Stripe vs Square: Which is better for online and in-person sales in 2026?

Choosing a payment processor is one of the most critical decisions for a small business. This system is the cash register and central nervous system for your entire revenue. A bad choice can mean high fees, lost sales, and cash flow headaches. A good choice means a seamless, reliable engine for growth.

For nearly every small business, the decision boils down to two of the biggest names in the industry: Stripe and Square.

On the surface, they seem to do the same thing: accept credit card payments. But dig deeper, and you’ll find they are built on two fundamentally different philosophies.

- Square is an all-in-one commerce ecosystem. It started with its iconic white card reader for in-person sales and built a complete “business in a box” around it, including POS hardware, payroll, marketing, and banking. It’s built for “Main Street” businesses like cafes, retail shops, and service providers.

- Stripe is a developer-first payments infrastructure. It started as a powerful, flexible API for online payments and built a suite of financial tools for internet-native businesses. It’s built for e-commerce stores, SaaS companies, platforms, and anyone who needs deep customization.

This definitive, data-driven comparison will break down every key feature, the critical pricing differences, and the real-world scenarios to help you decide which is the right choice for your specific business.

Key points (quick summary)

For readers scanning, here is a high-level breakdown of Stripe vs. Square.

- Stripe is best for… Online-first businesses, e-commerce stores, SaaS/subscription models, marketplaces, and any business that needs a custom-coded payment solution.

- Square is stronger in… In-person retail, restaurants, cafes, and service businesses (like salons or contractors) that need a single, all-in-one system for payments, POS, and business management.

- The main difference in pricing is… Their standard online transaction fees are identical (2.9% + 30¢), but their in-person fees and hardware costs differ significantly. Square’s chargeback protection (covering up to $250/mo) is a major cost-saver for small businesses.

- The key feature that separates them is… The ecosystem. Square‘s strength is its “business-in-a-box” hardware and software ecosystem. Stripe‘s strength is its powerful, developer-friendly API and financial infrastructure tools.

- The ideal audience for Stripe is… The tech-savvy, online-first, or platform-based business that prioritizes customization and scalability.

- The ideal audience for Square is… The “Main Street” small business that needs a simple, reliable, all-in-one solution for both in-person and online sales.

Head-to-head comparison (detailed breakdown)

We’ll now dive into the specific features to compare Stripe and Square side-by-side.

Market position & ideal use cases

- Stripe: Is the payments infrastructure for the internet. Its ideal user is an e-commerce store (like those on Shopify, which is powered by Stripe), a SaaS company needing recurring billing, or a platform (like Lyft or DoorDash) that needs to process payments for its users. It is built to be customized and integrated via its API.

- Square: Is the all-in-one commerce solution for small businesses. Its ideal user is a brick-and-mortar shop, a coffee cart, a hair salon, or a contractor. It provides a single, unified system for payments, point-of-sale, inventory, online booking, payroll, and marketing.

Hardware & device options

Hardware & device options

This is the most significant difference between the two. Square is a hardware-first company; Stripe is a software-first company.

- Square:

- Free Reader: Offers a free magstripe reader for your phone.

- Square Reader (Contactless): A small, low-cost device for tap-to-pay and chip cards.

- Square Terminal: A popular all-in-one handheld device with a built-in screen and receipt printer ($299).

- Square Stand: A counter-top stand that turns an iPad into a full-featured POS ($149).

- Square Register: A complete, two-screen POS system for high-volume retail ($799).

- Square for Restaurants & Retail: Specialized software kits for specific industries.

- Stripe:

- Stripe Terminal: This is Stripe’s answer to in-person payments, but it’s not a standalone POS. It’s a set of hardware (like the Stripe Reader M2 or BBPOS WisePad 3) that must be integrated into your own custom app or a third-party POS partner app (like the Shopify POS).

- Tap to Pay: Allows you to accept contactless payments directly on a compatible iPhone or Android device via the Stripe Terminal SDK.

