Traditional Payroll Processing vs. QuickBooks Payroll: Which is Best for Your Business?

Payroll processing is an important and necessary part of any business that employs workers. It ensures that employees are paid accurately and on time, which helps to keep them motivated and productive. Additionally, payroll processing involves a range of tasks, such as tax calculations, benefits administration, and compliance with state and federal regulations. Given the complexity of these tasks, businesses often find themselves taking up the better part of their time and resources to process their payroll.

Traditional payroll processing has been in use for many years, but with the advancement of technology, businesses can now leverage automated payroll processing systems to streamline their entire payroll process. Intuit QuickBooks Payroll has gained popularity in recent years due to its user-friendly interface and its proven ability to save time and increase accuracy.

In this article, we will explore the limitations and challenges involved in traditional payroll processing and the benefits of using an automated payroll processing system. Furthermore, we will analyze the key differences between manual payroll processing and QuickBooks Payroll, provide examples of businesses that have made the switch to QuickBooks Payroll, and discuss how QuickBooks Payroll could be the perfect fit for your specific business needs.

Traditional Payroll Processing

Traditional payroll processing refers to the manual method of calculating employee salaries and benefits. This process involves a range of tasks, like tracking employee hours, calculating taxes, and issuing paychecks.

In traditional payroll processing, businesses must manually collect and calculate employee time cards and manually calculate gross pay and deductions. Additionally, they must also manually calculate taxes, prepare tax returns, and remit payroll taxes to the appropriate authorities. This process can be time-consuming and prone to errors, particularly if the business has a large number of employees.

Manual payroll processing can be challenging for businesses, particularly those with a large workforce. With so many details to consider, there is a fair amount of room for errors like incorrect tax calculations or missed payroll deadlines. Traditional payroll processing also requires businesses to stay up-to-date with state and federal regulations, which can be a daunting task, as they are always changing and updating. These limitations and challenges can result in increased costs, reduced productivity, and a lack of compliance with payroll regulations.

Automated Payroll Processing

With automated payroll processing systems, businesses can completely streamline their payroll activities by reducing the need for tasks like manual data entry, time tracking, and tax calculations. These systems offer a range of benefits, such as increased accuracy, reduced costs, and improved compliance with state and federal regulations.

Automated payroll processing simplifies the payroll process by automating tasks that were, until now, done one at a time, manually. This automation saves businesses time and greatly reduces the risk of human-made errors. Another benefit of automated payroll systems is that they often integrate with other HR and accounting systems, further streamlining payroll operations.

The shift to automated payroll processing has addressed some of the most significant pain points of traditional/manual payroll processing. Here are some examples of how:

Time-consuming calculations: Manual payroll processing involves a lot of time-consuming calculations that can lead to errors, especially when dealing with large amounts of data. Automated payroll processing systems have built-in calculators that can perform these calculations quickly and accurately.

Tax compliance: Payroll tax compliance can be a daunting task for small business owners. Automated payroll processing systems can automatically calculate payroll taxes and generate tax forms, ensuring that businesses remain compliant with all tax laws.

Data entry errors: Entering data manually increases the risk of errors, which can lead to costly mistakes. Automated payroll processing systems can help reduce data entry errors by automating the process and ensuring that the data is accurate.

Employee self-service: With automated payroll processing systems, employees can access their payroll information, such as pay stubs and W-2 forms, online. This reduces the need for HR staff to manually distribute this information manually, saving time and resources.

