Best Accounting Software For Self-Employed in 2025

Managing finances as a self-employed individual can be overwhelming, especially when juggling expenses, invoices, and tax obligations. That’s where the right self-employment accounting software comes in. Designed to simplify bookkeeping and financial tracking, these tools help you stay organized, save time, and focus on growing your business. Whether you’re a freelancer, consultant, or solo entrepreneur, this list will help you find the ideal self-employed bookkeeping software for your unique needs.

Why You Can Trust the Expertise of Sonary

At Sonary, we are committed to providing accurate and trustworthy information to help you make informed decisions. Our research process is meticulous, transparent, and guided by a dedication to maintaining the highest standards of integrity, ensuring accurate, real-world insights.

Read more

Unlike many other review platforms, we conduct in-depth evaluations of the software and services we feature. Our expert team tests and actively uses the tools we review to understand their features, performance, and value comprehensively. Our assessments are based on real-world use, giving you insights beyond surface-level descriptions. Our research methodology includes analyzing key consumer factors such as pricing, functionality, device usability, scalability, customer support quality, and unique industry-specific features. This hands-on approach and dedication to transparency mean you can trust Sonary to deliver regular, up-to-date content and recommendations that are well-researched and genuinely helpful for your business needs.

If you’re self-employed, you know how tricky managing your finances can get—juggling invoices, tracking expenses, and staying on top of taxes. That’s where accounting software comes in. It’s designed to make your life easier by automating the tough stuff, so you can focus on growing your business. In this article, we’ll walk you through the best options for freelancers, gig workers, and small business owners.

Best Accounting Software for Self-Employed

Features

General Features

Track Expenses

Tax Preparation

Time-Saving Automations

Add-Ons

Supported Devices

Pros & Cons

Pros

Cons

Features

General Features

Track Expenses

Tax Preparation

Time-Saving Automations

Add-Ons

Supported Devices

Pros & Cons

Pros

Cons

Features

General Features

Track Expenses

Tax Preparation

Time-Saving Automations

Add-Ons

Supported Devices

Pros & Cons

Pros

Cons

Features

General Features

Track Expenses

Tax Preparation

Time-Saving Automations

Add-Ons

Supported Devices

Pros & Cons

Pros

Cons

Features

General Features

Tax Preparation

Time-Saving Automations

Add-Ons

Supported Devices

Pros & Cons

Pros

Cons

Quick Comparison

|

Accounting Software |

Key Features |

Best For |

|

QuickBooks |

Expense tracking, invoicing, tax deductions, mileage tracking |

Freelancers and small business owners needing an all-in-one tool |

|

Xero |

Cloud-based platform, multi-currency support, project tracking |

Self-employed professionals working internationally or on projects |

|

Patriot |

Affordable pricing, easy payroll integration, simplified bookkeeping tools |

Budget-conscious freelancers needing basic accounting |

|

FreshBooks |

User-friendly design, invoicing, time tracking, payment processing |

Freelancers managing client projects and payments |

|

Zoho Books |

Automated workflows, integrated CRM, tax compliance tools |

Entrepreneurs needing an integrated business management solution |

|

Square |

POS integration, invoicing, expense tracking |

Self-employed individuals in retail or service industries |

|

Sage |

Budgeting tools, cash flow management, customizable invoices |

Solo entrepreneurs needing robust financial reporting |

Our Top Picks

We’ve handpicked the best accounting software to make your self-employed life a little easier. These options are perfect for keeping track of your income, managing expenses, and staying on top of taxes without any stress. With these tools, you can spend less time worrying about finances and more time focusing on what you do best.

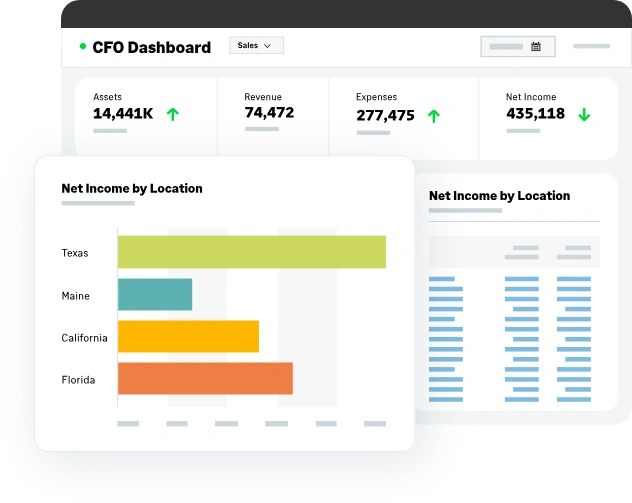

QuickBooks: Best for Small to Medium-Sized Businesses Needing Comprehensive Accounting

Unlimited custom invoices and quotes

Unlimited custom invoices and quotes  Smart invoicing with automated tracking

Smart invoicing with automated tracking QuickBooks is one of the most popular and comprehensive self-employed bookkeeping software options on the market. Designed to meet the needs of freelancers, small business owners, and self-employed professionals, it combines invoicing, expense tracking, tax management, and more in one intuitive platform. Its robust features and ease of use make it one of the best accounting software for self-employed individuals.

