The Future of Accounting Software: Trends to Watch in 2023 and Beyond

The world of accounting is constantly evolving, and technology plays a vital role in this evolution. The emergence of new technologies has changed the way accountants work and has significantly improved the efficiency of the entire accounting process. Accounting software has come a long way from simple bookkeeping to sophisticated solutions that are now able to automate many accounting tasks.

These technologies will revolutionize the accounting industry by improving efficiency, reducing errors, and providing real-time data. Intuit QuickBooks, one of the most popular accounting software solutions, has recognized the potential of these technologies and has begun incorporating them into its software.

In this article, we will discuss the role of automation, artificial intelligence, cloud-based solutions, mobile accounting, blockchain technology, and cybersecurity in the future of accounting software, and take a look at how QuickBooks is incorporating these trends into their software to provide a better user experience for its customers.

Automation

Automation in accounting involves the use of technology to replace human beings in performing repetitive and time-consuming tasks, such as data entry and bookkeeping. It streamlines accounting processes and reduces the risk of errors.

All told, 40% of small business owners spend more than 80 hours each year on accounting.

There are tons of useful benefits of automation in accounting. By having tasks run automatically, users can save time, reduce errors, and improve overall efficiency of workflows. It also frees up accountants to focus on higher-level tasks, such as analysis and decision-making (as only a human can do).

