How OnlyFans became a billion-dollar platform: Business model, strategy, and lessons for SMBs

In 2016, a small family-run startup launched from a London kitchen table with just £10,000 in seed funding. No venture capital, no massive team, no Silicon Valley address.

Eight years later, that same company — OnlyFans — pays out nearly $6 billion a year to creators, generates almost $700 million in annual profits, and is exploring a sale worth $7–8 billion.

Most people think of OnlyFans for its adult content. But for entrepreneurs, the more interesting truth is this: it’s a masterclass in lean startups, recurring revenue, customer-led growth, and extreme profitability.

This case study breaks down exactly how OnlyFans turned £10K into an $8B empire, and more importantly, what business owners can learn and apply from the journey.

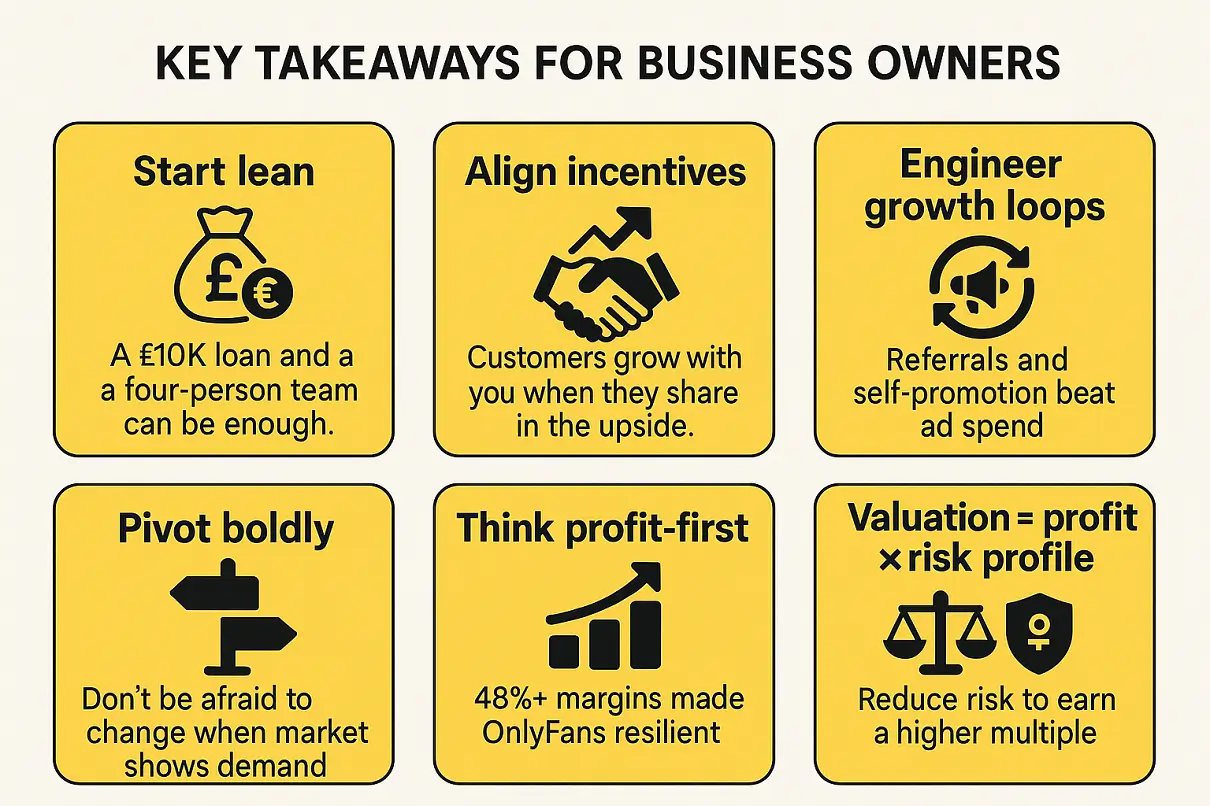

Key Takeaways for Business Owners

Before we dive into the story, here are the big lessons:

- Start lean: A £10K loan and a four-person team can be enough.

