Bill.com Review 2025

Bill.com Accounts Receivable Plans & Pricing

Bill.com Comparison

Expert Review

Pros

Cons

Bill.com Accounts Receivable's Offerings

Bill.com offers four pricing tiers: Essentials ($45/month), Team ($55/month), Corporate ($79/month), and Enterprise (custom pricing).

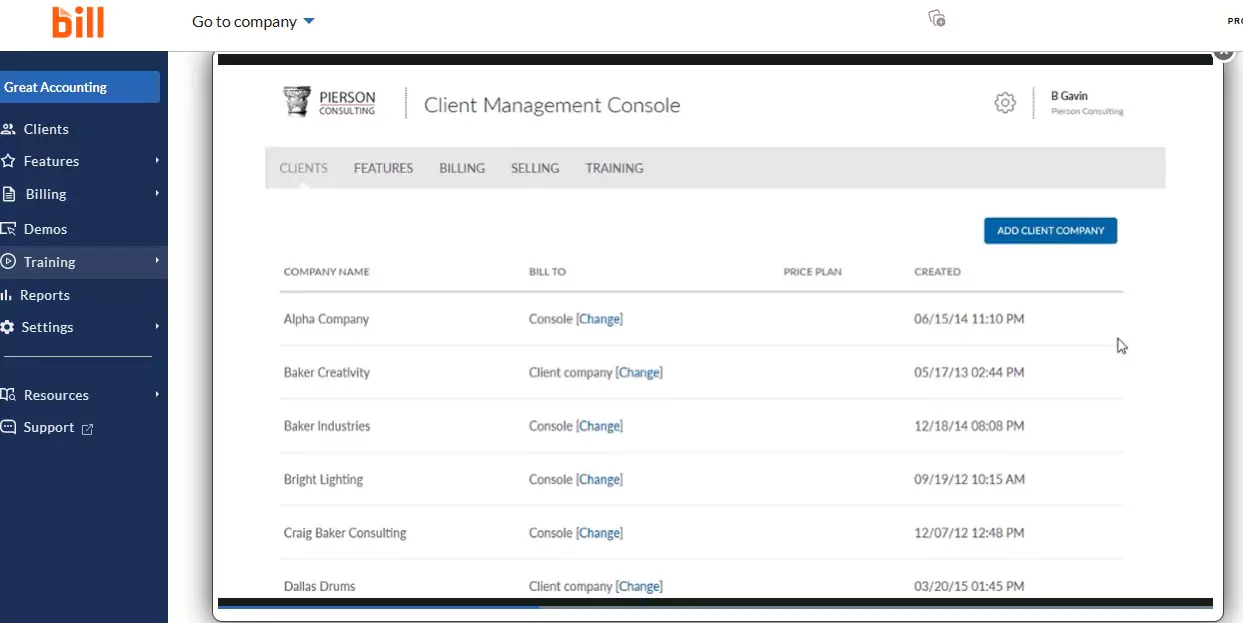

The Essentials plan includes accounts receivable or payable management, approvals and sign-offs, import/export of select data, and email/chat support. The Team plan adds custom user roles and integration with QuickBooks, QuickBooks Online, and Xero. The Corporate plan manages both accounts receivable and payable, while the Enterprise level integrates with midrange accounting solutions like Oracle NetSuite and Sage Intacct.

Customer Support

Bill.com offers live resources to assist customers, including a live support chat available from 5am to 6pm PST, Monday – Friday. They also provide support options such as a Resource Center (and one specific to accountants), a Learning Center, both with detailed articles and recommended reading and demos, as well as blogs, FAQs, and customer stories.

Live Chat

On Bill.com’s website, you can access the live chat feature throughout the site’s interface during weekdays from 5 a.m. to 6 p.m. PST.

Overall Experience

Bill.com offers a wealth of detailed and informative resources across various channels and learning modalities. Its Learning Center features comprehensive articles, blogs, and webinars that are easy to navigate and highly useful. However, to address urgent inquiries or those not covered in the resource centers, it would be advantageous for Bill.com to offer more live support options.

