How to Avoid High Chargeback Ratios For Your Business

Chargebacks are a growing concern for businesses, especially those operating in high-risk industries. These disputes, initiated when customers contest a charge, can significantly impact a business’s operations, revenue, and reputation. For high-risk merchants — such as those in e-commerce, subscription services, or travel — the stakes are even higher. Elevated chargeback ratios can lead to increased fees, restricted payment processing capabilities, or even the termination of merchant accounts.

Understanding and managing chargebacks is crucial for maintaining operational stability and fostering customer trust. This article explores the profound impact of high chargeback ratios on merchant accounts, delving into the challenges they pose and the strategies businesses can implement to mitigate their effects.

What Are Chargebacks?

Chargebacks are disputes initiated by customers when they challenge a transaction on their credit or debit card. While chargebacks were originally designed as a consumer protection mechanism against fraud or unauthorized charges, they have become a significant challenge for businesses, particularly those in high-risk industries like casinos, pharmaceuticals, or CBD. The chargeback process involves the reversal of funds, with the burden of proof often falling on the merchant. For businesses relying on credit card processing, this process can disrupt cash flow and increase operational costs. High chargeback ratios, especially for high-risk merchants, can lead to limited processing capabilities, withheld funds, or even permanent blacklisting by payment processors.

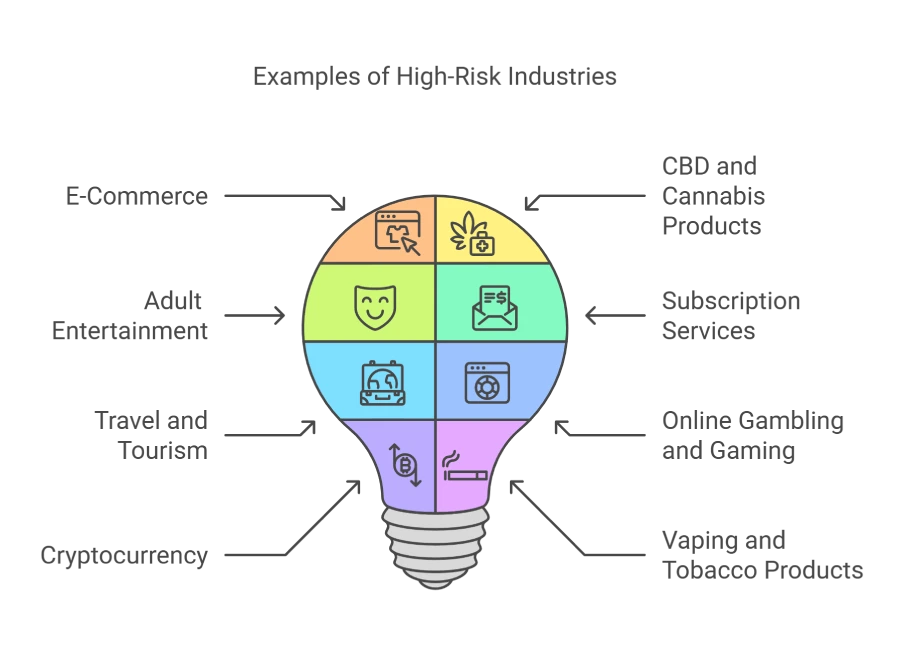

Who Is Considered a High-Risk Merchant

High-risk industries are businesses or sectors that payment processors deem more prone to chargebacks, fraud, or regulatory complexities. These industries often face stricter rules, higher fees, and specialized requirements for merchant accounts. Common high-risk industries include:

How Do Chargeback Ratios Work?

Chargeback ratios are calculated as the percentage of chargebacks compared to the total number of transactions processed. For example, if a business processes 1,000 transactions in a month and receives 10 chargebacks, the chargeback ratio is 1%.

Card networks like Visa and Mastercard impose strict thresholds for acceptable chargeback ratios. For instance:

- Visa’s dispute monitoring program considers chargeback ratios above 0.9% as excessive.

- Mastercard’s excessive chargeback program flags accounts with ratios exceeding 1%.

Exceeding these thresholds can lead to penalties, rolling reserves (when a payment processor holds a small percentage of your sales for a few months as a safety net), or even account termination. High-risk merchant accounts are especially scrutinized due to the elevated risk of fraud and disputes inherent in their industries.

