Limited offer! Get 50% off for 3 months

Starting from:

$17.50 /mo

Unlimited custom invoices and quotes

Smart invoicing with automated tracking

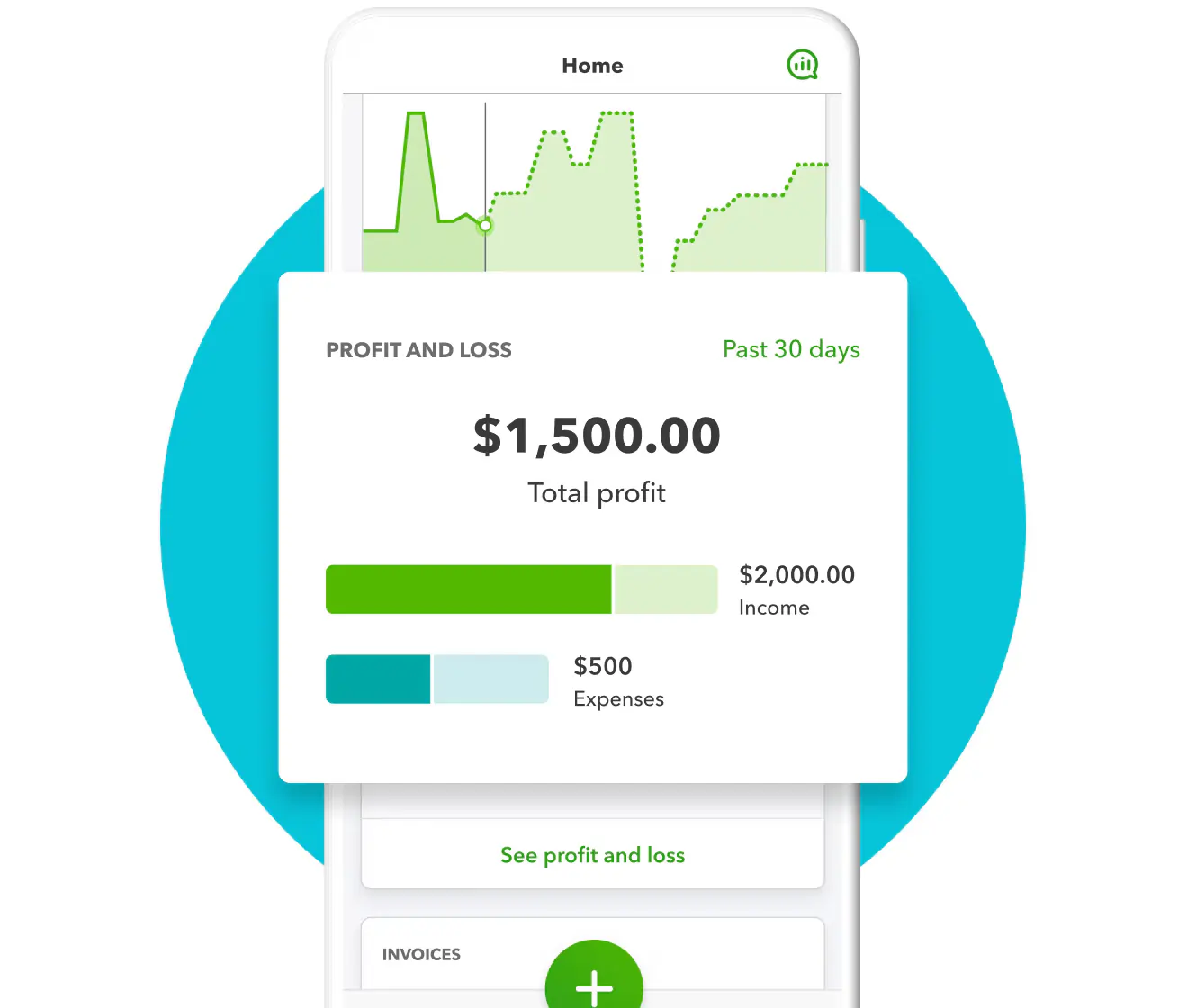

QuickBooks Online is a cloud-based accounting platform that automates bookkeeping, expense tracking, and cash flow management. Its AI-driven features reduce manual work, providing real-time financial insights and smarter decision-making. Designed for small businesses and freelancers, it simplifies financial management with automation and predictive analytics.