Key Features

- Expense tracking: Automatically categorizes expenses and syncs with your bank accounts to track spending in real-time.

- Invoicing: Create and send professional invoices, track payments, and set up automatic reminders.

- Tax deductions: Identifies potential deductions, helping you maximize savings at tax time.

- Mileage tracking: Tracks mileage via the mobile app, ensuring you never miss a deductible trip.

- Financial reporting: Provides detailed profit-and-loss statements, cash flow summaries, and other reports.

- Self-employment tax tools: Estimates quarterly taxes and helps with preparation, keeping you compliant year-round.

Pros

- All-in-one solution for tracking expenses, income, and taxes.

- User-friendly mobile app for on-the-go financial management.

- Scalable features for small business owners or growing freelancers.

- Integrates seamlessly with other tools like PayPal and Shopify.

Cons

- A monthly subscription can be costly for freelancers with minimal needs.

- Advanced features may require a learning curve for first-time users.

Who It’s For

Freelancers and self-employed individuals need a comprehensive, scalable solution for managing their finances efficiently.

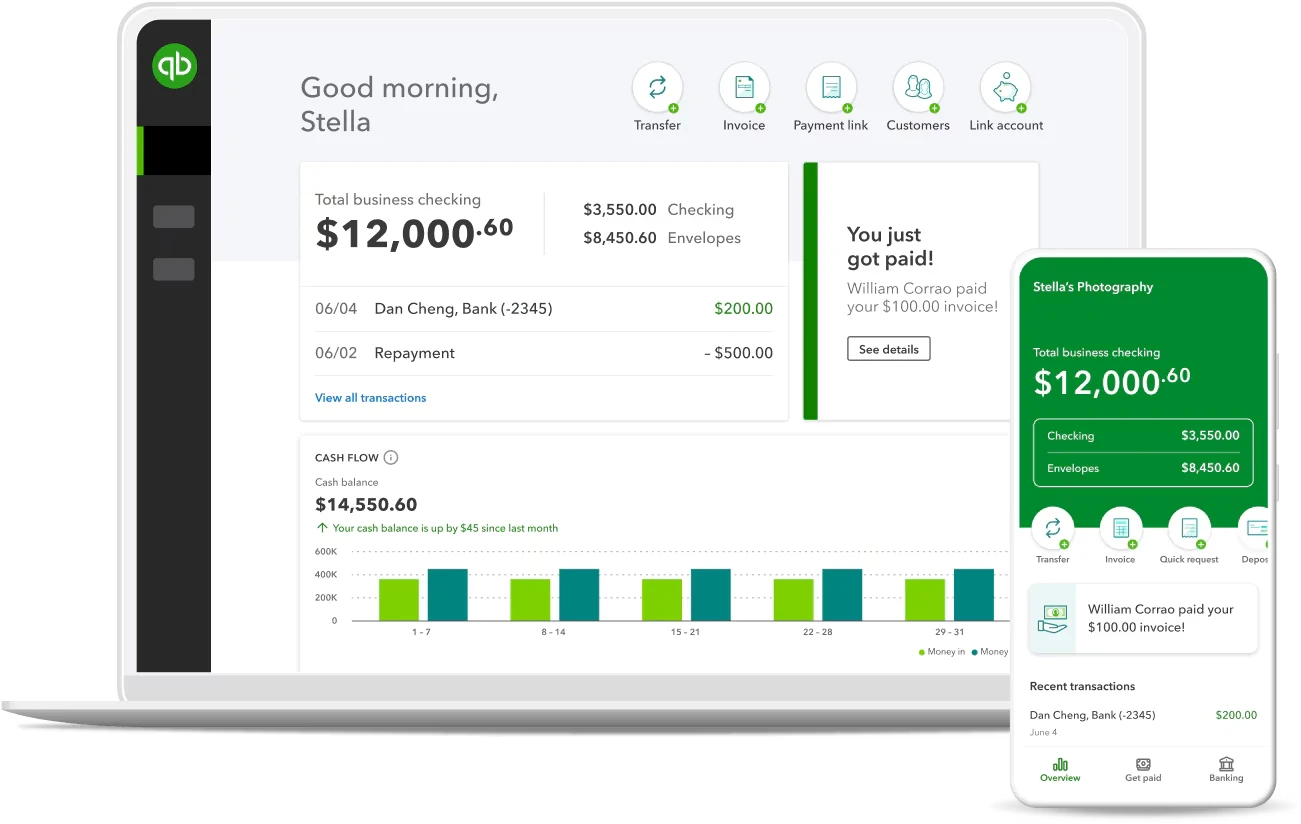

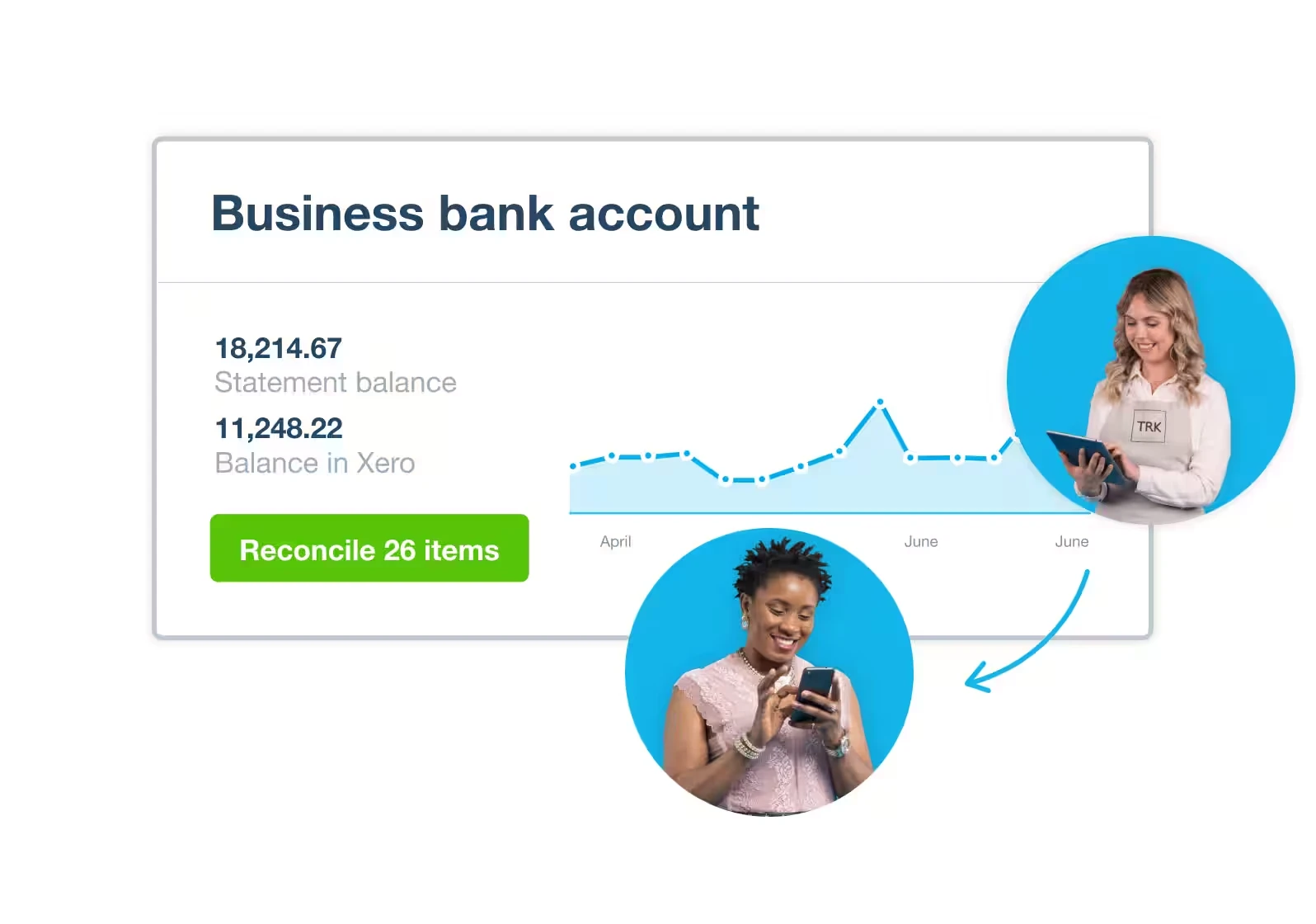

Xero: Best for Growing Businesses and Collaboration

Streamline onboarding

Streamline onboarding  Global bank connectivity

Global bank connectivity Xero is a cloud-based self-employment accounting software designed for freelancers, consultants, and small business owners. With a user-friendly interface and robust features like multi-currency support and project tracking, Xero simplifies bookkeeping and helps manage finances from anywhere. It’s especially valuable for self-employed professionals working on international projects or with diverse clients.

Key Features

- A cloud-based platform: Access your financial data anytime, anywhere, from any device.

- Multi-currency support: Automatically tracks and converts foreign transactions, making it ideal for international freelancers.

