CardX Review 2026

CardX Merchant Services Plans & Pricing

CardX Comparison

Expert Review

Pros

Cons

CardX Merchant Services's Offerings

I like that CardX offers a solution for payment processing to businesses, educational institutes, and government agencies.

CardX offers transparent pricing plans tailored to different payment methods:

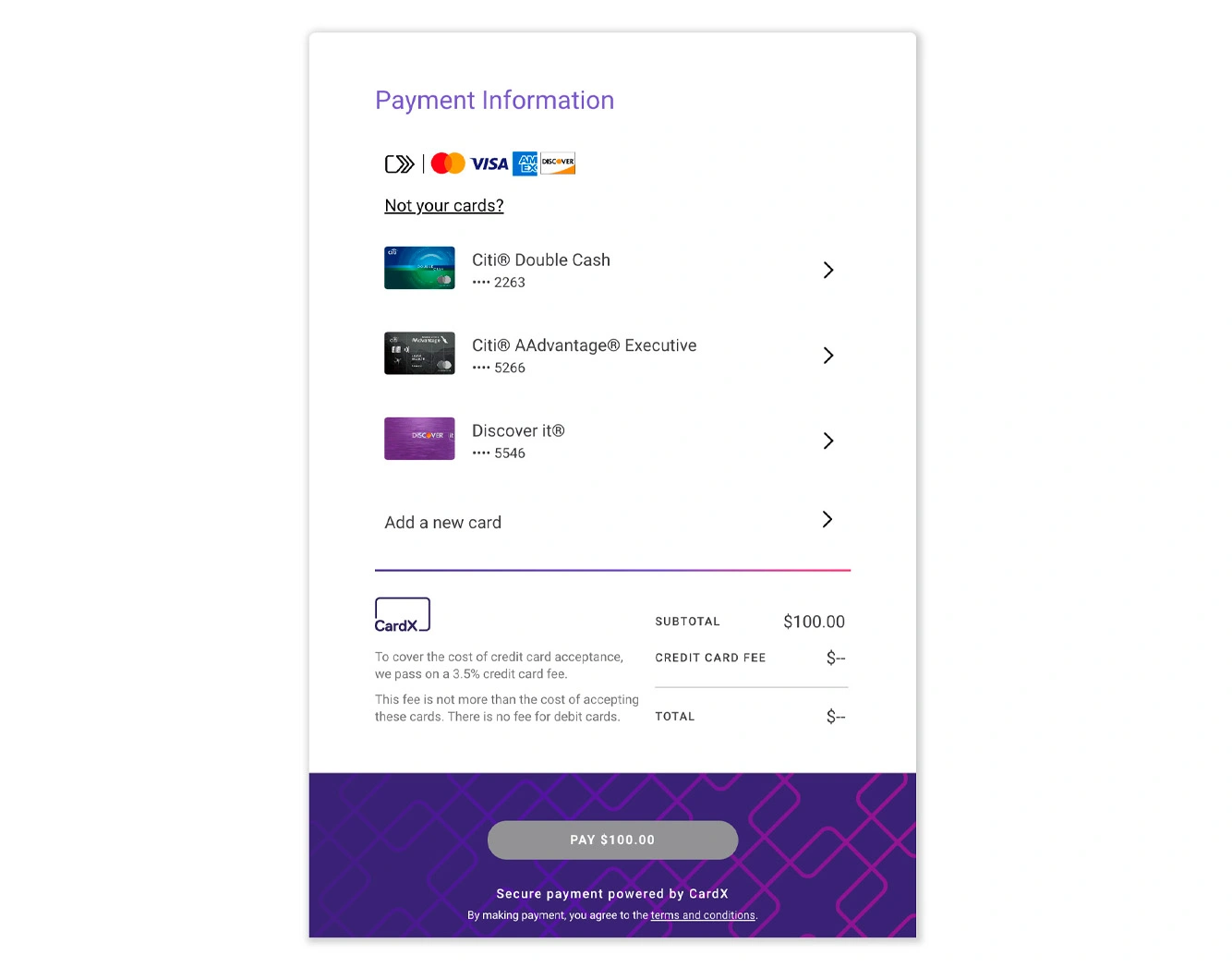

- Credit Cards: Merchants pay $0 per month, with a 3% fee added to the customer’s payment. This means if you sell an item for $100, the customer pays $103, and you receive the full $100.

