Worldpay vs PayPal: Which payment solution is better for your business in 2025?

Choosing a payment partner is one of the most critical decisions for any business, directly impacting cash flow, operational efficiency, and customer experience. For many, the choice narrows down to two giants: Worldpay, a traditional merchant services powerhouse, and PayPal, a digital-native platform that has expanded into a comprehensive commerce ecosystem. But comparing them is not a simple apples-to-apples exercise; it’s about understanding two fundamentally different approaches to payment processing.

PayPal offers an all-in-one, user-friendly point-of-sale (POS) and payment system, known as PayPal Zettle, designed for simplicity and predictability. In contrast, Worldpay from FIS is an enterprise-grade payment processor that acts as the financial engine behind thousands of third-party POS systems, offering customized solutions and pricing for businesses with higher transaction volumes. This guide will dissect the core differences, from hardware and features to pricing and scalability, empowering you to decide which model best aligns with your business’s unique operational and financial goals.

Key points

- Core business model: PayPal provides a complete, integrated POS system (PayPal Zettle) with built-in payment processing. Worldpay is a dedicated payment processor that integrates with various third-party POS software and hardware.

- Best for: PayPal is ideal for startups, sole proprietors, and small to medium-sized businesses (SMBs) who need a simple, out-of-the-box solution with predictable, flat-rate pricing. Worldpay is built for established, high-volume businesses, multi-location enterprises, and companies with complex needs requiring customized processing rates.

- Pricing structure: PayPal uses a transparent, flat-rate fee for all card transactions. Worldpay utilizes custom-quoted pricing models (like Interchange-plus), which can be significantly more cost-effective at scale but are more complex.

- Contracts & commitment: PayPal operates on a pay-as-you-go basis with no long-term contracts. Worldpay typically requires a multi-year merchant agreement.

The main difference: Think of it this way—with PayPal, you buy the whole car (engine, chassis, and interior). With Worldpay, you are buying a high-performance engine to install in a car of your choice.

Quick Overview Table

| Criteria | PayPal | Worldpay from FIS |

| Best For | Startups, SMBs, mobile businesses, and pop-up shops needing an all-in-one solution. | High-volume retailers, multi-location restaurants, franchises, and enterprises needing custom rates. |

| Starting Price | No monthly software fee. Pay only for hardware and processing. | Custom quote based on business volume and risk. Often includes monthly fees. |

| Processing Fees | Flat-rate: Currently 2.29% + $0.09 per in-person transaction. | Custom-quoted Interchange-plus or tiered pricing. Rates can be lower for high-volume merchants. |

| Free Version | The core PayPal Zettle POS app is free to use. | No free version; it is a contracted merchant service. |

| Key Feature 1 | Fully integrated hardware and software ecosystem for simple setup. | Advanced, customizable payment processing with global reach and robust security. |

| Key Feature 2 | Transparent, predictable flat-rate fees with no long-term contracts. | Integrates with hundreds of industry-leading third-party POS systems and software. |

What is PayPal?

PayPal, through its Zettle POS solution, provides a complete and user-friendly commerce platform designed for small and medium-sized businesses. It bundles a free point-of-sale app, proprietary hardware like card readers and terminals, and straightforward payment processing into a single, cohesive package. The system is engineered for simplicity, allowing merchants to start accepting in-person and online payments quickly with minimal technical setup and transparent, predictable transaction fees.

- Pros:

- Extremely easy to set up and use.

- Transparent, flat-rate pricing with no monthly fees for the POS app.

- No long-term contracts or cancellation penalties.

- Seamless integration with PayPal business accounts for unified fund management.

- Cons:

- Flat-rate processing fees can be more expensive for high-volume businesses.

- The feature set is less advanced compared to specialized POS systems.

- Limited selection of third-party hardware and software integrations.

What is Worldpay?

