High-Risk Merchant Account Fees and Pricing

Merchant accounts are essential for businesses to accept credit card payments, enabling seamless transactions between customers and financial institutions. All merchant accounts — whether standard or high-risk — come with associated fees, including transaction charges and account maintenance costs. However, businesses in high-risk industries like e-commerce, CBD, or travel often face additional fees due to elevated chargeback rates, fraud risks, and stricter compliance requirements.

While these higher costs can impact profitability, high-risk merchant accounts provide valuable tools like chargeback management, fraud prevention, and secure payment processing, which are critical for maintaining operational stability.

This guide explores the fees tied to high-risk accounts, why they differ from standard accounts, and actionable strategies to reduce costs while supporting business growth.

What Is a Merchant Account?

A merchant account is a type of bank account that enables businesses to accept payments through credit cards, debit cards, and other electronic payment methods. When a customer makes a purchase using a card, the merchant account acts as an intermediary, ensuring the transaction is authorized, processed, and settled securely. The funds are then transferred from the customer’s issuing bank to the merchant’s account.

For most businesses, a merchant account is essential for processing credit card payments, supporting e-commerce sales, and maintaining customer trust. However, not all merchant accounts are the same. Businesses operating in industries with higher risks often require a specialized high-risk merchant service.

What Is Considered a Risky Industry?

Payment processors categorize certain industries as “high risk” based on factors like chargeback frequency, fraud potential, and regulatory challenges. Businesses in these industries typically require high-risk merchant accounts to mitigate these challenges and continue accepting payments securely.

Examples of High-Risk Industries:

- E-commerce businesses: Online transactions are prone to fraud and chargebacks due to the lack of in-person verification.

- Subscription services: Recurring billing models can lead to disputes if customers forget about or misunderstand terms.

- Travel and hospitality: Frequent cancellations and high transaction values increase the risk of disputes.

- CBD and supplement sales: Regulatory complexities and strict compliance requirements categorize these businesses as high-risk.

- Adult entertainment: High chargeback rates and sensitive transactions place these businesses in the high-risk category.

- Gaming and betting: Online gaming and gambling face heightened fraud risks and regulatory scrutiny.

What Are High-Risk Merchant Account Fees?

High-risk merchant accounts come with fees designed to offset the risks associated with industries prone to chargebacks, fraud, and regulatory complexities. These accounts differ from standard merchant accounts because they require additional safeguards to ensure secure and reliable payment processing.

Why Do High-Risk Accounts Cost More?

- Fraud risk: High-risk industries like e-commerce or subscription services face elevated fraud potential, leading to more disputes.

- Chargebacks: Frequent chargebacks increase the administrative and financial burden on payment processors.

- Regulatory compliance: Industries like CBD or travel require stricter oversight, increasing providers’ operational costs.

Types of Fees You Can Expect

While specific costs vary by provider, typical charges include:

- Transaction fees

- Chargeback fees

- Rolling reserves

- Monthly maintenance fees

These tools protect businesses from potential financial losses and help maintain operational stability.

Breakdown of Common Fees for High-Risk Merchant Accounts

To better understand the pricing of high-risk merchant accounts, let’s explore each fee in detail, including its purpose and average costs:

- Setup fees: These are one-time costs for account activation, typically ranging from $500 to $1,000. These fees cover onboarding, fraud detection configuration, and compliance checks.

- Transaction fees: A percentage of each sale, averaging 3%–5%, with an additional flat fee of $0.10–$0.30 per transaction. Due to the increased risk processors face, these fees are higher than those for standard merchant accounts.

- Chargeback fees: High-risk accounts incur fees of $20–$50 per chargeback. These fees compensate processors for handling disputes and administrative tasks.

- Rolling reserves: Processors may hold 5%–15% of monthly sales for 90–180 days to cover potential chargeback losses. This practice ensures that funds are available for disputed transactions.

- Monthly fees: Providers charge $10–$100 monthly for account maintenance, reporting tools, and customer support.

- PCI compliance fees: Annual charges of $20–$100 to ensure businesses meet Payment Card Industry Data Security Standards (PCI DSS).

- Hidden costs: Some providers include early termination fees, statement fees, or annual account fees, which may not be disclosed upfront.