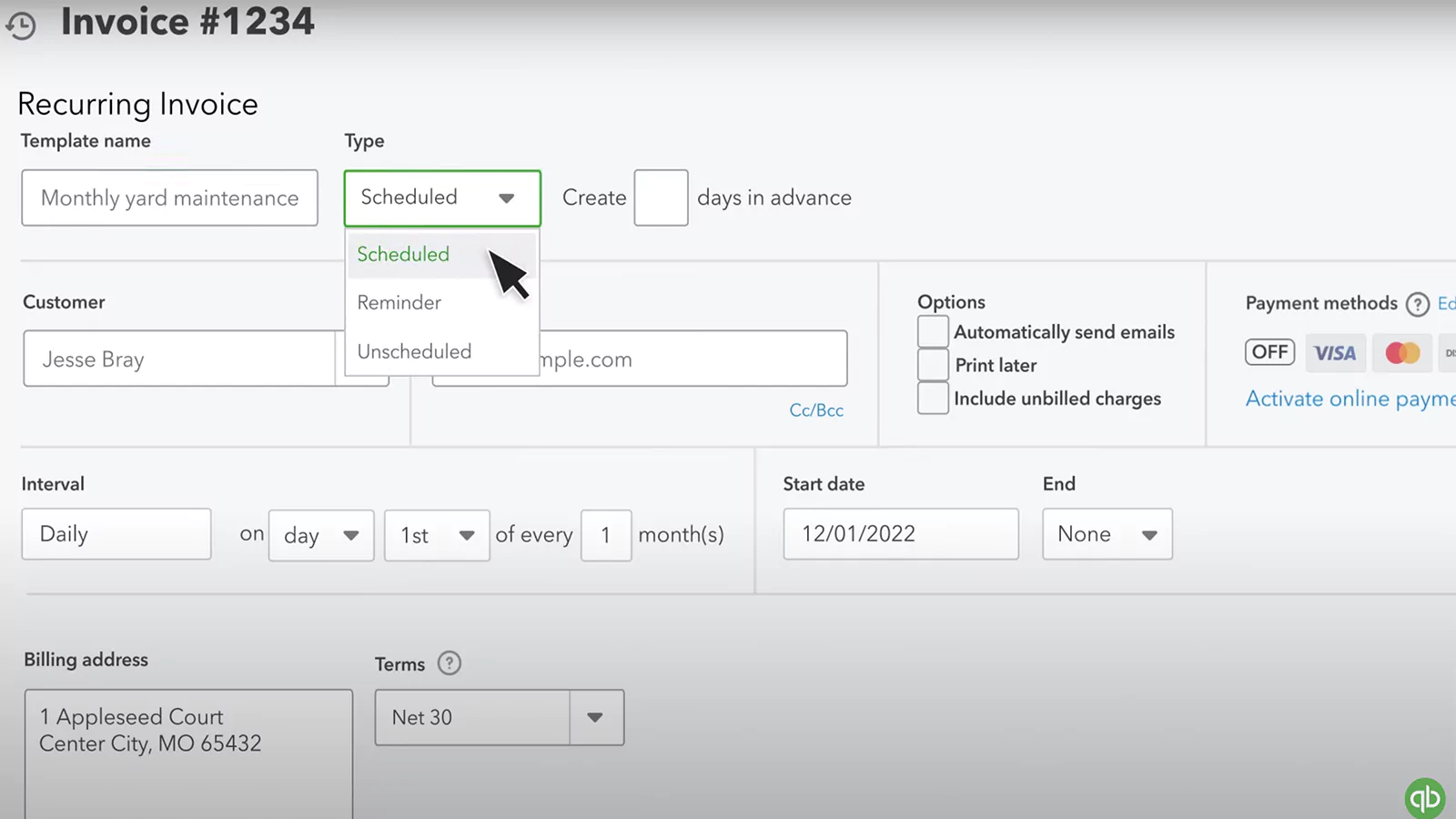

QuickBooks has incorporated automation into its software to improve the efficiency of accounting processes. For example, the software can automatically categorize transactions and reconcile bank statements. It can also automate the creation of invoices and other financial reports. QuickBooks’ invoicing automation feature allows users to set up recurring invoices and payment reminders, saving hours of work time.

Artificial Intelligence (AI) and Machine Learning (ML)

