How QuickBooks Payroll Can Help Small Business Owners Save Time and Money

Managing payroll for small businesses is widely regarded as one of the most complex and challenging accounting tasks business owners face. With the highest precision requirements and such little room for error, payday can quickly become a nightmare for bookkeeping and payroll departments. Managing payroll means staying up-to-date with the latest employment and taxation laws as well as maintaining contact with various taxation agencies, including the IRS. Given the numerous details that need to be handled, it is all too easy for mistakes to be made. Fortunately, small business owners can streamline their entire payroll process and save money, resources, and time, with the right payroll service.

Designed with small businesses in mind, Intuit QuickBooks Payroll is a cloud-based payroll system that streamlines all processes, making it easy to accurately and efficiently manage and run payroll. QuickBooks Online Payroll includes a wide range of helpful features, such as automated easy-track payroll runs, tax form filing, HR services, and other features geared specifically towards helping small business owners save time and prioritize other important aspects of their business.

In this article, we will look at how QuickBooks Payroll’s wide range of features targets the unique challenges faced by small business owners, and explore why it can be an all-around solution for when payday comes around.

QuickBooks Payroll Automation Full Service Features for Saving Time and Money

Intuit QuickBooks Payroll provides a full-service offering that enables small business owners to automate most of the tasks associated with running payroll and payroll management.

In this section, we will explore some of the key automation features offered by QuickBooks Payroll, including accurate and consistent reporting, quicker calculations, software integration, easy time tracking and scheduling features, and digital storage solutions to help you stay on top of things.

By leveraging these features, small business owners can significantly reduce the time and effort required for managing and running payroll, while also ensuring compliance with applicable tax laws and regulations.

Here are some of the most helpful and time-saving features offered by QuickBooks Payroll:

