Market Research: Your Step-by-Step Guide

Market research is the secret to understanding your customers, spotting growth opportunities, and staying ahead of the competition — which we all want to do.

By asking the right questions and gathering meaningful insights, market research empowers businesses to make smart, confident decisions. But because it’s such a big subject with so many layers, sometimes it’s hard to know where to start.

This guide will break down the steps to effective market research, showing you how to uncover valuable data, refine strategies, and set your business up for long-term success.

What is Market Research?

Market research is the process of collecting, analyzing, and interpreting information about your market, target customers, and competitors to make strategic business decisions. By leveraging market research data, businesses gain valuable insights into consumer behavior, industry trends, and the competitive landscape.

Using a variety of market research methods, such as SWOT analysis, surveys, focus groups, and digital market research tools, you can gather accurate and actionable insights. These insights help refine strategies for product development, pricing, and marketing strategies while addressing customer needs more effectively.

Market research tools empower your business to navigate its industries with clarity, ensuring every decision is backed by thorough market research analysis. Whether you’re exploring new opportunities or optimizing existing processes, this research is the foundation for staying competitive and driving growth.

Why is Market Research Important?

Market research is an essential tool for businesses to leverage in order to understand their market, customers, and competitors and fuel their business plans. Here’s why it matters:

- Identifies market opportunities: Helps uncover emerging trends, gaps, and growth areas within the industry.

- Enhances product development: Aligns product features and services with customer needs through actionable insights.

- Supports audience segmentation: Enables businesses to define target demographics and tailor marketing efforts effectively.

- Guides pricing strategies: Provides data on customer price expectations and competitor benchmarks to optimize profitability.

- Improves marketing efforts: Ensures campaigns resonate with the target audience by analyzing engagement data and consumer behavior.

- Strengthens sales approaches: Refines the sales funnel and outreach strategies to align with customer preferences.

- Boosts brand positioning: Aligns branding with customer values to build trust and market recognition.

- Drives customer loyalty: Helps develop retention programs based on customer feedback and satisfaction metrics.

Types of Market Research

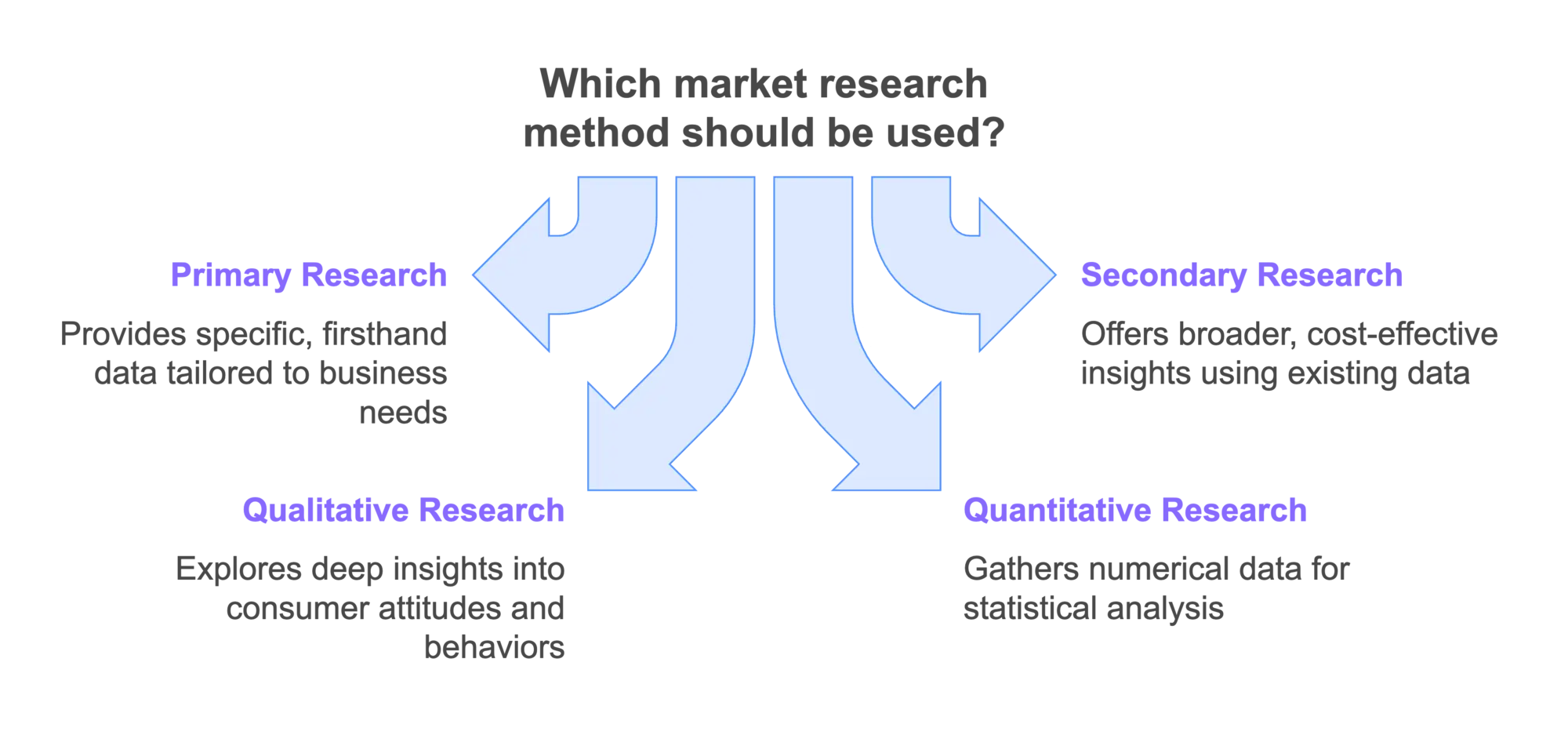

Market research can be categorized into distinct types, each serving a unique purpose and offering specific benefits to businesses. Primary Market research and secondary market research are the foundational approaches. Primary research gathers new, firsthand data directly from sources, ideal for specific, tailored insights. Secondary research, on the other hand, analyzes existing data from external sources, providing a broader understanding of market trends and competitor strategies.