Features & Functionality

General Features

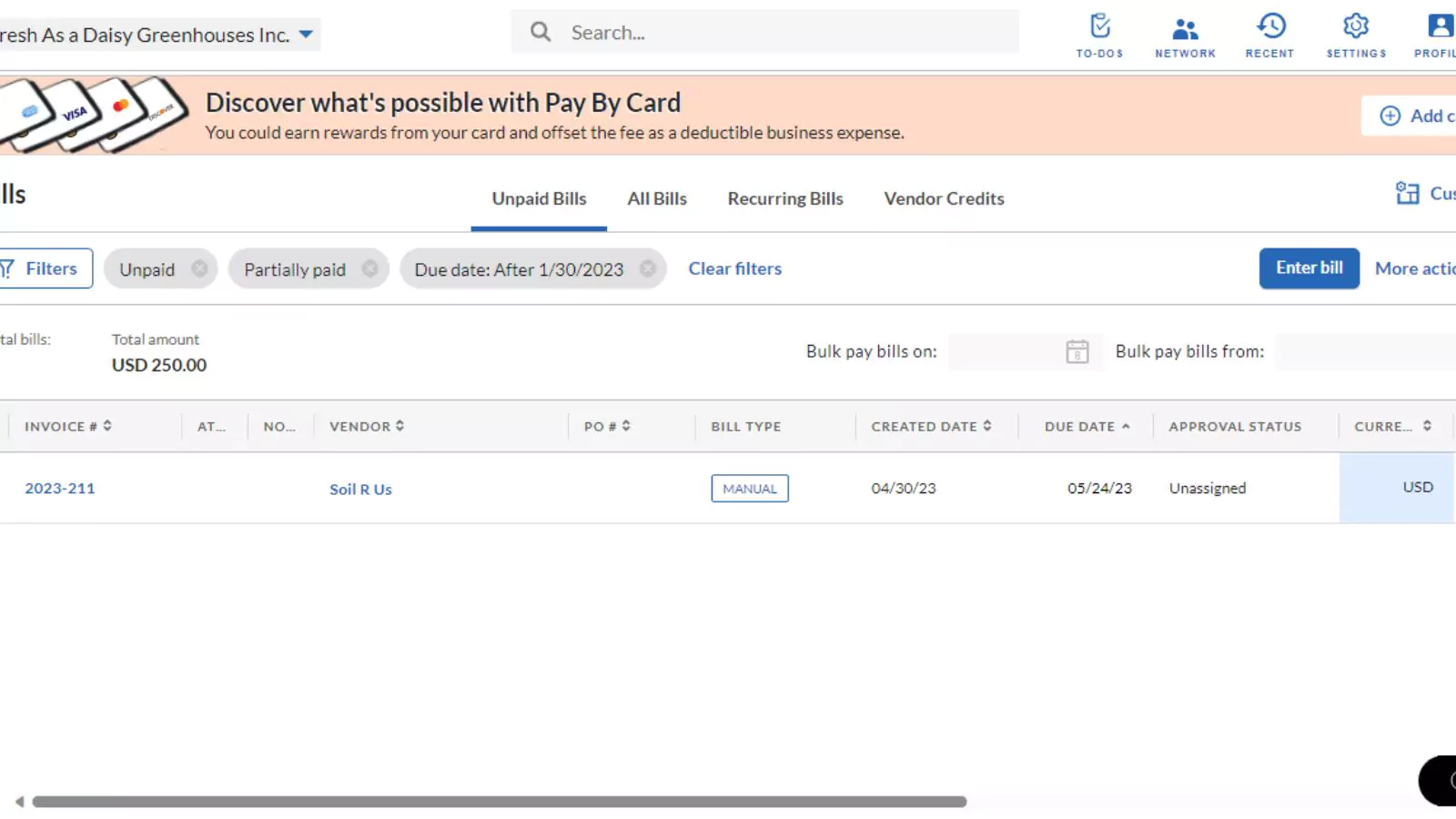

Bill.com provides several features to help individuals and businesses streamline their financial processes. One of the main benefits is Smart Automatic Data Entry, which saves time by eliminating the need for manual data entry. Additionally, the platform offers Smart Detection, which can detect duplicate entries and prevent human data entry errors.

