Clover Review 2025

Clover Merchant Services Plans & Pricing

Clover Comparison

Expert Review

Pros

Cons

Clover Merchant Services's Offerings

I liked that Clover offers pricing plans tailored for different business categories, providing flexibility with either monthly subscriptions or upfront purchases:

1. Full-Service Dining (FSD)

Starter Plan: $165/month for 36 months or $1,699 upfront + $89.95/month for software.

Hardware: Includes Station Solo, receipt printer, and cash drawer.

Transaction Fees: 2.3% + $0.10 for card swipes; 3.5% + $0.10 for manual entries.

Features: Table mapping, contactless dining, online ordering, tax reporting, and basic employee management.

2. Quick-Service Dining (QSD)

Starter Plan: $105/month for 36 months or $799 upfront + $59.95/month for software.

Hardware: Includes Mini POS with built-in receipt printer.

Transaction Fees: Same as FSD.

Features: Fast order processing, contactless QR code ordering, online order management, and customer database.

3. Retail

Starter Plan: Similar pricing as QSD but focuses on inventory tracking and stock management.

Features: Real-time sales reporting, itemized cost tracking, and support for loyalty programs.

4. Professional Services

Pricing: Typically aligned with QSD and Retail Starter Plans.

Focus: Invoicing, customer feedback management, and detailed reporting for service-based industries.

5. Personal Services

Pricing: Similar to Professional Services Starter Plan.

Features: Customer scheduling and management tools, integrated payment processing, and employee tracking.

6. Home and Field Services

Pricing: Matches other service plans with additional options for mobile payment acceptance.

Focus: Mobile-friendly solutions with real-time reporting and seamless customer payment experiences.

For additional features, upgrades to Standard and Advanced plans are available, which include more hardware and expanded functionality like advanced menu integrations, tableside ordering, and enhanced customer engagement tools.

Customer Support

Comprehensive Customer Support

When I tested Clover’s merchant services, I found their customer support to be exceptional.

They offer phone assistance Monday-Friday from 9:00 AM-8:00 PM EST and Saturday from 9:00 AM-5:00 PM EST. They also provide 24/7 email assistance, ensuring help is always available.

I reached out via phone and received prompt, knowledgeable responses, which is crucial for businesses relying on efficient card payment processing.

Additionally, Clover provides a live chat option through their website, offering real-time support for immediate concerns.

Extensive Online Resources

Exploring further, I discovered Clover’s well-maintained blog, featuring insightful articles and updates on credit card processing for businesses.

This resource is invaluable for staying informed about industry trends and best practices.

Their comprehensive FAQ section addresses a wide range of topics, from setting up credit card readers to managing online credit card processing systems, making it easier for businesses to find quick answers.

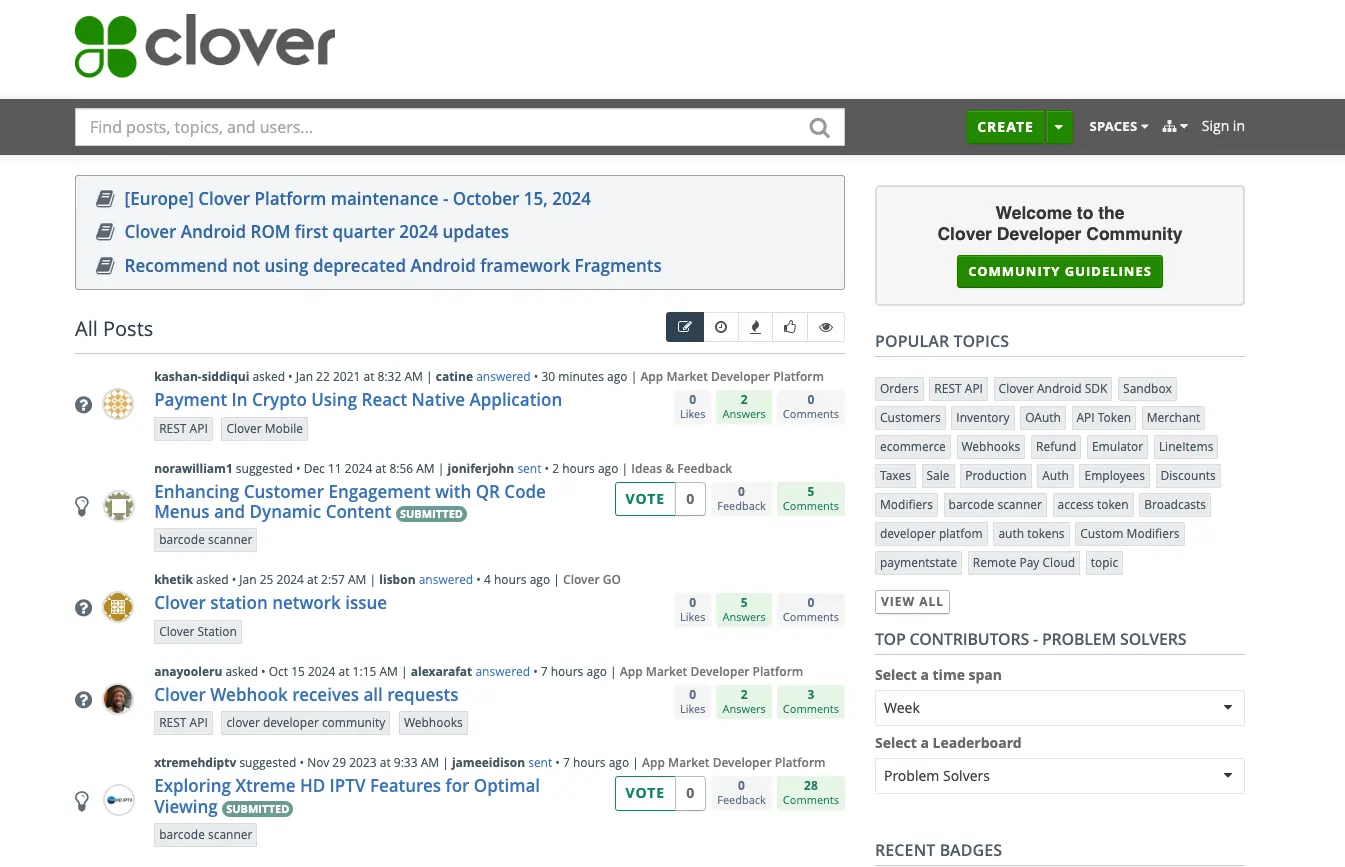

Engaged Community Forum

I also participated in Clover’s community forum, where users discuss experiences and share solutions related to merchant card processing.

This platform fosters a collaborative environment, allowing business owners to learn from each other about accepting credit card payments and optimizing their use of Clover’s services.

Overall, Clover’s comprehensive support system—including phone, email, chat, blog, FAQ, and community forum—provides business owners with the tools and assistance needed to effectively manage their credit card processing needs.

Features & Functionality

General Features

Clover’s solutions cover all of the capabilities required to initiate and develop an electronic transaction.

All major credit and debit cards, as well as NFC payments, are accepted. The option to handle payments offline is also provided. Clover’s hardware is consistently praised for its durability and longevity. The POS interface is particularly user-friendly, and Clover provides a variety of reports to help businesses make better decisions.

Clover is accessible via web browsers on both Mac and Windows and is also compatible with smartphones phones.

Here’s a list of some of the merchant services features:

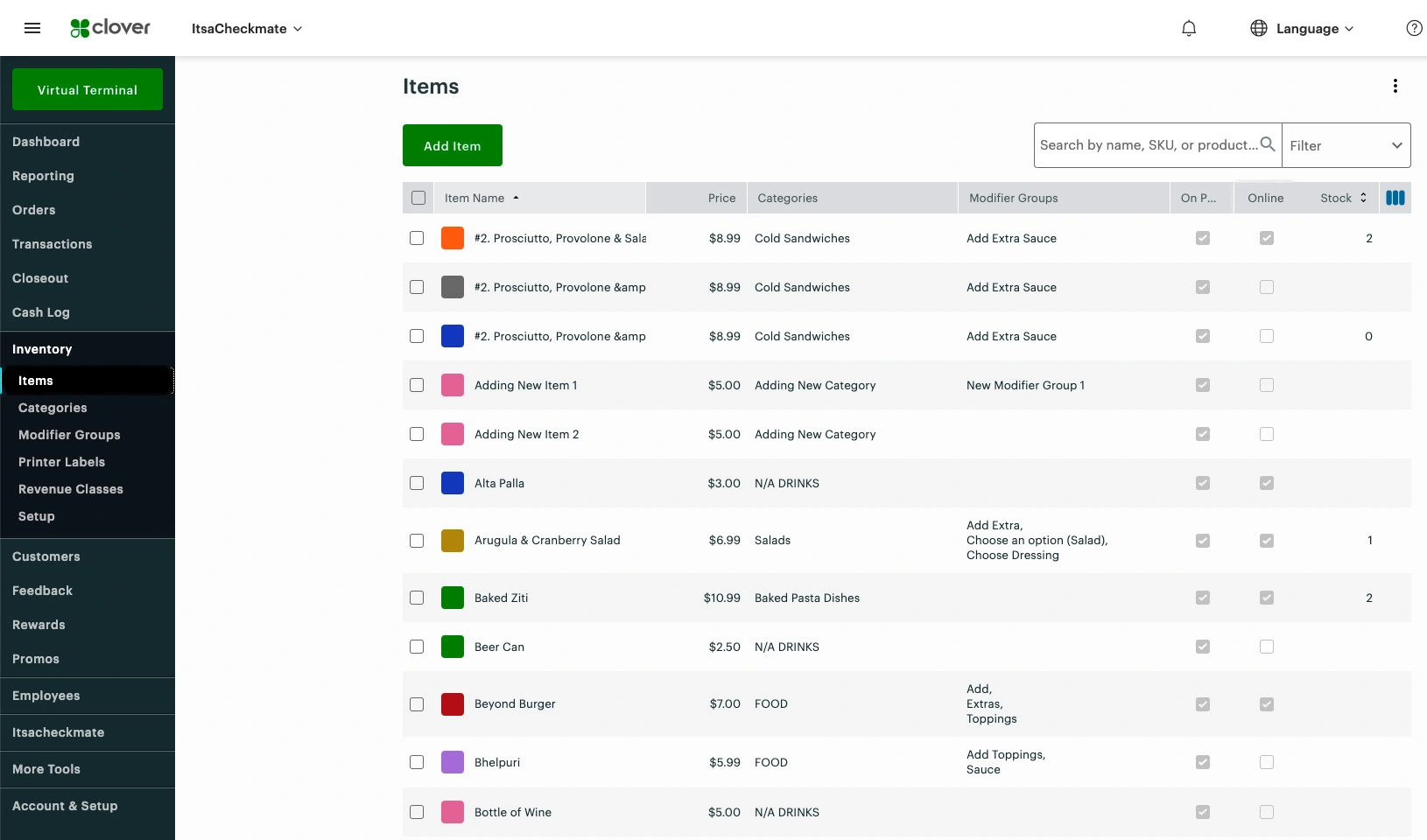

- Inventory management

- Easy-to-use interface

- Customer management

- Restaurant-specific features

- Rapid deposit functionality

- Employee management tools

- Customer loyalty programs

- Digital and physical gift card sales

- Online ordering capabilities

- Reporting and analytics tools

- Flexible funding through Clover Capital

- À la carte app integrations

- Portable and countertop POS hardware options

- Multi-payment acceptance (credit, debit, contactless, etc.)

- Integration with online stores and inventory sync features

Inventory Management

When I tested Clover’s inventory management feature, I found that it offers a competitive edge in the card processing industry. Although this tool is only available with Register Lite or enhanced subscriptions, it’s worth a shot for businesses focused on credit card processing for small business needs.

Clover’s inventory management helps retailers and restaurateurs monitor transactions and inventory levels, ensuring accurate tracking for merchant card processing. Whether you’re using a mobile credit card reader or handling online credit card processing, Clover’s inventory management makes it easier to accept credit card payments and optimize your operations.

Easy-to-Use Interface

Clover’s appeal lies in its easy-to-use interface. When I tried out the system, I was impressed by how simple it was to learn how to accept credit card payments, even for team members who aren’t tech-savvy.

Clover’s straightforward design makes it a popular choice among card processing companies, as it minimizes complex functions. Businesses searching for the best credit card processing companies will find Clover’s intuitive design ideal for streamlining card payment processing, whether through a credit card reader for phone or online credit card processing system.