Here’s a quick look at the key types of market research and their value:

|

Type of Market Research |

Description |

Examples |

Benefits |

|

Primary Research |

Collecting new, original data directly from the source to address specific business questions. |

Surveys, interviews, focus groups, observations. |

Provides tailored insights specific to your business, enabling informed decision-making and targeted strategy creation. |

|

Secondary Research |

Using existing data from external sources to gain insights about the market, competitors, or industry trends. |

Market reports, government statistics, competitor websites, academic studies. |

Cost-effective way to gather broad market knowledge and benchmark against competitors. |

|

Qualitative Research |

Exploring non-numerical data to understand underlying motivations, opinions, and behaviors. |

Open-ended surveys, interviews, focus groups, ethnographic studies. |

Helps uncover customer motivations, emotions, and preferences, guiding product development and messaging strategies. |

|

Quantitative Research |

Gathering numerical data to identify patterns, measure performance, or validate hypotheses. |

Structured surveys, statistical analysis, experiments, and online polls. |

Provides measurable, data-driven insights to track trends, forecast demand, and make objective decisions. |

A Step-by-Step Guide to Conducting Market Research

Conducting thorough market research might seem daunting, but once you get started, you’ll be walking down a path filled with riveting insights about your market, target audience, and product. You never really know what you’ll discover until you start.

Step 1: Define the Objective

Clearly defining your objective sets the foundation for effective market research and ensures your efforts are strategic and goal-oriented.

- Clarify your goals: Decide what you need to achieve. Examples include improving customer satisfaction, identifying untapped market opportunities, refining pricing strategies, or enhancing brand positioning.

- Understand your industry: Conduct a competitive analysis to explore market size, key players, and current market research trends. For example, global market research tools can uncover opportunities in new regions.

- Set specific, measurable outcomes: Examples include increasing customer retention by 20%, reducing costs by identifying inefficiencies or launching a product that meets unmet consumer needs.

- Determine scope and constraints: Decide whether your research will focus on B2B market research, consumer market research, or both. Define the timeline and budget to maintain realistic expectations.

Questions to consider:

- What decisions will this research inform?

- Who is the target audience for the insights?

- What market research data is already available, and what needs to be collected?

How to get it right: Clearly state what you intend to learn or solve through your research. Regularly check if your objectives align with strategic business goals and adjust to remain focused on outcomes that offer the highest value.

