How to Calculate Business Valuation

Understanding how to calculate business valuation is key to making informed decisions about your company’s future, whether you’re considering selling, securing funding, or simply assessing its worth.

Knowing how to value a business can provide crucial insights. This guide will walk you through the basics, common methods, and practical tips for determining your business’s value.

What Is a Business Valuation?

Business valuation is the process of determining a company’s economic value. It involves assessing all aspects of a business, including its assets, inventory, business profitability, liabilities, revenue, and market share and position, to estimate its worth. This valuation is often used during sales transactions, mergers, or when seeking investors.

Valuing a business isn’t just about crunching numbers. It’s a comprehensive business appraisal that considers your company’s market potential, financial health, and how it compares to similar businesses in your industry.

Whether you’re planning for growth or evaluating exit strategies, knowing the valuation of your business is a key step.

Why Is It Important to Calculate Business Valuation?

Understanding your business valuation goes beyond the figures on a balance sheet. It provides insights that can help you:

- Attract investors: Potential investors want to see a clear picture of what they’re investing in.

- Plan for growth: Understanding your valuation can guide strategic decisions to improve your company’s worth.

- Facilitate sales or mergers: When it’s time to sell, a precise valuation can make negotiations smoother.

- Ensure fair partnerships: If you’re adding a partner, knowing the value of your company can help set equitable terms.

By calculating your company valuation, you’re better equipped to make informed decisions and seize opportunities.

Common Valuation Methods

There’s no one-size-fits-all approach to valuing a business. The best method depends on your company’s size, industry, and financial structure, making it essential to consider how your company valuation varies across different sectors. Here are some common methods to consider:

1. Market Approach

This method involves comparing your business to similar companies that have recently been sold. It’s like estimating the value of a house based on comparable sales in the neighborhood. The market approach works best when there’s plenty of data on similar businesses in your industry.

2. Income Approach

The income approach focuses on your business’s earning potential. It calculates the present value of expected future cash flows. This method is common for businesses with stable, predictable revenue streams.

3. Asset-Based Approach

The asset-based approach looks at the value of your company’s assets, subtracting liabilities to determine net worth. This method works well for companies with significant tangible assets, like real estate or equipment.

4. Earnings Multiples

This method uses a multiplier to calculate the value based on your company’s earnings. For example, if similar businesses sell for 3x their annual profit and your business earns $200,000 annually, its valuation could be around $600,000.

Reccommended Accounting Software

QuickBooks: All-in-one accounting solution, perfect for SMBs seeking efficient management and growth.

Xero: Access your financial data anywhere, anytime with Xero’s cloud-based platform for dynamic businesses needing flexibility.

FreshBooks: Simplifies invoicing and expense tracking for freelancers and small businesses, prioritizing ease and integration.

5. Discounted Cash Flow (DCF)

DCF calculates the present value of projected cash flows and adjusts them for risks and the time value of money. It’s a detailed and reliable method but can be more complex to calculate.

