How to Write a Business Plan To Fund Your Business

Writing a business plan is often the biggest hurdle for entrepreneurs, not because they lack ideas, but because they lack a structure.

This guide is designed to be actionable. We have broken down how to create a business plan into its exact components. You can treat the headers below as the outline for your own document. By answering the specific questions and prompts in each section, you will build a professional, investor-ready business plan from scratch.

Whether you are applying for an SBA loan, pitching to angel investors, or building an internal roadmap for your SMB, this is the only guide you need.

TL;DR – Simple Guide to Writing a Business Plan

This step-by-step guide shows you how to write a clear, effective business plan. Perfect for startups and small businesses seeking funding or growth.

- Define your mission, goals, and value proposition

- Conduct in-depth market research and competitive analysis

- Structure your business operations and management team

- Develop marketing, sales, and go-to-market strategies

- Create clear financial projections and funding plans

- Avoid common mistakes like vague goals or unrealistic forecasts

Plus, you’ll get tips, templates, and AI tools to streamline your planning process. By the end, you’ll have a professional business plan that sets your company up for long-term success.

What is a Business Plan?

A business plan is a formal document that details your company’s goals and the strategy you will use to achieve them. It serves as a decision-making tool for management and a pitch deck for investors.

Data supports the necessity of planning. According to the Journal of Management Studies, businesses that plan grow 30% faster than those that do not. Furthermore, creating a plan allows you to identify gaps in your logic before they cost you money in the real world.

Key benefits include:

- Clarity: It forces you to articulate your value proposition.

- Funding: Lenders and investors require it to assess risk and ROI.

- Talent Acquisition: It helps attract high-quality employees who want to see a clear vision.

- Resource Management: It helps you allocate capital efficiently across marketing, operations, and R&D.

Preparation: Choose the Right Format

Before you type a single word, you must decide which structure fits your needs. Most businesses fall into one of two categories.

- The Traditional Business Plan

This is the standard format. It is detailed, comprehensive, and required for most financing options. It serves as a complete blueprint for the future.- Best for: Seeking financing, traditional bank loans, bringing on partners.

- Length: 20 to 40 pages.

- The Lean Startup Plan

This is a high-level summary often utilized by tech startups or businesses that plan to pivot quickly. It focuses on the “Business Model Canvas” approach.- Best for: Internal strategy, early-stage testing, explaining a concept quickly.

- Length: 1 to 5 pages.

Expert Recommendation: Even if you want a lean plan eventually, go through the process of writing a Traditional Business Plan first. The depth of research required will reveal weaknesses in your business model that a one-page summary might hide.

Preparation and Data Gathering

Before you open a blank document, you must gather your intelligence. A business plan based on guesses is a fiction novel. A business plan based on data is an asset.

The “Pre-Flight” Checklist:

- Financial History: If existing, gather your last 3 years of tax returns and P&L statements.

- Market Data: Access reports from IBISWorld, Statista, or Google Trends regarding your specific niche.

- Competitor Intel: List your top 5 competitors and gather their pricing sheets and marketing materials.

- Tech Stack Audits: Know what software you need to run operations.

- Audience Personas: Have a clear definition of who buys your product.