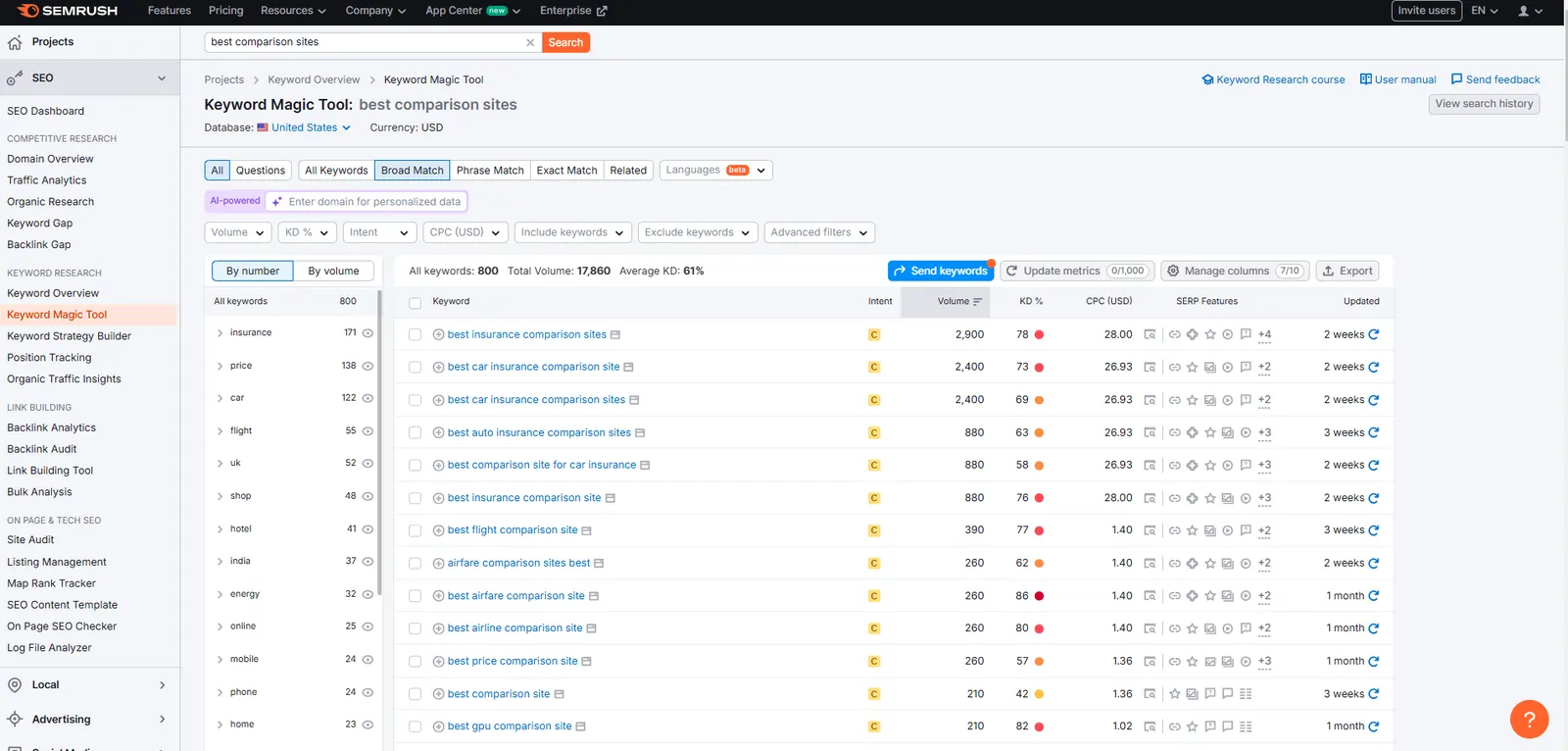

Tip: Use digital market research SEO tools like SEMrush, Ahrefs, or Sprout Social to identify understand what customers are searching for online and analyze industry benchmarks and competitor insights early in the process.

Example: SEMrush

Recommended SEO Tools:

SEMrush: Competitive analysis and keyword research, providing deep insights to outmaneuver competitors and capture more traffic.

Ahrefs: Backlink analysis and keyword tracking, essential for refining SEO strategies and understanding niche dynamics.

Rank Ranger: Comprehensive SEO analysis, offering detailed rank tracking and competitor insights to optimize online visibility and strategy.

Step 2: Identify Your Target Audience

Identifying your target audience goes beyond basic demographics to uncover their motivations, preferences, and behaviors. This step allows you to tailor your strategies to resonate with the right people.

- Collect primary data: Use market research surveys, focus groups, and interviews to gather firsthand insights into customer behavior and preferences.

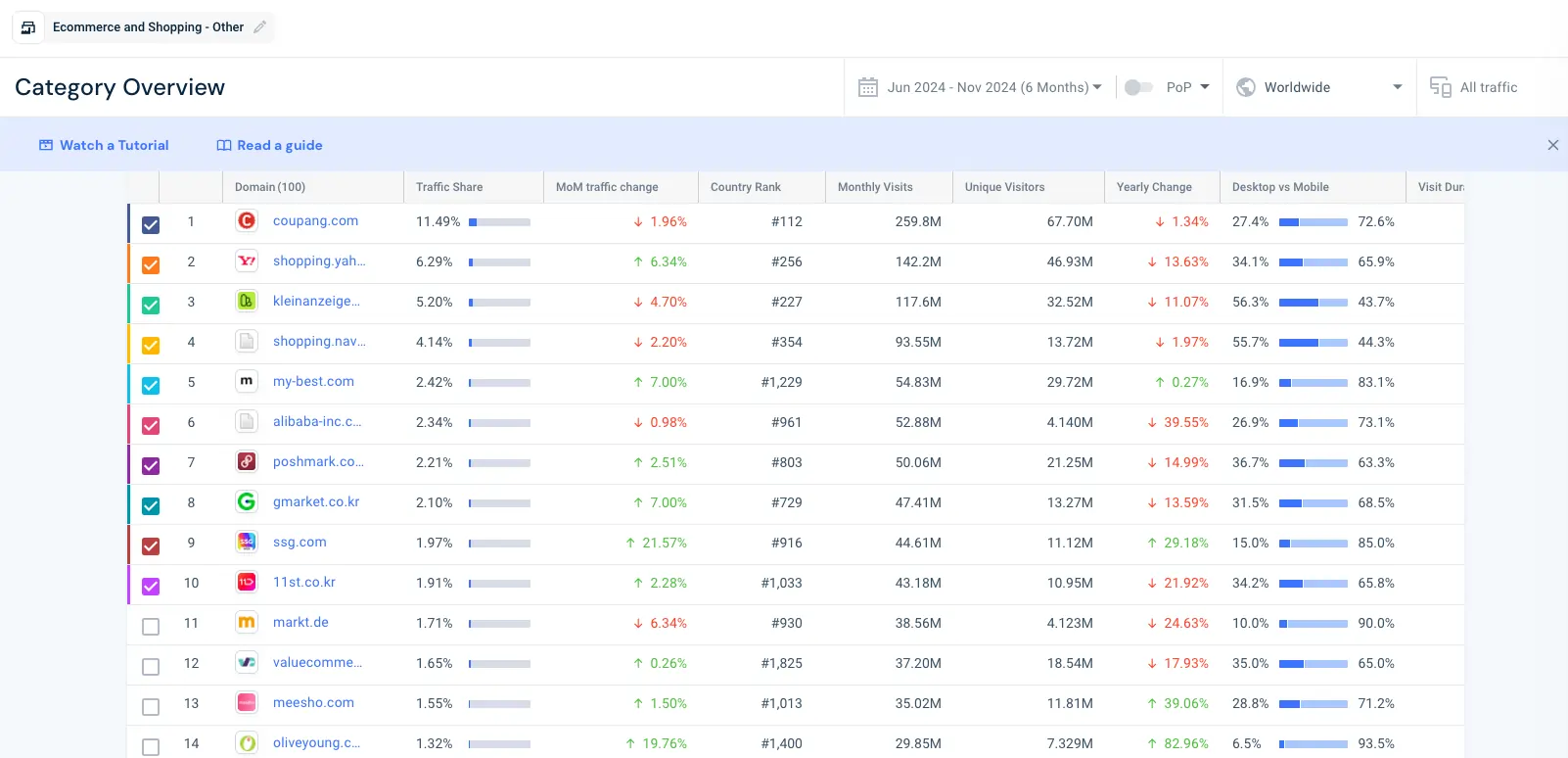

- Utilize secondary sources: Analyze industry reports, government statistics, and digital analytics platforms like Similarweb for broader audience insights.