- Debit Cards: A $0.25 monthly fee applies, plus 1.25% per transaction. For example, on a $100 debit card sale, you’d receive $98.75.

- In-Person Transactions: This plan is priced at $29 per month and includes a custom EMV-enabled terminal for secure, face-to-face payments.

- In-Office Payments: Starting at $29 per month, this plan provides access to a virtual terminal, allowing you to process payments without additional hardware.

These plans are designed to help businesses manage processing costs effectively while offering flexible payment solutions.

Customer Support

When I reached out to CardX’s customer support, I liked how they offer different phone lines and emails for sales, customer service, and partner inquiries. Instead of waiting in a general queue, you get directed to the right team immediately. This setup makes getting help faster and more efficient.

24/7 Support That Actually Responds

CardX promises 24/7 customer support, and from my experience, they deliver. My call was picked up quickly, and my email inquiry got a response within 24 hours. That’s not something every online payment platform can say. Having round-the-clock availability is a big plus for businesses that don’t work typical 9-to-5 hours.

Helpful Resources and Extra Support

Besides direct contact, CardX’s online merchant services include an FAQ section that answers common questions, plus a LinkedIn presence where they share updates. There’s also a demo option if you want to see how their payment gateway works before signing up, and a great blog with tons of useful advice.

Few Complaints, Lots of Happy Users

Unlike many online payment processing services, CardX doesn’t seem to have many negative reviews. That’s usually a good sign. My experience was positive—their team was quick to help and easy to talk to.

Features & Functionality

General Features

CardX specializes in providing compliant credit card surcharging solutions, allowing businesses to pass credit card processing fees to customers. While it offers essential features like debit/credit card processing, in-person payments, online payment processing, PCI compliance, and reporting/analytics, it may lack some advanced functionalities such as ACH payment processing, recurring billing, and POS integration.

I checked out the features the merchant service provider offers and I’ll go over them below.

- Data Security

- Debit/Credit Card Processing

- In-Person Payments

- Online Payment Processing

- PCI Compliance

- Automated Surcharging Compliance

- Virtual Terminal

- Lightbox Integration

- EMV Quick Chip Terminals

- Customer-Friendly Surcharging

- Real-Time Reporting

- Customizable Payment Links

- Chargeback Management

- Security & Fraud Protection

- Integration with Accounting Software

- CardX Government + Education

Business

By eliminating operational costs, CardX offers an ideal service to for-profit businesses. This enhances profit margins for the business. Moreover, payments can be received from customers through both credit and debit cards. Since these processing charges are public, the customer gets to make an informed decision regarding the card they would prefer to use.

Regarding discounts, CardX ensures that cash discounts are only used by businesses if they are compliant. Compliance with the CardX merchant services includes the display of product prices with and without the use of a credit card for payment. Through this compliant practice, customer trust in the company would be improved. It also keeps the business secure from any unwanted penalties and litigations for non-compliance.

Data Security

When I tested CardX’s Merchant Services software, I found that it prioritizes data security by ensuring full PCI compliance. This means your customers’ payment information is handled with the highest security standards, reducing the risk of data breaches and enhancing trust in your business.

Debit/Credit Card Processing

I tried out CardX’s online payment solutions and appreciated the seamless processing of both debit and credit card transactions. For credit cards, the platform allows surcharging, enabling businesses to pass the processing fee to customers, effectively reducing operational costs. Debit card transactions are processed with a minimal fee, offering a cost-effective payment option.

In-Person Payments

When I used CardX’s in-person payment system, the EMV Quick Chip terminals provided fast and secure transactions. These terminals are easy to set up and use, making face-to-face payments efficient and reliable for both businesses and customers.

