Using QuickBooks to Streamline Tax Season: A Guide for Small Business Owners

As a small business owner, tax season can be a stressful time. There are a lot of financial records to keep track of, and it can be challenging to ensure that everything is accurate, up-to-date, and filed on time. By staying organized and keeping accurate records throughout the year, you can make the tax filing process much more manageable, which is where Intuit QuickBooks comes in.

QuickBooks is an accounting software that helps small business owners track income and expenses, generate financial reports, and prepare for tax filing. It can help simplify the financial management process by automating tasks such as transaction tracking and generating reports so that, by the time tax season rolls around, you will have an accurate record of all expenses related to your business. In this article, we will explore how QuickBooks can help you streamline your tax season and provide tips for using it in the most effective way.

Tracking Expenses in QuickBooks

One of the biggest benefits of QuickBooks Online is that it tracks all business expenses throughout the year. This can be particularly helpful when it comes time to file your business taxes, as you’ll need to organize and present all of your business expenses. QuickBooks Online lets you categorize your expenses, making it easier to keep track of them in order to ensure that you claim all your tax deductions accurately.

![]()

When categorizing expenses in QuickBooks Online, it is essential to be accurate and consistent. This will ensure that your financial records are organized and easy to locate and pull. You should also make sure that you are using the correct tax codes for each and every expense you track, to be sure that they are claimed correctly on your tax return.

