247Payments Review 2025

247Payments Merchant Services Plans & Pricing

247Payments Comparison

Expert Review

Pros

Cons

247Payments Merchant Services's Offerings

When I reviewed 247Payments’ merchant services software, I found its pricing model to be transparent and scalable, catering to different business types.

- Flat Monthly Fee – 247Payments charges 7% of the merchant’s average monthly transaction volume, ensuring costs align with business growth.

- Retail Business Plan – For retail businesses, they offer a 1.49% credit rate, 0.29% debit rate, and a $9.99 monthly fee, including free equipment setup for qualified merchants.

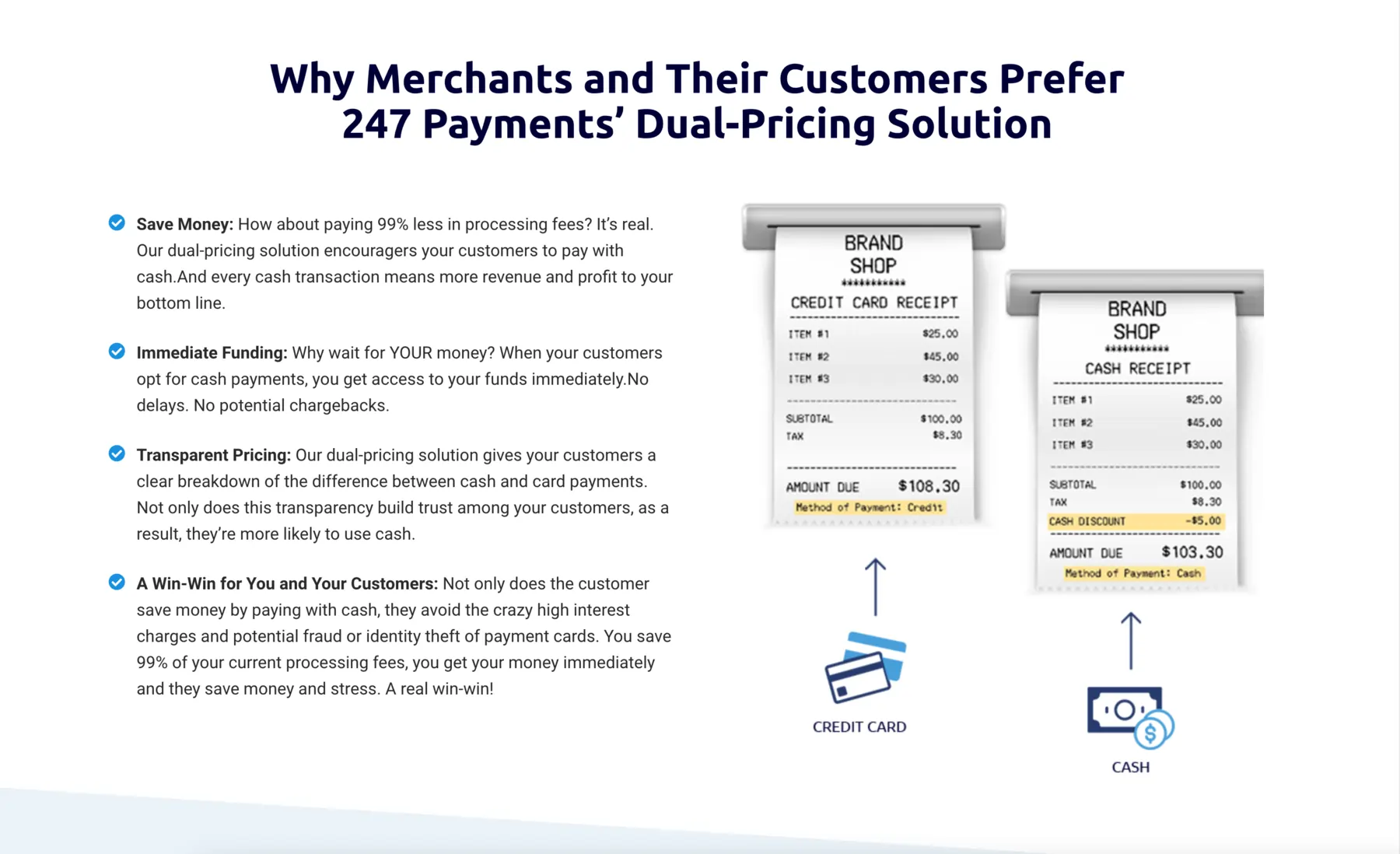

- Dual Pricing Program – Merchants can offset 99% of payment processing fees by offering cash and credit pricing, reducing transaction costs.