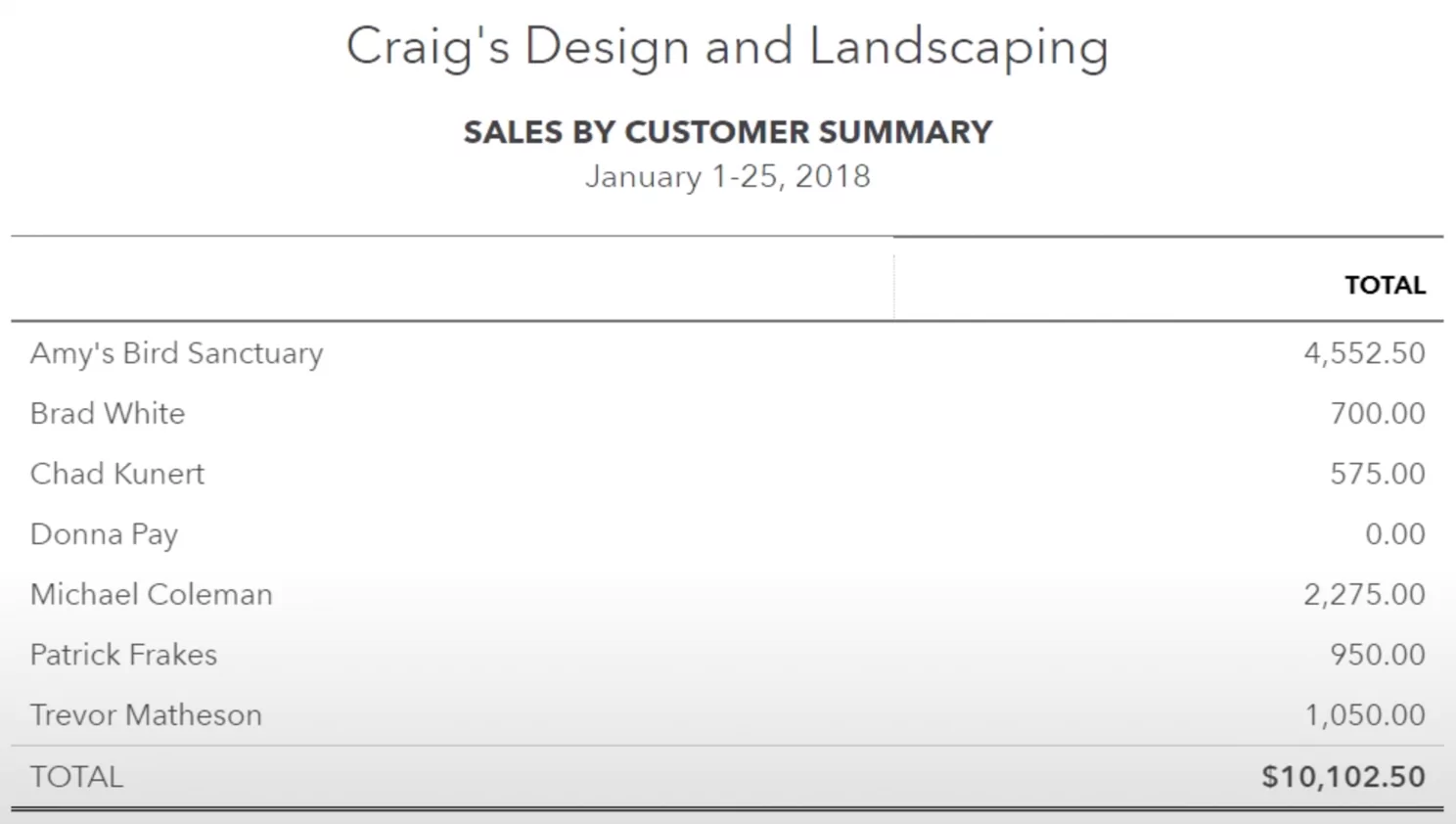

AI and ML are technologies that enable machines to learn and improve from experience without being explicitly programmed. In accounting, AI and ML can be used to analyze data, identify patterns, and provide real-time insights.

The benefits of AI and ML in accounting are similar to those of automation. They save time, reduce errors, and improve efficiency. Additionally, they can provide real-time insights into financial data, allowing businesses to make more informed and accurate decisions.

QuickBooks is investing heavily in AI and ML to improve its software’s capabilities. For example, the software can use AI and ML to analyze financial data and identify discrepancies, such as duplicate transactions or incorrect categorization. It can also use these technologies to provide real-time insights into cash flow, revenue, and expenses.

Cloud-based Accounting

Cloud-based accounting software allows businesses to store and access their accounting data securely online. This means that the software can be accessed from any device with an internet connection (as long as they have the necessary login credentials), making it easier for businesses to manage their finances from anywhere. Cloud-based accounting software also allows multiple users to access the same data simultaneously, making it easier for teams to collaborate and work together.

Cloud-based accounting has massive benefits for businesses, including:

- Accessibility: Cloud-based accounting software can be accessed from anywhere with an internet connection, which makes it easier for businesses to manage their finances on the go.

- Collaboration: Multiple users can access the same data simultaneously, making it easier for teams to collaborate and work together.

- Automatic Updates: Cloud-based software updates automatically, so businesses always have access to the latest features and security updates.

- Cost Savings: Cloud-based accounting software is often less expensive than traditional desktop software, as businesses don’t need to purchase expensive hardware or pay for IT support.