- Align incentives: Customers grow with you when they share in the upside.

- Engineer growth loops: Referrals and self-promotion beat ad spend.

- Pivot boldly: Don’t be afraid to change when the market shows demand.

- Think profit-first: 48%+ margins made OnlyFans resilient.

- Valuation = profit × risk profile: Reduce risk to earn a higher multiple.

OnlyFans: Company Snapshot

OnlyFans is a London-based subscription social platform that revolutionized the creator economy by allowing users to monetize content directly from “fans” without relying on advertisers. While it hosts diverse creators (fitness, music, cooking), it is primarily known for adult content.

| Category | Details |

| Founded | 2016 (London, UK) |

| Parent Company | Fenix International Limited |

| Headquarters | London, United Kingdom |

| CEO | Keily Blair (since July 2023) |

| Owner | Leonid Radvinsky (Ukrainian-American entrepreneur) |

| Employees | ~1,000+ |

The Founding Story: How it Started

Every business starts somewhere. The OnlyFans story shows that you don’t need big funding or a Silicon Valley network to build something extraordinary. What matters – apart from a great idea – is a lean beginning, a clear value proposition, and the courage to pivot when the market points you in a new direction.

- Founder: Tim Stokely, with prior experience in niche adult platforms.

- Seed investor: His father, Guy Stokely, lent him £10,000 (~$13K).

- Early team: Tim (CEO), Thomas Stokely (COO, brother), Guy (finance/backer), plus a few contractors.

The first product (2016)

- Subscription feed for lifestyle creators (fitness, cooking, music).

- Tips and pay-per-view (PPV) for upsells.

- Platform cut: 20% for OnlyFans, 80% to creators.

- Referral system: Recruiters earned 5% of a creator’s earnings for 12 months (up to $50K per referral).

The first pivot (2017)

- Lifted the ban on explicit content → attracted a massive underserved market.

👉 SMB lesson: You don’t need millions to start. Begin small, align incentives with customers, and be bold enough to pivot.

The OnlyFans business model explained

Understanding the business model shows you the mechanics of how OnlyFans makes money. For entrepreneurs, the insight is simple: create recurring revenue, design transparent economics, and make sure your customer’s success drives your own.

Revenue sources

- Subscriptions: Creator-controlled ($4.99–$49.99/month).

- Tips & Pay-per-view (PPV): Fans pay for extras.

- Platform take rate: 20%. Creators keep 80%.

2024 Numbers

- Gross fan spend: $7.2B

- Platform revenue (20%): $1.41B

- Profit (pre-tax): $684M (~48% margin)

- Payout to creators: $5.8B

Unit Economics (2024): How the math works

Knowing your unit economics helps you measure scalability. It’s the difference between growth that looks good on paper and growth that actually makes money.

- Average spend per fan: $7.2B ÷ 377.5M = $19.1/year

- Average revenue per creator: $1.41B ÷ 4.6M = $307/year

- Average GMV (gross merchandise value) per creator: $7.2B ÷ 4.6M = $1,565/year

👉 SMB lesson: If you know exactly what each customer is worth, you can forecast growth, set budgets, and build profitability into your model.

Revenue per employee: Efficiency at scale

Scaling doesn’t always mean hiring big teams. OnlyFans shows how small teams can achieve massive leverage by focusing on efficiency, outsourcing, and automation.

- Direct employees (2024): ~46

- Revenue: $1.41B ÷ 46 = $31M per employee

- Profit: $684M ÷ 46 = $15M per employee

👉 SMB lesson: Track revenue per employee as a key metric. Staying lean creates a competitive advantage.

Growth strategy: How OnlyFans went viral

Growth isn’t always about spending more on ads. OnlyFans proves that growth can come from referrals, customers marketing themselves, and tapping into cultural moments.

