Avoiding Payroll Processing Mistakes; Tips for Small-Medium Sized Businesses

Payroll processing is an essential part of any business operation, particularly for small-medium businesses (SMBs), that has employees or contractors working for it. Payroll processing involves calculating and distributing employee compensation, including salaries, wages, bonuses, and benefits.

Accurate payroll processing is critical for SMBs for several reasons. Firstly, it ensures that employees are paid correctly and on time, which is essential for maintaining employee morale and productivity. Secondly, accurate payroll processing helps businesses comply with local, state, and federal laws and regulations, reducing the risk of legal issues and penalties. Finally, accurate payroll processing helps SMBs manage their finances more effectively by keeping track of labor costs and expenses.

Because of its complexity of it, payroll processing mistakes are very common, and they can have significant consequences for businesses. The good news is that modern payroll processing solutions like Intuit QuickBooks Payroll can help businesses avoid these mistakes and streamline their entire payroll process.

In this article, we will discuss the most common payroll processing mistakes made by SMBs and discuss how QuickBooks Payroll can help businesses avoid them. We will also provide specific tips for using QuickBooks Payroll to optimize payroll processing and improve accuracy.

Common Payroll Processing Mistakes

Mistake #1: Incorrect Calculation of Employee Pay

Incorrectly calculating employee salaries is a common mistake that can have serious consequences. There are a number of ways a mistake in pay calculation can happen, including incorrectly inputting hours worked, hourly rates, and missed overtime. Not only can incorrect calculations lead to extremely unhappy employees, but there can also be legal disputes brought onto the company and even potential tax liabilities.

Mistake #2: Misclassification of Employees

Misclassifying employees can also lead to significant issues for SMBs when it comes to payroll. Misclassifying employees as independent contractors, for example, can result in legal action and significant financial penalties. It’s essential for businesses to correctly classify employees and contractors to avoid these problems.

Mistake #3: Failure to Withhold Taxes

Businesses are required to withhold various taxes, automatically, from employee pay, such as federal and state income tax, Social Security, and Medicare. Failure to withhold these taxes accurately can result in some serious tax liabilities and very nasty (and costly) legal issues that no business wants to deal with.

Mistake #4: Inadequate Record Keeping

Accurate record-keeping is crucial for payroll processing. Inadequate record-keeping can result in missed payments, incorrect tax filings, and legal issues. It’s essential for businesses to maintain accurate and up-to-date payroll records.

Mistake #5: Ignoring Payroll Compliance Regulations

Payroll compliance regulations are constantly changing, and it’s essential for businesses to stay up-to-date in order to avoid legal issues. Failure to comply with these regulations can result in serious consequences, including financial penalties, legal disputes with tax authorities, and damage to a business’s reputation.

Mistake #6: Failing to Keep Track of Sick and Vacation Time Accruals

Many companies offer their employees paid time off, such as sick leave and vacation time. However, failing to accurately track these accruals for each employee can result in either overpaying or underpaying workers. Additionally, some states have specific regulations regarding paid time off that businesses need to comply with to avoid legal issues.

Mistake #7: Not Properly Documenting Employee Time and Attendance

It’s essential for businesses to keep accurate records of employee time and attendance. Failure to do so can lead to incorrect payments, disputes over hours worked, and potential legal issues. Businesses should use a reliable time-tracking system to avoid these potential inputting errors.

Mistake #8: Incorrectly Handling Payroll Taxes for Multi-State Employees

If a business has employees who work in different states, it’s important to understand and comply with each state’s payroll tax laws, as they differ from state to state. Failure to do so can result in incorrect payroll tax withholdings, penalties, and legal disputes.

Mistake #9: Not Taking Advantage of Available Tax Credits and Deductions

There are many tax credits and deductions available to businesses for various payroll expenses, such as research and development, training programs, and hiring certain types of employees. Failing to take advantage of these can result in missed opportunities to save money and potentially reduce tax liabilities.

Mistake #10: Using Outdated Payroll Systems

Outdated payroll systems can lead to inefficiencies, errors, and increased risk of mistakes. Upgrading to a modern, automated payroll system can help businesses avoid these issues and improve accuracy and efficiency.

