Paycor Review 2025

Paycor Payroll Services Plans & Pricing

Paycor Comparison

Expert Review

Pros

Cons

Paycor Payroll Services's Offerings

For businesses under 50 employees, Paycor offers 4 pricing tiers. Businesses with over 50 employees require a consultation with a representative.

As of this review, they are also running several sign-up offers to include 50% off the first year and all setup fees waived.

Here’s a look at the 4 plans for businesses with less than 50 employees:

Customer Support

Paycor offers customer support via phone Monday through Friday, between 8 a.m. and 8 p.m. ET for Payroll, and 8 a.m. and 6 p.m. ET for all other products.

They have an online Support Center divided into categories for Employers, Administrators, and News, along with a limited on-screen chatbot.

Online Chatbot

The site features a Chatbot named “Cora” for quick questions. It does, however, only allow one to choose from pre-loaded responses before trying to connect you with the sales team.

Live Phone Conversation

As a non-user, all roads lead to a live conversation with one of their agents. I was able to get through in 3 rings and the representative was helpful.

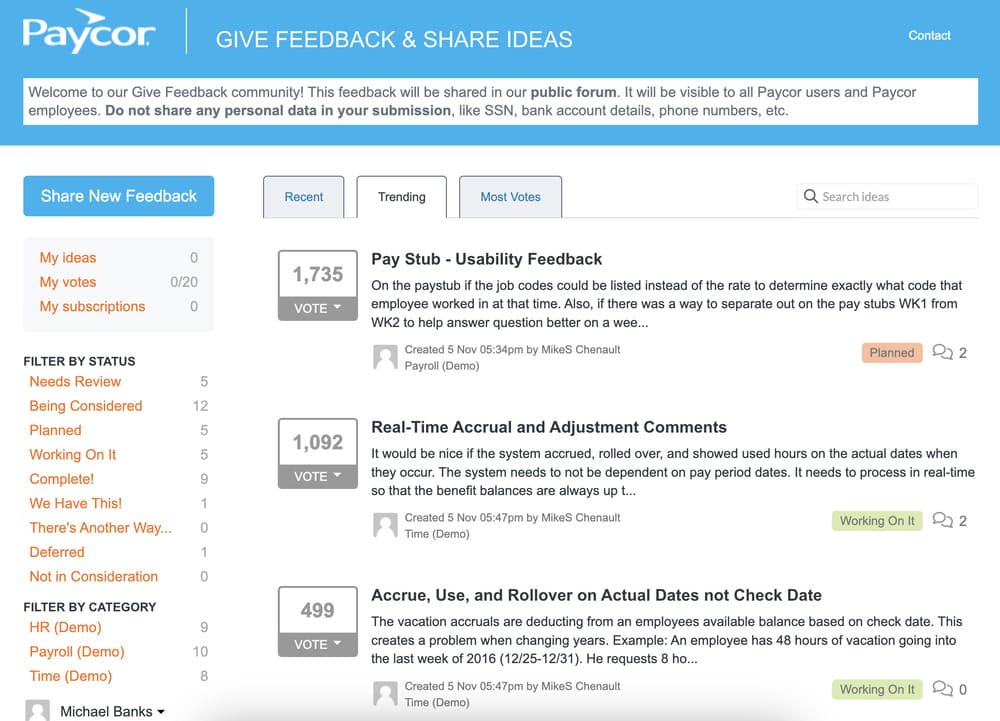

There is also a Paycor forum for employers to share and discuss issues with the software under the Product Feedback button:

Paycor also has a dedicated YouTube Channel for tutorials and new product reveals:

Overall Experience

Before signing up, help options are limited to phone consultations. After creating an account, there are email options and dedicated staff available. I found the customer service options to be limited for those who mind being on the phone.

Features & Functionality

Payroll Features

Check out this video to see a walk-through of Paycor’s main features:

Paycor offers 24/7 U.S.-based customer support and flexible services. Time and attendance tracking and management are also included along with PTO tracking.

Mobile App & Cash Account

Paycor has a mobile app for both employers and employees to track time, make/receive payments, and monitor employee data.

Automation Features

Automations include various HR tasks such as onboarding, benefits administration, and performance reviews, making the process faster and more efficient. Paycor also automates 401(k) plan administration, including compliance and reporting.

HR Features

Some of Paycor’s HR features benefits administration, performance reviews, and insurance services, including group health, dental, and life insurance options.

Tax Features

Paycor allows you to can calculate, file, and pay payroll taxes, and has 200+ compliance experts monitoring changing laws and regulations.

Integrations

Paycor also integrates via their APIs to connect to popular HR, productivity, and financial tools.

Ease Of Use:

Creating an account was fairly easy after searching their website for the free trial offer. This option was not made obvious on the homepage and took some digging.

Setup of the Payroll Software

Click the video to see the full sign-up process and the information you’ll need to create an account:

Run Payroll

In this video, we create an employee/contractor account and walk through the steps for running payroll:

Verdict:

Paycor is best for small to medium-sized businesses looking for a comprehensive human capital management solution. Pricing for under 50 employees is straightforward and per employee. For more than 50 employees you’ll have to contact a representative.

The software is feature-rich, offering a wide range of HR, payroll, and time and attendance tools to help streamline HR processes. Paycor also integrates with other popular business applications, such as QuickBooks and ADP.

Support is limited to business hours, and the employer dashboard takes some getting used to.

Click the video to see my closing thoughts: