Chase Payment Solutions Review 2025

Chase Payment Solutions Merchant Services Plans & Pricing

Chase Payment Solutions Comparison

Expert Review

Pros

Cons

Chase Payment Solutions Merchant Services's Offerings

I initially found that Chase Payment Solutions details the pricing on its website.

However, this pricing isn’t the easiest to see and compare, so I have summarized the pricing position for you in this review.

There is no monthly flat fee pricing, and all pricing is transaction-based.

You’ll pay:

- In-Person Transactions: $0.10 per transaction + 2.6% processing fee

- In-Person Keyed-In Transactions: $0.10 per transaction + 3.5% processing fee

- Online Transactions: $0.25 per transaction + 2.9% processing fee

It’s also essential to note that large businesses have the opportunity for negotiated rates. When you engage with Chase Payment Services, you will speak to a customer support agent, and you can start discussing your pricing needs at this point.

Customer Support

Customer Support – Available 24/7 but Less Personalized

As expected from one of the largest financial institutions, Chase Payment Solutions provides 24/7 customer support throughout the year. When I tested their services, I found that assistance was readily available via multiple channels. However, the trade-off of working with such a large provider is that the service lacks the personal touch offered by smaller online payment platforms.

Phone Support – Quick but Requires Escalation

I called Chase’s merchant services software helpline at (877) 843-5690 to inquire about Chase Payment Solutions pricing. The call was answered in about one minute, and the agent provided standard information on fees. However, when I asked about negotiable rates, I was told I would need to speak with an expert. While this step added extra time, it aligned with my expectations, as pricing flexibility depends on business size and industry.

Online FAQs and Resources – Helpful but Hard to Navigate

Chase provides extensive online documentation, including FAQs and hardware setup guides. While testing, I found the resources comprehensive but not always easy to locate. Some guides required multiple clicks to access, but once found, they offered detailed and actionable information for setting up e-commerce payment methods, hardware, and security settings.

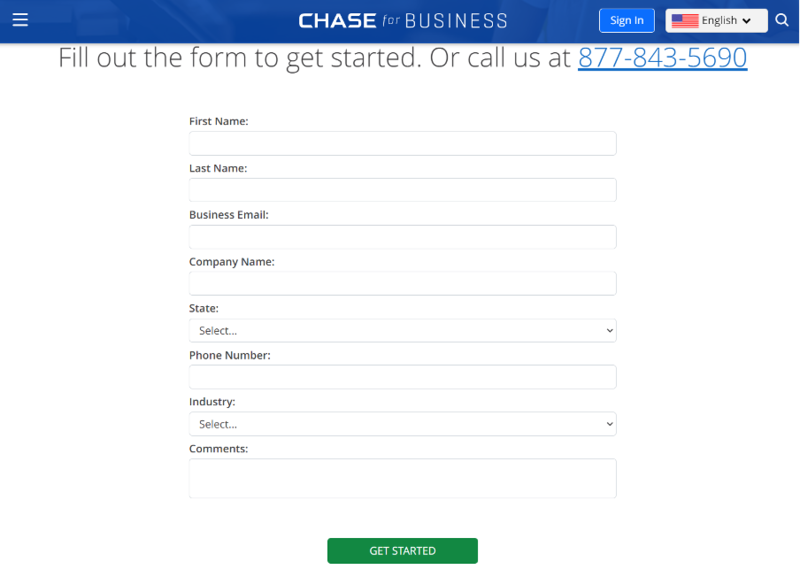

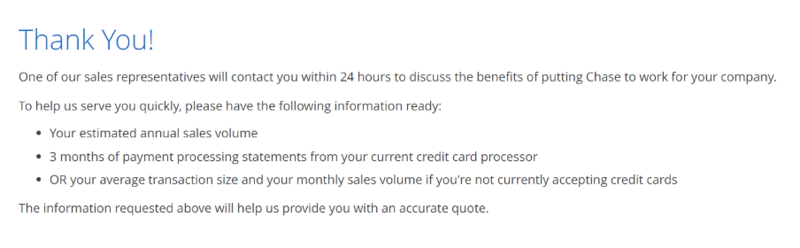

Contact Form – Callbacks Within 24 Hours

For businesses that prefer online inquiries, Chase offers a contact form to request assistance. When I completed the form, I immediately received a confirmation message stating that a callback would occur within 24 hours. True to their word, I received a call the next day from a sales representative who was polite, professional, and knowledgeable. They walked me through the benefits of Chase’s online payment processing services and standard pricing structures.