QuickBooks Payroll

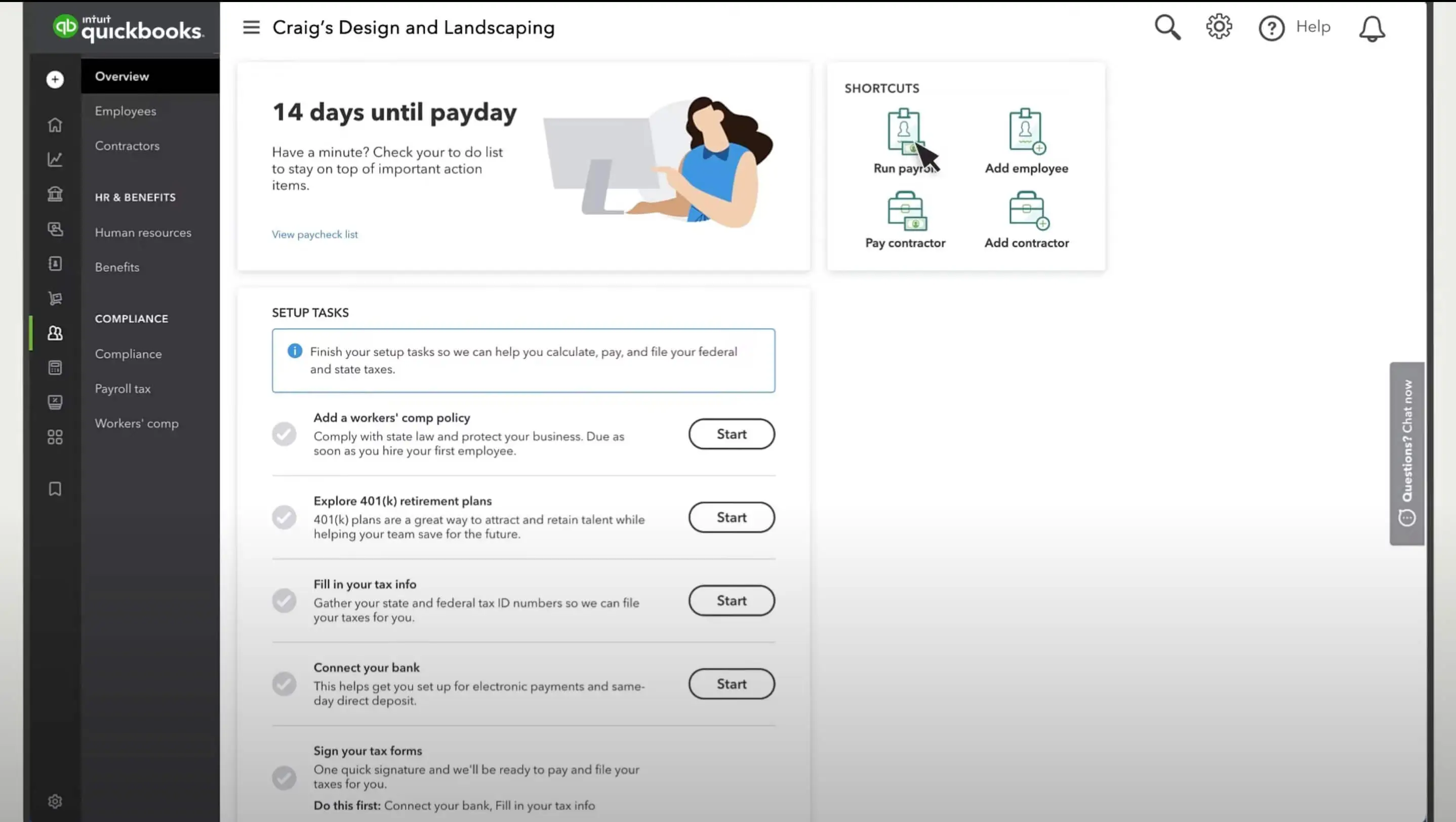

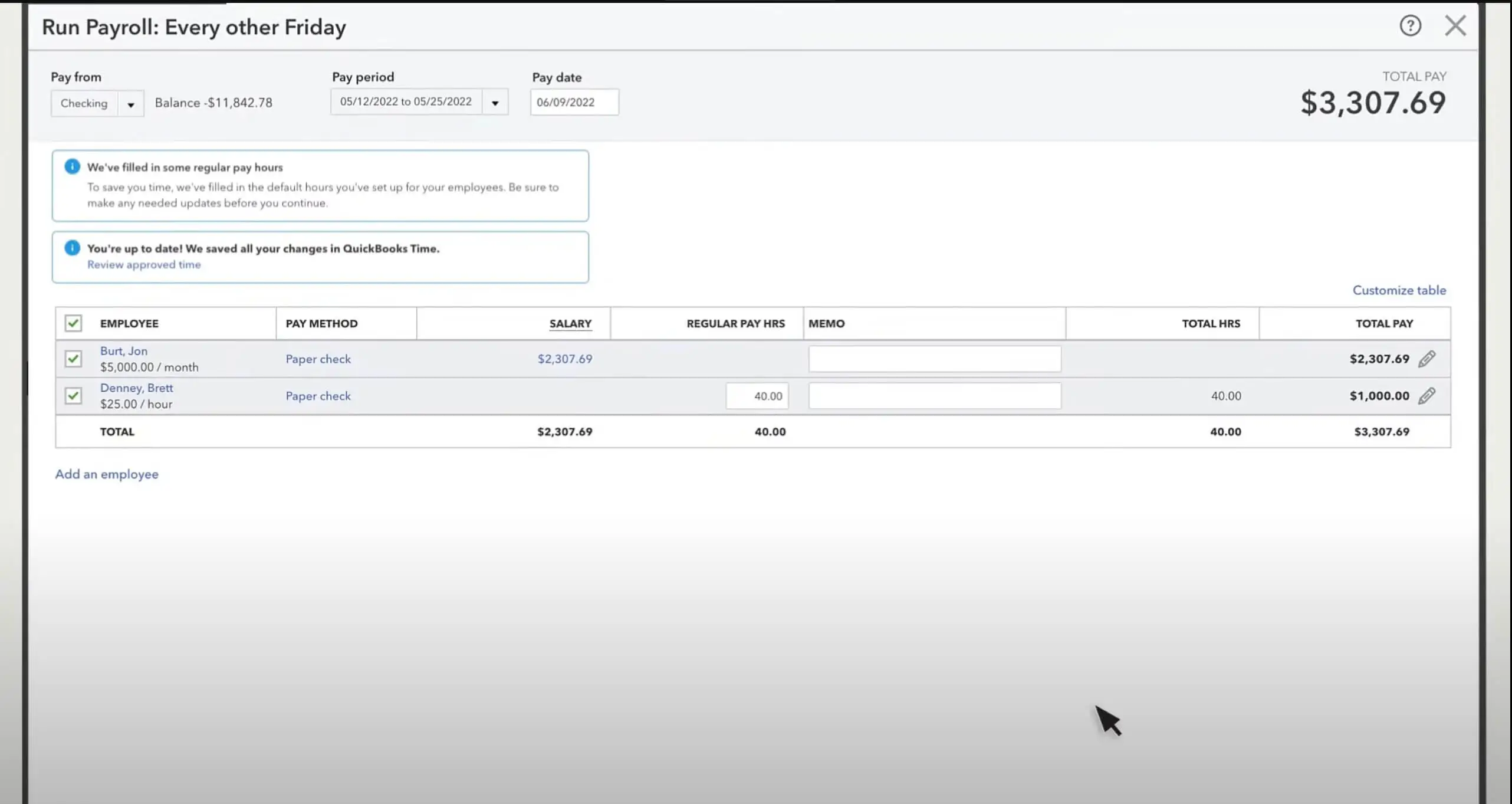

Intuit QuickBooks Payroll is a popular cloud-based payroll processing solution for small and medium-sized businesses. The automated payroll processing system is designed to help businesses manage their payroll tasks more quickly and efficiently.

QuickBooks Payroll offers several features that can save businesses significant amounts of time and increase accuracy in their payroll processing. QuickBooks Payroll’s automatic tax calculations can help eliminate errors that can occur when calculating taxes manually. This feature can also help save time by automatically calculating and deducting the correct taxes for each employee based on their location, pay rate, and other relevant factors.

