Worldpay vs Square POS (2025): Which Point of Sale and payment system is better for small businesses?

Choosing between Worldpay and Square POS comes down to one big question — do you want a simple, modern point-of-sale system that works out of the box, or a traditional payment processor with more customization?

Square POS is known for its all-in-one platform, which enables small businesses to accept payments, track sales, and manage inventory easily.

Worldpay (now part of FIS Global) is a long-established payment processor that works with many POS systems and banks to offer flexible payment solutions for larger or more complex businesses.

This comparison breaks down everything small business owners need to know — from pricing and hardware to ease of use and scalability — to help you decide which system fits your business best in 2025.

Key points (quick summary)

- Square POS is an all-in-one POS and payment system built for small businesses — easy to set up, free to start, and no contracts required.

- Worldpay is a global payment processor offering tailored solutions for medium to large businesses and enterprises.

- Square provides its own POS software, hardware, and flat-rate pricing.

- Worldpay integrates with third-party POS systems, offers custom pricing, and requires a contract.

- Square is ideal for small shops, cafés, and service providers. Worldpay is better for businesses with high sales volume or complex billing needs.

Market position & ideal use cases

Square POS

- Built for small to medium-sized businesses that need a simple setup and transparent pricing.

- Works best for retailers, salons, cafés, food trucks, and pop-up shops.

- Offers both payment processing and point-of-sale software in one system.

Worldpay

- Designed for medium to large businesses that process high transaction volumes.

- Commonly used by hotels, restaurants, franchises, and online retailers.

- Acts primarily as a payment processor, integrating with other POS platforms like Clover, Lightspeed, or Micros.

In short:

- Square = simplicity and affordability.

- Worldpay = flexibility and enterprise-level payment processing.

Quick comparison table: Worldpay vs Square POS features

|

Feature |

Square POS | Worldpay |

| Best for | Small to midsize businesses |

Medium to large businesses |

| Starting price | Free plan available | Custom quote only |

| Contracts | No contract, cancel anytime | Typically 12–36 month contracts |

| Processing fees | Flat 2.6% + 10–15¢ | Custom rates (usually lower for high volume) |

| Hardware | Square Reader, Terminal, Register | Works with many third-party POS systems |

| POS software | Built-in Square POS app | No native POS — integrates with others |

| Setup & ease of use | Plug-and-play, easy setup | Requires onboarding with a sales rep |

| Support | 24/7 phone & chat | 24/7 support via account manager |

| Ideal industries | Retail, food, beauty, services | Hospitality, enterprise retail, eCommerce |

Takeaway:

Square is plug-and-play.

Worldpay is powerful but requires setup help.

Hardware & device options

Square hardware

- Square Reader for contactless and chip payments ($49).

- Square Terminal (all-in-one card machine).

- Square Register (full touchscreen POS).

- Works with iPads, cash drawers, and printers.

Worldpay hardware

- Uses payment terminals from Verifone, Ingenico, or PAX.

- Compatible with most third-party POS systems (like Clover or Micros).

- Hardware depends on which POS partner or setup you choose.

Verdict:

Square offers its own easy, affordable hardware.

Worldpay lets you pick from a wider range but requires more setup coordination.

Core features & capabilities

Square POS

- Take in-person, online, or mobile payments.

- Track sales, inventory, and taxes automatically.

- Manage customer data and digital receipts.

- Add features like payroll, loyalty, or online booking.

- Free POS app included with all accounts.

Worldpay

- Accepts payments across multiple channels — in-store, online, phone, and recurring billing.

- Provides fraud protection and global currency processing.

- Integrates with other POS systems and shopping carts.

- Customizable merchant accounts with different fee structures.

Verdict:

Square offers a ready-to-use solution for daily business.

Worldpay is more technical and suited for high-volume or multi-channel processing.

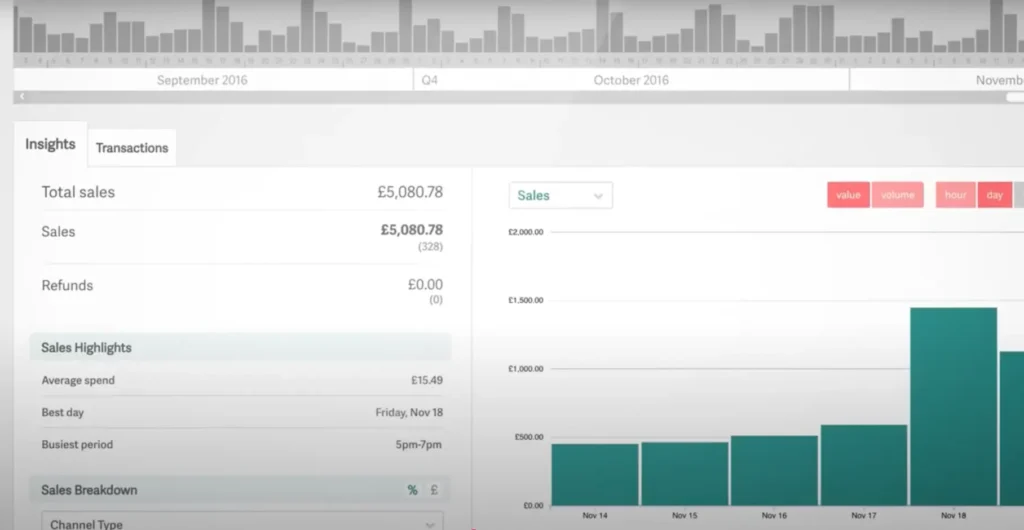

Reporting, analytics & insights

Square POS

- Built-in dashboard for daily sales, best-selling items, and customer activity.