How QuickBooks Payroll Can Help Avoid Payroll Processing Mistakes

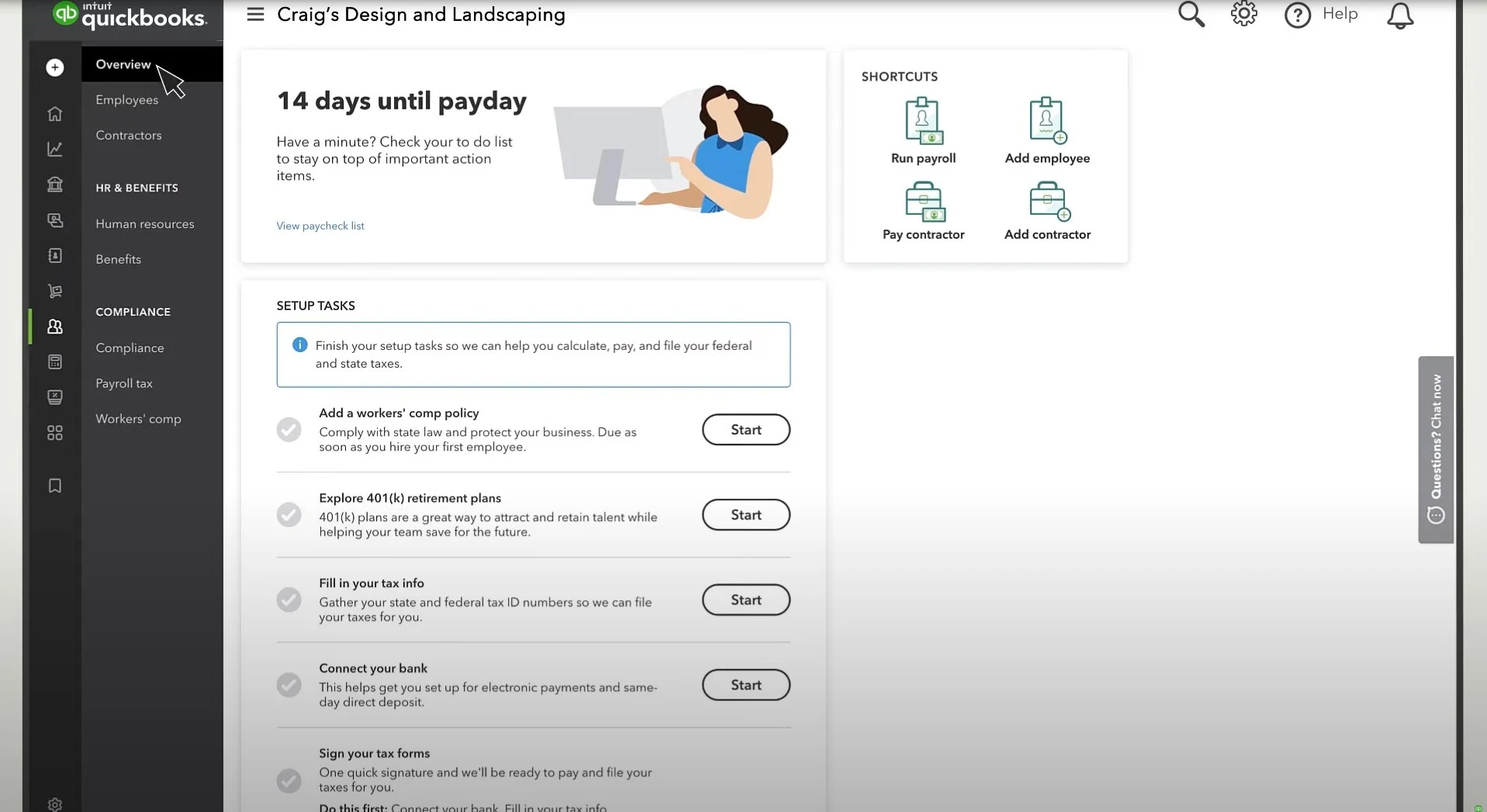

QuickBooks Payroll is a cloud-based payroll processing software that can help SMBs avoid common payroll processing mistakes. QuickBooks Payroll offers the following helpful features that allow businesses to streamline their payroll processes and significantly improve accuracy and efficiency:

Automated Calculations: QuickBooks Payroll can automatically calculate employee pay, including taxes, overtime, and other deductions. This reduces the likelihood of errors and ensures accurate pay for employees.

