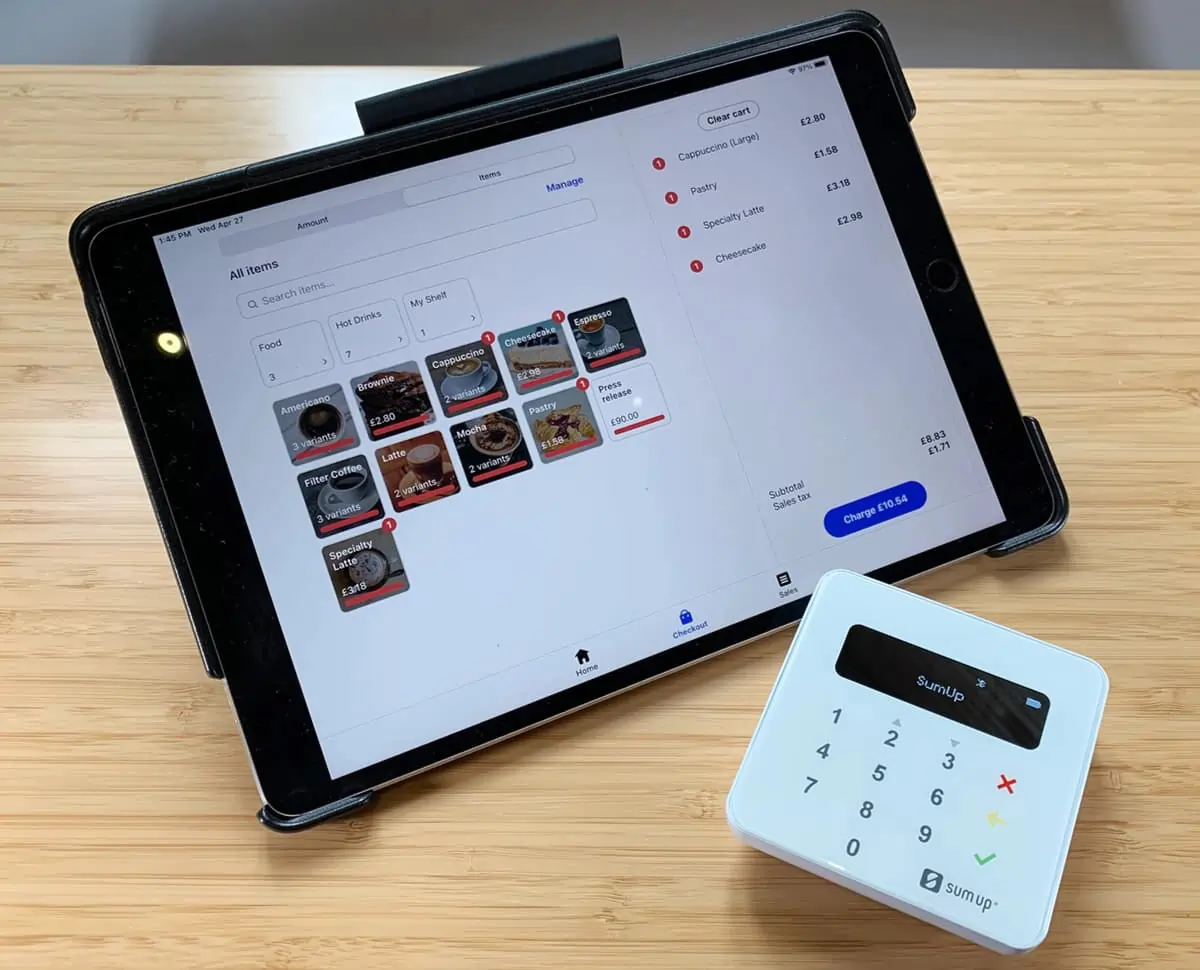

The SumUp POS system offers a versatile and user-friendly solution ideal for small to medium-sized businesses seeking streamlined payment processing and operational efficiency. If you’re a small business looking for a quick and easy payment processing solution then SumUp and the associated POS hardware are a great way to turn your venture into a much more versatile operation. SumUp overall is a good option for a POS solution.

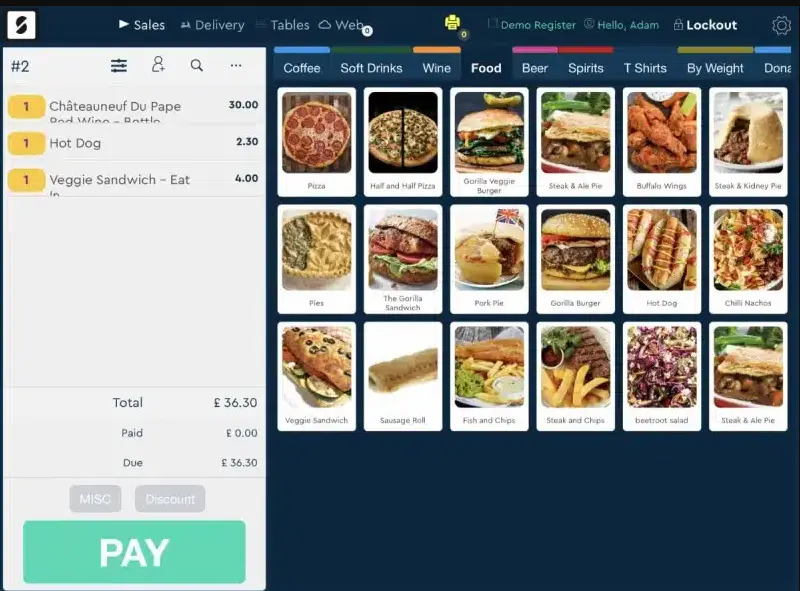

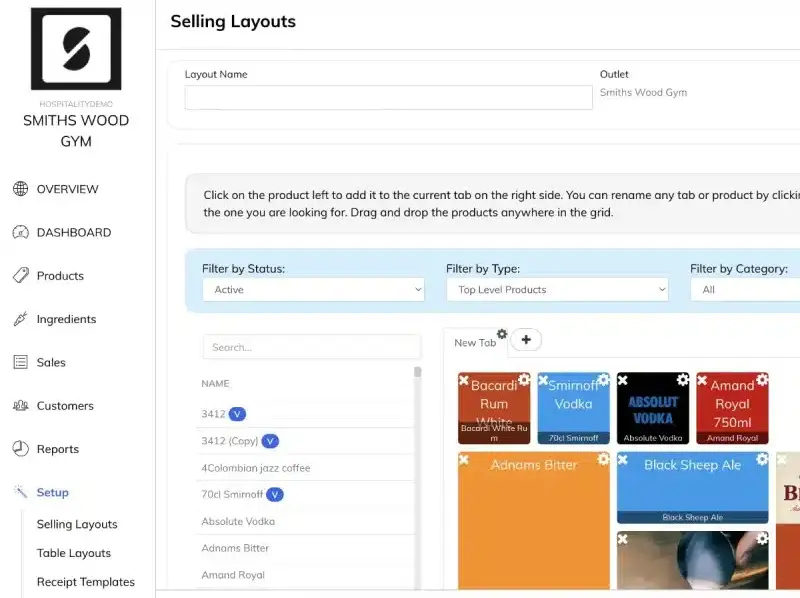

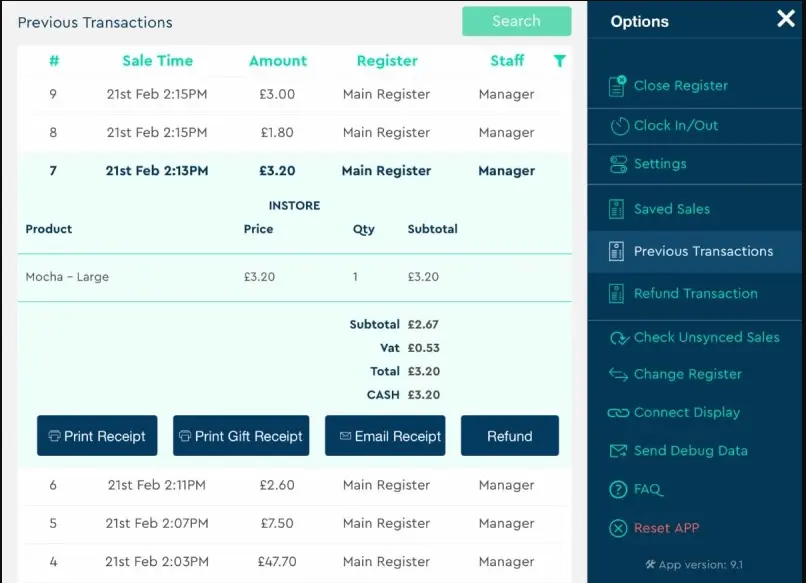

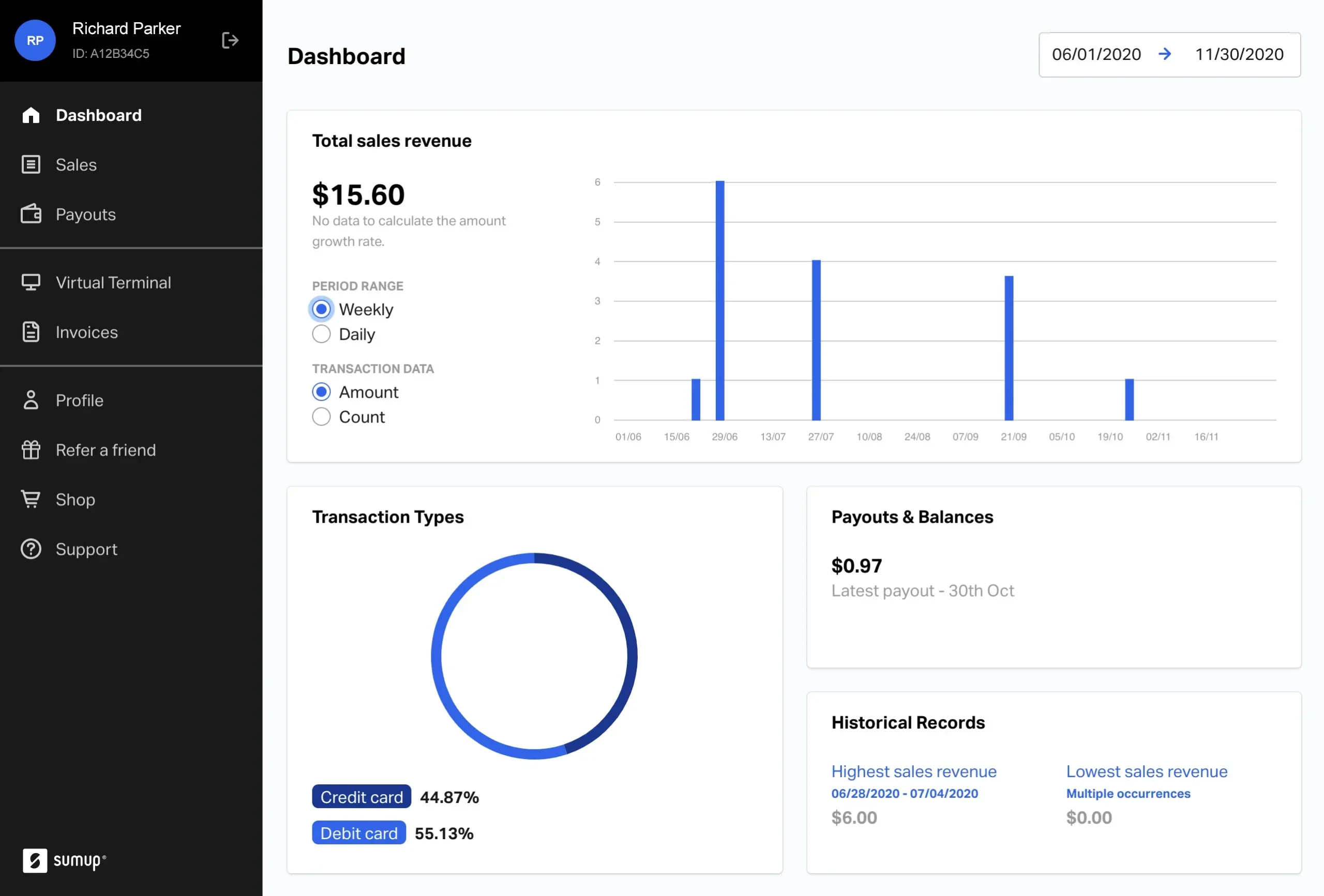

With standout features like seamless payment integration, real-time inventory management, mobile compatibility, customer loyalty programs, and detailed analytics, it empowers businesses to manage operations with ease. The inclusion of offline payment capabilities, customizable customer profiles, and tableside ordering enhances flexibility and customer service. While its limited customer support options may pose challenges, the overall value, coupled with comprehensive hardware and software options, makes the SumUp POS system a reliable choice for businesses aiming to modernize their operations and improve efficiency.