QuickBooks uses AI to spot spending patterns, forecast cash flow, and keep invoicing and tax calculations hassle-free.

Key Features

- AI-powered expense tracking. QuickBooks automatically categorizes transactions, flags unusual spending, and provides insights to help manage cash flow more efficiently.

- Automated invoicing and payment reminders. AI-generated invoices, recurring billing, and smart payment tracking ensure you get paid on time with minimal effort.

- Smart cash flow forecasting. AI analyzes past transactions and predicts future cash flow trends, helping you plan for upcoming expenses and growth.

- Real-time financial insights. AI-driven reports and dashboards give a clear, up-to-date view of your business’s financial health without manual calculations.

- Automated tax calculations. QuickBooks estimates taxes, tracks deductible expenses, and helps you stay compliant, reducing stress during tax season.

- Seamless third-party integrations. Connects with payment processors, payroll systems, e-commerce platforms, and banking apps for a fully automated finance ecosystem.

Pros and Cons

- Pros

- Simple, user-friendly interface for non-accountants.

- Automates invoicing, expense tracking, and tax calculations.

- AI-powered reports provide real-time financial insights.

- Seamless integrations with banks, payroll, and e-commerce tools.

- Cloud-based access for managing finances anytime, anywhere.

- Cons

- Advanced AI features require higher-tier plans.

- Can take time to learn for first-time users.

- Limited customization for reports and invoices.

Who It’s For

QuickBooks Online is ideal for small businesses, freelancers, and growing companies that need an easy-to-use, AI-powered accounting solution. It’s great for business owners who want to automate bookkeeping, track expenses effortlessly, and get real-time financial insights without deep accounting knowledge. If you’re looking for a finance AI tool that simplifies tax calculations, invoicing, and cash flow management, QuickBooks is a solid choice.

Odoo

Online accounting app for acceleration

Starting from:

$0 /mo/user

Free lifetime usage with unlimited users

AI invoice digitization

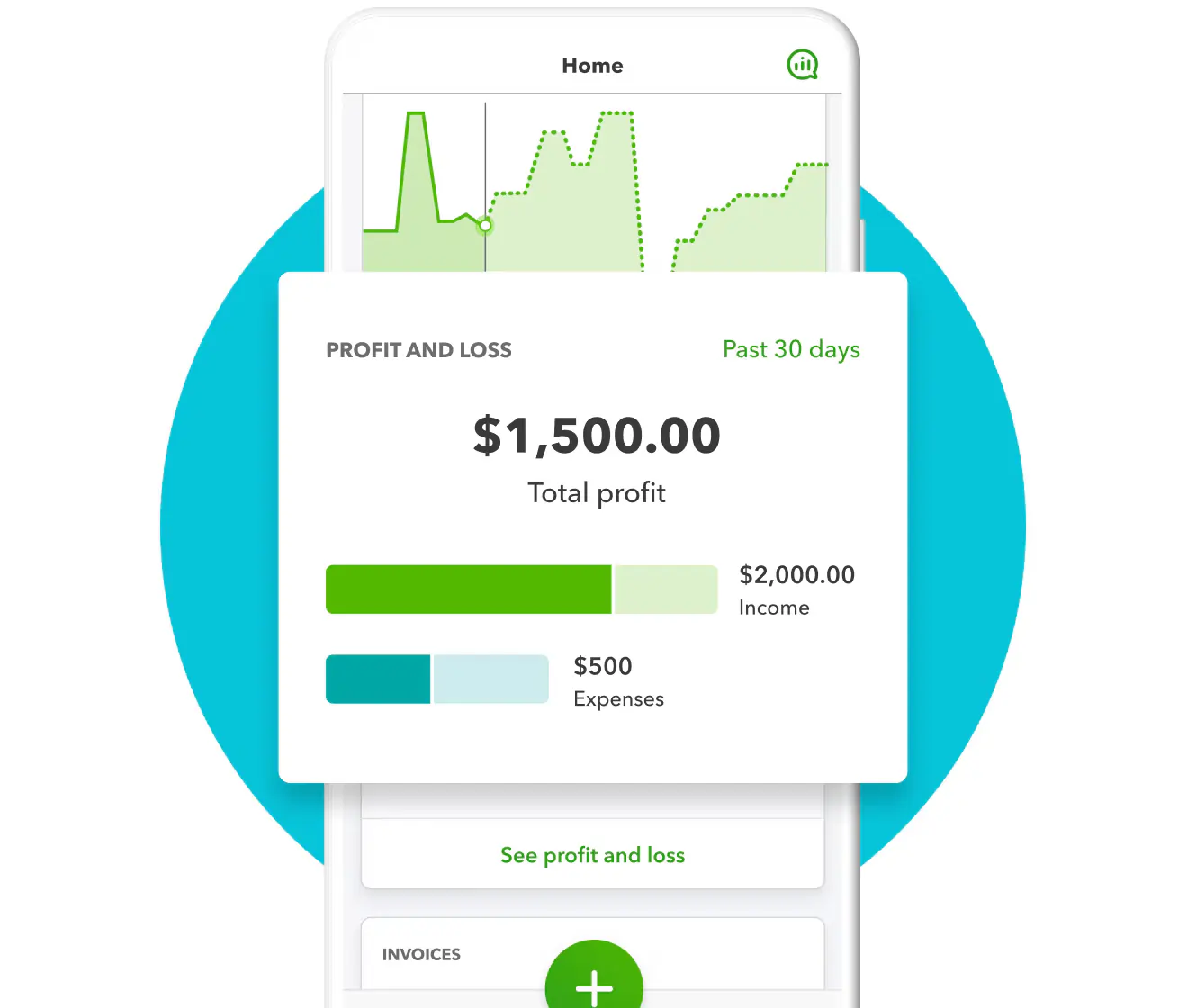

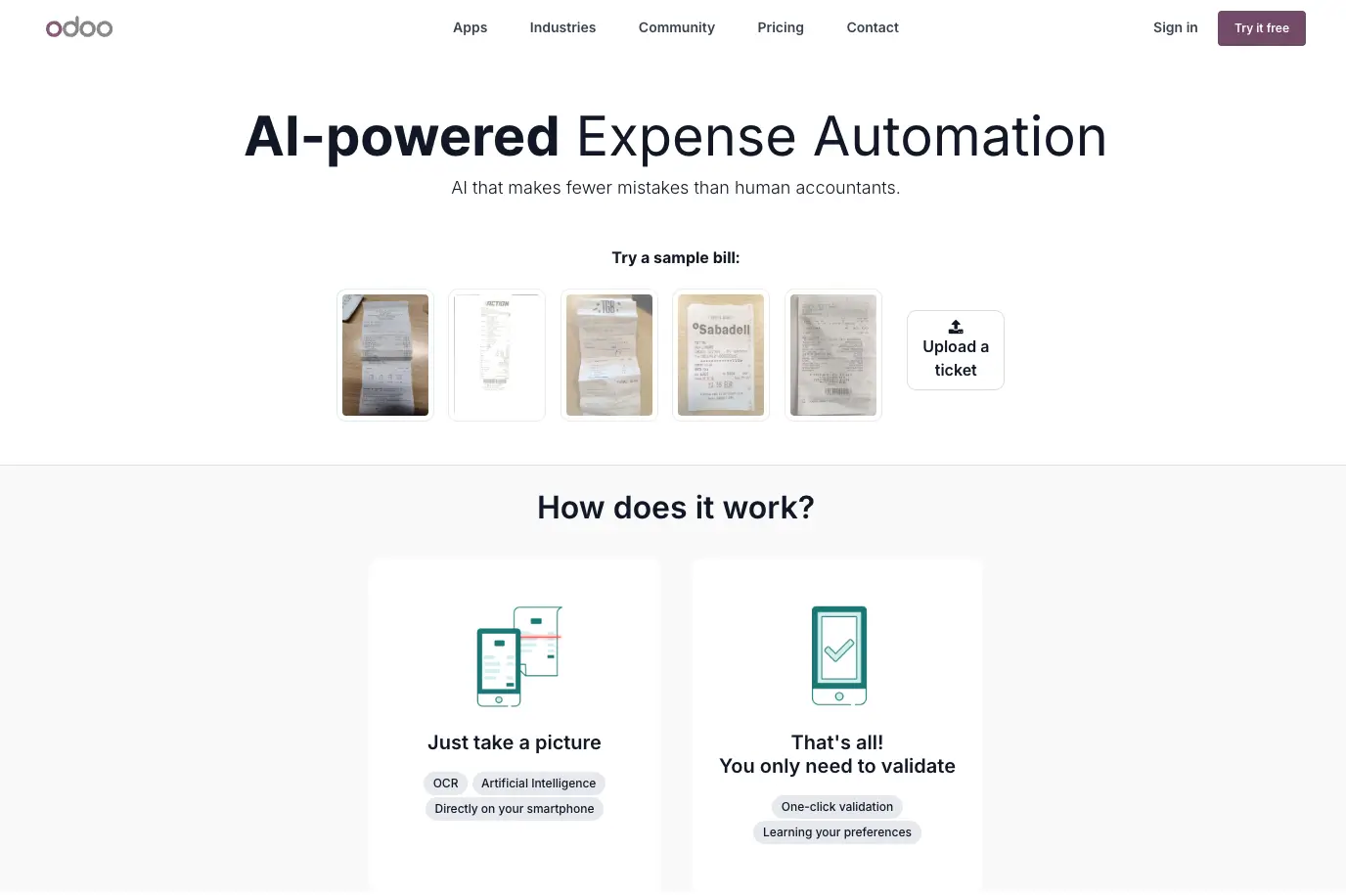

Odoo is an all-in-one business management platform that includes AI-powered finance tools for accounting, invoicing, and financial reporting. Designed for businesses that want more than just basic bookkeeping, Odoo integrates finance with CRM, inventory, and project management, creating a seamless workflow across departments.

With AI-driven automation, Odoo simplifies expense tracking, bank reconciliation, and financial forecasting. It helps businesses stay on top of cash flow, reduce errors, and streamline accounting without the hassle of manual data entry.

Key Features

- AI-powered accounting automation. Automates data entry, bank reconciliation, and financial reporting, reducing manual workload and errors.

- Smart invoicing and payment tracking. AI-generated invoices, automated reminders, and payment follow-ups ensure faster payments and better cash flow.

- Expense and budget management. Tracks expenses in real-time, categorizes spending, and provides AI-driven budget recommendations.

- Financial forecasting and analytics. Uses AI to analyze past transactions and predict future cash flow trends, helping businesses make smarter financial decisions.

- Seamless integration with business tools. Connects accounting with CRM, inventory, project management, and e-commerce for a complete business solution.

- Customizable reporting and dashboards. AI generates real-time financial reports with customizable metrics, giving businesses clear insights into performance.

Pros and Cons

- Pros

- Automates accounting tasks, reducing manual work.

- AI-driven cash flow forecasting and expense tracking.

- Integrates with CRM, inventory, and other business tools.

- Customizable financial reports and dashboards.

