Kibo Pay Review 2025

Kibo Pay Merchant Services Plans & Pricing

Kibo Pay Comparison

Expert Review

Pros

Cons

Kibo Pay Merchant Services's Offerings

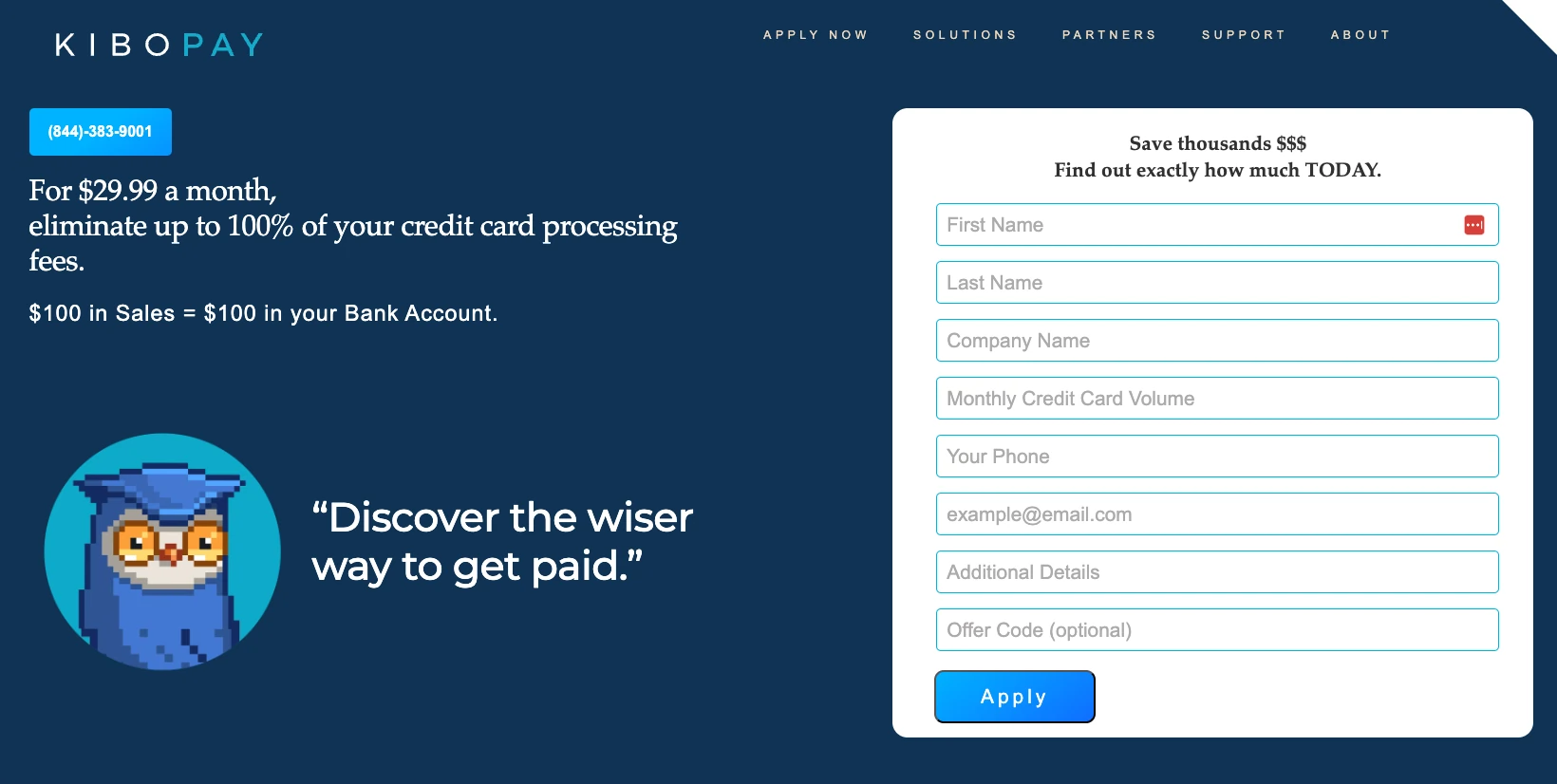

Upon some research, I found that Kibo Pay merchant services pricing plans advertise one option for users at $29.99 per month.

