QuickBooks Review 2025

QuickBooks Accounts Receivable Plans & Pricing

QuickBooks Comparison

Expert Review

Pros

Cons

QuickBooks Accounts Receivable's Offerings

Plans for QuickBooks accountant software range from $35/mo to $235/mo, and a 30-day free trial. Each plan has added benefits and helps manage all aspects of your business. They offer 50% off for the first 3 months plus a free guided setup to connect bank accounts, automate tasks, and learn best practices (not included with free trial or Self-Employed). A desktop software version is also available for $799/yr.

Customer Support

QuickBooks payments offers various resources to assist with account management, banking, and getting started, including video tutorials, webinars, and access to QuickBooks Certified ProAdvisors. In addition, they provide support options such as a phone number and email address for direct assistance, as well as community support through features like “Ask the community” and “Quickbooks Q&A”.

Phone Support

Quickbooks doesn’t offer a support hotline, but they do provide a sales phone number dedicated to answering inquiries about their pricing and plans. This automated system endeavors to assist users in resolving issues and answering queries before connecting them with a representative.

The system predicted a three-minute wait time to speak with a representative, and I was given the option to speak to one within three minutes of initiating the call. Although I had to wait around six minutes, the representative was highly supportive in addressing my concerns and aiding me with the task I was trying to complete.