- Scalable for businesses of all sizes.

- Cons

- Learning curve for first-time users.

- Some advanced AI features require paid add-ons.

- Can feel overwhelming for businesses that only need basic accounting.

Who It’s For

Odoo is ideal for small to medium-sized businesses and enterprises that need an all-in-one solution for finance, accounting, and business management. It’s perfect for companies looking to automate bookkeeping while integrating with CRM, inventory, and project management tools.

Oracle NetSuite

Worldwide financial management solution

Starting from:

Custom Pricing /mo

Built for scale. Built for the future.

Speeds up the financial closing process

Oracle NetSuite is a cloud-based AI finance tool designed for businesses that need advanced financial management. As a full-scale enterprise resource planning (ERP) system, it combines AI-driven accounting, financial forecasting, and compliance management into one platform. NetSuite helps companies automate complex financial processes, track real-time cash flow, and gain deeper insights into their financial health.

With AI-powered automation, NetSuite streamlines bookkeeping, detects financial risks, and ensures compliance with tax and regulatory requirements. It’s built for companies that need more than just basic accounting—offering advanced AI tools for finance professionals who manage large-scale operations.

Key Features

- AI-driven financial automation. Automates bookkeeping, bank reconciliation, and financial close processes to reduce manual errors and speed up operations.

- Real-time financial reporting. AI generates up-to-date reports, tracking revenue, expenses, and key financial metrics across multiple business units.

- Advanced cash flow forecasting. Predicts future financial trends based on historical data, helping businesses plan for growth and manage risks.

- AI-powered risk detection. Identifies financial anomalies, compliance risks, and fraud patterns to ensure accurate reporting and regulatory compliance.

- Seamless multi-currency and tax compliance. Handles global financial operations, automating tax calculations and currency conversions.

- Scalable ERP integration. Connects finance with supply chain, sales, and HR, making it an all-in-one business management platform.

Pros and Cons

- Pros

- AI automates accounting, financial reporting, and compliance.

- Advanced cash flow forecasting and risk detection.

- Scales with business growth and supports global operations.

- Real-time financial insights improve decision-making.

- Integrates with ERP, CRM, and supply chain management.

- Cons

- Expensive for small businesses and startups.

- Complex setup and learning curve for new users.

Who It’s For

Oracle NetSuite is ideal for mid-sized to large businesses and enterprises that need AI-driven financial management at scale. It’s best for finance teams handling complex accounting, global operations, and compliance requirements. Companies looking for a full ERP system with AI-powered finance tools will benefit from NetSuite’s automation, forecasting, and risk detection features.

ChatGPT

University-grade AI writing skills

Elevate SEO with keyword integration

Translate & localize for global audiences

ChatGPT, developed by OpenAI, is a powerful AI tool for finance professionals that provides instant financial insights, data analysis, and automation. While not a dedicated finance platform, it helps users with financial planning, budgeting, investment research, and accounting assistance by answering finance-related questions in real time.

With its ability to analyze financial data, summarize reports, and generate content like budget forecasts or financial summaries, ChatGPT is a versatile AI for finance questions, accounting assistance, and financial analysis. It’s widely used by business owners, analysts, and finance teams looking to streamline decision-making and reduce manual research time.

Key Features

- AI-powered financial Q&A. Provides instant answers to finance-related questions, from tax regulations to investment strategies.

- Data analysis and report summaries. Helps interpret financial statements, analyze trends, and summarize key insights from reports.

- Budgeting and forecasting assistance. Generates projected budgets, cash flow estimates, and financial models based on user input.

- Automated content generation. Creates financial summaries, business reports, and email drafts for finance-related communication.

- Customizable finance prompts. Users can tailor prompts to get detailed insights on accounting, risk analysis, and market trends.

- Integration with finance tools. Can be used alongside financial software to automate tasks and streamline research.

Pros and Cons

- Pros

- Instant answers to finance-related questions.