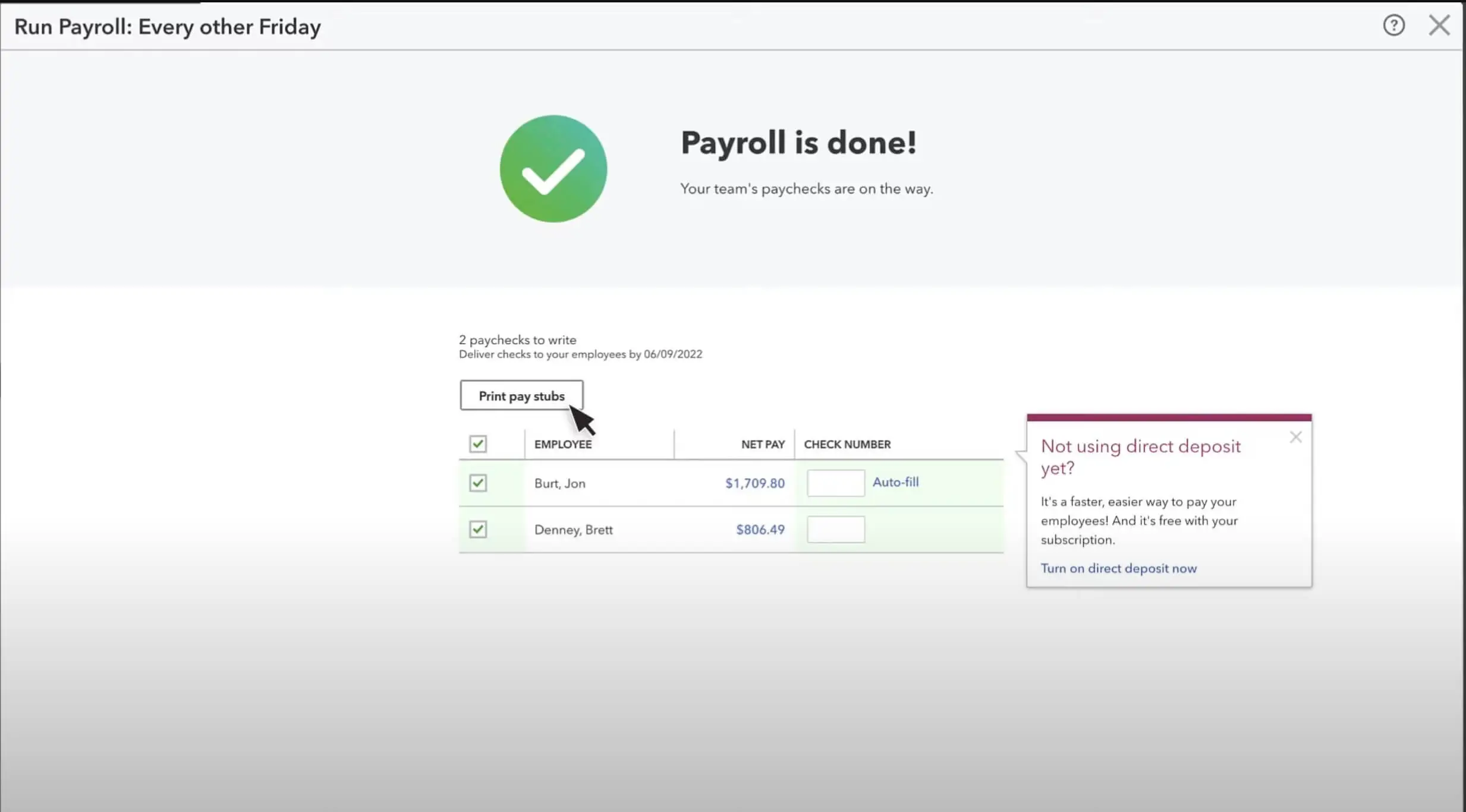

Another time-saving feature of QuickBooks Payroll is direct deposit. With direct deposit, businesses can easily and securely deposit employee paychecks directly into their bank accounts. This eliminates the need to print and distribute physical checks, which can be time-consuming and costly. There is also an option for next-day and same-day direct deposit, depending on which plan you choose, which means employees don’t have to wait for their paychecks, even if things are delayed on the business side.