FAQ

Q: What is SumUp?

A: SumUp is primarily a mobile payment processing company offering simple, low-cost card readers (like SumUp Air, SumUp Solo) paired with a free mobile Point of Sale (POS) app. It’s designed for micro and small businesses, sole traders, market stalls, and mobile service providers who need an easy way to accept card payments without complex setups or high monthly fees.

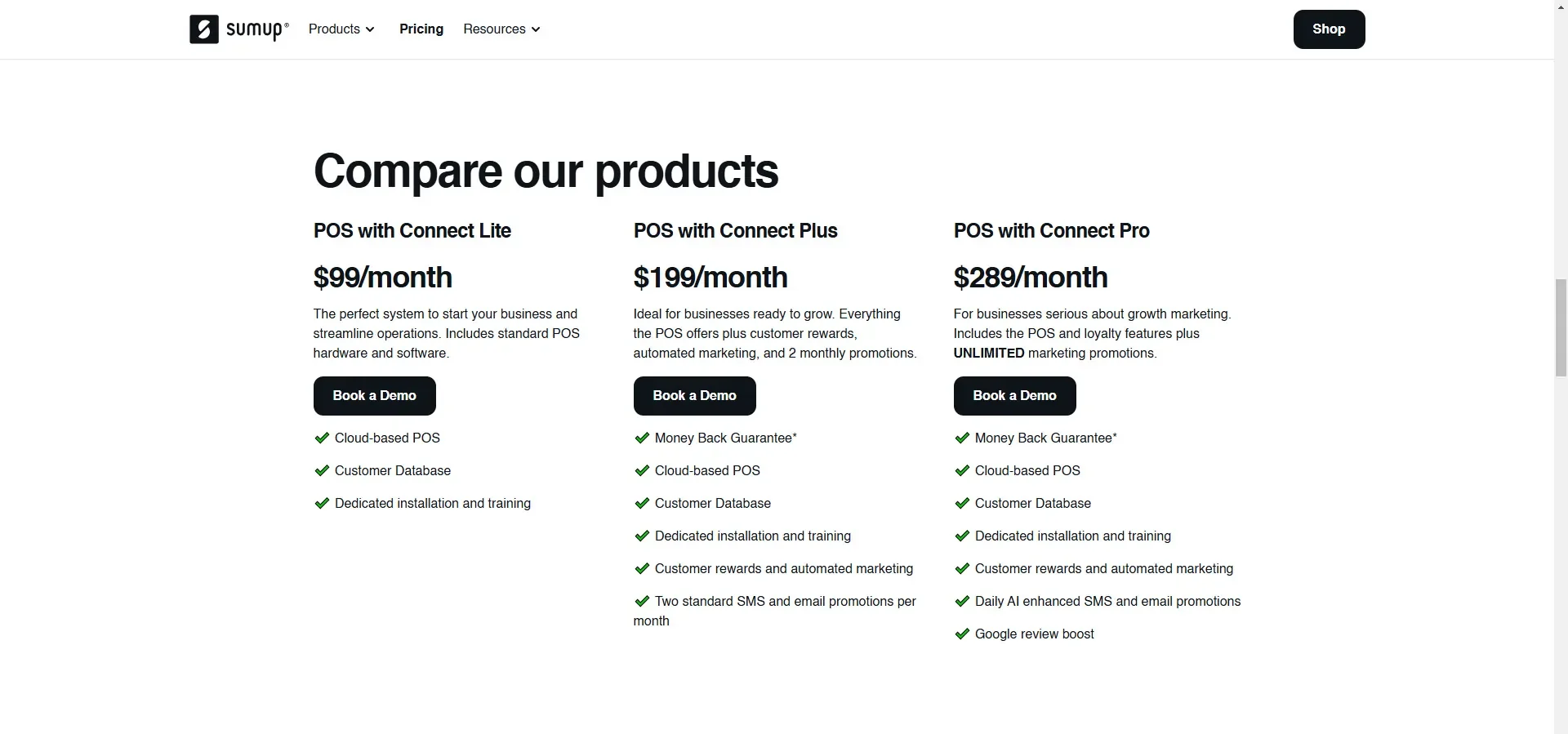

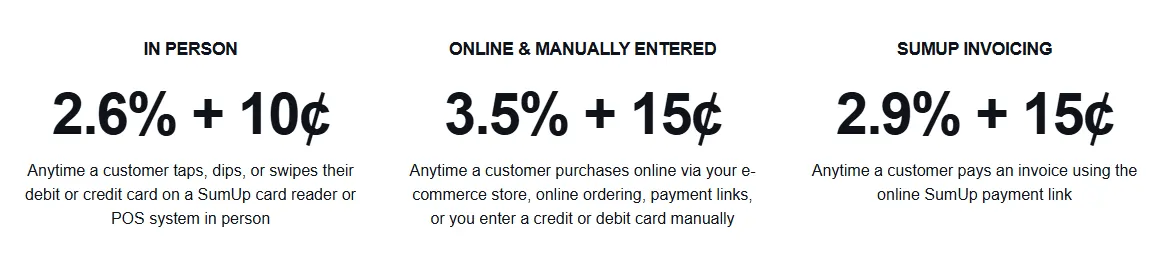

Q: How much does SumUp cost? Are there monthly fees?

A: SumUp’s main appeal is its pay-as-you-go model with no fixed monthly fees for standard usage. You purchase the card reader (hardware cost is upfront, often relatively low), and then you pay a flat-rate transaction fee for each card payment accepted (e.g., 2.6% + 10¢ in the US, or a similar flat percentage in other regions). There are no monthly software costs for the basic POS app.

Q: What are the most common complaints about SumUp?

A: Common complaints often relate to customer support accessibility and effectiveness (difficulty reaching support, slow response times), issues with account verification or unexpected fund holds (similar to other payment aggregators like Square/PayPal, triggered by risk algorithms), and limitations of the POS app’s features being too basic for more complex businesses. Connectivity issues with the card readers are also sometimes mentioned.

Q: Does SumUp require long-term contracts?

A: No. SumUp operates on a pay-as-you-go basis with no long-term contracts. You buy the hardware, and you can generally start or stop using the service anytime without facing early termination fees, offering significant flexibility for small businesses.

Q: Do I have to use SumUp’s payment processing with their card readers/app?

A: Yes. SumUp is an integrated payment solution. Their card readers and POS app are designed exclusively to work with SumUp’s own payment processing service. You cannot use SumUp hardware with a different merchant account or third-party payment processor.

Q: Does SumUp POS work offline if I lose internet/cellular connection?