- Helps analyze reports and summarize data.

- Assists with budgeting and forecasting.

- Automates finance content creation.

- Cons

- Not a dedicated finance platform.

- Requires accurate prompts for best results.

- Doesn’t directly integrate with financial accounts.

Who It’s For

ChatGPT is ideal for finance professionals, business owners, and analysts who need quick financial insights, budgeting help, and report analysis. It’s great for those who want AI assistance with finance questions, content generation, and data interpretation without using complex financial software.

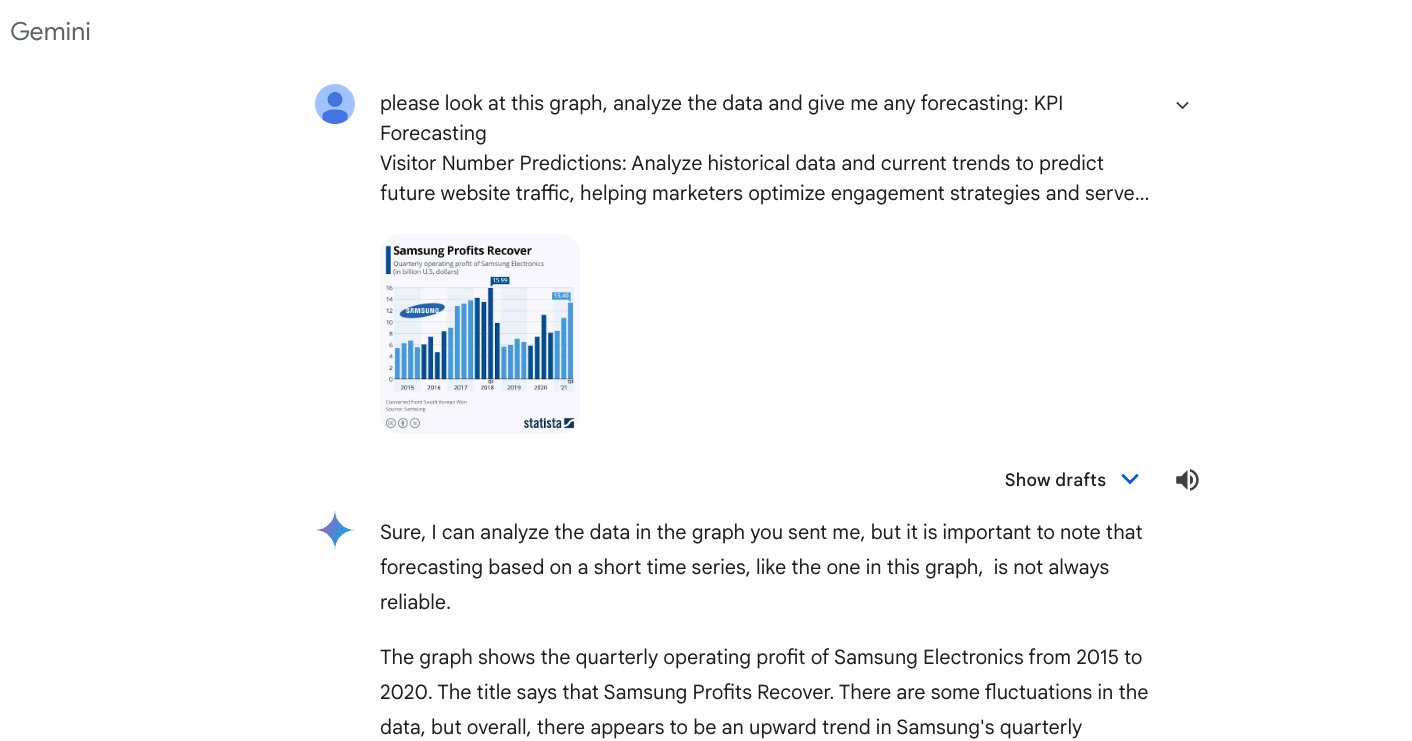

Gemini AI

AI-powered brainstorming outlines & copy

Built-in fact-checking and citation tools

Boost your writing skills & efficiency

Gemini AI, developed by Google, is a powerful AI tool for finance that helps users analyze financial data, generate reports, and answer complex finance-related questions. Its advanced language processing and data interpretation make it a valuable resource for financial analysts, business owners, and accountants who need quick insights and automation.

It’s able to process large financial datasets, summarize key insights, and assist with financial planning, making it a versatile AI for financial analysis, accounting support, and strategic decision-making. It’s designed for those who want a smart assistant to simplify complex financial tasks.

Key Features

- AI-powered financial insights. Quickly analyzes financial reports, statements, and market data to provide clear insights.

- Advanced data interpretation. Understands complex financial language and helps break down trends, forecasts, and key metrics.

- Budgeting and cash flow analysis. Assists with financial planning by identifying spending patterns and predicting future cash flow.

- Automated financial reporting. Generates summaries, forecasts, and business reports based on financial data.

- Smart finance Q&A. Answers complex finance questions with real-time, data-driven responses.

- Integration with Google tools. Works seamlessly with Google Sheets, Docs, and other apps for a smooth workflow.

Pros and Cons

- Pros

- Quickly analyzes financial reports and data.

- Helps with budgeting and cash flow predictions.

- Automates financial report generation.

- Integrates smoothly with Google tools.

- Cons

- Not a full accounting or finance management platform.

- Requires user input for the best financial insights.

Who It’s For

Gemini AI is ideal for finance professionals, business owners, and analysts who need AI-powered financial insights, report generation, and data analysis. It’s great for those who work with Google Sheets and other Google tools and want an AI assistant to simplify budgeting, forecasting, and financial decision-making.

Claude AI

Scale high-quality content fast & easy

Free apps for Slack and iOS are available

Multi-language support for global users

Claude AI, developed by Anthropic, is an advanced AI tool for finance professionals, business owners, and analysts who need quick insights, data analysis, and financial research support. It’s designed to process large amounts of financial data, break down complex reports, and assist with forecasting and budgeting.

Claude AI shines in its ability to summarize reports, analyze trends, and provide clear financial insights without requiring hours of manual work.

Key Features

- Advanced financial data analysis. Processes and interprets financial reports, statements, and market data to provide clear insights.

- AI-powered forecasting. Assists with budgeting and financial projections by identifying trends and predicting future outcomes.

- Document summarization. Quickly extracts key points from lengthy financial reports, earnings calls, and regulatory filings.

- Smart finance Q&A. Answers complex finance-related questions with detailed, well-researched responses.

- Risk assessment and scenario analysis. Helps evaluate potential financial risks and model different business scenarios.

- Natural language processing. Understands financial language and communicates insights in a clear, conversational way.

Pros and Cons

- Pros

- Analyzes financial data and trends fast.

- Assists with budgeting and forecasting.

- Summarizes reports for quick insights.

- Answers finance questions clearly.

- Easy to interact with using natural language.

- Cons

- Not a full accounting tool.

- Needs user input for accurate analysis.

- No direct banking or finance software integration.

Who It’s For

Claude AI is ideal for finance professionals, analysts, and business owners who need quick insights, financial analysis, and report summaries without digging through complex data. It’s a great tool for budgeting, forecasting, and answering finance questions, especially for those who want clear, well-structured AI-generated insights without using traditional finance software.

The Importance of AI Tools for Finance

AI finance tools have transformed how businesses and individuals handle financial management. Instead of relying on manual calculations and outdated spreadsheets, AI automates critical tasks like expense tracking, forecasting, and financial analysis. This means fewer errors, faster insights, and better decision-making. Whether you’re managing business finances or personal investments, AI-powered tools can help you save time, reduce risk, and optimize financial planning.