- Segment your audience: Apply market segmentation techniques to categorize customers based on demographics, psychographics, geography, or behavior.

- Create customer personas: Develop detailed profiles of your ideal customers, including their goals, challenges, and decision-making processes.

- Leverage digital analytics: Tools like Google Analytics and HubSpot can help you track visitor behavior on your website and understand how they interact with your brand.

- Benchmarking: Compare your audience data against industry averages to identify where your business stands relative to competitors.

- Social media listening: Platforms like Hootsuite can track audience sentiment and engagement on social channels, offering insights into preferences in real time.

- Competitor audience analysis: Investigate who your competitors are targeting to identify potential gaps or underserved segments.

Examples of Segmentation Criteria:

- Demographics: Age, income, education, occupation.

- Psychographics: Values, interests, lifestyle.

- Behavior: Purchase history, brand loyalty, preferred channels.

- Geography: Urban vs. rural, regional preferences, climate-specific needs.

Actionable Steps:

- Run a survey analysis to understand customer preferences and expectations.

- Use focus groups for qualitative insights on emotional and cultural factors influencing buying decisions.

- Leverage tools like Google Analytics, surveys, or social media insights to identify your audience.

- Map customer journeys to understand pain points and identify opportunities for improvement.

How to get it right: Create detailed profiles using demographic, psychographic, and behavioral data. Validate and refine these profiles by engaging with actual or potential customers through surveys or interviews, ensuring your audience insights are grounded in reality.

Tip: Combine qualitative and quantitative research methods to build a full picture of your target audience. For example, follow-up survey data with in-depth interviews can be used to explore specific trends or challenges.

Step 3: Choose Your Research Method

Selecting the right research method is critical to collecting accurate and actionable insights. The methods you choose will depend on your objectives, budget, and the type of data you need.

- Primary research: Collect firsthand data directly from your target audience. Use tools like surveys, interviews, focus groups, or direct observations to gather unique insights tailored to your business.

- Secondary research: Leverage existing data from sources such as market reports, academic studies, competitor websites, or government publications. This is a cost-effective way to understand broader industry trends and benchmarks.

- Combine methods: A hybrid approach often yields the most comprehensive results. For instance, conduct primary research to gain specific customer insights while using secondary research to analyze overall market conditions.

- Explore digital tools: Use platforms like Qualtrics, SEMrush, and Google Analytics to streamline data collection and analysis. Digital analytics tools can enhance efficiency and provide deeper insights.

- Consider qualitative and quantitative research: Use qualitative research methods like interviews to explore motivations and behaviors and quantitative methods like structured surveys to gather measurable data.

Actionable Steps:

- Create a research plan that outlines the methods, tools, and timelines for your study.

- Use online survey platforms to collect data quickly and cost-effectively.

- Review historical data and competitor analysis reports to inform your approach.

How to get it right: Match the research method to the specificity and depth of information you need. Quantitative methods for broad trends, qualitative for deep insights. Adjust methods based on preliminary results and feedback loops.

Tip: Use a lean market research approach for faster results if you’re working with limited resources. This method focuses on gathering only the most essential data, using tools like quick surveys as well as website traffic and social media analytics.

Step 4: Competitive Analysis

Understanding your competitors is crucial for carving out a competitive edge in your market. This step focuses on analyzing competitor strategies, strengths, weaknesses, and market positions to inform your business decisions.

- Evaluate competitor products: Study the features, benefits, and limitations of competitor offerings. Identify areas where your product can stand out.

- Analyze market share: Look at the market share distribution to understand the competitive landscape and identify leading players.

- Monitor marketing strategies: Review competitors’ marketing campaigns to gauge their messaging, target audiences, and marketing channels.

- Assess customer feedback: Examine customer reviews and feedback on competitor products to identify dissatisfaction points and areas for improvement in your own offerings.

Actionable Steps:

- Conduct a SWOT analysis to understand your competitors’ strengths, weaknesses, opportunities, and threats.