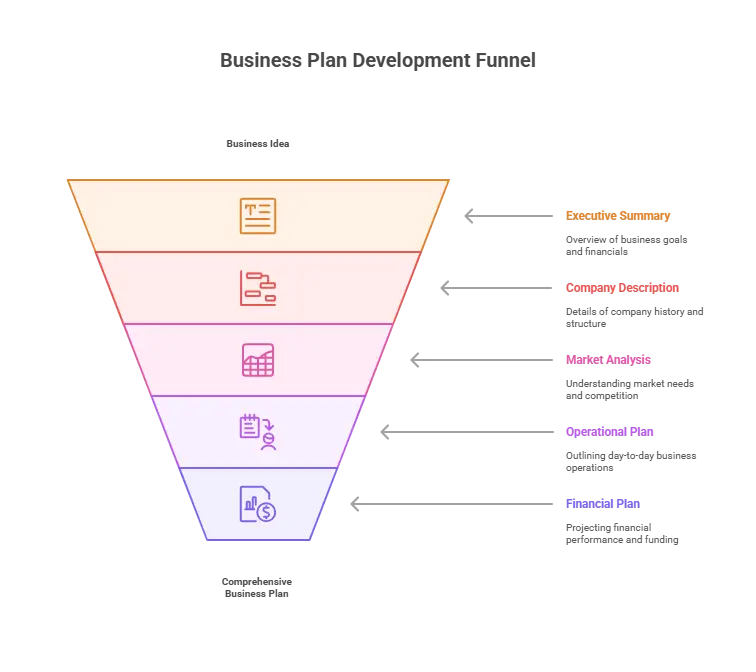

How to Write a Successful Business Plan Step-by-Step

Now that you’ve seen the overall outline, let’s dive deeper into each section and explore what to include, how to write it, and real-world tips.

1. Executive Summary

Crucial Note: Write this section last. It is a summary of the work you do in sections 2 through 9.

The Executive Summary is the “face” of your business plan. Investors review this page to answer one question: Is this worth my time? It must be compelling, concise (1-2 pages maximum), and hit the high notes immediately.

The “Copy-Paste” Executive Summary Template:

[Company Name] Executive Summary

The Opportunity (The Hook): Start with the problem. “Currently, [Target Audience] struggles with [Major Pain Point], resulting in [Loss of Time/Money/Efficiency]. Existing solutions are [Too Expensive/Outdated/Ineffective].”

The Solution (Value Proposition): “[Company Name] solves this by providing [Product/Service], which offers [Unique Benefit 1] and [Unique Benefit 2]. Unlike competitors, we utilize [Secret Sauce/Technology/Methodology].”

Market Potential: “The [Industry Name] market is valued at $[Dollar Amount] and growing at [Percentage]% annually. We are targeting the [Specific Segment], representing a $[Dollar Amount] opportunity.”

Execution Roadmap: “We plan to acquire [Number] customers in Year 1 using [Primary Marketing Channel]. Our operational focus is on [Key Operational Goal].”

Financial Snapshot:

-

Projected Revenue (Year 3): $[Amount]

-

Projected Net Margin: [Percentage]%

-

Break-Even Date: [Month/Year]

The Ask: “We are seeking $[Total Funding Amount] in exchange for [Equity Percentage/Debt Terms] to fund [Primary Use of Funds, e.g., Product Development and Sales Hiring].”

2. Company Description

This section establishes legitimacy. It answers the “Who” and the “Why.” It moves beyond the elevator pitch into the structural reality of the business.

2.1 Mission, Vision, and Values

-

Mission: What you do every day. (e.g., “To make healthy food accessible to busy professionals.”)

-

Vision: The future you are building. (e.g., “To eliminate obesity in the urban workforce.”)

-

Values: The guiding principles of your culture. (e.g., Transparency, Agility, Customer-Obsession.)

2.2 Legal Structure and Ownership This is a compliance requirement for lenders.

-

Entity Type: (LLC, C-Corp, S-Corp, Sole Proprietorship). Note: Investors almost exclusively prefer C-Corps due to tax implications on exit.

-

Ownership: Who owns the equity? List stakeholders and their percentage of ownership.

2.3 Company History and Milestones If you are a startup, focus on what you have achieved, not just what you want to do.

-

Date: Idea Conception

-

Date: Prototype Development

-

Date: First Beta User Acquired

-

Date: Patent Filed

Expert Tip: To ensure you hit future milestones, you need rigorous internal organization. Using verified project management software allows you to map these milestones to actual tasks and deadlines, which you can then showcase to investors as proof of your operational maturity.

3. Market Analysis (The “Proof” Section)

This is usually the section where entrepreneurs fail. Do not rely on “gut feelings.” You must demonstrate Product-Market Fit.