Worldpay from FIS is one of the world’s largest payment processors, providing merchant services to businesses of all sizes, with a strong focus on medium-to-large enterprises. Unlike PayPal, Worldpay does not offer its own branded, all-in-one POS system. Instead, it functions as a powerful payment processing backend that integrates with a vast network of third-party POS software (e.g., Clover, Lightspeed, Micros) and hardware terminals. Its primary value proposition is offering customized, volume-based pricing, advanced fraud protection, and global payment acceptance capabilities.

- Pros:

- Potentially lower processing rates for businesses with high sales volume.

- Extensive compatibility with a wide range of specialized POS systems and business software.

- Advanced security, fraud management, and reporting tools.

- Global reach, supporting payments in numerous currencies.

- Cons:

- Complex, custom-quoted pricing that lacks transparency.

- Typically requires a multi-year contract with potential early termination fees.

- Setup and onboarding process is more involved and less “plug-and-play.”

- Customer support experiences can be inconsistent for smaller clients.

Head-to-head comparison

Features

The feature comparison highlights the fundamental difference between the two services. PayPal offers a self-contained set of essential POS features, while Worldpay provides enterprise-grade processing features, with the day-to-day POS functionality being determined by the third-party system you pair it with.

- PayPal (Zettle):

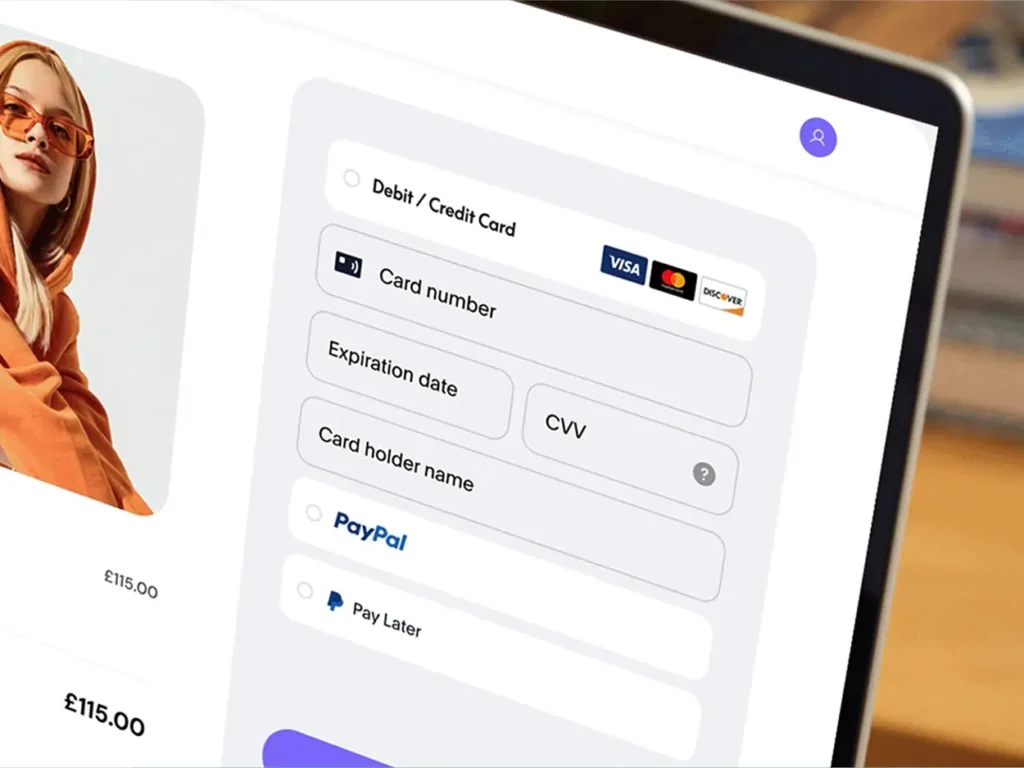

- Payment Acceptance: Accepts all major credit/debit cards, contactless payments, and PayPal/Venmo QR codes.

- Inventory Management: Basic tools for tracking stock levels, adding product variants, and receiving low-stock alerts.

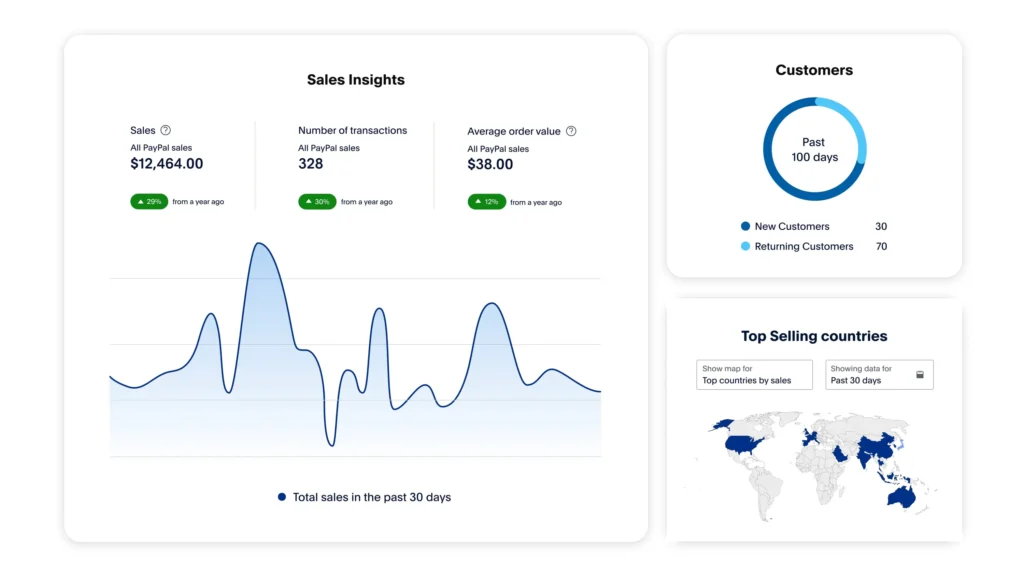

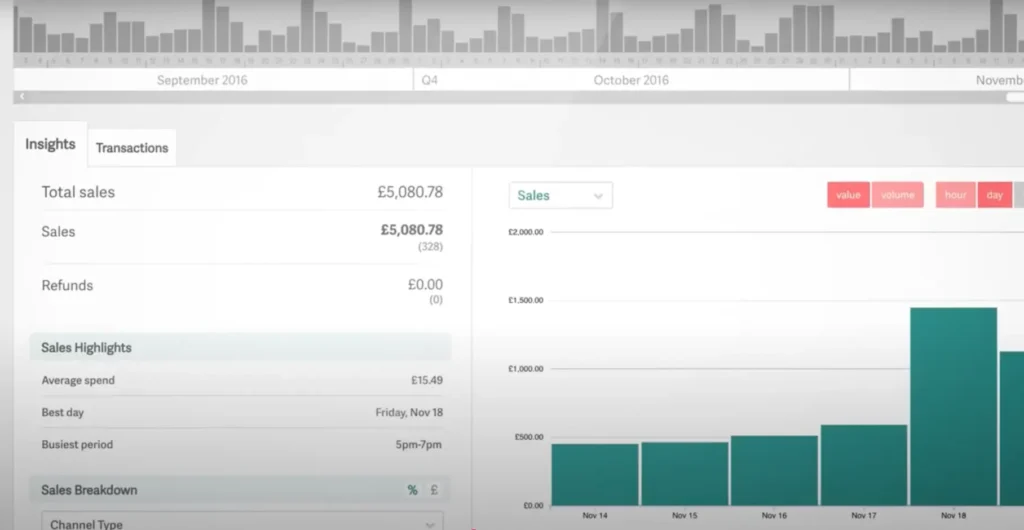

- Sales Reporting: Simple dashboard with insights on top-selling products, daily sales trends, and staff performance.

- Customer Management: Ability to build a customer directory and view purchase history.

- Invoicing: Create and send invoices directly from the app.

- Worldpay:

- Payment Acceptance: Processes all major credit/debit cards, ACH transfers, and digital wallets across in-person, online, and mobile channels.

