Best Accounting Software for Nonprofits in 2025

Accounting software is designed to help businesses and organizations track finances, manage budgets, and stay compliant with tax regulations. It automates tasks like bookkeeping, invoicing, and financial reporting, making it easier to manage money without the need for complex spreadsheets or manual calculations.

Why You Can Trust the Expertise of Sonary

At Sonary, we are committed to providing accurate and trustworthy information to help you make informed decisions. Our research process is meticulous, transparent, and guided by a dedication to maintaining the highest standards of integrity, ensuring accurate, real-world insights.

Read more

Unlike many other review platforms, we conduct in-depth evaluations of the software and services we feature. Our expert team tests and actively uses the tools we review to understand their features, performance, and value comprehensively. Our assessments are based on real-world use, giving you insights beyond surface-level descriptions. Our research methodology includes analyzing key consumer factors such as pricing, functionality, device usability, scalability, customer support quality, and unique industry-specific features. This hands-on approach and dedication to transparency mean you can trust Sonary to deliver regular, up-to-date content and recommendations that are well-researched and genuinely helpful for your business needs. When it comes to nonprofits, the needs for accounting software are a little different. You’re not just tracking revenue—you’re managing donations, grants, and restricted funds while ensuring compliance with nonprofit accounting standards. The best accounting software for nonprofits makes it easy to categorize funds, generate nonprofit-specific reports, and simplify budgeting so you can focus on your mission instead of getting lost in the numbers. Let’s explore the top nonprofit accounting software options to help you stay organized and financially secure.

When it comes to nonprofits, the needs for accounting software are a little different. You’re not just tracking revenue—you’re managing donations, grants, and restricted funds while ensuring compliance with nonprofit accounting standards. The best accounting software for nonprofits makes it easy to categorize funds, generate nonprofit-specific reports, and simplify budgeting so you can focus on your mission instead of getting lost in the numbers. Let’s explore the top nonprofit accounting software options to help you stay organized and financially secure.

Best Accounting Software for Nonprofits

Features

General Features

Track Expenses

Tax Preparation

Time-Saving Automations

Add-Ons

Supported Devices

Pros & Cons

Pros

Cons

Features

General Features

Track Expenses

Tax Preparation

Time-Saving Automations

Add-Ons

Supported Devices

Pros & Cons

Pros

Cons

Features

General Features

Track Expenses

Tax Preparation

Time-Saving Automations

Add-Ons

Supported Devices

Pros & Cons

Pros

Cons

Features

General Features

Tax Preparation

Time-Saving Automations

Add-Ons

Supported Devices

Pros & Cons

Pros

Cons

Quick Comparison

| Accounting Software | Key Feature | Ideal For | Platform | Pricing |

| QuickBooks | Fund tracking, donor management | Small to mid-sized nonprofits | Cloud, desktop, mobile app | Starts at $30/month |

| Sage | Grant tracking, budgeting | Large nonprofits and charities | Cloud, desktop | Custom pricing |

| Xero | Cloud-based accounting | Nonprofits needing cloud access | Cloud, mobile app | Starts at $13/month |

| Zoho Books | Multi-user acces | Small nonprofits and startups | Cloud, mobile app | Starts at $15/month |

Our Top Picks

Managing finances as a nonprofit isn’t just about balancing the books—it’s about stewarding donations, tracking grants, and making sure every dollar is used wisely. The right accounting software takes the stress out of financial management so you can focus on what really matters. These top picks will help you stay organized, transparent, and financially strong with the best accounting software on the market.