- Interchange Plus Pricing – Competitive rate structure with a $1,000 Visa gift card guarantee if they can’t beat a merchant’s current rate.

This 247Payments review highlights its online payment processing services as a flexible, affordable option for businesses seeking e-commerce payment methods with no hidden fees and multiple pricing plans.

Customer Support

As the name suggests, 247Payments offers a dedicated customer support service on a 24/7 basis. This means you can always get help if you have any issues or questions relating to payment processing, chargeback mitigation, and so on.

Dedicated Account Managers

One feature I liked when testing 247Payments’ online payment solutions is the inclusion of a dedicated account manager for every merchant. This ensures that businesses receive personalized assistance tailored to their industry and specific needs, helping them stay competitive.

Multiple Support Channels

Phone Support – Available 24/7, businesses can reach a support representative anytime for assistance with their online payment processing services.

Email Support – If a phone call isn’t convenient, merchants can email the team and receive prompt responses for their inquiries.

Live Chat – Currently, live chat is not available, which may be a downside for those who prefer instant online messaging for support.

Knowledge Base & Blog

I explored the 247Payments website, and it clearly explains the merchant services software it provides. The FAQ section covers essential details, while the blog offers insights on industry trends, payment solutions, and security best practices.

Overall, 247Payments’ customer support is reliable, offering 24/7 phone and email support, dedicated account managers, and a helpful resource center for merchants.

Features & Functionality

General Features

247Payments covers tons of different features and functionalities, including online payment solutions, electronic check processing, and top-tier merchant service software.

It ticks most boxes, and I will explore some of the best benefits of using 247Payments below:

- Surcharge/Dual Pricing

- Point of Sale (POS)

