Payarc Review 2025

Payarc Merchant Services Plans & Pricing

Payarc Comparison

Expert Review

Pros

Cons

Payarc Merchant Services's Offerings

Payarc offers flexible, custom pricing with no monthly fees, allowing businesses to accept payments seamlessly while eliminating processing costs through dual pricing.

Customer Support

You can contact Payarc’s customer service team via online form, email, or phone. I tested the responsiveness of Payarc’s support team by reaching out to the team through each customer support channel.

I submitted an online form query to ask about pricing structures. While the reply received did not detail the pricing structures due to Payarc’s bespoke pricing methods, I received a response in 3 minutes, which is an excellent turnaround for an online form query.

Phone support

Similarly, I called the phone number with a technical query about hardware. I asked about the benefits and drawbacks of the Pax hardware compared to the Dejavoo hardware and was met with a knowledgeable customer service agent. The Payarc phone support staff member answered my queries easily and in a friendly manner.

Email support

Finally, I sent an email query to Payarc’s support team asking about what size partners Payarc works with. I left a phone number for a callback and received a phone call later that day. Ultimately, I found Payarc’s customer service team to be responsive, professional, and knowledgeable.

Knowledge Hub

Payarc’s Knowledge Hub is a valuable resource, featuring a wide range of articles and guides on topics such as payment processing, fraud prevention, and compliance. This self-service portal empowers users to find answers independently, enhancing their understanding of the platform.

Blog

The company’s blog provides insights into industry trends, company news, and expert advice. Regular updates ensure that businesses stay informed about the latest developments in payment processing, aiding in strategic decision-making.

Contact Form

For specific inquiries or partnership opportunities, Payarc offers a contact form on their website. I utilized this form and received a personalized response, demonstrating their commitment to customer engagement.

Features & Functionality

General Features

I was really impressed by the comprehensive selection of features and tools Payarc offers as part of its merchant services. I’ll discuss some of them below:

- ACH Payment Processing

- Billing and Invoicing

- Data Security

- Debit/Credit Card Processing

- Virtual Terminal

- In-Person Payments

- Mobile Payments

- Online Payment Processing

- PCI Compliance

- POS Solutions and Integration

- Payment Fraud Prevention

- Payment Processing Services Integration

- Recurring Billing

- Customer Profiles

- Reporting and Analytics

- Mobile Credit Card Processing

- Contactless NFC

- Electronic Receipts

- Mobile Card Reader

- 3rd-Party Integrations

- Operations Support

ACH Payment Processing

When I tested Payarc’s ACH payment processing, it facilitated direct bank transfers, reducing dependency on paper checks. This streamlined cash flow and offered lower transaction fees compared to card payments, proving invaluable for recurring billing.

Billing and Invoicing

I tried out Payarc’s billing and invoicing tools and found them intuitive, allowing me to create and send personalized invoices effortlessly. This feature simplified payment collection, supporting both one-time and recurring payments, which enhanced my business’s efficiency.

