How to Price a Product for Maximum Profit

Setting the right price for your product is a critical decision that can shape the success of your business. A well-thought-out pricing strategy boosts profitability and attracts the right customers to ensure long-term sustainability. Pricing too high might deter potential buyers, while pricing too low can impact your bottom line.

This guide will walk you through the essential strategies, considerations, and product pricing models to help you determine the optimal price for your products.

Understanding Product Pricing

Let’s start with the basics:

What is Product Pricing?

Product pricing is the process of determining the optimal price for a product or service that balances the needs of the business with the needs of the customer. It involves considering factors such as production costs, market conditions, competition, and customer willingness to pay. Effective product pricing is crucial for businesses to achieve revenue and profitability goals.

When pricing a product, businesses must account for all production costs, including raw materials, labor, and overhead costs. Additionally, market research plays a vital role in understanding the competitive landscape and customer expectations. By analyzing these factors, businesses can set a price that covers their costs and aligns with their desired profit margins.

Importance of Pricing in Business

Pricing is critical to a business’s overall strategy, as it directly impacts revenue, profitability, and customer demand. A well-crafted pricing strategy enables companies to differentiate themselves from competitors, increase customer loyalty, and drive growth. On the other hand, poor pricing can lead to reduced sales, decreased revenue, and a loss of market share.

An effective pricing strategy considers the product’s perceived value to the customer. By aligning the price with customers’ value of the product, businesses can enhance their market positioning and build a strong brand reputation. Moreover, strategic pricing can help companies navigate economic fluctuations and maintain a competitive edge in the market.

Why Product Pricing is Important

Effective pricing impacts several aspects of your business, including:

-

Profitability: Ensuring a healthy margin while covering costs.

-

Market positioning: Establishing your brand as a budget, mid-range, or premium offering.

- Premium pricing strategy: Establishing your brand as a luxury or exclusive offering to target a specific market segment.

-

Customer perception: Influencing how your audience perceives the value of your product.

-

Competitive advantage: Helping you stand out in a crowded marketplace.

-

Revenue growth: Ensuring consistent cash flow and business expansion.

How to Calculate the Price of a Product

Product pricing requires a strategic approach that factors in total costs, profit margins, and market conditions. Begin by calculating all fixed and variable costs, including production, marketing, and distribution expenses. Once you’ve identified your total costs, determine your desired profit margin and evaluate competitor pricing to remain competitive.

- Calculate Total Costs:

- Add up all fixed costs (e.g., rent, salaries) and variable costs (e.g., raw materials, shipping).

- Use a detailed cost breakdown to avoid hidden expenses.

- Determine Desired Profit Margin:

- Decide the percentage of profit you want to earn (e.g., 20%, 50%).

- Align with industry standards and business objectives.

- Calculate your gross profit margin to understand the profitability of your product. Gross Profit Margin = (Selling Price – Cost of Goods Sold) / Selling Price.

- Consider Market Demand and Competitors:

- Research market conditions and competitor pricing.

- Position yourself competitively without undervaluing your product.

- Apply a Pricing Formula:

- Use formulas like Cost + Profit Margin = Selling Price.

- Factor in taxes, transaction fees, and shipping costs.

Related Articles

How to Determine the Price of an Item

Determining the right price for your product involves balancing costs, market positioning, and perceived value. Here’s how you can approach it:

- Analyze Market Trends:

- Use data from tools like Google Trends, industry reports, and customer surveys.

- Evaluate Your Unique Value Proposition:

- Identify what sets your product apart and justifies pricing.

- Test Different Pricing Models:

- Experiment with cost-plus, value-based, or penetration pricing strategies.

- Monitor Customer Feedback and Adjust Accordingly:

- Use analytics and feedback to refine pricing over time.

How to Calculate the Per Piece Cost of a Product

To determine the per-unit cost of a product, follow these steps:

- List All Production Costs:

- Include raw materials, labor, packaging, and shipping.

- Divide Total Costs by Production Volume:

- Calculate cost per unit by dividing total expenses by the number of units produced.

- Account for Overheads:

- Allocate a portion of fixed costs (e.g., rent, utilities) to each unit.

- Add Markup:

- Factor in the desired profit margin.

- Calculate Gross Profit Margin:

- Calculate the gross profit margin for each unit to ensure profitability. Gross Profit Margin = (Selling Price – Per Piece Cost) / Selling Price. This helps in determining appropriate sales prices for products and managing costs effectively.

Formula:

Per Piece Cost = (Total Fixed Costs + Total Variable Costs) / Number of Units Produced

How to Get Selling Price Formula

The selling price formula is essential for ensuring profitability. Use the following formula to calculate your product’s selling price:

Selling Price = Cost Price + (Cost Price × Markup Percentage)

Example:

If your product costs $50 to produce and you want a 40% markup:

Selling Price = $50 + ($50 × 0.40) = $70

Ensuring that the final price covers all costs and desired profit margins is crucial for business success.