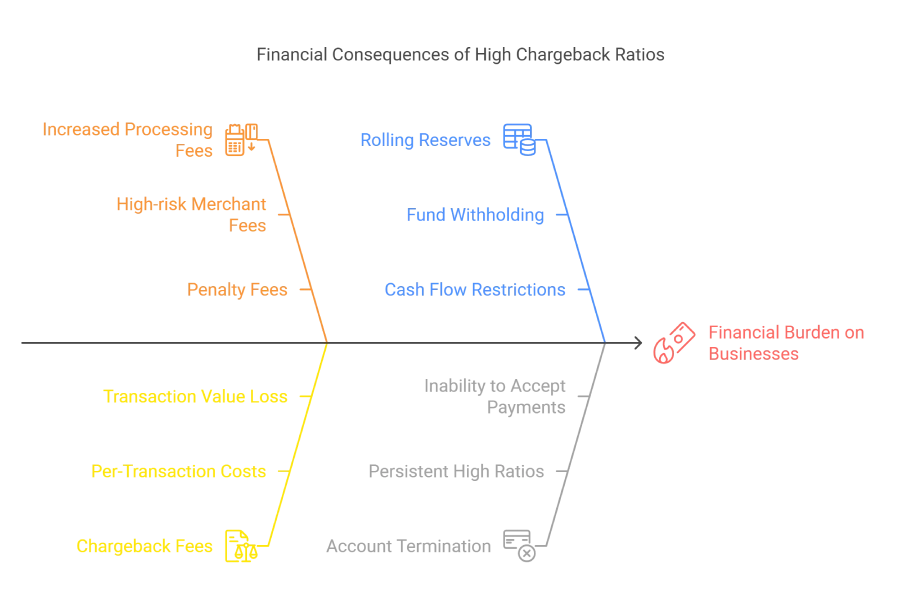

The Financial Impact of High Chargeback Ratios

The financial consequences of elevated chargeback ratios go beyond lost revenue from disputes. Businesses also face:

- Increased processing fees

- High-risk merchants may pay 3% to 5% per transaction in credit card processing fees due to elevated risk levels.

- Additional penalties can be imposed for exceeding chargeback thresholds.

- Chargeback fees

- Each chargeback can cost merchants between $20 and $50, on top of the loss of the transaction value. For high-volume businesses, this adds up quickly.

- Rolling reserves

- Payment processors may hold a portion of a merchant’s funds (typically 5% to 15%) to cover potential chargebacks, restricting immediate access to cash flow.

- Merchant account termination

- Persistent high chargeback ratios can lead to the termination of credit card processing capabilities, leaving businesses unable to accept payments.

These financial burdens highlight the importance of proactive chargeback management, particularly for businesses operating in high-risk industries.

Common Causes of High Chargeback Ratios

High chargeback ratios can pose significant challenges for high-risk merchants, often stemming from recurring issues that affect their credit card processing capabilities. Addressing these causes is crucial for maintaining a healthy business and avoiding costly disputes.

- Fraudulent transactions

- Fraud, including identity theft and unauthorized card use, is a primary contributor to chargebacks. Friendly fraud, where customers dispute legitimate purchases, is increasingly common in high-risk industries like e-commerce and travel.

- Billing discrepancies

- Customers may file disputes when the billing descriptor on their statement is unclear or unfamiliar. Using clear, recognizable descriptors for high-risk merchants and businesses can help prevent disputes and is considered a good practice.

- Unclear refund and return policies

- Lack of transparency or complicated policies often frustrates customers, leading them to file chargebacks instead of contacting the business. This is a key area for chargeback prevention.

- Misleading product descriptions

- Inaccurate or exaggerated descriptions can create mismatched expectations, leading to disputes. This is especially problematic for online transactions where customers rely heavily on product details.

- Delayed or unfulfilled deliveries

- Late or missing shipments are frequent triggers for chargebacks. High-risk businesses, such as subscription services, often face challenges in maintaining timely deliveries.

- Recurring billing issues

- Automatic renewals without clear consent or notification can frustrate customers. Clear communication and transparency is vital for reducing disputes in subscription-based models.

- Unresponsive customer support

- When customers cannot reach support to resolve issues, they may file a chargeback instead. Offering responsive, easily accessible customer service can reduce disputes and foster trust.

By identifying these root causes and implementing effective chargeback management strategies, businesses can protect their operations and maintain low chargeback ratios.

The Role of High-Risk Merchant Services in Chargeback Management

Managing chargebacks effectively is vital for businesses in high-risk industries, and partnering with specialized high-risk merchant services can make all the difference. These providers offer tailored solutions to protect credit card processing capabilities and reduce risks.