3.1 Industry Outlook Describe the macro-environment. Is the tide rising or falling?

-

Trend Analysis: What technological or cultural shifts are happening? (e.g., “The shift to remote work has increased demand for home office security by 400%.”)

-

Barriers to Entry: How hard is it for new competitors to enter? (High capital requirements, regulatory hurdles, patents).

3.2 Target Market Sizing (The TAM/SAM/SOM Model) Investors expect this specific framework. It creates a realistic view of your potential.

-

Total Addressable Market (TAM): The total market demand for a product or service.

-

Example: “The global CRM software market ($60 Billion).”

-

-

Serviceable Available Market (SAM): The segment of the TAM targeted by your products within your geographical reach.

-

Example: “CRM software for SMBs in North America ($12 Billion).”

-

-

Serviceable Obtainable Market (SOM): The portion of SAM that you can capture. This is your short-term target.

-

Example: “We aim to capture 1% of the SAM in 3 years ($120 Million).”

-

3.3 Customer Persona (The Avatar) Who is your buyer? Be specific.

-

Demographics: Male, 35-45, earns $100k+, lives in suburbs.

-

Psychographics: Values time over money, tech-savvy, worried about data privacy.

-

Buying Behavior: Researches on YouTube, buys via credit card, expects 24/7 support.

3.4 Competitive Analysis (SWOT Matrix) Create a matrix comparing yourself to your top 3 competitors.

| Feature | Your Company | Competitor A | Competitor B |

| Price | Affordable ($20/mo) | Expensive ($50/mo) | Cheap ($10/mo) |

| Quality | High | High | Low |

| Speed | Instant | Slow | Average |

| Unique Feature | AI Integration | Brand Name | None |

SWOT Analysis Template:

- Strengths: Internal things you control (Patents, Location, Team).

- Weaknesses: Internal gaps (Lack of budget, New brand).

- Opportunities: External factors (Competitor going bankrupt, New law passed).

- Threats: External risks (Economic recession, Supply chain failure).

4. Products and Services

Stop describing features. Start describing benefits.

-

Feature: “Our vacuum has a V8 motor.”

-

Benefit: “Our vacuum cuts cleaning time in half.”

4.1 Product Description Provide a detailed technical description but keep the language accessible.

-

Current Status: (Concept, Prototype, MVP, Fully Launched).

-

Differentiation: Why is this better than the alternative?

4.2 Intellectual Property (IP) and R&D Investors love “Moats”—defenses that protect your business.

-

Patents: Pending or Issued?

-

Trademarks: Brand protection.

-

Trade Secrets: Proprietary recipes or algorithms.

-

R&D Roadmap: What are you building next? (e.g., “v2.0 will launch in Q4 with AI capabilities.”)

5. Marketing and Sales Strategy

How do you turn strangers into paying customers? This is your Go-to-Market (GTM) strategy.

5.1 Pricing Strategy How you price determines how you are perceived.

-

Cost-Plus: Cost to make + Margin. (Safe, but often leaves money on the table).

-

Value-Based: Pricing based on how much value you provide. (Best for SaaS and consulting).

-

Penetration: Low price to enter the market, raising it later.

-

Freemium: Free basic version, paid upgrades.

5.2 The Marketing Mix (Promotion) Which channels will you use?

-

Inbound: SEO, Content Marketing, Social Media. (High effort, low cost, long-term).

-

Outbound: Paid Ads (PPC), Cold Calling, Trade Shows. (High cost, fast results).

5.3 The Sales Funnel Describe the journey of a lead.

-

Awareness: Customer sees a LinkedIn Ad.

-

Interest: Customer downloads a whitepaper.

-

Decision: Sales rep gives a demo.

-

Action: Customer signs contract.

Expert Recommendation: You cannot manage a complex sales funnel with spreadsheets. You will lose leads. Implementing a dedicated CRM software is essential to track your Customer Acquisition Cost (CAC) and ensure high conversion rates.