Verdict: For a simple, out-of-the-box, in-person payment solution, Square is the clear winner. Stripe Terminal is powerful, but it is designed for businesses that want to build a custom in-person checkout experience that integrates with their existing online system.

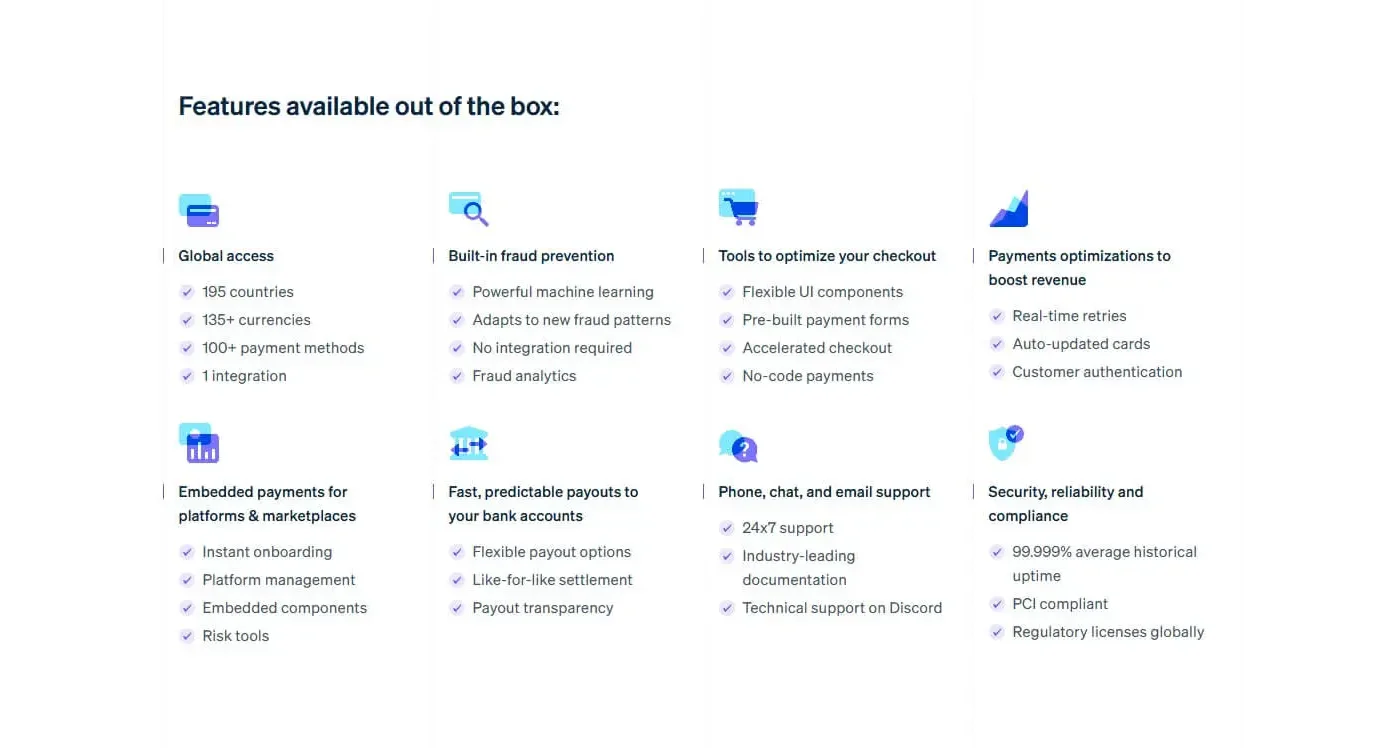

Core features & capabilities

- Online Payments: Both are excellent. Stripe offers more customization with its API and pre-built “Elements” (UI components). Square offers “Square Online,” a simple, free website builder, and easy “checkout links” you can send to customers.

- In-Person Payments: Square is the plug-and-play winner. Its hardware and software are one unified system.

