Employee Financial Wellbeing in 2023: How Payroll Software Can Help

Financial wellbeing is an essential component of overall health, affecting a person’s mental state, productivity, and ability to cope with any challenges that may arise. Yet the current economic climate is taking its toll on employees’ financial wellbeing, as inflation starts to bite. More than six in ten employees are currently stressed about their finances, a recent Bank of America survey found. Eight in ten are concerned about inflation, while more than seven in ten feel the cost of living is rising faster than their salary, leaving them worse off as time goes on. Little wonder, perhaps, that 97% of employers now feel a sense of responsibility for their employees’ financial wellness, up from 41% in 2013.

The good news is that it’s never been easier to provide resources for employees to understand their finances better and plan for the future. Intuit Quickbooks Payroll is taking active steps to help small businesses facilitate financial wellness for their employees through easy-to-use HR and payroll software and through services such as a personal HR advisor. Quickbooks Payroll allows small business owners and managers to automate payroll, ensuring employees are paid correctly and on time, but also to manage 401(k) retirement plans and health insurance payments, taking the stress out of financial planning for employees and enhancing their financial wellbeing.

35% of employees search for a new job for better benefits

Source: QuickBooks

It’s not just the employees who benefit when employers are proactive about financial wellness; with one in five employees thinking of switching jobs within the next year, offering such benefits can help with employee retention. Happier, less financially stressed employees are also more likely to be loyal, satisfied, engaged, and productive. Now that’s what you call a win-win situation.

What is Employee Financial Wellbeing?

The Financial Health Institute defines financial health as “the dynamic relationship of one’s financial and economic resources as they are applied to or impact the state of physical, mental, and social well-being.” They point to the World Health Organization’s definition of ‘health’ as not just an absence of illness, but “a positive concept emphasizing social and personal resources, as well as physical capacities,” and “a resource for everyday life.” In other words, the more financial stability and flexibility a person has, the more likely they are to be able to face the challenges, including mental and physical, that life throws at them.

Unfortunately, the current economic climate is not conducive to financial wellbeing. A recent survey by Bankrate found that four in ten Americans have fewer savings this year than they did last year, and nearly three-quarters are saving less this year than last, due to high inflation and other economic factors. Consequently, only 43% of Americans said that they would pay for an unexpected expense of $1,000 from their savings, while a quarter said they would have to take out credit card debt to do so – a record number since polling began in 2014. 36% of Americans now have more credit card debt than savings for use in emergencies, again, the highest on record since 2011.

Less than half of small business employees get retirement benefits

Source: QuickBooks

However, headline figures slightly obscure the true picture as they include the very young, who have not yet taken on debt, and retired people, who have relatively little debt. Among those of prime working age, between 27 and 58 years old, some 44.5% have more debt than savings, up from 28% just a year ago – that’s a staggering rise of 16.5 points in just twelve months. That figure alone demonstrates the difference the current poor economic conditions can make to employees, drastically impacting financial wellbeing and, by extension, employee performance.

Automated Software Can Help

Even in this economic climate, there is a lot that employers can do to enhance the financial wellbeing of your employees, no matter how big or small your organization is. One of the most straightforward is the use of an automated payroll system such as Quickbooks Payroll to ensure that salaries are paid accurately and on time. Simply knowing that they can rely on their salary relieves an enormous amount of stress for employees, which translates into happier, more productive people in the workplace.

But payroll is just the start. Good accountancy software such as Quickbooks Payroll now integrates seamlessly with other accounting functions and HR practices, allowing employers to offer a range of benefits and programs that can enhance employee financial wellbeing. Let’s take a deeper dive into some of those functions, and find out how Quickbooks Payroll is helping employers to safeguard their employee’s finances.

QuickBooks’ Efforts to Prioritize Employee Financial Wellbeing

Employees value benefits included in their remuneration package – one in ten even say that they would take a lower salary in return for better benefits, according to Forbes. Mindful of the key role that benefits play in attracting and retaining talented employees, Quickbooks has partnered with financial experts and organizations to offer seamless automated benefits payments as part of your payroll software.

