Bill.com Review 2025

Bill.com Accounts Payable Plans & Pricing

Bill.com Comparison

Expert Review

Pros

Cons

Bill.com Accounts Payable's Offerings

BILL has two plan options to manage how your business gets paid and makes payments. The essentials plan is $45/mo for each user, and the team plan is $55/mo for each user. Bill.com also has a corporate plan option for $79/mo for each user.

Customer Support

BILL claims to have live customer support Monday-Friday, however in order to get in touch with a specialist or an actual person instead of an automated system you have to submit a call request or schedule a 30-min meeting time slot to speak to a support specialist.

Email Support

After signing up for a 30-day free trial, I was greeted by an account representative that made himself available to any queries or issues I might have when using the platform. It was a nice welcome, especially as a free-trial user.

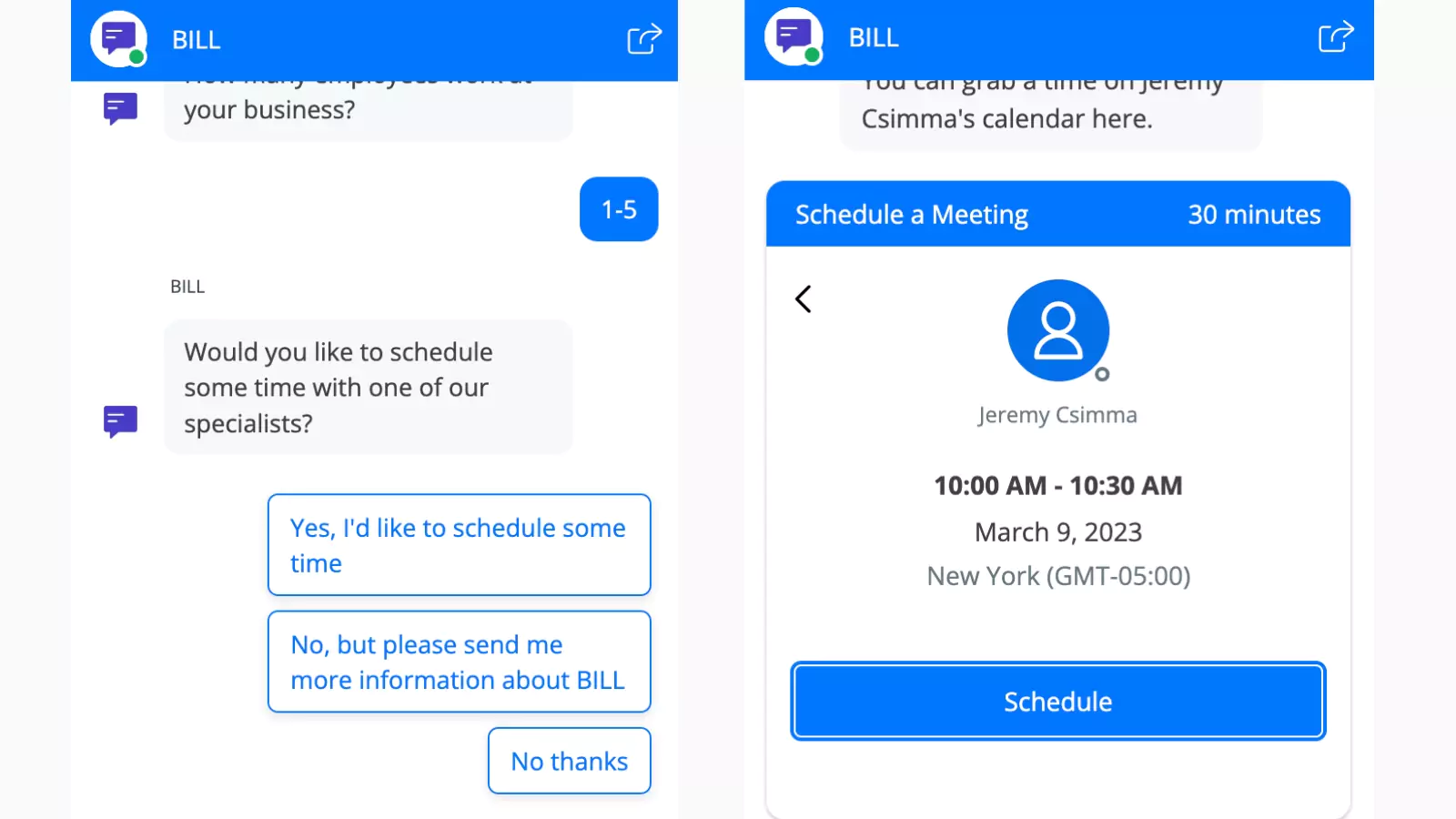

Chat Bot

I contacted BILL’s support via the live chat option and asked some questions about the software. They were helpful and answered my questions. They can only answer simple questions through the live chat automated system. You have to schedule a time to speak to a specialist, but unfortunately, there was no available time to speak to a specialist within the next two days.

Video Tutorials

BILL has many tutorial and demo videos on its youtube channel. They are very informative in explaining how the software works and how to perform the features and functionalities the software offers. They walk you through performing functions step by step with a video of their screen operations, which is easy to follow.

Overall Experience

The customer support at BILL was very informative and helpful in answering all of my questions. I was quickly put in touch with a specialist through the live chat option on the website and the customer support phone number.