- Ecosystem:

- Square: Offers a broad ecosystem for running a business: Square Payroll, Square Marketing, Square Loyalty, Square Banking (business checking), and Square Appointments.

- Stripe: Offers a deep ecosystem for managing finances: Stripe Billing (for subscriptions), Stripe Invoicing, Stripe Tax (automatic tax calculation), Stripe Atlas (for business incorporation), and Stripe Identity (for user verification).

Reporting, analytics & insights

- Square: Provides simple, clean dashboards in its app. It’s perfect for a shop owner who needs to see daily sales, top-selling items, and employee performance at a glance.

- Stripe: Offers an incredibly deep, data-rich reporting dashboard. It’s built for financial analysts and developers, providing granular data on MRR (Monthly Recurring Revenue), churn, payment methods, and complex financial reconciliation.

Integrations & connected tools

- Stripe: The king of developer integrations. Its API-first design means it can be connected to virtually any app, platform, or custom-coded website. It is the default, built-in payment processor for platforms like Shopify.

- Square: Also has a strong API and App Marketplace. It integrates well with popular e-commerce platforms like WooCommerce, BigCommerce, and Wix, but its main strength is how all of its own products (Payroll, POS, etc.) work together.

AI, automation & smart features

- Stripe: The standout feature is Stripe Radar, a best-in-class, AI-powered fraud detection and prevention tool. It learns from billions of global transactions to automatically block fraudulent payments. Stripe also uses AI for identity verification and optimizing payment authorization rates.

- Square: Is integrating Square AI across its ecosystem. This includes AI-generated product descriptions for your online store, AI-powered customer summaries in your contact directory, and smart recommendations and audience-building in Square Marketing.

Verdict: Stripe’s AI is focused on world-class security and financial optimization. Square’s AI is focused on being a helpful business and marketing assistant for the small business owner.

Pricing & payment processing

This is the most critical comparison. Their standard online fees are identical, but the other fees tell the real story.

| Feature | Stripe | Square |

|

Standard Online Fee |

2.9% + 30¢ |

2.9% + 30¢ |

|

Standard In-Person Fee |

2.7% + 5¢ |

2.6% + 10¢ |

|

Keyed-In / Manual Entry |

3.5% + 15¢ |

3.5% + 15¢ |

|

Invoice |

3.4% + 30¢ (paid online) |

3.3% + 30¢ (paid online) |

|

Monthly Fee (Standard) |

$0 |

$0 |

|

Chargeback Fee |

$15 (refunded if you win) |

$0 (with Chargeback Protection)* |

*Square Chargeback Protection is a major benefit for small businesses. Square will cover the cost of eligible chargebacks (up to $250 a month) at no cost to you, saving you both the fee and the lost sale.

Verdict: For standard online payments, it’s a tie. For in-person payments, the better option depends on your average sale (Stripe is cheaper for sales over $50; Square is cheaper for sales under $50). For overall peace of mind, Square’s $0 chargeback fee is a significant financial advantage.

Support, reliability & customer experience

- Stripe: Has historically been seen as developer-focused (email/chat) but has significantly invested in its support. It now offers 24/7 phone, email, and chat support for all users.

- Square: Also offers 24/7 phone support and a robust community forum. Its support is generally seen as more “small business-friendly,” but both platforms face complaints about account holds or shutdowns, which is a common risk with any payment aggregator.

Scalability & growth potential

- Stripe: Is built for infinite scale. It is the platform of choice for high-growth tech companies, global e-commerce, and complex financial platforms. It easily handles international payments, multi-currency, and massive transaction volume.

- Square: Scales exceptionally well for physical and omnichannel businesses. You can grow from a single food truck to a multi-state restaurant chain all within the Square ecosystem. It is less suited for scaling a pure-online, international SaaS or marketplace business.

Real-world scenarios / use case analysis

Example 1: The local coffee shop

- Needs: A fast in-person checkout, simple inventory for beans and pastries, and a way to manage employee timecards.