- Invoicing: Customize and send invoices, track payments, and set reminders for overdue accounts.

- Project tracking: Monitor time, expenses, and profitability for individual projects.

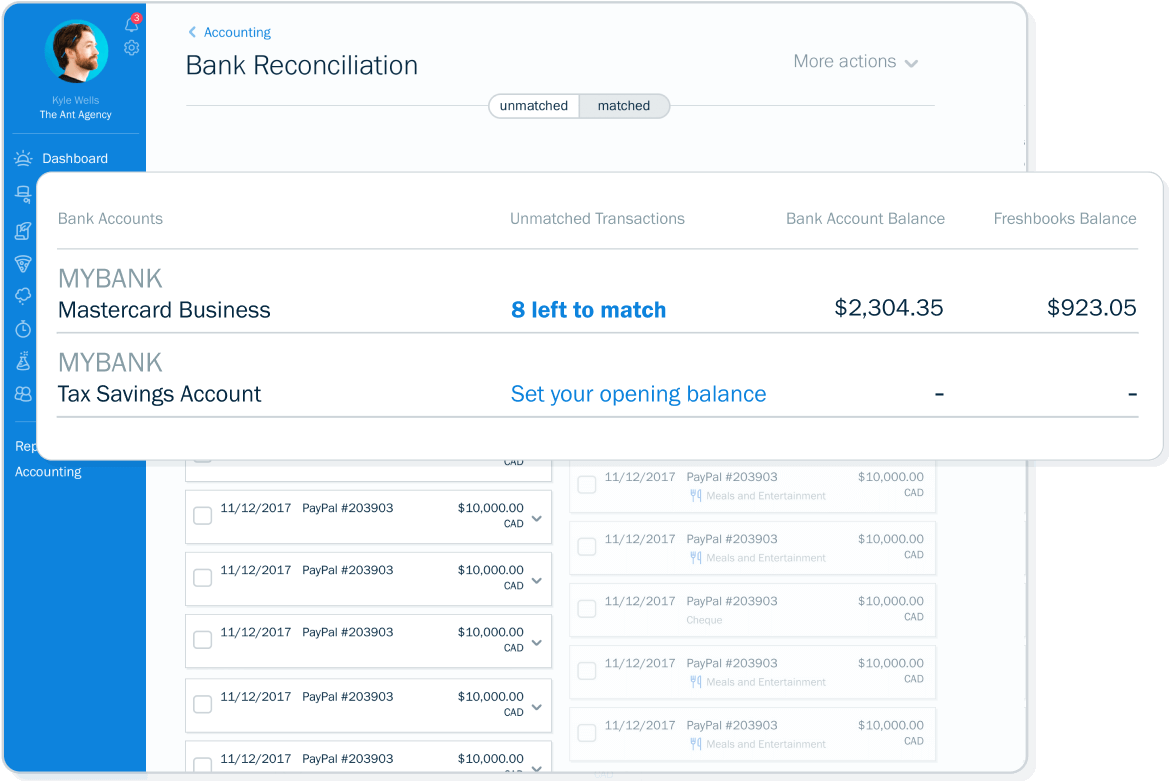

- Bank reconciliation: Syncs with your bank accounts to match transactions, ensuring up-to-date records.

- Tax tools: Simplifies VAT, GST, and sales tax calculations, ensuring compliance with local regulations.

Pros

- Intuitive, cloud-based platform for real-time financial management.

- Strong multi-currency support for international professionals.

- Comprehensive invoicing and project tracking features.

- Scalable plans for growing self-employed individuals or businesses.

Cons

- Advanced features may be overkill for those with basic accounting needs.

- Slightly higher pricing tiers compared to some competitors.

Who It’s For

Self-employed professionals working internationally or managing multiple client projects who need flexibility and robust features.