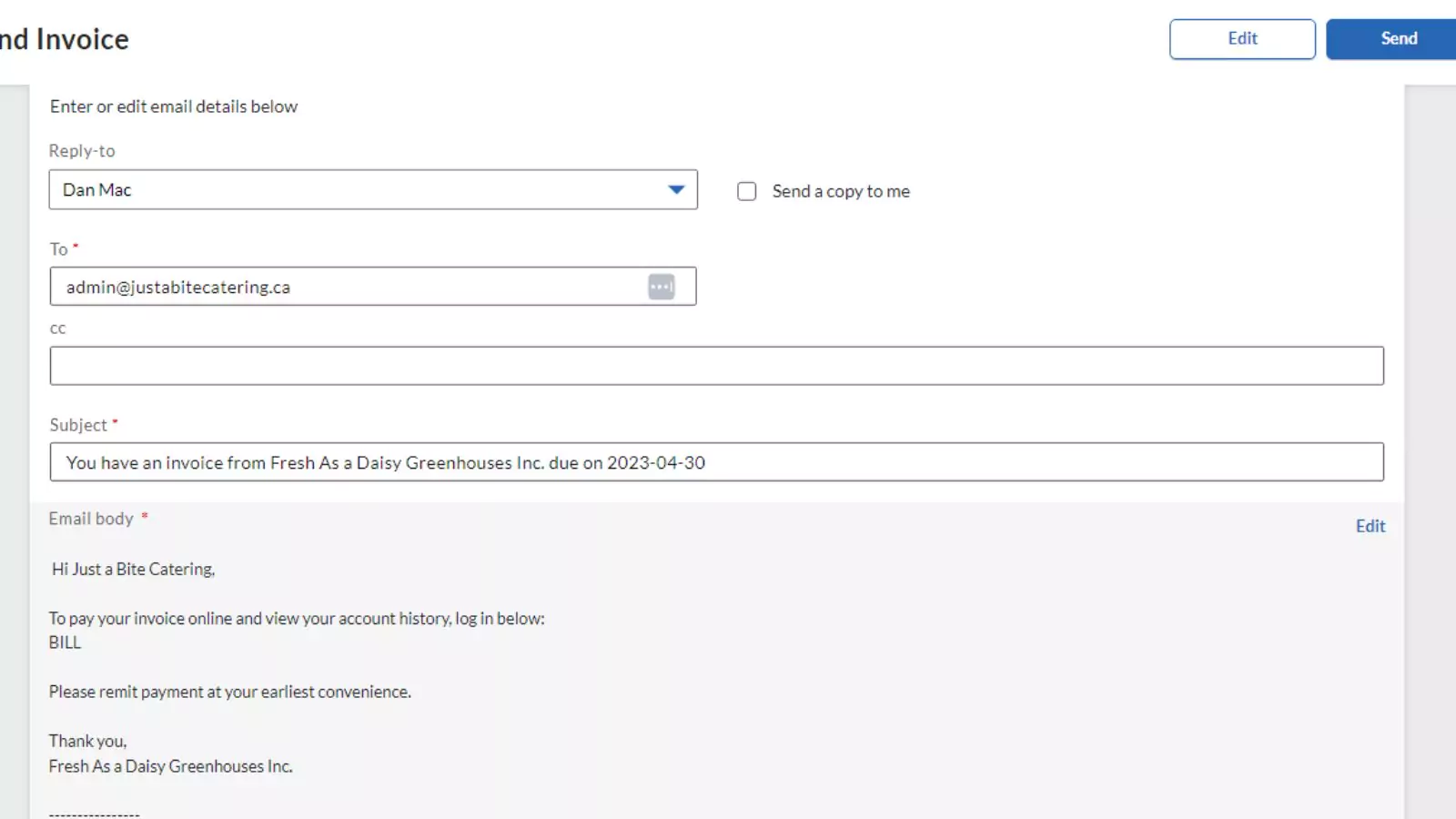

Another key feature is the cloud service, which provides real-time information about financial transactions. Payment flexibility is also available through ACH, virtual cards, and more. Users can also schedule and record bill payments, as well as send email invoices and reminders.

Bill.com also provides detailed training and learning modules to help users navigate and set up their accounting processes.

