PaymentCloud Review 2026

PaymentCloud Merchant Services Plans & Pricing

PaymentCloud Comparison

Expert Review

Pros

Cons

PaymentCloud Merchant Services's Offerings

PaymentCloud merchant services offer customized pricing plans tailored to meet the unique needs of businesses across various industries, focusing on flexibility and competitive transaction rates.

Customer Support

As mentioned earlier, PaymentCloud provides its customers with a dedicated account manager as your main PaymentCloud point of contact. They advocate and negotiate for you and answer any questions you have.

Aside from that, you have numerous support options ranging from phone and email to self-help stuff like FAQs and YouTube videos.

Additional support includes:

Blog: PaymentCloud’s blog covers general business and merchant services topics.

Paycloud’s phone support line operates in the following hours:

Monday – Friday, 7:00 AM – 6:00 PM PST

Saturday, 7:00 AM – 3:00 PM PST

Sunday, 9:00 AM – 5:00 PM PST.

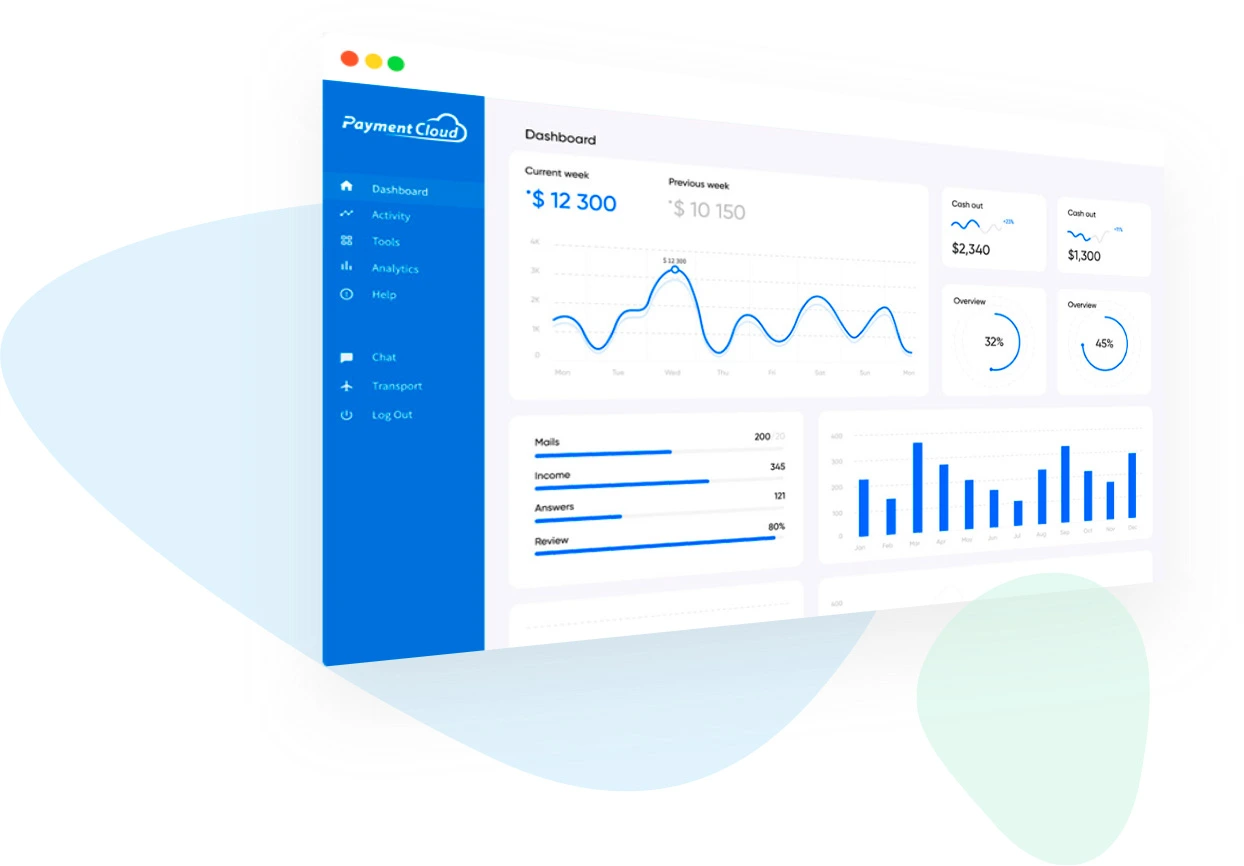

Features & Functionality

General Features

PaymentCloud merchant services software offers a wide host of online payment solutions, as well as features to protect your business and promote improved workflows. Here are some of the merchant service tools you can leverage:

- Custom-tailored payment solutions for low to high-risk businesses

- Mobile billing & invoicing capabilities

- Advocacy and negotiation

- Custom-tailored payment solutions

- Advanced fraud prevention

- Chargeback protection tools

- Seamless integrations with platforms

- ACH and electronic check processing

- Mobile and contactless payment options

- Business funding and merchant cash advances

- Free terminals and mobile credit card readers

- Personalized account management with advocacy and negotiation support

- API integrations for e-commerce

- Text and email-based billing and invoicing

- POS systems for retail and online merchants

- Dedicated solutions for various industries

Custom-Tailored Payment Solutions for Low, Medium & High-Risk Businesses

PaymentCloud merchant services provider specializes in creating personalized payment solutions for businesses across all risk levels. From low-risk industries like retail to high-risk categories such as dating sites, firearms, and tobacco, PaymentCloud provides tailored services to ensure seamless payment processing. Their solutions include robust point-of-sale (POS) systems, competitive processing rates, and free hardware options, enabling businesses to operate confidently and effectively regardless of their risk profile.

Mobile Billing & Invoicing Capabilities

With PaymentCloud, you can turn your customers’ phones into your POS system — thanks to PaymentCloud’s acquisition of Paysley. You can send estimates with deposit requests and invoices via SMS or email. Plus, you can add your logo and branding to these documents for more personalization.

Advocacy and Negotiation

The merchant service provider offers a dedicated account manager to help you with various things. One of these is advocating for and negotiating on behalf of your company with your bank and processor. PaymentCloud will do its best to keep your account open, prevent funds from being held, lower your reserve, and obtain higher processing limits, among other things.