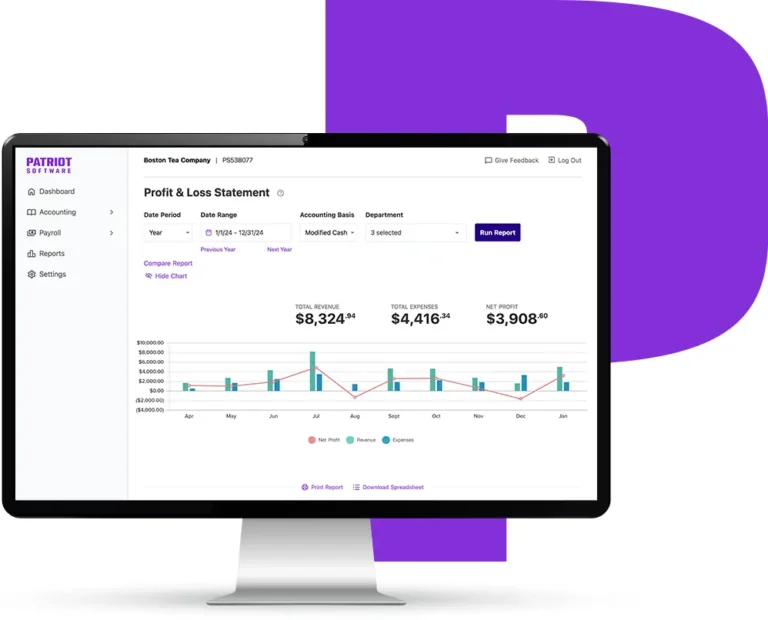

Patriot: Best for Freelancers and Service-Based Businesses

Free 60 day trial with unlimited use

Free 60 day trial with unlimited use  Easy start up wizard

Easy start up wizard Patriot is a budget-friendly accounting software for freelancers and self-employed professionals seeking an affordable, straightforward solution. While it offers fewer advanced features than some competitors, its ease of use and integration with payroll tools make it an excellent choice for those looking for essential bookkeeping capabilities without overspending.

Key Features

- Simplified bookkeeping: Tracks income and expenses, ensuring accurate records for tax reporting.

- Payroll integration: Offers seamless integration with Patriot Payroll for those who manage small teams.

- Customizable invoices: Create and send professional invoices tailored to your business branding.

- Bank reconciliation: Match transactions with your bank accounts to maintain up-to-date financial records.

- Affordable pricing plans: Budget-friendly plans cater to freelancers and self-employed individuals.

- Tax reporting: Generates tax-ready reports, simplifying quarterly and annual filings.

Pros

- Cost-effective solution for basic bookkeeping and accounting.

- Simple, intuitive platform with a minimal learning curve.

- Great for freelancers managing their own finances.

- Offers payroll integration for those transitioning into small business operations.

Cons

- Limited advanced features for larger or more complex businesses.

- No mobile app for on-the-go accounting.

Who It’s For

Budget-conscious freelancers and self-employed individuals looking for self-employed bookkeeping software with essential features.

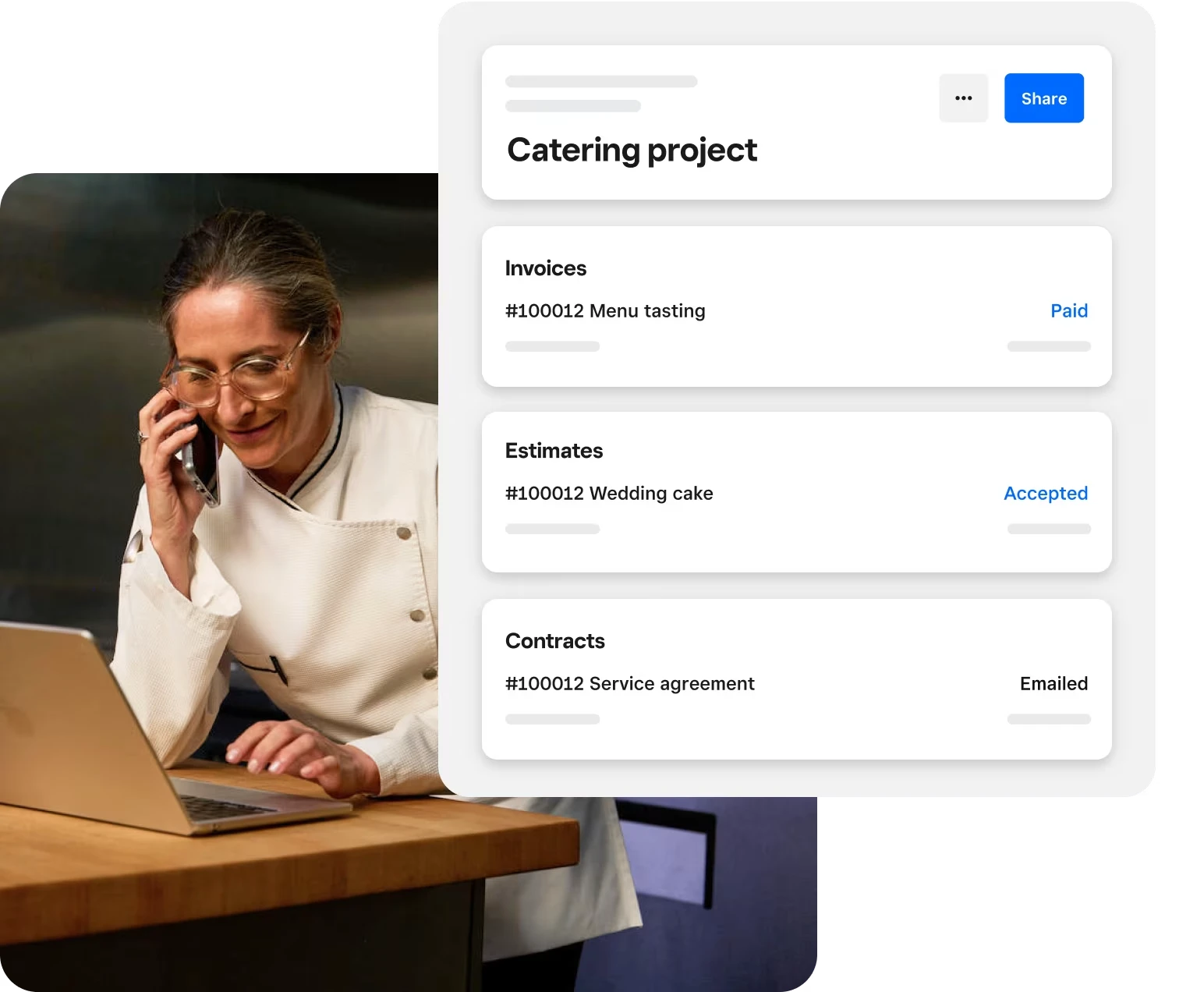

FreshBooks: Best for Freelancers and Service-Based Businesses

Award-winning customer service

Award-winning customer service  Seamless integration & user-friendly

Seamless integration & user-friendly FreshBooks is a user-friendly freelancer accounting software that simplifies invoicing, expense tracking, and payment processing. It’s perfect for self-employed professionals managing client projects, offering a clean interface and tools tailored for solo entrepreneurs. With its time-tracking capabilities and project management features, FreshBooks is an excellent choice for freelancers juggling multiple clients.

Key Features

- Invoicing: Create and send professional invoices, customize templates, and set up recurring billing for ongoing clients.

- Expense tracking: Link your bank account to monitor expenses in real time and categorize them easily.

- Time tracking: Log billable hours directly into projects or invoices for accurate client billing.

- Payment processing: Accept online client payments through credit cards, ACH, or PayPal.

- Project management: Collaborate with clients and track project progress from start to finish.

- Tax preparation: Generate tax-ready reports for simplified filings.

Pros

- Intuitive interface with tools tailored to freelancers.

- Strong invoicing and payment processing features.

- Ideal for tracking billable hours and managing projects.

- Mobile app allows on-the-go financial management.

Cons

- Higher pricing tiers may not suit all freelancers.

- Limited advanced accounting tools for more complex needs.

Who It’s For

Freelancers and self-employed professionals managing client-based projects and payments.

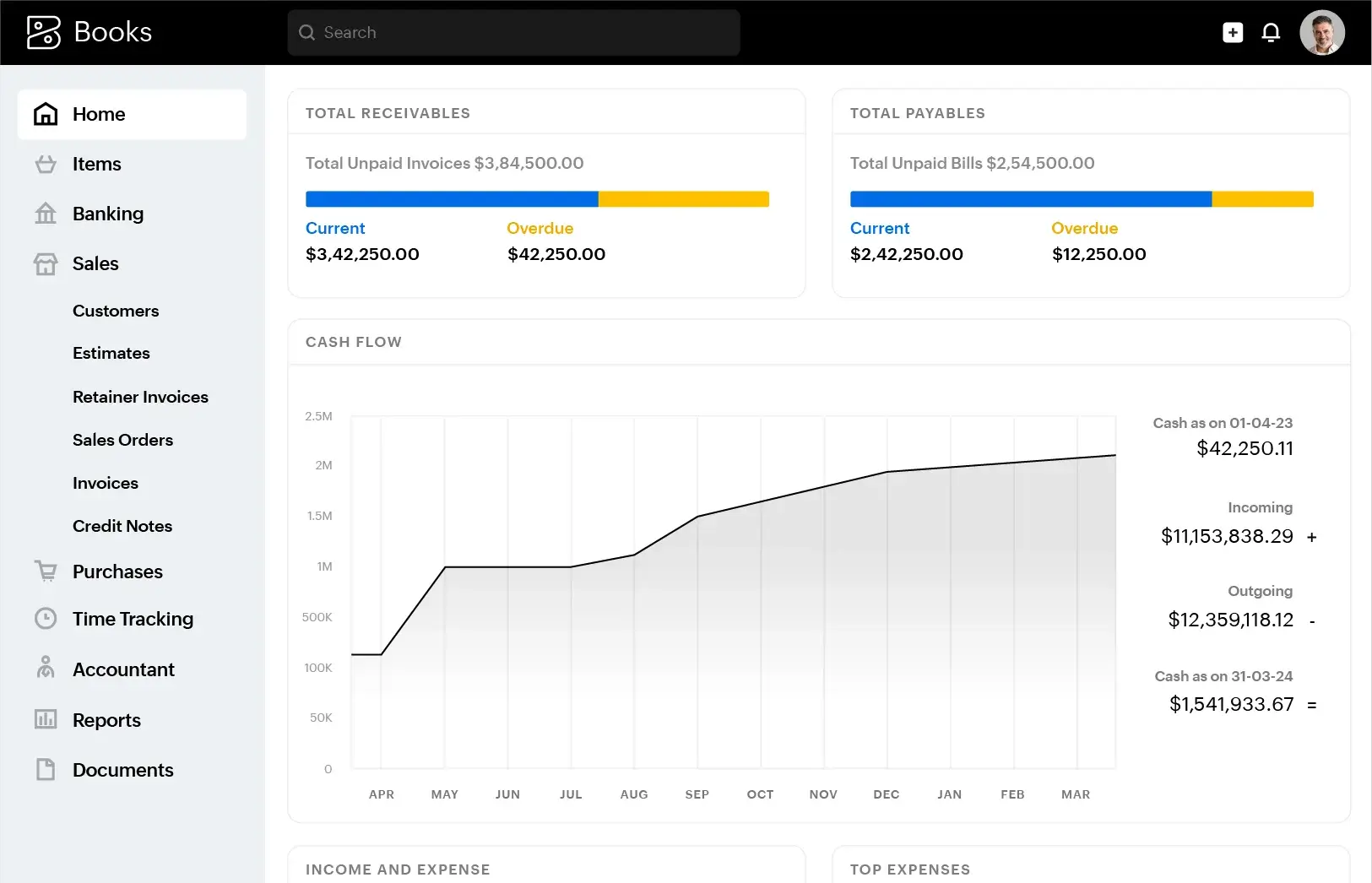

Zoho Books: Best for Businesses Already Using Zoho Ecosystem

Accounting A to Z

Accounting A to Z  Account reconciliation & secured banking

Account reconciliation & secured banking Zoho Books is an all-in-one self-employment accounting software that simplifies bookkeeping, automates workflows, and integrates seamlessly with other Zoho tools. It offers robust features like tax compliance, expense tracking, and invoice management, perfect for entrepreneurs and freelancers. Its affordability and scalability make it one of the best accounting software for self-employed individuals who need more than just basic accounting tools.

Key Features

- Automated workflows: Streamline repetitive tasks like invoicing, payment reminders, and bank reconciliations.

- Tax compliance: Handles GST, VAT, and other taxes, ensuring accurate calculations and reporting.

- Integrated business tools: Works seamlessly with Zoho CRM, Projects, and other Zoho apps for a unified business management experience.

- Invoicing: Create, customize, and easily send invoices, and set up automated recurring invoices for ongoing clients.

- Expense management: Tracks expenses by syncing with bank accounts and categorizing transactions automatically.

- Mobile app: Access financial data, send invoices, and track payments on the go.

Pros

- Affordable pricing plans for self-employed professionals and small businesses.

- Integrates with other Zoho tools for comprehensive business management.

- Strong automation features save time and reduce manual work.

- Excellent customer support and detailed documentation.

Cons

- May feel overwhelming for those with basic accounting needs.

- Limited third-party integrations outside the Zoho ecosystem.

Who It’s For

Entrepreneurs and freelancers who need versatile self-employed bookkeeping software with integrated tools for managing all aspects of their business.

Square: Best for Retailers and Businesses with Point-of-Sale Needs

You only pay when you get paid

You only pay when you get paid  Set up tracking & payment reminders

Set up tracking & payment reminders Square is a versatile accounting software for freelancers and self-employed individuals, particularly those in retail or service industries. Known for its seamless integration with Square’s point-of-sale (POS) systems, it simplifies expense tracking, invoicing, and financial reporting. For freelancers managing both in-person and online payments, Square offers a user-friendly and reliable solution.

Key Features

- POS integration: Syncs with Square’s POS system to manage sales, track revenue, and generate financial reports.

- Invoicing: Create and send invoices, accept payments online, and track overdue accounts.

- Expense tracking: Automatically categorizes expenses and links to connected bank accounts for real-time tracking.

- Payment processing: Accept payments through multiple methods, including cards, ACH, and mobile wallet s.

- Financial reporting: Provides detailed insights into sales, expenses, and cash flow, helping you make informed decisions.

- Mobile app: Manage payments, send invoices, and track finances from anywhere with Square’s intuitive mobile app.

Pros

- Perfect for freelancers in retail or service industries using Square POS.

- Seamless payment integration across multiple platforms.

- User-friendly interface with excellent mobile app functionality.

- Provides clear financial insights to manage cash flow effectively.

Cons

- Limited advanced accounting features compared to competitors.

- Best suited for freelancers already using Square POS for payments.