The sales agent was polite, friendly, and helpful on the call back the following day. They detailed the benefits of using Chase Payment Solutions and talked us through the standard pricing options. It was an easy process to go through, and there were no issues noted.

From our experience, we would recommend calling the helpline as the first step. The process was easy, there was almost no wait time, and the customer agent we spoke with was knowledgeable.

From my experience, calling the helpline is the best first step for businesses needing support. The response time was fast, and the customer agent I spoke with was well-informed. While Chase’s customer service isn’t as personalized as some online merchant services, it provides reliable, around-the-clock assistance for businesses seeking a payment gateway backed by a trusted financial institution.

Features & Functionality

General Features

Chase Payment Solutions offer customers the following features and functionalities via its payment processing solution:

- Merchant Account

- ACH Payment Processing

- Data Security

- Debit/Credit Card Processing

- In-Person Payments

- Mobile Payments

- Online Payment Processing

- POS Integration

- Payment Fraud Prevention

- Payment Processing Services Integration

- Recurring Billing

- Reporting/Analytics

- Virtual Terminal

- Developer-Friendly API

- Chase QuickAccept

- International Payments

- Developer Options

- Enhanced Security Levels

- Specialized Industry Services

Merchant Account

As Chase is a payment processor and an acquiring bank, you will have guaranteed faster payments, and any issues can be dealt with directly with Chase.

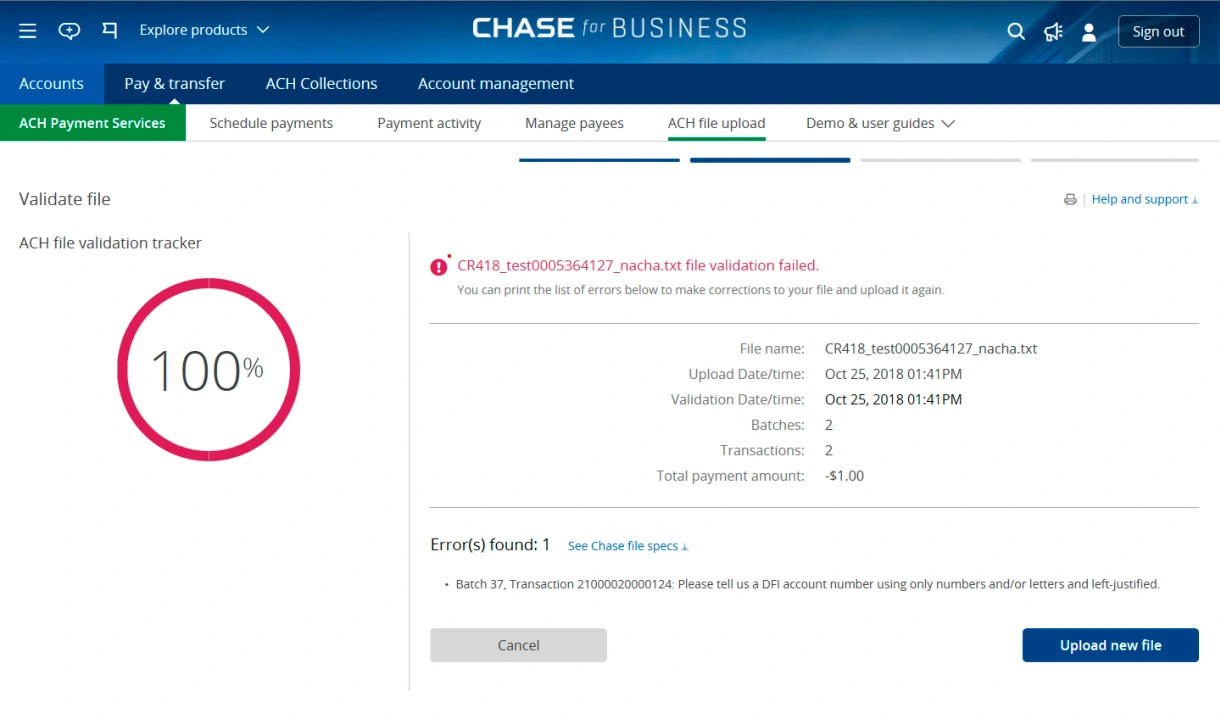

ACH Payment Processing

Chase offers ACH payment processing, enabling businesses to accept direct bank transfers. This feature is particularly advantageous for recurring payments, as it reduces reliance on card networks and can lower transaction fees. When I utilized this service, it streamlined billing processes and improved cash flow management.