Classification Assistance: QuickBooks Payroll can assist businesses in correctly classifying employees and contractors, reducing the likelihood of misclassification and potential legal issues.

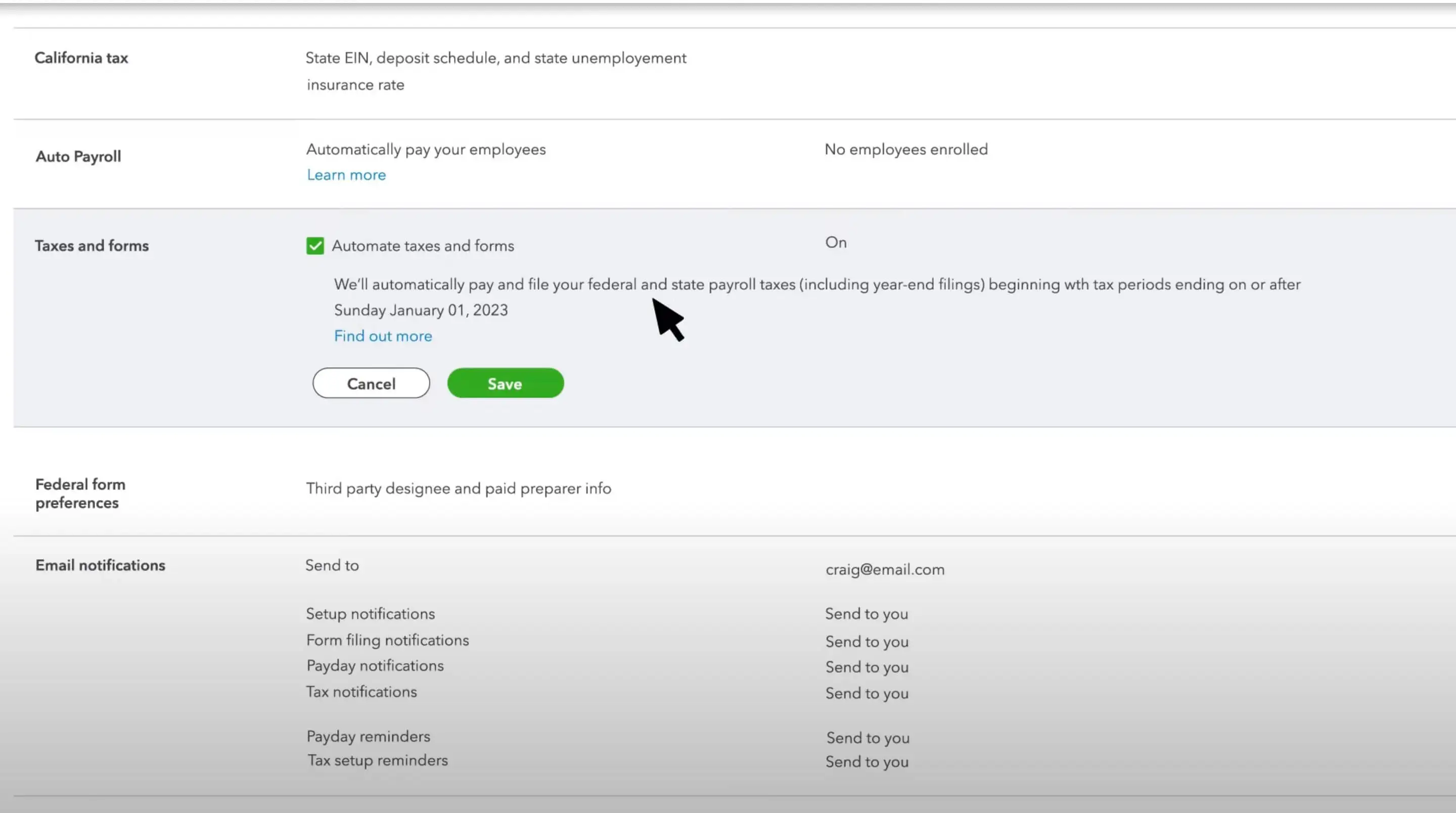

Tax Withholding: QuickBooks Payroll can automatically calculate and withhold taxes from employee paychecks, ensuring compliance with tax laws and reducing the likelihood of tax liabilities.