Other popular formulas include:

-

Break-even Pricing: Selling Price = (Fixed Costs / Units) + Variable Costs

-

Target Return Pricing: Selling Price = Cost + Desired Return on Investment

-

Psychological Pricing: Setting prices slightly below round numbers (e.g., $9.99 instead of $10)

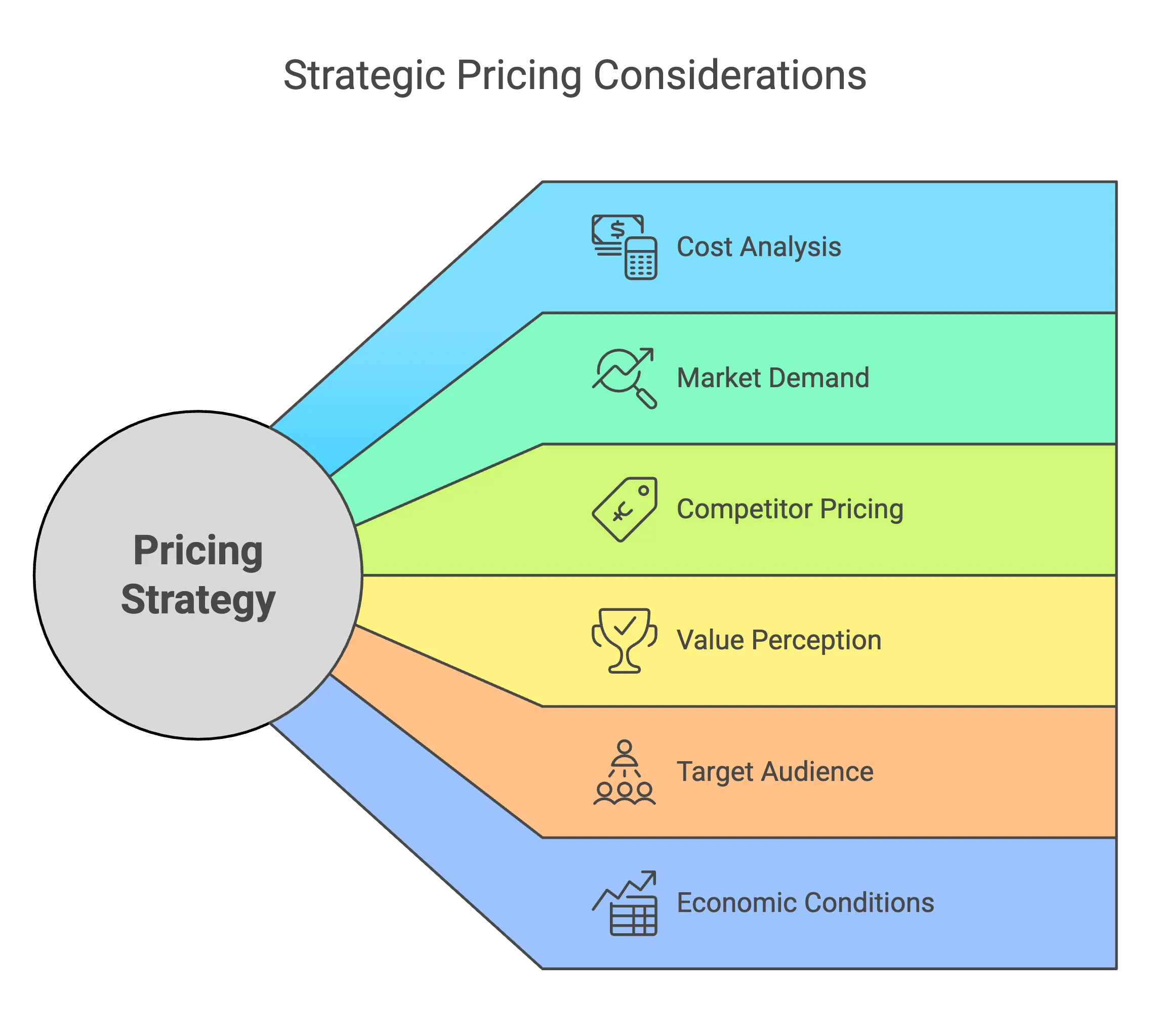

Key Factors to Consider When Pricing a Product

- Cost Analysis:

- Fixed Costs: Rent, salaries, utilities.

- Variable Costs: Raw materials, packaging, shipping.

- Break-even Analysis: Determine how many units need to be sold to cover costs.

- Market Demand:

- Conduct market research to understand customer willingness to pay.

- Use surveys and A/B testing to validate pricing strategies.

- Competitor Pricing:

- Analyze competitor pricing strategies to identify trends.

- Position your pricing strategy based on your unique value proposition.

- Value Perception:

- Evaluate the unique selling points (USPs) that justify premium pricing.

- Consider branding, quality, and customer experience.

- Consider implementing a premium pricing strategy to position your product as a luxury or exclusive offering.

- Target Audience:

- Customer demographics and purchasing behavior influence pricing strategies.

- Adjust pricing to match different segments of your market.

- Economic Conditions:

- Inflation, market trends, and seasonal fluctuations impact pricing.

- Be flexible when adjusting pricing models in response to economic changes.