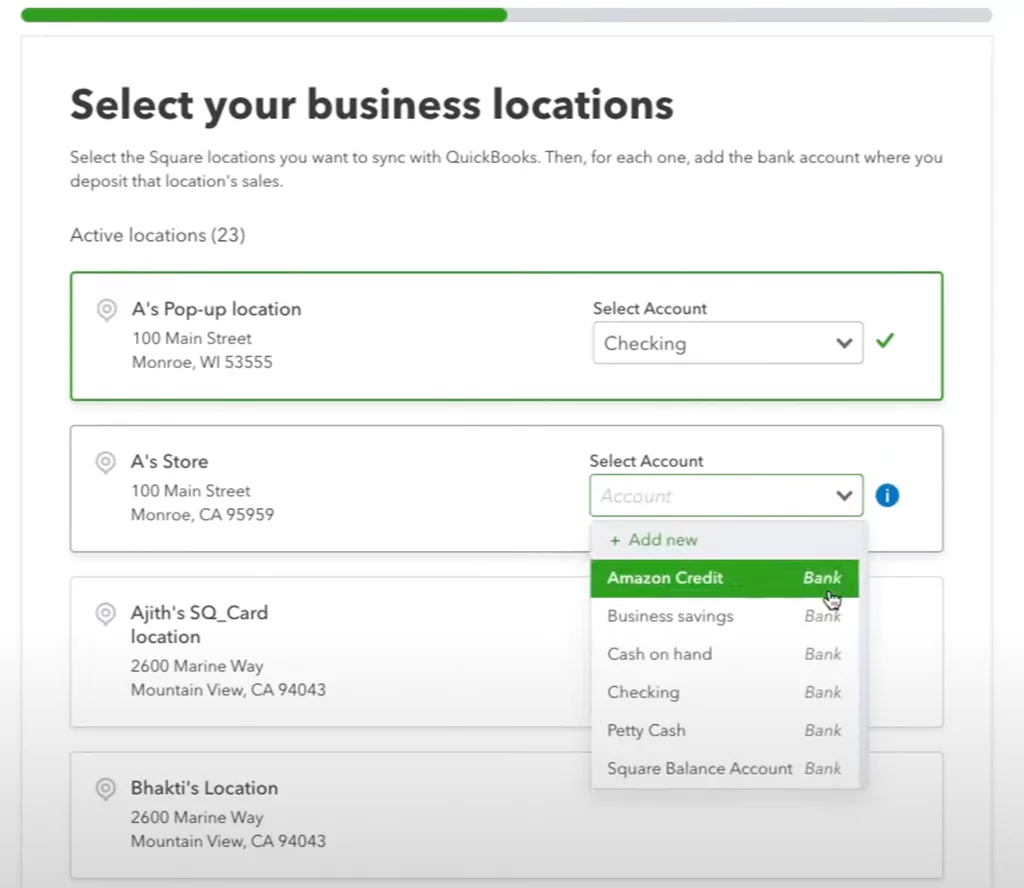

QuickBooks Online is an example of cloud-based accounting software that has gained popularity in recent years. The cloud-based accounting software allows businesses to manage their finances from anywhere with an internet connection. QuickBooks Online offers features such as:

- Cloud Storage: All financial data is stored securely in the cloud, making it accessible from any device with an internet connection.

- Mobile Access: QuickBooks Online can be accessed from any mobile device with their mobile application, which makes it easy for business owners to manage their finances from anywhere.

- Auto Sync: All information is automatically synced across all devices, so multiple users can access the same data, and be sure it is up-to-date.

- Automatic Updates: QuickBooks Online updates automatically, so businesses always have access to the latest features and security updates.