- Global Processing: Capable of handling transactions in over 140 currencies.

- Advanced Security: Offers robust fraud protection tools (FraudSight) and end-to-end encryption.

- Recurring Billing: Advanced capabilities for subscription-based businesses.

- Reporting: Provides detailed, transaction-level financial data and reconciliation reports through its merchant portal (iQ). Day-to-day sales reports come from the connected POS.

Pricing & fees

This is the most significant point of divergence. PayPal prioritizes simplicity and predictability, whereas Worldpay focuses on customized value for scale.

|

PayPal |

Worldpay from FIS |

|

|

Software cost |

Core POS app is free. |

Depends on the integrated POS partner; Worldpay itself may have monthly account fees. |

|

Processing fees |

2.29% + $0.09 for in-person card transactions. |

Custom-quoted, typically using an Interchange-plus model. Can be significantly lower than 2% for high-volume merchants. |

|

Monthly fees |

$0 |

Varies by account; can include monthly minimums, statement fees, and PCI compliance fees. |

|

Contract terms |

None (pay-as-you-go). |

Typically 2-3 year contracts with early termination fees (ETFs). |

Export to Sheets

For a business processing $20,000 per month, PayPal’s fees would be a predictable $458 + $0.09 per transaction. With Worldpay, a custom rate of Interchange + 0.20% + $0.10 could result in significantly lower costs, but this depends heavily on negotiation and card type mix.

Hardware

PayPal operates within a closed hardware ecosystem, ensuring seamless integration and ease of use. Worldpay offers flexibility by supporting a wide range of industry-standard, third-party terminals.

- PayPal:

- Zettle Reader 2: A small, mobile card reader for contactless and chip payments.

- Zettle Terminal: An all-in-one smart terminal with a built-in printer, scanner, and POS app.

- Hardware is purchased directly from PayPal and is designed to work exclusively with its software.

Worldpay:

-

- Third-Party Terminals: Works with a vast selection of terminals from leading manufacturers like Verifone, Ingenico, and PAX.

- POS System Hardware: The hardware used (registers, scanners, printers) depends entirely on the chosen third-party POS system (e.g., a Clover Station, an iPad running Lightspeed, etc.).

Ease of use & onboarding

PayPal is the clear leader for businesses that prioritize a fast, simple, do-it-yourself setup.

- PayPal: The onboarding process is self-service. You can sign up for an account, download the app, order a card reader, and start selling within a day. The interface is intuitive and requires minimal training.

- Worldpay: The onboarding process is sales-driven. It involves contacting a sales representative, undergoing an underwriting process, negotiating a contract, and then integrating the merchant account with your chosen POS system. This process can take several days or even weeks.

Integrations & app marketplace

Here, Worldpay has a distinct advantage due to its business model, which is built entirely on integration.

- PayPal: Offers a limited but functional set of integrations, primarily for e-commerce and accounting. Key integrations include QuickBooks, BigCommerce, and WooCommerce. The focus is on keeping users within the PayPal ecosystem.

- Worldpay: Boasts one of the largest integration networks in the industry. It can connect to hundreds of leading POS systems (from Oracle Micros for hospitality to NCR for retail), e-commerce platforms (Magento, Shopify), accounting software, and enterprise resource planning (ERP) systems. This flexibility allows businesses to choose best-in-class software for their specific industry without being locked into a single vendor.

Customer support

Both are massive global companies, and customer support experiences can vary widely. However, their support models are structured differently.

- PayPal: Support is primarily accessed through online help centers, chat, and phone support lines. There is no dedicated account representative for small businesses.

- Worldpay: While it offers standard phone support, larger clients are often assigned a dedicated account manager who can provide more personalized service, assistance with chargebacks, and account optimization advice.

Use case analysis: Which should you choose for your business?

Who should choose PayPal?

- Startups and new businesses: If you are just starting and need to accept payments immediately with minimal upfront cost and no long-term commitment, PayPal is the perfect choice.