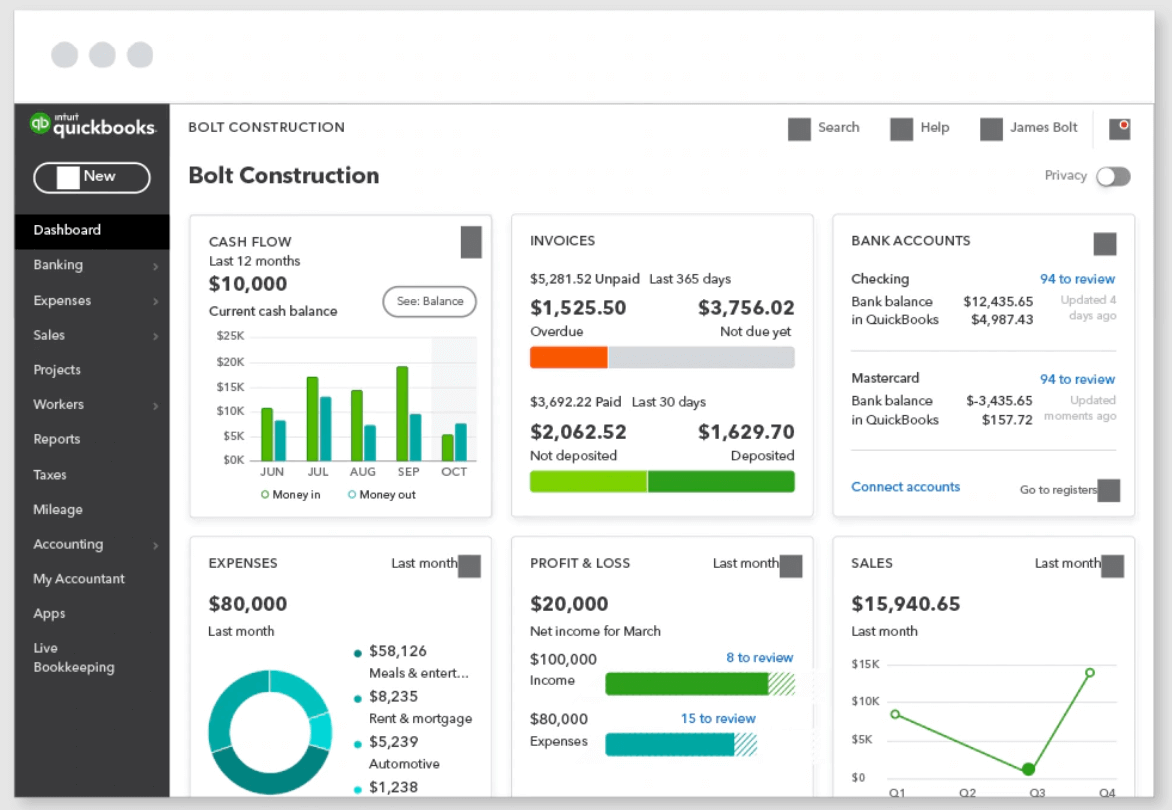

QuickBooks

Unlimited custom invoices and quotes

Unlimited custom invoices and quotes  Smart invoicing with automated tracking

Smart invoicing with automated tracking QuickBooks is one of the most widely used nonprofit accounting software solutions, offering fund tracking, donor management, and automated financial reporting. It’s designed for small to mid-sized nonprofits that need an easy, efficient way to manage finances without hiring a full accounting team.

With features tailored for charities and nonprofit organizations, QuickBooks makes it simple to track donations, manage grants, and ensure compliance with nonprofit accounting standards. Its cloud-based access and automation tools help nonprofits save time while keeping their finances accurate and organized.

Key Features

- Fund tracking and donor management. Easily track donations, grants, and restricted funds to ensure proper allocation and transparency.

- Automated financial reporting. Generates nonprofit-specific reports, including tax forms and financial statements, to simplify compliance.

- Grant tracking and expense management. Monitors grant funds and categorizes expenses to ensure proper spending and reporting.

- Cloud-based access and multi-user support. Allows multiple team members to manage finances from anywhere with real-time updates.

- Automated invoicing and bill payments. Streamlines recurring donations, invoices, and vendor payments to save time and reduce manual work.

- Seamless integration with nonprofit tools. Connects with fundraising, payroll, and donor management software for a complete financial solution.

Pros and Cons

- Pros

- Easy to use, even for non-accountants.