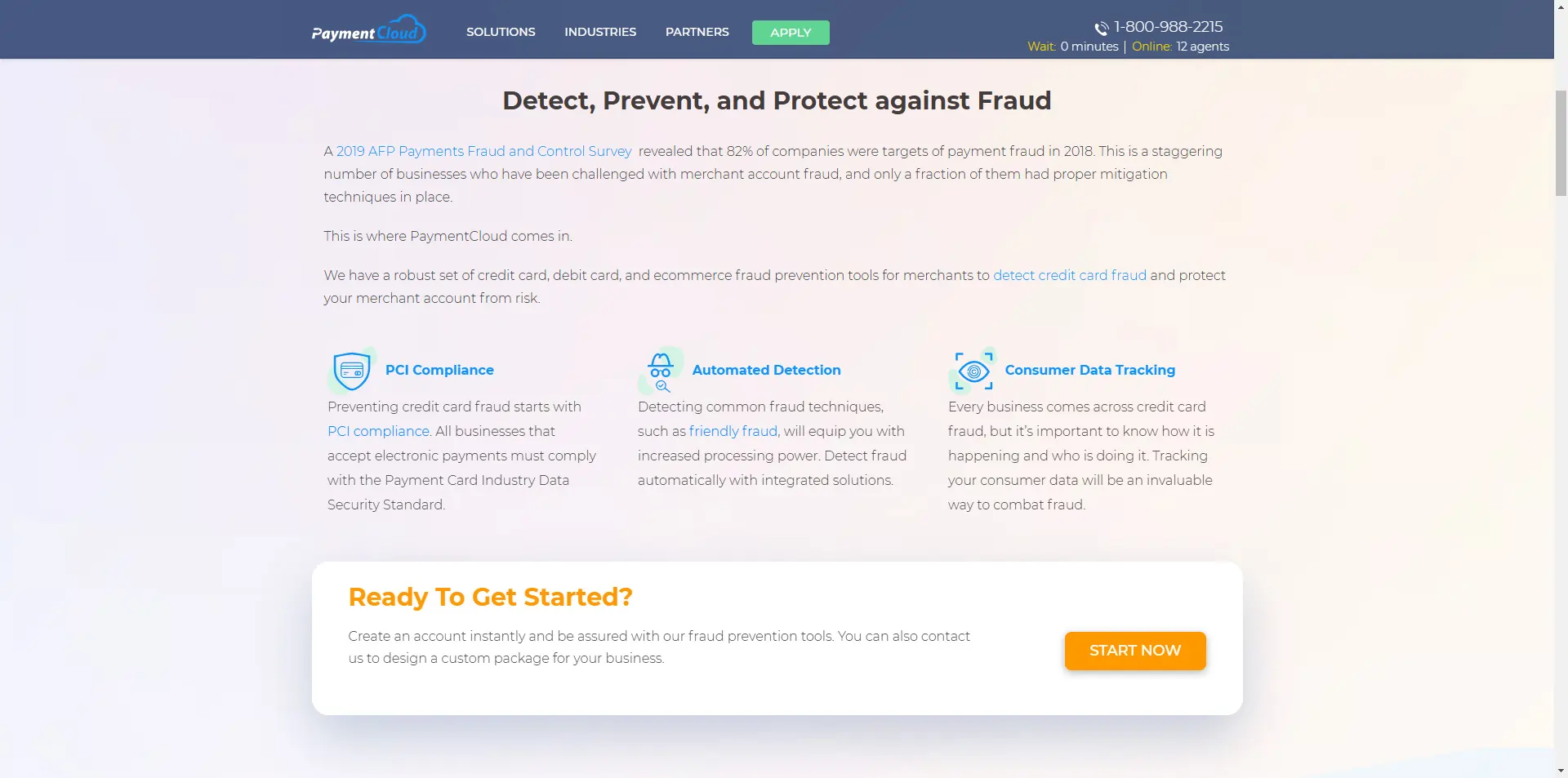

Advanced Fraud Prevention

PaymentCloud offers state-of-the-art fraud prevention tools designed to protect businesses from unauthorized transactions and fraudulent activities. By leveraging cutting-edge technology, they help merchants monitor transactions, detect anomalies, and reduce fraud risks, providing peace of mind for businesses in both low and high-risk categories.

Chargeback Protection Tools

Chargebacks can significantly impact business operations, and the PaymentCloud merchant services software addresses this with advanced chargeback protection solutions. Their tools include real-time alerts and tailored strategies to help merchants minimize disputes and recover revenue, ensuring businesses maintain financial stability.