Users pay the monthly premium for Kibo Pay merchant services software, which eliminates their credit card processing fees and unlocks access to Kibo Pay eCommerce services.

Kibo Pay offers new users a free trial of the software by filling out a request on their website or calling the customer support number to apply for a trial subscription. Kibo Pay has zero cancellation fees and no signup contracts.

Customer Support

I researched the support options and found that Kibo Pay offers two main ways to contact customer support: Their phone number (844) 383-9001, and support email support@Kibo Pay.com can be found very easily on the company website.

Kibo Pay does not offer 24/7 customer support, nor does it offer live chat support. Phone support is by far the fastest way to reach a live representative for assistance. Kibo also has a dedicated YouTube channel with many helpful videos.

Phone Support

When I called, the Kibo Pay phone support was very helpful. A customer service representative answered the phone quickly, and there was no automated system that gave you the “runaround” before actually connecting you to someone.

They answered my questions very clearly and gave me more in-depth information about the features. Although they try to upsell you to sign up, they will offer you a free 3 month trial of the software before you have to start paying for it. You may have to add a payment method on file in order to start the merchant software free trial.

Email Support

I emailed Kibo Pay support with a couple of questions about the software and did not receive a response after 24 hours. However, as I have stated above, the phone support option will connect you with someone from customer support within 5 minutes or less.

Features & Functionality

General Features

Kibo Pay merchant services software offers a set of features for small businesses that need payment processing solutions. Here are some of the software’s key features:

- Dual pricing option

- Point-of-Sale (POS) Hardware & Software

- Free payment processing equipment

- No setup or cancellation fees

- Customized Processing Solutions

- Versatile Payment Gateways

- Invoicing, Reporting, & Analytics

- Next-Day Funding

- Recurring Billing & Subscription Management

- Loyalty Programs

- Fraud Detection & Security Tools

Kibo Pay provides a range of payment processing services designed to eliminate up to 100% of credit card processing fees for businesses. Businesses can avoid these processing fees by paying a monthly fee of $29.99, allowing them to receive the full amount from their sales.

I’ll go into detail about some of the most important features:

Dual Pricing Option

When I tested Kibo Pay’s online payment processing service, I found its dual pricing model to be a valuable cost-saving feature. Businesses can offer two different prices—a lower rate for cash payments and a slightly higher price for credit card transactions to cover processing fees.

This e-commerce payment method can help eliminate up to 100% of credit card processing fees, potentially saving businesses thousands of dollars annually. Kibo Pay provides a free, pre-programmed terminal, making implementation easy.