Data Security

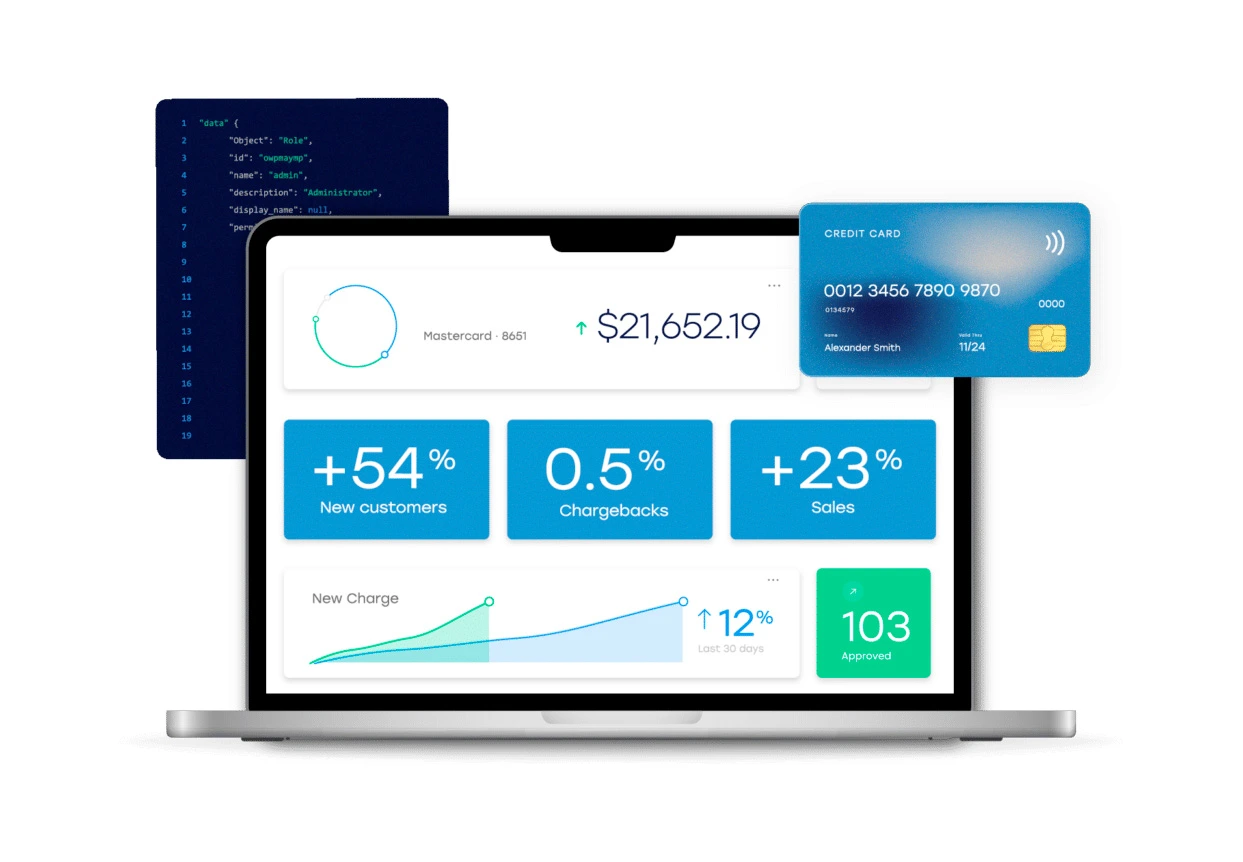

Security is paramount in online payment solutions, and Payarc addresses this with advanced encryption and tokenization technologies. These measures protect sensitive customer information, ensure compliance with PCI DSS standards, and foster trust between businesses and their clients.

The company also offers customer location information for blocking and transaction-limiting purposes. CVV, tokens, and encryption are used to protect customer cards. Plus, a secure API and SDK hub is available for developers

Ultimately, the fact that Payarc has integrated with some of the biggest companies in the world (such as Apple Pay and Google Pay) shows that the company is serious about its security responsibilities.

Debit/Credit Card Processing

I played with Payarc’s debit and credit card processing capabilities, and accepting major cards was seamless. This expanded my customer base and ensured quick, secure transactions, enhancing the overall customer experience.

Virtual Terminal

The virtual terminal is a game-changer for businesses handling remote or phone payments. It transforms any device into a secure payment processor, allowing transactions without physical card readers. Perfect for service-based businesses, it streamlines invoicing, recurring billing, and contactless payments effortlessly.

In-Person Payments

For brick-and-mortar establishments, Payarc offers versatile point-of-sale (POS) systems. These user-friendly terminals integrate seamlessly with the platform, allowing businesses to manage sales, transactions, and customer interactions efficiently. The in-person payment solutions are designed to optimize operations and improve service delivery.

Mobile Payments

I experimented with Payarc’s mobile payment options, and catering to mobile shoppers became effortless. Customers could pay using their smartphones, providing a fast and convenient checkout experience that boosted sales.

Online Payment Processing

Payarc’s online payment processing services facilitate seamless e-commerce transactions. The platform supports various payment methods, ensuring that businesses can cater to diverse customer preferences. The integration process is straightforward, allowing businesses to start accepting online payments quickly.

PCI Compliance

Navigating PCI compliance was hassle-free with Payarc’s support. They provided the necessary tools to maintain standards, reducing the risk of data breaches and ensuring customer trust.

POS Solutions and Integration

The main USP of Payarc is its selection of POS services. Payarc offers a range of POS products for small and medium size companies, ranging from the functional to the stylish and everything in between. Its service prioritizes security, is PCI compliant, and you’ll receive funds on a daily basis.

Payarc’s solutions also integrate seamlessly with existing POS systems, allowing businesses to unify their in-store and online operations. This integration ensures consistent data across all sales channels, improving inventory management and reporting accuracy.

Payment Fraud Prevention

To safeguard businesses against fraudulent activities, Payarc incorporates comprehensive fraud detection and prevention tools. These features monitor transactions in real-time, flagging suspicious activities and minimizing potential losses.

Payment Processing Services Integration

Managing transactions became centralized with Payarc’s integration capabilities. Handling all payments from a single platform simplified financial management and enhanced operational efficiency.

Recurring Billing

For businesses offering subscription-based services, Payarc’s recurring billing feature automates the payment process. This ensures timely payments, reduces administrative tasks, and improves customer retention by providing a hassle-free payment experience.

Customer Profiles

Payarc’s Customer Profiles feature offers a secure and efficient way to manage customer data, facilitating seamless recurring transactions. By storing essential information such as names, emails, and payment preferences, businesses can enhance their payment workflows and improve customer experiences. This functionality is particularly beneficial for subscription-based services and businesses aiming to streamline their billing processes.

Here’s how to create them:

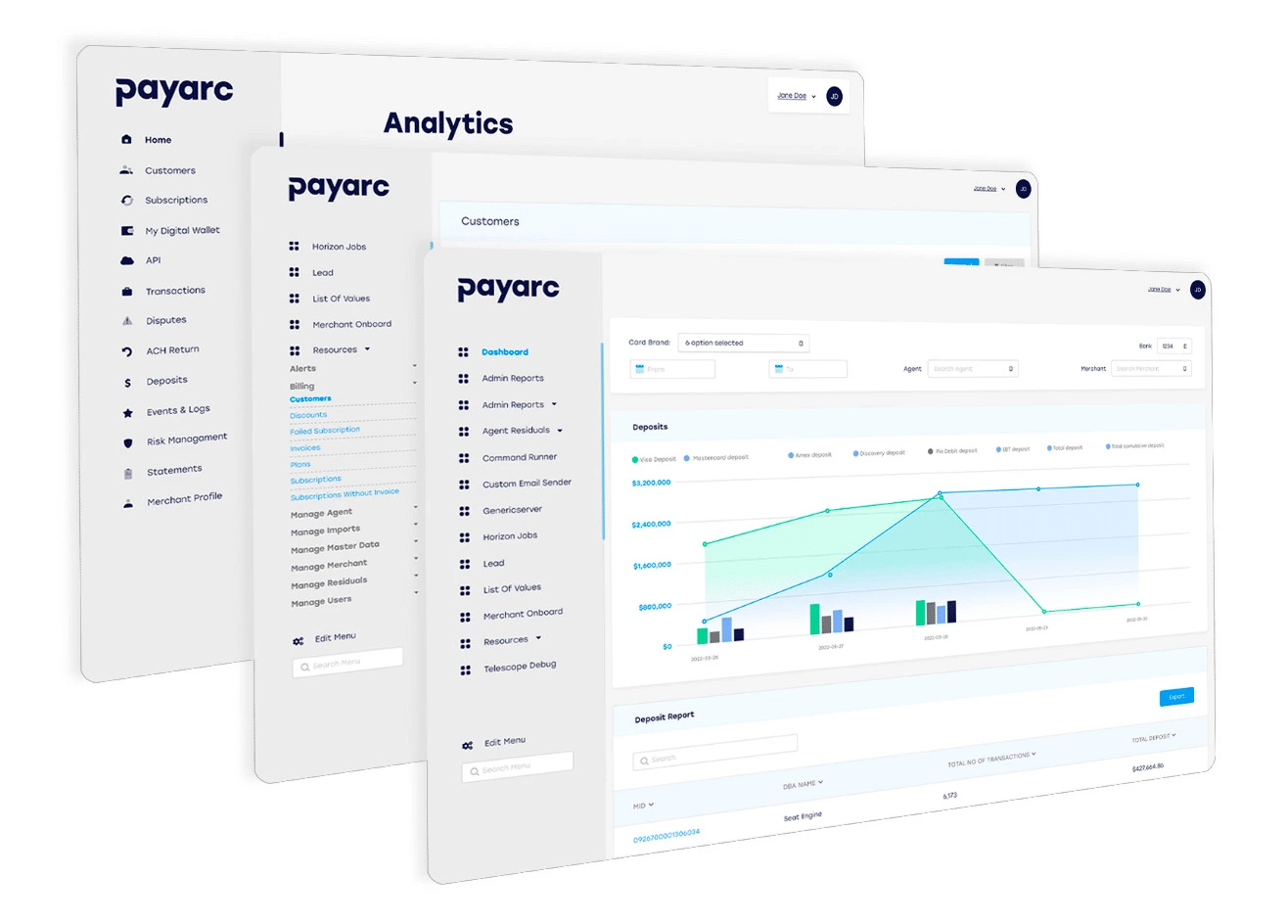

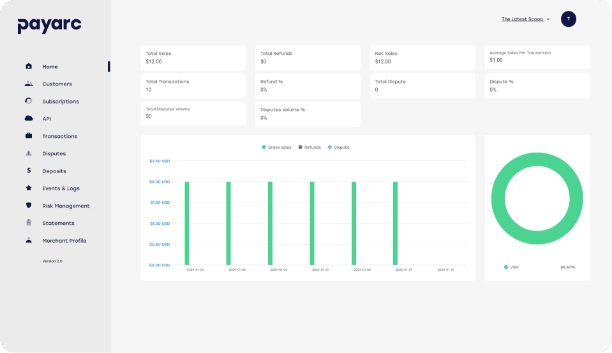

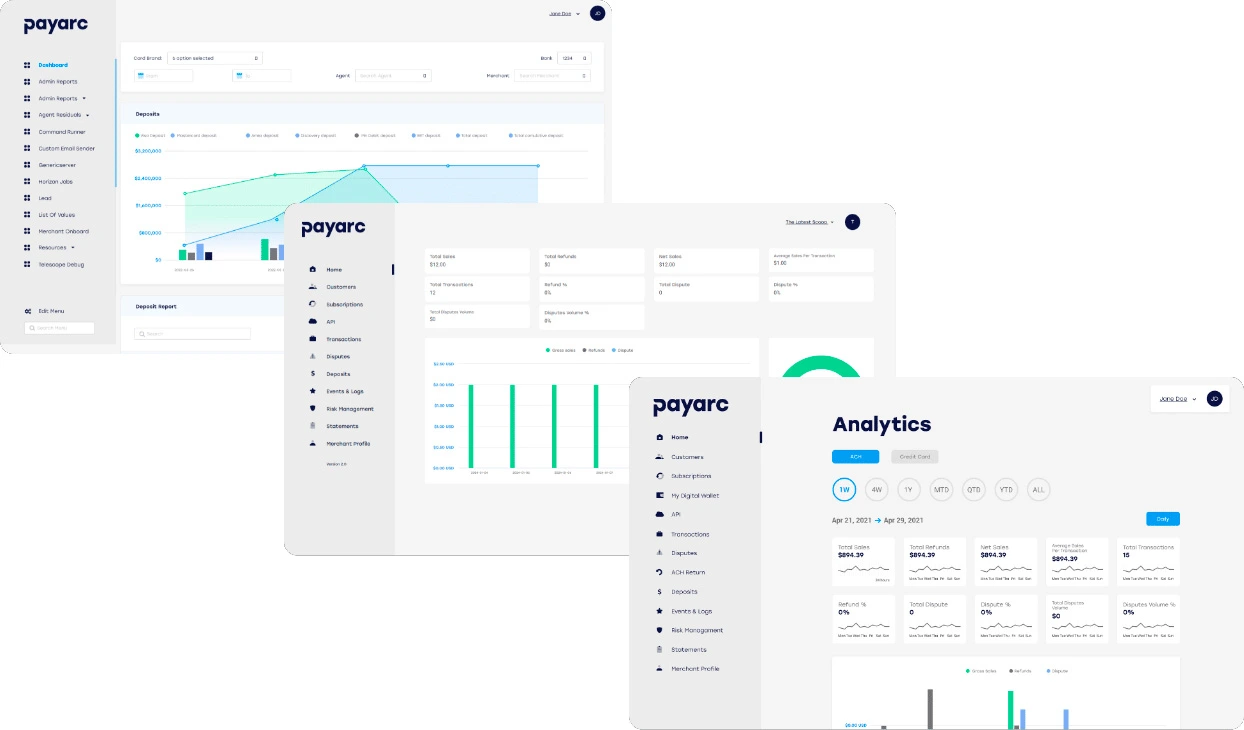

Reporting and Analytics

I explored Payarc’s reporting and analytics tools, which provided comprehensive insights into sales trends and customer behavior. This data-driven approach enabled informed decision-making and strategic planning.