Data Security

Ensuring transaction security is paramount, and Chase excels in this area. The platform employs advanced encryption and adheres to strict PCI compliance standards. During my testing, I found that these measures not only protect sensitive customer information but also enhance trust, which is crucial for online merchant services.

Debit/Credit Card Processing

Chase supports a wide range of debit and credit card processing, accommodating various card brands. This inclusivity ensures that businesses can cater to a broad customer base. In my experience, transactions were processed swiftly, minimizing wait times and enhancing customer satisfaction.

In-Person Payments

For businesses with physical locations, Chase provides robust solutions for in-person payments. The point-of-sale systems are intuitive and integrate seamlessly with other services. When I tried out the in-person payment setup, it was straightforward, and the hardware was reliable, making daily operations smoother.

Mobile Payments

Chase’s support for mobile payments allows businesses to accept payments via smartphones and tablets. This flexibility is ideal for on-the-go transactions or pop-up events. I found the mobile payment interface user-friendly, and it synced effortlessly with the main account, ensuring consistent record-keeping.

Online Payment Processing

As an online payment platform, Chase facilitates seamless e-commerce transactions. The integration with various shopping carts and online storefronts is commendable. During my testing, online payments were processed without hitches, providing a reliable experience for both merchants and customers.

POS Integration

Chase’s systems offer excellent POS integration, allowing businesses to unify their in-store and online operations. This cohesion simplifies inventory management and sales tracking. When I integrated the POS system, the process was smooth, and it significantly reduced administrative tasks.

This can be acquired through a one-off fee or a ‘free’ terminal with conditions. I suggest buying a terminal, as the ‘free’ terminal has extensive T&Cs and early exit fees if you wish to stop using the product.

Payment Fraud Prevention

To combat fraudulent activities, Chase incorporates advanced payment fraud prevention tools. These systems monitor transactions in real-time and flag suspicious activities. In my experience, these measures provided an added layer of security, giving peace of mind to both the business and its customers.

Payment Processing Services Integration

Chase supports integration with various payment processing services, enhancing its versatility. This feature is beneficial for businesses utilizing multiple platforms or those transitioning from another service. I found the integration process to be straightforward, with ample support resources available.

Recurring Billing

For subscription-based models, Chase offers a recurring billing feature. This automates the billing process, reducing manual intervention and ensuring timely payments. When I set up recurring billing, it was easy to configure, and customers appreciated the convenience.

