QuickBooks vs Xero: Which accounting software is a better fit for your small business?

Choosing accounting software is a big call. It’s how you send invoices, reconcile the bank, run payroll, and keep clean books come tax time. But not every platform fits every workflow.

QuickBooks Online is the feature-packed option with deep reporting, built-in payroll add-ons, and a huge app ecosystem. The trade-off: higher list prices and user limits on most tiers.

Xero is the leaner, more affordable alternative with unlimited users on every plan and slick day-to-day bookkeeping. The catch: some advanced tools (like multicurrency and projects) sit on the higher plan, and U.S. payroll runs through Gusto.

This QuickBooks vs Xero guide compares pricing, core features, reporting, integrations, and ease of use so you can decide which accounting software works best for your business in ’2025’.

TL;DR

- QuickBooks: Best for teams that want advanced features (inventory, projects, granular reporting) and native payroll, even if it costs more.

- Xero: Best for growing teams that want unlimited users and lower monthly pricing. Multicurrency, expenses, and projects are on the top plan; best for affordability, unlimited users, and clean day-to-day bookkeeping.

QuickBooks pulls ahead if you need feature depth.

Xero comes out cheaper than QuickBooks for most teams.

Both platforms are capable – your choice depends on whether you value advanced tools or cost-friendly collaboration.

QuickBooks vs Xero at a glance

Both platforms are top-tier options, but they serve different business profiles. QuickBooks caters to growing companies that want detailed financial management and advanced reporting. Xero appeals to small businesses that need simple, scalable accounting with predictable costs.

QuickBooks Online

- Feature-rich: inventory, projects, and robust reporting.

- Payroll offered natively in the U.S.

- User limits by plan can make scaling expensive.

- Pricing escalates as you grow.

Xero

- Unlimited users across all plans.

- Easy invoicing, bank reconciliation, and day-to-day bookkeeping.

- Advanced tools (projects, multicurrency, expenses) only at the highest tier.

- Payroll in the U.S. runs through Gusto integration.

Quick comparison

|

Category |

QuickBooks Online |

Xero |

|

Ease of use |

Clean interface but more complex menus; learning curve for advanced features. |

Very intuitive for day-to-day bookkeeping; fewer menus, faster onboarding. |

|

Pricing |

Higher monthly costs; user caps make scaling more expensive. |

More affordable; unlimited users included on every plan. |

|

Setup speed |

Guided onboarding and templates make setup straightforward, but customizing reports takes time. |

Quick setup for core functions like invoicing and bank feeds; advanced features require configuration. |

|

Customization |

Strong reporting customization and add-ons; project tracking, inventory, and payroll available at higher tiers. |

Less customization overall; advanced features gated to the top plan. |

|

Reporting |

Robust, detailed reports; good for accountants and data-driven SMBs. |

Solid core reports; analytics are less advanced unless paired with third-party apps. |

|

Integrations |

750+ apps; strong ecosystem with payroll, e-commerce, and payment processors. |

1,000+ apps; strong for collaboration tools and business management. |

|

Scalability |

Grows with features, but costs rise quickly due to per-user pricing. |

Scales affordably since all plans allow unlimited users. |

|

Best for |

SMBs who need detailed reporting, industry-specific features, and payroll in one system. |

SMBs who want affordable, collaborative accounting with simple daily workflows. |

Feature-by-feature breakdown

1. Invoicing & billing

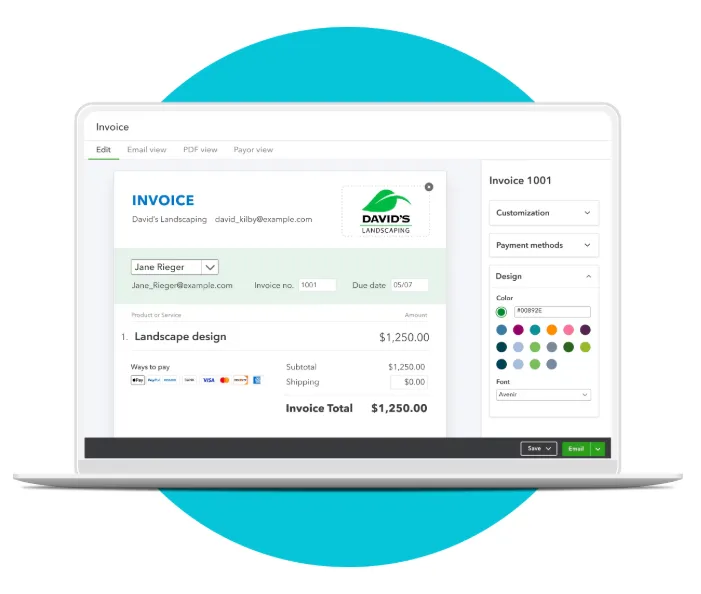

QuickBooks Online

- Professional-looking invoices with customizable templates.

- Automates recurring invoices and late-payment reminders.

- Accepts online payments (credit cards, ACH, PayPal) through QuickBooks Payments.

- Sales tax is automatically applied based on location.

- More advanced invoice customization and progress invoicing are available on higher tiers.

- Strong fit for SMBs that need polished, client-facing invoices tied directly to payments and tax compliance.

Xero

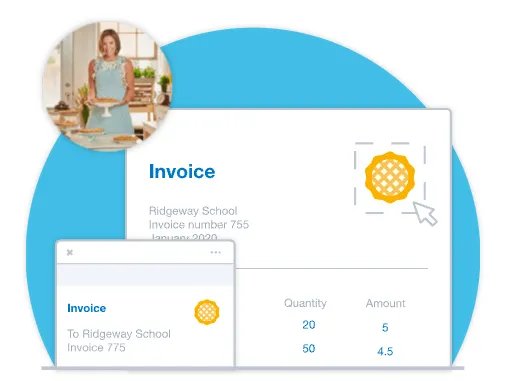

- Clean, easy-to-use invoice creation with unlimited invoices on all plans.

- Customizable templates with branding (logo, colors, payment terms).

- Online payments through Stripe, GoCardless, PayPal, and other integrations.

- Automatic reminders for overdue invoices.

- Batch invoicing for multiple customers at once.

- Less advanced invoice customization than QuickBooks, but easier for day-to-day use.

Verdict:

QuickBooks wins on invoice customization and advanced features (like progress invoicing and integrated payments). Xero shines for simplicity and unlimited invoicing across all plans, making it ideal for teams that send lots of invoices but don’t need deep customization.

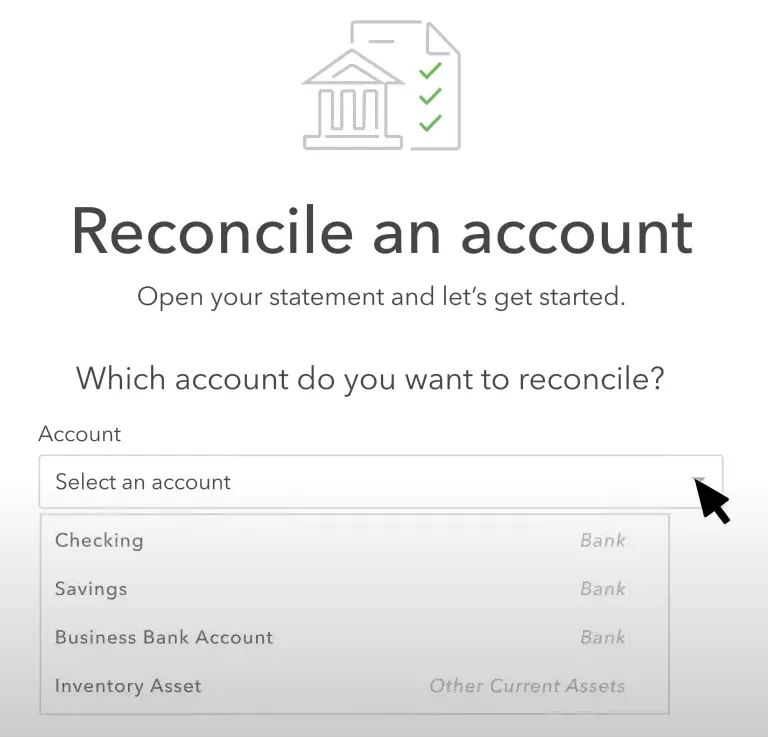

2. Bank reconciliation & expense tracking

QuickBooks Online

- Automatic bank feeds import transactions daily from connected accounts.

- Smart categorization rules learn over time, reducing manual entry.

- Built-in receipt capture via mobile app: snap a photo, auto-match to transactions.

- Mileage tracking for business trips included in most plans.

- Expense tracking is tied to projects, vendors, and tax categories, making it easy to prepare for audits and tax filing.

- Strong for SMBs that want their bank data and expense receipts fully synced into reports without heavy manual work.

Xero

- Bank feeds connect to major U.S. and international banks.

- Fast reconciliation with “OK-to-match” suggestions for recurring transactions.

- Mobile app supports receipt capture and expense claims.

- Batch reconciliation lets you approve multiple matches at once.

- Expense management and claims are only available on the Established plan, which can be a limitation for smaller businesses.

- Best suited for teams that want clean reconciliation and simple expense logging without deep tax-specific categorization.

Verdict:

QuickBooks has the edge for detailed expense management, especially if you need tax categories, mileage tracking, and project-level expense allocation. Xero is more streamlined for fast reconciliation and team-wide access, but you’ll need the higher-tier plan for advanced expense tools.

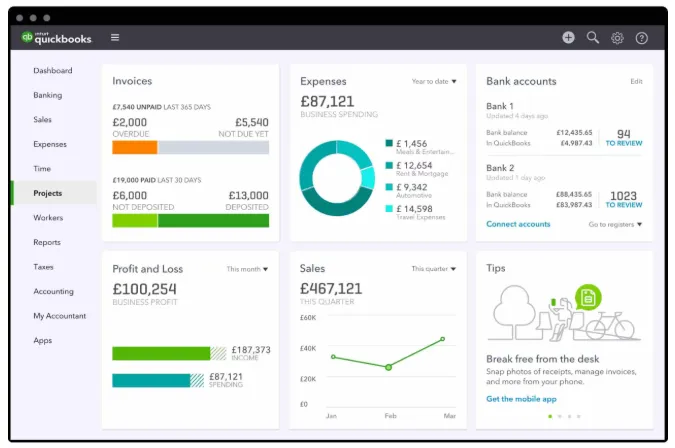

3. Reporting & analytics

QuickBooks Online

- Offers 100+ pre-built reports, including profit & loss, balance sheet, cash flow, and detailed sales/expense breakdowns.

- Advanced tiers unlock custom report builder, management reports, and KPI tracking.

- Industry-specific versions (contractors, nonprofits, retailers) provide tailored reports.

- Forecasting and budgeting tools built into higher tiers.

- Reports can be scheduled, exported to Excel, or shared directly with accountants.

- Best for SMBs that need detailed, accountant-level insights or industry-specific reporting.

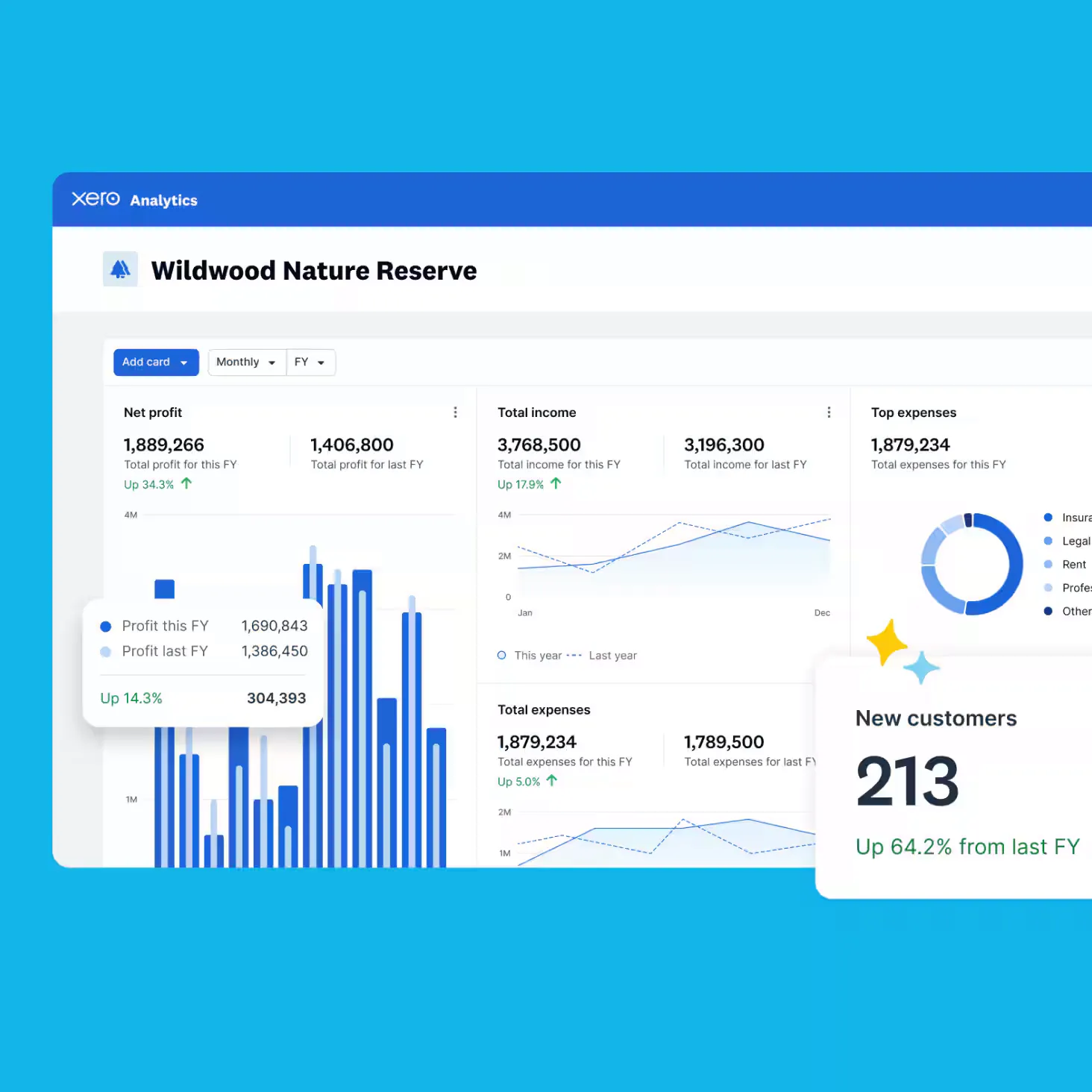

Xero

- Core reports include profit & loss, balance sheet, aged receivables/payables, and cash flow.

- Customizable layouts let you edit columns, formulas, and filters.

- Budget manager allows for financial planning and variance tracking.

- Analytics Plus add-on ($10/month) adds trend analysis, predictions, and deeper insights.

- Reports are easy to share with unlimited users, making collaboration straightforward.

- Best for SMBs that want clean, flexible reports without complexity – but advanced analytics may require the add-on.

Verdict:

QuickBooks wins on depth and industry-specific reports; it’s the go-to if you want granular financial visibility and advanced forecasting. Xero keeps things simpler and more collaborative, with unlimited user access to reports, but relies on an add-on for advanced analytics.

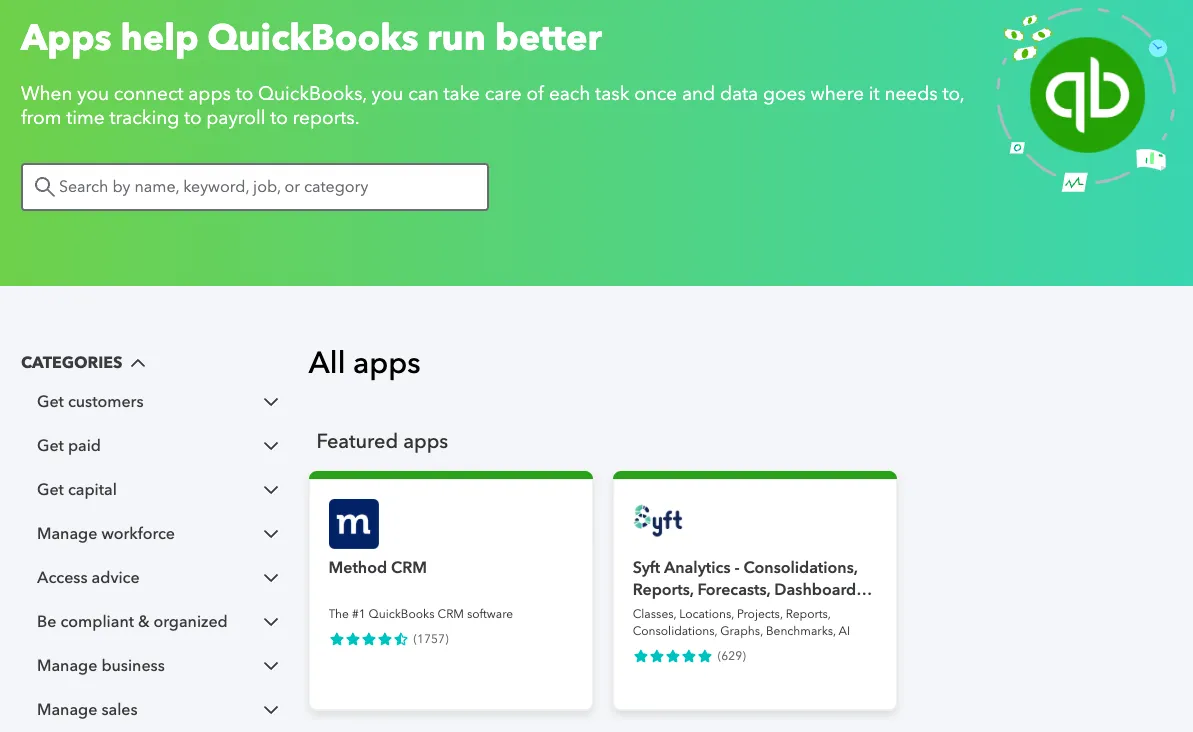

4. Integrations & ecosystem

QuickBooks Online

- Connects with 800+ third-party apps, including Shopify, Square, PayPal, and Gusto.

- Native integrations with QuickBooks Payroll, QuickBooks Time (TSheets), and QuickBooks Payments create a unified Intuit ecosystem.

- Built-in tax prep and accountant access are especially strong in the U.S.

- Most integrations are “plug-and-play,” requiring minimal technical setup.

- Best for SMBs that want accounting to sync seamlessly with sales, payroll, and tax.

Xero

- Integrates with 1,000+ apps via the Xero App Store – strong in areas like project management, e-commerce, and payments.

- Popular connections include Stripe, Square, PayPal, HubSpot, and Gusto.

- Strong bank feed integrations across U.S. and international markets.

- Works well for businesses that need flexibility outside of a single ecosystem.

- Best for SMBs that want a broader app marketplace and international banking support.

Verdict:

Xero wins on breadth of integrations and global reach. QuickBooks is stronger if you prefer a tight, native ecosystem with Intuit-owned tools for payroll, payments, and taxes.

5. Payroll & employee management

QuickBooks Online

- Offers QuickBooks Payroll as a native add-on (U.S. only).

- Handles automated payroll runs, tax filings, and year-end forms (W-2s/1099s).

- Integrates directly with accounting, syncing employee expenses and benefits.

- Tiers include same-day direct deposit and HR tools in higher plans.

- Strong for SMBs that want payroll, accounting, and tax handled under one roof.

Xero

- Discontinued U.S. payroll in 2018; now integrates with Gusto for U.S. businesses.

- Gusto handles payroll, benefits, and compliance, but requires a separate subscription.

- Outside the U.S., Xero offers built-in payroll in countries like the U.K., Australia, and New Zealand.

- Payroll data still syncs into Xero for reporting, but setup requires dual management.

- Works best for SMBs already using Gusto or businesses outside the U.S. where Xero payroll is fully supported.

Verdict:

QuickBooks is the clear winner for U.S.-based payroll; its native integration reduces friction. Xero is viable if you’re outside the U.S. or already using Gusto, but it adds another vendor to manage.

6. Ease of use & setup

QuickBooks Online

- Guided onboarding walks you through linking bank accounts, setting up invoices, and importing contacts.

- Dashboard is clean but can feel crowded — especially as you add more features (inventory, projects, payroll).

- Strong documentation and large support community. Phone and chat support available on paid plans.

- Learning curve can be steep for beginners, particularly with advanced reporting and customization.

- Best for SMBs with some accounting knowledge or a bookkeeper on hand.

Xero

- Simple, uncluttered interface — many users describe it as more “user-friendly” than QuickBooks.

- Bank reconciliation and invoicing are straightforward, with minimal setup required.

- Help center and community support are strong; live support is ticket-based.

- Limited in-app guidance compared to QuickBooks’ onboarding flows.

- Best for small teams or business owners who want to get started quickly without much training.

Verdict:

Xero is easier for beginners to pick up and navigate day-to-day. QuickBooks is more powerful, but that extra depth makes setup and learning more complex.

7. Scalability

QuickBooks Online

- Scales with features: Advanced plan supports up to 25 users, advanced reporting, and premium support.

- User caps on each tier mean costs rise quickly as teams grow.

- Add-ons (Payroll, Time, Payments) deepen functionality but increase monthly spend.

- Switching out: exporting data is straightforward, but moving customized reports/workflows can be tricky.

- Best for SMBs that expect to grow steadily and want industry-specific tools already baked in.

Xero

- Unlimited users on every plan, making it easier for businesses to add staff without extra costs.

- Feature set grows with higher tiers (Established adds multicurrency, projects, expenses).

- Stronger scalability for collaborative teams or firms with many users but lighter feature needs.

- Switching in: simple CSV import for contacts and balances.

- Best for SMBs that want predictable pricing as they expand their team.

Verdict:

QuickBooks scales better on features and depth, but gets expensive as you add users. Xero scales better on team size and affordability, though advanced capabilities only unlock at the top tier.

Pricing breakdown

QuickBooks Online Pricing

|

Plan |

Cost (per month) |

Best for |

Key features |

|

Simple Start |

$38 |

Solopreneurs and freelancers |

1 user, invoicing, expenses, basic reports, receipt capture, mileage tracking |

|

Essentials |

$75 |

Small teams needing collaboration |

3 users, bill management, time tracking, recurring invoices |

|

Plus |

$115 |

Growing SMBs with inventory or projects |

5 users, inventory tracking, project profitability, budgeting |

|

Advanced |

$275 |

Larger SMBs that need full functionality |

25 users, advanced reporting, premium support, workflow automation, custom roles |

Takeaway: QuickBooks is feature-rich, but the per-user caps make it expensive for larger teams. The Plus plan is often the sweet spot for small businesses that need inventory and project tools without jumping to enterprise pricing.

Xero Pricing

|

Plan |

Cost (per month) |

Best for |

Key features |

|

Early |

$20 |

Freelancers or very small businesses |

20 invoices & quotes, 5 bills, bank reconciliation, Hubdoc for receipts |

|

Growing |

$47 |

Small businesses needing unlimited invoices |

Unlimited invoices & bills, bulk reconciliation, unlimited users |

|

Established |

$80 |

Larger SMBs with advanced needs |

Everything in Growing + multicurrency, expenses, project tracking, advanced analytics add-on |

Takeaway: Xero is one of the most cost-effective platforms, especially for teams. Every plan allows unlimited users, so collaboration doesn’t add to the price. The Established plan unlocks advanced tools, but even at $80/month, it’s significantly cheaper than QuickBooks Advanced.

Pricing verdict

- Xero wins on value. It delivers unlimited users, strong invoicing, and collaborative accounting at less than half the cost of QuickBooks Advanced.

- QuickBooks wins on functionality. Its inventory, project tracking, and native payroll integrations make it the more powerful system if you need advanced features.

- Your choice comes down to whether you prioritize affordable collaboration (Xero) or deep features and advanced reporting (QuickBooks).

Verdict for SMBs

QuickBooks Online

- Best for SMBs that need advanced functionality: inventory, project tracking, and detailed reporting.

- Strong choice if you want U.S. payroll natively integrated with your accounting.

- More expensive, especially as you add users — but powerful if you need depth.

Xero

- Best for SMBs that want affordable collaboration with unlimited users.

- Ideal for teams that prioritize clean daily bookkeeping and predictable pricing.

- Lighter on advanced features unless you’re on the Established plan, but much cheaper than QuickBooks at scale.

Bottom line:

- Choose QuickBooks if you value depth and advanced reporting more than cost.

- Choose Xero if you value affordability, unlimited users, and simplicity.

Related articles

What if neither Quickbooks nor Xero is the right fit?

Not every small business will fit neatly into QuickBooks or Xero. If you’re looking for other options, here are some worth considering:

FreshBooks

Award-winning customer service

Award-winning customer service  Seamless integration & user-friendly

Seamless integration & user-friendly Why choose it:

- User-friendly interface built for non-accountants.

- Strong invoicing tools with time tracking, recurring billing, and expense management.

- Integrates easily with payment processors for fast client payments.

- Mobile-friendly, making it easy for business owners on the go.

- Affordable pricing tiers that scale with business needs.

Best for:

- Freelancers, solopreneurs, and small service-based businesses.

- Businesses that rely heavily on invoicing and client billing.

- Owners who want simple bookkeeping without complex features.

Limitations:

- Limited advanced accounting features (not ideal for larger or product-based businesses).

- Can get expensive as you scale with additional clients or team members.

Sage (Sage Business Cloud Accounting)

Serves over 20K businesses

Serves over 20K businesses  Custom solutions by experts

Custom solutions by experts Why choose it:

- Long-established brand with robust accounting credibility.

- Solid double-entry accounting system with advanced financial features.

- Good for compliance-heavy businesses with audit trails and VAT/GST support.

- Offers multi-currency and inventory tracking options.

- Flexible plans that can support businesses at different stages.

Best for:

- Small to mid-sized businesses needing more advanced accounting than entry-level tools.

- Companies that want strong compliance and tax features.

- Product-based businesses that benefit from inventory tracking.

Limitations:

- Less intuitive interface compared to modern, design-first tools like FreshBooks or Xero.

- Some features locked behind higher-tier plans.

- Limited third-party integrations versus newer SaaS competitors.

Oracle NetSuite

Built for scale. Built for the future.

Built for scale. Built for the future.  Speeds up the financial closing process

Speeds up the financial closing process Why choose it:

- Comprehensive, all-in-one ERP platform that goes beyond accounting.

- Highly scalable for growing SMBs and mid-market companies.

- Strong automation across finance, payroll, inventory, and CRM.

- Advanced reporting and real-time analytics for data-driven decisions.

- Cloud-based, secure, and customizable to fit different industries.

Best for:

- SMBs on a growth trajectory that expect to scale quickly.

- Companies needing multi-entity management or operating across regions.

- Businesses looking for a single platform to unify accounting, payroll, inventory, and operations.

Limitations:

- Higher cost compared to entry-level solutions (not ideal for freelancers or microbusinesses).

- Complex setup and implementation — may require outside consultants.

- Steeper learning curve for teams without prior ERP experience.

Bottom line

For small businesses, both QuickBooks and Xero are strong accounting software choices, but the best fit depends on your priorities.

- QuickBooks is ideal if you need advanced features, deep reporting, and payroll under one roof. You’ll pay more, but the functionality is hard to beat.

- Xero is better if you want affordable collaboration, unlimited users, and streamlined bookkeeping. You’ll sacrifice some advanced tools, but gain predictable pricing and ease of use.

The key is to align the software with how your business works today and where you expect to grow. If cost control and collaboration matter most, Xero is tough to beat. If feature depth and industry-specific reports matter more, QuickBooks is the safer choice.