- Centralized Inventory

- Next Day Payout

- Reliable Equipment

- Supports High-Risk Businesses

- Intelligent Reports

- 24/7 Customer Support

- Fingerprint Security

- Virtual Terminal

- E-Commerce Payment/Online Checkout

- Mobile Payments

- Recurring Billing

- Custom Invoicing

- Fraud Prevention Measures

- Compliance Assistance

- Global Payment Capabilities

- eCheck Processing

- Customer Relationship Management (CRM) Integration

- Chargeback Protection

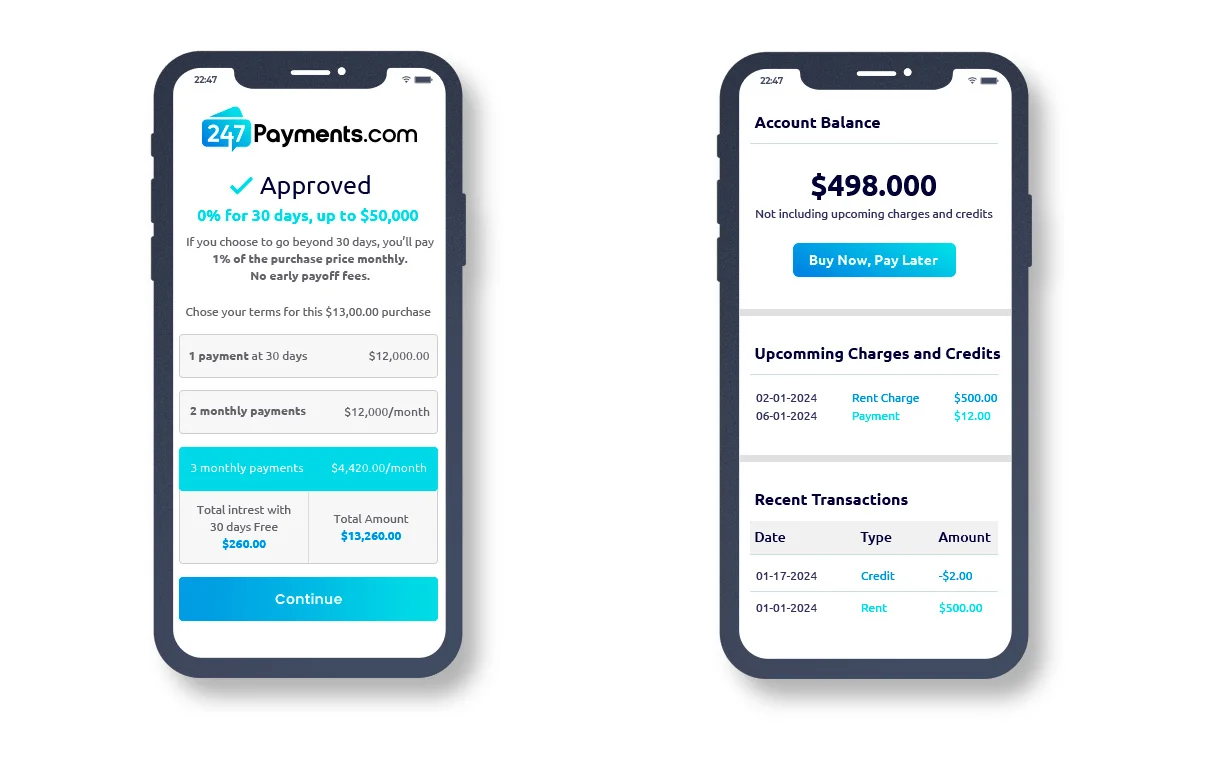

- Buy Now, Pay Later

Surcharge/Dual Pricing

With the dual pricing program, you can add a surcharge to the cardholder when they want to use a credit card instead of cash or a check. This means you’re passing on the fees to the customer rather than having to pay them yourself.

Customers will get a cash or credit option before paying, so they can see the exact prices they will pay depending on their chosen payment option.

Point of Sale (POS)

247Payments provides full-scale retail solutions without charging for the POS payment gateway equipment. The setup will be in 24 hours or less, with the pricing being transparent. These systems also incorporate top-tier security to protect your customers.

The company also offers mobile POS systems for field sales, or industries that have large warehouses such a home & garden stores.

Centralized Inventory

I played around with 247Payments’ centralized inventory system, and it’s a solid choice for businesses managing large inventories or multiple store locations. It integrates seamlessly with POS solutions, so stock levels update instantly. This is a game-changer for businesses juggling both online payment platforms and in-store sales, ensuring accuracy across all sales channels.

Next-Day Payout

One thing I really liked about 247Payments’ online payment processing services was how fast payouts happen. After a customer purchase, you can receive same-day or next-day transfers straight to your bank account. When I tried this feature, the funds landed quickly, which is great for cash flow and makes it a reliable online payment solution.

Reliable Equipment

I checked out 247Payments’ hardware, and it’s built for credit cards, digital wallets, and contactless payments. The best part? Free installation is included, making setup hassle-free. I found the equipment responsive and easy to use, which is a huge plus for businesses needing secure and efficient e-commerce payment methods.

Supports High-Risk Businesses

Some high-risk businesses can struggle to get access to leading merchant services providers, and this can lead to them having to pay higher rates with fewer perks.

247Payments has a 99.9% approval rating, so it is happy to work with partners operating in more high-risk sectors like firearms, online gambling, and the adult sector.