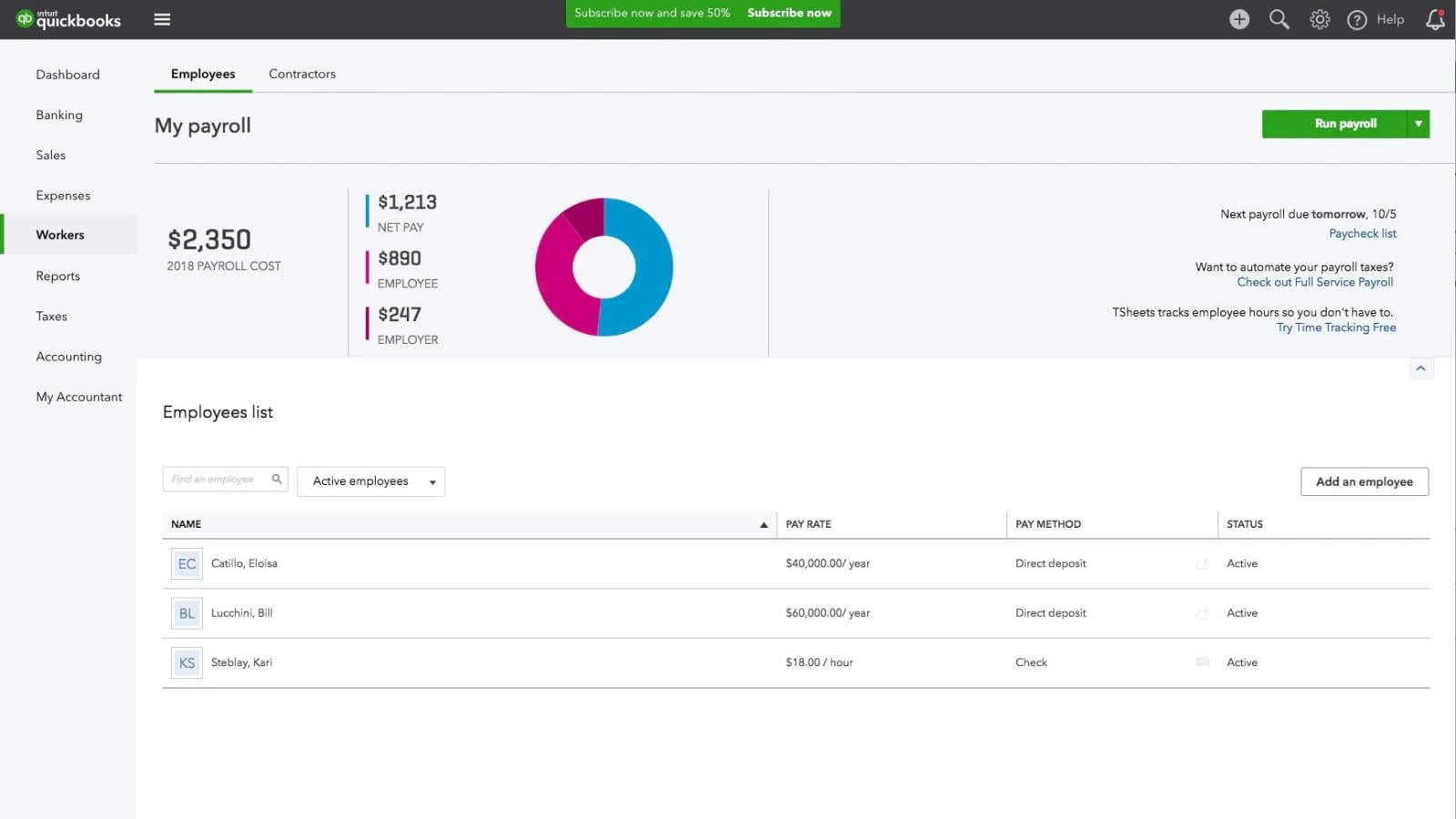

Quick and Easy Employee Onboarding

Onboarding new employees to the payroll is easy with QuickBooks Payroll. Simply enter the full name and email address of the new employee(s) and a notice will be sent to them requesting them to fill in their personal tax and banking information. Once the information is entered into the system, employees can also view information including pay stubs, W-2 forms, and other personal information.

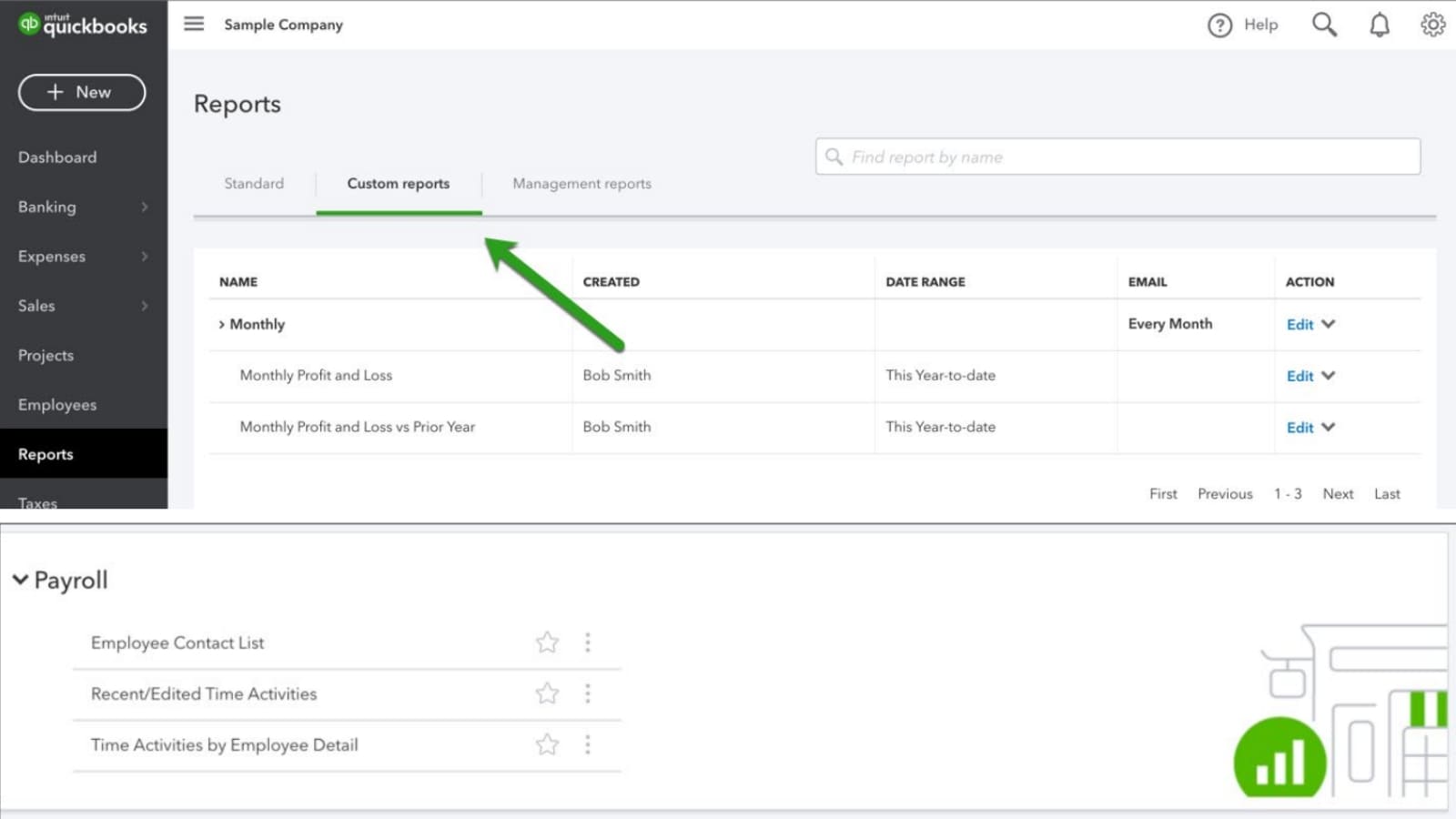

Accurate and Consistent Reporting

QuickBooks payroll software generates accurate payroll reports, in seconds, that help small business owners make informed decisions. The reports provide meaningful insights into data such as time spent on tasks and hours tracked within a pay period, which can be used to run high-level reports to better predict, plan and execute projects. The reports can be customized to fit the business’s unique requirements and can be easily accessed through the payroll software’s dashboard.