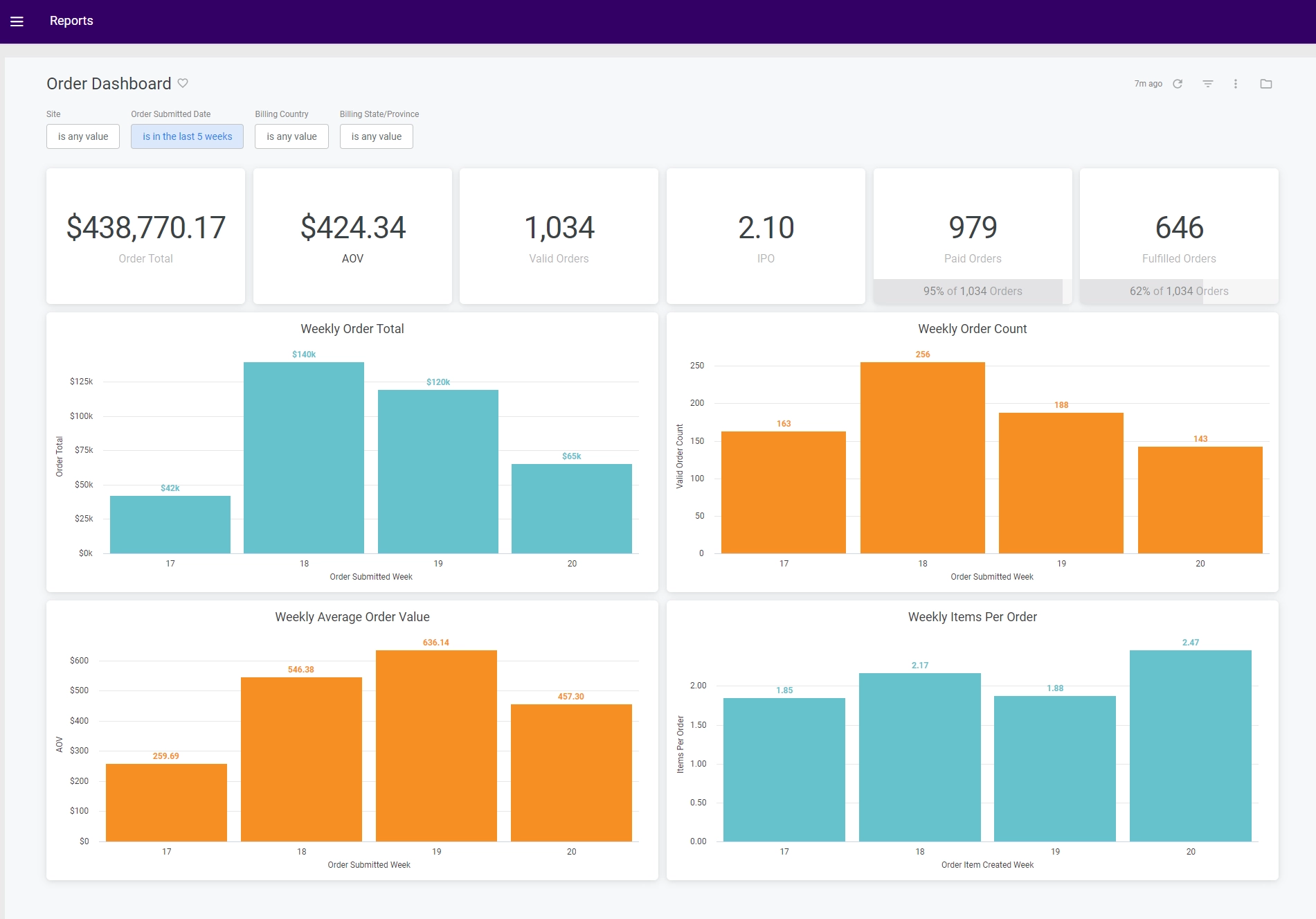

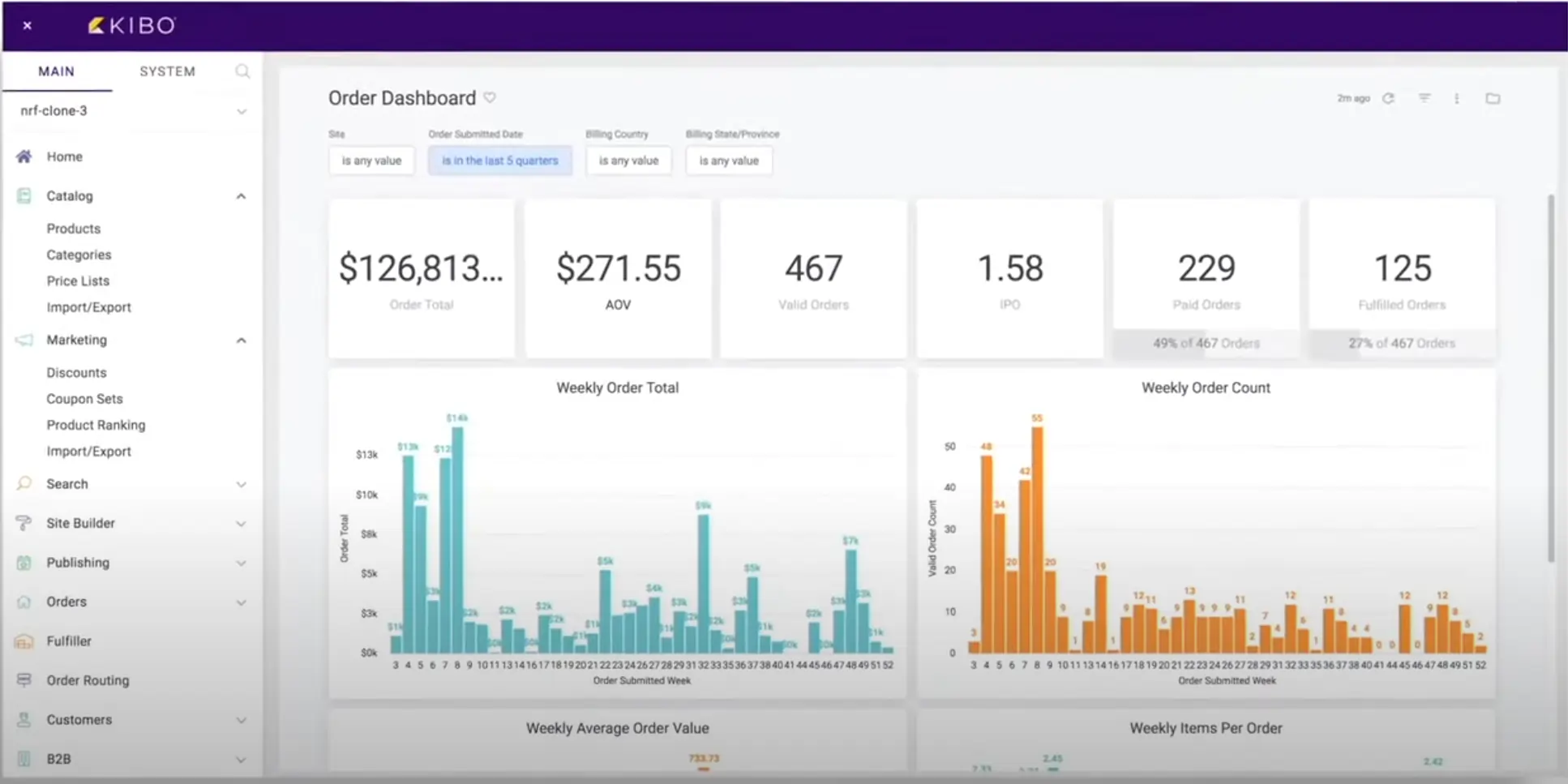

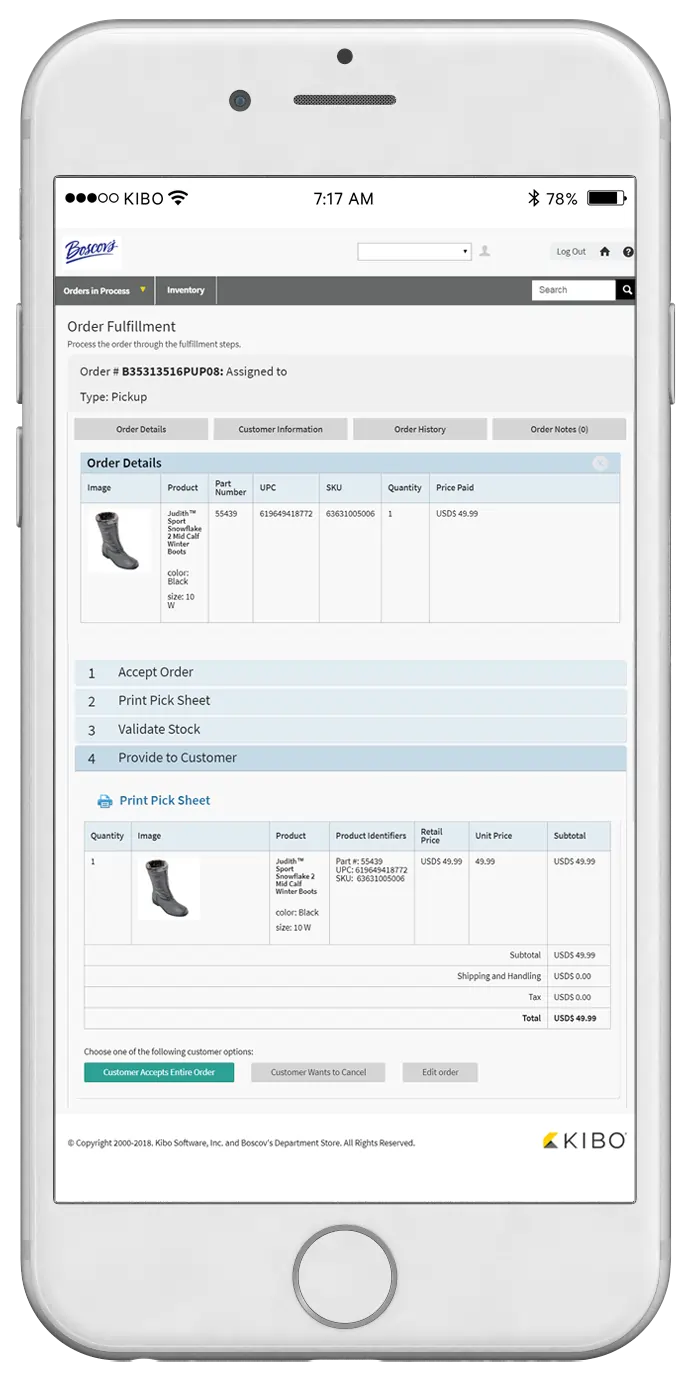

Order Dashboards

I found the Kibo Pay order dashboard useful for managing transactions in real-time. Businesses can track pending, completed, and refunded payments from a single interface. The dashboard integrates with online payment solutions, providing insights into e-commerce payment methods and streamlining order processing for online merchant services.

Traditional Credit Card Processing

For businesses preferring standard online payment solutions, Kibo Pay’s payment gateway also supports traditional credit card processing, ensuring flexibility in transaction methods while maintaining secure and reliable payment processing.

Point-of-Sale (POS) Hardware & Software

Kibo Pay merchant services tool will improve your efficiency and boost profitability with a customized point-of-sale solution for every industry. Free POS equipment is included with Kibo Pay merchant services. Members also get safe, secure, fast e-commerce payment methods and software with an online inventory catalog all through Kibo Pay’s online account management portal.