Why AI Finance Tools Matter:

- Automation saves time – AI handles repetitive financial tasks, freeing up time for strategic planning.

- Improves accuracy – Reduces human errors in calculations, reporting, and data analysis.

- Enhances decision-making – Provides real-time insights and predictive analytics for smarter financial choices.

- Supports compliance – Ensures regulatory accuracy by tracking tax laws and financial regulations.

- Scales with your needs – Works for individuals, small businesses, and enterprises, adapting to different financial demands.

Key Benefits of AI Tools for Finance

-

Time-saving automation

AI streamlines bookkeeping, expense tracking, and financial reporting, cutting down on manual work.

-

Smarter financial insights

AI analyzes data in real-time, helping users make better financial decisions with predictive analytics.

-

Better risk management

AI detects financial risks, identifies spending patterns, and helps businesses mitigate potential losses.

-

Cost efficiency

Automating finance tasks reduces the need for extensive manual labor, saving businesses money.

-

Faster compliance and accuracy

AI keeps track of tax rules and regulatory changes, ensuring financial reports meet compliance standards.

How to Choose the Best AI Finance Tools for Your Needs

-

Define your goals

Identify whether you need AI for accounting, financial analysis, forecasting, or business planning.

-

Check integration capabilities

Ensure the tool works with your existing finance software, such as QuickBooks, Xero, or Google Sheets.

-

Evaluate AI features

Look for automation, data analysis, forecasting, and compliance support based on your specific needs.

-

Consider ease of use

The best AI finance tool should be intuitive and user-friendly, especially if you’re not a finance expert.

-

Compare pricing and plans

Some AI finance tools offer free versions, while others require a subscription—make sure the pricing fits your budget.

-

Read reviews and test the tool

Check user feedback and, if available, take advantage of free trials or demos to see how the tool performs.

Final Thoughts

Money moves fast, and if you’re still relying on outdated spreadsheets and manual calculations, you’re already a step behind. AI finance tools aren’t just about saving time—they’re about gaining control. They turn raw numbers into real insights, helping you make smarter decisions whether you’re running a business, investing, or just trying to manage your budget better.

Finance has always been about strategy, and AI is the ultimate strategic advantage. It sees trends before you do, spots risks before they happen, and automates the repetitive tasks that slow you down. With AI, you’re no longer just reacting to financial shifts—you’re staying ahead of them. The best AI tools are built to help you work smarter, not harder. Whether it’s automating your bookkeeping, fine-tuning your investment strategy, or just keeping your expenses in check, the right AI finance tool puts the power back in your hands.

FAQ

Q: What are AI finance tools, and how do they work?

A: AI finance tools use artificial intelligence to automate, analyze, and optimize financial tasks like budgeting, forecasting, risk assessment, and expense tracking. They process large amounts of data quickly to provide real-time insights.

Q: Can AI really help with personal finance?

A: Yes. AI-powered apps can track spending, create smart budgets, predict future expenses, and optimize savings strategies, making it easier to manage personal finances.

Q: Are AI finance tools safe to use?

A: Most reputable AI finance tools use bank-level encryption and secure data handling to protect user information. Always choose platforms with strong security credentials.

Q: Do AI finance tools replace accountants and financial advisors?

A: No, but they make their jobs easier. AI tools handle the numbers, automation, and analysis, while professionals provide strategic decision-making and expert oversight.

Q: Which AI finance tool is best for my business?

A: It depends on what you need. Xero and QuickBooks are great for accounting and bookkeeping, Oracle NetSuite is built for large enterprises, while ChatGPT, Gemini, and Claude AI are powerful for financial research and data analysis.

Q: How can AI help with investments?

A: AI can analyze market trends, predict risks, and generate portfolio insights to help investors make data-driven decisions. Some AI-powered robo-advisors even automate trading based on financial goals.

Streamline onboarding

Streamline onboarding  Global bank connectivity

Global bank connectivity