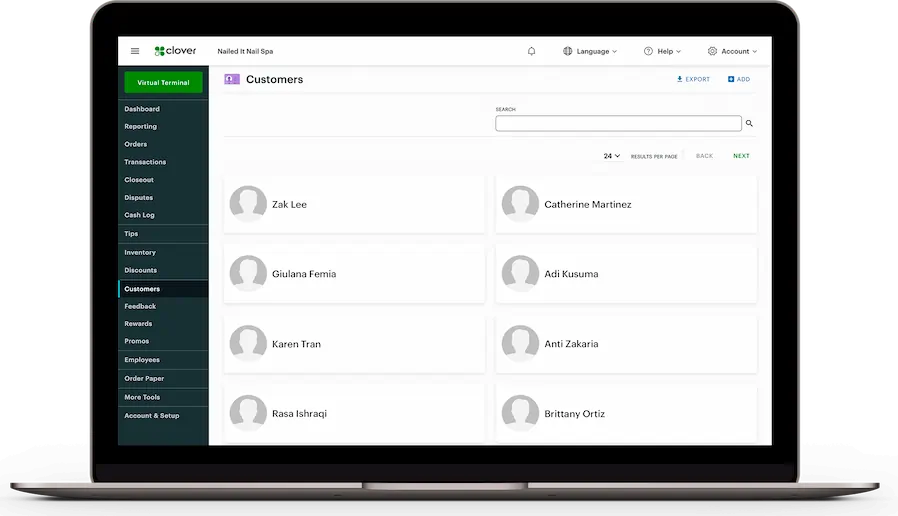

Customer Management

Clover’s customer management feature stood out to me when I tested their merchant services. I was able to create client profiles, send customized emails, add loyalty points, and request feedback, which helps build strong customer relationships.

This feature benefits both traditional brick-and-mortar businesses and online credit card processing systems. If you’re looking for how to take credit card payments and increase customer engagement, Clover’s customer management tools make it easy to accept credit card payments and boost customer loyalty.

Restaurant-Specific Features

While looking at Clover’s card payment processing system for restaurant operations, I discovered features designed specifically for the food industry.

These include the ability to organize floorplans, map tables, and offer tableside ordering. These features make Clover a compelling choice for businesses focused on how to accept credit card payments in the restaurant space, offering a seamless solution for accepting credit cards and enhancing overall operations.

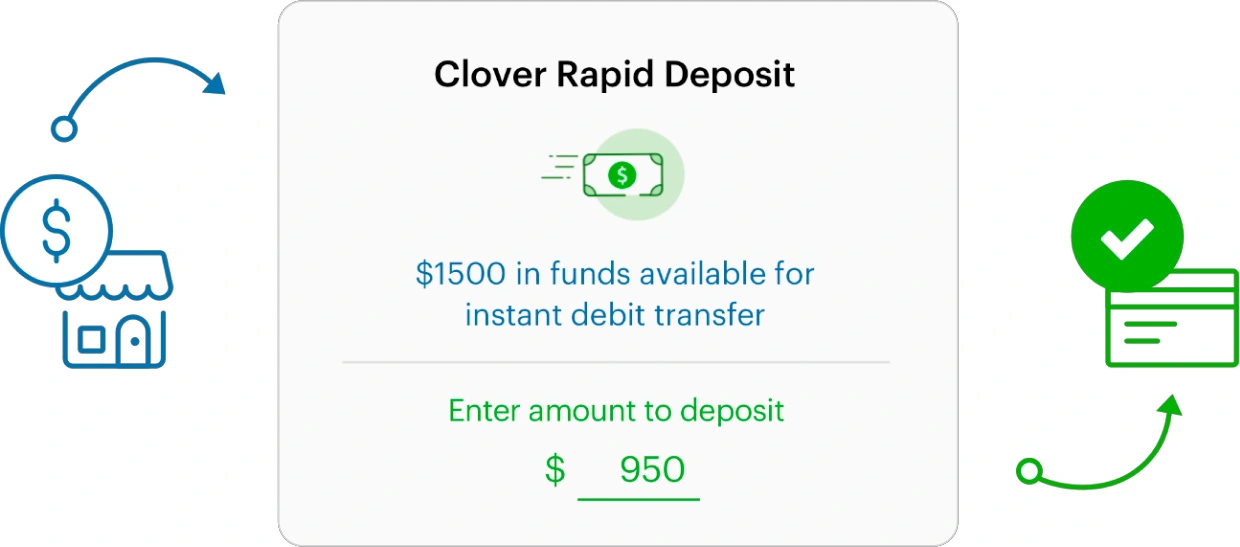

Rapid Deposit Functionality

One feature that stood out to me was Clover’s rapid deposit functionality. Unlike some card processing merchants that take days to transfer funds, I saw payments moved in minutes.

This quick and secure service is crucial for businesses needing reliable credit card processing for business cash flow. Clover’s rapid deposit feature makes it a strong contender among the best credit card processing companies for fast, secure transactions.

