Payment Depot Review 2026

Payment Depot Merchant Services Plans & Pricing

Payment Depot Comparison

Expert Review

Pros

Cons

Payment Depot Merchant Services's Offerings

Interestingly, Payment Depot provides merchant services to its users via three basic plans: Starter Membership, Most Popular Membership, and Enterprise Membership. There are also custom plans you can negotiate and opt for when you contact a sales representative.

Customer Support

From experience and the reviews left by the users of Payment Depot, this merchant service provider supports its customers via:

Features & Functionality

General Features

24-Hours Funding

Suppose you happen to roll your earnings back into your business for your merchandise purchase. In that case, Payment Depot allows you the flexibility of accessing your profit within a day of each transaction. You can also monitor each transaction (and its earnings) right from your dashboard.

Advance Funding

Has your business been in regular operation for more than 24 weeks, and you rake in a monthly gross income of $15,000 consistently for three months? Payment Depot allows you access to advance funding for your business. Don’t forget that you must have a minimum of 500 FICO credit scores.

Built-In Payment Gateway for Online Transactions

If you accept online transactions, Payment Depot allows you to set up an online payment gateway on your website. With this gateway, your customers can easily key in their card details to pay for your merchandise from their respective locations.

Virtual Payment Processing

In addition to accepting online transactions from remote customers, Payment Depot also supports a virtual payment platform. This option is available for free on all Payment Depot subscriptions and allows you to receive payments using mobile devices. You can easily key in your customers’ payment details on your mobile browsers without them having their cards.

