Luminous Payments Review 2025

Luminous Payments Merchant Services Plans & Pricing

Luminous Payments Comparison

Expert Review

Pros

Cons

Luminous Payments Merchant Services's Offerings

Luminous Payments does not clearly state how much they charge for the use of their service as everything is customized depending on your business needs.

However, users can select four different merchant service plans according to the payment cards they accept and their processing volumes per month. In no particular order, these plans are the Interchange Plus Plan, the Cash Discount Plan, the Flat Rate Plan, and the Tiered Rate Plan.

Cash Discount Pricing

Merchants can pass processing fees to customers.

Allows businesses to offset up to 100% of fees.

Encourages cash payments to reduce costs.

Interchange+ Pricing

Charged at the actual interchange rate plus a service fee.

Provides full transparency on transaction costs.

Ideal for businesses wanting detailed cost breakdowns.

Flat Rate Pricing

A fixed rate for all card transactions.

Simplifies budgeting with predictable costs.

No surprises on monthly statements.

Tiered Rate Pricing

Groups transactions into three tiers: Qualified, Mid-Qualified, and Non-Qualified.

Rates vary based on the type of card used.

Helps businesses control processing costs based on transaction type.

Customized Pricing

Tailored pricing based on business needs.

Merchants work with a representative to create a custom plan.

Best for high-volume or industry-specific businesses.

Customer Support

When I explored Luminous Payments’ merchant services software, I found their customer support to be comprehensive and accessible, aligning well with the needs of businesses seeking reliable online payment solutions.

24/7 Phone Support

I called their 24/7 merchant support line (877-220-2056) late at night, and someone actually picked up. That’s a huge plus for businesses that need help outside of regular hours. They also have a separate sales line (800-787-3539), but it’s only available Monday-Friday.

Email and Online Contact

For non-urgent matters, I found it convenient to use their online contact form available on their website. This allows businesses to submit inquiries and receive responses via email, providing a documented trail for reference.

Resource Center and FAQs

The Resources section on their website offers valuable information, including a detailed FAQ page. This resource addresses common questions about their online payment platforms, application processes, and equipment compatibility, aiding in quick self-service support.

Additional Support Channels

While Luminous Payments excels in phone and email support, I noticed the absence of live chat and a dedicated blog for ongoing updates. However, their strong emphasis on direct communication channels ensures that businesses receive timely and personalized assistance for their online merchant services needs.

Features & Functionality

General Features

I was surprised by the wide range of merchant service tools offered by Luminous Payments. I listed them below and will share my experience.

- ACH Payment Processing

- Billing & Invoicing

- Data and Funds Security

- Debit/Credit Card Processing

- In-Person Payments

- Mobile Payments

- Multiple Payment Gateways

- Online payment processing

- PCI Compliance

- POS Integration

- Payment Fraud Prevention

- Payment Processing Services Integration

- Recurring Billing

- Reporting and Analytics

- Mobile Credit card processing

- Cash Transactions

- Contactless NFC

- Electronic Receipts

- Mobile Card Reader

- 3rd-Party Integrations

- Virtual Payments

- Offline Transactions

- Inventory and Order Management

- Multi-Currency and Multi-Country Support

- Chargeback Management

- Integration with Accounting Software

ACH Payment Processing

I tested Luminous Payments’ ACH payment processing, and it’s a great option for businesses that need to accept direct bank transfers. This feature allows businesses to process large transactions at lower costs compared to credit card payments. It’s an excellent addition to online payment solutions for industries that handle recurring invoices or high-ticket sales.

Billing & Invoicing

The billing and invoicing feature makes it easy to send and manage payment requests. I liked how businesses can track outstanding payments directly from the dashboard, reducing the need for third-party invoicing tools. This feature helps streamline online merchant services, making payment collection more efficient while improving cash flow management.

Data Security

When I tested Luminous Payments’ merchant services software, I was impressed with its PCI compliance and built-in security measures. Transactions are encrypted, protecting sensitive customer data from breaches. The system also flags suspicious activity, reducing fraud risks for businesses using online payment processing services. Secure transactions build customer trust and minimize chargebacks.

Debit/Credit Card Processing

I played with Luminous Payments’ debit/credit card processing, and it worked smoothly for both e-commerce payments and in-person transactions. Businesses can accept all major cards, ensuring customers have flexible payment options. Whether in-store or online, this payment gateway processes transactions quickly, minimizing downtime and ensuring businesses get paid without unnecessary delays.

In-Person Payments

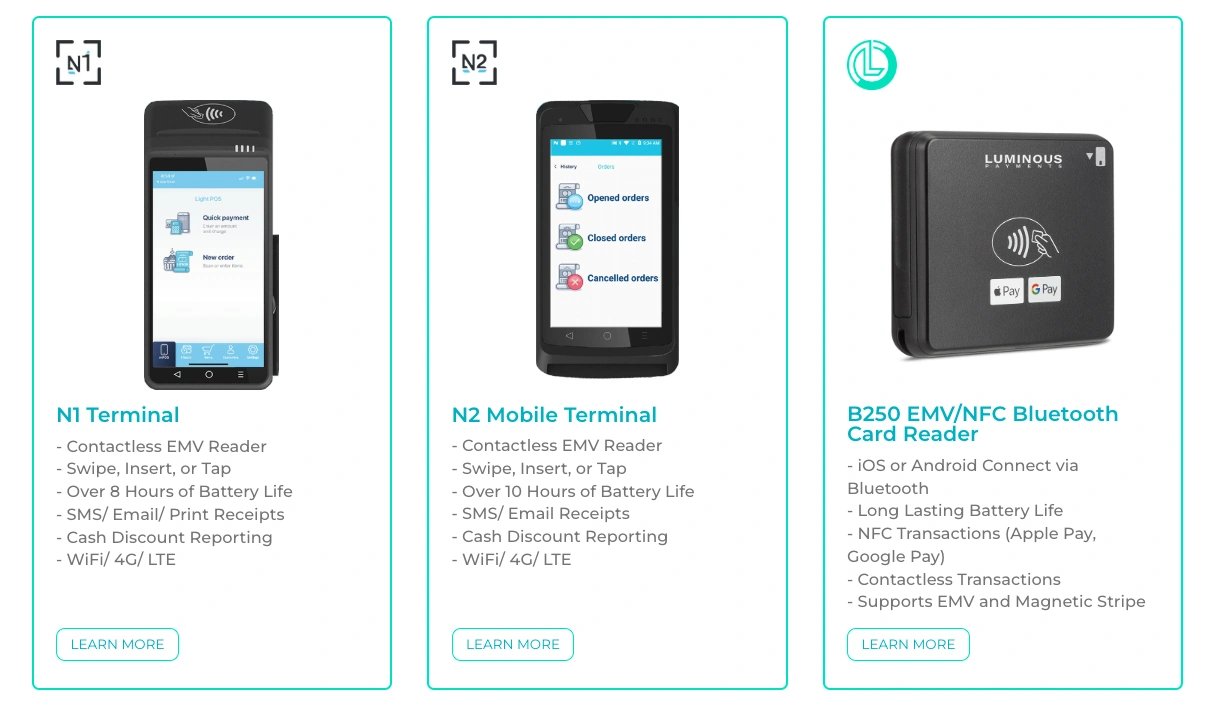

I tested Luminous Payments’ in-person payment system, and the hardware is solid. The N1 and N2 Mobile EMV Terminals process payments quickly, supporting chip, swipe, and tap transactions. For businesses relying on online payment platforms but needing physical transactions, this is a great option. Contactless and mobile wallet support makes transactions even more seamless.

Mobile Payments

I liked how Luminous Payments allows businesses to accept mobile payments, including Apple Pay and Google Pay. This feature is crucial for modern e-commerce payment methods, making checkout quicker and more convenient for customers. It’s a great way to speed up in-store payments while also supporting digital transactions for online stores.

Multiple Payment Gateways

I tested how Luminous Payments integrates with multiple payment gateways, and it worked well with different business setups. Having access to multiple gateways helps businesses manage transactions efficiently while ensuring compatibility with their existing merchant services software. This flexibility is great for companies that use different platforms for e-commerce payments.

Online Payment Processing

I tried out Luminous Payments’ online payment processing, and transactions were processed quickly and securely. The system supports recurring billing, making it ideal for subscriptions or service-based businesses. With electronic check processing and credit/debit support, businesses can accept virtual cards for online payment, creating a seamless checkout experience.

PCI Compliance

Ensuring PCI compliance can be a headache, but Luminous Payments’ tool automates this process. I liked how it keeps businesses compliant with security regulations while protecting customer data. This feature is essential for businesses processing sensitive payment information through online payment solutions, keeping transactions safe and minimizing fraud risks.

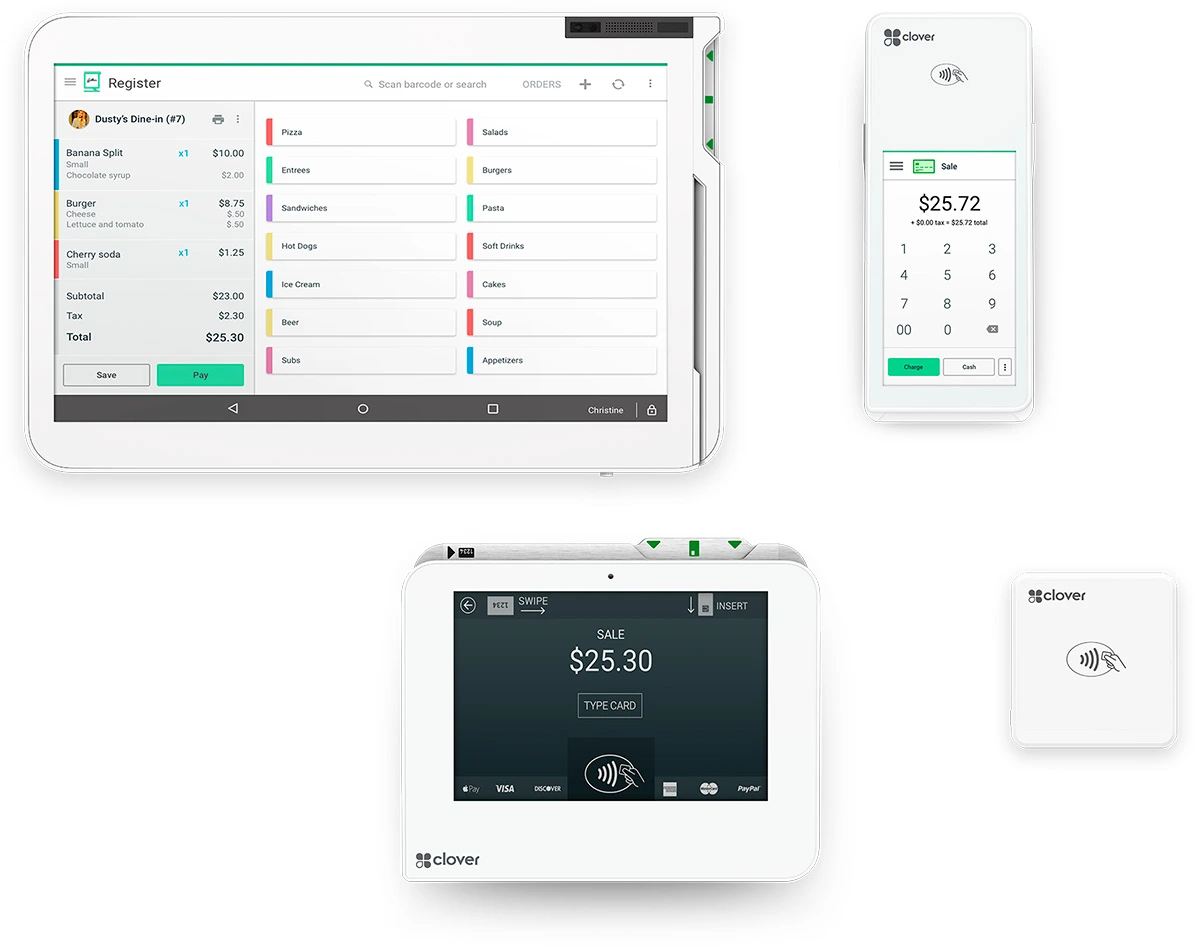

POS Integration

Luminous Payments utilizes POS hardware from top brands like Clover and HotSauce to deliver top-notch point-of-sale services to its customers. Depending on the device you opt for, this service makes a lot of payment processes like credit and debit card processing and online payments fast and efficient.

I tested Luminous Payments’ POS integration, and it connected seamlessly with existing e-commerce payment systems. Businesses can sync transactions across multiple locations, reducing errors and simplifying bookkeeping. This integration ensures smoother day-to-day operations while allowing businesses to manage sales more efficiently.