6. Operational Plan

This section transforms your “ideas” into “logistics.” It demonstrates to investors that you understand the mechanics of running a business.

6.1 Production and Supply Chain

-

Manufacturing: In-house or outsourced?

-

Vendors: Who are your primary suppliers? Crucial: Do you have backup suppliers? (Supply chain redundancy is a key risk mitigator).

-

Fulfillment: How does the product get to the customer? (Dropshipping, 3PL, In-house delivery).

6.2 Technology Requirements List the hardware and software required to operate.

-

Hardware: Servers, manufacturing equipment, POS systems.

-

Software Stack: Accounting, CRM, Project Management, HR tools.

6.3 Location and Facilities

-

Physical Footprint: Office space, retail frontage, warehousing.

-

Lease Terms: Cost per square foot, lease length.

-

Remote Strategy: If you are a remote-first company, describe how you manage distributed teams.

7. Management Team

This is often the deciding factor for investors. “Bet on the jockey, not the horse.”

7.1 The Organization Chart Include a visual chart showing the hierarchy.

-

C-Level: CEO, CTO, CMO, CFO.

-

Department Heads: VP of Sales, Head of Product.

7.2 Key Personnel Bios Do not just list degrees. List relevant achievements.

-

Bad Bio: “John has an MBA.”

-

Good Bio: “John has an MBA and previously scaled a SaaS company from $0 to $10M ARR.”

7.3 Board of Advisors If you are a young team, surround yourself with gray hair. List mentors, industry veterans, or legal/financial experts who advise you. This lends borrowed credibility to your startup.

8. Financial Plan (The Engine Room)

This is the most intimidating section, but it is the most critical. You must translate your strategy into mathematics.

8.1 Revenue Model Be specific about how you charge.

-

One-time purchase?

-

Recurring subscription (SaaS)?

-

Hourly service fee?

-

Affiliate commission?

8.2 Financial Projections (3-5 Years) You must provide three standard financial statements.

A. The Income Statement (Profit & Loss) This shows if you are profitable.

-

Formula: Revenue – Cost of Goods Sold (COGS) = Gross Profit.

-

Formula: Gross Profit – Operating Expenses (OpEx) = Net Income.

B. The Cash Flow Statement This shows if you can pay your bills.

-

Why it matters: A company can be “profitable” on paper (waiting for invoices to be paid) but go bankrupt because they have zero cash in the bank to pay rent. You must project your Cash Burn Rate.

C. The Balance Sheet A snapshot of your financial health at a specific moment.

-

Assets: What you own (Cash, Inventory, Equipment).

-

Liabilities: What you owe (Loans, Credit Card Debt).

-

Equity: Assets – Liabilities.

8.3 Key Financial Ratios Investors will calculate these to check your health. Do it for them.

-

Gross Margin: (Revenue – COGS) / Revenue.

-

Break-Even Point: Fixed Costs / (Price – Variable Costs).

Expert Recommendation: Financial modeling is prone to human error. One wrong formula can ruin your credibility. Use professional accounting software to generate these reports. Tools like QuickBooks or Xero can automate your P&L and ensure your balance sheet actually balances.

9. Funding Request and Exit Strategy

If you are asking for money, be precise.

9.1 The Ask

-

Amount: “$500,000.”

-

Instrument: “Convertible Note,” “SAFE,” “Equity,” or “Term Loan.”

-

Valuation: (If Equity) “at a $2.5M Pre-Money Valuation.”

9.2 Use of Funds Break down exactly where the money goes. Investors hate vague requests like “General Working Capital.”

-

40%: Product Development (Engineering salaries).

-

30%: Growth Marketing (Ad spend).

-

20%: Key Hires (Sales Director).

-

10%: Legal/Admin.

9.3 Exit Strategy Investors need to know how they get their money back (with profit).

-

Acquisition: Being bought by a larger competitor (e.g., Google, Salesforce).

-

IPO: Going public (rare for SMBs).

-

Profit Distribution: Paying dividends to shareholders.