They even offer tips to stay in good standing with your banks:

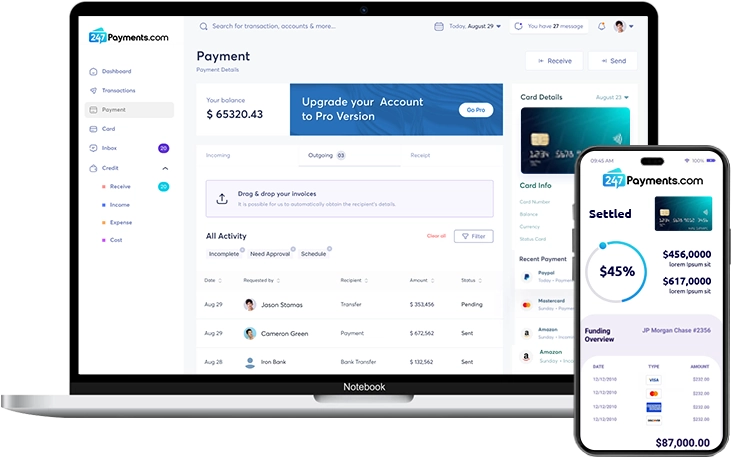

Intelligent Reports

The web-based analytics system is another standout feature. I tested the reporting tools and could instantly track sales trends, transaction volumes, and customer insights. These reports help businesses make smarter decisions and optimize their merchant services software, whether for e-commerce payments or electronic check processing.

Fingerprint Security

I checked out 247Payments’ security features, and the fingerprint authentication stood out. This adds an extra layer of protection, ensuring that only authorized users can access merchant services software and online payment processing services. It’s a great feature for businesses handling sensitive e-commerce payment methods, reducing fraud risks and improving security.

Virtual Terminal

You are able to access and use a virtual terminal on any type of device connected to the internet. It allows you to get electronic check processing, as well as ACH and credit card payments, with a few clicks. You can easily set up recurring billing or access custom reporting from anywhere.