Quicker Calculations

QuickBooks Payroll software can calculate employee wages, tax deductions, and benefits quickly and accurately. The software ensures that all calculations are done correctly, minimizing the risk of potentially devastating (and expensive) mistakes. Instead of entering and calculating data line by line, HR employees simply enter all information at once, and the system will take over from there.

Software Integration

QuickBooks Payroll can seamlessly integrate with other accounting software, making it easy for small business owners to streamline their entire accounting processes. With the QuickBooks Payroll’s integration, small business owners can sync QuickBooks Time with QuickBooks Online Payroll to run payroll much faster. Small businesses can track employee work times, and sync the timesheet data to automatically run payroll, saving hours of time and eliminating the risk of human error.

Avoid Calculation Errors

Calculating payroll manually leaves a lot of room for error, which can result in time lost and financial penalties. By completely automating the entire payroll process, QuickBooks Payroll totally eliminates these potential calculation errors. It ensures that all calculations are accurate (as only a software can), reducing the risk of errors that could lead to trouble.

Employee Self-Service (ESS) Portal

With QuickBooks Payroll’s ESS Portal, employees can enter working hours and other information themselves. By providing access to the ESS Portal, employees can enter and track their working hours, apply for vacation or sick leave, and view their timesheet balances.

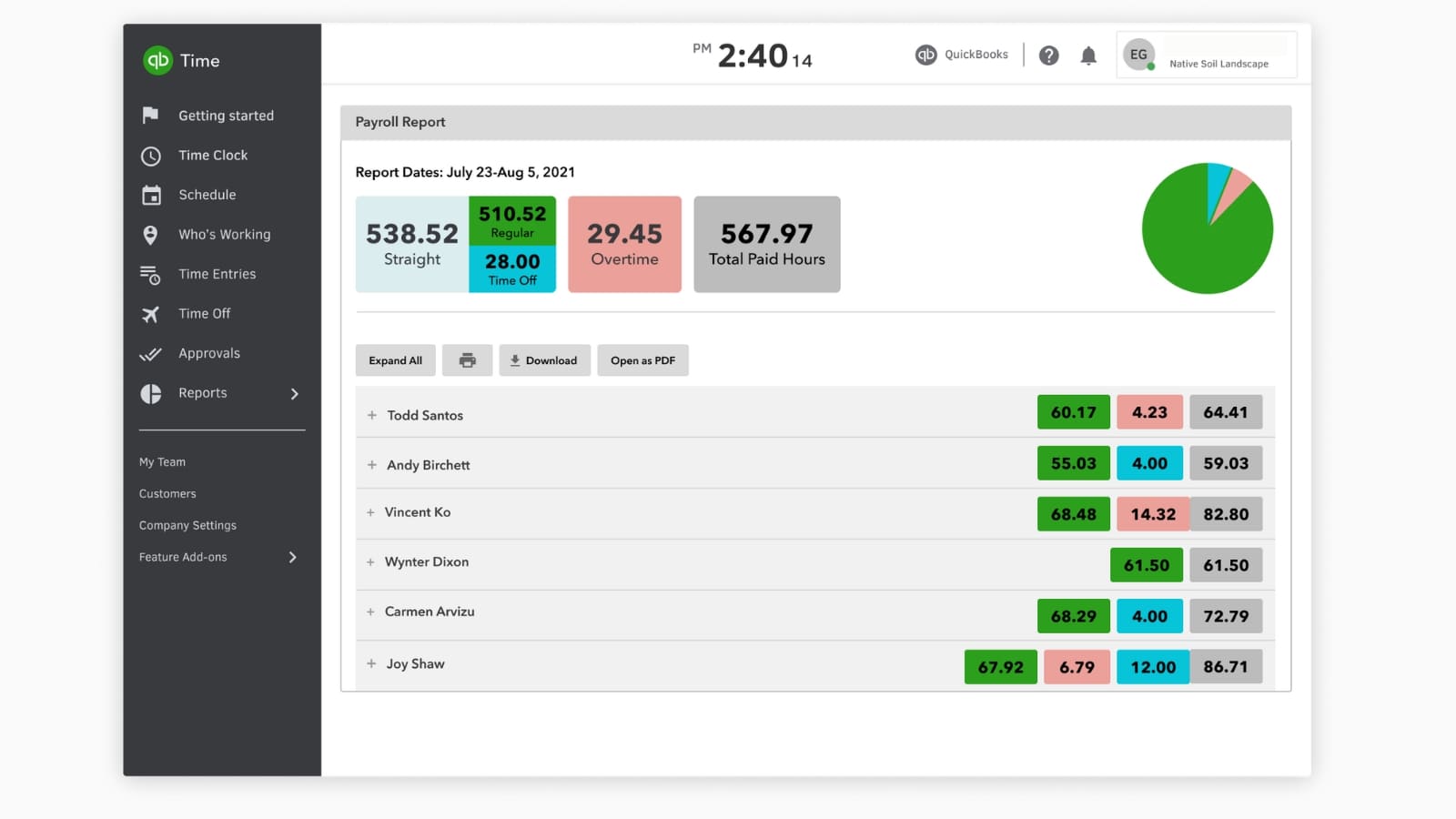

Easy Time Tracking and Scheduling Features

In companies throughout North America, 38% of employees are still using manual systems such as timesheets and punch cards to track their working hours – leading to a whopping 80% of timesheets needing to be corrected at the end of a pay period.

More than 1 in 3 time tracking systems is outdated

– Source: QuickBooks

QuickBooks Payroll service has an easy-to-use time tracking and scheduling feature that allows small business owners to track all employee hours and schedule shifts and payments. This feature eliminates the very time-consuming, tedious, and error-prone task of manual small business employee time tracking.

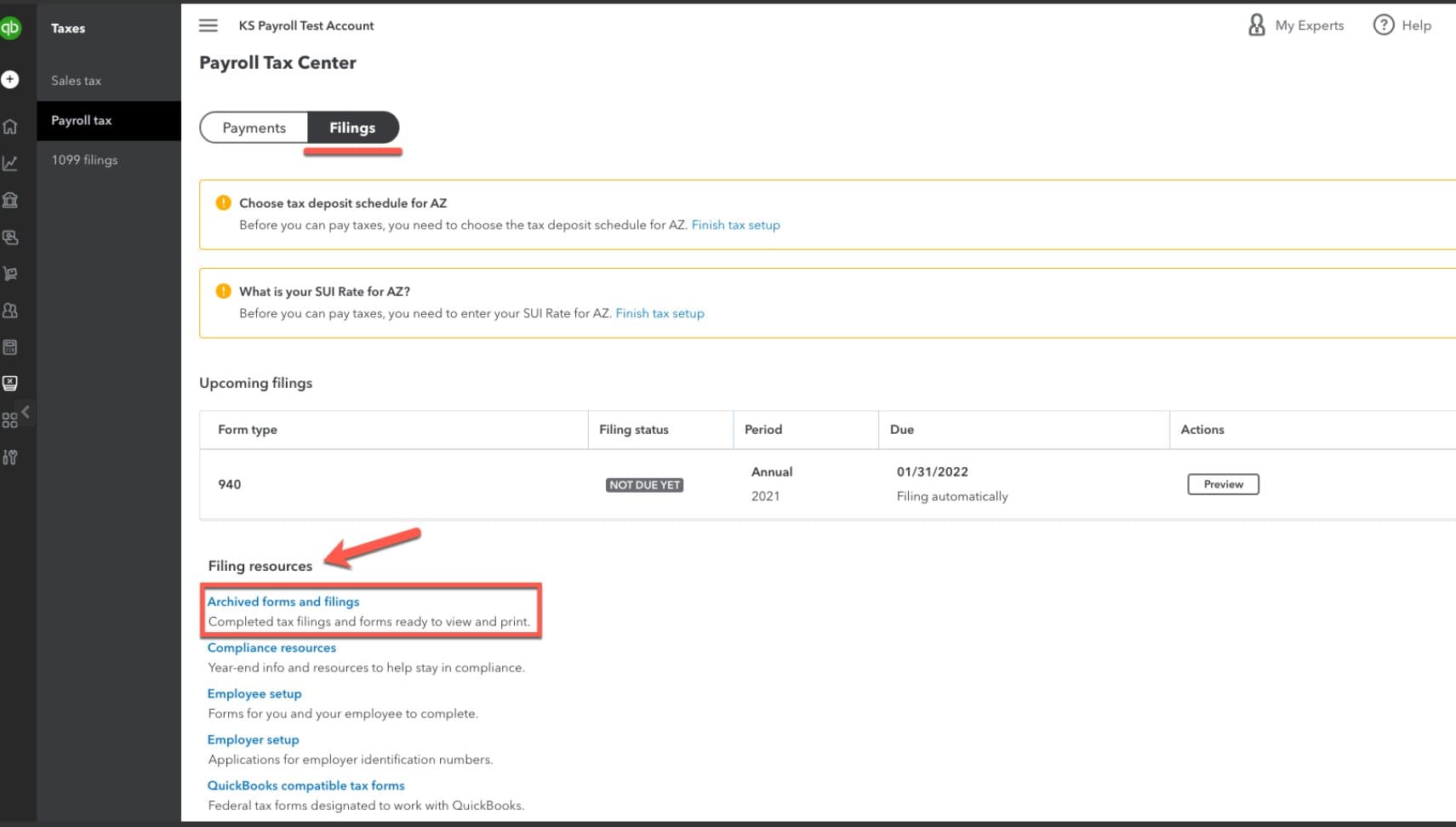

Reduce Compliance Risks

Compliance risks can arise when a business fails to comply with local and/or federal tax regulations. QuickBooks Online Payroll ensures compliance with all regulations by automatically updating all tax code changes, calculating tax deductions, and generating tax forms. With QuickBooks Payroll, small business owners can ensure that all compliance audits run as smoothly as possible and avoid trouble from the CRA when tax season rolls around.