Mobile Accounting

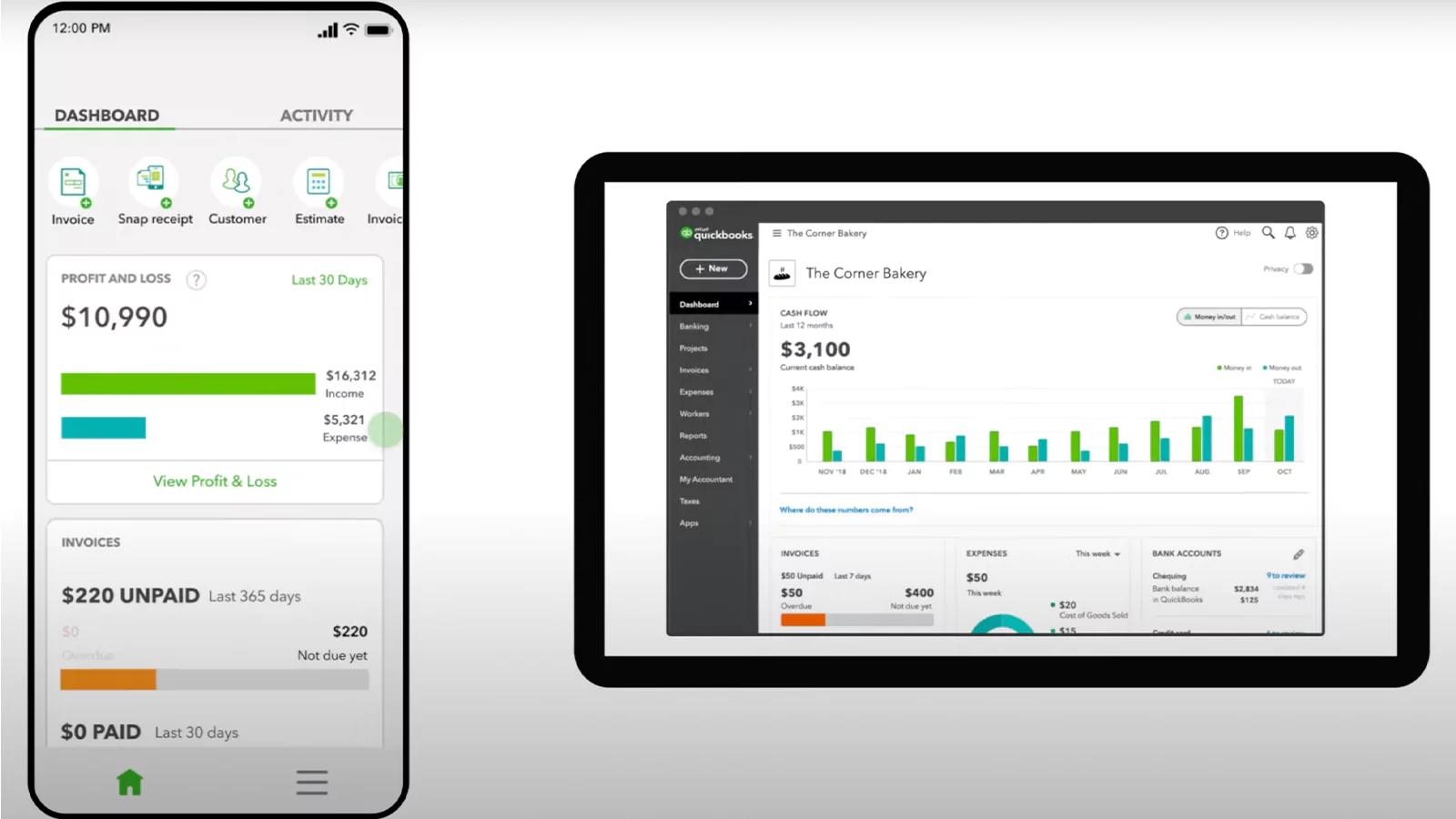

Mobile accounting software allows businesses to manage their finances from their mobile devices. This means that business owners can access their financial data on the go, which can be particularly useful for businesses with employees who work remotely or travel frequently. Mobile accounting software also allows businesses to keep track of their finances in real time, which can help them stay on top of their business at all times, allowing them to make better business decisions.

The QuickBooks Mobile App is an example of mobile accounting software that has gained popularity in recent years. With the QuickBooks mobile app, users can view their account balances, send and track invoices, record expenses, and access customer information from their smartphone or tablet. The app also allows users to take photos of receipts and automatically categorize expenses, which saves time and reduces errors.

Additionally, the QuickBooks mobile app offers a feature called “Mileage Tracking” that uses GPS to automatically track and categorize business mileage. This feature can save businesses money by accurately tracking deductible mileage for tax purposes. The app also allows users to create and send estimates, capture and attach photos to transactions, and view and pay bills on the go. With the increasing popularity of mobile devices, mobile accounting software like QuickBooks Mobile App is becoming more essential for businesses to manage their finances efficiently and stay competitive in today’s fast-paced market.

Blockchain Technology

Blockchain is a distributed ledger technology that allows multiple parties to maintain a single source of truth. It has the potential to revolutionize the accounting industry by creating a more transparent and efficient way of managing financial transactions. The use of blockchain technology in accounting has led to increased transparency, accuracy, and security. By leveraging blockchain technology, accountants can securely store financial data and automate complex transactions, reducing the potential for fraud and error.