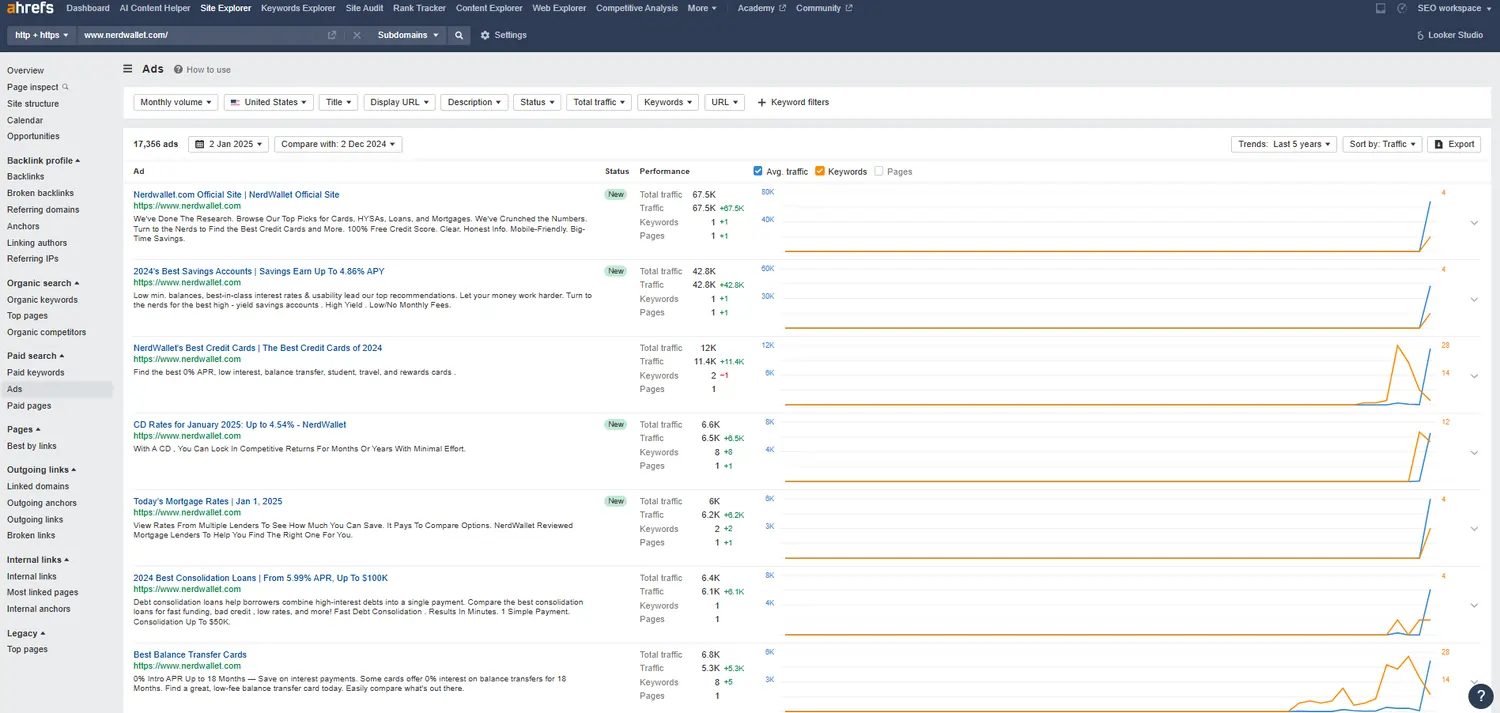

- Use SEO tools like SEMrush or Ahrefs to analyze competitors’ online presence, audience interest, and SEO strategies.

- Review industry reports and market research studies to gather comprehensive data on your competitors.

How to get it right: Identify competitors who closely match your business in size, services, and market presence. Analyze a select group of 3-10 companies, focusing on those most similar to your own operations rather than the largest players in the industry.

Tip: Regularly update your competitive analysis to adapt to new market entrants and changes in competitor strategies. This proactive approach helps maintain your competitiveness and strategic agility.