Automation Features

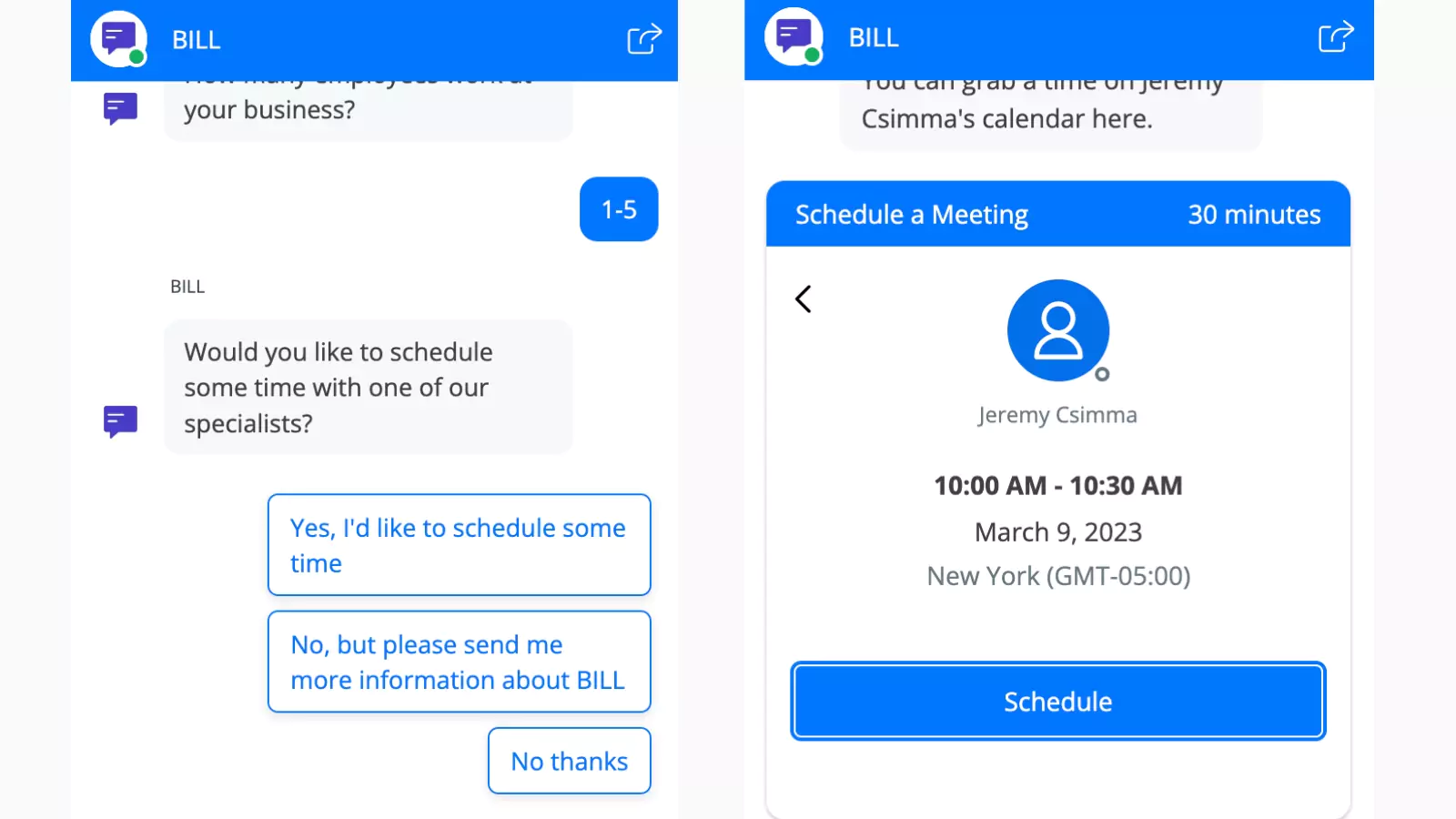

Bill.com offers automated tools for sending invoices, following up on past due payments, receiving payments, and paying suppliers. Businesses can create and send invoices directly from the platform, and customers can make payments online through various payment methods.

Additionally, Bill.com can automate payment reminders and provide real-time updates on payment status, allowing businesses to stay on top of their cash flow. On the supplier side, Bill.com enables businesses to easily track and manage their bills, schedule payments, and automate approvals.