- Referral program: Affiliates and agencies recruited creators.

- Creator-led marketing: Creators promoted their profiles on Twitter, Reddit, Instagram.

- Celebrity boosts: Bella Thorne ($1M in 24 hrs), Bhad Bhabie ($1M in 6 hrs).

- Pandemic surge: 2020 lockdowns → 75% spike in creators and fans.

- Controversy = free PR: Media debates on adult content kept OnlyFans in headlines.

👉 SMB lesson: Build growth mechanics where your customers do the work for you, and be ready to seize cultural moments that drive organic buzz.

Growth in Numbers

Hard numbers show the trajectory of growth and the impact of each strategic move. Tracking the right metrics makes growth tangible and keeps businesses focused on what really matters.

| Year | Fans (Users) | Creators | Gross spend | Revenue | Profit |

|

2019 |

13.5M |

348K |

$270M |

$49M |

N/A |

|

2020 |

85M |

1.6M |

$2.2B |

$358M |

N/A |

|

2023 |

305M |

4.1M |

$6.6B |

$1.3B |

$649M |

|

2024 |

377M |

4.6M |

$7.2B |

$1.41B |

👉 SMB lesson: Keep your growth funnel simple. Focus on the link between supply (creators), demand (fans), and revenue.

Marketing strategy: The tactics that turned OnlyFans into a global brand

Marketing isn’t always about pouring money into ads. OnlyFans grew by designing a model where creators themselves became the marketing channel. This is a blueprint for SMBs looking to scale without massive ad budgets.

Initial strategy (2016–2017):

- Referral program: Affiliates earned 5% of referred creator earnings (12 months, capped at $50K). This gave agencies and creators financial motivation to bring new supply.

- Direct outreach: Tim Stokely and early staff personally recruited creators.

The viral loop (2017–2020):

- Creator-led growth: Creators marketed themselves on Twitter, Reddit, Instagram. Whenever they shared their OF link, they effectively advertised the platform for free.

- Controversy = PR: Lifting the ban on adult content brought global headlines.

Acceleration moments:

- Celebrity catalysts: Bella Thorne ($1M in 24 hrs), Bhad Bhabie ($1M in 6 hrs), and Beyoncé’s “OnlyFans” lyric (+15% traffic surge).

- Pandemic boom (2020): Lockdowns pushed both creators and fans onto the platform, with a 75% spike in just two months.

👉 SMB lesson: Instead of relying solely on ads, design marketing loops where your users or customers naturally promote your product.

Related Articles

Finance & Profitability

Many founders think they need to sacrifice profit for growth. OnlyFans proves you can have both rapid scale and industry-leading margins.

| Year | Revenue | Profit | Profit Margin |

|

2022 |

$1.1 Billion |

$525 Million |

~48% |

|

2023 |

$1.3 Billion |

$649 Million |

~50% |

|

2024 |

$1.41 Billion |

$684 Million |

~49% |

👉 SMB lesson: Profitability funds growth, increases valuation, and gives you leverage.

Valuation Explained

Valuation isn’t a magic number, it’s a formula. Understanding it helps entrepreneurs know what drives investor appetite and how to increase their own company’s worth.

- 2024 profit: $684M.

- Valuation multiple: ~10× profit.

- Estimated sale price: $7–8B.

What does $7–8 billion mean?

It’s the price someone would pay to buy 100% of OnlyFans.

📊 Calculation: $684M profit × 10 = ~$6.8B → adjusted for growth = $7–8B.

If this were a lower-risk SaaS company, the multiple could be 15–20×, making OnlyFans worth $10–13B. But adult-content risk caps it around 10×.

👉 SMB lesson: Your valuation = profit × multiple – risk. Reduce risk (diversify, strengthen compliance), and you’ll earn a higher valuation multiple.

How much does an OnlyFans model make?