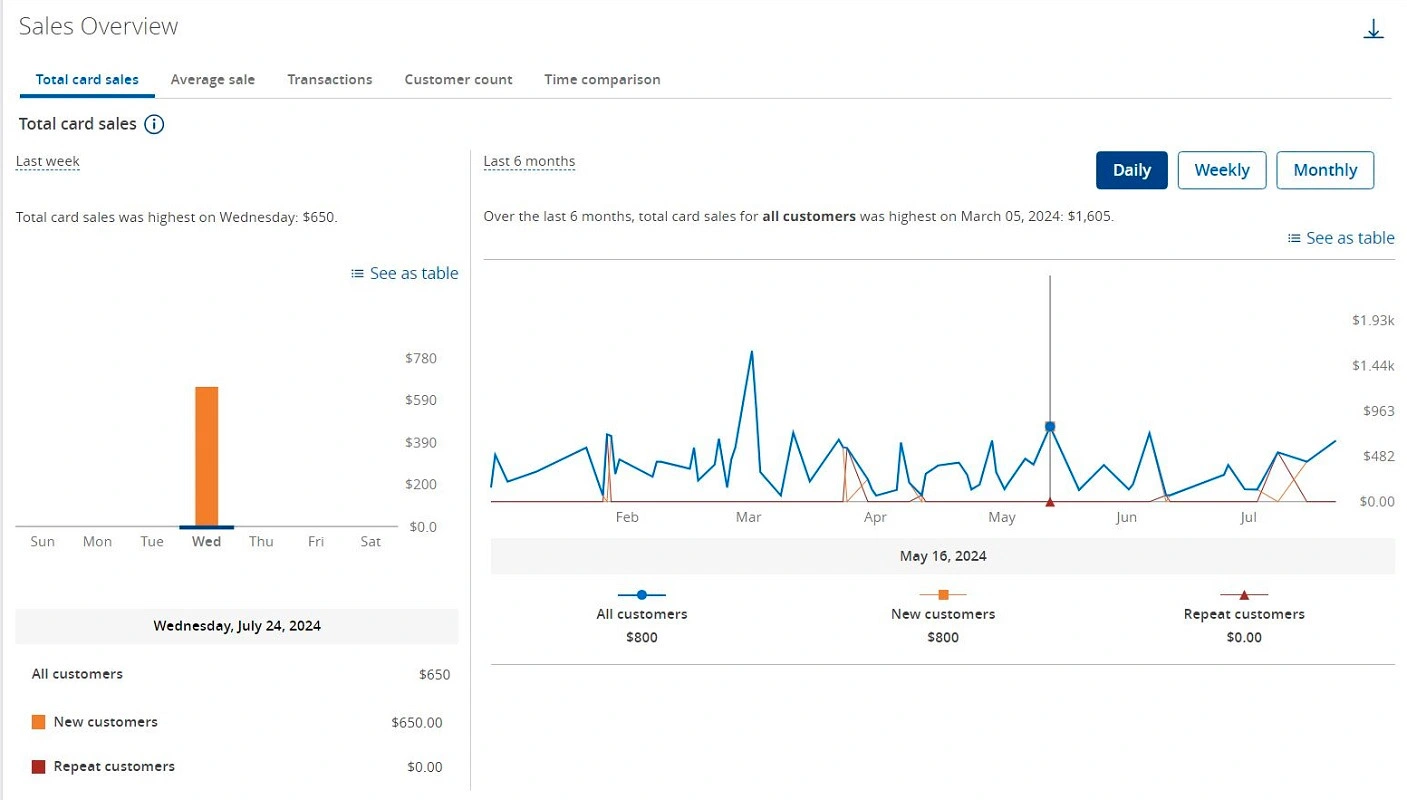

Reporting/Analytics

Access to detailed reporting and analytics is a strong suit of Chase Payment Solutions. The platform provides insights into sales trends, customer behavior, and financial metrics. I found the analytics dashboard to be comprehensive, aiding in informed decision-making and strategic planning.

Developer-Friendly API

Chase Payment Solutions offers a developer-friendly API that integrates seamlessly with online payment platforms and e-commerce payment methods. When I tested it, the documentation was clear, making integration smooth. Businesses can customize online payment processing services, automate transactions, and enhance security, ensuring a flexible merchant services software experience.

Virtual Terminal

Chase offers a virtual terminal, allowing you to use your computer or phone as a credit card terminal and avoid using bulky hardware. Using the virtual terminal attracts lower processing costs.

Chase QuickAccept

If you are a Chase business banking customer, you can use QuickAccept. This lets you accept card payments through the Chase Mobile app, and you will receive the funds on the same day.

Reporting and Insights

Chase Payment Solutions offers a comprehensive reporting suite, including real-time data, charts and trends, and analytical reports free of charge. Ultimately, this helps you understand your customers better and make better business decisions.

International Payments

While most suitable for businesses in the US, Chase Payment Solutions still offers payment support for over 100 currencies globally.

Developer Options

If you’re on the lookout for customized solutions and are technically comfortable, Chase allows access to its development center. This includes access to Chase Merchant Services SDK, and support is available. However, this is only recommended for people with advanced-level development skills.

Enhanced Security Levels

Working with a payment processor as established as Chase gives peace of mind that all transactions will be secure and compliant.

Specialized Industry Services

Chase Payment Solutions offers specialist, tailored solutions to specific industries, most notably healthcare. Chase Healthcare integrates specifically with health employee records and management systems to ensure the stressful process of making healthcare payments is as smooth as can be and compliant with HIPAA processes. Automated payments and patient billing are also available.

Hardware & Software

Chase offers three different terminals for in-store use that will meet the needs of most businesses. Chase Payment Solutions also offers fixed pricing for a range of standalone terminals. Options available are as follows:

| Terminal Type | Features | Price |

| Countertop terminal | For a standard shop payment terminal setup | $299 |

| Smart terminal | or receiving credit card payments around a store | $399 |

| Mobile card terminal | A simple device for accepting payments on the move | $49 |

Chase Smart Terminal

This is the top-of-the-line POS terminal offered by Chase and costs $399. Customers can swipe or tap their cards anywhere in the store, and the sleek, professional design helps the terminal stand out when used. Consumers can also use mobile wallets such as Google Pay and Apply Pay, allowing the highest levels of user experience.