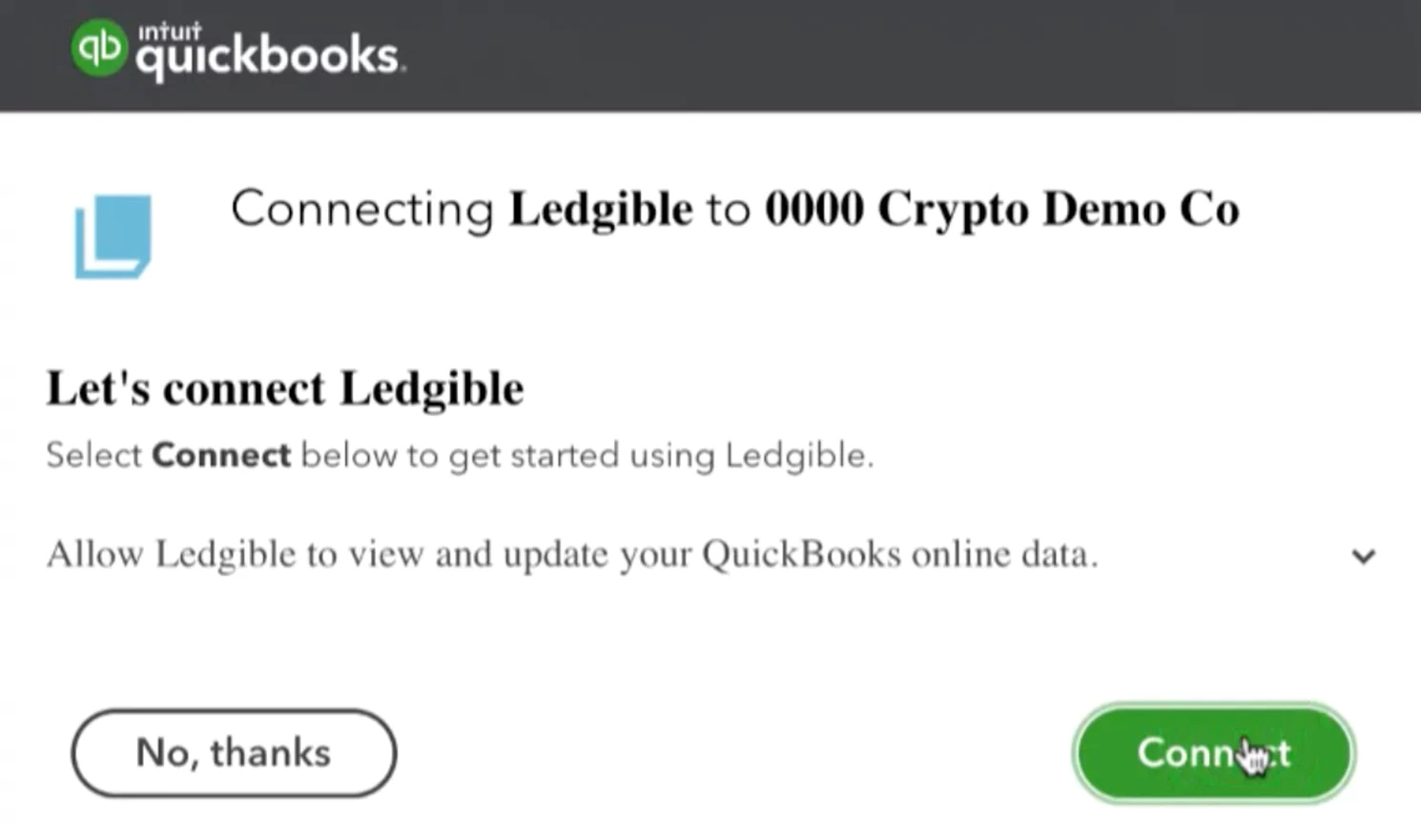

QuickBooks is exploring the potential of blockchain technology and has partnered with companies such as Ledgible and Blockpath to offer blockchain-based solutions to its users. Ledgible allows users to track and manage cryptocurrency transactions, while Blockpath offers a blockchain-based accounting platform that allows users to manage their financial transactions in a secure and transparent way.

The integration of blockchain technology into QuickBooks accounting software will offer businesses greater security and transparency while reducing the risks associated with fraud and error. By using a distributed ledger system, QuickBooks is able to eliminate the need for intermediaries in transactions, reduce processing times, and minimize the risk of data loss or manipulation.

In addition to enhancing the security and accuracy of accounting data, the use of blockchain technology can also improve audit and compliance processes. With blockchain-based accounting software, transactions are recorded and verified on a decentralized ledger, making it easier for auditors to access and verify financial data.

Cybersecurity

As the use of technology in accounting continues to grow, cybersecurity is becoming an increasingly important concern. Cyber attacks can have devastating consequences for businesses, including the loss of sensitive financial information and the theft of funds. It is important for businesses to take steps to protect their financial data and ensure that their accounting software is secure.

QuickBooks has a comprehensive security program that encompasses multiple layers of protection for its users. The program includes secure data centers, firewalls, intrusion detection and prevention systems, as well as vulnerability scanning and testing. QuickBooks also adheres to industry-standard security practices and undergoes regular third-party security audits to ensure that its security measures are up to par.

Furthermore, QuickBooks provides its users with guidance and resources to help them safeguard their financial data. This includes tips on creating strong passwords, recognizing phishing scams, and staying vigilant against potential threats. Additionally, QuickBooks offers training and certification programs to help its users become more knowledgeable about cybersecurity best practices.

With these robust cybersecurity measures in place, QuickBooks provides businesses with peace of mind when it comes to the protection of their financial data.

Conclusion

The future of accounting software is bright, with new technologies and trends emerging that have the potential to transform the accounting industry. QuickBooks is at the forefront of these changes, embracing automation, artificial intelligence, cloud-based solutions, mobile accounting, blockchain technology, and cybersecurity to provide its users with the most advanced and efficient accounting software possible.

As businesses continue to rely on technology to manage their finances, the demand for accountants who are knowledgeable about these new technologies will continue to grow. By embracing these changes and staying up-to-date with the latest trends and technologies, accountants can position themselves for success in the years to come.

For those interested in experiencing the future of accounting software, QuickBooks Online is a great option. With its powerful features and innovative solutions, QuickBooks Online is a leading accounting software solution that is sure to meet the needs of businesses of all sizes, now and in the future.