Employee Management Tools

Clover’s POS systems include efficient employee management tools. When I tested this feature,

I was able to track shifts, manage schedules, and monitor performance with ease. This made workforce management more s

Customer Loyalty Programs

When I tried out Clover’s customer loyalty programs, I was impressed with how customizable they were.

The programs integrated directly into the POS system, making it easy for businesses to incentivize repeat purchases with rewards.

I found it simple to track customer behavior and tailor promotions to increase engagement. For businesses focused on accepting credit cards and building lasting relationships, Clover’s loyalty programs are a great addition to their merchant card processing tools.

Digital and Physical Gift Card Sales

Clover makes it easy to sell and manage both digital and physical gift cards. I tested this feature and liked how seamlessly it integrated into the POS system.

It’s a great way to drive revenue, enhance customer retention, and create upsell opportunities.

For businesses looking to maximize their card payment processing options, Clover’s gift card functionality adds value to both in-person and online credit card processing operations.

Flexible Funding Through Clover Capital

Clover Capital stood out when I looked into credit card processing for business growth. This feature provides fast and flexible funding by converting future sales into working capital.

I saw that approvals typically happen within 1-2 business days, and repayment is adjusted to match sales performance. This option provides businesses with a financial safety net, making it a great partner among card processing companies.

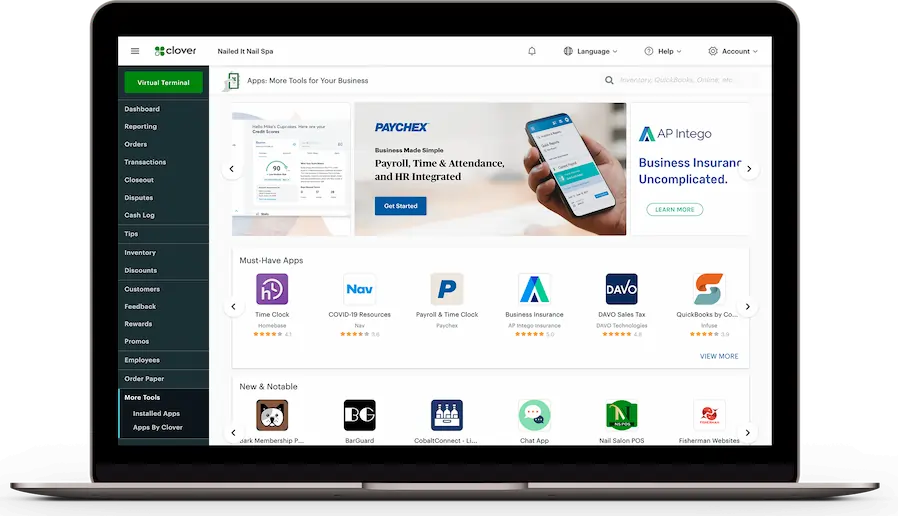

À la Carte App Integrations

Clover’s app marketplace offers a wide range of à la carte integrations.

I explored different apps for accounting, inventory, and marketing, finding that these options allowed businesses to customize their POS system.

This flexibility ensures that businesses can evolve their credit card processing capabilities to meet changing needs. It’s a strong reason why Clover ranks among the best credit card processing companies.

Portable and Countertop POS Hardware Options

I tested different Clover hardware options, including portable devices like Clover Flex for on-the-go transactions and the Clover Station Duo for high-volume environments.

Each device was designed for durability and ease of use, supporting multiple payment methods like credit cards, debit cards, and contactless payments.

For businesses seeking how to take credit card payments efficiently, Clover’s versatile hardware options make it a solid choice.

Integration With Online Stores and Inventory Sync Features

Clover integrates seamlessly with popular e-commerce platforms, and I found the inventory sync feature incredibly useful. This tool allowed me to manage stock levels in real-time across both online and in-store channels.

Businesses focused on online credit card processing and inventory management will find this feature essential for reducing errors and improving operational efficiency. This makes Clover an excellent option for accepting credit cards and optimizing credit card processing for small businesses.

Hardware & Software

Clover’s credit card processing system is compatible with both Android and iOS devices, making it a versatile option for businesses looking to accept credit card payments. The following hardware options are available from Clover and work seamlessly with their merchant card processing software:

Clover Go

I found Clover Go to be an affordable and portable mobile credit card reader priced at $69. It works on both iOS and Android, making it compatible with all Clover products. This device is perfect for businesses needing how to take credit card payments on the go.