1. Fraud Detection and Prevention

Advanced fraud detection tools, such as Address Verification Services (AVS) and 3D Secure authentication, are essential for high-risk businesses. These technologies help block fraudulent transactions, a leading cause of chargebacks, and provide a critical layer of protection for high-risk merchant accounts.

2. Real-Time Chargeback Alerts

Many providers offer real-time alerts that notify merchants as soon as a chargeback is initiated. Quick action in resolving disputes can minimize financial losses and prevent escalation. For businesses wondering how high-risk merchant services reduce chargebacks, this is a key benefit.

Related Articles

3. Automated Chargeback Management Tools

High-risk merchant services often include automated tools to streamline the chargeback dispute process. These platforms manage deadlines, compile evidence, and submit responses, helping merchants maintain low chargeback ratios.

4. Rolling Reserve Policies

While rolling reserves are common in high-risk merchant accounts, many providers offer flexible terms. This ensures businesses retain cash flow while meeting the requirements of their payment processors.

5. Compliance Support

Staying compliant with Visa and Mastercard guidelines is critical for avoiding penalties. Providers assist merchants in adhering to these rules, ensuring that their credit card processing capabilities remain intact.

6. Custom Analytics and Reporting

High-risk payment processors supply detailed transaction analytics, allowing businesses to identify trends, understand common dispute triggers, and refine their operations for improved chargeback management.

Recommended High-Risk Merchant Service Providers

247Payments: Secure and reliable merchant services for businesses of all sizes.

North Payments: Dependable and efficient payment processing for businesses.

Merchant One: Secure payment processing tailored to your business needs.

By leveraging these tools and strategies, businesses can reduce their chargeback ratios and lower the risk of having their payment services suspended.

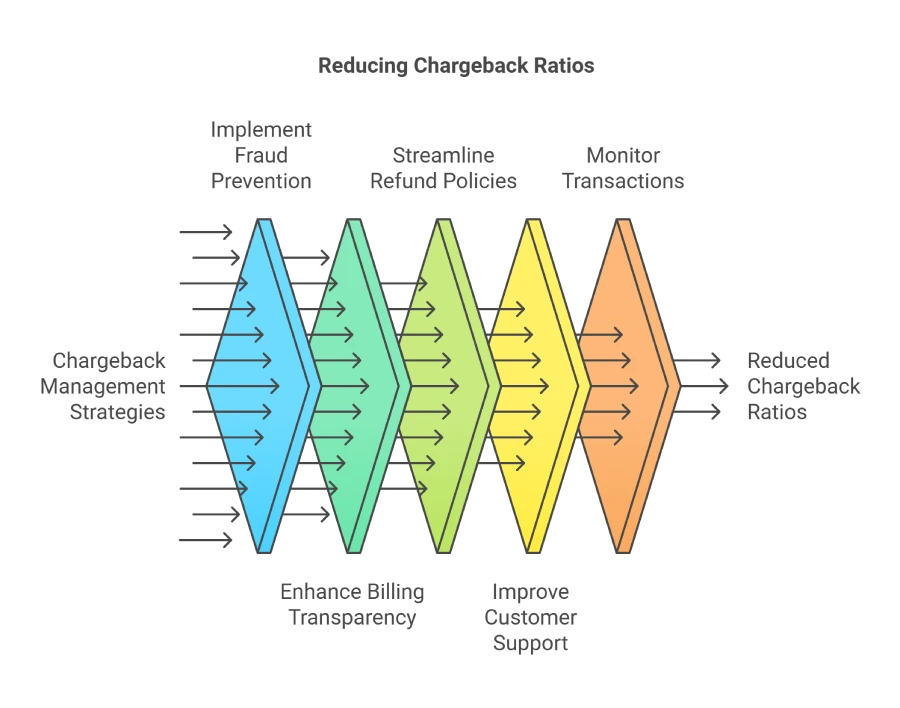

How to Reduce Chargeback Ratios

Proactively managing chargebacks is critical for businesses in high-risk industries to maintain stable merchant accounts and avoid excessive fees or terminating their credit card processing capabilities. Here are some effective strategies to reduce chargeback ratios:

|

Strategy |

Description |

Benefit to Businesses |

|

Fraud detection tools |

Advanced systems like AVS and 3D Secure authentication to prevent fraudulent transactions. |

Reduces chargebacks caused by unauthorized or suspicious transactions. |

|

Real-time chargeback alerts |

Instant notifications of initiated disputes, allowing for quick response and resolution. |

