized this for contract approvals and found it expedited the agreement process, eliminating the need for physical paperwork and enabling quicker transaction finalization.

In-Person Payments

For brick-and-mortar establishments, U.S. Bank provides robust in-person payment solutions. I tested their point-of-sale system and found it user-friendly, with seamless integration of hardware and software, ensuring efficient transaction handling and inventory management.

Mobile Payments

The platform’s mobile payment capabilities allow businesses to accept payments via smartphones and tablets. When I tried this feature, it provided flexibility for on-the-go transactions, which is beneficial for service-based industries and pop-up retail events.

Multiple Payment Gateways

I explored U.S. Bank Payment Solutions’ multiple payment gateway support, and it offers businesses maximum flexibility when accepting payments. The platform integrates with various e-commerce payment methods, allowing businesses to choose a gateway that best suits their operations.

Whether using third-party payment processors or in-house solutions, the system ensures seamless transactions. I found that integration was straightforward, making it easy to connect with online payment platforms.

This feature enhances the customer payment experience by offering a range of payment options, ensuring businesses can process transactions efficiently across multiple sales channels.

Online Payment Processing

The online payment processing feature enables businesses to accept payments through their websites securely. I found the integration process straightforward, and it provided customers with a convenient and safe method to complete transactions, which is essential for expanding online sales channels.

PCI Compliance

Ensuring PCI compliance is critical for protecting cardholder data. U.S. Bank assists businesses in adhering to these standards, offering guidance and tools to maintain compliance. This support reduces the risk of data breaches and associated penalties, providing peace of mind.

Payment Fraud Prevention

The platform employs advanced payment fraud prevention tools, including encryption and tokenization, to safeguard transactions. These measures help protect sensitive customer data and reduce the risk of fraudulent activities. I found that implementing these security features instilled confidence in both the business and its customers.