Clover Flex

Clover Flex is a complete POS system that fits in the palm of your hand. Priced at $499, it provides a card reader and card payment processing solution for businesses of all sizes. It supports accepting credit cards, NFC payments, and mobile credit card reader functions.

Clover Mini

The Clover Mini is a compact, countertop POS system priced at $749. When I tested it, I found it to be ideal for businesses looking for credit card processing for small business operations. Its small footprint makes it a great fit for limited counter space while providing robust card processing capabilities.

Clover Station

Clover Station is a full countertop POS system designed to meet the needs of larger businesses. It costs $1,349 and offers high performance for card payment processing. It’s a great option for businesses that want reliable credit card processing for business with enhanced functionality.

Clover Station Pro

The Clover Station Pro is the latest and most advanced offering, priced at $1,649. This system features a customer-facing screen in addition to the standard functionality of the Clover Station. It’s an ideal choice for businesses looking for the best credit card processing companies that offer an enhanced customer experience and seamless merchant card processing.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

When I tested Clover’s merchant services, I found their performance to be exceptional across several key areas:

Speed and Reliability

Clover’s systems are designed for swift and dependable card payment processing. The Clover Station Solo, for instance, boasts robust processing power, ensuring quick transactions and minimizing customer wait times. Its multiple connectivity options—WiFi, Ethernet, and 4G/LTE—provide consistent uptime, crucial for uninterrupted business operations.

Security Measures

Security is paramount in credit card processing for businesses, and Clover excels in this domain. Their end-to-end encryption and tokenization technologies safeguard sensitive data from the moment a credit card is swiped, dipped, or tapped. This comprehensive approach helps businesses maintain PCI compliance and reduces the risk of data breaches.

Feature-Rich Platform

Clover offers a suite of features that enhance merchant card processing. Their systems support various payment methods, including EMV chip cards, magnetic stripe, and contactless payments like Apple Pay and Google Pay. Additionally, Clover provides tools for inventory management, employee tracking, and sales reporting, all accessible through an intuitive interface.

Scalability and Flexibility

Whether you’re a small business owner or managing a larger enterprise, Clover’s solutions are scalable to meet diverse needs. Their range of hardware—from the compact Clover Mini to the comprehensive Clover Station Duo—caters to various business environments, ensuring efficient credit card processing for small businesses and larger operations alike.

Clover’s merchant services deliver high-performance solutions characterized by speed, reliability, robust security, and a rich feature set, making it a top contender among credit card processing companies.

Ease Of Use:

Effortless Onboarding

When I tried out the Clover POS system, I immediately noticed how easy it was to use. The setup process was quick, and the interface was intuitive, making it simple for any business owner to get started with card payment processing. New users can learn how to accept credit card payments without much hassle, which is a huge benefit for small businesses.

User-Friendly Interface

I found that even staff members with limited tech experience quickly got the hang of using Clover’s credit card reader. The clean design and logical layout made it easy to handle everything from processing sales to accepting credit card payments online.

Support and Resources

The 24/7 customer support was a game-changer when I had questions. Plus, Clover’s FAQ section, blog page, and community forum provided additional support for more complex topics. It’s an ideal choice for businesses that want to work with one of the best credit card processing companies.

Uniqueness:

Clover stands out among credit card processing companies with its seamless integration of POS and merchant services. Its all-in-one system supports various payment methods, offers real-time reporting, and includes advanced security features. The customizable solutions cater to businesses of all sizes, ensuring efficient and secure card payment processing.

Verdict:

Overall, Clover offers an excellent return on investment made in a POS system and merchant service. It provides all the necessary features needed for efficient operation of the point of sales services, as well as obtaining apt payments from the clients.

Although Clover provides services to small and medium businesses, large businesses can also find it useful, given that it offers high reliability and security. If you are searching for merchant service and payment provider, Clover should be your go-to partner.

User Review

- NONE

- HIDDEN FEES

- It accepts CC payments.

- Fraudulent transactions are too easy. It accepts incorrect information for valid transactions. When looking for specific transactions, if you click on the CC charge you would like to review , then back out of that screen to look at another, you have to re-group everything all over again to find the one you want. It will accept CC transactions with the minimal information and allow it to go through, which has led to fraud. Not enough security checkpoints to avoid and catch fraudulent transactions. It takes an average of an hour to get someone on the phone to be able to answer your questions, and that's even if they can. I definitely say, do not choose this company, look elsewhere.

- Refunding credit and debits cards seems to be a bit of a process.

- The customer support at Clover isn't the best, and it takes a while to get back to you.