87% of employees would take more benefits over a pay raise

Source: QuickBooks

Health Benefits

It’s probably no surprise that health benefits routinely top the list of benefits most desired by employees when looking for a new job, or when considering a move. We all worry about how we might look after loved ones and retain hard-earned assets should illness strike; it’s only natural, then, that a solid healthcare package can really set employees’ minds at ease and enhance their financial wellbeing.

Quickbooks Payroll has teamed up with SimplyInsured to offer medical, dental, and vision insurance at a budget to suit your business and employees’ needs. The value, deductibles, coverage, and costs of each plan can be easily compared so that you can easily choose the plan that’s right for you, and applying takes just ten minutes. Best of all, Quickbooks’ payroll software automatically calculates the payments to be made each month and adds them to the payroll accounting, so you know the values are correct, and payments are being made accurately.

Workers Compensation

Health worries aren’t only down to illness. Unfortunately, workplace accidents can still happen no matter how much attention is paid to workplace safety, and a bad accident can significantly impact an employee’s ability to work and provide for their family. Not only can a good comp package take some of that worry away for employees and employers alike, but it’s also actually a requirement in all states except Texas.

Quickbooks Payroll is collaborating with Next to offer workers comp’ plans that integrate with your payroll. Simply choose your plan, connect it to your payroll account and let the software take care of the rest.