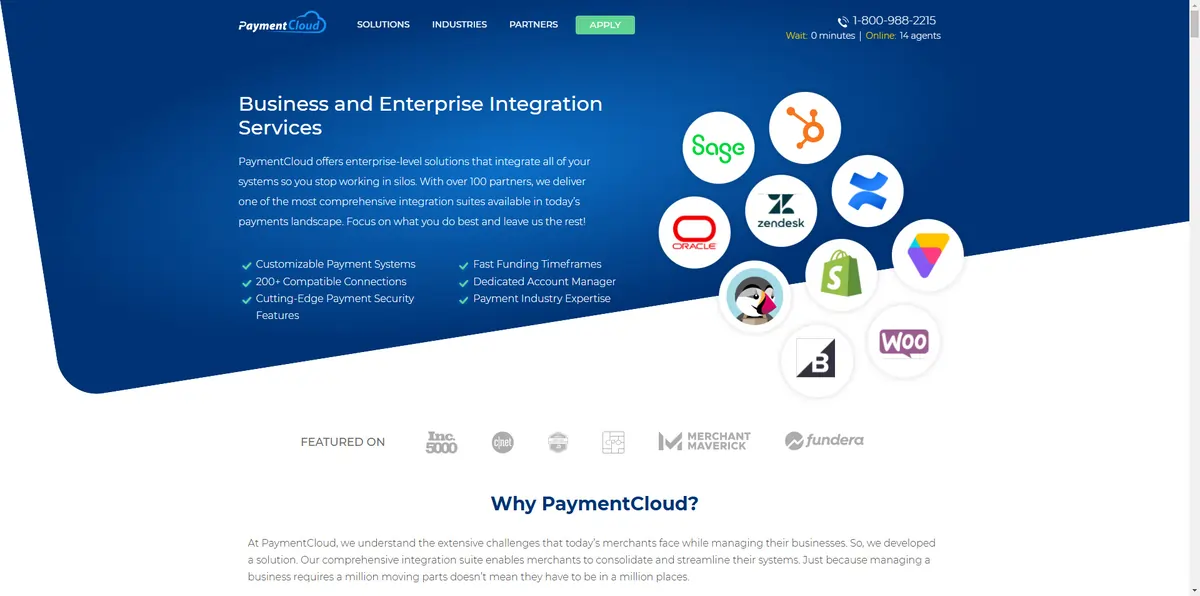

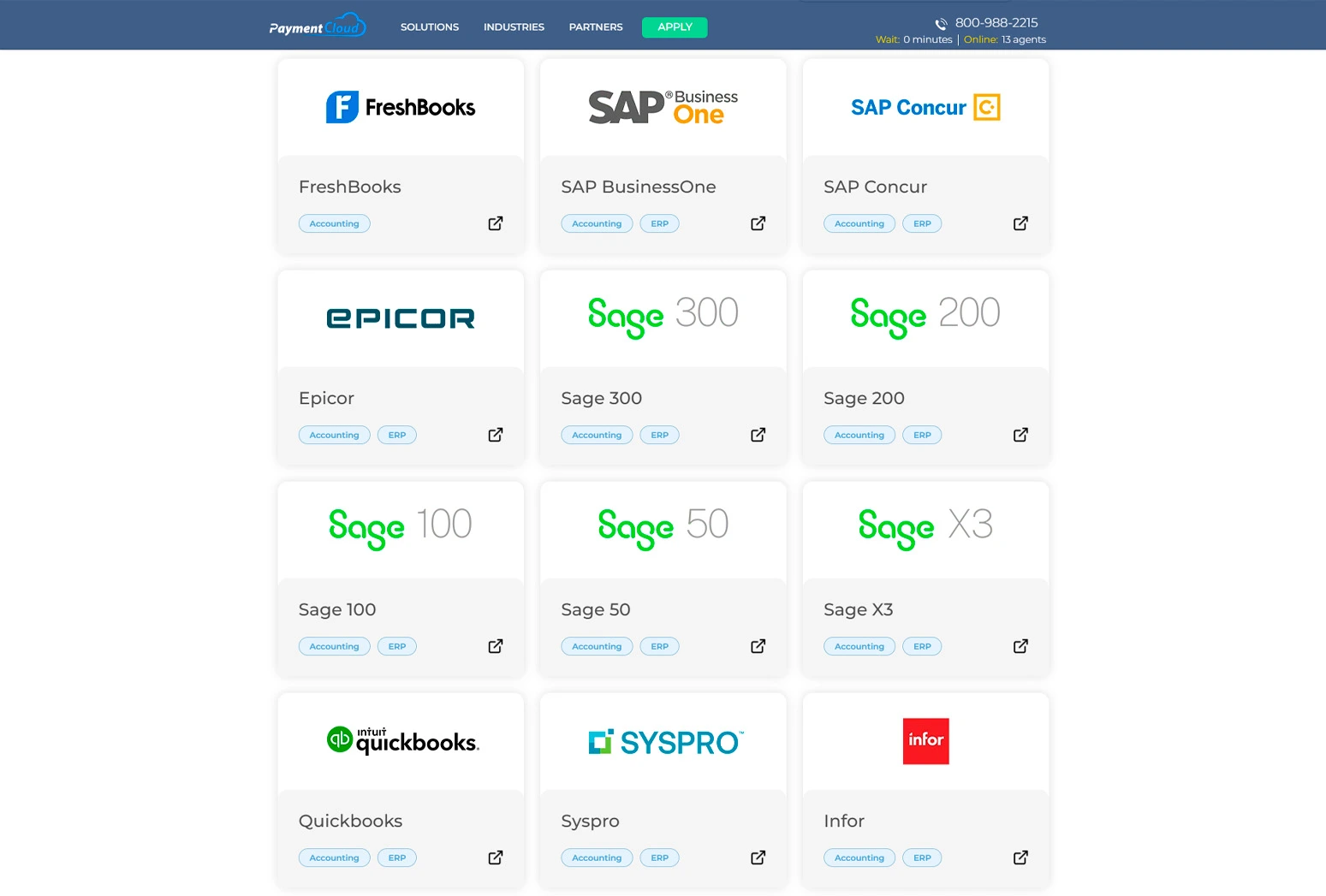

Seamless Integrations with Platforms

PaymentCloud ensures seamless connectivity with leading platforms, including Shopify, Authorize.net, USAePay, and NMI. These integrations allow businesses to enhance their e-commerce capabilities, offering streamlined workflows, secure payment gateways, and customization options to meet unique operational needs.

ACH and Electronic Check Processing

The merchant services software supports ACH and electronic check processing, enabling businesses to accept payments directly from customer bank accounts. This service expands payment options, allowing merchants to cater to clients who prefer electronic transfers over credit cards.

Mobile and Contactless Payment Options

With mobile and contactless payment solutions, PaymentCloud empowers businesses to accept payments anytime, anywhere. Customers can pay using their smartphones or other NFC-enabled devices, ensuring convenience and modernized transaction experiences.

Business Funding and Merchant Cash Advances

PaymentCloud provides access to business funding and merchant cash advances, offering financial support for businesses looking to expand, purchase inventory, or cover operational costs. This service helps businesses maintain liquidity and invest in growth opportunities.

Personalized Account Management with Advocacy and Negotiation Support

A key feature of PaymentCloud’s merchant services is its dedicated account management. Their representatives advocate for merchants by negotiating with banks and processors to secure better terms, resolve issues, and ensure uninterrupted service, offering a personalized, white-glove approach.

API Integrations for E-Commerce and Custom Workflows

PaymentCloud’s API integrations provide flexibility for businesses to create custom workflows and optimize e-commerce processes. This allows merchants to build tailored solutions that align perfectly with their operational goals while offering a seamless payment experience to customers.

Text and Email-Based Billing and Invoicing Capabilities