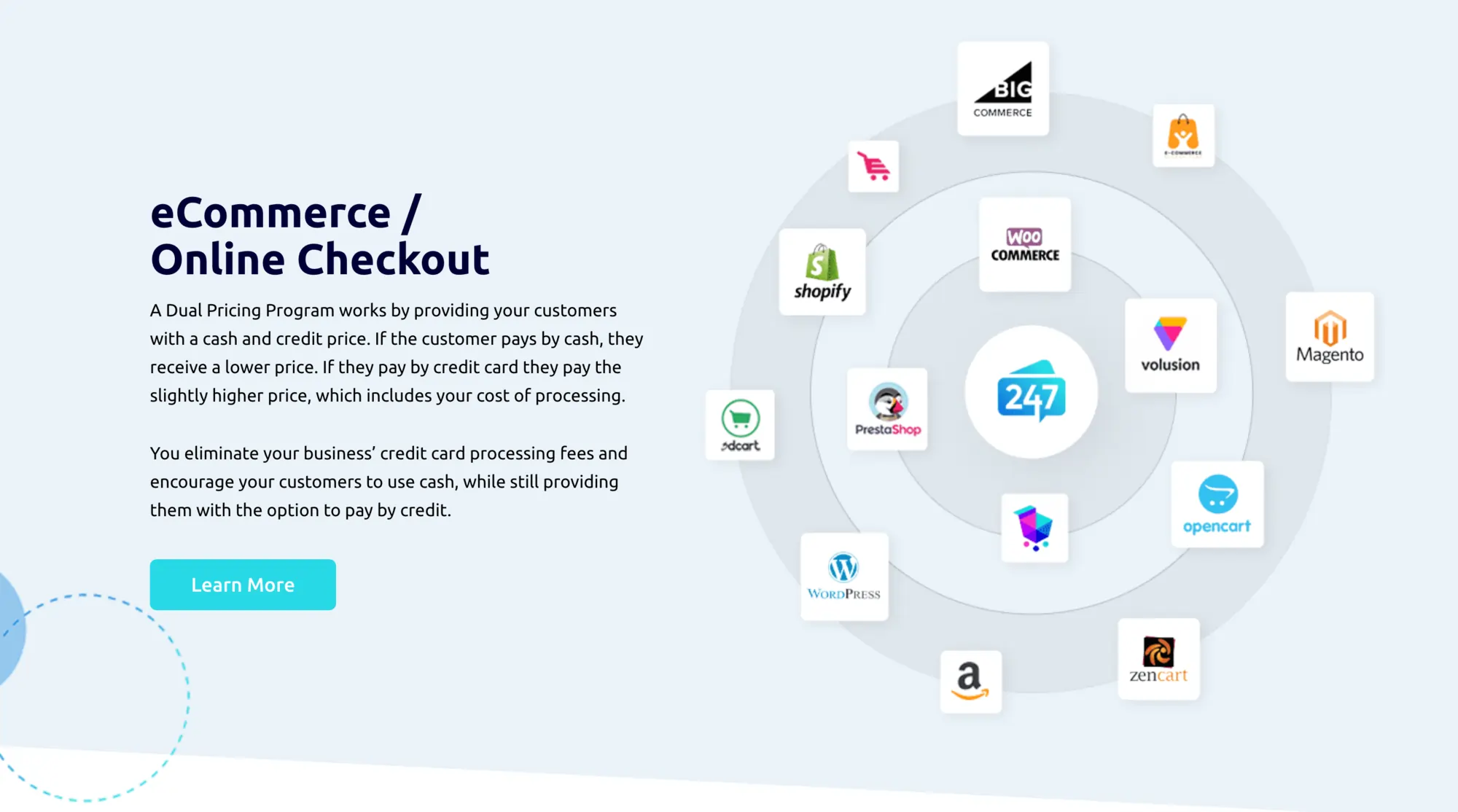

E-commerce and Online Checkout

247Payments offers online payment processing services for eCommerce transactions and allows for the integration of hundreds of useful APIs and apps.

It can integrate a 1-click shopping cart to help boost conversions, has instant fraud screening, and has a chargeback prevention program in place. 247Payments also supports numerous e-commerce payment methods, except for cryptocurrencies.

Mobile Payments

247Payments offers a mobile POS app that allows you to take payments directly through a phone. It can even accept a virtual card for online payment.

There is a dedicated app for iOS and Android users, giving people the ultimate flexibility when they are selling on the go. You can check real-time analytics and see your current inventory as you please.

Recurring Billing

I tried out 247Payments’ recurring billing feature, and it made payment automation seamless. Instead of manually processing repeat transactions, the system handles them automatically, saving time and reducing errors. This is especially useful for subscription-based businesses using online payment solutions and merchant services software to streamline operations.

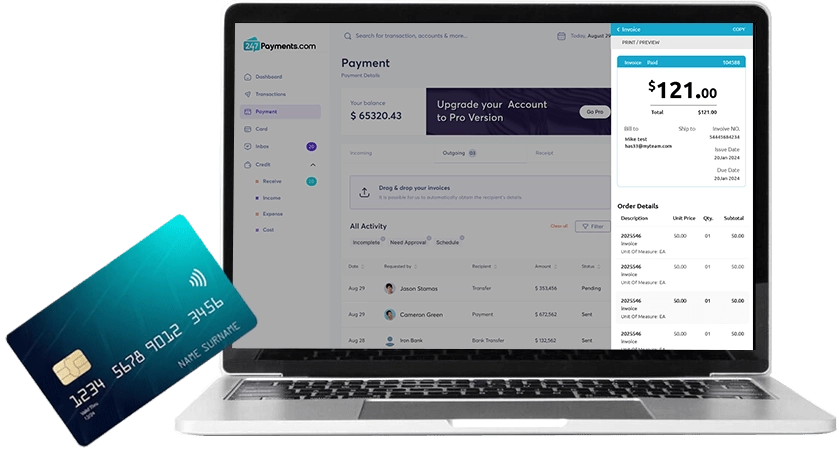

Custom Invoicing

When I explored custom invoicing, I found it flexible enough to accommodate different client needs. Businesses can personalize invoices with specific terms, branding, and payment options, making transactions smoother. You can customize invoices, set up recurring billing, and send payment requests via SMS, email, or QR code. This feature simplifies electronic check processing and virtual cards for online payment transactions.

Fraud Prevention Measures

Security is a major focus for 247Payments’ online payment platforms. All payment details are encrypted, and no data is stored on devices after processing. When I tested transactions, I saw that these fraud prevention measures add a strong layer of security for both merchants and customers.