The short answer is that income on OnlyFans is drastically unequal. While you hear about celebrities making millions, the vast majority of creators earn a modest amount that is often less than a part-time job.

Here is the realistic breakdown of what OnlyFans models make in 2024–2025 based on available data.

- The “Average” Creator (The Reality

- Median Earnings: ~$180 per month

- Average Earnings: ~$150 – $180 per month

- The Bottom 50%: A significant portion of accounts earn less than $100/month.

Context: Most new creators without an existing social media following struggle to get subscribers. Because there is no internal “discovery” algorithm (like TikTok or Instagram), you have to bring your own traffic to the site. If you don’t have fans elsewhere, you likely won’t make money here.

- The Top Percentiles (The “Middle Class” & High Earners)

OnlyFans ranks creators by percentile (e.g., “Top 5%”).- Top 10%: Usually have a small but dedicated niche following (e.g., 10k–50k followers on Instagram/Twitter).

- Top 1%: Treat it as a full-time business. They post daily, market aggressively on Reddit/Twitter/TikTok, and often have 100k+ followers on other platforms.

-

The “Whales” (Celebrities & Superstars)

- Earnings: $1 Million – $20 Million+ per month

- Who they are: Celebrities (Cardi B, Iggy Azalea) or mega-influencers (Amouranth, Bhad Bhabie).

- Why: They bring millions of pre-existing fans to the platform. They do not rely on OnlyFans to get famous; they use it to monetize the fame they already have.

Risks & Diversification

Printing billions doesn’t make you invincible. OnlyFans is a masterclass in how a wildly profitable empire can be built on a foundation of pure dynamite. It’s a cautionary tale for any entrepreneur who thinks profit is the same as safety.

Dependence

An estimated 90% of the company’s revenue comes from adult content. This isn’t a business model; it’s a bet-it-all-on-black strategy. OnlyFans built the world’s most profitable skyscraper on a single pillar. One crack from a cultural shift, a new law, or a competitor, and the entire structure is at risk of total collapse.

Payments

OnlyFans isn’t in charge of its own bank account. The real bosses are Visa, Mastercard, and the banks. The 2021 ban scare wasn’t just a PR crisis; it was a terrifying reminder that these financial giants can flip the “off” switch on their entire business overnight, for any reason they want. This multi-billion-dollar operation exists only because a handful of boardrooms allow it to.

Regulation

The secret to this insane profit is the tiny “skeleton crew.” But governments are waking up, and new laws require armies of expensive lawyers and content moderators. Every new compliance rule is a direct attack on the lean model that fuels the OnlyFans money-printing machine, threatening to bury the small team in the very operational costs its has so brilliantly avoided.

Diversification

The OnlyFans team sees the writing on the wall, so they’re scrambling for an escape hatch. They’ve launched OFTV (their safe-for-work ghost town), thrown money at creator funds, and paid for mainstream partnerships. It’s a desperate race to look legitimate, but the question is whether they’re building a lifeboat fast enough to escape a battleship already taking on water.

👉 SMB lesson

The lesson here is brutal and simple: Use current profits to build future stability. Your cash cow will eventually die. Use the money it prints today to build a fortress for tomorrow, not just a bigger penthouse. Don’t get high on your own supply.

Lessons SMB Owners Can Apply

The real value of this case study isn’t in OnlyFans’ numbers, it’s in the blueprint that any business can adapt.

- Bootstrap smartly: Start with small funding.

- Recurring revenue: Build predictable income streams.

- Referral programs: Reward growth that comes from customers.

- Align incentives: Your success should mirror your customer’s success.

- Stay lean: Focus on automation and efficiency.

- Profit first: Margins are your shield.

- Ride momentum: Be opportunistic with timing.

- Diversify early: Don’t rely on one risky stream.

Conclusion

The OnlyFans business model is one of modern business’s most powerful case studies. From a £10K family loan and a four-person team, it grew into a global platform worth $7–8 billion — not through massive funding, but through vision, discipline, aligned incentives, and profitability from day one.