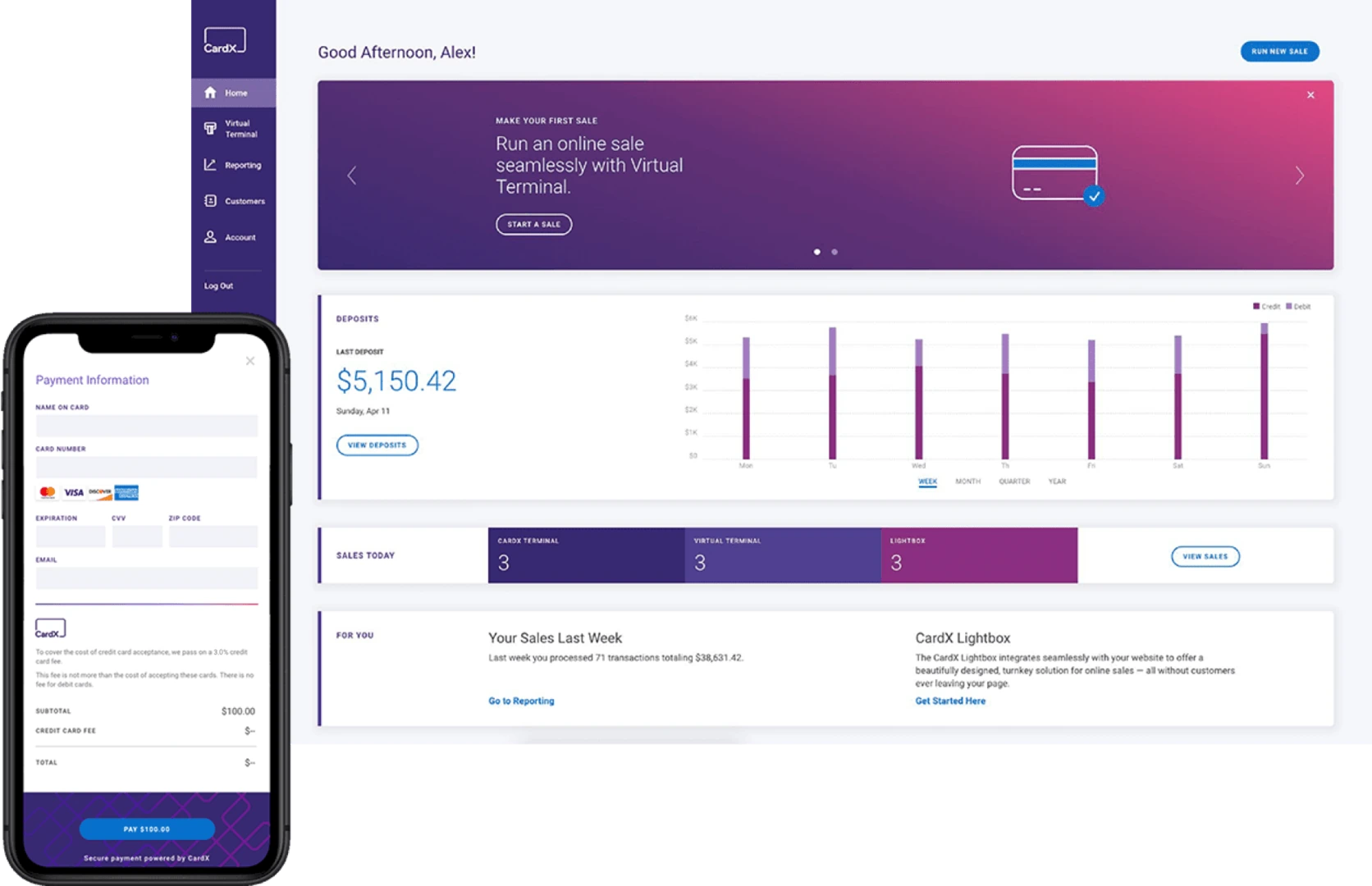

Online Payment Processing

Businesses can receive online payments through their websites. Since CardX has its payment gateway, customers are not redirected to another page. This will allow the business to have complete control over the stages of its interaction with customers without third-party intervention.