Customized Processing Solutions

Kibo Pay’s team will create a customized processing solution designed to fit the needs of your business. They have a processing solution for every industry, restaurant, bar, bridal, beauty & nail, auto repair, coffee houses, food trucks & pop-ups, e-commerce, floral, gas stations, B2B large transactions, convenience & grocery, or dental & medical.

Versatile Payment Gateways

Kibo Pay allows businesses to accept payments in-store, online, and via mobile. When I explored its e-commerce payment methods, I found it supports major credit cards, including American Express, Discover, Mastercard, and Visa. A customer service agent mentioned that Kibo Pay is still expanding its e-commerce merchant services software. The platform also supports electronic check processing and allows customers to use a virtual card for online payment, providing flexibility for different transaction types.

Invoicing, Reporting, & Analytics

I found the Kibo Pay invoicing and reporting tools useful for tracking business performance. The platform allows businesses to generate invoices, manage inventory, and monitor transactions in real-time.

I explored the reporting and analytics features, which help businesses collect customer data, sales trends, and website traffic insights. These tools provide valuable insights for optimizing online payment processing services and improving overall financial management.

Kibo Pay has also stated plans to expand its platform with additional features, making it a growing merchant services software with evolving capabilities for businesses managing e-commerce payment methods.

Next-Day Funding

Kibo Pay offers small businesses an option to apply for working capital with next-day funding, providing a flexible solution for managing short-term cash flow needs. When you sign up with Kibo Pay, you are automatically pre-qualified for a working capital advance, which is based on your future sales.

This advance can be a great tool for businesses needing fast access to cash, as the funds are typically deposited by the next business day. Additionally, the repayment terms are flexible, with payments tied to a percentage of your sales, which means if your sales decrease, your payments do as well.

The merchant service provider also has no cancellation fees, no hidden fees, no set-up fees, and no term contracts for its online payment solutions.

Recurring Billing & Subscription Management

Kibo Pay’s e-commerce tool allows businesses to set up subscription options for products or services, providing you with a seamless way to manage recurring billing for your customers.

This online payment solution supports customizable subscription plans, enabling businesses to offer tiered pricing options and automated billing cycles, ensuring a smooth customer experience.

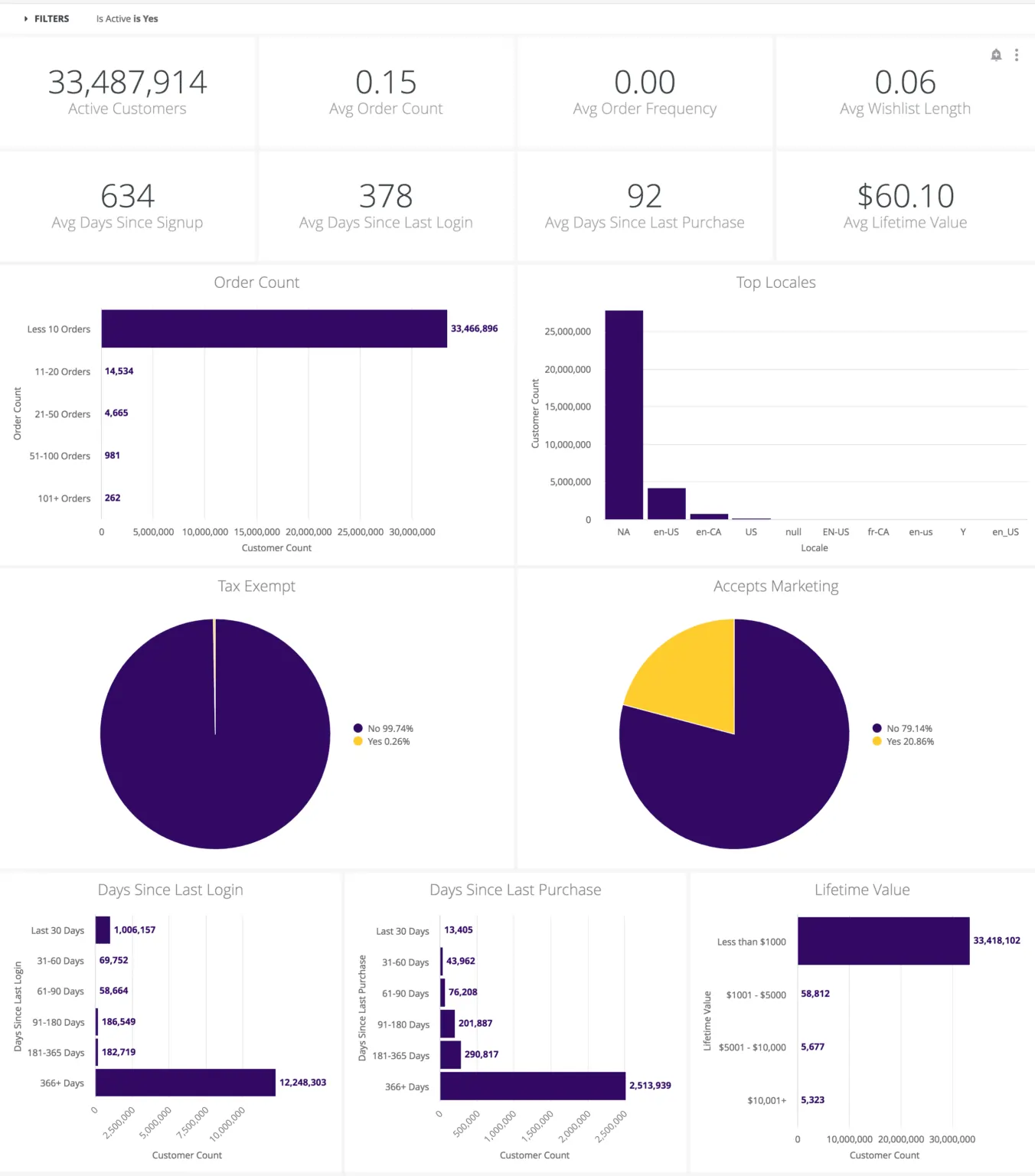

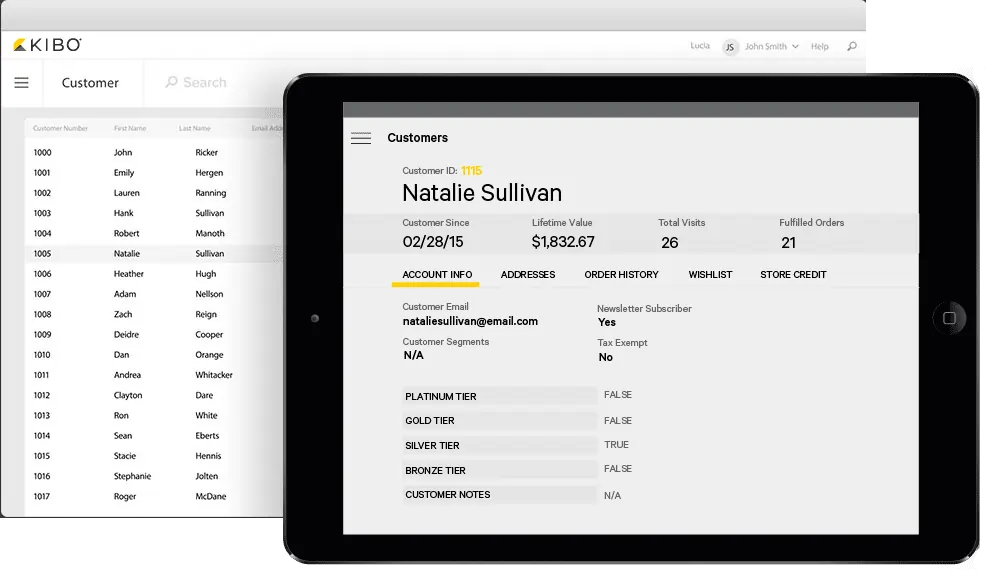

Customer Profiles

I thought the customer profile management tools were useful for retention and loyalty programs. Businesses can track purchase history, payment preferences, and transaction behavior, helping them offer personalized promotions and incentives. The system integrates with e-commerce payment methods, making repeat transactions seamless. This feature enhances online payment solutions by improving customer engagement and encouraging long-term loyalty through targeted rewards and offers.

Loyalty Programs

Additionally, Kibo Pay integrates loyalty programs that reward returning customers, helping businesses boost retention and customer satisfaction. By combining these features with real-time reporting and analytics, the merchant service provider empowers businesses to manage subscriptions while offering incentives to keep customers engaged efficiently.

Fraud Detection & Security Tools

Kibo Pay is PCI compliant, meaning it adheres to the strict Payment Card Industry Data Security Standards (PCI DSS), ensuring secure handling of cardholder data. In addition, Kibo Pay offers advanced fraud detection and security tools that help safeguard businesses from fraudulent activities and breaches. These features make Kibo Pay a safe and secure payment processing solution for all types of businesses, providing peace of mind for businesses and their customers.

Hardware & Software

Integrated tools for efficient merchant operations.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

I tried out Kibo Pay’s merchant services software, and found its transaction speed comparable to other online payment platforms. Payments process quickly, ensuring smooth transactions for businesses and customers. Kibo Pay is PCI compliant, which means it meets industry security standards. Additionally, the platform includes fraud detection tools that help protect against suspicious transactions, making it a secure option for online payment processing services.