Chase Countertop Terminal

The most popular POS product offered by Chase Payment Solutions is the Chase Countertop Terminal. This high-speed device allows payments from mobile wallets and cards, and connectivity can be provided by wireless or ethernet. The device also comes with a long-life battery and a printer as standard. A countertop terminal costs $299.

Chase Contactless Mobile Card Reader

The mobile card reader operates with your mobile phone to allow payments to be received from anywhere. It works via Bluetooth and your phone’s connectivity to accept payments from wallets or cards on the go. The Chase contactless mobile card reader is priced at $49.95. You will need to download the Chase Mobile app to your phone to use this payment solution.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

Performance levels are where Chase Payment Solutions really begins to stand out. Due to Chase Payment Solutions being both an acquiring bank and a payment processor, customers are guaranteed swift transaction speeds. Deposits are fast as there is no third-party payment processor or acquiring bank to go through, and the solution can be integrated with most eCommerce platforms.

Transaction Speed and Reliability

When I tested Chase Payment Solutions, I found that being both the acquirer and processor eliminates third-party dependencies, resulting in faster transaction approvals and fund deposits. For businesses with a Chase Business Banking account, same-day deposits are available, enhancing cash flow efficiency. This direct processing model ensures high reliability, minimizing potential points of failure in payment transactions.

Integration and Compatibility

I explored Chase’s integration capabilities and found that it seamlessly connects with various e-commerce platforms, including partnerships with BigCommerce. This flexibility allows businesses to incorporate Chase’s payment gateway into their existing systems without significant overhauls. Additionally, Chase offers a range of point-of-sale (POS) systems, catering to diverse business needs from retail to online services.

Advanced Features

Chase provides robust reporting tools through its Customer Insights platform. When I utilized these tools, I could easily monitor sales trends, customer demographics, and peak shopping periods. This data-driven approach enables businesses to make informed decisions and tailor their strategies effectively. However, it’s worth noting that international customers or businesses with low transaction volumes might face certain limitations, such as higher fees or less favorable terms.

Chase Payment Solutions offers a high-quality payment processing option with swift transactions, reliable integrations, and insightful analytics, making it a strong contender for businesses seeking comprehensive merchant services software.

Ease Of Use:

Onboarding Process – Slow but Thorough

When I tested Chase Payment Solutions, the onboarding process was slower than expected. Unlike some online payment platforms that allow instant setup, Chase requires verification and an agent consultation before activation. The process took about a week, whereas some merchant services software gets businesses up and running in a day. However, this extra step allows for potential rate negotiation, depending on business size and industry, which can be beneficial in the long run.

Hardware Compatibility – Limited but Reliable

Chase’s online payment solutions work exclusively with approved Chase hardware providers. This means businesses must purchase compatible devices from Chase-approved vendors. While this limits hardware flexibility, I found that Chase partners with a wide range of point-of-sale (POS) systems, ensuring businesses have plenty of options to choose from.

Cloud-Based and Simple to Set Up

Once activated, Chase’s merchant services software is cloud-based and relatively easy to configure. I found the step-by-step setup process simple, with customer service agents available to assist if needed. Additionally, Chase provides instructional videos and guides, making setup accessible even for businesses without dedicated IT teams.

User Experience – Smooth and Intuitive

After setup, I tested Chase’s interface and found it straightforward and easy to navigate. Reporting tools were intuitive, allowing for quick access to transaction insights. Drilling down into detailed analytics was also seamless, making it easy to track e-commerce payment methods, refunds, and sales trends.

Chase Payment Solutions may not be the fastest option for online merchant services, but it offers a structured onboarding process, reliable hardware, and user-friendly reporting tools. If you can handle a slightly longer setup, the benefits of security, scalability, and customer support may outweigh the wait.

Here’s a little info about the payment solutions:

Uniqueness:

Chase Payment Solutions stands out by being both an acquiring bank and a payment processor, offering faster deposits, seamless integrations, and customizable pricing, making it a powerful choice for businesses of all sizes.

Verdict:

As long as you don’t need a payment solution instantly, we recommend you look into Chase Payment Solutions. Being an acquiring bank and a payment processor guarantees quick payments, and the pricing offered is reasonable (if not the easiest to understand). Chase is suitable for all business sizes, but we believe it to be best for companies with a large volume of transactions (that are not micro-transactions). If you want to know more, click one of the links to get in touch with a Chase customer service team member today!