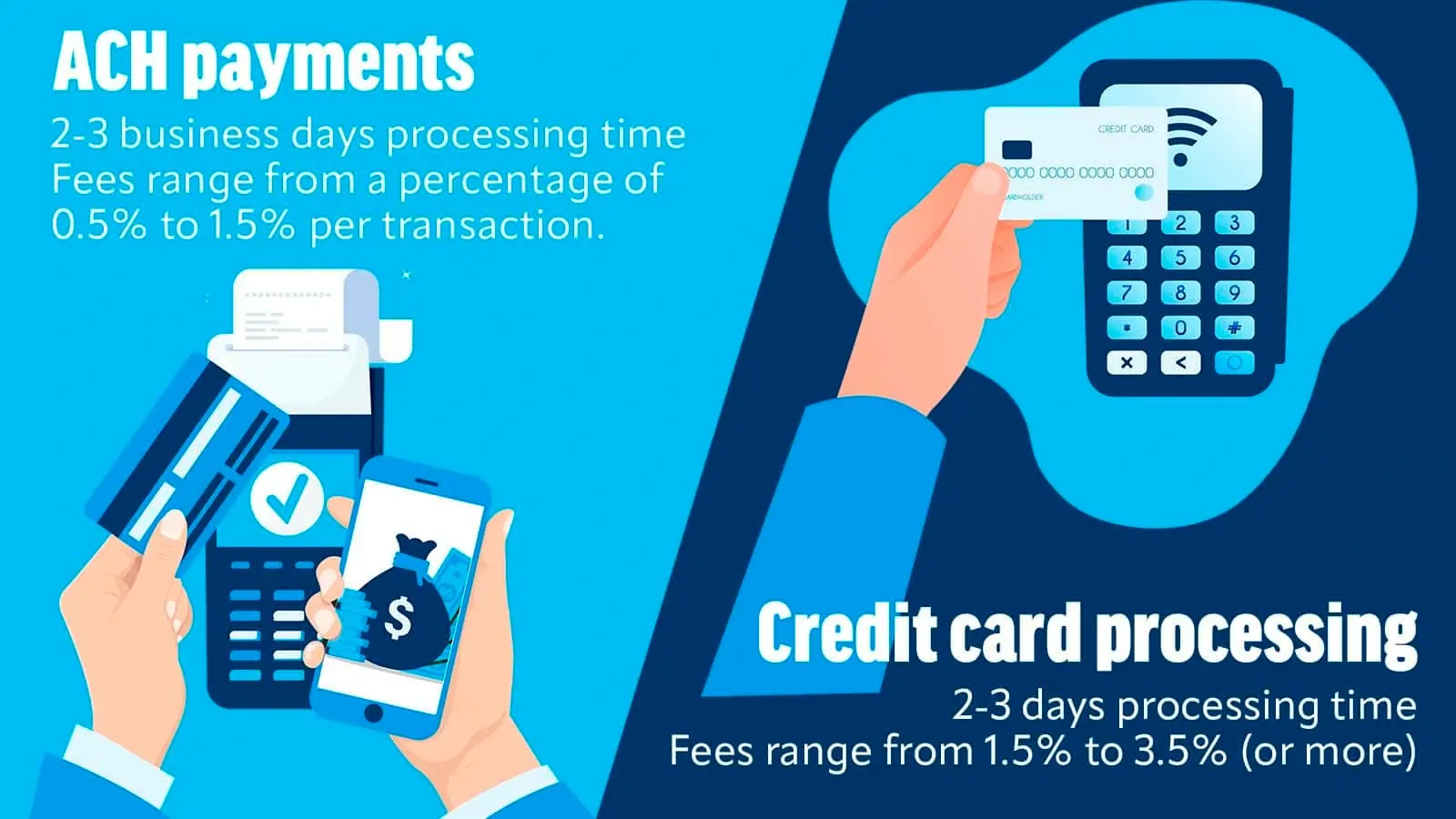

ACH Payments

While Payment Depot doesn’t divulge about e-checks on their website, they process ACH payments. You may need to speak with your sales agent to gather more information about this payment method.

Inventory and Staff Management

When you opt for advanced plans and hardware like the smart terminals and the point-of-sale systems, you enjoy inventory and staff management options. You can easily monitor each item’s sales history to restock as necessary. You can also monitor your employees and their interactions with your customers.

Hardware & Software

Payment Depot partners with card processing companies like Poynt, Vital, Clover and SwipeSimple for hardware. However, suppose you purchase the service after buying some devices from other merchant service providers. In that case, they can easily tweak your gadgets to run their transactions for you.

However, from our observations, it would be best that you purchase your necessary hardware from Payment Depot. Other merchant providers’ devices may not have some of the updated features required for Payment Depot’s services.

So, below is a list of the hardware solutions you will need to enjoy Payment Depot’s services:

Standard Terminals for Countertop Transactions

PAX A80 – this SwipeSimple Android terminal with EMV chip, NFC contactless, and magnetic strips allow flexible payment with credit and debit cards. It goes for $299 and also supports Apple and QR payments.

Ingenico Desk 3500 – similar to the PAX A80, this Telium TETRA OS terminal costs $299.

Ingenico Desk 5000 – This colour-display and Ethernet-enabled terminal cost $349 and capture signature during transactions.

First Data FD150 – this compactly designed terminal supports credit and debit cards. It goes for $299 and also features a built-in thermal printer.

Smart Payment Depot Terminals

Clover Flex – this portable smart terminal goes for $499 and accepts all kinds of payments, even on the go.

Vital Plus – this intuitive and portable Android terminal goes for $499 and accepts card and QR code enabled payments.

Poynt Terminal – this dual touch screen goes for $599. It allows you and your customers to enjoy seamless transactions on different screens.

POS Solutions

Clover Mini LTE – this all-encompassing POS system goes for $749 and supports traditional and offline payments. It also features item-level reporting, inventory and employee management, tax computing, and discounts.

Although this POS features a single screen, Vital Select helps you run your business better by supporting preorders and combining orders. At $1,499, Vital Select helps Payment Depot merchant services run as smoothly as possible.

Clover Station POS – this ultra-fast complete station goes for $1,599. With this station, you can run staff and inventory management and transaction reporting. And the best part, you and your customers interact from separate screens.

Mobile Hardware

These options allow you to accept payments from the comfort of your mobile devices. They are the Authorize.net BBPOS Chipper and the SwipeSimple B250, and they go for $99 each.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Ease Of Use:

Payment Depot is relatively easy to use as you can get your merchant account approved within one business day. They also provide you with a free payment terminal (depending on your preferred subscription plan). Hence, they’ve adequately eliminated the stress of sourcing suitable payment processing hardware for your business.

Suppose you also have compatible hardware before you subscribe to this merchant service. In that case, a sales rep will be available to configure your hardware for free during set-up.

Payment Depot’s intuitive mobile application also makes the service easy to use. You can easily navigate the platform to view your transaction history and seamlessly manage your product inventory and employee records.

Verdict:

Payment Depot may not be the cheapest merchant service provider for small and infrequent businesses. Still, its transparency tops the bar among most providers. You know precisely what you are charged for, and peradventure you choose not to continue with them or your current plan, you can opt-out at the cost of nothing. Let’s not forget that their zero-percentage markup makes the bargain even sweeter – if you frequently transact every month. The user-friendliness and vast integrations available on Payment Depot make it ideal for small businesses and startups. And while they turn away from high-risk companies like airlines and adult product merchants, their customer services will make any small and mid-sized business owner stick with them.