Payment Methods and Mobile Wallets

Kibo Pay supports all major e-commerce payment methods, including American Express, Discover, Mastercard, and Visa. When I explored its online payment solutions, I found that businesses can also accept mobile payments through digital wallets. While the platform is still expanding, a customer support agent mentioned that Kibo Pay is actively working on adding new features to enhance its payment gateway offerings.

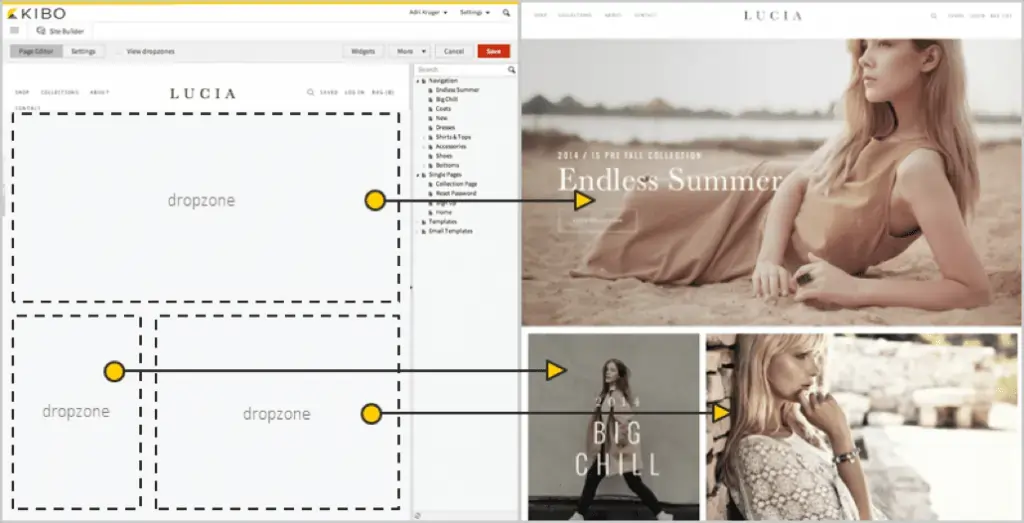

POS and E-Commerce Payment Platforms

The platform includes POS and e-commerce payment solutions within the user portal, allowing businesses to manage both in-person and online transactions from one system. When I checked out the platform on both desktop and mobile, I found it user-friendly and responsive. Whether customers access an online merchant service from a PC or mobile device, the interface adapts smoothly, ensuring a seamless e-commerce payment experience.

Ease Of Use:

User Interface and Dashboard

When I tested Kibo Pay’s merchant services software, I found the interface user-friendly and well-organized. The dashboard is designed for efficiency, making it easy to manage transactions, set up an inventory catalog, and oversee e-commerce payments. Even for users with no prior experience in online payment platforms, the navigation is intuitive. The ability to access payment gateway settings, transaction history, and customer details from one central hub streamlines business operations.

Onboarding and Setup Process

If you’re a new user, you must apply for a demo or speak with a representative over the phone. When I requested a demo, the form was simple to complete, and the response time was quick. This approach allows businesses to receive personalized guidance, ensuring a smooth onboarding process with clear instructions for integrating online payment solutions into their operations.

Customization and Flexibility

Kibo Pay supports all major e-commerce payment methods, including credit cards, electronic check processing, and virtual card for online payment. When I explored customization, I found the platform adaptable to various industries. The Kibo Pay team assists businesses in tailoring payment processing options to their needs, ensuring seamless transactions. This flexibility makes Kibo Pay a reliable payment gateway for businesses looking for a customizable online payment processing service.

Verdict:

Overall, I think Kibo Pay is great for small businesses that use an online e-commerce store or a physical retailer. The merchant services software removes up to 100% of the credit and debit card fees for businesses.

Kibo Pay has many features, and they are adding more. They offer one low-cost monthly price for their merchant service tool and E-Commerce tool.

Kibo Pay can save your business money on payment processing fees with a user-friendly account management portal at an affordable monthly price.