Payarc allows its customers to fully customize dashboards, meaning you will only see information that is relevant to you. This, in addition to the standard reporting suite offered, gives great insights into your business. Helpfully, there are tutorials available online to show how to customize reporting so that it is specific to your needs.

Mobile Credit Card Processing

With Payarc’s mobile credit card processing, I accepted payments on-the-go using mobile devices. This flexibility was ideal for operating in various locations, ensuring I never missed a sale.

Contactless NFC

Embracing modern payment technologies, Payarc supports contactless Near Field Communication (NFC) payments. This allows customers to make quick and secure payments by simply tapping their NFC-enabled cards or devices, enhancing the checkout experience.

Electronic Receipts

To promote sustainability and convenience, Payarc offers electronic receipts. Customers receive their receipts via email or SMS, reducing paper usage and providing an easy way to keep track of purchases.

Mobile Card Reader

I used Payarc’s mobile card readers that connected seamlessly with smartphones or tablets. This solution was perfect for processing payments in various locations, offering flexibility without compromising security.

3rd-Party Integrations

Understanding the diverse needs of businesses, Payarc’s platform supports integrations with various third-party applications. This allows businesses to customize their payment processing environment, ensuring compatibility with existing tools and workflows.

Operations support

You can manage all of your billing and invoicing processes by using Payarc. Doing so will help ensure constant cash flows into your business and makes invoicing simple. You can set invoicing frequencies, recurring invoices and incorporate promotions and discounts.

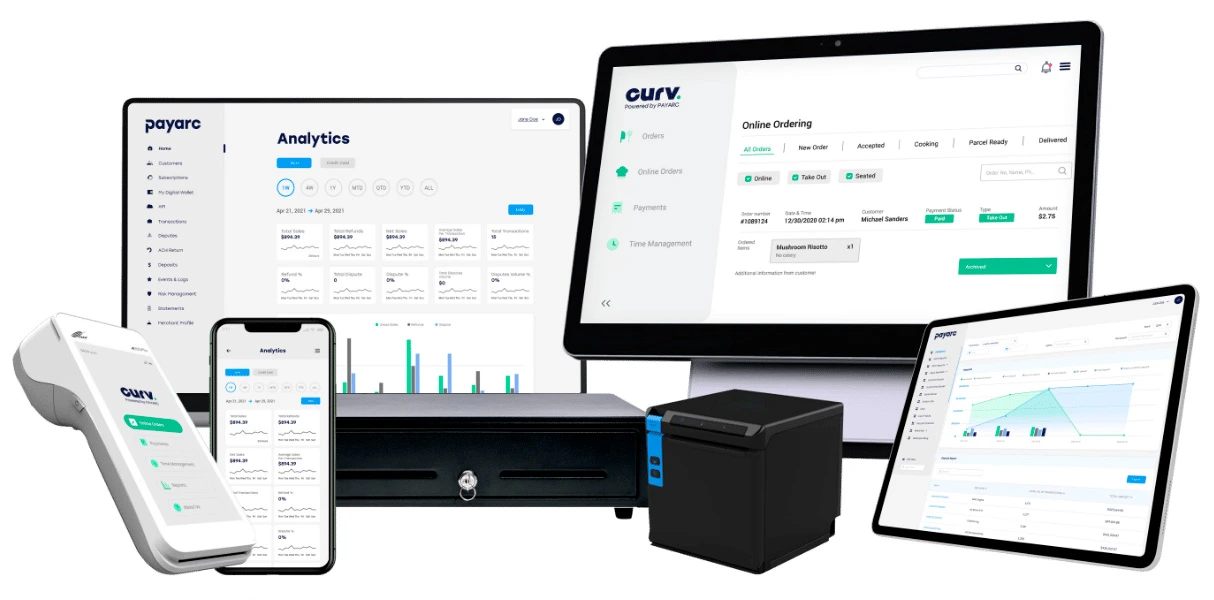

Hardware & Software

Payarc offers customers a range of POS hardware from Pax and Dejavoo to meet the needs of any small to medium-sized business.

Pax E800

This top-of-the-line POS is perfect for hospitality and upmarket retail stores. Alongside offering superfast connection, the striking terminal boasts a 15-inch display screen, Bluetooth synchronicity and works over Wi-Fi and 4G. There is also a second, 8-inch customer-facing display screen. The terminal is very durable and can operate in a wide range of conditions and temperatures.

Pax E700

The Pax E700 is a 12.5-inch touchscreen tablet designed as a flexible POS application. Customers can pay via contactless or card reader, and there is also a printer and dual cameras. Since it is small and light, the Pax E700 is best suited for retail or entertainment environments.

Pax E500

The Pax E500 is a perfect choice for a business that will require frequent POS use. This device is smaller than the E800 and offers an 8-inch merchant touchscreen with a 4.3-inch customer-facing touchscreen. The E500 connects via 4G, Wi-Fi, and Bluetooth. It’s also very compact, making it perfect for small retail spaces with high throughput.

Pax A920

The A920 was Pax’s entry into the POS market and remains its best-selling product. This 5-inch touchscreen terminal offers reliability, long battery life, and a high-speed printer for busy businesses on the move. The high-speed printer helps companies that are pressed for time to increase customer throughput, and the small terminal is elegant and easy to carry in one hand.

Dejavoo Z8

Dejavoo’s Z8 terminal operates over an Ethernet line and is a perfect handheld POS system for small businesses with high throughput. The terminal offers a customer privacy screen and a built-in printer. It is also easy to use; plus, settling batches is very straightforward, even if you’ve not used the terminal before. The Z8 is suitable for Apple Pay, Google Wallet, Visa, MasterCard, and many more payment options.

Dejavoo Z6

The Z6 terminal offers a 3.5-inch touchscreen and a built-in NFC contactless reader. It requires Ethernet connectivity to run and has a high-security CPU while providing a protective customer screen for PIN privacy.

Dejavoo Z1

The Dejavoo Z1 is the perfect POS device for smaller companies that need the greatest flexibility and a cost-effective POS solution. This simple pin pad terminal operates on 3G or Wi-Fi and offers a user-friendly touch screen with a signature style.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

When I tested Payarc’s online payment solutions, transactions processed swiftly, minimizing delays. The platform’s robust infrastructure ensures consistent uptime, crucial for uninterrupted business operations. Its seamless integration with various e-commerce payment methods enhances reliability, providing a smooth experience for both merchants and customers.

Security Measures

Security is paramount in online payment platforms, and Payarc excels in this area. The platform employs advanced encryption and tokenization to protect sensitive data, ensuring compliance with PCI DSS standards. During my evaluation, I found that these security features effectively safeguard against potential threats, instilling confidence in their online payment processing services.

Feature-Rich Platform

Payarc offers a comprehensive suite of features, including virtual card for online payment, electronic check processing, and support for various e-commerce payment methods. These tools are designed to cater to diverse business needs, enhancing operational efficiency. The intuitive interface allows for easy navigation and management of transactions, making it a versatile payment gateway solution.

Ease Of Use:

After watching a product demo, speaking to customer service agents, and analyzing online reviews, I can safely say that Payarc’s payment processing solution is easy to use.

The interface is simple and intuitive, and the ability to manage your billing and invoices from your phone is great. Similarly, having a web-based solution allows for the flexibility that small and agile businesses need.

You don’t need to be a rocket scientist to understand how Payarc works and how to use the solution provided.

Yet, if you struggle with any of the more technical aspects, Payarc’s customer service team has shown themselves to be very responsive and know their product well.

Everything I’ve seen indicates that this is one of the most straightforward payment processing solutions on the market.

Verdict:

Payarc’s payment processing solutions are best for small to medium-sized businesses that need a simple but flexible payment processor. Payarc’s customizable reporting can be easily tailored to your needs, and its billing and invoices module makes running your payment operations easy. Another plus is that Payarc takes its security responsibilities very seriously. The company is PCI-compliant, uses customer location and IP tools to block transactions, and utilizes CVV and encryption to prevent theft and fraud.

The main drawback with Payarc is the lack of any pricing visibility. As all pricing offered is bespoke, Payarc will not provide you with indicative pricing until they know all about your business. In many cases, small to medium-sized companies want to have an indication of how much a service will cost them before sharing company details. This is likely to put off many potential customers.

User Review

- Great fit for smallish businesses.