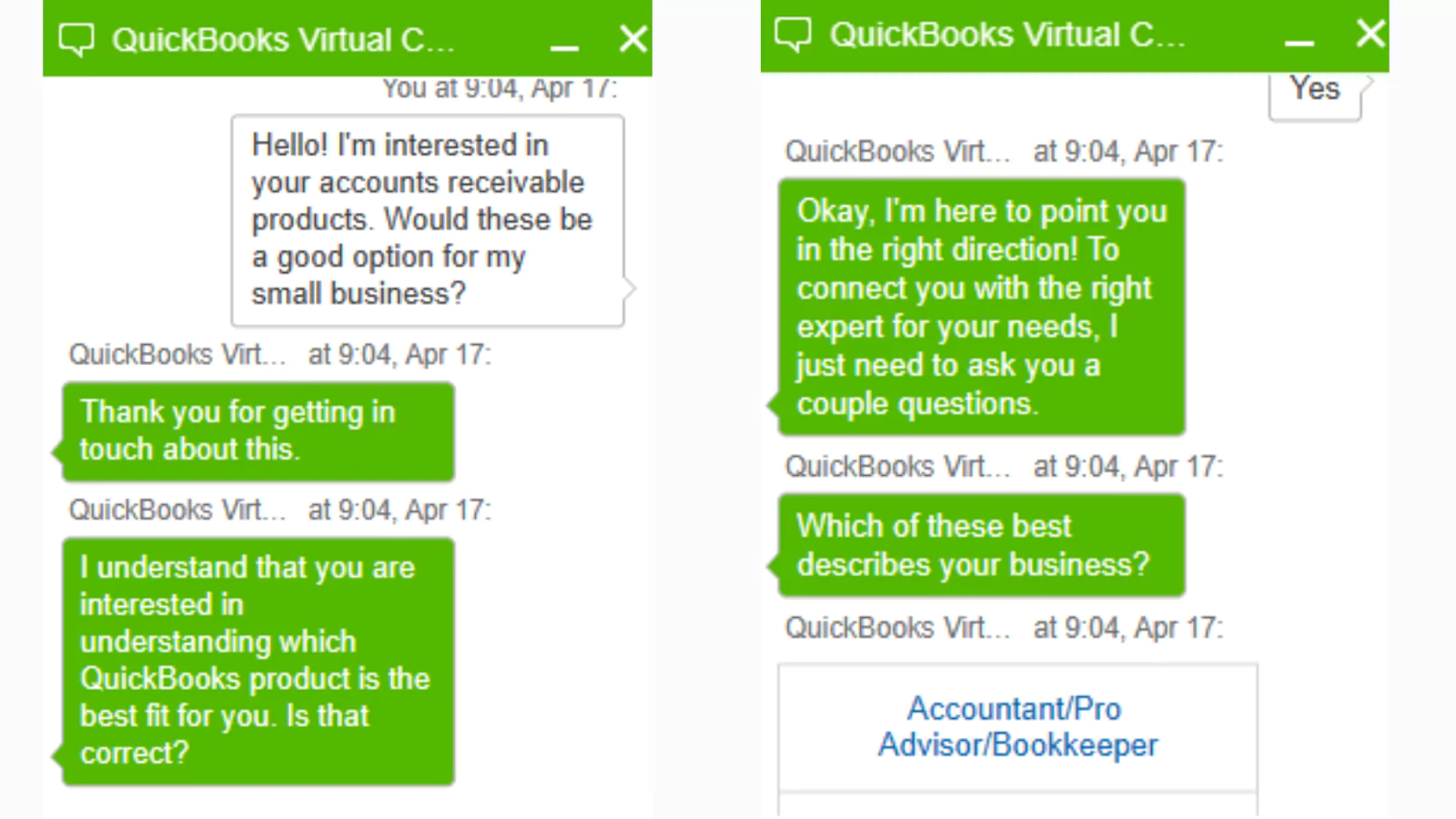

Live Chat

I contacted them via the live chat option on the website. I asked questions about which plan would be best for my business and live chat replied within minutes. I was directed to the site’s page with pricing options.

Video Tutorials

The video tutorials are beneficial and informative. They cover many different features and how to use them efficiently. The videos are screen recordings with voice-over instructions, making them very easy to understand.

Overall Experience

QuickBooks has very effective ways to get information and answer specific questions. The live chat option on their website is extremely helpful as well as the video tutorials explaining features with instructions on how to use them.

Features & Functionality

General Features

QuickBooks features a user-friendly layout that allows for easy navigation. On its main page, you’ll find convenient links to various sections, including an overview, bookkeeping, payroll, adding clients, tasks, sales, banking, reports, workflows, and time.

Additionally, this platform offers excellent accounting reports, making it a straightforward and practical tool to use.

Automation Features

QuickBooks offers the option to link your bank and credit card accounts during the setup process. This allows the software to automatically monitor and manage your expenses and bills.

Manual tracking is also an option. Whether you’re paying in cash or by check, it’s simple to input the transaction directly into the system.

In addition, QuickBooks provides a range of reports for analyzing your financial activity. By keeping track of your bills, you can easily stay on top of upcoming payments and avoid any late fees.