Scheduling Made Easy

QuickBooks Payroll has a scheduling feature that allows small business owners to schedule shifts and manage employee work schedules. With this feature, there is no more need for chasing employees individually to manage their shift scheduling. Instead, every employee can simply check the scheduling feature and know exactly where and when to come to work.

Digital Storage Solution

QuickBooks Payroll offers a digital storage solution that allows small business owners to store payroll documents securely. Digital storage eliminates the need for paper documents, reducing the risk of document loss and damage, and eliminating the need for thousands of paper and printing expenditures. Not to mention, it’s a more sustainable and modern solution than hundreds of filing cabinets taking up space in the office.

Advantages of QuickBooks Payroll

Having a payroll software like QuickBooks Payroll offers a whole host of benefits. Aside from simply saving time and money, here are a few advantages small business owners can look forward to with QuickBooks Payroll:

Tax Penalty Protection:

Automatically and instantly calculate and file taxes, almost eliminating the risk of tax penalties or trouble with the IRS.

We’ll pay up to $25,000 if you make an error and receive a payroll tax penalty

– Source: QuickBooks

Same-Day Direct Deposit:

Keep employees motivated and productive by ensuring that they are paid on time every payday. QuickBooks Payroll offers same-day direct deposit, ensuring that employees receive their wages on time, even down to the last day.

Auto Taxes and Forms:

QuickBooks Payroll can automatically conduct a tax calculation and generate tax forms, eliminating the need for complicated manual tax filing.