Payment Fraud Prevention

Fraud prevention tools are a must, and I was happy to see Luminous Payments include them. The system flags potentially fraudulent transactions, reducing chargebacks and financial losses. For businesses using online payment processing services, having built-in fraud detection helps minimize risks while keeping transactions secure.

Payment Processing Services Integration

I tried integrating Luminous Payments with other merchant services software, and it worked without major issues. Businesses can sync their payment data with accounting and CRM tools, making financial management easier. This feature is valuable for businesses that rely on online merchant services and want an all-in-one payment solution.

Recurring Billing

I tested the recurring billing feature, and it’s a time-saver for subscription-based businesses. Payments are automatically deducted on set dates, reducing late payments and improving cash flow. This feature is a must-have for companies offering membership services or monthly subscriptions through their online payment platforms.

Reporting & Analytics

I checked out the real-time reporting dashboard, and it was easy to track transactions, refunds, and sales trends. Businesses using e-commerce payment methods can generate detailed reports to optimize their sales strategies. Having access to clear, up-to-date data is a game-changer for financial planning.

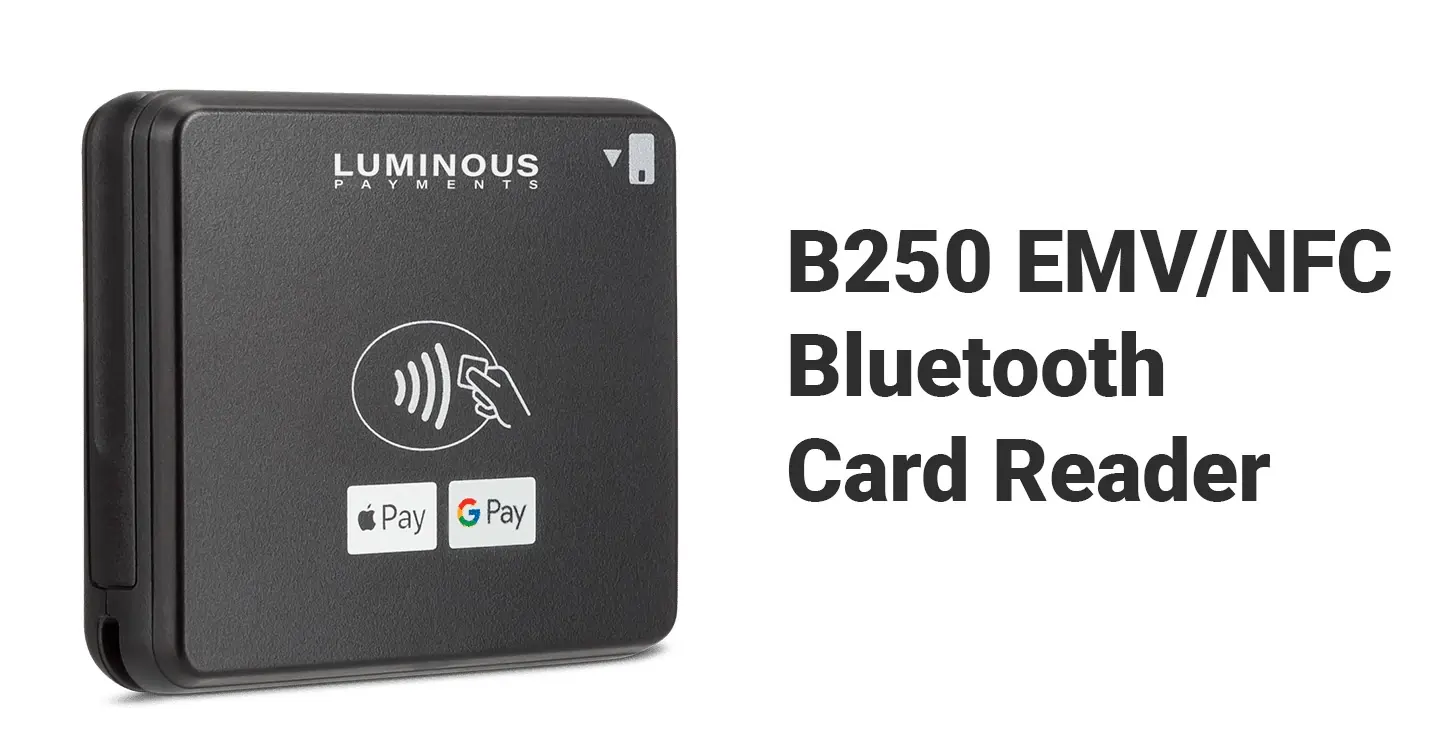

Mobile Credit Card Processing

For businesses that operate outside a fixed location, Luminous Payments’ mobile credit card processing is a great feature. I used their B250 EMV/NFC Bluetooth Card Reader, and it worked smoothly for tap, swipe, and chip payments. It’s perfect for food trucks, vendors, or businesses needing flexible online payment processing services.

Cash Transactions

While Luminous Payments specializes in online payment solutions, businesses can still handle cash transactions through their POS system. I liked how the platform allows merchants to track cash sales alongside card transactions, keeping records organized and minimizing discrepancies.

Contactless NFC

I tested contactless NFC payments, and it worked flawlessly with mobile wallets and tap-to-pay cards. For businesses focusing on e-commerce payment methods, having NFC-enabled payment gateways is essential for offering a fast and convenient checkout experience.

Electronic Receipts

Instead of printing paper receipts, I liked how Luminous Payments offers electronic receipts via SMS and email. This feature is a win for both businesses and customers, ensuring proof of purchase while reducing waste. It’s especially useful for businesses with high transaction volumes.

Mobile Card Reader

I tested Luminous Payments’ mobile card reader, and it was easy to use. The reader connects via Bluetooth, making it perfect for businesses that need portable merchant services software. Whether for pop-up shops or delivery services, this tool makes accepting payments on the go seamless.

3rd-Party Integrations

Luminous Payments allows you to synchronize your online store and shopping carts with its configured hardware devices. This synchronization ensures that you can effortlessly run your eCommerce business with the software at no extra cost.