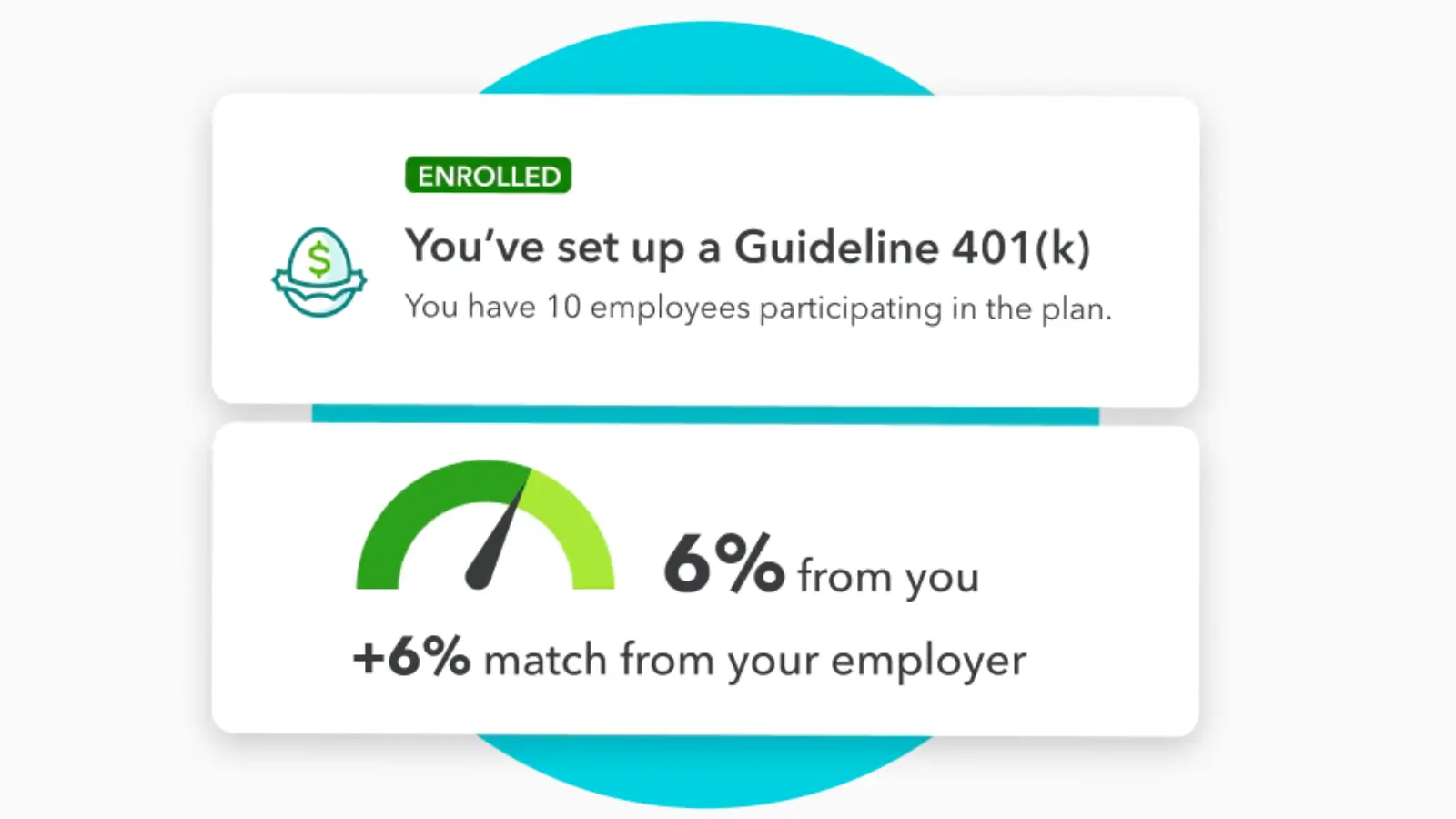

401(k) Plans

A good retirement plan is an essential component of long-term financial stability, and can really help put workers’ minds at rest about what their financial future holds. Yet too many workers still aren’t saving adequately for retirement – with the shortfall landing disproportionately on women. Quickbooks has partnered with Guideline to help employers offer affordable, easy-to-manage 401(k) plans to employees.

Quickbooks offer three levels of plans to suit every budget. Core is ideal for small businesses wanting to make a contribution to their employees’ 401(k) plan; Flex is perfect for those who want the flexibility to choose their own features to meet personalized goals; and Max offers the most customizable options, allowing businesses to maximize savings and gain access to expert help. We can help you find the plan that’s right for you.

HR Advisors

HR is easy when you first set out in business: if you started as a solopreneur, you only had yourself to worry about. But as your enterprise expands and you start taking on staff, laws and regulations start to come into play, along with employee expectations. To avoid having to wade through mountains of regulations and best practice papers yourself, Quickbooks Payroll has partnered with Mineral Inc to offer an HR advisory service to our customers. They can help with a whole host of HR functions, including recruitment, onboarding, career development and legal compliance, but they can also help you to offer financial education workshops, and resources to enhance your employees’ financial wellbeing.

Going Beyond Benefits

As alluded to above, enhancing your employees’ financial wellbeing doesn’t only have to be about putting money into their paychecks as salary or benefit payments. Sometimes, all it takes are some words of advice and support from a friendly expert.

Increasingly, companies are offering bespoke financial wellness programs for their employees. The best of these programs involve sitting down with employees to figure out how they can set and stick to a budget to get out of debt or start saving for life goals like home ownership and retirement. Others might involve offering a financial planning course or literature on the subject.

Company culture is also an essential component of employee financial wellness. Business owners may also want to consider the culture of their company, and whether it offers a supportive environment when it comes to financial wellbeing. Simply being able to discuss financial concerns with a line manager, or, in smaller organizations, with the owner, can greatly dissipate any concerns that employees may have about their financial situation. Conscientious employers may want to conduct an audit of their company’s culture, whether through anonymous surveys or a series of friendly company-wide conversations, to identify ways to improve company culture when it comes to financial wellbeing.

Conclusion

High inflation and an uncertain economic outlook have taken their toll on employees’ financial wellbeing in 2023, eroding savings and pitching more people into debt. At the same time, employers feel a greater sense of responsibility for their employees’ financial wellbeing than ever before. Thankfully, automated payroll systems can do a lot to put both business owners’ and employees’ minds at ease when it comes to financial planning, chief among them: simply making sure that employees are paid accurately and on time.

Mindful of the current economic climate, Quickbooks Payroll has partnered with a range of expert organizations to help small business owners go a step further and offer reliable financial planning products and services. Quickbooks customers can use their account to automate 401(k), health insurance, and workers comp payments, taking the stress out of managing these vital benefits.

Intuit Quickbooks Payroll customers can also benefit from the services of an HR expert, who can help roll out financial wellness programs and workshops, adding value to employees above and beyond financial help in their paychecks. To get the most out of the outstanding features Quickbooks Payroll offers when it comes to employee wellbeing, take a look at what they can offer you today.