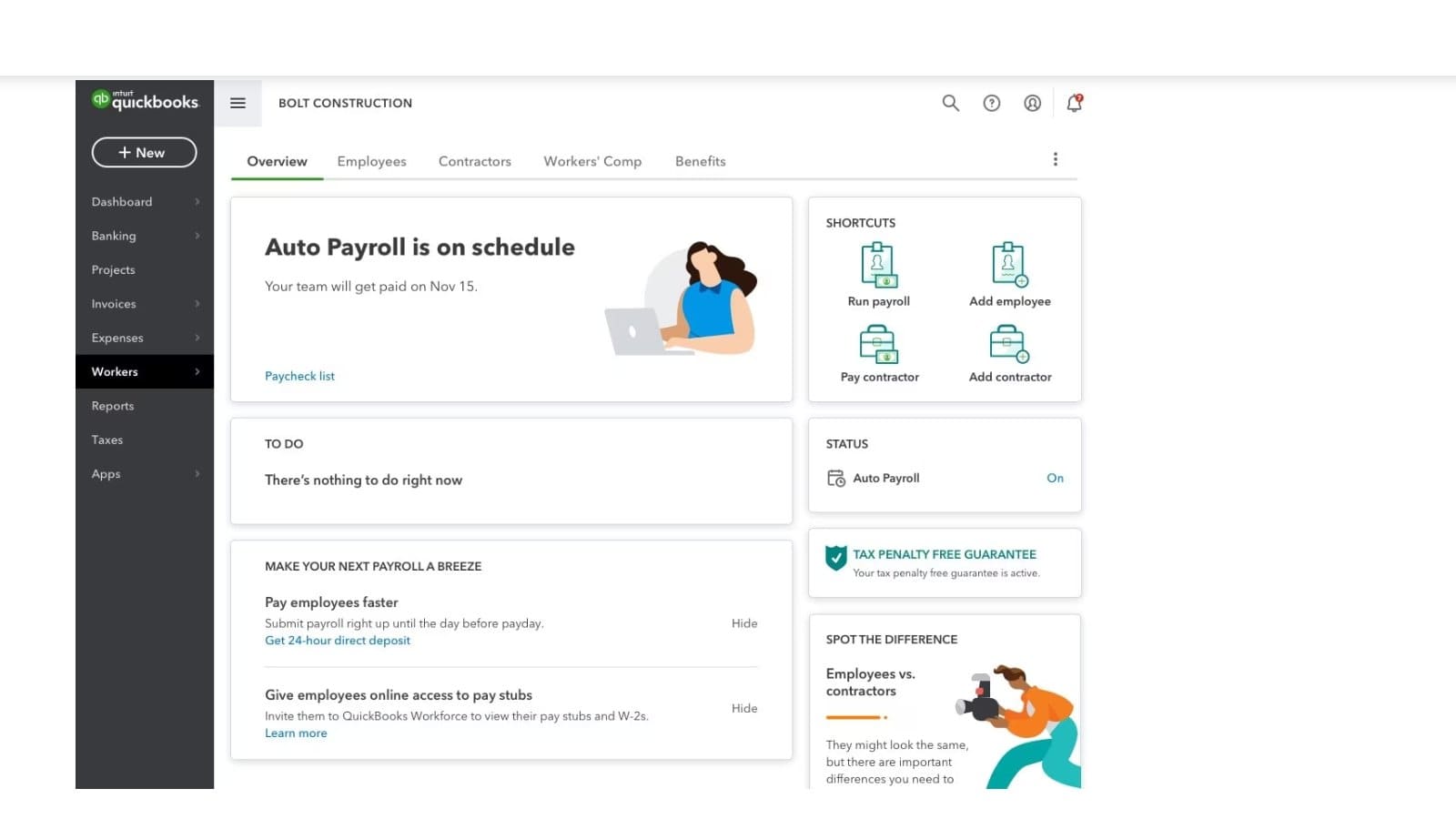

Auto Payroll:

Employee wages and tax deductions are automatically calculated and dispensed with QuickBooks Payroll. Employees are paid the correct amount automatically at an exact, predetermined time.

Time-Tracking:

QuickBooks Payroll’s time-tracking feature allows small business owners to accurately and automatically track employee hours, without having to manually count up each one’s working hours.

24/7 Expert Customer Support:

On the company website, QuickBooks Customer Support is an extensive research center full of helpful articles, community discussions, video tutorials, and more. QuickBooks also offers access to Certified ProAdvisor Accounting professionals, who can help with bookkeeping, taxes, and payroll, as well as financial advice, help with improving business processes and share a wealth of knowledge and expertise.

QuickBooks Free Payroll Tools

In addition to its full service payroll automation software, QuickBooks Payroll also offers several free payroll tools that bring massive benefits to small business owners. Some of these tools include:

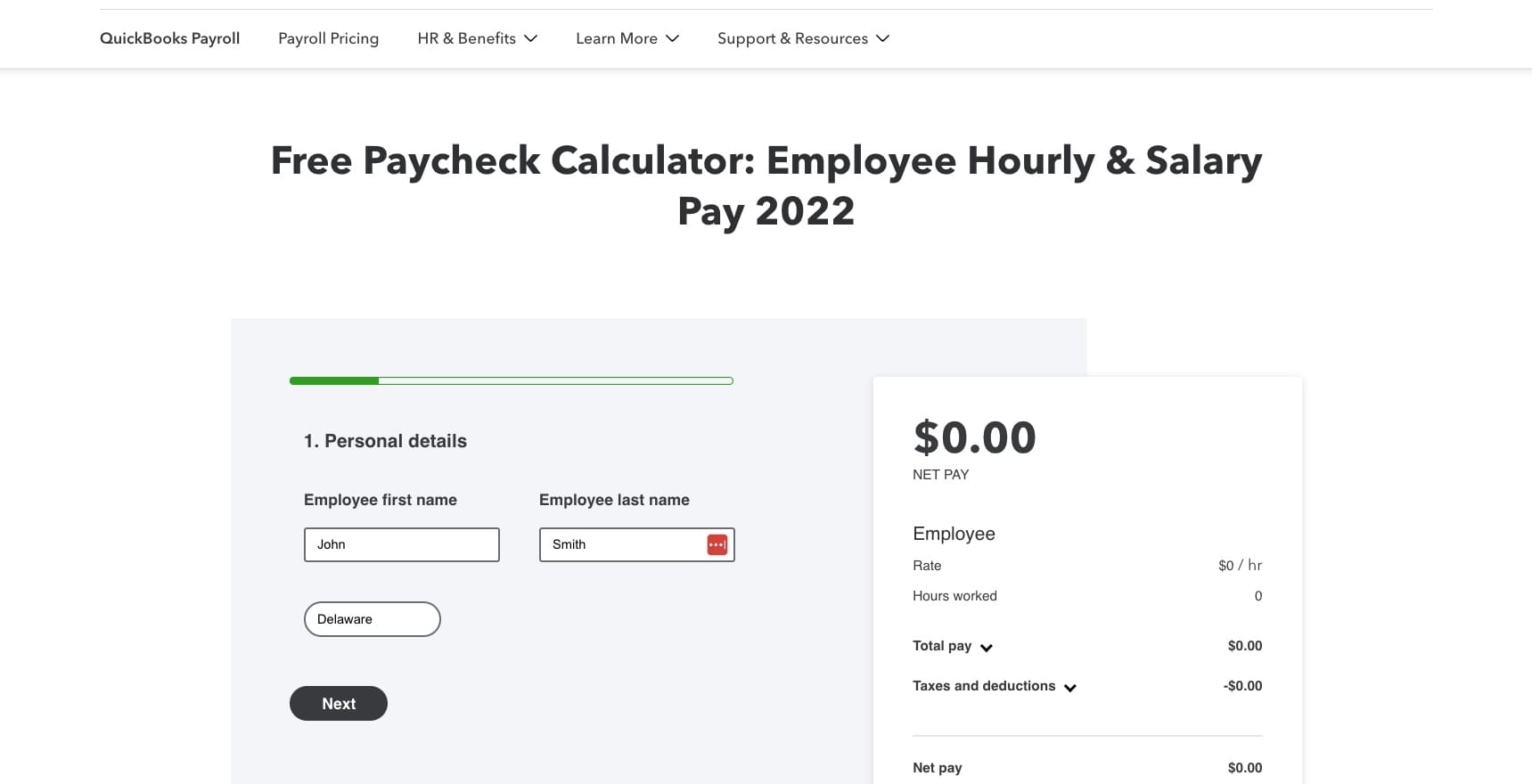

Paycheck Calculator:

This tool helps small business owners calculate the exact amount to pay their employees while looking at factors like taxes, deductions, and overtime hours worked.

To explore this free paycheck calculatore, click here.

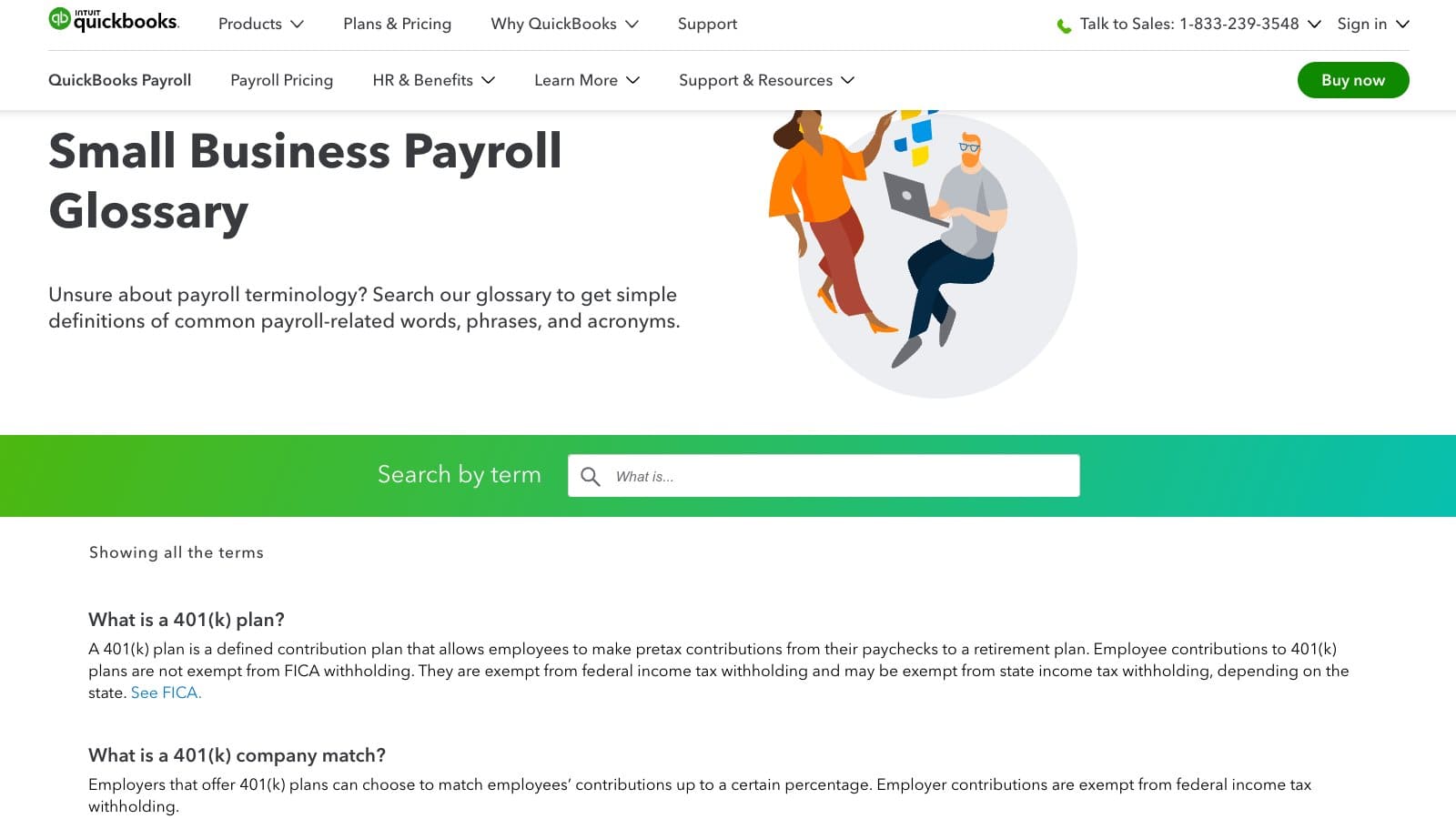

Payroll Glossary:

QuickBooks’ payroll glossary contains all the terms and concepts related to payroll management, making it an excellent resource for small business owners looking to improve their understanding of payroll jargon.