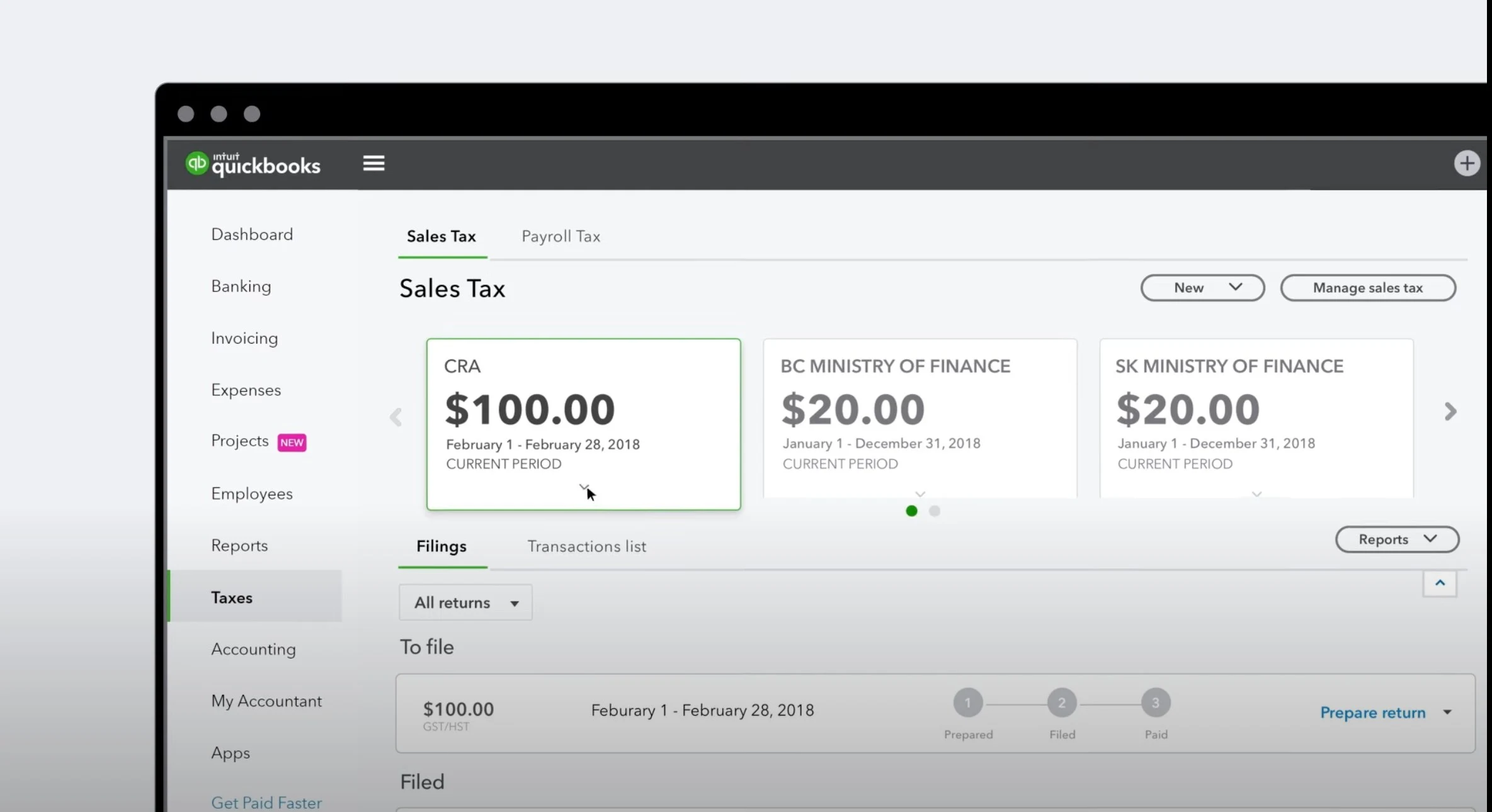

Accurate and up-to-date financial reports are imperative to a smooth tax season. QuickBooks Online generates various reports, such as profit and loss statements and balance sheets, that help to simplify tax preparation. These reports can also provide valuable insights into your business’s financial health and help you make informed financial decisions.

QuickBooks Online offers several tax-related reports, such as a Profit and Loss by Customer report and a Sales Tax Liability report. These reports can help you see which customers are most profitable and track all of your sales tax obligations. You can also customize reports to meet your specific business needs, such as adding or removing columns or filtering data by category.

Customizing reports in QuickBooks Online can help you make the most out of your financial data. You can add, remove, or change columns, change the date range, and filter data to show only the specific information you are searching for. Customizing reports can help you see the financial data you need to make informed business decisions and simplify the tax preparation process.

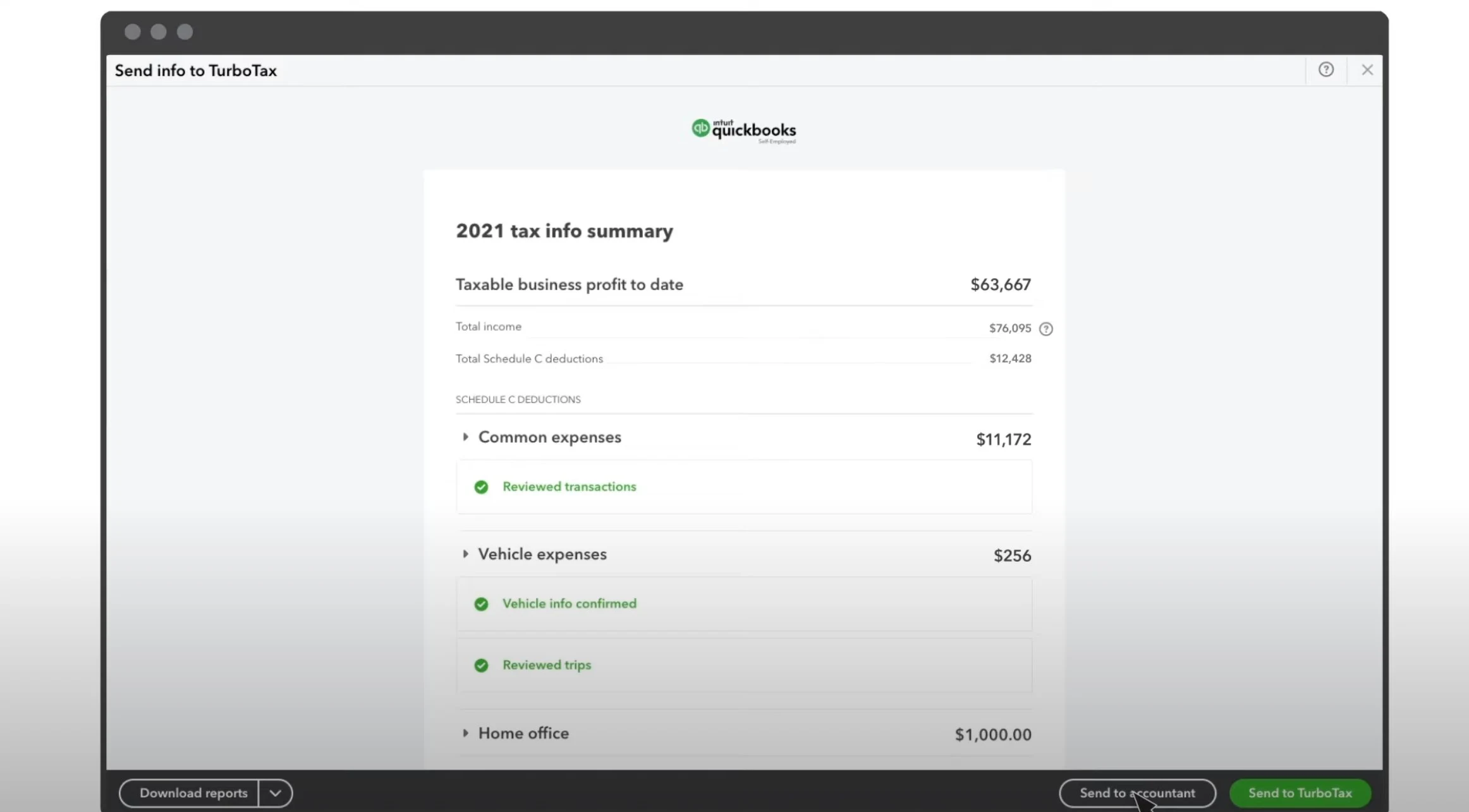

Preparing for Tax Filing with QuickBooks

QuickBooks Online can both speed up and simplify the process of preparing for tax filing by automating tasks such as generating W-2 and 1099 forms. This can save you time and ensure that your tax filings are accurate and submitted on time.