I played with CardX’s online payment platform and found it integrates smoothly with e-commerce websites. The Lightbox feature offers a user-friendly checkout experience, ensuring customers can complete their purchases without being redirected, which can help reduce cart abandonment rates.

PCI Compliance

Ensuring compliance can be daunting, but CardX automates this process. The system automatically detects card types and applies the correct surcharges, keeping your business aligned with current regulations and reducing the administrative burden.

Automated Surcharging Compliance

CardX automates surcharging compliance, automatically detecting card types and applying appropriate fees. This ensures adherence to regulations without manual intervention, reducing the risk of non-compliance and associated penalties.

Virtual Terminal

When I used CardX’s virtual terminal, it allowed me to process payments without additional hardware. This feature is particularly useful for phone or mail orders, providing flexibility in how payments are accepted and expanding the avenues through which businesses can receive funds.

Lightbox Integration

I integrated the Lightbox feature into an e-commerce payment system and found it surprisingly smooth. Unlike traditional redirects that can disrupt the buying experience, this online payment solution keeps customers on the website, overlaying the payment form directly on the checkout page. This not only maintains brand consistency but also reduces cart abandonment by ensuring a frictionless process.

During testing, the Lightbox integration loaded quickly, worked across different browsers, and was fully mobile-responsive—important for businesses handling online payment processing services. It also supports multiple e-commerce payment methods, giving customers flexibility while keeping transactions secure.

EMV Quick Chip Terminals

The EMV Quick Chip terminals offered by CardX ensure secure, chip-enabled transactions. When I tested them, transactions were processed quickly, enhancing customer satisfaction and reducing wait times at the point of sale.

Customer-Friendly Surcharging

CardX’s surcharging model is transparent, passing on fees only for credit card transactions. This allows customers to choose debit cards as a no-fee option, providing flexibility and potentially increasing customer satisfaction by offering multiple payment choices.

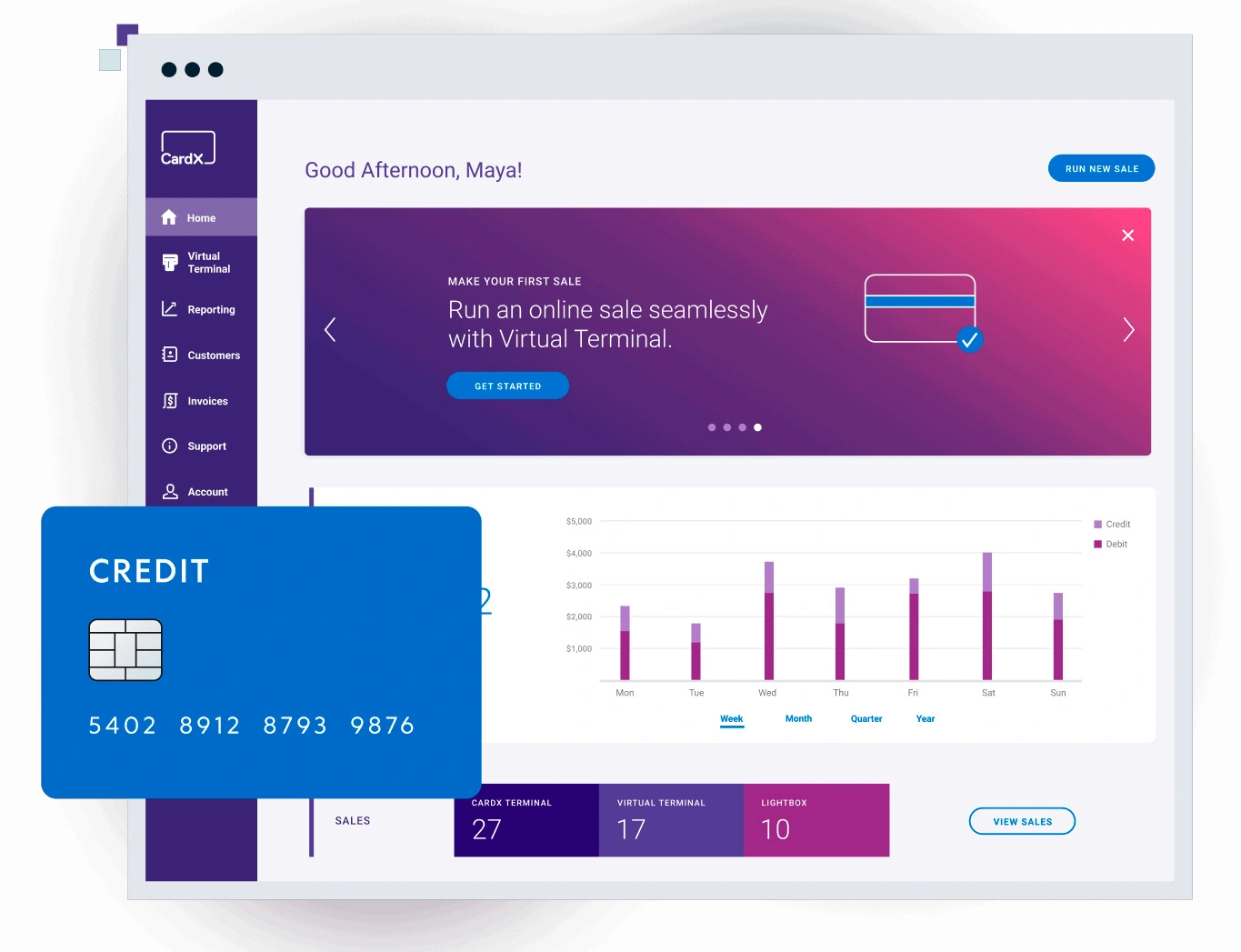

Real-Time Reporting

The real-time reporting feature provides up-to-date insights into transaction data. When I accessed the dashboard, I could monitor sales and identify trends immediately, aiding in informed decision-making and effective business management.

Customizable Payment Links

I created customizable payment links with CardX, which can be sent directly to customers. This feature simplifies the payment process, especially for remote transactions, and can be personalized to align with your brand, enhancing the customer experience.

Chargeback Management

I tested CardX’s chargeback management and found it helpful for handling disputes efficiently. The platform offers clear guidelines, automated alerts, and support to resolve issues before they escalate. This feature helps businesses protect revenue by addressing disputes quickly, reducing losses, and maintaining positive cash flow.

It also keeps chargeback ratios low, which is crucial for avoiding penalties from payment providers. For businesses processing frequent transactions, this online payment solution is a valuable tool for risk management.

Security & Fraud Protection

CardX is PCI compliant and pays extra diligence to information security. Therefore, customers’ financial information collected by a business will not be prone to system breaches. The implications of information breaches are severe and can lead businesses to bankruptcy. CardX merchant services offer extensive protection in this regard.

When I tested CardX’s Merchant Services software, I liked how it actively monitors transactions for suspicious activity. The system uses fraud detection tools to flag high-risk payments, reducing chargebacks and unauthorized transactions. Since online payment processing services are vulnerable to fraud, having built-in security measures is a major plus. PCI compliance adds another layer of protection, ensuring cardholder data stays secure.

For businesses handling frequent transactions, CardX provides peace of mind with strong fraud prevention and secure payment processing.

Integration with Accounting Software

When I connected CardX’s Merchant Services software to my accounting software, it automatically synced transactions, reducing manual entry and errors. This integration made financial reporting smoother, saving time on bookkeeping. For businesses managing e-commerce payments, having online payment solutions that work with accounting software ensures better cash flow tracking and more efficient financial management.

CardX Government + Education

CardX merchant service extends a Government + Education feature that enables government agencies and educational institutions to receive payments. In under a second, the technology-empowered service can determine information, such as the card type of the customer and determine the processing fee which will be charged.