A: SumUp card readers require an active internet connection (via Wi-Fi or cellular data through your paired smartphone/tablet) to process card payments securely in real-time. They do not offer a robust offline mode for queueing card transactions. If you lose connectivity, you generally cannot accept card payments until it’s restored.

Q: What kind of hardware does SumUp offer? Is it expensive?

A: SumUp offers several proprietary, compact card readers:

-

SumUp Air: Connects via Bluetooth to a smartphone/tablet running the SumUp app.

-

SumUp Solo: A standalone touchscreen device with built-in Wi-Fi/cellular connection.

-

SumUp Plus/Pro: Older models, features vary. The hardware requires a one-time purchase, and prices are generally affordable compared to full POS terminals (often ranging from $30 to $150 depending on the model and promotions). They don’t typically offer free readers.

Q: How is SumUp’s customer support? Is it easy to get help?

A: Customer support reviews are mixed, leaning towards challenging. While SumUp offers support channels (email, sometimes phone), users frequently complain about slow response times, difficulty reaching live agents, needing multiple attempts to resolve issues, and challenges with account-specific problems like fund holds or verification delays.

Q: How does SumUp compare to Square for a very small business or sole trader?

A: Both target similar users with simple hardware and flat-rate pricing. SumUp often has slightly lower hardware costs upfront but lacks Square’s free initial magstripe reader. Square’s processing rate might be slightly different, and its POS app ecosystem is generally more developed with more add-on features (though potentially more complex). Square also offers a more functional offline mode for swiped cards. SumUp might appeal for its simplicity and potentially lower hardware entry cost, while Square offers a broader platform.

Q: Are there hidden fees with SumUp?

A: SumUp is generally transparent about its flat-rate processing fees and lack of monthly charges. There aren’t typically the complex statement fees, PCI fees, or monthly minimums found with traditional merchant accounts. The main costs are the hardware purchase and the per-transaction processing fee. However, be aware of potential fees for chargebacks or currency conversion if applicable.