Features & Functionality

General Features

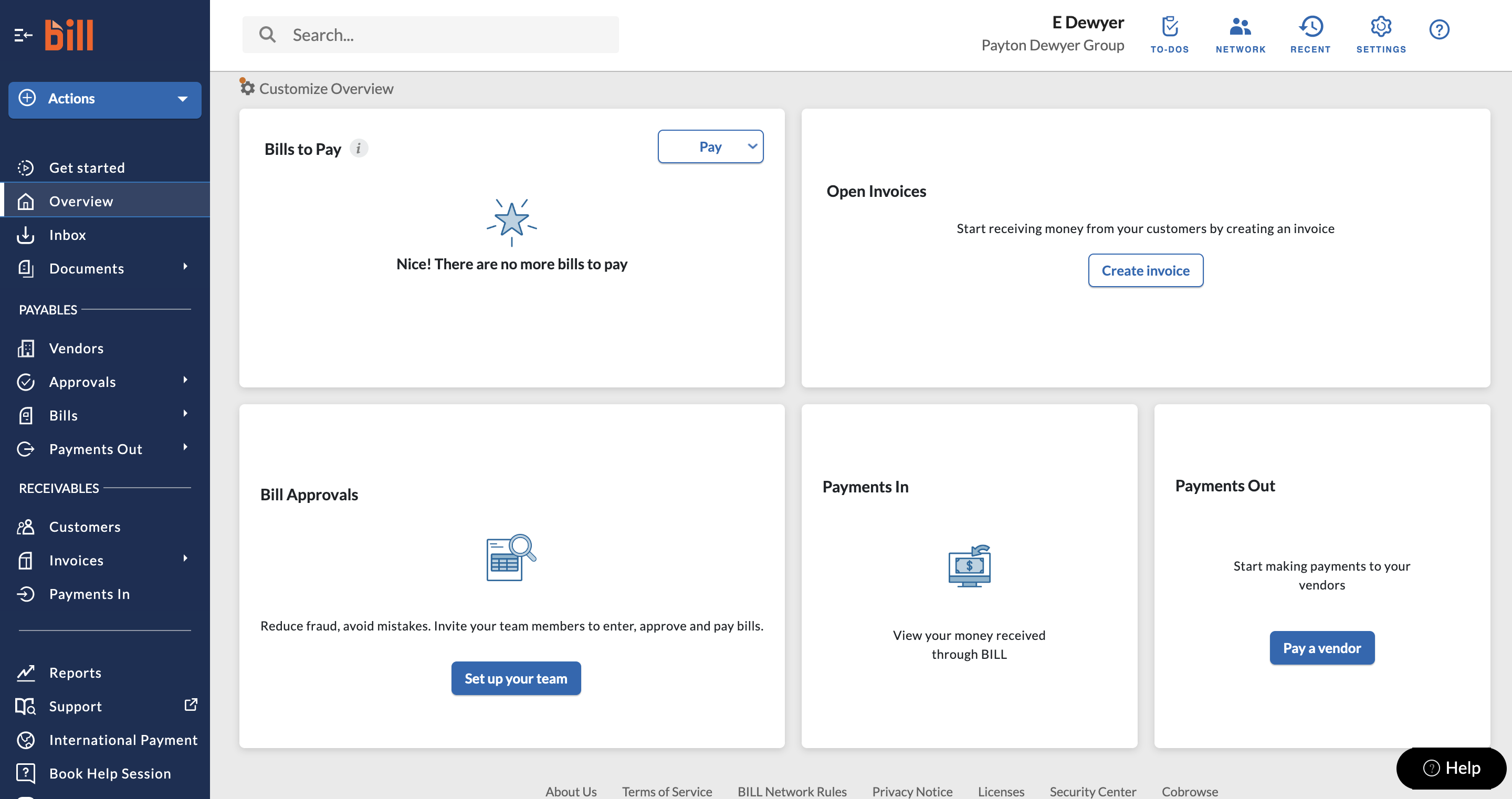

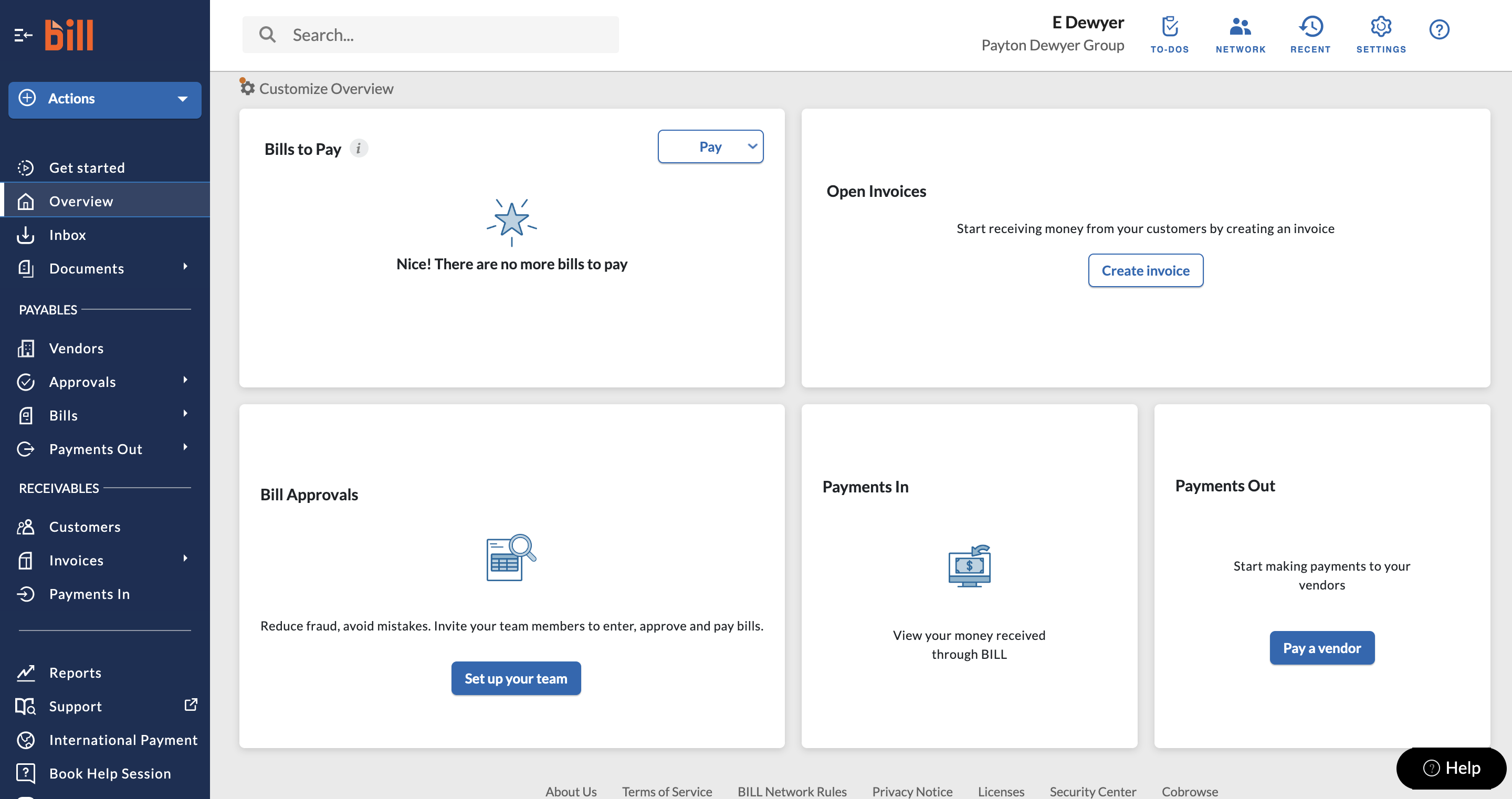

Account Dashboard

BILL’s account dashboard has a user-friendly layout with well-placed links to all features. It’s also very easy to navigate and find what you’re looking for.

Integrations

BILL integrates with QuickBooks Online, QuickBooks pro/premier, and Xero. They have many integrated features such as a centralized inbox, invoice data capture, invoice templates, unlimited document storage, auto-charge and auto-pay, and automated email reminders.