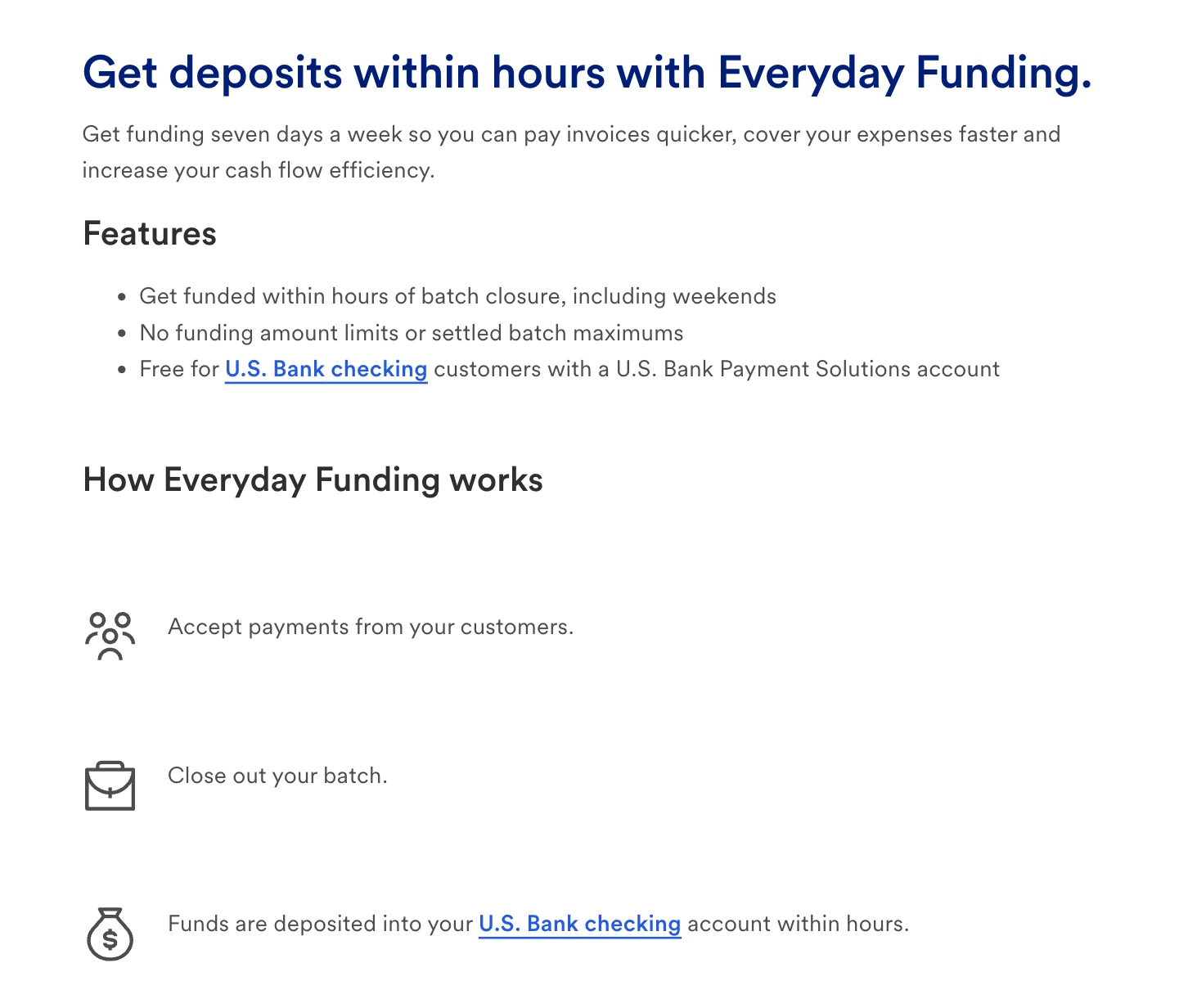

Everyday Funding

Improve cash flow with industry-leading Everyday Funding, available 7 days a week, with no daily funding limits.

Payment Processing Services Integration

U.S. Bank’s solution integrates with various payment processing services, enabling businesses to accept multiple payment methods, such as credit cards, debit cards, and mobile payments. This flexibility caters to diverse customer preferences, potentially increasing sales opportunities. During my evaluation, the integration process was straightforward and enhanced the payment acceptance experience.

Recurring Billing

The recurring billing feature allows businesses to set up automatic, periodic payments for subscription-based services. This automation reduces manual invoicing efforts and ensures timely revenue collection. I found this particularly beneficial for managing memberships and service contracts efficiently.