This feature allows client businesses to not bear the cost of transactions, and all such processing charges are paid by customers. The demerits of flat-rate pricing, which is the use of low fees from low-cost cards to balance the high charges from high-processing rate cards, are also disabled.

Hardware & Software

POS

The CardX POS terminals are powered by Verifone. The presence of these terminals at sales points can make payments simple and convenient for people in businesses, government agencies, and educational institutions. CardX accepts both debit cards and credit cards at its POS. Moreover, web payments and virtual payments are also accepted, and the option to choose between in-person payments and in-house payments is also provided.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

Speed and Reliability

When I tried out CardX’s Merchant Services software, I was impressed by its efficiency. Transactions processed swiftly, ensuring customers aren’t left waiting. The platform boasts a 99.99% uptime, meaning it’s almost always ready when you need it.

Feature-Rich Online Payment Solutions

Exploring CardX’s features, I found tools that cater to various business needs. The virtual terminal is handy for phone or mail orders, allowing easy manual entry of payment details. For online merchants, the Lightbox integration offers a seamless checkout experience on your website. In-person transactions are covered with EMV-enabled terminals, ensuring secure chip card processing.

User-Friendly Online Payment Platforms

Navigating through CardX’s dashboard, I appreciated its intuitive design. It was easy to monitor transactions, generate reports, and manage customer data. The platform also supports electronic check processing, adding flexibility to payment options. Plus, with virtual card for online payment capabilities, businesses can handle diverse e-commerce payment methods efficiently.

Reliable Online Payment Processing Services

In my experience, CardX stands out among online merchant services for its reliability and comprehensive features. Whether you’re handling in-person sales or online transactions, this payment gateway offers a robust solution to meet your business needs.

Ease Of Use:

CardX offers various features that enable an easy-to-use service. The software is entirely free and no upfront payments are taken. Businesses can simply acquire the service by signing up on the CardX website, without the need of purchasing servers or paying for hosting.

Once an account is set up, the business owner can access the dashboard to review extensive information regarding their business’s financial activities. Transaction figures can be sorted by day, week, month, quarter, and year. Sales statistics can be viewed from the CardX terminal, the virtual terminal, and the Lightbox. A sales report can be generated to make informed decisions.

When I tested CardX’s Merchant Services software, I found the setup process refreshingly simple. There are no upfront costs, and businesses can sign up directly on the CardX website—no need for additional servers or hosting fees.

User-Friendly Dashboard for Financial Insights

Once logged in, the online payment platform provides an intuitive dashboard where transaction figures can be sorted by day, week, month, quarter, or year. This flexibility makes it easy to track business performance and cash flow.

Seamless Transaction Management

Sales statistics can be accessed from multiple sources, including the CardX terminal, virtual terminal, and Lightbox, ensuring a smooth e-commerce payment experience. Generating reports is simple, allowing businesses to make data-driven decisions about their online payment solutions.

Efficient and Transparent Processing

I liked how CardX’s online merchant services provide full transparency in payment gateway transactions, making it a reliable choice for businesses looking for online payment processing services with clear reporting and compliance.

Uniqueness:

CardX stands out with 0% credit card fees, full compliance with surcharging laws, seamless e-commerce payment integration, and real-time reporting—making it a top choice for online payment processing services.

Verdict:

While some advanced features of merchant service remain missing in CardX, when compared to other merchant service providers, CardX offers efficient and reliable service at zero credit card processing fee and maximum compliance. The platform is intuitive and easy to use that expert consultation and hiring would not be required. Rather, inexperienced team members will also be able to operate the service to initiate transactions when needed.

Moreover, the requirement for nearly no upfront costs enhances the value propositions of the service. The research performed for this review also reveals that the company is yet to receive any complaints regarding its customer service. Similarly, no complaints were identified concerning a difference in the marketing of the service and the final product. Therefore, the lack of experience has not stopped CardX from providing premium and high-quality services to its customers.