I explored some of the integrations, and they made managing payments easier. Businesses using online merchant services can sync transactions with accounting software and CRMs, reducing manual entry. This feature is great for companies looking to automate operations and streamline payment tracking.

Virtual Payments

Do your customers prefer to shop cardless? Luminous Payments support contactless payments where your customers do not need to have their cards physically present to pay for your goods and services. You can securely accept virtual payments for your online or physical store by connecting your virtual payment device to your smartphone.

Offline Transactions

When you purchase the Clover Flex POS device, you can enjoy offline transactions for periods when the wireless connection is unstable. As soon as connectivity is restored, all your transactions will be synchronized.

Inventory and Order Management

When you use hardware devices like the Clover Mini POS, you benefit from comprehensive inventory management from Luminous Payments. This platform allows you to keep an eye on each item’s history for prompt restocking. In addition, by opting for the HotSauce POS, you can manage your orders, track each table (for restaurant owners), and sync your kitchen and counter data for greater efficiency.

Multi-Currency and Multi-Country Support

I explored the platform’s multi-currency and multi-country capabilities, which enable businesses to accept payments from international customers. This feature is invaluable for companies aiming to expand their global reach, as it simplifies transactions across different currencies and regions.

Chargeback Management

Managing chargebacks can be challenging, but I found that Luminous Payments provides tools to handle disputes effectively. The platform offers clear guidelines and support, assisting businesses in resolving issues promptly and maintaining healthy cash flow.

Integration with Accounting Software

I tested the integration capabilities with popular accounting software, and it streamlined financial workflows seamlessly. This feature reduces manual data entry and ensures that transaction data is accurately reflected in financial records, enhancing efficiency and accuracy in bookkeeping.

Hardware & Software

Luminous Payments can be configured on a host of merchant business hardware. You can also use the service with third-party hardware. However, the following devices and systems have been provided for use by the company – at varying prices:

Card readers and Payment Gateways

Essentially, Luminous Payments features only two devices for the processing of card and online payments. These devices include:

- NMI virtual reader, which allows businesses to accept online payments. This system can be integrated with online store shopping carts to manage batch payments and recurring customer bills.

- B250 Bluetooth Card reader comes with a durable battery, a magnetic stripe, and NFC for payments via Apple Pay and Google Pay. This Bluetooth-enabled device lets you connect your Luminous Payments account with a mobile payment service for effortless transactions.