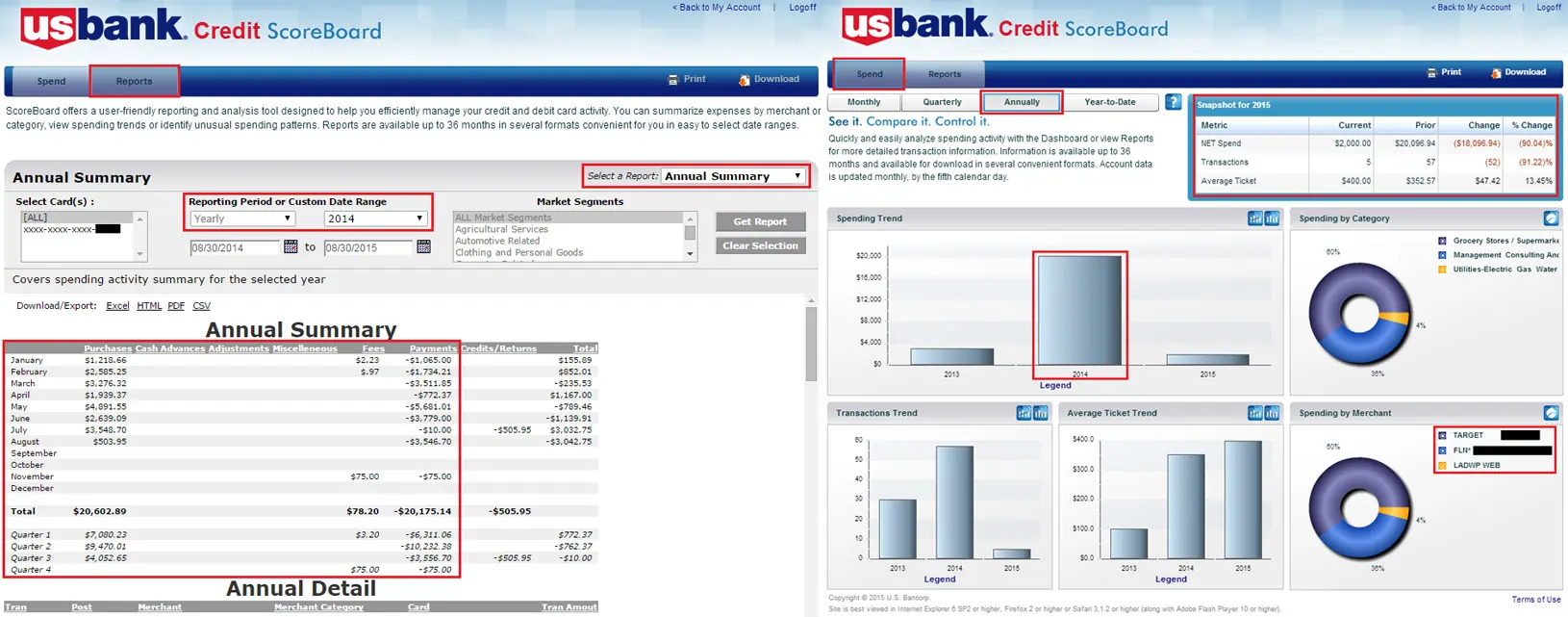

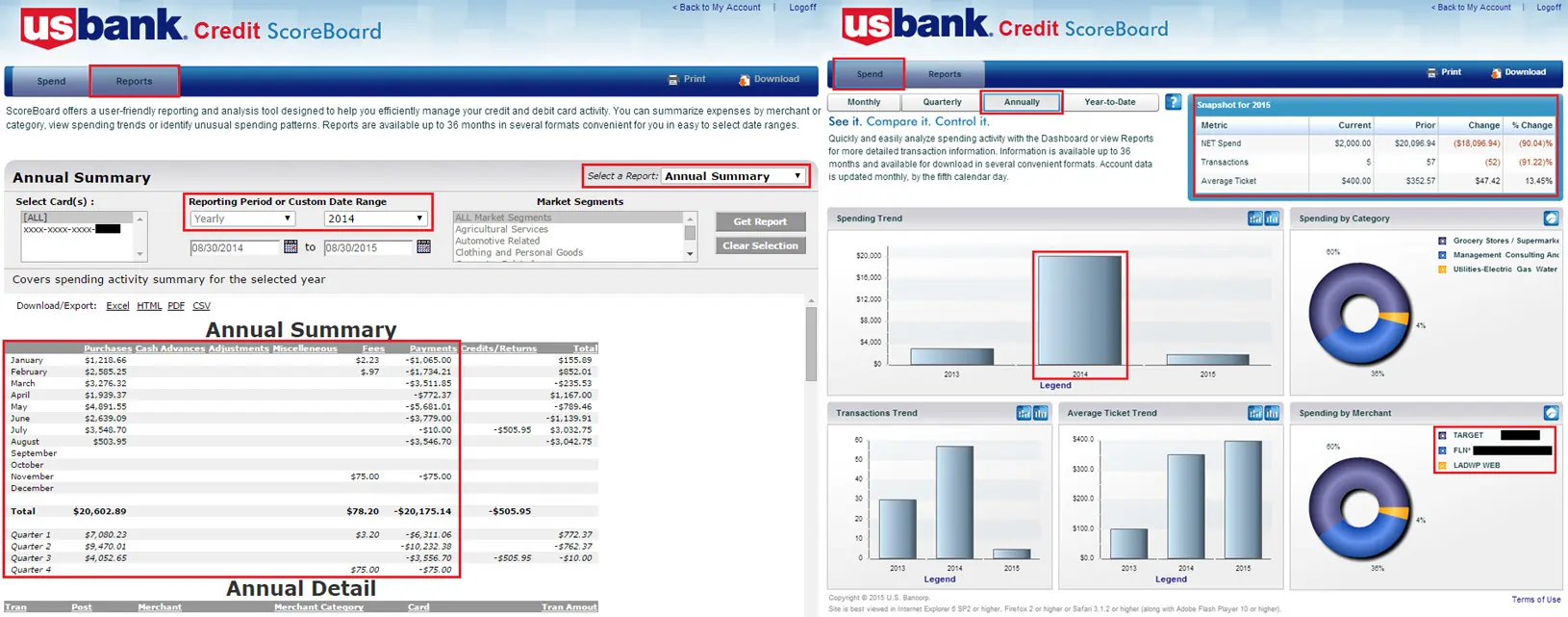

Reporting/Analytics

U.S. Bank provides comprehensive reporting and analytics tools, offering insights into sales trends, customer behavior, and financial performance. These data-driven insights assist businesses in making informed decisions and identifying growth opportunities. When I played around with these tools, they proved invaluable for strategic planning and performance monitoring.