By understanding these fees, businesses can better evaluate providers and select cost-effective options that suit their needs.

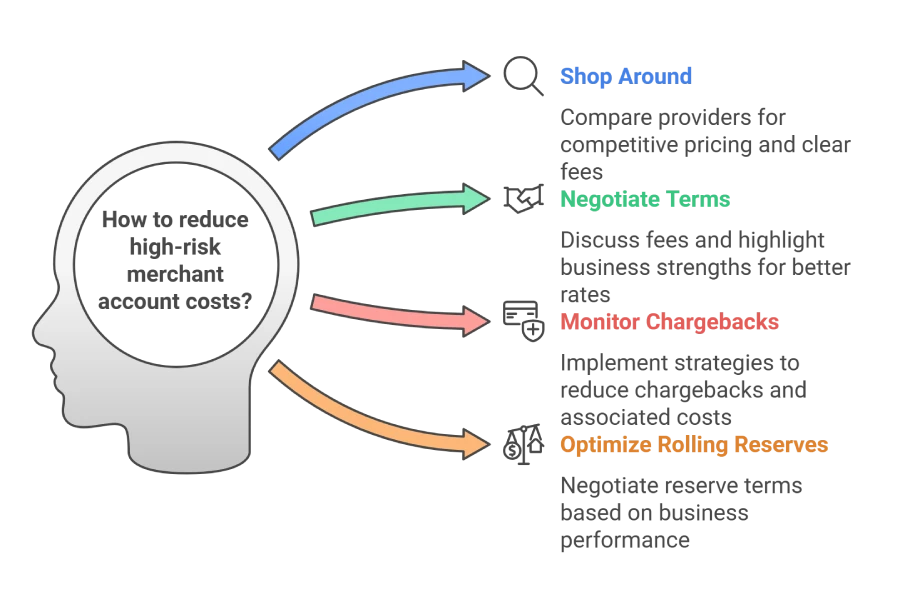

Tips for Reducing High-Risk Merchant Account Costs

Managing costs effectively is crucial for small businesses relying on high-risk merchant services. While these accounts come with inherently higher fees, businesses can take proactive steps to negotiate better terms, minimize unnecessary expenses, and optimize their overall payment processing costs.

1. Shop Around for Transparent Providers

Not all providers charge the same rates or include hidden fees. Compare multiple high-risk payment processors to find one that offers competitive pricing and clear fee structures. Look for providers specializing in your industry, as they will likely offer tailored solutions at fair rates.

2. Negotiate Terms

Many fees, such as setup costs, rolling reserve percentages, and annual charges, can be negotiated. When discussing terms with a provider, highlight your business’s strengths, such as consistent transaction volume or low chargeback ratios, to secure better rates.

3. Monitor and Minimize Chargebacks

Chargebacks are one of the biggest cost drivers for high-risk merchant accounts. To reduce chargebacks:

- Use clear billing descriptors to prevent confusion.

- Provide excellent customer service to resolve issues before disputes escalate.

- Implement fraud prevention tools like AVS (Address Verification Service) and 3D Secure.

4. Optimize Rolling Reserves

While rolling reserves are often non-negotiable, some providers may agree to lower percentages or shorter holding periods based on your business’s performance. Maintaining low chargeback ratios and stable transaction patterns can strengthen your case for better reserve terms.

5. Bundle Services for Discounts

Some providers offer bundled packages that include payment gateways, POS systems, and fraud prevention tools at a discounted rate. Bundling services not only reduces costs but also simplifies payment management.

6. Avoid Hidden Fees

Carefully review contracts for hidden costs such as early termination or statement fees. Opt for providers with transparent policies and negotiate to eliminate unnecessary charges.

7. Leverage Transaction Volume

If your business processes a high volume of transactions, use this as leverage to negotiate lower transaction fees. Providers are often willing to offer volume-based discounts to secure your business.

8. Stay PCI Compliant

Non-compliance with PCI DSS standards can result in monthly penalties. By meeting compliance requirements, businesses avoid fines and strengthen data security and customer trust.

Maximizing Value While Reducing Costs

By implementing these strategies, businesses can optimize their high-risk payment processing fees, improve cash flow, and enhance their financial health. With a proactive approach to cost management, high-risk businesses can focus on growth and delivering exceptional value to their customers.