Minimizes financial losses and improves the chance of winning disputes. |

|

Automated chargeback tools |

Platforms that manage evidence submission and deadlines for disputes. |

Streamlines the chargeback process and ensures compliance with card network timelines. |

|

Rolling reserve flexibility |

Providers set aside a percentage of sales to offset chargeback risks with negotiable terms. |

Maintains cash flow while meeting financial obligations. |

|

Compliance support |

Guidance on adhering to Visa and Mastercard rules for chargeback thresholds. |

Avoids penalties and ensures uninterrupted credit card processing. |

|

Custom analytics and reporting |

Detailed transaction and chargeback data to identify trends and operational vulnerabilities. |

Enables proactive adjustments to reduce disputes and improve overall chargeback ratios. |

Long-Term Implications of Poor Chargeback Management

Failing to manage chargebacks effectively can have severe long-term consequences for businesses, particularly those in high-risk industries. Beyond immediate financial losses, the ripple effects can disrupt operations, damage reputations, and even threaten a business’s viability.

1. Increased Credit Card Processing Fees

High chargeback ratios often lead to elevated processing fees. Payment processors impose higher transaction fees on high-risk merchant accounts to offset their exposure to disputes. For businesses already facing thin margins, these increased costs can erode profitability.

2. Rolling Reserves and Withheld Funds

Payment processors may implement rolling reserves or hold a portion of funds for extended periods to cover potential chargeback liabilities. This practice restricts cash flow and limits a business’s ability to invest in growth.

3. Risk of Merchant Account Termination

Persistent high chargeback ratios can result in the termination of merchant accounts. Losing the ability to process credit card payments can cripple businesses, particularly in e-commerce or other industries reliant on instant credit card processing.

4. Difficulty Obtaining Future Merchant Services

Businesses with a history of high chargebacks may struggle to secure new credit card processing agreements. Even if approved, they are often labeled as high-risk, leading to stringent terms, higher fees, and mandatory rolling reserves.

5. Damage to Business Reputation

Excessive disputes signal operational inefficiencies or poor customer service, eroding customer trust. A tarnished reputation can make it harder to attract new clients and retain existing ones.

6. Lost Revenue From Disputes

Beyond the administrative fees, chargebacks result in lost product costs, shipping fees, and potential future sales. For many businesses, especially small or medium-sized enterprises, these losses add up quickly and threaten sustainability.

7. Limited Scalability

Businesses facing chargeback challenges may struggle to expand into new markets or offer additional payment options. For example, adopting mobile card readers for iPhone or Android or integrating e-commerce platforms becomes more challenging when chargebacks strain operational resources.

The Role of Compliance in Chargeback Management

Adhering to Payment Card Industry (PCI) standards and card network rules is vital for managing chargebacks effectively. Compliance not only reduces the risk of penalties but also ensures uninterrupted credit card processing.

Advanced Tools for Enhanced Chargeback Management

Effective chargeback management requires cutting-edge technologies tailored for high-risk merchant accounts. These tools focus on reducing disputes, optimizing credit card processing, and providing valuable insights for long-term growth.

1. AI-driven root cause analysis

Advanced AI tools analyze transaction data to uncover recurring chargeback causes, empowering high-risk businesses to address issues like unclear billing or delivery delays. This proactive approach supports sustainable chargeback prevention strategies.

2. Dynamic risk scoring

Risk scoring systems evaluate transactions in real-time, flagging potentially fraudulent activity. High-risk merchants benefit from preventing disputes before they impact chargeback ratios.

3. Pre-authorization fraud checks

By validating payment details upfront, businesses in high-risk industries like crypto currency can reduce disputes caused by unauthorized transactions. These systems are integral to maintaining stable merchant accounts.

4. Chargeback forecasting models

Predictive analytics tools forecast chargeback trends, enabling high-risk merchants to allocate resources effectively and refine operational strategies.

5. Cross-border payment optimization

International businesses can leverage tools that manage localized payment methods, reducing chargebacks due to unfamiliar billing practices. This is particularly valuable for merchants using high-risk merchant services for global transactions.

6. Dispute Resolution Automation

Automated tools streamline the chargeback dispute process by compiling necessary documentation and submitting claims to card networks. This reduces manual effort and ensures faster resolutions for high-risk merchants, minimizing financial losses.

Prevention and Optimization

Instead of reacting to disputes, these tools shift the focus to prevention and optimization. By adopting these innovative technologies, high-risk businesses can maintain stable merchant accounts, safeguard their credit card processing capabilities, and reduce chargeback ratios sustainably.