Download Free Templates for Business Plans

Having a well-structured template can significantly simplify creating a business plan. Here are two free templates to help you get started. Be sure to tailor each section to reflect your business’s unique aspects and needs to create a compelling and actionable plan:

Traditional Business Plan Template

Review and Refine: The “Red Team” Test

Once your draft is done, do not send it. You must stress-test it.

The Red Team Checklist:

- The “So What?” Test: Read every paragraph. Ask “So what?” If the sentence doesn’t explain a benefit or a risk, delete it.

- The Logic Check: Does your marketing budget in Section 5 match the expenses in Section 8? (Inconsistencies here are fatal).

- The Formatting Audit: Is the font consistent? Are the headers clear? Is the document scannable?

Why Write a Business Plan?

Creating a business plan is crucial for startups, small businesses & established businesses. For startups, it provides a structured approach to turning an idea into a viable business. For established businesses, a business plan aids in strategic planning and managing growth.

Benefits of a Business Plan

- Securing funding: Essential for attracting investors or obtaining loans.

- Strategic direction: Provides a clear roadmap and strategic focus.

- Performance measurement or KPIs: Helps track progress against set objectives.

- Risk management: Identifies potential challenges and outlines mitigation strategies.

- Resource allocation: Ensures efficient use of resources by prioritizing key activities.

- Communication tool: Communicates the business vision and strategy to relevant stakeholders.

Creating a business plan is not just a formality but a critical tool for business success and sustainability.

Tips for Creating a Successful Business Plan

Here are some crucial tips to ensure you know how to build a business plan and to ensure it is comprehensive, clear, and effective:

- Market Analysis

- Unique Selling Proposition (USP)

- Growth Strategy

- Business Focus and Clarity

- SWOT Analysis

- KPIs and Performance Metrics

- Go-to-Market Strategy

Market Analysis

Understanding your market is critical to your business’s success. Conduct thorough research to determine the market size, growth potential, and trends. Analyze your target audience’s demographics, behaviors, and needs.

For example, if you’re launching a tech gadget, assess the tech adoption rate and purchasing power in your target demographics. Use reliable sources such as industry reports, market surveys, and competitor analysis to gather data. Here are the practical steps you should take:

- Define Your Objectives: Clearly define what you want to achieve with your market research, which includes understanding consumer demand, assessing market size, and identifying competitors.

- Identify Your Target Audience: Determine who your potential customers are. Create detailed buyer personas that include demographics, psychographics, and behaviors.

- Conduct research: Select a combination of industry reports, such as IBISWorld or Statista, governmental publications, academic research, and competitor analysis tools that will provide comprehensive data.

- Collect data: Gather data systematically using the chosen methods. Ensure your sample size is large enough to provide reliable insights.

- Analyze data: Interpret the data using data analysis techniques. These could include a SWOT analysis, a PEST analysis, customer segmentation, or Porter’s Five Forces. Look for patterns, trends, and insights to inform your business strategy.

- Present findings: Compile your findings into a clear and actionable report. Include visual aids like charts and graphs to illustrate key points.

- Implement insights: Use the insights gained from your market research to inform your business decisions. This could involve adjusting your marketing strategy, refining your product offerings, or exploring new market opportunities.

By following these steps and utilizing these techniques, you can conduct effective market research to provide a solid foundation for your business plan and strategy.

Unique Selling Proposition (USP)

Your USP differentiates your business from competitors. Clearly define what makes your product or service unique and why customers should choose you over others. For instance, if you’re in the food delivery business, your USP could be offering organic meals with delivery in under 30 minutes. To determine your USP, you must take the following steps:

- Identify Customer Pain Points: Understand your target audience’s specific needs and problems.

- Highlight Unique Features: Focus on what makes your product or service different and better than the competition.

- Communicate Value: Clearly articulate the benefits and value customers will receive from your product or service.

Growth Strategy (including Quick Growth Opportunities)

Identify both short-term and long-term growth opportunities. Quick growth can be achieved by targeting underserved market segments, leveraging new technologies, or forming strategic partnerships.