- Tracks donations, grants, and restricted funds.

- Automates nonprofit financial reporting.

- Cloud-based with multi-user access.

- Integrates with fundraising and donor management tools.

- Cons

- Higher-tier plans needed for advanced nonprofit features.

- Can feel overwhelming for first-time users.

- Limited customization for nonprofit-specific reporting.

Who It’s For

QuickBooks is ideal for small to mid-sized nonprofits, charities, and foundations that need an easy-to-use, cloud-based accounting solution. It’s built for organizations that track donations, manage grants, and require automated financial reporting without needing a full accounting team. If you want a simple, scalable nonprofit accounting software that integrates with fundraising and donor management tools, QuickBooks is a strong choice.

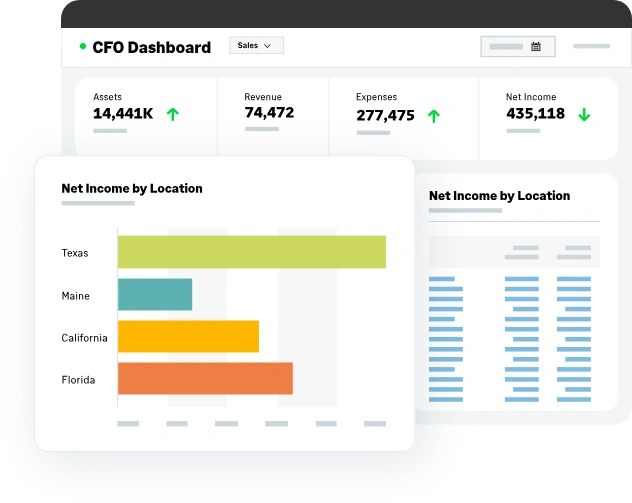

Sage

Serves over 20K businesses

Serves over 20K businesses  Custom solutions by experts

Custom solutions by experts It’s designed for larger charities, foundations, and nonprofits that need more control over their finances without getting lost in spreadsheets. If your nonprofit deals with grants, restricted funds, and detailed financial reporting, Sage is built for you.

With budgeting, grant tracking, and compliance tools, Sage helps you keep your funding organized and your reports accurate. It’s able to track multiple funding sources, automate accounting tasks, and generate nonprofit-specific reports.

Key Features

- Grant and fund tracking. Categorizes restricted and unrestricted funds, making it easy to track how donations and grants are allocated.

- Advanced budgeting tools. Helps nonprofits plan, monitor, and adjust budgets across multiple programs and funding sources.

- Compliance and audit support. Generates financial reports that align with nonprofit accounting standards, making audits and tax filings easier.

- Automated expense management. Tracks spending across programs, preventing overspending and ensuring funds are used properly.

- Multi-user access with permissions. Allows different team members to manage finances while maintaining control over who can access what.

- Integration with fundraising and payroll systems. Connects with donor management and payroll software to create a seamless financial system.

Pros and Cons

- Pros

- Tracks grants, restricted funds, and multiple funding sources.

- Strong budgeting tools for nonprofit financial planning.

- Generates compliance-ready reports for audits and tax filings.

- Automates expense tracking to prevent overspending.

- Supports multi-user access with role-based permissions.

- Cons

- Steeper learning curve compared to simpler nonprofit accounting tools.

- Higher cost, making it better suited for larger nonprofits.

- Requires setup and customization to fit specific nonprofit needs.

Who It’s For

Sage is ideal for mid-sized to large nonprofits, charities, and foundations that manage multiple funding sources, grants, and complex budgets. It’s a great fit for organizations that need strong financial oversight, compliance support, and detailed reporting. If your nonprofit requires customizable accounting tools and can handle a bit of a learning curve for more advanced features, Sage is a solid choice.

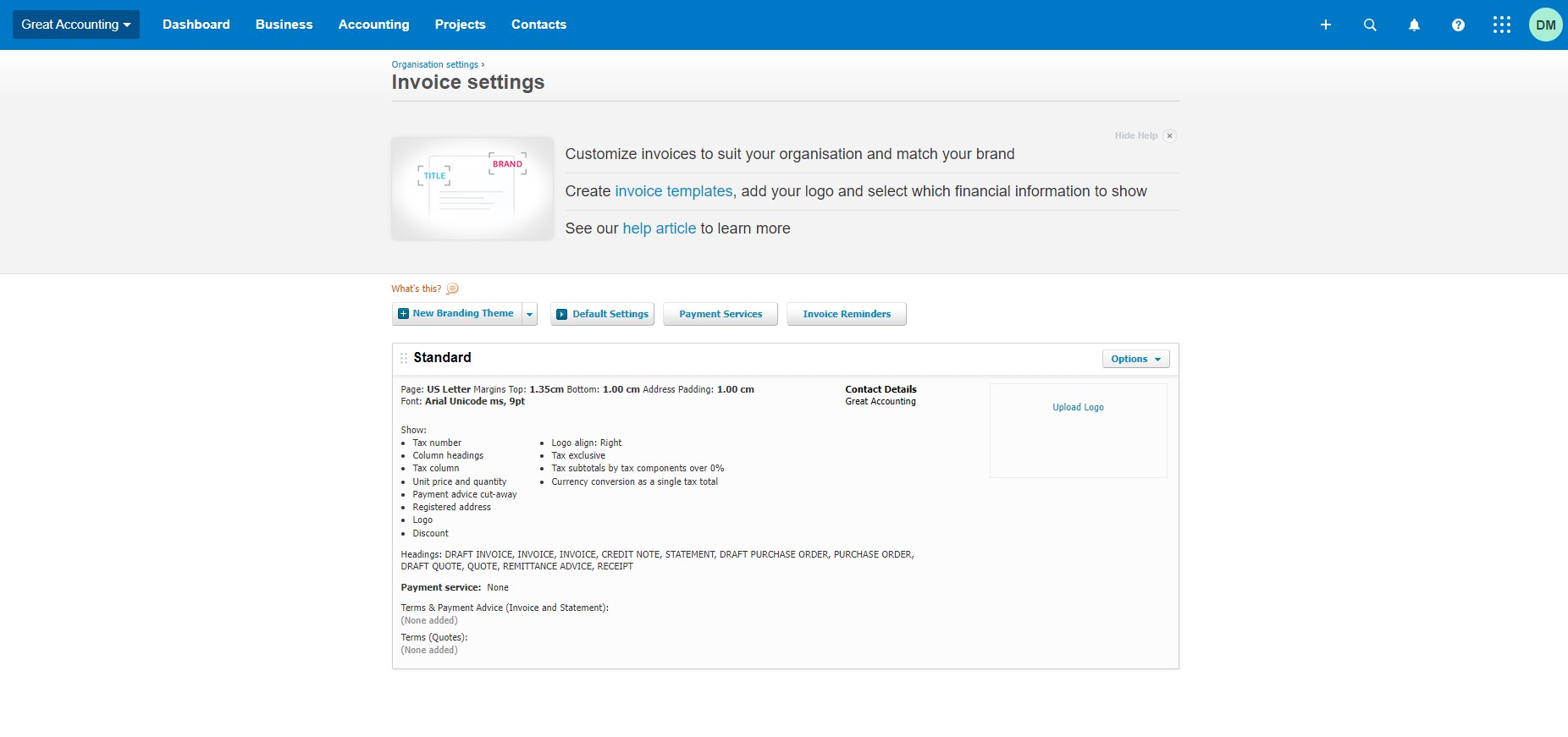

Xero

Streamline onboarding

Streamline onboarding  Global bank connectivity

Global bank connectivity Xero is a cloud-based nonprofit accounting software designed for organizations that need an easy, accessible, and scalable financial solution. It’s perfect for small to mid-sized nonprofits that want automated bookkeeping, real-time financial tracking, and easy collaboration without being tied to a desktop.

With Xero you can track donations, manage expenses, and generate nonprofit-specific reports, all from an intuitive platform that can be accessed anywhere.

Key Features

- Cloud-based accessibility. Manage your nonprofit’s finances from anywhere, with real-time updates and multi-user collaboration.

- Automated bank reconciliation. Syncs with your bank to categorize and match transactions, reducing manual data entry.

- Donation and fund tracking. Keeps records of donations, grants, and restricted funds to ensure proper allocation.

- Budgeting and financial reporting. Generates nonprofit-specific reports and tracks budgets to help with financial planning.

- Expense and bill management. Automates expense tracking and payment scheduling to keep spending organized.

- Integration with fundraising and donor management tools. Connects with platforms like Stripe, PayPal, and donor software for seamless financial management.

Pros and Cons

- Pros

- Cloud-based and easy to access.

- Automates bank reconciliation and expenses.

- Tracks donations and restricted funds.

- Generates nonprofit financial reports.

- Integrates with donor and fundraising tools.

- Cons

- Advanced features cost extra.

- Setup can take time.

- Limited built-in grant management.

Who It’s For

Xero is a great fit for nonprofits that want flexibility and automation without complicated accounting software. If your team works remotely or needs real-time financial tracking from multiple locations, Xero’s cloud-based platform makes collaboration easy. It’s especially useful for organizations managing recurring donations, handling day-to-day expenses, and needing simple but effective financial reporting. If you’re looking for an accounting tool that saves time, reduces manual work, and integrates with donor platforms, Xero is a solid choice.

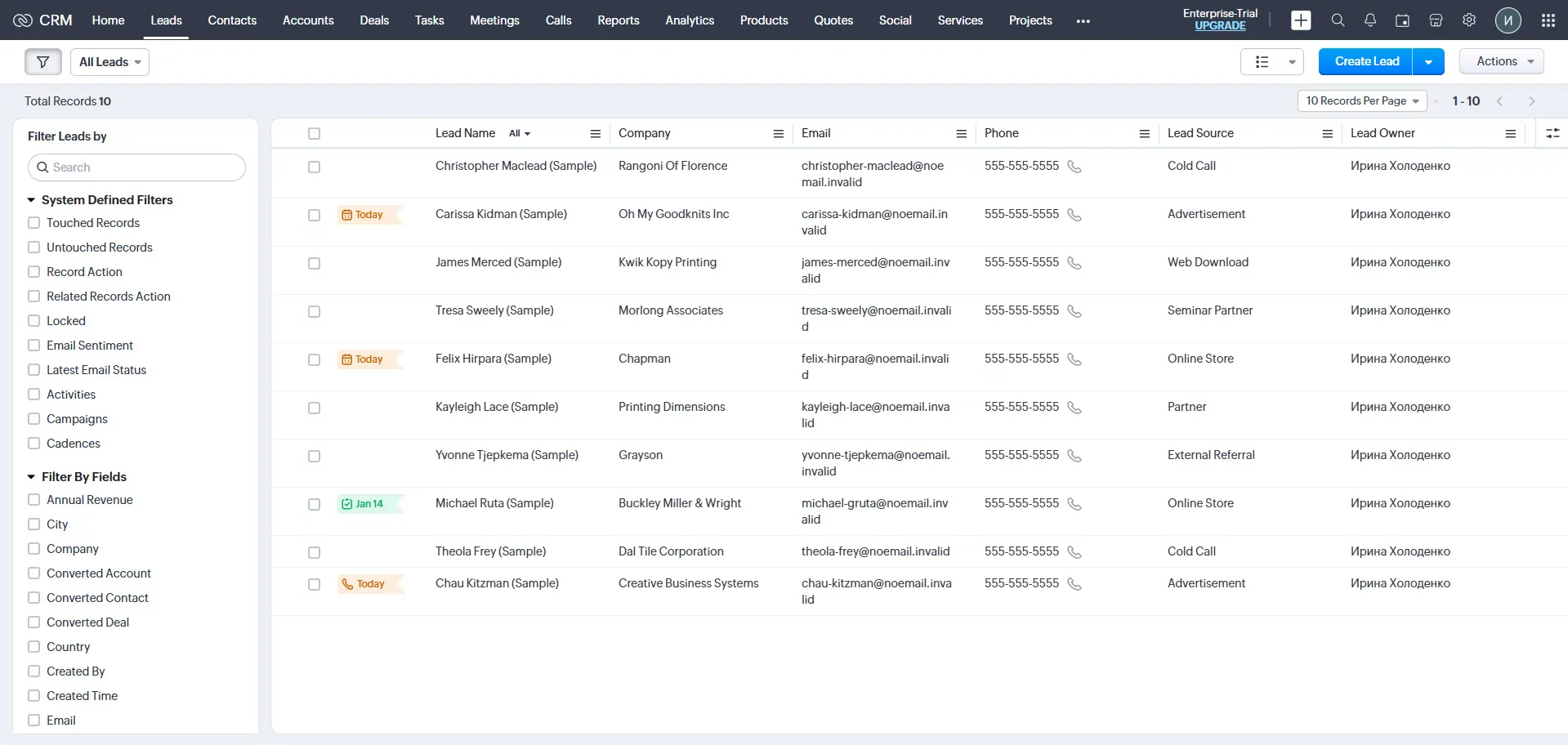

Zoho Books

Accounting A to Z

Accounting A to Z  Account reconciliation & secured banking

Account reconciliation & secured banking Zoho Books is a cost-effective nonprofit accounting software designed for small nonprofits, grassroots organizations, and startups that need easy financial management without a big budget. It offers automated invoicing, expense tracking, and fund management, making it a simple yet powerful tool for nonprofits looking to stay organized.

Key Features

- Affordable nonprofit accounting. Budget-friendly pricing with essential accounting tools for small nonprofits.

- Automated invoicing and expense tracking. Streamlines payments, bills, and reimbursements with automation.

- Donation and fund tracking. Keeps records of donor contributions and allocated funds for transparency.

- Nonprofit financial reporting. Generates reports for budgeting, compliance, and tax preparation.

- Cloud-based multi-user access. Allows teams to collaborate and manage finances from anywhere.

- Integration with payment and donor management tools. Connects with Stripe, PayPal, and fundraising platforms for seamless accounting.

Pros and Cons

- Pros

- Budget-friendly for small nonprofits.

- Automates invoicing and expense tracking.

- Tracks donations and allocated funds.

- Cloud-based with multi-user access.

- Integrates with payment and donor tools.

- Cons

- Lacks advanced grant management features.

- Limited customization for nonprofit-specific reporting.

- Higher-tier plans required for some automation features.

Who It’s For

Zoho Books is ideal for small nonprofits, grassroots organizations, and startups that need affordable, easy-to-use accounting software. It’s a great option for teams that track donations, manage expenses, and generate financial reports without requiring complex features. If your nonprofit wants a simple, cloud-based tool that automates invoicing and integrates with donor platforms, Zoho Books is a great choice.

The Importance of Accounting Software for Nonprofits

Managing finances as a nonprofit is all about transparency, accountability, and making every dollar count. Unlike traditional businesses, nonprofits must track donations, grants, and restricted funds, all while ensuring compliance with nonprofit financial regulations. Without the right tools, managing these finances manually can lead to errors, inefficiencies, and financial mismanagement. Here’s why nonprofits need the right accounting software:

- Tracks donations and grants – Ensures funds are allocated correctly and used for their intended purpose.

- Improves financial transparency – Helps nonprofits maintain clear records for donors, stakeholders, and regulatory bodies.

- Automates expense tracking – Reduces manual work and minimizes errors when managing day-to-day expenses.

- Simplifies compliance and reporting – Generates financial reports that align with nonprofit accounting standards.

- Supports better budgeting – Helps organizations plan and allocate funds effectively to sustain their mission.