Reporting & Analytics

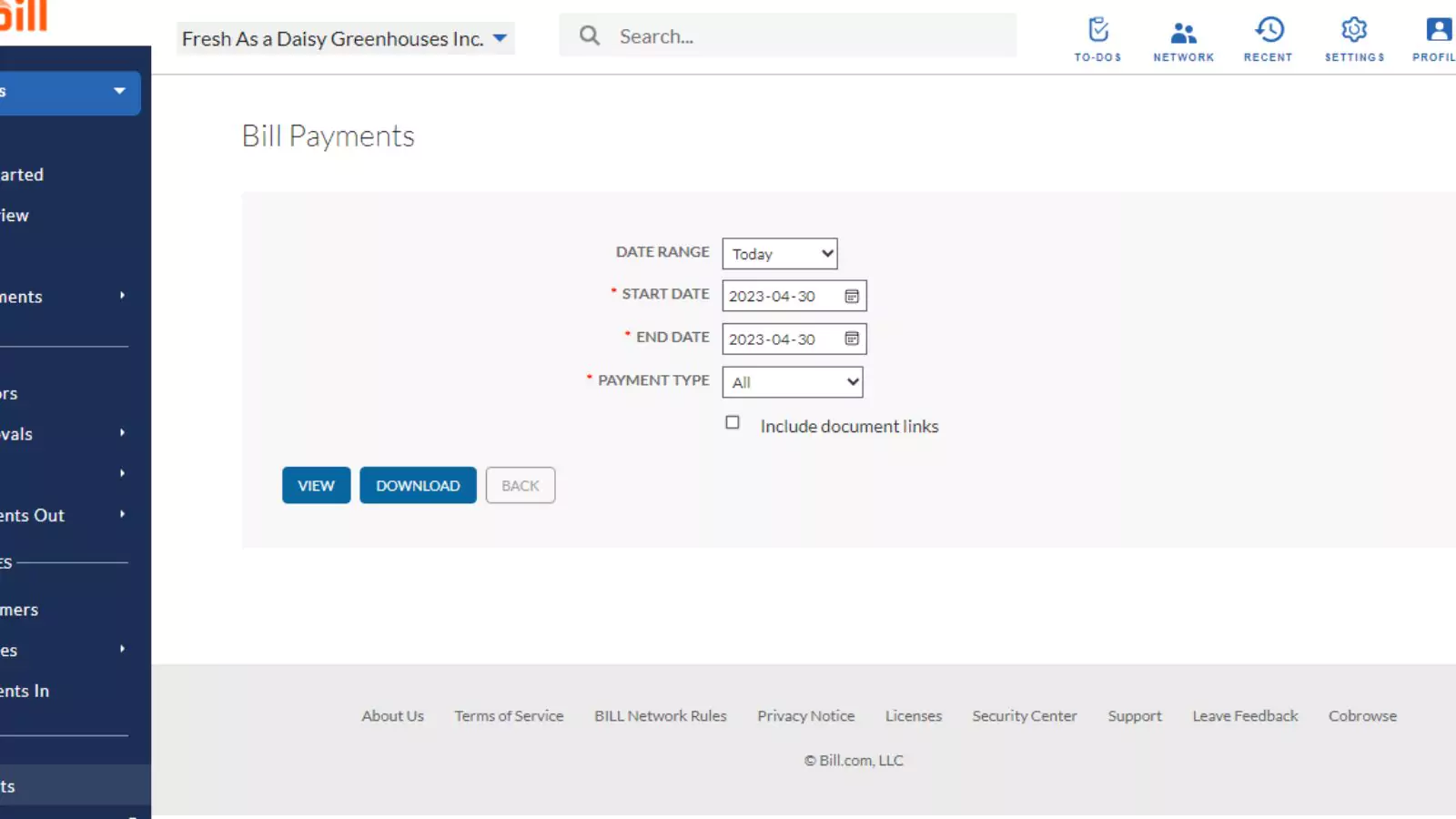

Bill.com is a platform that enables users to manage their financial transactions, including electronically managing all payments and receipts. As part of its features, Bill.com provides users with the ability to export data in CSV format. Once a user has set their preferences on the platform, they can easily extract data on payments and transactions and convert it into a CSV file format, which can be useful for accounting and financial analysis.

Cash Flow Features

Bill.com helps users monitor their business operations by providing detailed reports, timely, cloud-based invoicing services, while accepting multiple forms of payment. The software utilizes automation and online payments which can also increase profitability as a long-term strategy.

Integrations & Add-Ons

Bill.com offers automatic two-way sync that enhances efficiency by ensuring that your accounting system and BILL have current and accurate information. With automatic sync, you can avoid manual errors that may arise from double entry, as payments made in BILL are synced automatically. This feature saves you time and minimizes the possibility of errors.

Additionally, syncing critical payment data with matching invoices enables faster reconciliation, and you can access transparent remittance information for all transactions.

Ease Of Use:

When you first log in to Bill.com, you will be required to undergo multi-factor authentication, which involves entering a code sent to you via either phone or text. Additionally, you must verify your email address before proceeding with the setup process. Once these steps are completed, you will be prompted to link a bank account and add a team member, enabling you to generate your first payment. The platform’s dashboard has a user-friendly layout, making it easy to navigate, and the features are both straightforward and easily accessible. Moreover, there are numerous informative articles and blogs available to provide guidance on how to use each feature.

Create Invoice

Thanks to its user-friendly interface, generating invoices is a straightforward process, with fields arranged in a logical sequence.