To check out the small business payroll glossary, click here.

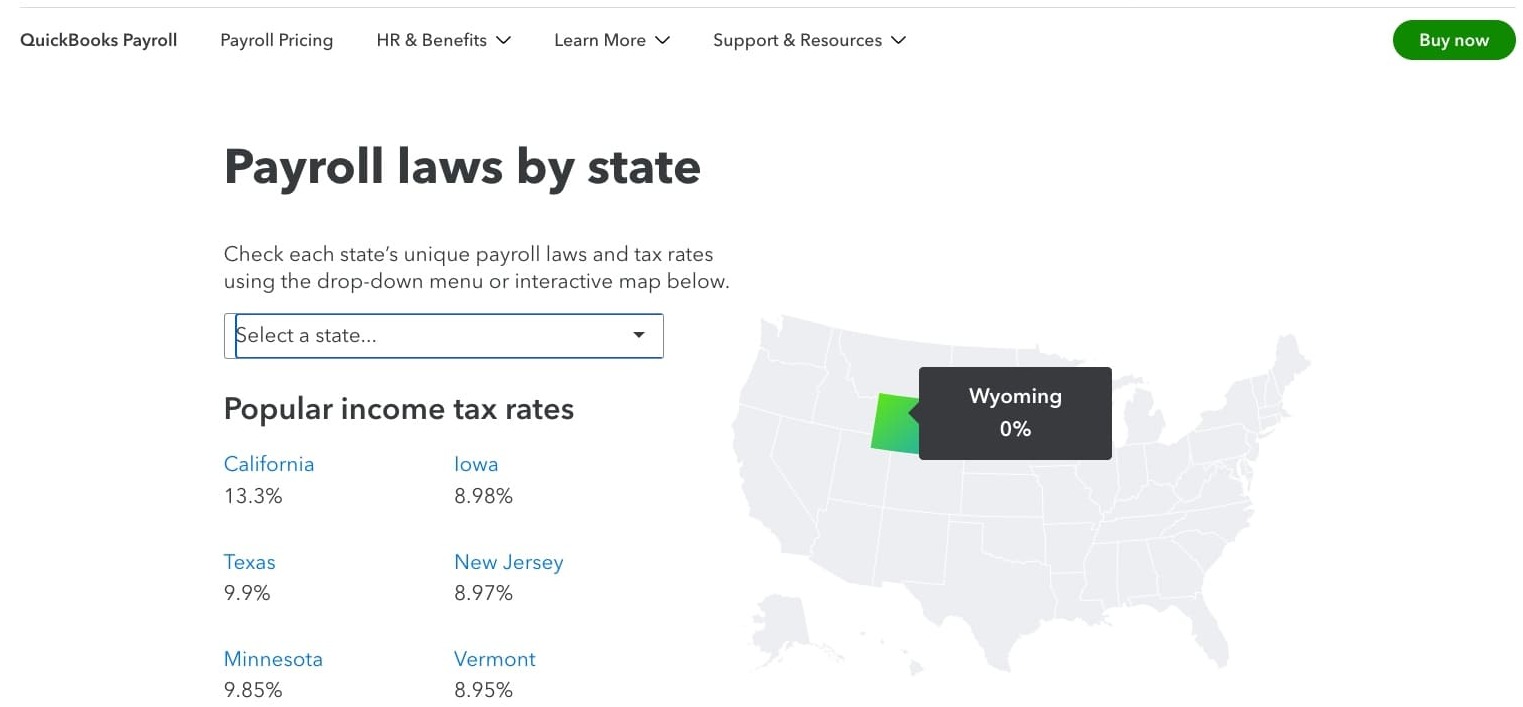

Payroll Tax Map:

The payroll tax map is an excellent resource for small business owners, as it helps them navigate the complicated world of payroll taxes by providing detailed information on tax codes and rates by state.

To see what your state’s tax codes and rates are, click here.

Conclusion

Small business owners face unique and intimidating challenges when it comes to managing their company’s payroll. QuickBooks Payroll can help save them time and money by automating payroll runs, tax form filing, and HR tasks. With its user-friendly interface, expert support, and robust set of features, it’s an excellent solution for small business owners looking to streamline their payroll management process. Eliminate tedious and time-consuming tasks like data entry and tax compliance checks using payroll software that can work in a fraction of the time a human can while significantly reducing the chance of calculation error.

Overall, QuickBooks Payroll is an excellent option for small business owners who are looking to simplify their payroll management process and reduce their compliance risks. With its comprehensive feature set and user-friendly interface, QuickBooks Payroll is a brilliant choice for any small business looking to streamline its payroll management processes and save loads of time, money, and resources on small business employee payroll. Simply put, using an automated payroll system like QuickBooks frees up small business owners to have the time to focus on growing their business.