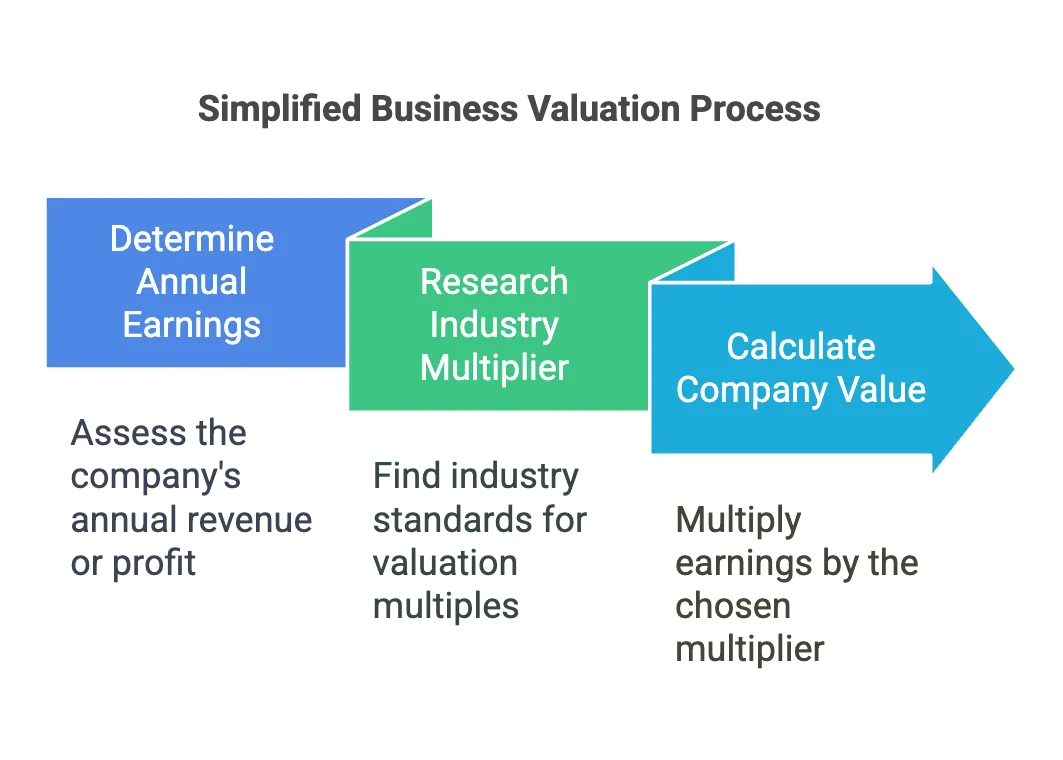

Quick Calculation Steps

Want a rough idea of your business’s value? Here’s a simplified approach to help you understand how to do a business valuation:

- Start with earnings: Determine your annual revenue or profit with accurate accounting.

- Choose a multiplier: Do market research to understand industry standards for valuation multiples.

- Calculate value: Multiply your earnings by the chosen multiplier.

For example, if your annual profit is $100,000 and the standard multiplier is 3, your company valuation would be approximately $300,000. Keep in mind this is a basic calculation and may not account for all variables.

Common Mistakes & Tips

Valuing a business can be tricky. Here are some common pitfalls to avoid and tips to ensure accuracy:

Mistakes to Avoid:

- Overestimating earnings: Be realistic about your revenue and expenses.

- Ignoring liabilities: Don’t forget to factor in debts and other obligations.

- Relying on one method: Use multiple methods for a well-rounded valuation.

Tips for Success:

- Stay updated on industry trends: Market conditions can significantly impact your valuation.

- Consult professionals: Accountants or valuation experts can provide valuable insights.

- Keep detailed financial records: Accurate bookkeeping is key to precise valuations.

Recommended Bookkeeping Software:

QuickBooks: Automates bookkeeping, simplifying financial management with features like automatic transaction categorization and integrated payroll services.

Square: Streamlined bookkeeping with easy integration across sales and inventory, perfect for businesses seeking a unified view of their financial and operational data.

Zoho Books: Automated bookkeeping solutions with intuitive compliance tracking and real-time collaboration features for prioritizing scalability and regulatory adherence.