Compliance Assistance

Staying compliant can be complex, but 247Payments’ payment systems help businesses meet tax and regulatory requirements. The system automates reporting and tracks transactions to ensure compliance, making it a great tool for businesses using online payment processing services that need accurate financial records.

Global Payment Capabilities

One thing I liked about 247Payments is its global reach. The platform supports 170 different currencies, allowing businesses to accept international payments effortlessly. If you’re looking for online merchant services that expand your customer base beyond local markets, this feature makes it easier to accept payments worldwide.

eCheck Processing

I tried out 247Payments’ eCheck processing, and it’s a great option for businesses needing secure online payment solutions. Merchants can accept electronic check payments directly from customers, reducing credit card fees. Transactions process quickly, and funds are deposited seamlessly, making it a reliable online payment processing service for various industries.

Customer Relationship Management (CRM) Integration

I tested CRM integration, and it worked well with leading CRM systems. This helps businesses automate customer interactions, track purchase history, and enhance personalization, making the e-commerce payment experience more efficient.

Chargeback Protection

Chargebacks can hurt businesses, but 247Payments’ chargeback protection is designed to minimize disputes. The system detects fraudulent transactions early and provides tools to dispute claims effectively. This feature helps businesses using merchant services software protect their revenue and maintain good standing with payment gateways.

Buy Now, Pay Later (BNPL)

247Payments allows merchants to offer customers an option to buy now and pay later for their purchases. The merchant will get the full sale and allow you to potentially capture more sales than you otherwise would. BNPL is a huge trend that is sweeping the young consumer demographic, and this option can boost sales tremendously.

Hardware & Software

Integrated tools for efficient merchant operations.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

Speed and Reliability

Payments process quickly, with transactions transferring to your bank account within 24 to 48 hours. This timeframe helps businesses maintain steady cash flow without long waiting periods. In my experience, payouts were consistent, and I didn’t encounter unexpected delays.

Advanced Analytics and Customizable Dashboard

The customizable dashboard makes it easy to track key payment insights, from transaction history to customer behavior. I liked how I could tailor the dashboard to show only the most relevant data, eliminating clutter and making decision-making faster.

Multiple Payment Methods

Businesses using 247Payments can accept credit cards, electronic check processing, and ACH transfers. This variety allows merchants to accommodate different customer preferences, improving the checkout experience.

Fraud Prevention and Data Security

Security is a major priority. 247Payments’ fraud prevention system helps detect suspicious transactions, and customer data is never stored on devices, reducing risks. When I tested different payment methods, I found security features running in the background without slowing down transactions.

Seamless Integrations

The platform supports third-party APIs and apps, making it easy to integrate with existing business tools. This eliminates the hassle of manually transferring data between systems and keeps everything running efficiently.

User Experience

From setup to daily use, I found 247Payments’ interface straightforward. The system runs smoothly, ensuring businesses and customers experience hassle-free transactions. It’s a reliable online payment solution for companies needing secure, flexible, and easy-to-use payment processing.

Ease Of Use:

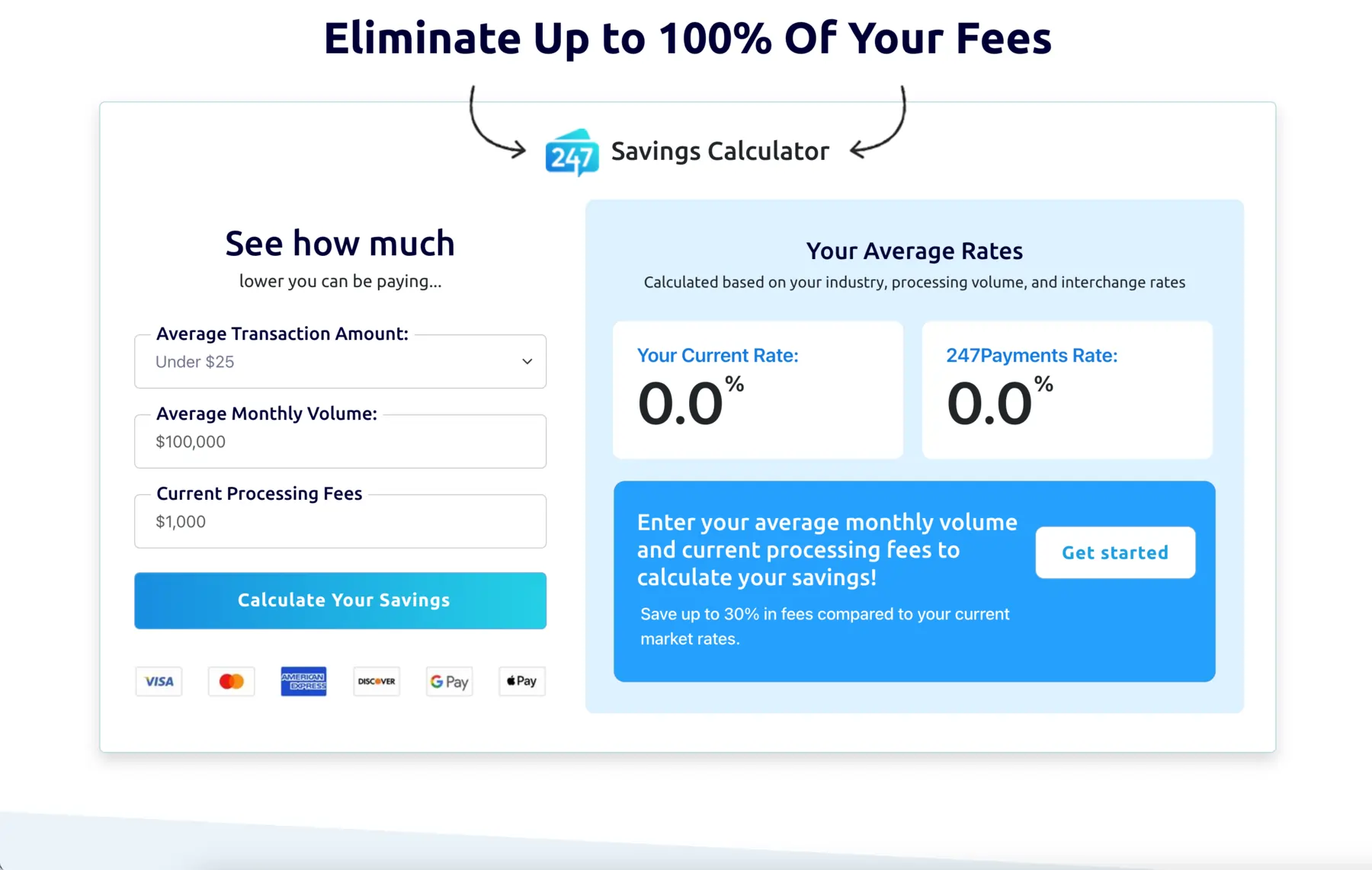

When I tested 247Payments’ merchant services software, I found the sign-up process simple and the platform easy to navigate. The website features a savings calculator that lets you input your average transaction amount, monthly volume, and current processing fees to see how much you could save. According to 247Payments, businesses can reduce fees by up to 30% with their online payment processing services.

Quick and Simple Onboarding

Getting started is fast and hassle-free. In most cases, businesses can start accepting payments within 24 hours, making it a great online payment solution for those who don’t want delays. If you’re running a larger business with multiple terminals, setup may take a bit longer, but mobile payment processing is even faster.

Straightforward Account Setup

To sign up, just fill out the form on the 247Payments website with basic business details. A representative will reach out to finalize the process, and once approved, your online payment platform will be ready to go. I found the entire experience efficient and well-structured, making 247Payments a great fit for businesses looking for seamless online merchant services.

The merchant service providor also has videos with tips on how to grow your business, and more. So you’re learning a lot from 247Payments:

Verdict:

247Payments is a great fit for the needs of most types of merchants as it offers very competitive pricing, top-of-the-line equipment, technology, and all sorts of great features.

The 24/7 support means that you can quickly get set up or resolve any issues, and the next-day payouts mean you’re not waiting too long for payments to process, resolving cash flow concerns. This is why 247Payments got such a high score across the board.