QuickBooks Payroll offers a variety of reporting options that can help businesses keep track of their payroll data and make more informed decisions. For example, businesses can generate reports that show their payroll expenses by department, by employee, or by pay period. These reports can be used to identify areas where costs can be reduced or to track the effectiveness of various cost-cutting measures.

There is also an employee self-service option, where employees can have access to their pay stubs, benefits, vacation and sick leave, as well as working hours and upcoming shifts. This can help reduce the administrative burden on HR staff and give employees greater control over their working and payroll information.

Overall, QuickBooks Payroll can help businesses save time and increase accuracy in their payroll processing. Its automated tax calculations, direct deposit, reporting options, and employee self-service features make it a valuable tool for businesses of all sizes.

Manual Payroll Processing vs. QuickBooks Payroll

When it comes to payroll processing, businesses have traditionally used manual methods such as spreadsheets or even pen and paper. While these methods may have worked in the past, they often take up a lot of time to complete and can leave a lot of room for potentially costly mistakes. On the other hand, QuickBooks Payroll offers an automated solution that can help businesses save time and increase accuracy in all of their payroll processing activities.

While manual payroll processing may be suitable for small businesses with only a few employees, all-sized businesses can benefit greatly from the automation and advanced features offered by QuickBooks Payroll.

39% of businesses, globally, claim that at least 30% of all business expenses are put toward payroll.

Source: Intuit QuickBooks

In fact, many businesses have already started to notice where they are lacking in their payroll processing and would experience immediate significant improvements upon making the switch to an automated payroll processing system. According to a study conducted by Intuit QuickBooks, 39% of businesses, globally, claim that at least 30% of all business expenses are put toward payroll. Also, they found that business owners were spending an average of over four calculating, filing, and preparing payroll taxes. Despite these numbers, around a third of businesses are still using manual payroll processing methods. Automating these tedious payroll processes gives business owners more time to focus on the more important aspects of their business.

Is QuickBooks Payroll Right for Your Business?

Depending on the size of your business, the complexity of your payroll processing needs, and your budget, QuickBooks Payroll could be the perfect fit for you.

For small businesses with only a very small number of employees and simple payroll processing needs, manual methods may be sufficient. However, as businesses grow and their payroll processing needs become more complex, the benefits of automation and advanced features become increasingly important.

Businesses should also consider the cost of QuickBooks Payroll compared to the cost of their current payroll processing methods. While QuickBooks Payroll may have an initial cost associated with it, the time and cost savings it can provide over the long term will most likely outweigh this initial investment.

Conclusion

Payroll processing is an important aspect of business operations that can have a significant and direct impact on a company’s bottom line. While manual methods have been used in the past, QuickBooks Payroll offers an automated solution that can help businesses save time and money, and increase the accuracy and efficiency of their payroll processing.

With the wide range of benefits discussed throughout this article, including automatic tax calculations, direct deposit, reporting options, and employee self-service features, businesses can put their attention and resources towards other aspects of the business that require critical thinking and decision-making, which only a human being can do. Businesses should carefully consider their specific needs and budget when deciding if QuickBooks Payroll is right for them.

Before potentially wasting more time, effort, and money, businesses of any size should evaluate their current payroll processing methods and consider the benefits of QuickBooks Payroll. By making the switch to QuickBooks Payroll, businesses can save hours of manual labor, increase accuracy, and improve their overall payroll processing efficiency, from start to finish.