- Recommendation: Square

- Reason: This is Square’s perfect use case. Square for Restaurants or a standard Square Register provides an all-in-one POS, payment processor, and team management system out of the box.

Example 2: The online subscription box business

- Needs: A reliable way to charge customers on a recurring monthly basis, manage failed payments (dunning), and integrate with a custom website.

- Recommendation: Stripe

- Reason: Stripe Billing is the industry standard for subscriptions. Its API and dunning management tools are built to handle the complexities of recurring revenue, which is a core feature, not an add-on.

Example 3: The artist selling at markets and on an e-commerce site

- Needs: A simple, low-cost reader for weekend markets and a way to process payments on their online store.

- Recommendation: Square

- Reason: Simplicity and cost. The free magstripe reader (or low-cost contactless reader) is perfect for markets. The Square Online store is a simple, free way to get online, and it syncs inventory with the POS app. The $0 chargeback fee also protects them from a risky transaction.

Final verdict & recommendation table

| Factor | Best Choice | Reason |

|

Ease of use (for beginners) |

Square |

The all-in-one hardware and software is plug-and-play. No coding needed. |

|

Best for online-only |

Stripe |

The developer API, subscription billing tools, and fraud protection are unmatched. |

|

Best for in-person retail |

Square |

This is its core business. The hardware and POS software ecosystem is best-in-class. |

|

Hardware ecosystem |

Square |

A wide range of high-quality, fully integrated hardware for every type of retail. |

|

Developer tools & API |

Stripe |

The product is its API. It’s the most powerful and flexible for developers. |

|

Pricing value |

Square |

The $0 chargeback fee and free standard POS software provide incredible value and peace of mind. |

|

Best for scalability |

Stripe (for online) / Square (for retail) |

Stripe scales infinitely for internet businesses. Square scales infinitely for retail businesses. |

FAQ: Stripe vs Square

How is Stripe different from Square?

The main difference is their focus. Square is a small-business ecosystem designed for in-person retail (like cafes and shops) that also works online. Stripe is a financial infrastructure platform designed for online businesses (like e-commerce and SaaS) that also offers hardware for in-person payments.

Which is cheaper, Stripe or Square?

For standard online credit card payments, they are exactly the same price (2.9% + 30¢).

- Square is often cheaper overall for small businesses because its Free Forever plan includes a free website, free POS software, and $0 chargeback fees (up to $250/mo), which can save you significant money.

- Stripe can be cheaper for in-person sales if your average transaction is high (over $50), as its fee is 2.7% + 5¢ (vs. Square’s 2.6% + 10¢).

How to migrate from Square to Stripe?

To migrate, you would export your customer list and item catalog from Square as a CSV file. Then, you can import this CSV file directly into Stripe. You will need to re-create your payment links or re-integrate your website with Stripe’s API, as the payment infrastructure itself cannot be “migrated.”

Can I import data from Stripe to Square?

Yes. Similar to migrating the other way, you can export your customer list and product library from Stripe as a CSV file. You can then import this CSV file into your Square Dashboard to populate your Square customer directory and item catalog.

Does Stripe have a physical card reader?

Yes. It’s called Stripe Terminal. Unlike Square’s readers, which work with the all-in-one Square POS app, Stripe’s readers are designed to be integrated into your own custom-built mobile app or a pre-existing partner platform (like the Shopify POS app).

Is Square good for an online-only business?

Yes. Square Online is a full-featured e-commerce platform (website builder) that is included with your free Square account. You can build a robust online store, and it syncs perfectly with your in-person inventory if you ever decide to sell at a physical location.

What is Stripe Radar?

Stripe Radar is Stripe’s industry-leading, AI-powered fraud prevention tool. It analyzes every transaction against a massive global network to block fraudulent payments in real-time, which is a key feature for any high-volume online business.

Which has better customer support?

Both platforms offer 24/7 phone and email support. In the past, Square was known for being more small-business friendly, while Stripe was more developer-focused. Today, both have invested heavily in support, and the experience is very comparable.