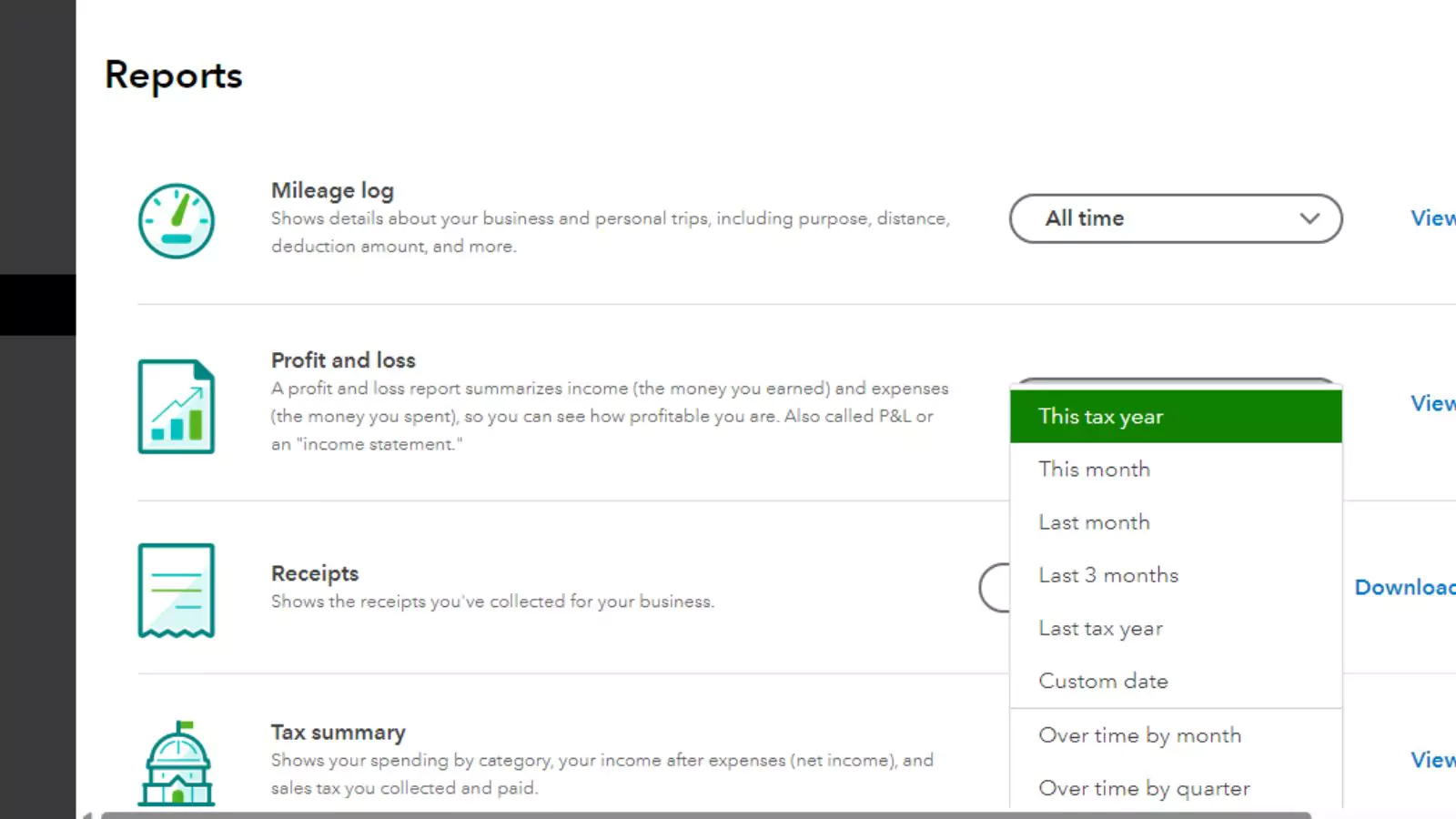

Reporting & Analytics

With QuickBooks, it’s easy to generate and review various reports, such as the number of outstanding invoices, the total amount due from clients, and the details of each invoice (whether paid or due). QuickBooks provides numerous reports to analyze your expenses and bills. By keeping a record of your bills, you can effortlessly track upcoming payments and ensure timely payments.

Cash Flow Features

When using the QuickBooks Accounting application on your mobile phone, you have the ability to import receipts, digital invoices, and printed receipts onto any of the expense or bill payment options.

The software will automatically extract data from these uploaded documents when you use the mobile app. However, if you access the login page of the QuickBooks website for online accounting software, you will need to manually enter all of the expense and bill information, including the vendor, date, amount, category, type of payment used, memo or description, and attachment such as a copy of the physical receipt, since the website will not pull data from uploaded receipts or invoices.

Integrations & Add-Ons

The QuickBooks platform has seamless integration, allowing for effective management of your business finances. The Performance Center, located on the account dashboard, generates charts depicting your business’s profits and expenses. The platform also offers advanced capabilities for tracking reports, payments, and payroll management. However, the software lacks the ability to extract data or vendor invoice information from uploaded invoices.

Performance:

Payment notifications

QuickBooks allows users to turn notifications on and off, according to the module they want to receive notifications from.

Reminders

QuickBooks allows users to set reminders for payments, to avoid any oversights.

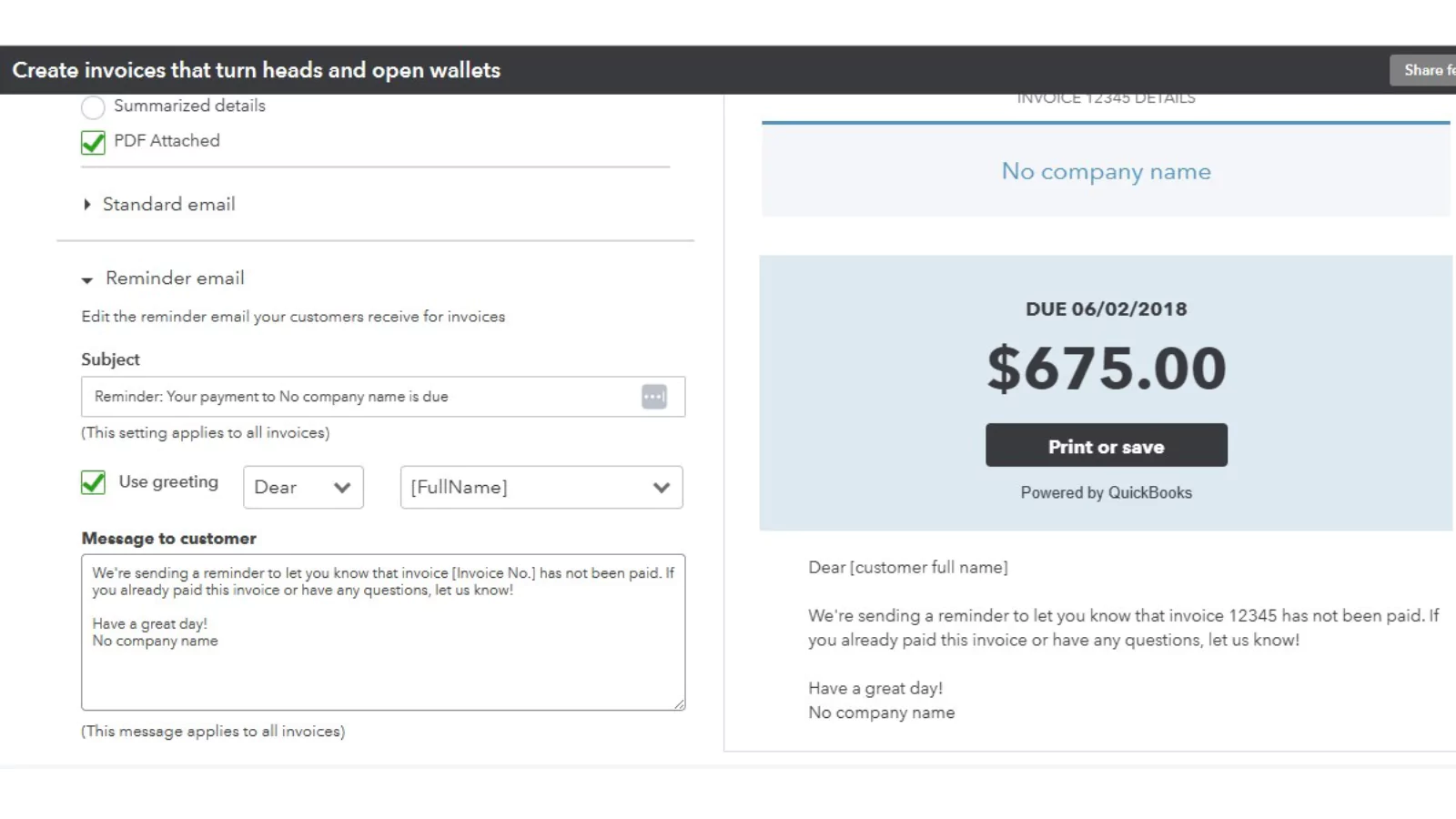

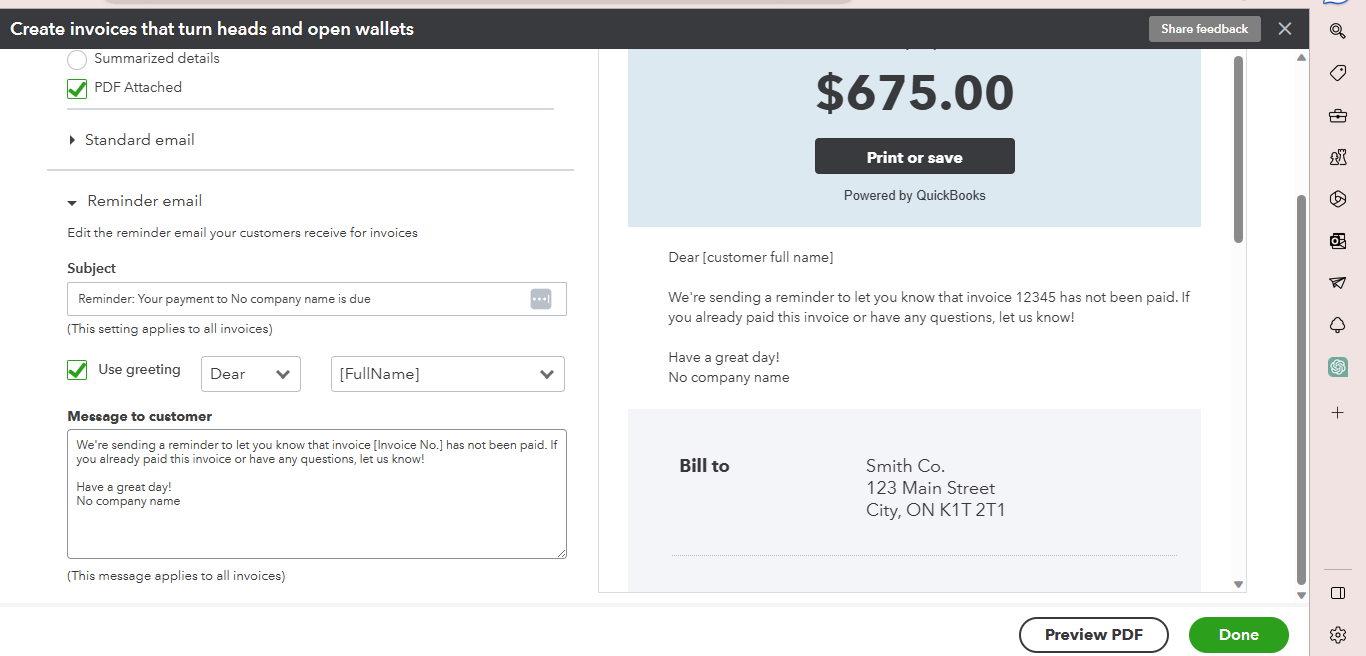

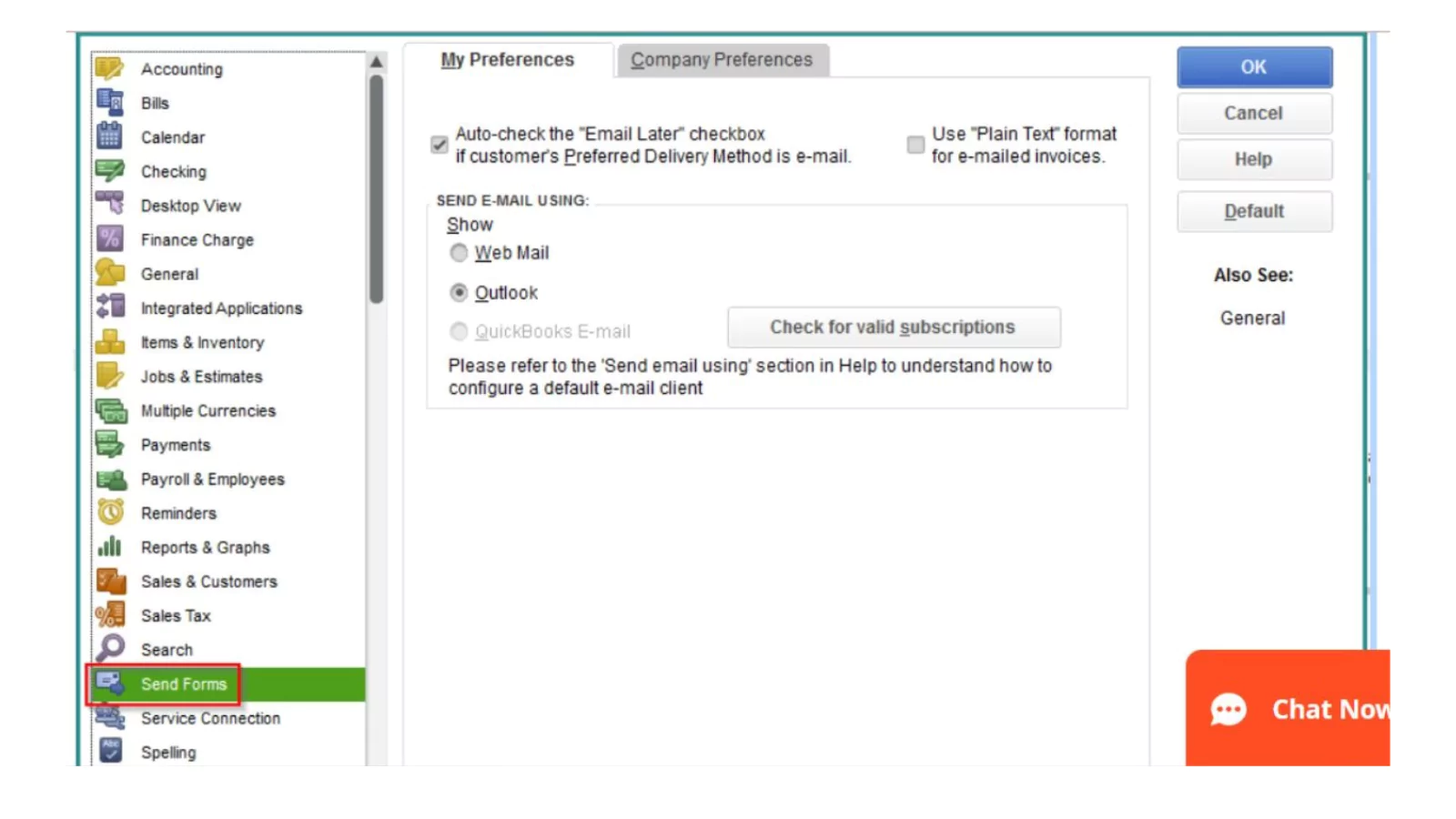

Sending Emails

QuickBooks allows users to send invoices via email, allowing for easy and seamless delivery.