High-Risk vs. Standard Merchant Accounts Compared

High-risk and standard merchant accounts serve the same purpose: Enabling businesses to accept and process credit card payments. However, the costs, terms, and features of these accounts differ significantly due to the varying levels of risk associated with the industries they serve.

Understanding these differences helps small businesses evaluate the value of a high-risk merchant account and make informed decisions.

Key Differences Between High-Risk and Standard Merchant Accounts

|

Feature |

High-Risk Merchant Accounts |

Standard Merchant Accounts |

|

Transaction Fees |

3%–5% per transaction plus $0.10–$0.30 |

1.5%–2.9% per transaction plus $0.10–$0.25 |

|

Chargeback Fees |

$20–$50 per chargeback |

$10–$20 per chargeback |

|

Rolling Reserves |

5%–15% of monthly sales held for 90–180 days |

Rarely required |

|

Setup Fees |

$500–$1,000 |

$0–$500 |

|

Approval Requirements |

Stringent checks focusing on industry, transaction volume, and chargeback history |

Simple approval process |

|

Fraud Prevention |

Advanced tools like Address Verification Services (AVS) and 3D Secure authentication |

Basic fraud detection tools |

|

Compliance Support |

Comprehensive guidance for PCI and regulatory compliance |

Minimal compliance support |

Are High-Risk Accounts Worth the Cost?

While high-risk merchant accounts come with higher fees, they provide essential services like chargeback management, fraud prevention, and advanced analytics. For businesses in high-risk industries, these accounts are not just a necessity—they’re a safeguard against operational disruptions.

Recommended High-Risk Merchant Service Providers

247Payments: Secure and reliable merchant services for businesses of all sizes.

North Payments: Dependable and efficient payment processing for businesses.

Merchant One: Secure payment processing tailored to your business needs.

Factors That Influence Pricing for High-Risk Merchant Accounts

The pricing for high-risk merchant accounts depends on several key factors that reflect the risks and challenges of the industries they serve. Understanding these influences helps businesses make informed decisions and negotiate better terms with providers.

1. Industry Type

Certain industries, such as online gambling, CBD sales, or subscription services, are labeled high-risk due to frequent chargebacks, higher fraud rates, and regulatory complexities. These risks drive providers to charge higher fees to safeguard their operations.

- For instance, an e-commerce store typically faces lower fees than a gambling platform due to differences in chargeback exposure, even though both these industries are considered “high-risk.”

2. Transaction Volume

Businesses with higher transaction volumes may qualify for lower per-transaction fees. Providers are often willing to offer discounts to high-risk merchants who process significant monthly sales, as larger volumes help offset risk.

- A subscription box service with steady monthly payments may negotiate lower fees compared to a seasonal tour operator that sees large fluctuations in sales throughout the year.

3. Chargeback Ratios

A business’s chargeback history directly impacts fees. High chargeback ratios signal greater risk to processors, leading to increased transaction fees and stricter terms like rolling reserves.

- A gaming website offering in-app purchases may face higher fees if users frequently dispute charges, whereas a fitness club with a transparent cancellation policy might keep its ratios low and enjoy better terms.

4. Rolling Reserves

Providers often withhold a percentage of monthly sales as a rolling reserve to mitigate potential losses from disputes. This reserve typically ranges from 5% to 15% of monthly transactions and is held for 90 to 180 days.

- A vape retailer with high dispute rates might have a 10% rolling reserve, while a long-established e-commerce platform with a good track record could negotiate a 5% reserve and faster release periods.

5. Compliance Requirements

High-risk industries often face stricter compliance standards, such as PCI DSS requirements. Providers that offer compliance support may charge higher monthly fees.

- For instance, an online pharmacy must comply with prescription verification and data protection laws, which increase compliance costs, whereas a subscription-based streaming service faces fewer regulatory hurdles and lower fees.

6. Geographic Location

Businesses operating in regions with stricter financial regulations or higher fraud rates face elevated fees. International transactions may also incur additional charges for currency conversion and cross-border payment processing.

- For example, a US-based e-commerce business selling globally may pay higher fees for currency conversion and international fraud protection, while a local retail store serving only domestic customers will avoid these extra costs.