For example, a fashion retailer might quickly grow by collaborating with popular influencers. Consider expanding your product lines, entering new geographical markets, or developing new business models for long-term growth. A better understanding of best practices for business growth is crucial so you know what you need to prioritize to reach your goals.

Business Focus and Clarity

Maintain a clear and focused approach to your business plan. Every section should be concise and to the point, avoiding jargon and overly technical language. Clearly outline your business objectives and ensure all stakeholders understand your vision and goals.

For example, a startup might set a clear goal to become a market leader in eco-friendly packaging within five years.

SWOT Analysis

Conducting a SWOT analysis and competitor analysis is crucial for identifying your business’s strengths, weaknesses, opportunities, and threats and understanding your competitive landscape.

This helps you craft a compelling, unique selling proposition (USP) and develop effective strategies. Here’s how to do it:

Identifying Direct and Indirect Competitors

Direct Competitors:

- Definition: Direct competitors are businesses offering the same or similar products or services as your business, targeting the same customer base.

- Identification: Look at companies within your industry that serve the same market. For example, if you are launching a new coffee shop, direct competitors are other coffee shops in your area.

- Research Methods: Visit their websites, read customer reviews, visit their physical locations, and analyze their marketing materials.

Indirect Competitors:

- Definition: Indirect competitors offer different products or services that satisfy the same customer need or solve the same problem.

- Identification: Consider businesses that offer alternative solutions. For example, a coffee shop’s indirect competitors could be juice bars or cafes offering a different type of experience.

- Research Methods: Like direct competitors, analyze their online presence, customer feedback, and market strategies.

Assessing Competitors’ Strengths and Weaknesses

Strengths:

- Quality of Products/Services: Evaluate the quality and variety of competitors’ offerings.

- Customer Base: Look at their market reach and customer loyalty.

- Brand Reputation: Assess their brand image and reputation in the market.

- Marketing Strategy: Analyze their marketing campaigns, online presence, and advertising methods.

Weaknesses:

- Customer Complaints: Identify common complaints or negative reviews.

- Operational Inefficiencies: Look for any visible operational challenges.

- Product/Service Gaps: Notice areas where their offerings may be lacking or could be improved.

KPIs and Performance Metrics

Define Key Performance Indicators (KPIs) to measure the success of your business. KPIs could include metrics like customer acquisition cost, customer lifetime value, profit margins, and sales growth rates.

For instan

Go-to-Market Strategy

Develop a comprehensive go-to-market strategy that outlines how you will reach your target customers and achieve a competitive advantage. This should include:

- Market Positioning: How you want your brand to be perceived in the market. For example, positioning a premium coffee brand as the go-to choice for coffee connoisseurs.

- Pricing Strategy: Competitive pricing models that reflect the value of your products. For instance, you could use a penetration pricing strategy to gain market share quickly.

- Distribution Channels: The platforms and locations where customers can purchase your products, such as online stores, retail partnerships, or direct sales.

- Promotional Tactics: Marketing activities like advertising, social media campaigns, sales promotions, and public relations efforts. For example, launching a social media campaign targeting health-conscious consumers for a new line of fitness products.

By incorporating these tips and examples into your business plan, you can create a robust and effective roadmap that will guide your business to success.

Types of Business Plans

Different types of business plans cater to specific purposes and audiences, depending on your business goals, stage, and target market. Here are the main types:

- Traditional business plans: Comprehensive documents used to secure funding, including sections like market analysis, organizational structure, and financial projections. Ideal for businesses seeking detailed planning and investment.

- Example: A manufacturing company seeking substantial investment would use a traditional plan to present a thorough market analysis and growth strategy.

- Lean business plans: Concise plans focused on key business aspects designed for internal use to maintain flexibility and adapt quickly to market changes.

- Example: A tech startup using agile methods might use a lean plan to highlight its value proposition and target market.