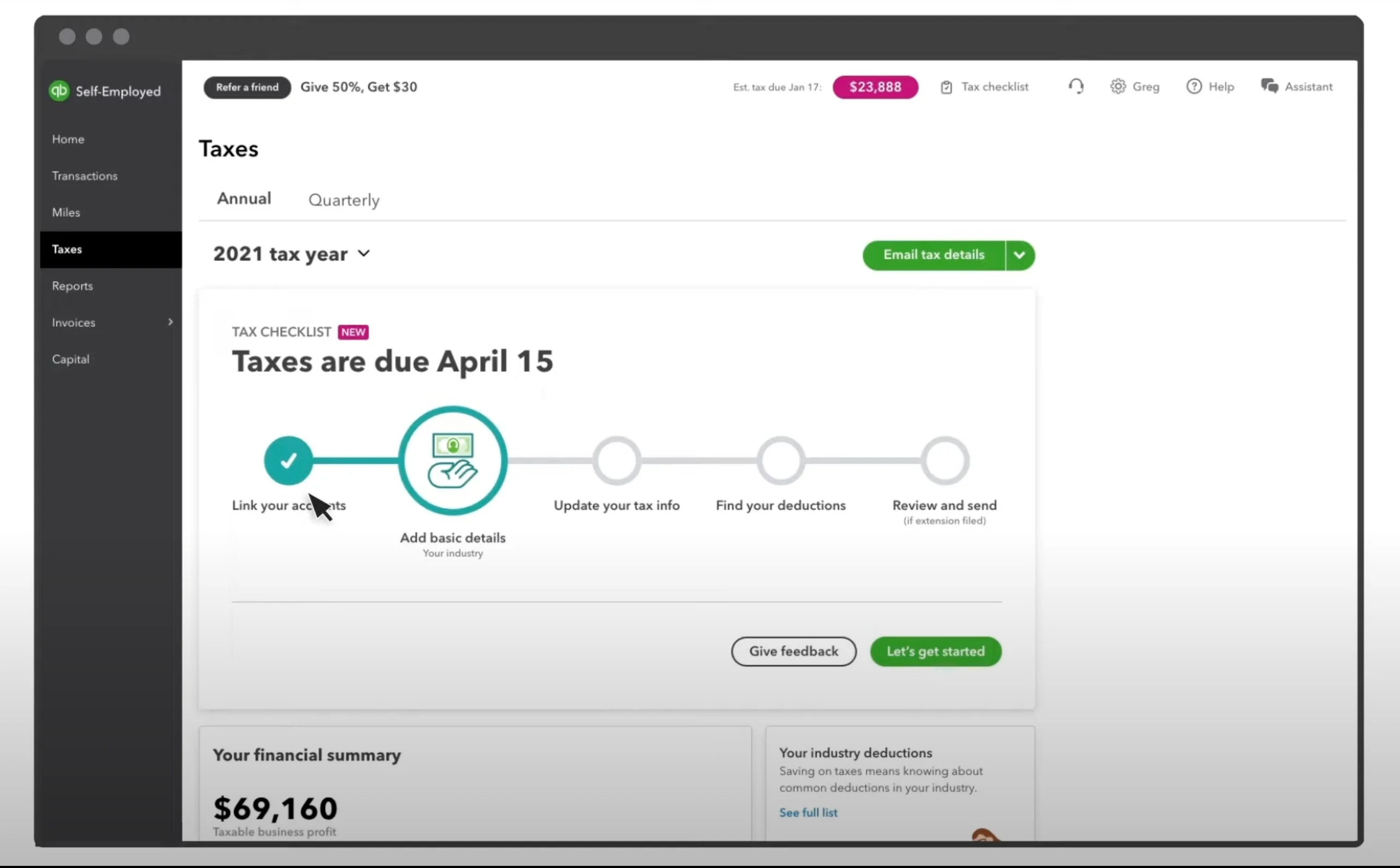

Preparing for tax filing using QuickBooks Online is very straightforward. The cloud-based accounting software features a Tax Center that gives you a checklist of everything you need to file your taxes, like a summary of your income and expenses, tax forms, and payments.