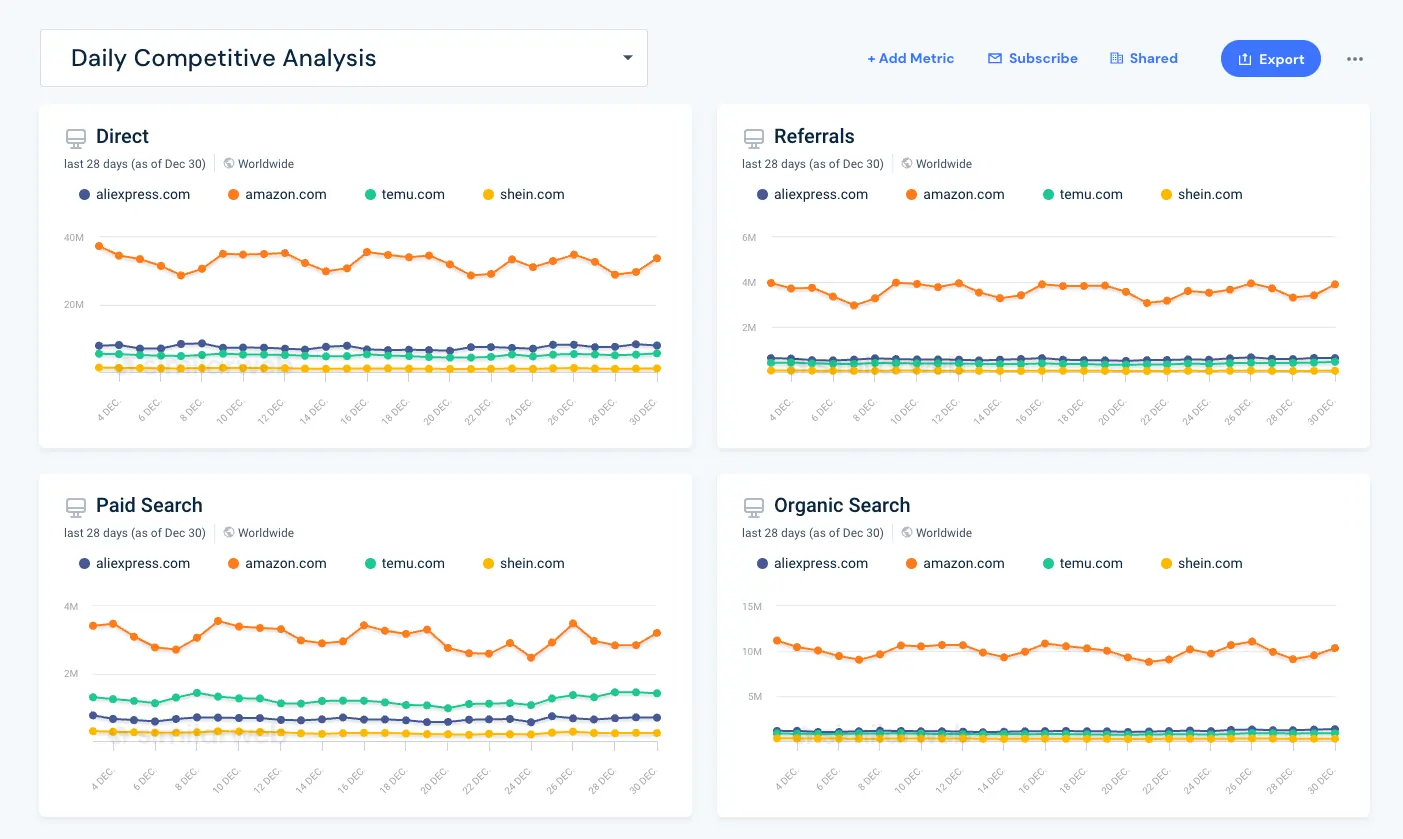

Example: Similarweb

Step 5: Product Methodology

Understanding how your product fits into the market is essential for ensuring its success. This step focuses on analyzing your product’s unique value and comparing it with competitors.

- Evaluate product features: Assess how your product addresses customer needs and stands out from competitors. Identify key strengths and potential areas for improvement.

- Test usability: Use focus groups, user testing platforms like UserTesting, or beta programs to gather feedback on the customer experience.

- Analyze market gaps: Identify unmet needs or gaps in the market that your product can fill. Use competitor analysis to spot opportunities for differentiation.

- Iterate based on feedback: Incorporate insights from surveys, reviews, and focus groups to refine your product and align it with market demands.

Actionable Steps:

- Conduct usability testing to observe how customers interact with your product.

- Map your product’s unique selling proposition to key customer pain points.

- Compare your product’s features and pricing with competitors to identify competitive advantages.

How to get it right: Continuously gather user feedback during product trials to refine features. Compare your product’s performance against competitor products to identify unique selling points and areas for improvement.

Tip: Regularly review consumer insights and market research data to ensure your product evolves with changing customer preferences and market trends.

Step 6: Pricing Methodology

Pricing is a crucial element of your market positioning, directly impacting customer perception and profitability. A well-researched pricing strategy ensures that your offerings align with market expectations while maximizing revenue.

- Understand customer expectations: Conduct surveys to identify how much your target audience is willing to pay and what value they associate with your product or service.

- Analyze competitors: Perform a competitor analysis to understand pricing structures within your industry and identify opportunities to differentiate.

- Experiment with pricing models: Test various models, such as tiered pricing, subscription plans, or limited-time discounts, to determine what works best for your audience.

- Factor in costs and margins: Ensure your pricing strategy accounts for production costs, operational expenses, and desired profit margins.

Actionable Steps:

- Use market research surveys to gather data on customer perceptions of value and affordability.

- Benchmark your pricing against competitors while highlighting unique product features that justify your price.

- Monitor the impact of pricing experiments through metrics like conversion rates and customer feedback.

How to get it right: Conduct market testing with different pricing tiers to understand price sensitivity. Monitor competitor pricing strategies and customer feedback to find your pricing sweet spot.

Tip: Use digital market research tools like pricing analytics platforms to assess market trends and adjust your strategy dynamically based on real-time data.

Step 7: Analyze and Interpret Data

Turning raw data into actionable insights is the core of effective market research. This step involves organizing, evaluating, and drawing conclusions from the information gathered.

- Organize your data: Categorize data based on demographics, behaviors, or preferences to identify patterns and trends. Tools like Tableau, Power BI, and Excel can simplify visualization.

- Look for correlations: Analyze the relationships between variables to uncover deeper insights, such as how pricing influences purchasing behavior or how brand positioning impacts loyalty.

- Identify opportunities and risks: Use trend forecasting and data analytics to highlight potential growth areas or challenges.

- Present findings: Summarize key insights in a clear, actionable format, such as dashboards or reports, to share with stakeholders. Visuals like charts and graphs make complex data easier to understand.

Actionable Steps:

- Review survey analysis and focus group feedback for recurring themes.

- Use competitive analysis to benchmark your findings against industry norms.

- Collaborate with your team to brainstorm strategies based on the interpreted data.

How to get it right: Use statistical analysis to validate your findings and uncover patterns. Create visual representations such as graphs and charts to make the data accessible to all stakeholders. Ensure your conclusions are actionable by linking them clearly to business objectives and potential strategies.

Tip: Regularly revisit and update your analysis to ensure it reflects the latest consumer behavior and market dynamics. Staying agile helps you adapt to changes effectively.

Step 8: Develop a Marketing Strategy

Your market research insights lay the foundation for crafting a targeted marketing strategy that resonates with your target audience and drives engagement. This step ensures your messaging, channels, and campaigns align with customer needs and preferences.

- Define key messages: Use consumer insights and market research data to develop messaging that highlights your product’s value and addresses customer pain points.

- Select marketing channels: Identify where your audience spends their time—social media, email, search engines—and tailor your approach to those platforms.

- Leverage market segmentation: Customize campaigns for different audience segments to ensure relevance and impact.

- Optimize with digital analytics: Use tools like Google Analytics and SEMrush to track campaign performance and refine strategies based on data.

Actionable Steps:

- Use survey analysis to identify the messaging that resonates most with your audience.

- Segment your campaigns by customer demographics or behaviors for personalized outreach.

- Benchmark against competitors to see which marketing campaigns and channels bring them the most website traffic.

- Regularly review performance metrics to adjust content, timing, or channel selection.

- Research into your competitors’ PPC ads and online campaigns to see which messaging is resonating with your audiences.

How to get it right: Craft messages based on proven customer preferences and behaviors. Test marketing campaigns in segmented demographics to optimize reach and impact before a full rollout.