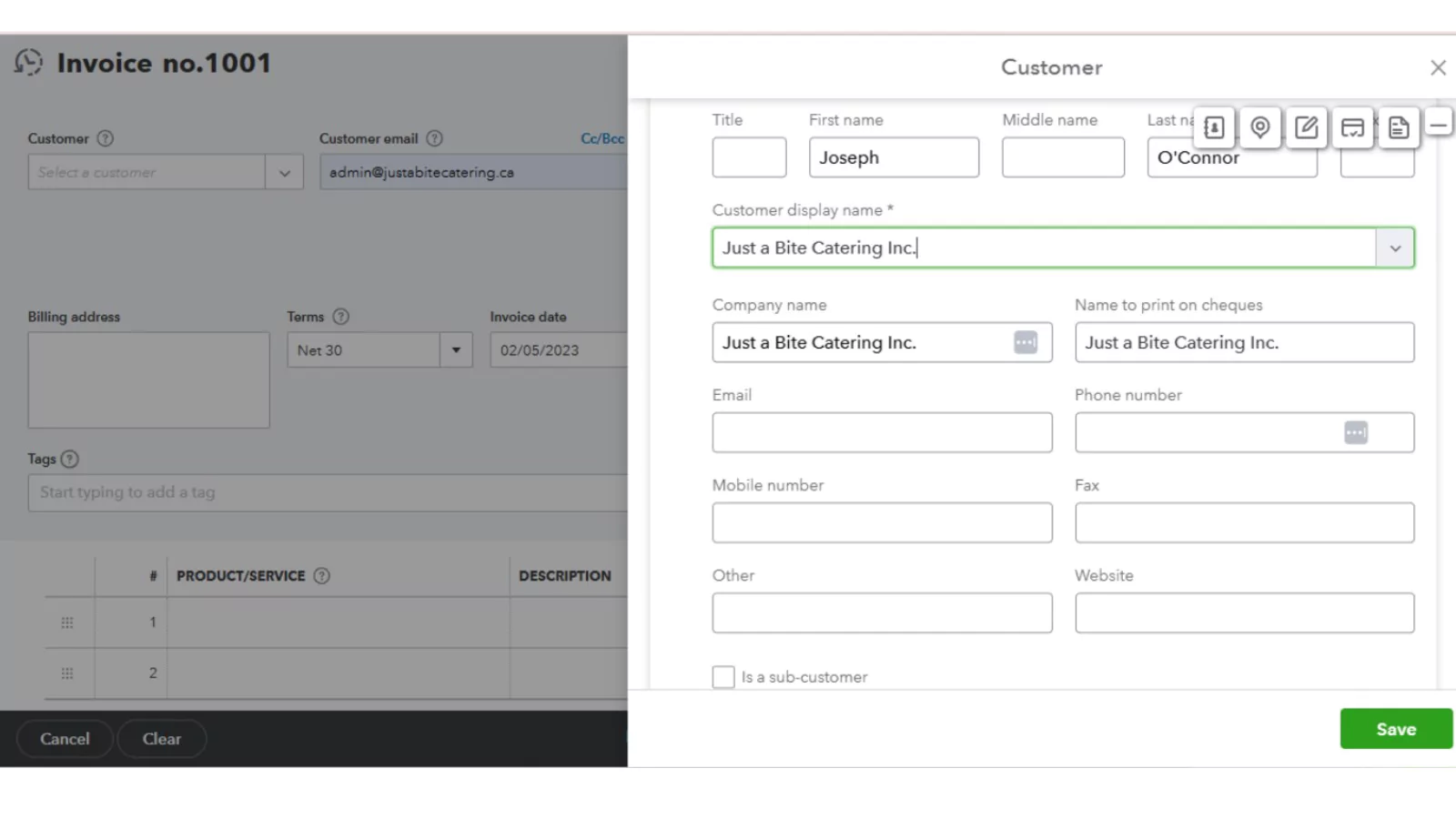

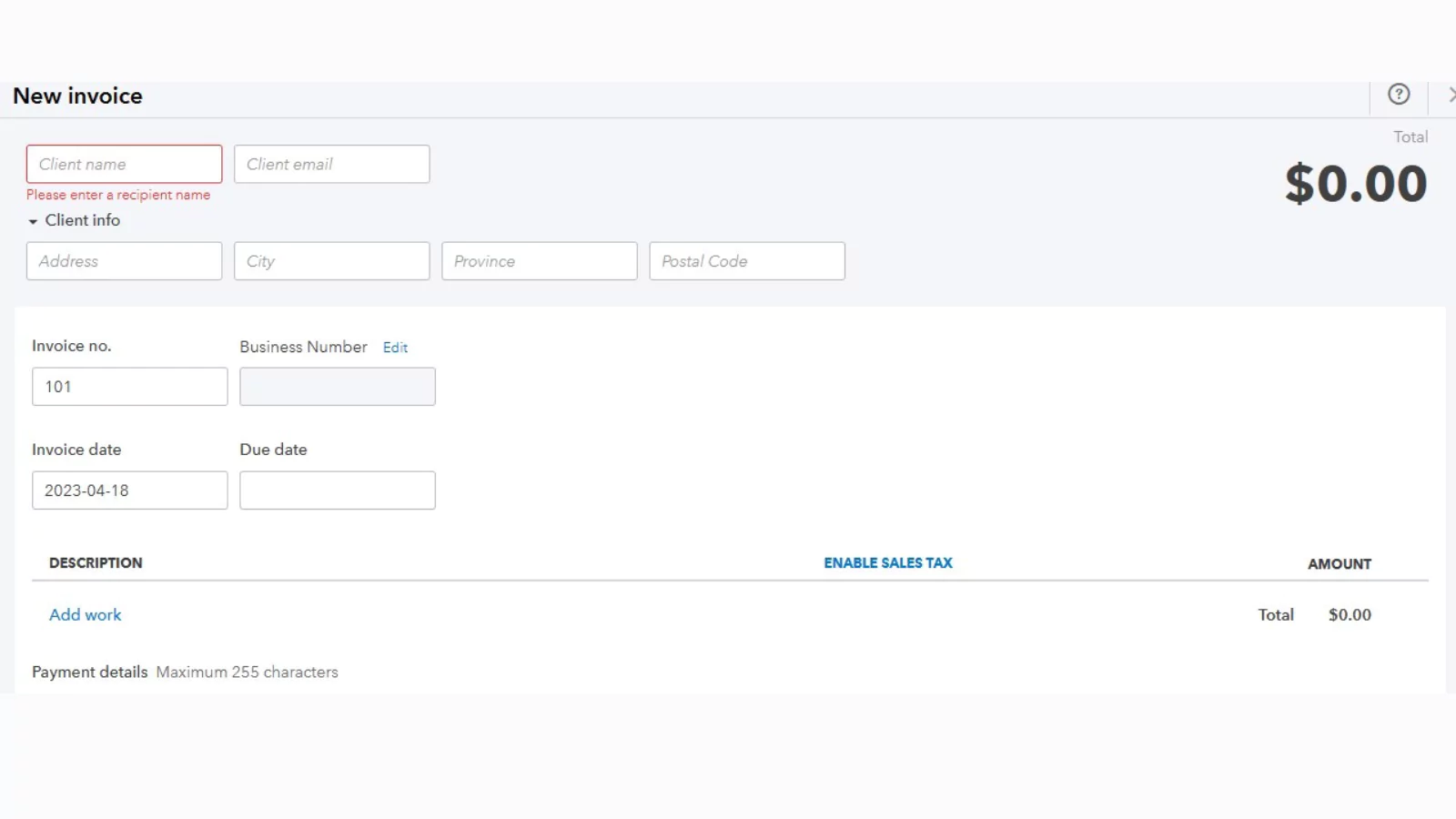

Invoice Creation

QuickBooks allows users to easily create professional invoices that are personalized with company branding.

Ease Of Use:

It was easy to register for QuickBooks, and only took a few minutes. The dashboard has an excellent layout that makes it easy to navigate, and the features are conveniently accessible. Additionally, there are video tutorials available to provide guided assistance when using the features.

This video will demonstrate the easy setup process in QuickBooks:

Create Invoices

Creating invoices is very intuitive, thanks to the user-friendly interface. The fields are laid out in a logical manner.