7. Provider-Specific Policies

Each provider has unique policies that influence pricing. Some may include hidden fees like early termination charges or annual account maintenance costs.

- A business locked into a three-year contract with steep early termination fees could face significant costs if it switches providers, while a merchant with a month-to-month agreement retains flexibility without penalties.

Optimizing Costs

Businesses should reduce chargebacks, maintain compliance, and negotiate terms with providers to minimize fees. By understanding these factors, small businesses can select a high-risk merchant account that balances costs and security, ensuring reliable and affordable credit card processing.

The Impact of Elevated Chargeback Ratios on High-Risk Merchant Accounts

For high-risk merchants, managing chargeback ratios is critical to maintaining account stability. Payment processors impose strict thresholds for chargebacks — typically no more than 1% of total transactions. Exceeding these limits can result in severe consequences, including financial penalties, increased fees, and even account termination.

Consequences of Elevated Chargeback Ratios

- Higher processing fees

Elevated chargeback ratios increase the risk to payment processors, often leading to higher transaction fees and stricter terms. - Rolling reserves

Providers may increase the percentage of rolling reserves held, reducing immediate cash flow for the business. - Account termination

If chargeback ratios remain consistently high, providers may terminate the merchant account. This leaves businesses unable to process credit card payments and impacts revenue streams. - Placement on the MATCH list

Persistent chargeback issues can lead to placement on the MATCH (MasterCard Alert to Control High-Risk Merchants) list. Once listed, it becomes extremely difficult to secure another merchant account, as most processors view MATCH-listed businesses as too risky.

Strategies to Maintain Acceptable Chargeback Levels

- Implement clear billing descriptors

Ensure customers recognize charges on their statements by using clear and consistent billing descriptors. - Provide transparent policies

Display refund, return, and cancellation policies prominently to set clear expectations for customers. - Enhance fraud prevention

To prevent unauthorized transactions, use tools like the Address Verification Service (AVS), 3D Secure authentication, and fraud detection software. - Monitor chargeback trends

Regularly analyze chargeback data to identify patterns or recurring issues. This allows you to address root causes effectively. - Offer responsive customer support

Resolve customer disputes quickly to prevent them from escalating into chargebacks. - Use chargeback alerts

Enroll in chargeback alert programs to be notified of disputes early. This will allow you to resolve issues before they escalate.

High-risk merchants can avoid penalties, maintain account stability, and ensure uninterrupted payment processing by actively managing chargebacks and staying within acceptable thresholds.