Mobile Credit Card Processing

The platform supports mobile credit card processing, enabling businesses to accept payments via smartphones or tablets using a mobile card reader. This feature is ideal for on-the-go transactions, such as at events or in-field services. I find that this enhances payment flexibility and customer convenience.

Cash Transactions

In addition to electronic payments, U.S. Bank’s system accommodates cash transactions, allowing businesses to record and manage cash sales within the same platform. This unified approach simplifies financial tracking and reporting. During my assessment, handling cash transactions alongside digital payments streamlined the overall sales process.

Contactless NFC

The solution supports contactless Near Field Communication (NFC) payments, enabling customers to pay using contactless cards or mobile wallets like Apple Pay and Google Pay. This feature enhances the checkout experience by offering quick and secure payment options. Customers will appreciate the speed and convenience of contactless payments.

Electronic Receipts

U.S. Bank’s system offers electronic receipts, allowing businesses to send receipts to customers via email or SMS. This eco-friendly option reduces paper usage and provides customers with convenient record-keeping. When I implemented electronic receipts, it improved customer satisfaction and streamlined receipt management.

Mobile Card Reader

The platform provides a mobile card reader compatible with smartphones and tablets, facilitating secure payment acceptance on the go. This device is particularly useful for businesses without a fixed location or those that offer delivery services. I found the mobile card reader easy to set up and use, enhancing payment mobility.

Statement Analysis

Their complimentary statement analysis service identifies hidden fees and unnecessary expenses associated with your current processing service.

Integrations & Add-Ons

U.S. Bank integrates with various third-party solutions, including payment gateways, software platforms, payment terminals, and point-of-sale devices. Regarding security, U.S. Bank Payment Solutions uses end-to-end encryption to protect customer payment data. It is compatible with contactless payments, chip and pin, Google Pay, and Apple Pay. It also utilizes tokenization technology, which replaces a cardholder’s card numbers, making the payment information useless to hackers.

Hardware & Software

U.S. Bank Payment Solutions is compatible with most devices and operating systems, including Apple (iPhone, iPad, iMac, etc.), Android, and PC. There are no specific hardware requirements mentioned, suggesting that the service is flexible and can work with existing hardware.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

U.S. Bank Payment Solutions delivers a high-performance, reliable, and secure payment processing experience, making it a strong contender among merchant services software options.

Speed and Efficiency

When I tested U.S. Bank Payment Solutions, I found the transaction processing speed to be impressive. The platform offers Everyday Funding, enabling businesses with U.S. Bank deposit accounts to receive funds seven days a week, including weekends and holidays. This feature significantly enhances cash flow management, allowing for quicker access to funds.

Reliability

Throughout my usage, the system demonstrated high reliability. Transactions were processed without delays or errors, ensuring consistent performance. The platform’s robust infrastructure supports various payment methods, including in-store, online, mobile, and invoicing, catering to diverse business needs.