The Future of Chargeback Management Innovation

As technology continues to evolve, businesses in high-risk industries will gain access to more advanced tools for managing chargebacks and protecting their merchant accounts. These future innovations aim to prevent disputes and enhance overall operational efficiency for businesses relying on credit card processing.

1. AI-powered behavioral analytics

Emerging tools will use artificial intelligence to analyze customer behavior and purchase patterns in real time. These insights will help merchants predict potential disputes before they happen, offering an opportunity to intervene proactively.

2. Blockchain for transparent transactions

Blockchain technology could revolutionize chargeback management by providing an immutable ledger of transactions. This transparency would make disputes easier to resolve and reduce fraudulent chargebacks in industries prone to card-not-present (CNP) transactions.

3. Biometric verification for payments

Biometric authentication, such as fingerprint or facial recognition, is expected to play a larger role in verifying payments. This added layer of security can reduce unauthorized transactions, a common cause of chargebacks.

4. Smart contracts

For industries with recurring billing or subscription models, smart contracts can ensure payments are processed only under agreed conditions. This reduces disputes caused by unclear terms or unexpected renewals.

5. Machine learning for personalized risk scoring

Advanced machine learning algorithms will enable more precise risk scoring tailored to each transaction. By identifying nuanced fraud signals, businesses can prevent disputes without delaying legitimate transactions.

6. Global payment ecosystem integration

As international commerce grows, tools will integrate payment processing, localized billing practices, and dispute resolution into a single platform. This will be particularly beneficial for high-risk e-commerce platforms handling cross-border transactions.

7. Consumer dispute education platforms

Future tools may include customer-facing platforms that educate consumers on the chargeback process and encourage them to resolve issues directly with the merchant before filing disputes.

Embracing the Future of Chargeback Management

These innovations promise to make chargeback management more predictive, transparent, and customer-focused. For high-risk businesses, adopting future-ready tools will be crucial for maintaining low chargeback ratios and ensuring stable credit card processing capabilities.

Final Thoughts

Chargebacks are a significant challenge for businesses, particularly those operating in high-risk industries. Excessive chargeback ratios can lead to higher processing fees, withheld funds, and even the loss of merchant accounts, disrupting operations and threatening business viability.

By understanding the root causes of chargebacks, leveraging advanced chargeback management tools, and implementing proactive strategies, businesses can reduce disputes and maintain stable credit card processing capabilities.

High-risk merchant services play a critical role in supporting businesses through tailored solutions like real-time chargeback alerts, compliance support, and predictive analytics. Looking ahead, innovations like blockchain, biometric verification, and AI-driven tools will provide even greater opportunities to manage disputes and improve customer trust.

For businesses aiming to thrive in high-risk environments, embracing these strategies and technologies is not just about reducing financial risk—it’s about ensuring long-term growth, operational stability, and customer satisfaction. With the right approach, businesses can navigate the complexities of chargeback management and focus on what truly matters: Delivering value to their customers.

FAQ

Q. What is a chargeback?

A. A chargeback occurs when a customer disputes a credit or debit card transaction, requesting their bank to reverse the payment. The process involves the issuing bank investigating the claim, and if the dispute is resolved in the customer’s favor, the funds are returned to them, and the merchant bears the financial loss.

Q. What is a high chargeback ratio, and why is it problematic?

A. A high chargeback ratio refers to the percentage of transactions that result in chargebacks exceeding acceptable thresholds, typically above 0.9% for Visa and 1% for Mastercard. High chargeback ratios can lead to increased fees, rolling reserves, account monitoring, or termination of the merchant account.

Q. How can I reduce chargebacks in my business?

A. To reduce chargebacks, you should take these steps:

- Use clear billing descriptors.

- Provide transparent refund and return policies.

- Implement fraud detection tools like Address Verification Services (AVS).

- Offer responsive customer support to resolve disputes quickly.

- Monitor chargeback data and refine operational processes.

Q. How can a high-risk merchant service lower chargebacks?

A. High-risk merchant services offer:

- Real-time chargeback alerts.

- Automated evidence submission tools.

- Fraud prevention technologies.

- Analytics to identify chargeback trends.

- Compliance support for card network rules.

Q. What happens if my chargeback ratio gets too high?

A. Exceeding acceptable chargeback thresholds can result in:

- Higher processing fees.

- Additional penalties or fines.

- Rolling reserves that hold a percentage of your funds.

- Termination of your merchant account, limiting your ability to process credit card payments.