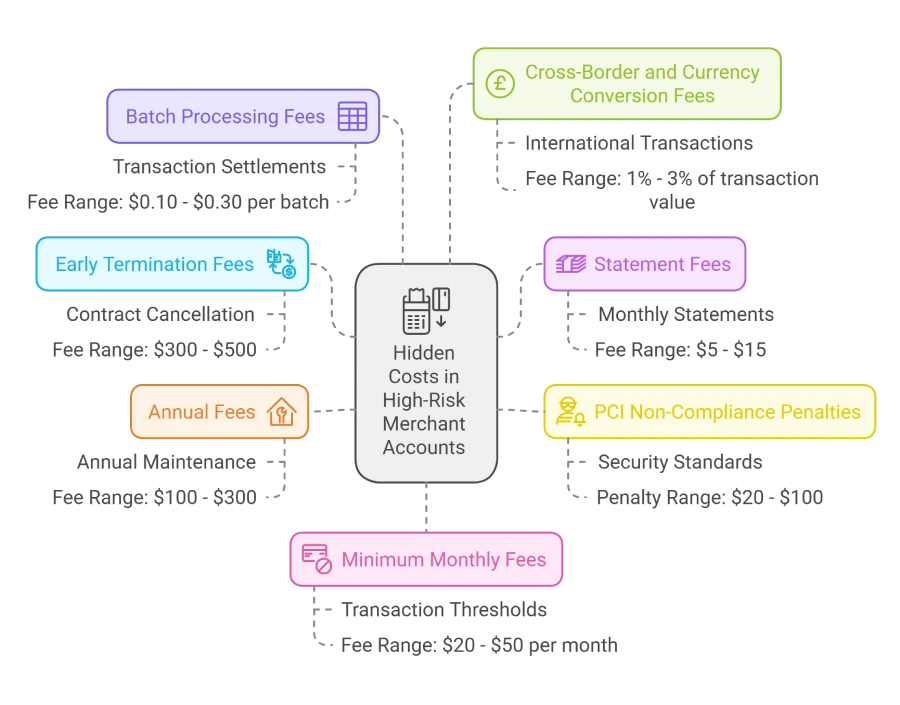

Hidden Costs to Watch Out For in High-Risk Merchant Accounts

While high-risk merchant accounts come with standard fees like transaction and setup costs, many providers also include hidden charges that can significantly impact a business’s bottom line. Recognizing these fees is crucial for small businesses to avoid unexpected expenses and choose a transparent provider.

1. Statement Fees

Providers may charge a monthly fee for sending account statements, often between $5 and $15. While this may seem minor, it adds up over time and is avoidable with providers offering digital statements at no extra cost.

2. Early Termination Fees

Some providers charge fees if you cancel your contract before its term ends. These fees can range from $300 to $500 or more, depending on the agreement. To avoid this, look for providers offering month-to-month contracts or negotiate termination terms upfront.

3. PCI Non-Compliance Penalties

Businesses that fail to meet PCI DSS (Payment Card Industry Data Security Standards) can face monthly penalties ranging from $20 to $100. Non-compliance not only results in fines but also increases the risk of data breaches, making it essential to stay compliant.

4. Annual Fees

Some providers impose annual account maintenance fees, which can cost $100 to $300 annually. These fees are often overlooked during contract negotiations but can be waived by some providers if requested.

5. Batch Processing Fees

For businesses that process multiple transactions daily, batch processing fees are charged when transactions are settled into your account. These fees typically range from $0.10 to $0.30 per batch and can add up for businesses with high transaction volumes.

6. Cross-Border and Currency Conversion Fees

If your business processes international transactions, you may incur additional charges for currency conversion or cross-border payments. These fees vary by provider, ranging from 1% to 3% of the transaction value.

7. Minimum Monthly Fees

Some providers require businesses to meet a minimum monthly transaction amount. If the threshold isn’t met, a fee is charged to cover the difference. This cost can range from $20 to $50 per month.

Final Thoughts

High-risk merchant accounts are vital for businesses in industries with elevated risks of chargebacks, fraud, and compliance challenges. These accounts enable secure credit card processing and provide essential tools like chargeback management, rolling reserves, and fraud prevention. While transaction fees and monthly maintenance charges can be higher, these services ensure operational stability for high-risk merchants.

By understanding high-risk merchant account fees, small businesses can compare providers, identify transparent pricing, and negotiate better terms. Reducing chargeback ratios and maintaining compliance with PCI DSS standards are key strategies for minimizing costs and safeguarding revenue.

Though high-risk payment processing comes at a premium, the benefits outweigh the risks. These accounts allow businesses to build customer trust, maintain consistent cash flow, and operate smoothly in competitive and regulated environments. High-risk businesses can therefore focus on growth and long-term success by leveraging the right merchant services.

FAQ

Q. What industries are considered high-risk for merchant accounts?

A. Industries such as online gambling, CBD sales, adult entertainment, travel services, and subscription-based businesses are often labeled high-risk due to higher instances of chargebacks, fraud, or regulatory scrutiny.

Q. How are high-risk merchant account fees determined?

A. Fees are influenced by industry type, transaction volume, chargeback ratios, and the merchant’s credit history. Providers assess these elements to gauge risk and set appropriate pricing.

Q. What is a rolling reserve, and why is it applied?

A. A rolling reserve is a percentage of a merchant’s revenue withheld by the payment processor to cover potential chargebacks or fraud. It’s a common practice for high-risk accounts to mitigate financial risk.

Q. Can high-risk merchant account fees be negotiated?

A. Yes, merchants can negotiate fees by demonstrating stable transaction volumes, low chargeback rates, and compliance with industry regulations. Building a positive processing history can also strengthen negotiation positions.

Q. How can I minimize fees associated with high-risk merchant accounts?

A. To reduce fees, maintain low chargeback ratios, ensure compliance with PCI DSS standards, process higher transaction volumes, and select a provider specializing in your industry with transparent pricing.