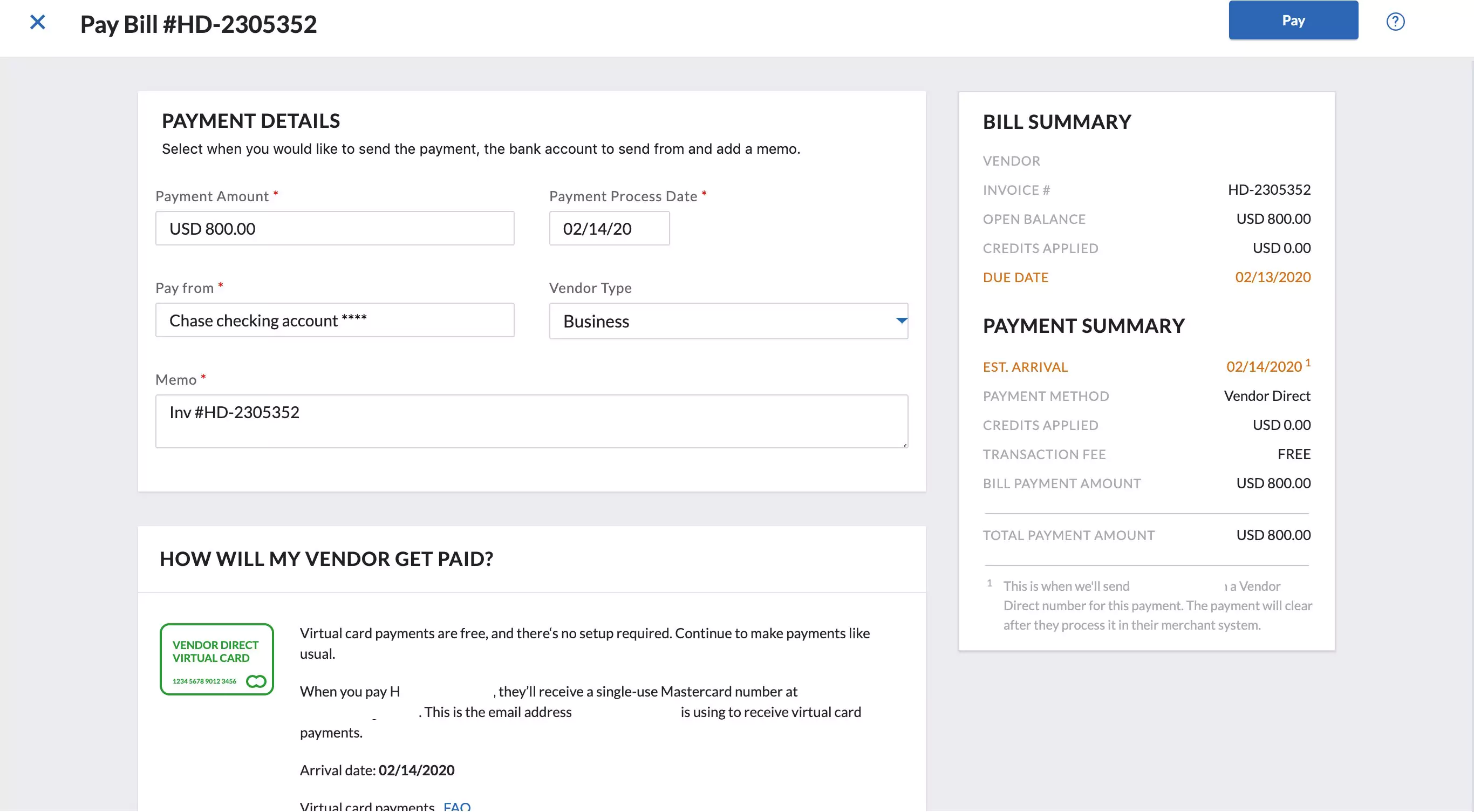

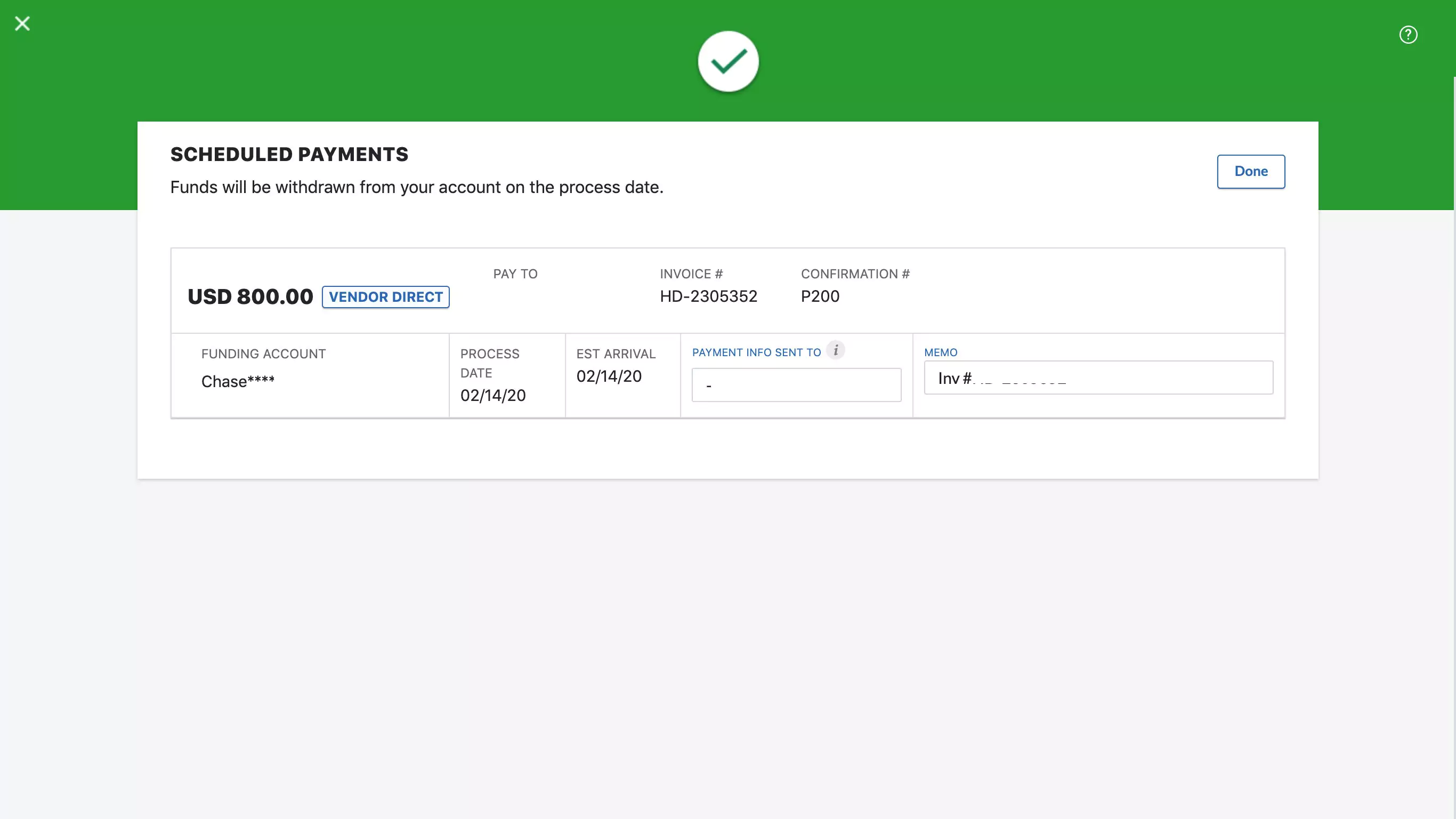

Payment Features

Making payments through through BILL is easy, and you can pay overseas vendors in US dollars or in their local currency. You can link either a credit card, debit card, or bank account to make payments on BILL. You can set automated payment approvals and also schedule payments at future dates. You can also upload, save invoices and pay them later, or email invoices to your account on BILL for easy filing.