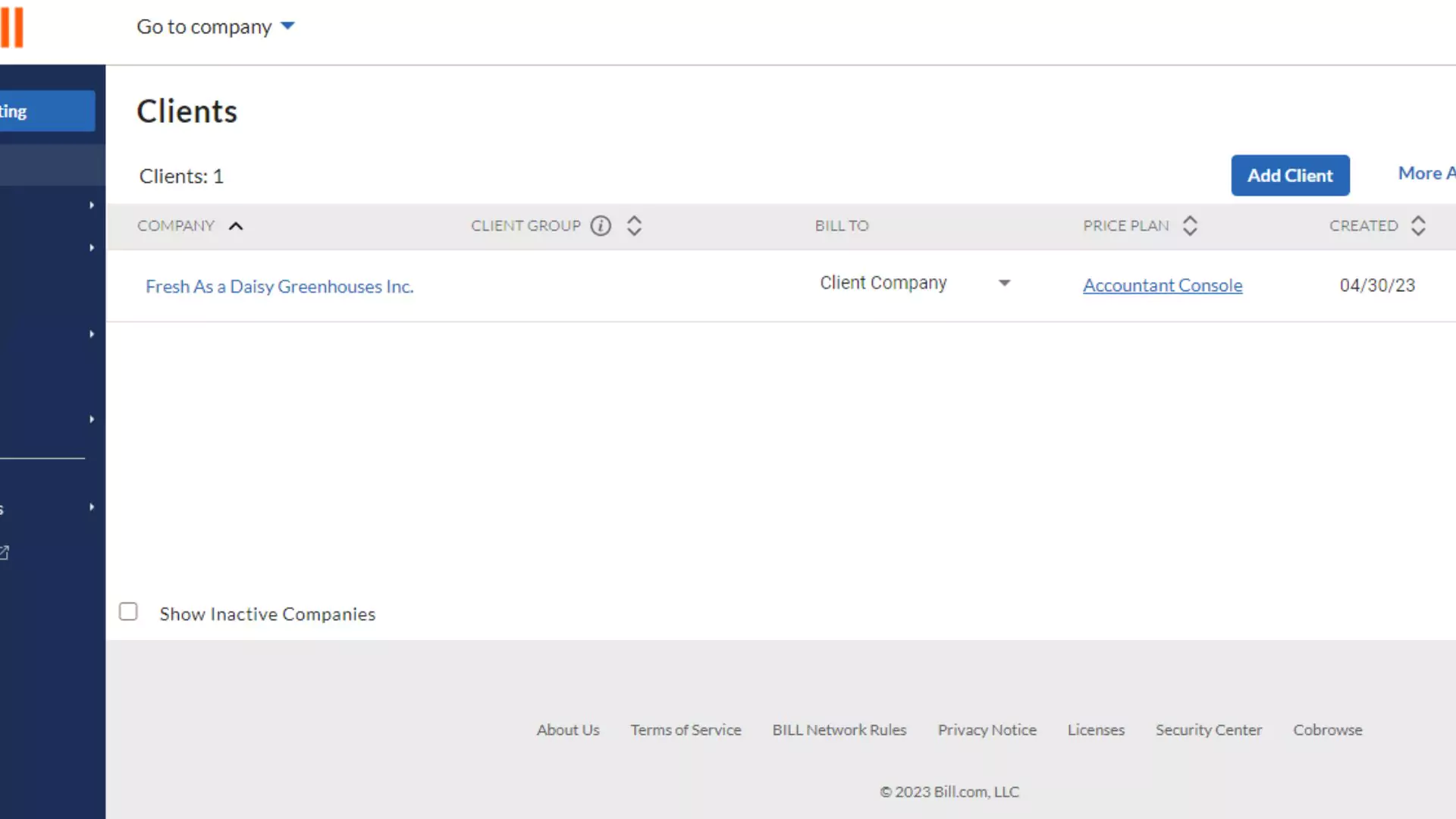

Find Client

Bill.com users can create customer records, and it’s possible to include extra contacts in a customer’s file, which allows for communication with and billing to multiple individuals associated with that customer.

Customize Reports

Bill.com does allow users to export data into a CSV format (such as payments and transactions) once you’ve set your preferences.

Verdict:

Bill.com is an online accounting service that offers advanced workflow automation for accounts payable and receivable. It allows businesses to import bills and convert them into electronic records, which can be approved and paid electronically or by paper check. Invoicing is also simple. It can be used as a standalone application or integrated with accounting solutions like QuickBooks Online or Xero for transaction synchronization.