PaymentCloud’s billing and invoicing tools allow businesses to send payment requests via SMS or email. This feature includes customization options like branding with logos and colors, making it easier for businesses to maintain professionalism and streamline collections.

POS Systems for Retail and Online Merchants

PaymentCloud offers robust POS systems suitable for both retail and online merchants. These systems include countertop terminals and mobile card readers, ensuring businesses have access to tools that facilitate quick and secure transactions.

Dedicated Solutions for Various Industries

PaymentCloud provides industry-specific solutions, catering to the unique needs of sectors like apparel, beauty, and auto parts. Their tailored approach ensures that businesses in niche markets receive customized tools and services to drive efficiency and growth.

Hardware & Software

PaymentCloud gives you one free credit card terminal per merchant account. You can also choose from a number of POS and mobile payment systems. PaymentCloud offers personalized deployment, making sure all your processing hardware is set up to work correctly.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Ease Of Use:

PaymentCloud is easy to use since they offer personalized deployment to help you set up everything to work for your business. The UI on all their software components (like the invoices you can send) is fairly intuitive as well.

Verdict:

PaymentCloud is a strong company in the payment processing space. They cater to high-risk merchants, yet don’t take advantage of the situation to extort their high-risk clients through hefty fees. There are hundreds of shopping carts (and some other integrations), and the company has a surprisingly low number of online complaints.

Overall, PaymentCloud is a great, reliable merchant services provider — especially for high-risk companies.

User Review

- There is no risk associated with it. In my opinion, all the admission processes indicate that the software is secure.

- Customer support needs to be addressed urgently