Tip: Integrate digital market research tools to monitor trends and consumer behavior in real-time, allowing you to stay ahead of competitors and refine your brand positioning.

Example: Ahrefs

Step 9: Sales Strategy

A well-informed sales strategy aligns seamlessly with the insights gained from your market research. This step ensures your sales efforts target the right customers and leverage data-driven techniques to convert leads into loyal customers.

- Refine the sales funnel: Use data and sales metrics to identify gaps or bottlenecks in your sales process and optimize each stage.

- Discover effective tools: Equip your team with CRM software and digital tools that streamline workflows and track customer interactions to boost sales.

- Personalize outreach: Tailor sales pitches and follow-ups based on customer preferences and pain points uncovered during audience research.

- Empower your sales team: Share competitive analysis and consumer insights with your team to enhance their ability to close deals effectively.

Actionable Steps:

- Analyze customer behavior to identify patterns in purchasing decisions.

- Implement CRM tools like Salesforce or HubSpot to track and manage leads.

- Provide ongoing training to your sales team based on evolving consumer market research insights.

How to get it right: Utilize CRM software data to tailor sales approaches to customer behaviors and preferences. Regularly update strategies based on sales trends and direct customer feedback.

Tip: Use digital market research techniques to continuously refine your approach, ensuring your sales strategy adapts to market changes and consumer expectations.

Step 10: Build Loyalty and Retention Strategies

Long-term success depends not only on acquiring customers but also on keeping them engaged and satisfied. Developing loyalty and retention strategies ensures a steady customer base and fosters long-lasting relationships.

- Create loyalty programs: Reward repeat purchases with discounts, points systems, or exclusive perks to encourage customer retention.

- Enhance branding: Align your brand identity with customer values, creating an emotional connection that drives loyalty.

- Monitor feedback: Use market research surveys, online reviews, and direct customer interactions to understand satisfaction levels and address concerns proactively.

- Personalize experiences: Leverage consumer insights and market segmentation to offer tailored solutions and recommendations.

Actionable Steps:

- Use digital analytics tools to track customer engagement with loyalty programs.

- Incorporate customer behavior data into personalized offers and communications.

- Analyze survey feedback to continuously refine retention efforts.

How to get it right: Track the effectiveness of loyalty programs with specific metrics like repeat purchase rates. Adjust based on customer feedback to continually enhance the customer experience.

Tip: Regularly assess loyalty programs using data analytics to identify what’s working and adjust strategies to keep customers coming back.

Step 11: Conduct Market Segmentation

Market segmentation is the key to tailoring your strategies to different groups of customers, ensuring greater relevance and impact. By dividing your market into distinct segments, you can focus on addressing the specific needs of each group.

- Define segments: Use criteria such as demographics, psychographics, geography, and customer behavior to group your audience.

- Prioritize segments: Determine which segments offer the greatest potential for profitability or alignment with your business goals.

- Tailor offerings: Customize products, services, and marketing campaigns to resonate with the unique needs of each segment.

- Test and refine: Use survey analysis and focus groups to validate your segmentation and adjust strategies as needed.

Actionable Steps:

- Use market research tools like HubSpot or SEMrush to identify key audience characteristics.

- Run A/B testing within specific segments to measure engagement and effectiveness.

- Align your messaging, branding, and product features with the priorities of each segment.

How to get it right: Regularly reassess and refine market segments based on new data. Ensure marketing efforts address the specific needs and preferences of each segment effectively.

Tip: Combine qualitative and quantitative market research methods to validate your segmentation and adapt to shifting consumer preferences over time.

Step 12: Perform Trend Analysis and Forecasting

Staying ahead in a competitive market requires anticipating future trends. Trend analysis and forecasting allow businesses to adapt to shifts in customer behavior, market dynamics, and industry developments.

- Monitor industry trends: Use market research tools like Google Trends, IBISWorld, and social media analytics to identify emerging patterns and behaviors.

- Predict customer needs: Analyze historical data and consumer insights to anticipate changes in preferences and demands.

- Innovate strategically: Use insights to develop new products, features, or services that align with upcoming market opportunities.

- Evaluate external factors: Consider how economic shifts, technological advancements, or regulatory changes may impact your industry.

Actionable Steps:

- Collect and analyze global market research data to identify regional and industry-specific trends.

- Use predictive data analytics tools to create detailed forecasts for demand and growth.

- Incorporate forecasting insights into strategic planning for marketing and product development.

How to get it right: Stay abreast of industry changes by regularly reviewing market research reports and consumer data. Utilize predictive analytics to forecast future trends and prepare strategic responses. Adjust your business strategies based on these forecasts to maintain a competitive edge and meet evolving market demands.

Tip: Regularly update your trend analysis to reflect real-time market conditions and refine your approach as new data becomes available.

Step 13: Evaluate Distribution Channels

Understanding how your product reaches customers is critical for maximizing reach and operational efficiency. This step focuses on assessing and optimizing distribution strategies to meet customer expectations.

- Assess current channels: Evaluate the performance of existing methods such as retail, e-commerce, or direct-to-consumer models.

- Explore alternatives: Consider additional channels such as partnerships, affiliate marketing, subscription models, or leverage influencers in your niche.

- Optimize logistics: Use market insights to streamline supply chain processes and improve delivery times.

- Leverage digital channels: Invest in online marketplaces and influencer collaborations to enhance digital reach.

Actionable Steps:

- Conduct competitive analysis to benchmark your distribution strategy against industry standards.

- Use customer feedback and digital analytics to identify preferred purchasing methods as well as popular traffic sources.

- Experiment with new channels and evaluate their performance through key metrics like sales volume and customer satisfaction.

How to get it right: Analyze each channel’s reach and efficiency. Continuously seek customer input to refine the distribution strategy, ensuring timely delivery and customer satisfaction.