For SMB owners, the lessons are clear: start small, design recurring revenue, empower your customers, focus on profit, and manage risk. That’s how you can turn £10K into £1B+.

FAQ: The OnlyFans Business Model

Q1. What is the OnlyFans business model?

OnlyFans is a subscription-based content platform where creators monetize access to their content. Fans pay for monthly subscriptions, tips, and pay-per-view messages, and OnlyFans takes a 20% cut while creators keep 80%.

Q2. How did OnlyFans start?

OnlyFans was founded in London in 2016 by Tim Stokely with a £10,000 loan from his father. Initially built for lifestyle creators (fitness, cooking, music), it pivoted in 2017 to allow adult content — which drove massive growth.

Q3. How does OnlyFans make money?

The company earns revenue through a 20% platform fee on all fan payments (subscriptions, tips, PPV). In 2024, this amounted to $1.41 billion in revenue on $7.2 billion in fan spending.

Q4. How profitable is OnlyFans?

Extremely. In 2024, OnlyFans reported $684 million in pre-tax profit, representing a ~48% margin. Few digital platforms operate at this level of profitability.

Q5. Why is OnlyFans worth $7–8 billion?

Valuation is based on profit multiples. With $684M profit and a 10× multiple, the business is worth ~$7B. Because of recurring revenue, growth, and cashflow, buyers place its valuation in the $7–8B range. Risk factors (adult-content reliance, payment processors, regulation) prevent higher multiples.

Q6. How many users and creators are on OnlyFans?

As of 2024:

- 377.5 million registered fans (users)

- 4.6 million creators

Q7. How much do creators make on OnlyFans?

Earnings vary widely:

- Average creator earns ~$1,300/year.

- Top 1% of creators earn over $100,000 annually.

- Stars like Bhad Bhabie and Bella Thorne earned $1M+ within 24 hours.

Q8. How does OnlyFans acquire new creators?

Through a referral program (5% of referred creator earnings for 12 months, up to $50K per referral), direct outreach, and creator self-promotion on social media.

Q9. What was OnlyFans’ initial marketing strategy?

No ads. Growth came from:

- Referrals and affiliates

- Creators promoting themselves on Twitter and Reddit

- Controversy and media attention around adult content

- Celebrity sign-ups and endorsements

Q10. How does OnlyFans handle payments?

Fans pay via credit/debit cards and digital wallets. Creators receive payouts weekly. The company has faced challenges with payment processors — notably in 2021 when banks pressured it to briefly ban adult content, before reversing the decision.

Q11. How many employees does OnlyFans have?

Around 46 direct employees (2024 filings). With revenue of $1.41B, that’s $31M per employee — an astonishing efficiency level.

Q12. What makes OnlyFans different from Patreon or other platforms?

- Higher creator payout (80%)

- Adult content allowed (Patreon restricts this)

- Stronger direct fan-to-creator interactions (PPV chats, tips, personalized messages)

- Much higher average revenue per creator

Q13. What are the biggest risks for OnlyFans?

- Dependence on adult content (~90% of revenue).

- Reliance on payment processors (Visa, Mastercard).

- Regulatory scrutiny (age verification, compliance costs).

- Slowing user growth compared to pandemic peak.

Q14. What can SMB owners learn from the OnlyFans business model?

- Start lean (OnlyFans began with £10K).

- Build recurring revenue (subscriptions).

- Use referral programs for growth.

- Keep operations lean and automate.

- Profitability is strategy, not just an outcome.

- Reduce risk to increase valuation multiples.

Q15. Can the OnlyFans model work in other industries?

Yes. Any business can apply the principles:

- Fitness coaches: subscription programs with premium content.

- Consultants: gated community with exclusive insights.

- Local services: membership perks, VIP access.

- SaaS companies: tiered subscriptions with add-ons.