Square POS Review For 2026

Square POS Plans & Pricing

Square Comparison

Expert Review

Pros

Cons

Square POS's Offerings

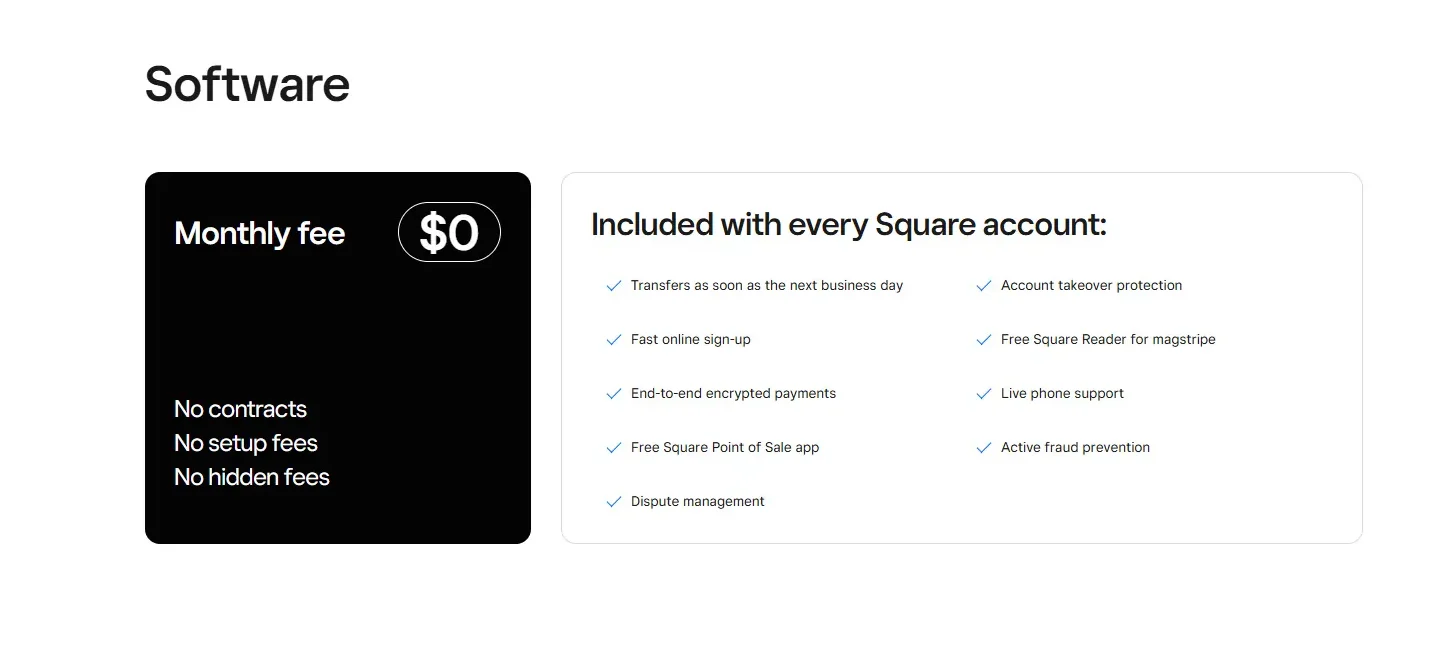

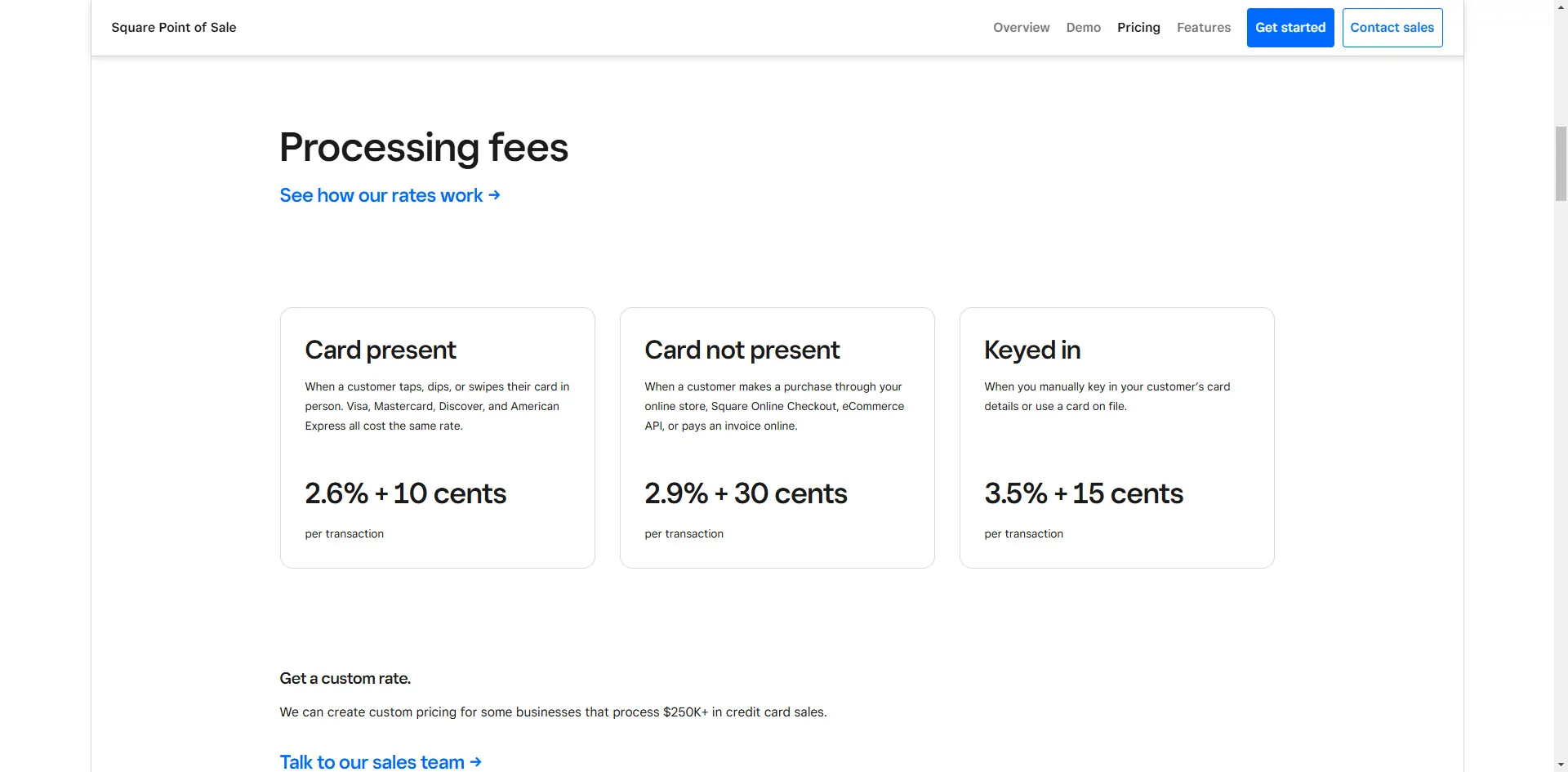

Here’s a breakdown of the current pricing landscape (as of 2025) for Square POS. All pricing should be verified for your local currency / region (Israel may have different rates).

Software & Transaction Fees

- Free plan (“Square Point of Sale software”) — $0/month. Processing rate: 2.6% + 15¢ (or ~10¢) for in-person transactions.

- Online payments: around 2.9% + 30¢ per transaction.

- Manually-entered (card-not-present) transactions: ~3.5% + 15¢.

Vertical-specific Plans

- Square for Retail: Free plan per location; Plus plan costs ~ $89/month/location adding features like advanced inventory management, vendor management, staff management.

- Square for Restaurants: Free plan supports basic setup; Plus plan ~ $69/month/location for features like menu management, floor plan, kitchen display system (KDS), 24/7 support.

- Square Appointments (for service-based businesses): Free for individual, Plus around $29/month, Premium higher.

Hardware Costs & Other Add-Ons

- Card readers: e.g., contactless/chip reader approximate $49-59 USD.

- Terminal/Full Register hardware: e.g., Square Terminal around $299 USD.

- Add-ons: Loyalty program ~$45/month/location; email/text marketing add-ons from ~$10-$15/month plus per-usage.

Hidden/Important Notes for SMBs

- While software monthly fee may be $0 for the basic plan, you still pay processing fees and buy hardware.

- If you scale to many locations or require advanced features, monthly fees will add up.

- Always check local currency, taxes, hardware import/shipping (for Israel) and compatibility with your bank/card-processor environment.

- No long-term contract means you have flexibility, but also means you should review processing fees as volume grows.

The plans include a free plan, plus plan, and a premium plan. Each plan comes with the following:

- Transfers as soon as the next business day

- Account takeover protection

- Fast online signup

- End-to-end encrypted payments

- Live phone support

- Free Square Point of Sale app

- Active fraud prevention

- Dispute management

The pricing plans are designed to meet the needs of businesses of different sizes and can be customized based on the specific requirements of each business.

Customer Support

Square offers multiple support channels: live chat, self-help documentation, and phone support (depending on plan). According to reports, 24/7 chat support is available on higher-tier plans.

That said, some users and reviews note variation in support responsiveness and the need to upgrade to get the best support. For small businesses starting out with the free plan, support may not be as comprehensive as for enterprise-tier systems.

It’s wise to check what level of support you’ll require (single-location vs multi-location, 24/7 vs business hours) and choose accordingly.

Features & Functionality

Best For

Tailored solutions for retail stores, coffee shops, nightclubs, quick service, bars, restaurants, and food trucks.

General Features

General / Core Features

Square POS allows in-person and online payments: it accepts major credit cards, contactless payments, mobile wallets (e.g., Apple Pay, Google Pay), keyed-in/manual transactions, and even offline mode so you can process while internet is temporarily down and sync later.

For SMBs, this means you can serve customers through multiple channels with one system, minimizing friction and hardware complexity.

Sales & Checkout Workflow

The system supports a streamlined checkout process, with options for discounts, refunds/exchanges, tipping (in restaurant/hospitality versions), and payment splits. Because the hardware ecosystem is mature (tablet stands, terminals, mobile reader) you can implement setups for counter checkout, mobile/table-side checkout, pop-ups or market stalls.

This helps SMBs by giving flexibility across different selling formats without needing entirely different systems.

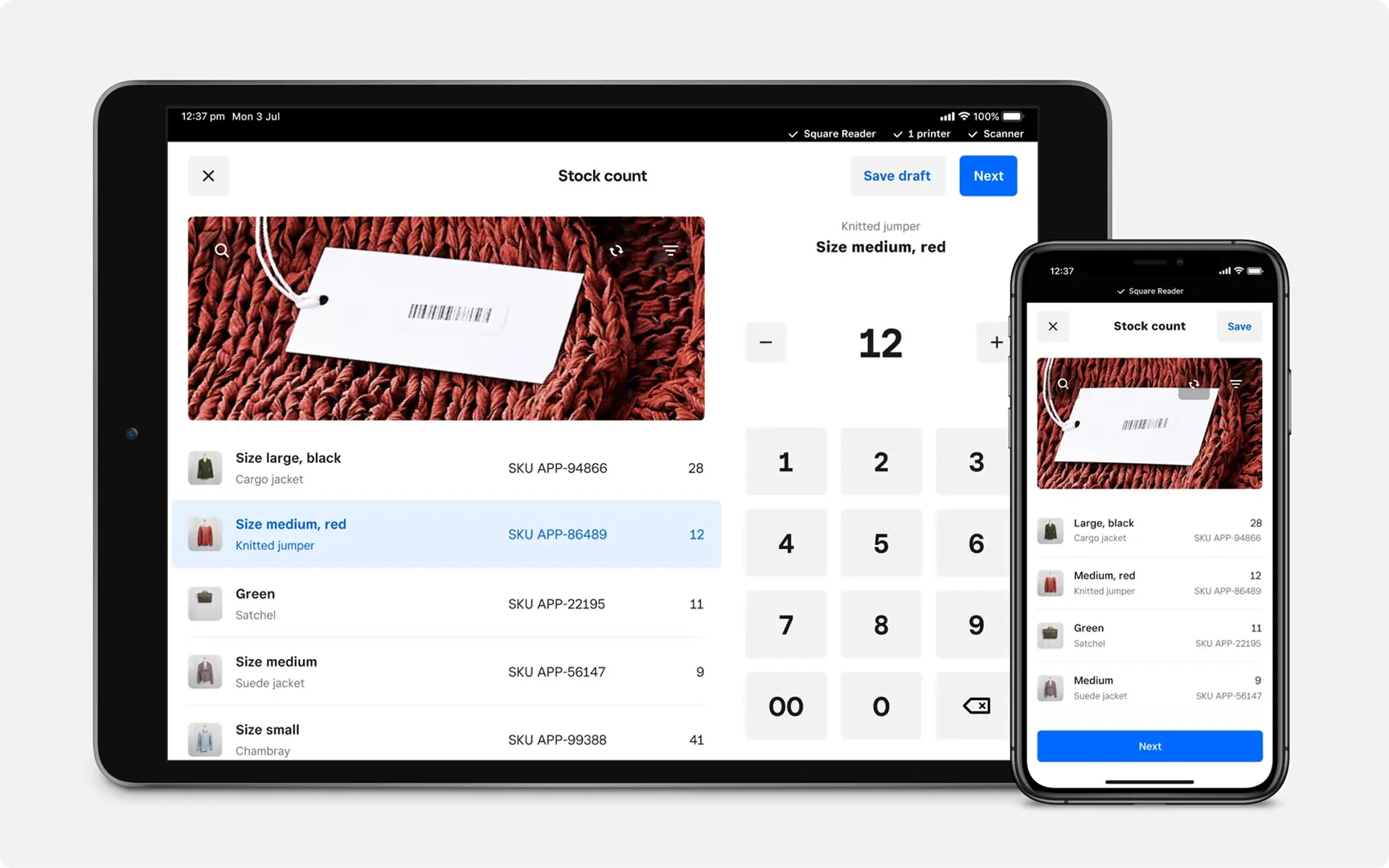

Inventory & Product Management

Square for Retail and other plans include inventory management: you can add/edit items, track stock levels, set low-stock alerts, print barcode labels, auto-generate SKUs, manage vendors and purchase orders (on higher tiers).

For SMBs, this means you can keep track of your product flow, avoid stock-outs, and scale from single to multi-product operations.

One limitation: bulk-import workflows and complex inventory structures may feel less refined than niche systems.

Multi-location & Staff Management

Square POS supports multiple business locations (in many plans), enables location-based reporting, transfers between locations, staff user accounts and permissions (in upgraded plans).

For SMBs wanting to expand or with multiple sites, having one system to manage all locations is efficient; still, very large multi-site enterprises may need more advanced features.

Customer Engagement & Loyalty

Square offers a customer directory (tracking purchase history, contact details), digital gift cards (customisable) and add-on loyalty programs.

This helps SMBs build repeat business, collect customer data and run targeted marketing, often without needing separate third-party systems.

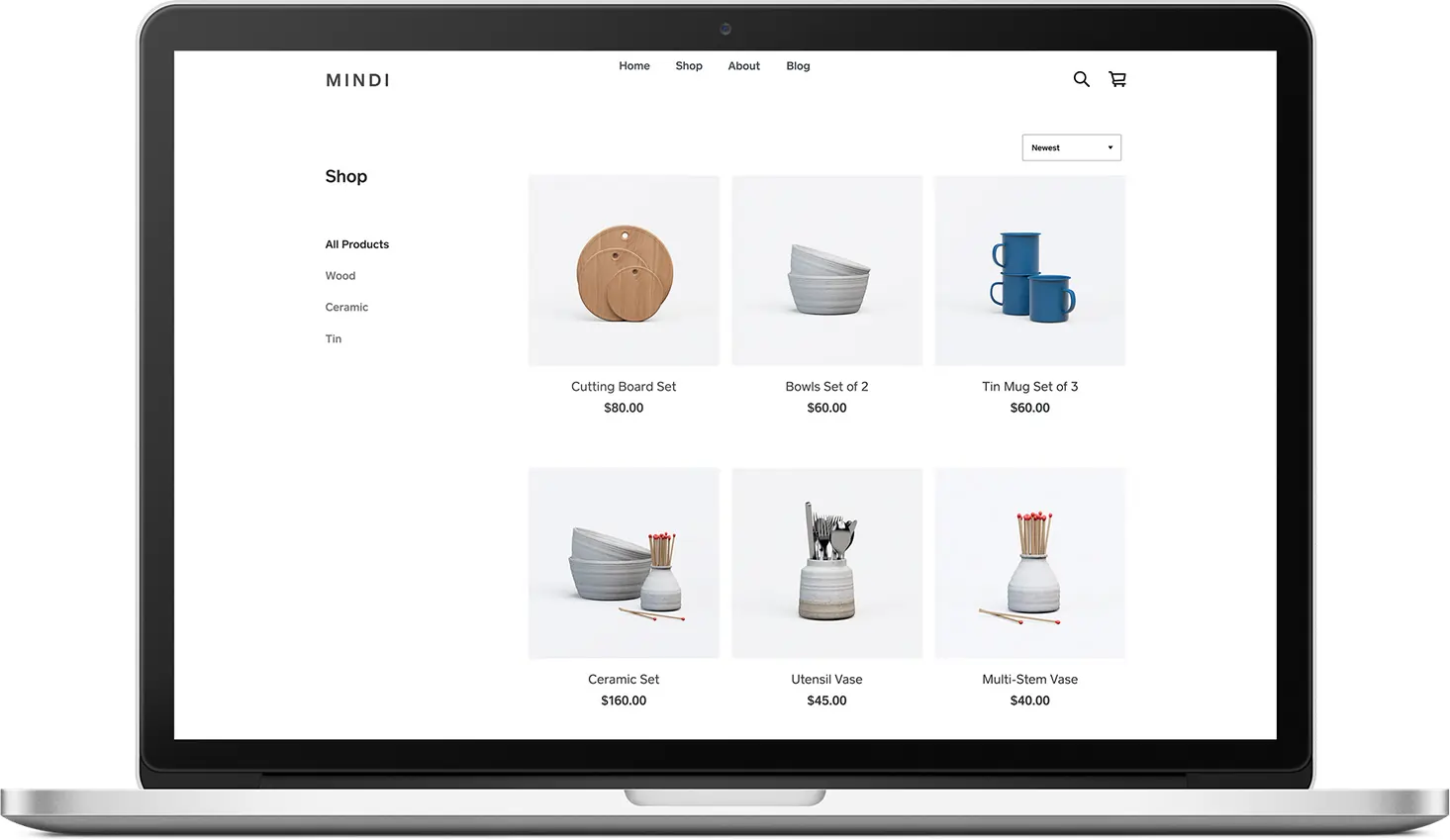

Online Store / Omnichannel Selling

Square’s POS integrates with its own online store offering, and supports linking e-commerce channels (web, social). Inventory and sales sync across channels.

For SMBs that sell both in-store and online, this unified approach simplifies operations and ensures consistency.

Hardware Ecosystem

Square provides a suite of hardware from basic readers to full registers. The hardware integrates tightly with the software. For SMBs, this means you can choose a minimal setup and expand as needed.

For example: free magstripe reader on signup in some regions.

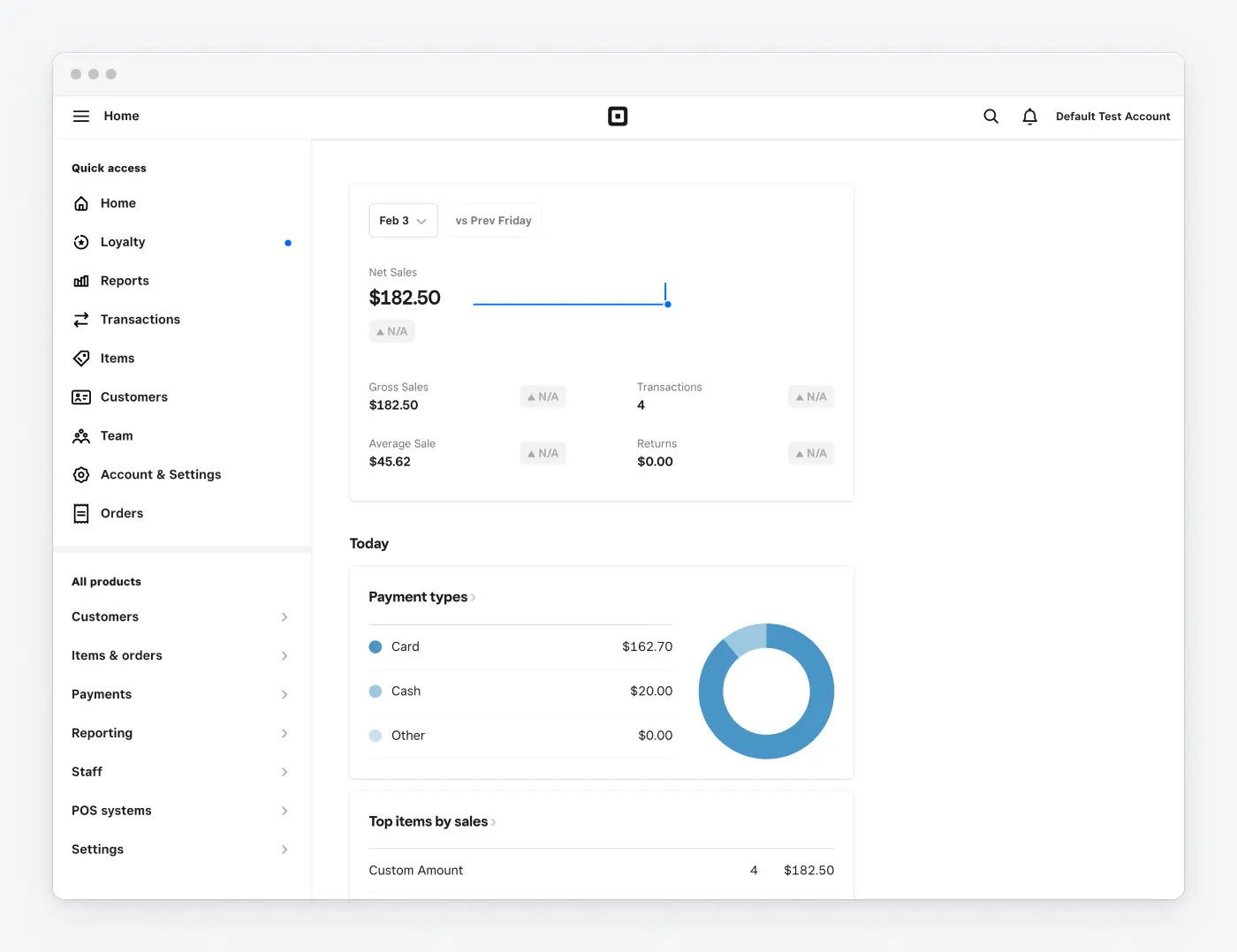

Reporting & Analytics

Square includes dashboards of sales, inventory, top items, staff performance. On higher plans you gain more advanced analytics. Reviewers note the interface is clean and usable.

This helps SMBs make data-driven decisions (which products sell, when to restock) without needing separate business-intelligence tools.

Add-Ons & Extensions

Beyond core POS you can add payroll, email/text marketing, loyalty, appointments, online bookings etc. For example, loyalty starts at ~$45/month; email marketing ~$15/month for up to 500 contacts.

For SMBs, this modular approach means you can add features as you grow, rather than paying for a large bundle up front.

Free Mobile Processing

Square is one of the only POS companies that offers a free mobile payment processing feature. It’s not the best in the industry, but given that it’s free, it’s hard to beat their offer. They also process payments quickly and withdrawals will land in your bank account within 2 business days.

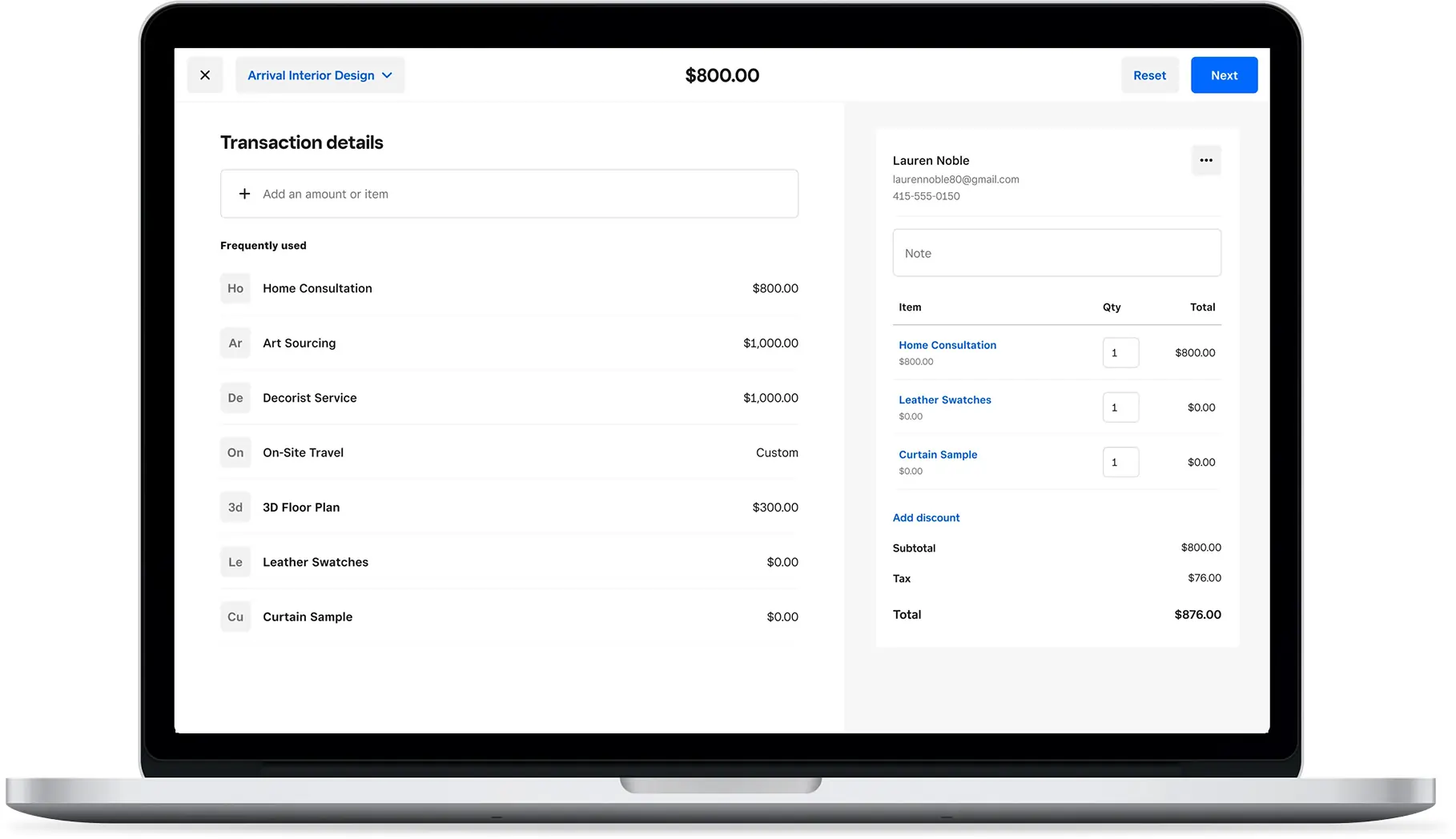

Payment Terminal

Square makes all payment types easy. Using the Square Virtual Terminal, you can take card payments from any device with an internet connection. You can even take payments from a desktop through your browser.

What makes Square even better is that you can set up recurring payments or invoices just as easily. You can even use Square Capital to offer financing to your customers. You still get paid upfront and Square assumes the risk of non-payments meant to be made through Square Capital.

Different Packages

Square has separate packages for different industries. It’s not the best for every industry, but each product offers a different set of features for:

- Retail

- Restaurants

- Appointment-based businesses

- Generic stores

Online Tools

Square offers a plethora of tools for online ordering and eCommerce. If you already have an online presence, Square makes it easy to integrate with many major companies.

With Square, you can seamlessly integrate web store hosting and payment gateways. You can also integrate online ordering for pickup.

Inventory

Square’s inventory management is easily the most comprehensive of all the major POS systems that don’t charge a monthly fee. When compared against the entire POS industry, it’s more or less on par. Square for Retail is the most customizable of the Square packages, offering:

- Adjustments to stock levels

- Bulk inventory import & export

- Inventory counts

- Item add-ons

- Item categories

- Item pictures & descriptions

- Online and in-store inventory sync

- Partial quantities

- Separate tax rates

Dashboard

Hardware & Software

Hardware requirements

The simplest hardware option for Square is to have your own iPad and order their free card reader. But Square also offers:

- A Square stand with a chip reader for $169

- A Square Register for $799

The latter option offers the most comprehensive POS service. But you can use most of Square’s features with an iPad and mobile devices with internet connections.

Software

Integrations & Add-Ons

Square offers integrations with many apps including:

- Acuity Scheduling

- BigCommerce

- Cuboh

- Ecwid

- GoDaddy

- JotForm

- Setmore

- Shippo

- Wix

- WooCommerce

- Wufoo

- Zoho Books

Pricing Options

Flexible pricing plans to meet different business needs.

Performance:

In the real world, Square POS delivers solid performance for the vast majority of SMBs. Transaction speeds, hardware responsiveness, and cloud reporting are generally strong. For example, the system’s offline mode for card-present payments is available, so you won’t be halted entirely if connectivity drops.

Some reports indicate that very high-volume/complex workflows may face limitations (e.g., slower bulk imports, less depth in custom reporting). But for day-to-day operations, uptime & reliability are good, and the hardware ecosystem is mature.

Ease Of Use:

Ease of use is another area where Square excels. If your business is in retail, restaurant, or appointment-based services, you will have no trouble figuring out how to efficiently use Square. You just need to choose the right package and get started.

While you can simply use your own iPad, if you have comprehensive inventory management needs or something beyond the ordinary, you will have an easier time using the Square Register.

Uniqueness:

What helps Square POS stand out:

- Free basic software: You can start with no monthly subscription, paying only transaction fees.

- All-in-one ecosystem: Payments + POS + hardware + online store + add-ons (loyalty, payroll, appointments) all from one vendor.

- Flexible hardware options: From a mobile card reader to a full register.

- Strong for SMBs: Low barrier to entry, fast startup, simple scaling.

- Transparent pricing model: Flat-rate transaction fees, no long-term contracts in many cases.

These combined make Square POS highly accessible. The trade-off is that very specialized or enterprise-grade features may be less robust than those found in some niche systems.

Integrations

Square POS supports a wide array of integrations and plugins. Some highlights:

-

Accounting: e.g., integration with QuickBooks Online.

-

E-commerce/Website builders: e.g., integration with Wix, WooCommerce, and other online platforms.

-

App Marketplace: Square’s App Marketplace allows third-party apps for loyalty, inventory, bookings, etc.

-

Hardware & Payment Gateways: Square’s own hardware, card readers, terminals, plus support for contactless/wallet payments, QR codes.

-

Platform Add-ons: payroll, text/email marketing, gift cards, appointment scheduling.

In overall commentary, the integrations are strong for SMBs, giving flexibility without needing custom development. For highly specialized enterprise needs, however, the depth/customisation of integrations may lag more specialised POS systems.

Verdict:

Square POS is a very strong fit for small to medium-sized businesses that need a reliable, easy-to-use POS that scales reasonably, especially if you’re looking to keep upfront costs low and get started quickly. Ideal use-cases include retail shops, cafés, food trucks, mobile sellers, salons, or service providers.