Who It’s For

Freelancers and self-employed professionals in retail or service industries who need integrated payment and self-employment accounting software.

Sage: Best for Larger Businesses and Advanced Accounting Needs

Serves over 20K businesses

Serves over 20K businesses  Custom solutions by experts

Custom solutions by experts Sage offers a reliable and scalable self-employed bookkeeping software solution, designed to simplify financial management for solo entrepreneurs and freelancers. Known for its robust reporting and budgeting tools, Sage provides the insights needed to manage cash flow effectively. Its flexibility and powerful features make it a strong contender for the best accounting software for self-employed professionals who value detailed financial oversight.

Key Features

- Cash flow management: Monitors cash flow in real-time, helping you plan for expenses and maintain financial stability.

- Customizable invoices: Create professional invoices with custom branding, send them directly, and track payments.

- Expense tracking: Categorizes expenses automatically, ensuring accurate financial records for tax purposes.

- Financial reporting: Offers comprehensive income, expenses, and cash flow reports to help you make informed decisions.

- Budgeting tools: Enables you to set financial goals and monitor progress, perfect for freelancers managing unpredictable income streams.

- Multi-user access: Provides options to share access with an accountant for streamlined collaboration.

Pros

- Strong financial reporting tools for tracking cash flow and profitability.

- Customizable invoices cater to diverse business needs.

- Budgeting features tailored to freelancers managing variable income.

- Supports multi-user access for collaboration with accountants.

Cons

- Steeper learning curve for users unfamiliar with accounting software.

- Advanced features may be unnecessary for those with simpler needs.

Who It’s For

Solo entrepreneurs and freelancers needing robust reporting and cash flow management tools in their self-employed accounting software.

Choosing the Best Accounting Software for Self-Employed Professionals

Selecting the right self-employed bookkeeping software is crucial for managing your finances effectively and saving time. Here’s a guide to help you evaluate and choose the best accounting software for self-employed individuals based on your unique needs:

1. Features that match your needs

The right software should include essential features like invoicing, expense tracking, and tax preparation. If you handle multiple clients or projects, look for tools with time-tracking or project-management capabilities.

Tip: Avoid paying for advanced features you won’t use, like inventory tracking, unless relevant to your work.

2. Ease of use

Your accounting software should simplify bookkeeping tasks, not complicate them. A clean, intuitive interface ensures you can quickly learn the platform and manage finances without frustration.

Tip: Choose software with a user-friendly design and tutorials or support for beginners.

3. Tax compliance

Tax preparation and compliance are essential for freelancers and self-employed professionals. Software that calculates, tracks, and files taxes automatically will save time and reduce errors during tax season.

Tip: Look for tools that offer features like estimated tax calculations and reminders for filing deadlines.

4. Scalability

If you anticipate growing your business, opt for a solution that can scale with you. Software with additional features like payroll integration or multi-user access will save you from switching platforms as your needs evolve.

Tip: Check pricing for upgraded plans to ensure affordability as your business expands.

5. Mobile Accessibility

Freelancers and self-employed professionals often work on the go. Accounting software with mobile apps lets you track expenses, send invoices, and monitor cash flow from anywhere.

Tip: Ensure the mobile app includes the same core features as the desktop version.

6. Budget

While free options exist, they may lack advanced features. Balance your budget with your needs to find software that offers good value without unnecessary expenses.

Tip: Consider free trials to test whether the software meets your requirements before committing.

By evaluating these factors—features, usability, tax compliance, scalability, mobile access, and budget—you can confidently choose the best accounting software for self-employed individuals to simplify your financial management.

Final Thoughts

The right accounting software for self-employed professionals can transform how you manage your finances, save time, and ensure compliance with tax regulations. From invoicing and expense tracking to detailed reporting, the tools in this guide offer features tailored to freelancers, consultants, and solo entrepreneurs. Take the time to evaluate your needs and priorities to select the solution that best supports your business and helps it thrive.

FAQ

Q. Do I need accounting software if I’m self-employed?

A.Yes, accounting software simplifies tasks like tracking income, managing expenses, preparing taxes, saving time, and reducing errors.

Q. Do self-employed people need an accountant?

A. Not always. Accounting software often provides the tools needed to manage finances independently, but an accountant can be helpful for complex tax or financial advice.

Q. What accounting software is most popular for self-employed people?

A. Popular options include QuickBooks, FreshBooks, and Xero, which offer features tailored to self-employed individuals and freelancers.

Q. What is the easiest accounting software to use?

A. Software like FreshBooks and QuickBooks are known for their user-friendly interfaces and streamlined workflows, which are ideal for beginners.

Q. Do I still need an accountant if I use accounting software?

A. Accounting software covers most day-to-day tasks, but an accountant may still be useful for filing, financial planning, or managing complex finances.