- Simple performance graphs and inventory reports.

Worldpay

- Transaction-level reporting via the Worldpay Dashboard.

- Advanced financial summaries for multi-location businesses.

- Can integrate with external analytics tools (depending on POS used).

In short:

Square is easier to understand and use daily.

Worldpay provides more complex data for accounting and finance teams.

Integrations & connected tools

Square integrations

- QuickBooks & Xero – Accounting and reconciliation.

- Wix, Weebly, WooCommerce – Online store setup.

- DoorDash & Uber Eats – Delivery services.

- Mailchimp – Email and marketing campaigns.

- Square App Marketplace – Hundreds of add-ons for loyalty, scheduling, and more.

Worldpay integrations

- POS Systems: Clover, Micros, Lightspeed, Oracle, NCR Silver.

- eCommerce Platforms: Shopify, Magento, BigCommerce, WooCommerce.

- Accounting Tools: QuickBooks, Sage, Xero.

- Security Tools: Fraud detection and chargeback protection.

Takeaway:

Square’s ecosystem is easier for small businesses.

Worldpay connects to more enterprise-grade tools.

Automation & smart features

- Square: Automates receipts, inventory updates, low-stock alerts, and daily summaries.

- Worldpay: Automates settlements, recurring billing, and multi-currency processing.

Verdict:

Square automates daily tasks.

Worldpay automates complex payment workflows.

| Square POS | Worldpay | |

| Software cost | Free core POS | Varies (based on POS partner) |

| Processing fees | 2.6% + 10–15¢ (in-person) | Custom (usually 1.5–2.9%) |

| Hardware | $49–$799 | Custom quote (varies by provider) |

| Contracts | None | 12–36 months |

| Hidden fees | None | Possible termination or monthly fees |

Summary:

Square’s pricing is predictable and great for startups.

Worldpay offers lower rates at scale but comes with contracts and complexity.

Support & reliability

Square support

- 24/7 chat and phone support.

- Help center and community forums.

- Fast setup and self-service troubleshooting.

![]()

Worldpay support

- 24/7 phone support and dedicated account managers.

- Onboarding for enterprise and multi-location clients.

- Reliable uptime and payment processing SLA.

Verdict:

Square is easy to start and self-manage.

Worldpay offers more hands-on support for enterprise accounts.

Scalability & multi-location management

- Square: Ideal for small or growing businesses; multi-location features are simple and affordable.

- Worldpay: Built for enterprise scaling, multi-country transactions, and customized setups.

In short:

If you’re expanding locally, use Square.

If you’re expanding globally, use Worldpay.

Real-world examples

- Local coffee shops: Can use Square POS for in-person sales and loyalty rewards.

- Retail chain: Can use Worldpay for custom payment processing and multiple POS integrations.

- Food truck or pop-up: Would find Square POS easier to start immediately.

- Hotel or franchise: Worldpay supports multiple outlets and currencies.

Final verdict & recommendation table

| Factor | Best choice | Why |

| Small/local business | Square | Free, easy setup, no contract |

| High-volume business | Worldpay | Lower custom rates for large volume |

| Ease of use | Square | All-in-one platform |

| Customization | Worldpay | Integrates with multiple POS systems |

| Short-term flexibility | Square | Month-to-month, cancel anytime |

| Enterprise scalability | Worldpay | Handles global transactions |

| Hardware simplicity | Square | Comes with its own POS devices |

Summary:

Square wins for simplicity and transparency.

Worldpay wins for scale and flexibility — but requires more setup and commitment.

FAQs – Worldpay vs Square POS (2025)

- Which system is cheaper for small businesses?

Square POS, because it has no monthly fees and simple flat-rate processing. - Does Worldpay have a free plan?

No. Worldpay requires a quote and usually a contract. - Which is easier to set up?

Square, which can be up and running in minutes.

Worldpay setup takes longer and usually needs a rep. - Which offers better rates for large businesses?

Worldpay. Its custom pricing lowers costs for higher transaction volumes. - Can both systems accept online payments?

Yes — both support eCommerce, but Square’s online tools are easier to use. - Which works better for restaurants?

Square for small cafés or food trucks; Worldpay for large restaurants or franchises using third-party POS systems. - Are there long-term contracts?

Square: No.

Worldpay: Yes, usually 12–36 months.

Final word: Which payment system should you choose?

If you’re a small business owner who wants an easy-to-use, all-in-one POS system, go with Square POS. It’s affordable, transparent, and ready to use right away.

If you’re a larger business or need a custom setup that works with multiple POS systems, Worldpay is a better choice. It offers lower rates for big transactions, more payment flexibility, and dedicated support.

In summary:

👉 Choose Square if you want simplicity and freedom.

👉 Choose Worldpay if you need power, customization, and scalability.