Choosing a Pricing Strategy

Businesses can use several pricing strategies, each with its own advantages and disadvantages. Here’s an overview of pricing strategies that are commonly used:

-

Cost-plus pricing: This strategy adds a markup to the production cost of a product to determine its selling price. It ensures that all costs are covered while achieving a desired profit margin. For example, if the production cost is $50 and the markup is 40%, the selling price would be $70.

-

Competitive pricing: This strategy sets prices based on similar products competitors offer. It helps businesses remain competitive by aligning their prices with the average selling price of comparable products.

-

Value-based pricing: This strategy sets prices based on the perceived value of a product to the customer. It focuses on the benefits and unique features that justify a higher price. For instance, if customers perceive a product worth $200 due to its superior quality, the business can price it accordingly, even if the production cost is only $50.

-

Premium pricing: This strategy sets a higher price for a product or service to convey a sense of luxury or exclusivity. It targets customers who associate higher prices with higher quality and are willing to pay a premium for perceived value.

-

Penetration pricing: This strategy sets a low initial price to attract customers and gain market share. Once the product gains traction, the price can be gradually increased. This approach is often used to introduce new products in a competitive market.

When choosing a pricing strategy, businesses should consider factors such as their target market, competition, production costs, and desired profit margin. It’s also important to regularly review and adjust pricing strategies to ensure they remain effective and aligned with business goals. By selecting the right pricing strategy, businesses can optimize their pricing to drive sales, enhance profitability, and achieve long-term success.

Common Pricing Formulas and Examples

Each pricing strategy serves different business goals and scenarios. Here are some commonly used formulas:

- Markup Pricing:

- Formula: Selling Price = Cost + (Cost × Markup Percentage)

- Use this when you want a straightforward pricing approach to ensure profitability.

- Example: If the cost is $100 and the markup is 30%, Selling Price = $100 + ($100 × 0.30) = $130

- Calculate the gross profit margin to ensure your markup is sufficient. Gross Profit Margin = (Selling Price – Cost) / Selling Price.

- Target Return Pricing:

- Formula: Selling Price = (Total Cost + Desired Return) / Number of Units

- Ideal for businesses looking to meet specific profitability goals.

- Example: If the total cost is $10,000 and desired return is $5,000 for 500 units, Selling Price = ($10,000 + $5,000) / 500 = $30

- Break-even Pricing:

- Formula: Selling Price = (Fixed Costs + Variable Costs) / Number of Units

- Best for businesses looking to cover their costs before aiming for profit.

- Example: Fixed costs of $5,000, variable costs of $20 per unit, and 500 units: Selling Price = ($5,000 + (500 × $20)) / 500 = $30

- Value-Based Pricing:

- This method involves setting a price based on perceived customer value rather than cost.

- Use this when your product offers unique features or benefits that justify a higher price.

- Example: If customers perceive the product to be worth $200 based on its unique benefits, you can price it accordingly, even if production costs are only $50.

Calculate Your Cost of Goods Sold (COGS) or Cost of Sales

Calculating your cost of goods sold (COGS) is crucial for determining your profitability. COGS includes all direct costs of producing goods your business sells, such as raw materials, labor, packaging, and shipping expenses.

To calculate COGS, identify all direct costs and factors in manufacturing overheads, like machinery usage and energy consumption, and include inventory changes. The formula for COGS is:

Cogs = beginning inventory + purchases during the period – ending inventory

For example, if you start with an inventory worth $10,000, purchase an additional $5,000 worth of goods, and end with $3,000 worth of inventory, your COGS would be:

COGS = $10,000 + $5,000 – $3,000 = $12,000

Understanding your COGS allows you to set product prices that cover production costs and align with your profit objectives. Accurately calculating COGS also provides valuable insights into production efficiency, financial planning, and tax compliance. Understanding your gross profit margin helps in setting product prices that ensure profitability.

Common Pricing Mistakes to Avoid

-

Ignoring costs: Setting a price too low without considering total expenses.

-

Overpricing: Deterring potential customers with unrealistic price points.

-

Not monitoring competition: Failing to adjust prices based on competitor actions.

-

Lack of flexibility: Being rigid with pricing despite market changes.

-

Failing to test: Not experimenting with different price points.

-

Not considering the final price: Failing to ensure that the final price covers all costs and desired profit margins.

Final Thoughts

The price of a product must balance covering costs, staying competitive, and delivering perceived value to customers. It requires an in-depth understanding of your business costs, market dynamics, customer expectations, and competitive landscape. In addition to ensuring profitability, effective pricing influences brand perception, customer loyalty, and long-term sustainability.

The pricing strategy must be constantly analyzed and adjusted based on market trends, economic conditions, and customer feedback. Businesses should use data analytics and pricing tools to optimize their approach for different customer segments.

It’s also important to align pricing with your business goals—whether they’re market penetration, premium positioning, or short-term profits. Maintaining flexibility in adapting to changing market conditions while reviewing pricing strategies can help businesses stay ahead.

Businesses can achieve sustainable growth and long-term profitability by using the proper pricing strategies and continuously monitoring performance.