Tip: Use data analytics tools to monitor channel performance and adapt distribution strategies to changing customer needs and behaviors.

Example: Similarweb

Step 14: Test Marketing and Sales Strategies

Before fully launching your marketing and sales campaigns, testing ensures that your strategies are effective and resonate with your audience. This step helps identify potential improvements and mitigates the risk of wasted resources.

- Run pilot campaigns: Test your marketing and sales strategies on a smaller scale to gather initial feedback and insights.

- Analyze results: Use survey analysis and data analytics to evaluate performance metrics like engagement rates, conversion rates, and ROI.

- Iterate and improve: Adjust messaging, channels, or tactics based on test outcomes to optimize your approach before a full-scale rollout.

- A/B testing: Experiment with different variables such as headlines, CTAs, or pricing models to determine what works best for your audience.

Actionable Steps:

- Use digital market research tools like HubSpot or Mailchimp to run and track test campaigns.

- Compare pilot campaign results against industry benchmarks to assess effectiveness.

- Incorporate feedback from focus groups or customer surveys to refine strategies.

How to get it right: Conduct small-scale pilot campaigns to test different marketing and sales approaches. Analyze the data to identify which strategies yield the best engagement and conversion rates. Use these insights to refine tactics before implementing them across broader segments to optimize overall effectiveness.

Tip: Continuously monitor your campaigns even after launch, using real-time data to make ongoing adjustments and maximize performance.

Step 15: Assess Risks and Mitigation Strategies

Market research isn’t just about identifying opportunities—it’s also about uncovering potential risks and preparing for them. Assessing risks helps businesses build resilience and remain adaptable in a dynamic environment.

- Identify threats: Evaluate risks such as economic downturns, new competitors, or changes in customer behavior.

- Develop contingency plans: Prepare strategies to address risks, such as diversifying your offerings or pivoting marketing approaches.

- Monitor external factors: Stay informed about regulatory changes, technological advancements, or industry disruptions that could impact your business.

- Leverage competitive analysis: Use insights from your competitors to anticipate challenges and adopt best practices.

Actionable Steps:

- Conduct a SWOT analysis to identify strengths, weaknesses, opportunities, and threats.

- Use predictive analytics to model potential scenarios and outcomes.

- Collaborate with cross-functional teams to create robust risk mitigation strategies.

How to get it right: Regularly evaluate potential risks that could impact your market position or operational efficiency. Develop robust mitigation plans for identified risks, including alternative strategies and contingency plans. Continuously monitor and adjust these plans in response to new threats and changes in the market environment.

Tip: Regularly revisit your risk assessment as market conditions change, ensuring your business stays agile and prepared for unforeseen challenges.

Leveraging Market Research Tools

Market research tools simplify the process of gathering and analyzing data, enabling businesses to make well-informed decisions. Here’s a list of powerful tools and what they offer:

- Google Analytics: Provides in-depth insights into website traffic, user behavior, and audience demographics. Ideal for tracking key metrics like bounce rates, conversion rates, and traffic sources.

- SEMrush: A robust platform for SEO and digital marketing, offering keyword research, competitor analysis, and performance tracking to optimize online visibility.

- Qualtrics: A flexible survey tool for collecting customer feedback, conducting market research surveys, and analyzing responses to uncover actionable insights.

- Similarweb: Offers comprehensive analytics on web traffic and digital market intelligence, ideal for benchmarking against competitors, understanding audience behavior, and identifying growth opportunities across various digital channels.

- HubSpot: A CRM and marketing tool that supports audience segmentation, campaign tracking, and email marketing while integrating data analytics for better customer engagement.

- Sprout Social: Monitors social media conversations, audience sentiment, and engagement trends, making it perfect for understanding customer opinions and tracking brand mentions.

- Tableau: Turns raw data into interactive visualizations and dashboards, helping businesses identify trends, track performance, and present insights effectively.

- Hootsuite: Allows businesses to manage multiple social media accounts, monitor audience engagement, and gather real-time insights to optimize social strategies.

- UserTesting: Provides direct feedback on user experiences, enabling businesses to test websites, apps, or prototypes for usability and functionality.

- Ahrefs: An SEO-focused tool that analyzes backlinks, keywords, and competitor rankings, offering actionable insights to improve search engine performance.

- Zoho Analytics: Combines advanced analytics and reporting capabilities, enabling businesses to track KPIs and gain a deeper understanding of operational data.

These tools cover a wide range of market research needs, from data visualization and survey analysis to digital analytics and social listening, empowering businesses to stay competitive. Let me know if you’d like further elaboration on any tool!

Final Thoughts

Market research is your secret weapon for understanding your customers, spotting opportunities, and staying ahead of the competition. It’s not just a one-time task—it’s an ongoing process that keeps your business sharp and adaptable.

By following these steps and using the right tools, you’ll uncover insights that guide smarter decisions and fuel growth. Stay curious, keep asking questions, and let market research lead the way to your next big success!

FAQ

Q: Why is market research important for businesses?

A: Market research helps businesses understand their customers, identify opportunities, and make data-driven decisions to stay competitive and grow effectively.

Q: What’s the difference between primary and secondary research?

A: Primary research involves collecting original data directly from sources like surveys or interviews, while secondary research uses existing data like market reports or industry studies.

Q: How can market research benefit small businesses?

A: Market research helps small businesses target the right audience, optimize pricing, refine products, and create effective marketing strategies with limited resources.

Q: What tools can simplify the market research process?

A: Tools like Google Analytics, SEMrush, Qualtrics, and HubSpot streamline data collection, audience insights, and competitive analysis for efficient research.