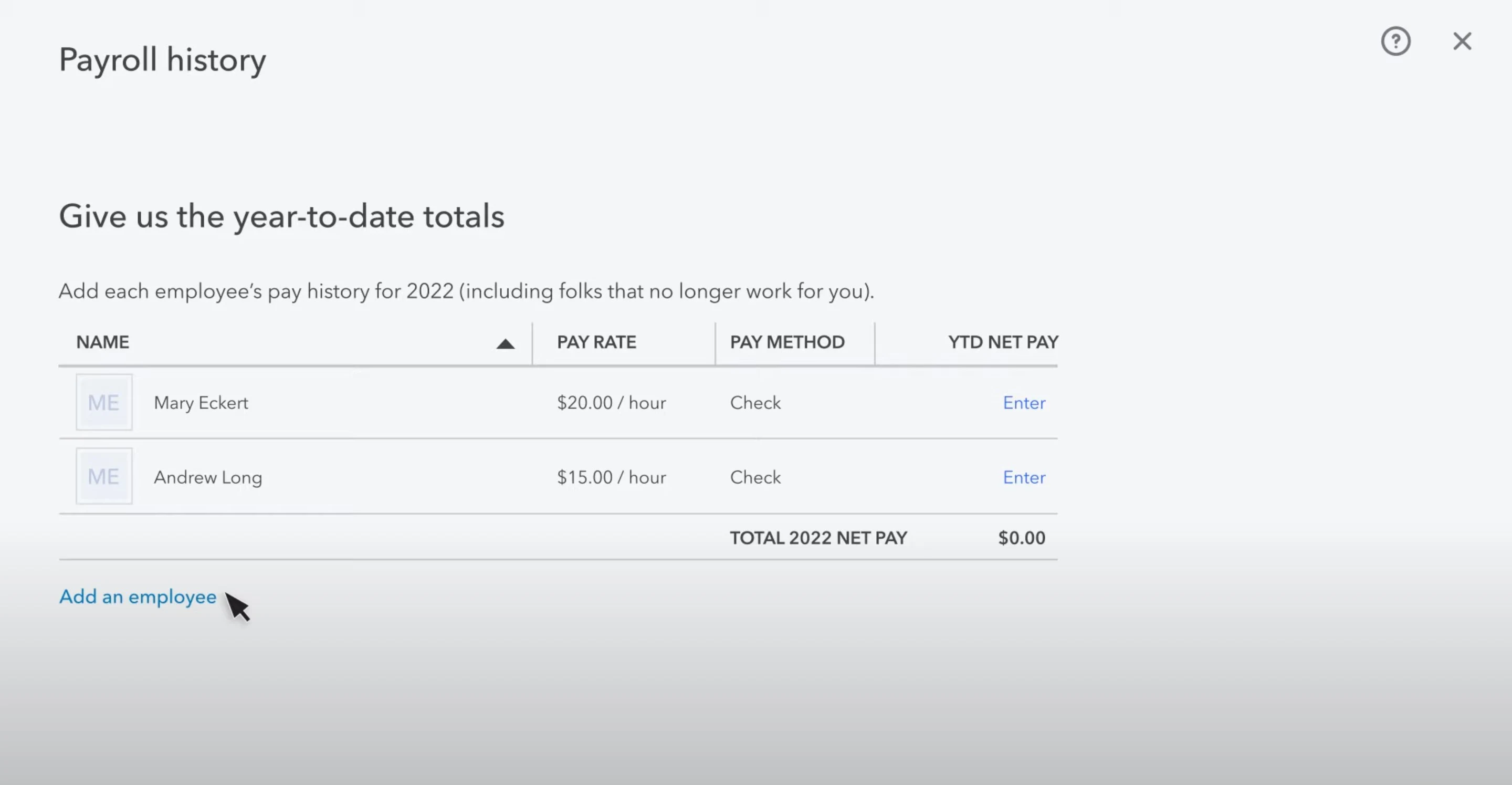

Record Keeping: QuickBooks Payroll can help businesses maintain accurate and up-to-date payroll records, reducing the likelihood of missed payments, incorrect tax filings, and legal issues.

Compliance Assistance: QuickBooks Payroll can help businesses stay up-to-date on payroll compliance regulations, reducing the likelihood of legal issues and financial penalties.

Tips for Avoiding Payroll Processing Mistakes with QuickBooks Payroll

Tip #1: Get Set Up Correctly

Getting set up correctly with QuickBooks Payroll is crucial for accurate payroll processing. It’s essential to input accurate employee information, including hours worked, hourly rates, and other deductions. It’s also crucial to correctly classify employees and contractors.

Tip #2: Use Automated Calculations

QuickBooks Payroll’s automated calculations can reduce the likelihood of errors in payroll processing. Ensure that all employee information is correctly entered, and QuickBooks Payroll will do the rest.

Tip #3: Keep Accurate Records

QuickBooks Payroll can help you keep accurate records of all employee-related transactions, including wage payments, tax deductions, and benefits. This can help you avoid errors related to overpaying or underpaying employees, and ensure that all payroll-related transactions are recorded correctly.

Tip #4: Review Employee Information Regularly

One of the most common payroll processing mistakes is entering incorrect employee information, such as names, addresses, and social security numbers. QuickBooks Payroll allows you to store and review employee information regularly to ensure that it is up-to-date and accurate.

Tip #5: Keep Up-to-Date with Tax Regulations

Tax regulations can change frequently, and it is important to keep up-to-date with these changes to avoid errors related to tax payments. QuickBooks Payroll provides regular updates to ensure that your payroll processing is in compliance with the latest tax regulations.

Tip #6 Utilize Payroll Reports

QuickBooks Payroll provides a variety of payroll reports that can help you identify potential errors and discrepancies in your payroll processing. These reports can help you quickly identify and correct any errors before they become more significant problems.

Best Practices for Using QuickBooks Payroll to Optimize Payroll Processing

Set up payroll correctly: The first step in optimizing your payroll processing with QuickBooks Payroll is to ensure that you have set up your payroll correctly. This includes entering accurate employee information, setting up pay rates, and ensuring that tax calculations are correct.