Key Benefits of Accounting Software for Nonprofits

-

Automated financial tracking

Accounting software keeps track of donations, grants, and expenses automatically, reducing the risk of manual errors. -

Budgeting and financial planning

Helps nonprofits allocate resources efficiently, ensuring funds are used effectively to support programs and initiatives. -

Faster and more accurate reporting

Generates detailed financial statements, tax reports, and donor summaries with just a few clicks, making audits and compliance easier. -

Transparency for donors and stakeholders

Provides clear financial records that build trust with donors, grant providers, and regulatory agencies. -

Time and cost savings

Reduces the time spent on manual bookkeeping, allowing nonprofits to focus more on their mission and less on financial admin work.

How to Choose the Best Accounting Software for Your Nonprofit

-

Assess your nonprofit’s financial needs

Determine whether you need basic bookkeeping, grant tracking, donor management, or full financial reporting. -

Look for nonprofit-specific features

Choose software that supports fund tracking, donation management, and compliance reporting. -

Consider ease of use

Opt for a platform with an intuitive interface so your team can manage finances without extensive training. -

Check for integrations

Make sure the software works with donor management, payroll, and payment processing tools your nonprofit already uses. -

Compare pricing and scalability

Find a solution that fits your budget while allowing for growth as your organization expands. -

Read reviews and test the software

Look at user feedback from other nonprofits and take advantage of free trials or demos before making a decision.

Final Thoughts

The right accounting software for your nonprofit is next-level in keeping your organization compliant and financially healthy. Think of it as a tool that works in the background so you don’t have to track donations, juggle spreadsheets, or stress over manual reporting; you get a system that keeps everything in order, automates the busy work, and gives you the clarity to focus on your mission.

If financial management has felt like a struggle, it doesn’t have to be. The best accounting software helps you plan smarter, spend wiser, and stay accountable, all while giving you more time to do the work that truly makes a difference. Because at the end of the day, a well-managed nonprofit is a stronger, more impactful nonprofit—and that’s what really counts.

FAQ

Q: What is nonprofit accounting software?

A: Nonprofit accounting software is designed to meet the unique financial management needs of nonprofit organizations, including fund accounting, donation tracking, grant management, and compliance with nonprofit reporting standards.

Q: Why do nonprofits need specialized accounting software?

A: Nonprofits handle diverse revenue streams like donations and grants, requiring tools that can manage restricted funds, ensure transparency, and generate reports aligned with nonprofit accounting standards.

Q: What are the key features to look for in nonprofit accounting software?

A: Essential features include fund accounting, donation and grant tracking, budgeting tools, compliance reporting, and integration capabilities with donor management systems.

Q: How does fund accounting differ from standard accounting?

A: Fund accounting focuses on accountability rather than profitability, emphasizing the tracking of funds from various sources to ensure they are used according to donor restrictions and organizational objectives.

Q: Can small nonprofits afford accounting software?

A: Yes, there are affordable options tailored for small nonprofits that offer essential features like expense tracking, donation management, and basic financial reporting.

Q: How do I choose the best accounting software for my nonprofit?

A: Assess your organization’s specific needs, such as fund tracking, budget management, and reporting requirements. Consider factors like user-friendliness, scalability, integration capabilities, and cost.

Q: Are there free accounting software options for nonprofits?

A: Some providers offer free versions with limited features suitable for small nonprofits, but it’s important to ensure they meet your organization’s requirements for compliance and reporting.

Q: How important is integration with other nonprofit tools?

A: Integration with donor management, CRM, and fundraising platforms can streamline operations, reduce data entry errors, and provide a comprehensive view of your organization’s financial health.

Q: What are the benefits of cloud-based nonprofit accounting software?

A: Cloud-based solutions offer accessibility from anywhere, real-time updates, automatic backups, and often lower upfront costs, making them a flexible option for many nonprofits.

Q: How can accounting software help with compliance and reporting?

A: It can generate financial statements and reports that adhere to nonprofit accounting standards, simplifying audits and ensuring stakeholder transparency.