- Mobile businesses & pop-ups: Food trucks, market stall vendors, and service professionals (e.g., plumbers, artists) benefit from PayPal Zettle’s simple mobile reader and straightforward app.

- Low-volume merchants: Businesses processing less than $10,000 per month will find PayPal’s predictable flat-rate pricing easier to manage than a complex Interchange-plus statement.

- Businesses prioritizing simplicity: If you want a single provider for your POS software, hardware, and payment processing, PayPal’s all-in-one model eliminates the complexity of managing multiple vendors.

Who should choose Worldpay?

- High-volume businesses: Any business processing over $20,000-$30,000 per month should explore Worldpay. The potential savings from a lower, negotiated processing rate can amount to thousands of dollars per year.

- Multi-location chains and franchises: Worldpay’s ability to integrate with sophisticated, industry-specific POS systems and provide consolidated reporting makes it ideal for managing complex, multi-site operations.

- Restaurants and large retailers: These industries often rely on specialized POS systems (like Toast, Aloha, or Lightspeed Retail) with advanced features. Worldpay acts as the ideal processing partner to plug into these powerful systems.

- Businesses with international sales: Worldpay’s superior multi-currency processing capabilities are essential for companies that sell to a global customer base.

Final verdict summary table

| PayPal | Worldpay from FIS | |

| Pros | – Easy setup & use – Transparent pricing – No contracts – All-in-one system |

– Lower rates at scale – Massive integration network – Advanced security tools – Global processing |

| Cons | – Can be expensive at high volume – Limited features & integrations – Less personalized support |

– Complex contracts & fees – Lengthy setup process – Requires a separate POS system – Not ideal for small businesses |

Conclusion

Declaring a single “winner” between PayPal and Worldpay is impossible because they are not direct competitors playing the same game. They serve different segments of the business world with fundamentally different solutions. The right choice depends entirely on your business’s size, volume, and technical requirements.

Choose PayPal if your priority is simplicity, speed, and predictability. It is an outstanding all-in-one solution for small businesses that want to get up and running quickly without the headache of contracts and complex fee structures.

Choose Worldpay if your priority is minimizing costs at a high volume and maintaining the flexibility to use best-in-class, specialized business software. It is the powerful financial engine for established, growing businesses that have outgrown simple, flat-rate processing and require a more sophisticated, customized payment infrastructure.

FAQ: PayPal vs Worldpay

- What is the main difference between PayPal and Worldpay? The main difference is their business model. PayPal offers an all-in-one POS system with integrated, flat-rate payment processing. Worldpay is a specialized payment processor that offers custom-quoted rates and integrates with hundreds of different third-party POS systems.

- Which is cheaper for a small business, PayPal or Worldpay? For a small business with low to moderate sales volume (typically under $10,000/month), PayPal is almost always more cost-effective and easier to manage due to its lack of monthly fees and simple, transparent rate structure.

- Does Worldpay require a long-term contract? Yes, Worldpay typically requires merchants to sign a multi-year contract (often 2-3 years). These contracts often include an early termination fee if you switch providers before the term is up. PayPal does not require any long-term contracts.

- Can I use my own POS system with PayPal? No, PayPal’s in-person payment processing is designed to work exclusively with its own Zettle POS app and hardware.

- Can I use my own POS system with Worldpay? Yes, this is Worldpay’s primary strength. It is designed to integrate with a vast ecosystem of third-party POS providers, from small business solutions to enterprise-level platforms.

- Which is better for an online store? Both offer robust solutions for e-commerce. PayPal is known for its simple “Pay with PayPal” button, which can improve conversion rates. Worldpay offers a highly customizable and secure payment gateway that can integrate with major platforms like Shopify and Magento, often at a lower cost for high-volume online retailers.

- Are there hidden fees with Worldpay? While not intentionally “hidden,” Worldpay’s pricing statements can be complex and may include various fees beyond the processing rate, such as monthly statement fees, PCI compliance fees, batch fees, and monthly minimums. It’s crucial to review the merchant agreement carefully.