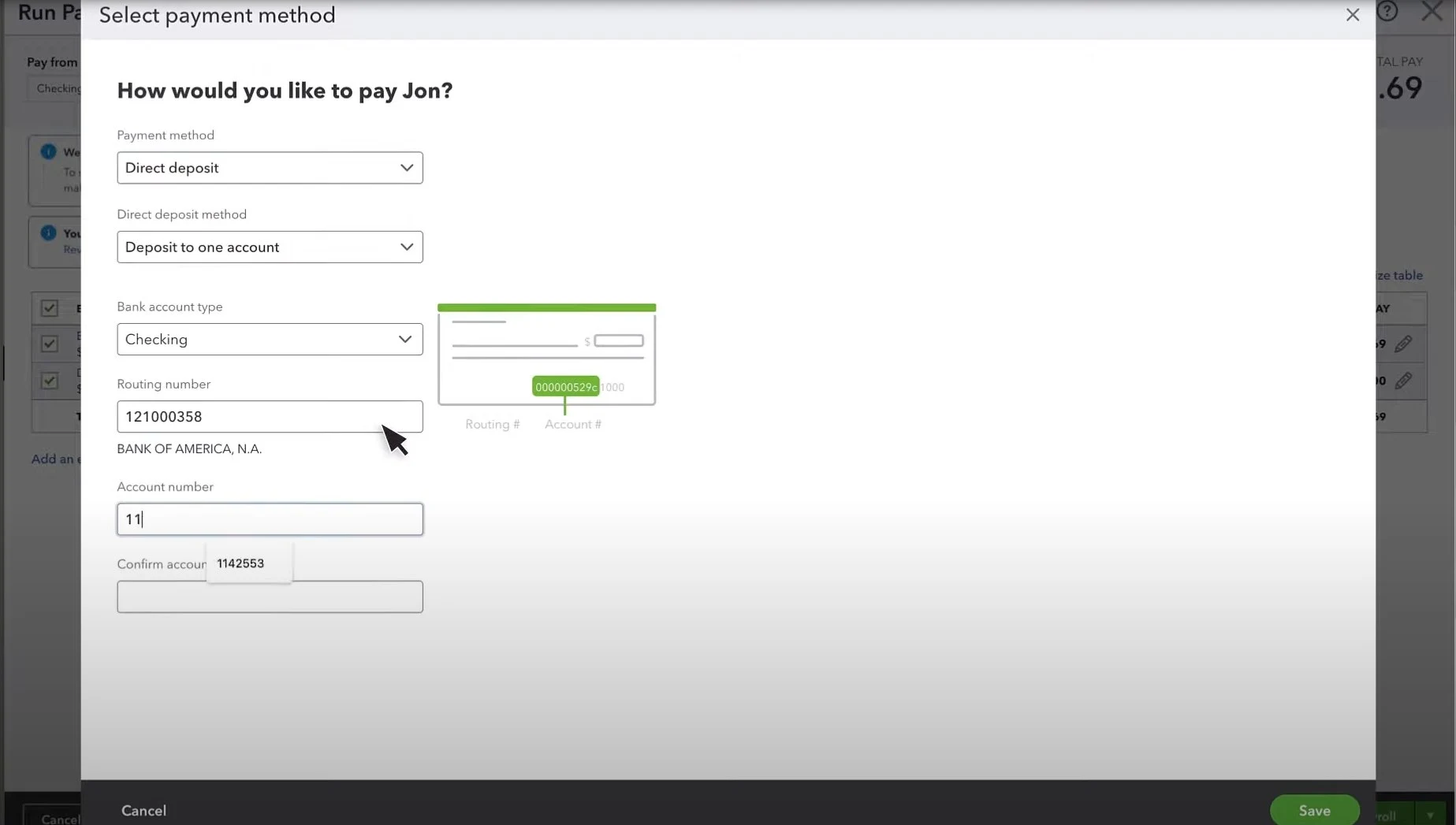

Use direct deposit: Direct deposit can help you save time and reduce the risk of errors related to paper checks. QuickBooks Payroll allows you to set up direct deposit for your employees, which can help you ensure that all payments are made accurately and on time.

Review payroll regularly: It is important to review your payroll processing regularly to ensure that it is accurate and up-to-date. QuickBooks Payroll provides a variety of reports that can help you quickly identify any errors or discrepancies in your payroll processing.

Keep up-to-date with tax regulations: As mentioned earlier, tax regulations can change frequently, and it is important to keep up-to-date with these changes to ensure that your payroll processing is in compliance with the latest regulations.

Seek help when needed: QuickBooks Payroll provides support services to help you with any questions or issues related to your payroll processing. If you are unsure about how to use a particular feature or need assistance with a specific issue, don’t hesitate to contact the QuickBooks Payroll support team for help.

Conclusion

Small-medium businesses must prioritize accurate and efficient payroll processing to avoid costly mistakes that can impact their financial health and reputation. By utilizing QuickBooks Payroll and implementing the tips and best practices outlined in this article, businesses can minimize the risk of errors and streamline their payroll processing.

Switching to QuickBooks Payroll can provide businesses with a modern, automated payroll system that can help them save time and reduce the likelihood of mistakes. By switching to QuickBooks Payroll, small-medium businesses can reevaluate their current payroll processing methods and optimize and streamline their payroll processing to ensure accuracy and efficiency and avoid costly mistakes.