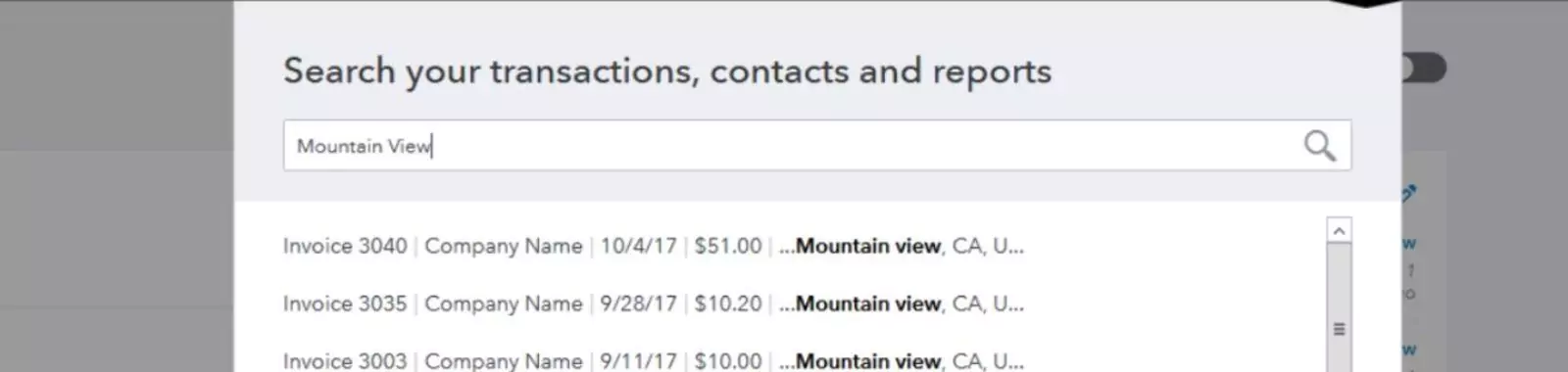

Find Client

QuickBooks users can create detailed customer records, which can be retrieved easily by name or customer ID.

Customize Reports

The user-friendly interface makes the process of creating reports very intuitive, and the options available are clearly indicated.

Verdict:

By using QuickBooks, you can conveniently monitor financial tasks such as tracking income and expenses, employee expenditures, and real-time inventory management, while also easily fulfilling your tax obligations. When your financial concerns are taken care of, you can prioritize driving business growth and generating revenue.