Here are the steps to prepare for filing your taxes:

Start by reviewing your income and expense reports to ensure that all transactions are categorized correctly. This will help you identify any discrepancies or missing information that may need to be corrected before filing your taxes.

Generate a profit and loss statement for the year to date. This report will give you an overview of your business’s revenue, expenses, and net income or loss for the year. You can access this report by selecting “Reports” from the left-hand menu and then selecting “Profit and Loss” under the “Business Overview” section.

Review your payroll reports to ensure that all employee information and wages are accurate. QuickBooks can generate W-2 and 1099 forms for your employees and contractors, which can save you time and effort during tax season. You can access payroll reports by selecting “Payroll” from the left-hand menu and then selecting “Reports” under the “Payroll” section.

Generate a balance sheet report to provide a snapshot of your business’s financial health. This report will show your assets, liabilities, and equity as of a specific date. You can access this report by selecting “Reports” from the left-hand menu and then selecting “Balance Sheet” under the “Business Overview” section.

Finally, review your tax reports to ensure that all tax payments and forms have been filed correctly. QuickBooks can generate a variety of tax-related reports, including sales tax and payroll tax reports. You can access these reports by selecting “Reports” from the left-hand menu and then select “Taxes” under the “Business Overview” section.

In order for small business owners to ensure accuracy and avoid common mistakes during tax preparation, here are some best practices to keep up with throughout the year:

Keep accurate records throughout the year, including receipts, invoices, and bank statements. QuickBooks can help you track your business transactions and ensure that your records are up to date.

Make sure that all transactions are categorized correctly. This will help you generate accurate reports and ensure that your tax forms are filed correctly.

Double-check all employee and contractor information, including Social Security numbers and addresses, before generating W-2 and 1099 forms.

Review all tax forms and reports for accuracy before submitting them to the IRS or other tax authorities. This will help you avoid penalties and other issues down the line.

Consider working with a tax professional or accountant to ensure that your taxes are filed correctly and to get advice on how to minimize your tax liability.

By following these tips and using QuickBooks Online to streamline the tax preparation process, small business owners can reduce the stress that typically comes with tax season.

Benefits of Using QuickBooks for Tax Season

Compared to manual methods of tax preparation, using QuickBooks Online offers a range of benefits for small business owners. Some of the key benefits include:

Time savings: By automating many of the tax-related tasks and generating customized reports, QuickBooks can save business owners a significant amount of time during tax season. QuickBooks also offers a free sales tax calculator tool to use, free of charge.

Improved accuracy: With the ability to track transactions and generate accurate reports, QuickBooks can help business owners avoid common mistakes and ensure that their tax forms are filed correctly.

Customization: QuickBooks allows small business owners to customize their financial reports to suit their specific needs. This flexibility can be particularly useful when preparing for tax season, as business owners can create reports that highlight the data they need to file their taxes accurately.

Easy collaboration: If you work with an accountant or other financial professionals, QuickBooks can make it easy to collaborate with them during tax season. By granting access to your QuickBooks account, you can allow others to view and work with your financial data without the need to share paper documents.

Centralized data: With QuickBooks, all your financial data is stored in one centralized location, making it easy to access and organize. This can be a significant advantage during tax season, as it can help reduce the stress of searching for receipts and other financial documents.

In addition to the benefits mentioned above, QuickBooks Online also offers an intuitive user interface that makes it easy for small business owners to navigate and manage their finances. The platform’s dashboard provides a quick snapshot of the business’s financial health, including key metrics like cash flow, expenses, and profit and loss. This can be particularly helpful during tax season, as business owners can quickly identify areas where they may need to make adjustments to improve their tax situation.

Moreover, QuickBooks is continuously updated to ensure compliance with tax regulations and accounting standards, reducing the risk of errors or penalties. The platform also integrates with a range of other business tools, such as payment processors and inventory management software, to streamline business operations and further simplify tax preparation.

Conclusion

Tax season is typically a demanding time for small business owners. Fortunately, QuickBooks Online simplifies the process, providing a comprehensive solution to all the tax-related complexities. Using QuickBooks Online can help streamline the entire tax process and make it much more manageable. By tracking expenses throughout the year, generating reports, and preparing for tax filing using QuickBooks Online, small business owners can save valuable time and reduce a lot of the effort required to complete these tasks, manually.

If you are a small business owner, you should explore how QuickBooks Online can help streamline your tax season and improve your overall financial management. By taking advantage of the many features and benefits offered by QuickBooks Online, you can simplify the tax season and say goodbye to all of the stress that generally comes along with it.

By utilizing its user-friendly tools and features, businesses can keep their finances organized, reduce errors, and increase their chances of getting the maximum possible tax refund. Harness the full potential of QuickBooks Online, to not only navigate the tax season more efficiently but also pave the way for long-term business success.