Invoicing Features

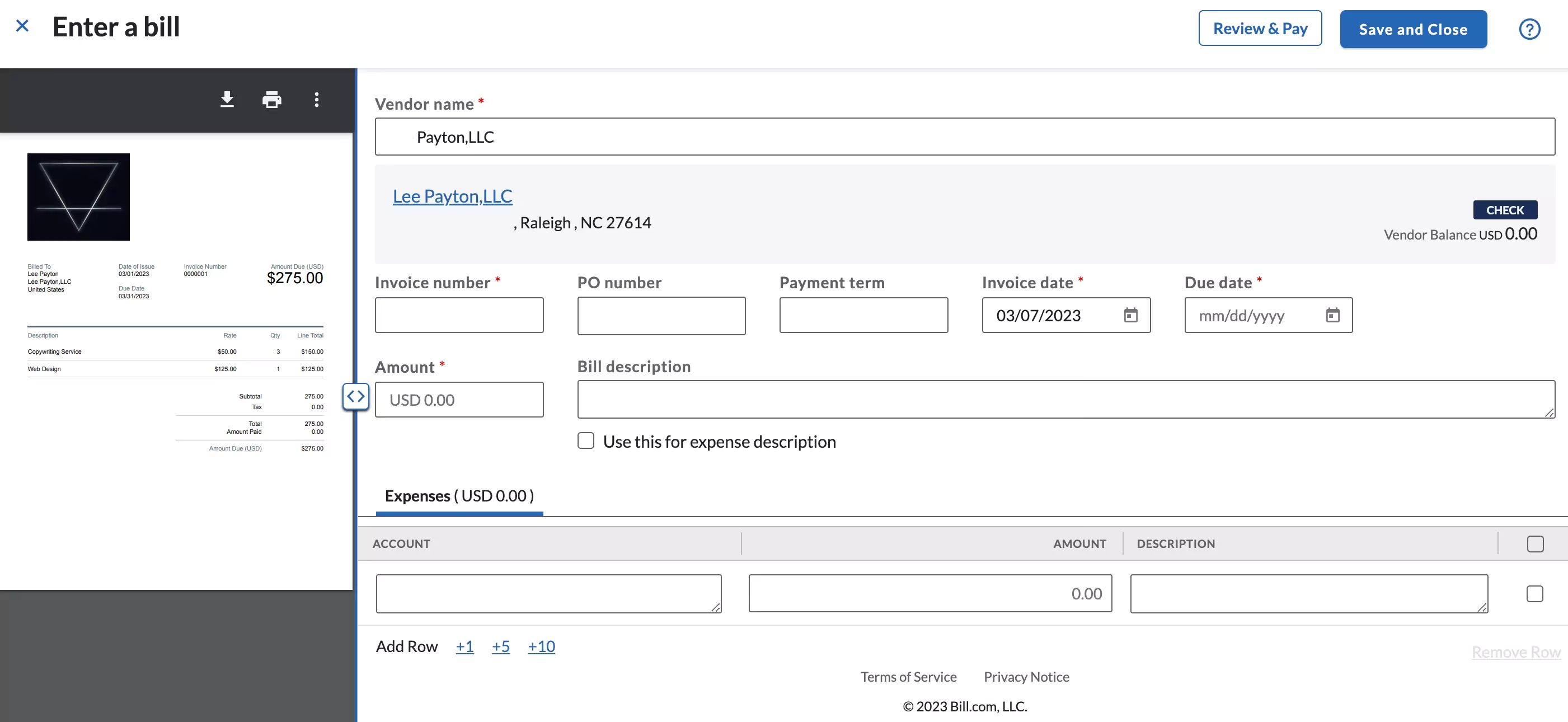

Invoice Importing

You can easily email invoices to your account on BILL, where it will file them for you in one location. “Iva,” the AI integration also captures information on your uploaded or emailed invoices like date, amount, bill information, and vendor information.

You can also import invoices on BILL, and the software will pull data from your invoices to keep a record of expenses and bills for your company. The pulled data integration built into the BILL software works well and can organize your bills and expenses. With BILL it’s also easy to set up your account and auto-pay your bills. You can save them and pay one (or multiple invoices) on the spot or schedule them for a future time.

Here’s a video showing you how:

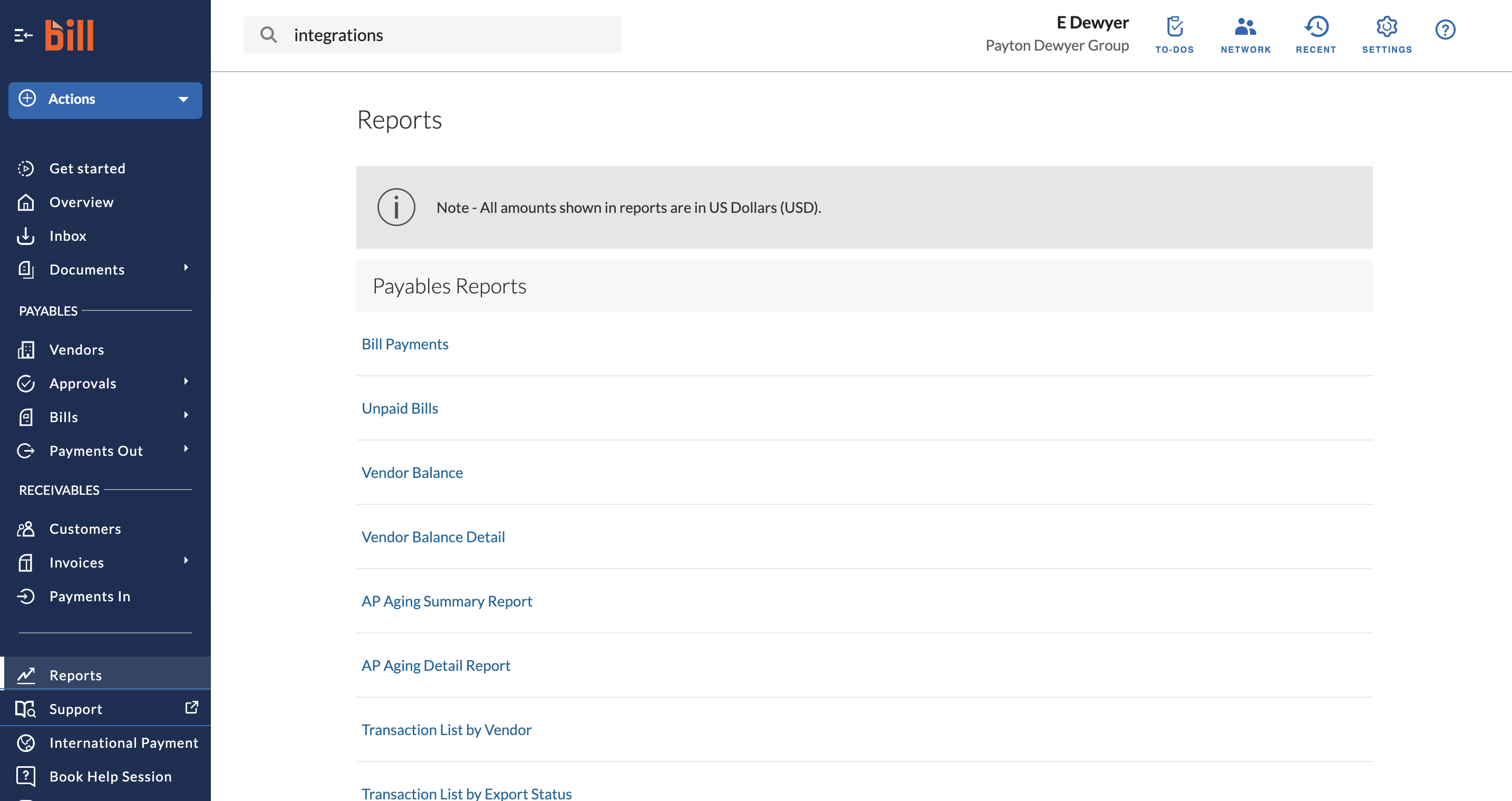

Reporting & Analytics Features

Reports

Payable reports available include bill payments, unpaid bills, vendor balance, vendor balance detail, AP aging summary report, AP aging detailed report, transaction list by vendor, transaction list by export status, bill approval audit, funds transfer for BILL payments, unrealized foreign exchange gain or loss, & foreign currency paid gain or loss.

Ease Of Use:

Overall Experience

BILL.com was fairly easy to use. However it’s not the easiest to find all the features and functions on the platform until you familiarize yourself with the software. Overall my experience with BILL was positive, and the functions offered by BILL operate as needed.

Use Cases

Searching and paying vendors is easy in the BILL platform. It was not difficult to schedule future payments and approve payments. BILL has customized reports but it was a little challenging to find at first.

Setup BILL Account

BILL’s sign-up process is simple and requires your email, password, name, business name, and address, as well as other information about your business. They also send you a text message with a 4-digit verification code to finalize account setup. Bill is a great accounting software that integrates with other software to help you manage and maintain your business expenses and payments. It also has integrated pull data for uploading invoices.

This video will show the easy setup process on Bill:

Dashboard

The dashboard on BILL is easy to use and payables and receivables are segmented in the platform. Its also easy to find and use the software’s many integrations. You can upload invoices, add vendors, and send bills or invoices to clients as well as view your reports from the dashboard.

Verdict:

BILL is great for any small to mid-size company looking for accounts payable software with all the features necessary for tracking your business at an affordable monthly rate. BILL integrates with QuickBooks, and has approval workflows, making it easy to control your payables and avoid fraud. Another plus, BILL takes care of all check mailing and ACH payment processing. Overall, BILL is one of the better quality accounts payable softwares, and provides a wide variety of features at an affordable rate.