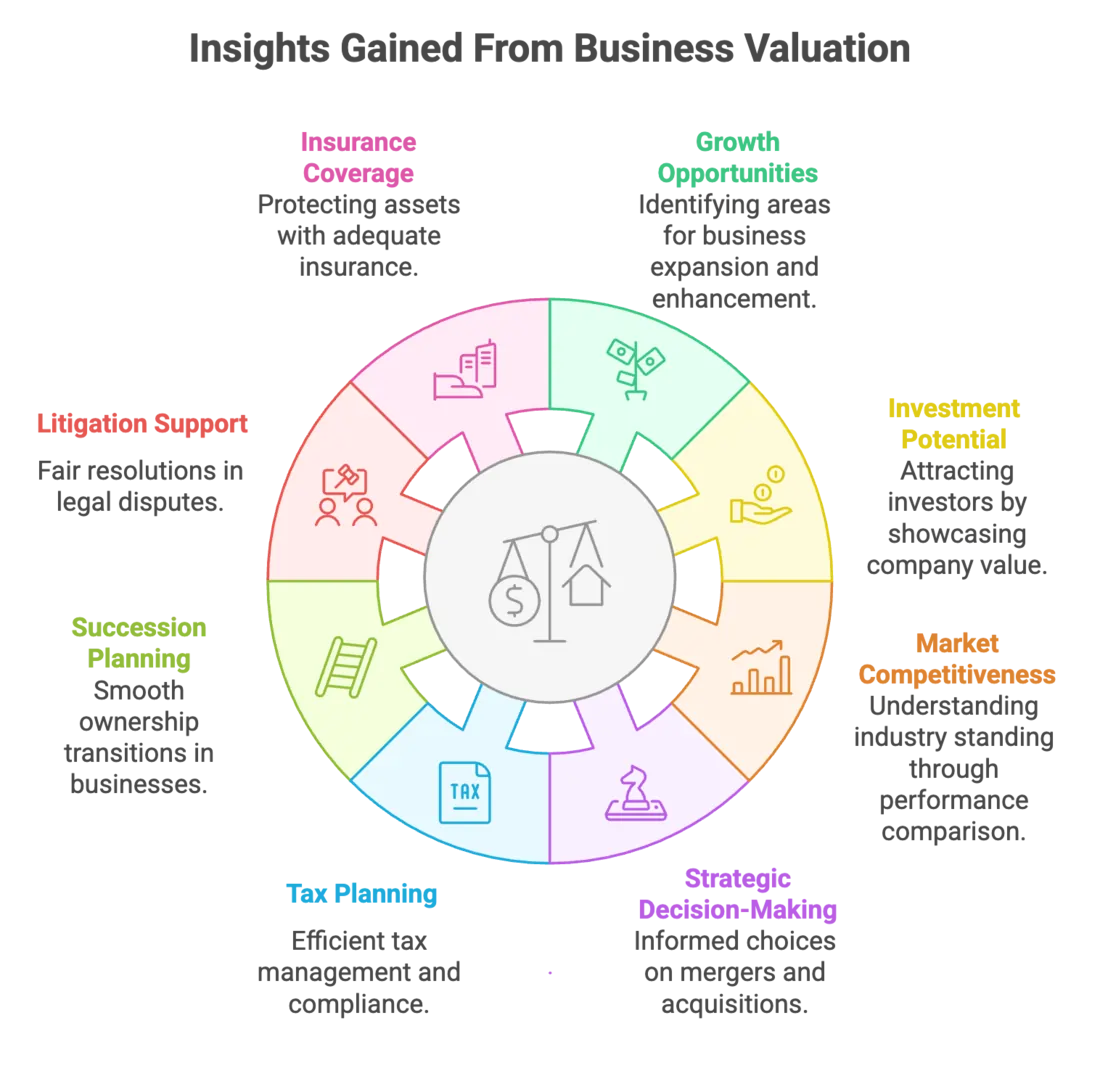

What Does Business Valuation Tell You?

Business valuation provides a snapshot of your company’s financial health and market position. It can reveal:

- Growth opportunities: Pinpoint areas for enhancement or potential expansion to optimize and grow your business.

- Investment potential: Showcase your company’s value to attract and secure funding from potential investors.

- Market competitiveness: Compare your business’s performance against competitors to understand your standing in the industry.

- Strategic decision-making: Facilitate informed decisions about mergers, acquisitions, and divestitures by understanding the value of business assets.

- Tax planning and compliance: Ensure regulatory compliance and efficient tax management by maintaining accurate valuation records.

- Succession planning: Enable smooth transitions in ownership within family-owned or closely held businesses through clear valuation processes.

- Litigation support: Provide a solid foundation for fair resolutions in legal disputes involving business valuation.

- Insurance coverage: Determine adequate insurance levels to protect the company’s assets and future earning potential based on its valuation.

Understanding your business’s valuation helps you make smarter decisions, whether you’re planning for growth, seeking funding, or preparing to sell.

Final Thoughts

Calculating your company valuation doesn’t have to be overwhelming. By exploring common methods like the market, income, or asset-based approaches, you can get a clearer picture of your company’s worth and how it relates to the broader concept of company valuation.

Whether you’re planning for the future or exploring current opportunities, knowing your business’s value puts you in control. If needed, consider consulting professionals to ensure accuracy and gain deeper insights.

FAQ

Q: What is business valuation?

A: Business valuation is the process of determining the economic value of a company by assessing its assets, liabilities, revenue, and market position.

Q: How do you calculate business valuation?

A: Common methods include the market approach, income approach, asset-based approach, earnings multiples, and discounted cash flow.

Q: Why is business valuation important?

A: It’s essential for securing funding, planning growth, selling a company, or attracting investors.

Q: Can I calculate my business valuation on my own?

A: Yes, but consulting a professional can provide a more accurate and comprehensive valuation.

Q: What factors influence business valuation?

A: Key factors include revenue, assets, liabilities, industry trends, and market conditions.