Feature-Rich Platform

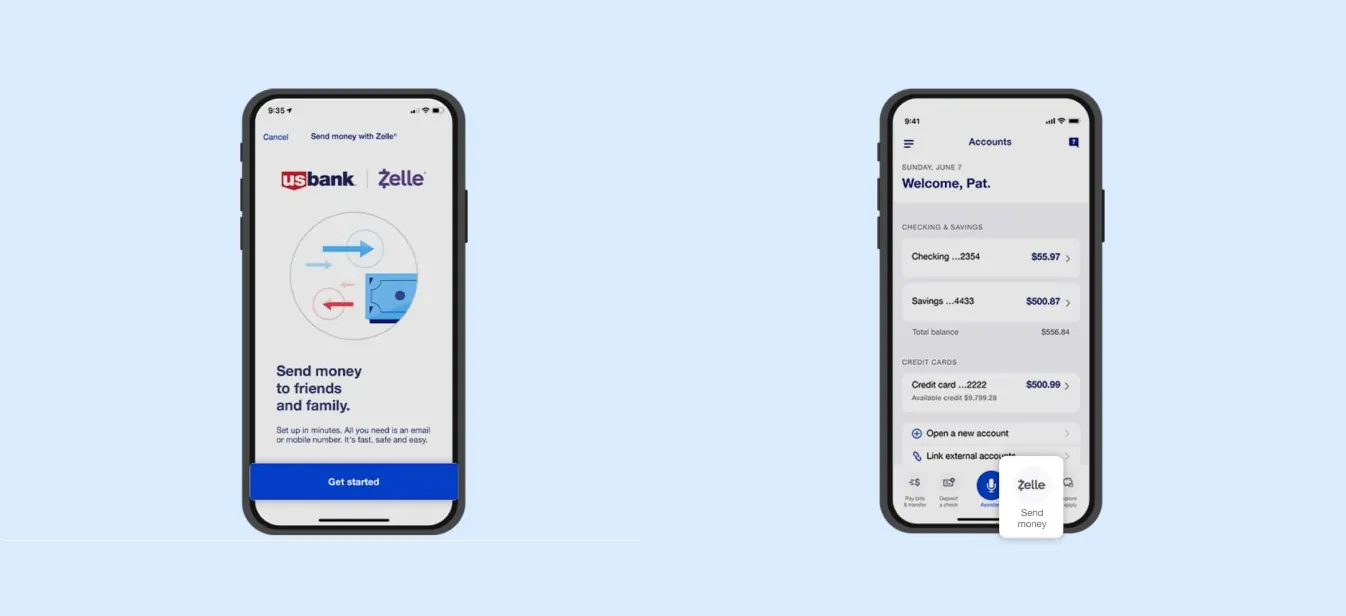

I explored the platform’s features and found it to be comprehensive. It supports Zelle® payments, allowing customers to make fast, secure payments directly to a business’s U.S. Bank account. Additionally, the platform offers remote deposit capture, enabling businesses to deposit checks without visiting a branch, further streamlining operations.

Security Measures

Security is a critical aspect of any online payment platform, and U.S. Bank Payment Solutions excels in this area. The platform employs advanced fraud protection tools, including encryption and tokenization, to safeguard sensitive data. These measures help businesses comply with Payment Card Industry Data Security Standards (PCI DSS), ensuring secure transactions.

Scalability

The platform is designed to scale with business growth. Whether you’re a small business or a large enterprise, U.S. Bank Payment Solutions offers customizable options to meet evolving needs. The system’s flexibility allows for seamless integration with existing processes, making it a versatile choice for businesses aiming to expand their e-commerce payment methods.

Ease Of Use:

User-Friendly Interface

When I tested U.S. Bank Payment Solutions, I found the platform’s interface to be intuitive and user-friendly. The dashboard is well-organized, allowing for easy navigation through various features. Even without extensive technical knowledge, I could efficiently manage transactions and access essential tools. This design ensures that businesses can focus on operations without being bogged down by complex systems.

Streamlined Payment Processes

I tried out the payment processing features and appreciated the simplicity of accepting payments across multiple channels, including in-store, online, and mobile. The system supports various payment methods, making it versatile for different business models. This flexibility is crucial for businesses aiming to provide a seamless payment experience to their customers.

Efficient Account Management

Managing accounts was straightforward. The platform offers tools to monitor transactions, generate reports, and handle invoicing with ease. These features are beneficial for maintaining accurate financial records and making informed business decisions. The emphasis on user-centric design makes U.S. Bank Payment Solutions a practical choice for businesses seeking efficient and accessible online payment solutions.

Uniqueness:

U.S. Bank Payment Solutions stands out with Everyday Funding, allowing businesses to receive deposits seven days a week, seamless Zelle® payments, remote deposit capture, and advanced fraud protection. Its scalability makes it a strong online payment processing service for growing businesses.

Verdict:

After evaluating U.S. Bank Payment Solutions, I found it to be a comprehensive and customizable merchant services software suitable for businesses of all sizes. The platform offers a variety of secure payment methods, including in-store, online, mobile, and invoicing options, catering to diverse business needs.

The 24/7/365 customer support ensures assistance is always available, which is crucial for maintaining smooth operations. Transparent pricing structures provide clarity, allowing businesses to manage costs effectively.

The emphasis on flexibility and scalability makes it a reliable choice for businesses aiming to streamline their payment processes and support growth. Overall, U.S. Bank Payment Solutions stands out as a robust online payment processing service that adapts to evolving business requirements.