Limitations: If you are a large operation with many locations, need very advanced back-office or industry-specific workflows (complex ingredient tracking, heavy multi-location inventory transfers, ultra-low payment processing costs) then you might grow out of it or find other systems better suited.

So: “Use-case appropriate” — for many SMBs it’s a top pick; for large-scale / very specialized needs, evaluate alternatives.

FAQ

Q: What is Square POS?

A: Square POS is a popular point-of-sale system known for its simple setup, transparent flat-rate pricing, and free basic software plan. It includes hardware (like card readers, terminals, registers) and software apps to help businesses take payments, manage sales, inventory, customers, and more. It’s widely used by small businesses across retail, food service, and appointments.

Q: How much does Square POS cost? Is there really a free plan?

A: Yes, Square offers a genuinely free basic POS software plan (Square Point of Sale) with no monthly fees. You only pay flat-rate payment processing fees per transaction (e.g., 2.6% + 10¢ for tapped/dipped/swiped cards). They also offer paid plans (Plus, Premium) with more advanced features for specific industries (Retail, Restaurants, Appointments) starting around $29-$60/month per location. Hardware costs are separate.

Q: What are the most common complaints about Square POS?

A: The most frequent complaints center around sudden account holds or terminations (often due to risk assessment algorithms), difficulty reaching live customer support (especially for free plan users), and limitations in advanced features (like complex inventory or reporting) compared to more expensive, specialized systems. Processing fees, while transparent, can be higher for high-volume businesses compared to negotiated rates elsewhere.

Q: Why does Square sometimes hold funds or freeze accounts?

A: Square, like Stripe and PayPal, acts as a payment aggregator. They use automated risk management systems to monitor transactions. Sudden large transactions, unusual sales patterns, high chargeback rates, or selling in high-risk industries can trigger automated holds or account reviews while they verify activity. This can be very disruptive for businesses relying on immediate cash flow.

Q: Can I use my own bank or a different payment processor with Square POS hardware/software?

A: No. Square operates as an all-in-one system. You must use Square’s built-in payment processing (Square Payments) to accept card payments through their software and hardware. You cannot connect Square POS to an external merchant account or processor.

Q: Are there any hidden fees with Square POS?

A: Square is generally known for transparent pricing, especially compared to traditional merchant services. The main costs are the flat processing rates and any optional monthly fees for Plus/Premium plans or add-on services (like Payroll, Marketing, Loyalty). There aren’t typically hidden statement fees, PCI compliance fees, or complex tiered rates like some competitors. However, costs for hardware and add-on software can add up.

Q: Does Square POS require long-term contracts?

A: No. One of Square’s major advantages is that its services are generally month-to-month with no long-term contracts required. You can typically start, stop, or switch plans without facing large early termination fees.

Q: How reliable is Square’s offline mode if the internet goes down?

A: Square POS offers an offline mode, allowing you to accept swiped card payments (not usually chip or tap) when connectivity is lost. Transactions are stored and processed once you reconnect. However, there’s an increased risk that these offline payments could be declined later, and you (the business owner) are responsible if that happens. You need to enable it before you lose connection, and there are time limits (e.g., 24-72 hours) for reconnecting to process them.

Q: What kind of hardware does Square offer? Is it expensive?

A: Square offers a range of hardware:

-

Magstripe Reader: Often free for new accounts.

-

Contactless + Chip Reader: Small, portable, relatively inexpensive (~$50-$60).

-

Square Stand: Turns an iPad into a countertop POS.

-

Square Terminal: All-in-one handheld payment device.

-

Square Register: Larger, dual-screen countertop system. Hardware costs vary, from free/low-cost readers to several hundred or over a thousand dollars for the Register. It’s generally considered reasonably priced compared to proprietary systems from Toast or Clover.

Q: How is Square’s customer support? Is it hard to talk to someone?

A: This is a common pain point, especially for users on the free plan. While Square has extensive online help documentation, reaching live phone support can sometimes be difficult or require going through specific steps in the app/dashboard. Support quality is often described as hit-or-miss. Paid plan users generally have better access to support channels.

User Review

- No monthly fees! Also didn't cost anything to get started.

- Can be a bit confusing setting up payments plans, but after some diligence it becomes super easy.

- Selling online and delivery has been a breeze, completely transformed how I conduct sales.

- Doesn't integrate with Wix which was one difficulty I had to work around.

- No monthly fee to administer gift cards, and super easy to set up site.

- Somethings could be more streamlined such as the integration with bookkeeping and actual reports.

- The dashboard is easy to learn and navigate.