Mobile Terminals

The mobile terminal available for use with Luminous Payments allows you to read cards and process payments on the go. These terminals are:

- The N1 Mobile EMV Terminal also doubles as a card reader and mobile payment processing device. The N1 terminal boasts an 8-hour battery capacity and card reading slots. It also supports electronic and printable receipts for seamless business transactions.

- The N2 Mobile Terminal features similar functions as the N1 but lasts for an extra 2 hours. It also should be noted that the N2 doesn’t have a printer, so the terminal can only Text or email receipts to customers.

POS Systems

If your business needs services beyond what terminals and card readers can offer, you should opt for one of this software’s POS systems.

- Clover Station Solo: a portable POS system that features a 14” HD display and a detached printer. This system works with 4G and Wi-Fi connections and is EMV, NFC and MSR enabled for faster payment processing.

- Clover Station Duo: a portable and functional POS system similar to the Clover Station Solo but can be used to complete contactless payments.

- Clover Mini: this system comprises a 7” monitor with a front-facing camera and a supplementary receipt printer. It can be paired with a cash drawer to complete physical and contactless payment processing. This POS features advanced security configurations and inventory management and can be synchronized with other Clover devices.

- Clover Flex: a POS system similar to the Clover Mini but is configured to run offline transactions. Nevertheless, this system has no design considerations for a cash drawer.

- HotSauce POS: In addition to the features of the Clover Mini POS, this system supports kitchen receipt printing, order and discount management, and table tracking.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

Performance Overview

When I tested Luminous Payments’ merchant services software, I found it to be a robust solution for businesses seeking efficient online payment processing services. The platform offers a range of features designed to enhance transaction speed and reliability.

Speed

I was impressed with the platform’s quick transaction processing times. Payments are typically settled within 24 hours, and there’s an option for same-day funding, which is a significant advantage for maintaining cash flow. The N1 Mobile EMV Terminal and NMI Virtual Reader facilitate swift in-person and online payments, respectively, ensuring minimal delays.

Reliability

During my use, the system consistently delivered dependable performance. The hardware options, including the N2 Mobile Terminal, are designed for durability, featuring extended battery life to support continuous operations. The platform’s compliance with PCI DSS standards further enhances its reliability by ensuring secure transactions.

Features

Luminous Payments offers a comprehensive suite of features tailored to diverse business needs. The platform supports multiple e-commerce payment methods, including credit/debit cards and digital wallets like Apple Pay and Google Pay. The NMI Virtual Reader integrates seamlessly with online shopping carts, facilitating batch processing and recurring billing. Additionally, the system provides advanced fraud protection tools and chargeback management, which are crucial for mitigating risks associated with online payment platforms.

Ease Of Use:

Simple and Cloud-Based

When I tried out Luminous Payments’ merchant services software, I found its cloud-based system refreshingly simple. There’s no need for bulky servers or complex installations, making it easy for businesses to get started quickly.

Hassle-Free Registration and Setup

Luminous Payments makes onboarding easy. Their customer support team guides businesses through registration and account setup, ensuring a smooth experience. It took little time to set up, and I was able to access the dashboard almost immediately.

Interactive Dashboard for Easy Management

Once logged in, I liked how Luminous Payments’ online payment platform provides an interactive dashboard that’s simple to navigate. Viewing transactions, managing payments, and generating reports felt seamless.

Fast Approvals and Same-Day Funding

I tested the same-day funding feature, and it’s a game-changer. Quick account approvals mean businesses can start processing payments almost immediately. However, payment speeds depend on the card or mobile payment gateway network conditions.

Risk-Free Opt-Out

If the service isn’t the right fit, Luminous Payments offers a risk-free cancellation, giving businesses full flexibility in choosing their online payment solutions.

Verdict:

Like most other merchant service software, Luminous Payments allows you to process and accept payments from your customers via different platforms. In addition, it offers funds and data security without cutting back on simplicity and user-friendliness. However, there isn’t so much information on their website to help business owners decide whether or not the service is ideal for their business. There isn’t a free trial period or a demo to give potential users a heads-up on what they should expect with the service.

Nevertheless, Luminous Payments customer support can be reached via phone for clarification. You can also request an estimate of what it would cost your business to use the platform. And this service’s zero termination fee makes it inexpensive to opt out if you discover that it doesn’t serve your business as you’d want.