- Nonprofit business plans: Emphasize the mission and impact, detailing the problem, solution, and funding strategies to achieve social goals.

- Example: A nonprofit improving literacy rates would outline programs, target communities, and impact measurement.

- Specialized business plans: Tailored for specific needs like securing loans or attracting investors, with a focus on financial sustainability and growth potential.

- Example: A business seeking a loan would create a plan highlighting its ability to repay, with detailed financial statements and projections.

Choosing the right plan type ensures effective communication of your business’s goals and strategies, increasing your chances of success.

Common Mistakes That Will Sink Your Plan

As an expert reviewer of business plans, here are the top errors I see that lead to immediate rejection:

- The “Hockey Stick” Illusion Projecting that revenue will stay flat for 6 months and then suddenly shoot up vertically without a clear reason. Growth is usually gradual. Be conservative.

- Ignoring the Competition Claiming “We have no competition” is a sign of amateurism. Even if there is no direct product like yours, there is status quo competition (people doing it the old way).

- Poor Cash Flow Management Focusing only on Profit and ignoring Cash. You need to account for “Accounts Receivable Lag”—the time between making a sale and getting the cash.

- Vague Target Audience Targeting “Everyone.” A product for everyone is a product for anyone. Niche down.

- Lack of Skin in the Game Investors want to see what you have invested. If you haven’t put your own time or money into this, why should they?

Additional Resources and AI Tools

Creating a business plan can be a complex process, but numerous resources and AI tools are available to assist you. Here are a few that you may find helpful when writing your business plan:

Final Thoughts

Writing a comprehensive business plan is vital for any entrepreneur or business owner. It serves as a roadmap for your business and helps secure funding and attract investors. By understanding the different types of business plans and their specific uses, you can tailor your plan to meet your unique needs.

Avoid common mistakes such as overly optimistic projections, lack of research, ignoring weaknesses, and poor organization. Instead, focus on creating a clear, realistic, and well-researched plan that addresses potential challenges and outlines a solid strategy for growth.

FAQ

Who needs a business plan?

Anyone starting a new business, expanding an existing business, or seeking funding needs a business plan. It is essential for entrepreneurs, small business owners, and established businesses looking to set strategic goals and secure investment.

What are the 7 steps of a business plan?

The 7 steps of a business plan include: Executive Summary, Company Description, Market Analysis, Organization and Management, Products/Services, Marketing and Sales Strategy, Financial Projections.

Can I write a business plan myself?

Yes, you can write a business plan yourself. This guide provides you with a comprehensive step-by-step guide on writing a business plan for different types of businesses.

How many hours does it take to write a business plan?

Writing a business plan can take anywhere from 20 to 100 hours, depending on the complexity of the business, the amount of research needed, and the level of detail required. For more intricate plans to secure significant investment, expect to spend more time ensuring all aspects are thoroughly covered.

How long should a business plan be?

A business plan should typically be 15 to 30 pages, depending on your business size, industry, and purpose. A traditional plan with detailed financials and research will be longer, while a lean plan can be as short as 1–5 pages.

What are the three pillars of a business plan?

The three core pillars of a solid business plan are:

- Strategy: Your goals, vision, and business model.

- Market Understanding: Research on your industry, competitors, and target customers.

- Financial Planning: Revenue model, projections, funding needs, and profitability.

What are the three main structures of a business?

The three most common business structures are:

- Sole Proprietorship: Owned and operated by one person.

- Partnership: Owned by two or more individuals sharing responsibilities and profits.

- Corporation (or LLC): A legally separate entity offering liability protection and formal management structure.

Does Google Docs have a business plan template?

Yes, Google Docs offers free business plan templates through its template gallery.

Are there business plan templates?

Yes, we provide free business plan templates you can download and customize.

What does a real business plan look like?

A real business plan is a structured, well-organized document that includes:

- Executive Summary

- Company Overview

- Market Research

- Product or Service Description

- Marketing & Sales Strategy

- Financial Projections

- Funding Request (if applicable)

- Appendices with supporting documents