QuickBooks Review 2025

QuickBooks Merchant Services Plans & Pricing

QuickBooks Comparison

Expert Review

Pros

Cons

QuickBooks Merchant Services's Offerings

Quickbooks requires you to have a Quickbooks Online account (the main accounting/bookkeeping service) to sign up for Quickbooks Payments and Quickbooks Cash. That said, Quickbooks has a 30-day free trial, during which you can try out the merchant services.

As for transaction fees:

- ACH: 1% (for a max of $10 per transaction)

- Swiped payments: 2.4% + 0.25 per transaction

- Invoice: 2.9% + $0.25 per transaction (if paid with a credit card, ACH invoice payments are free, at least from what we’ve seen on the special Self-Employed plan)

- Keyed: 3.4% + $0.25 per transaction

These are generally lower than Quickbooks Payments’ main competitors, such as Square and PayPal.

Customer Support

Quickbooks has 24/7 online chat support. Phone customer support is available 6 am – 6 pm PST during the week and 6 am – 3 pm on Saturdays. Advanced plan users can access 24/7 premium support, too. Quickbooks offers plenty of educational resources for your self-help needs, such as FAQs, video tutorials, blogs, and community forums.

Additional support includes:

Blog — Quickbooks’ blog covers all manner of business topics, especially those pertaining to accounting and finance.

Community Forum — Discuss Quickbooks and other business topics with other members in the Quickbooks community forum.

Features & Functionality

General Features

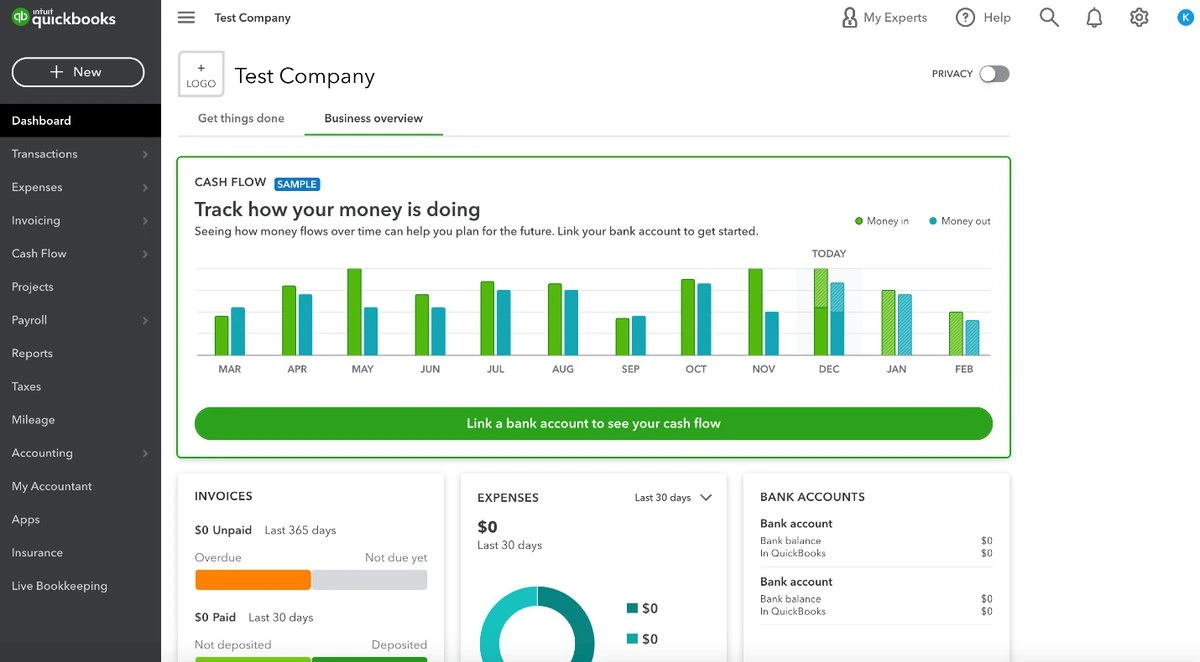

Dashboard

Customer Quoting, Invoicing, and Payment Tracking

Quickbooks comes with plenty of quoting and invoicing features that streamline much of the billing and invoicing process. You can send payment reminders, set up recurring charges, and track client/customer payment statuses, among other things. Customers can pay straight off the invoice with a couple of button clicks. As for the invoices themselves, they’re fairly customizable. You can easily duplicate invoices if needed or go off of invoice templates.

Quickbooks also let you factor discounts, shipping, and taxes into invoices.

![]()

eCommerce

Thanks to Quickbooks’ numerous integrations (covered in the next section), it can integrate with numerous eCommerce platforms and accept payments made for purchases from your eCommerce store. Then, Quickbooks tracks these payments, deposits them to your bank account, and handles much of the bookkeeping — leading to plenty of time savings on your part.

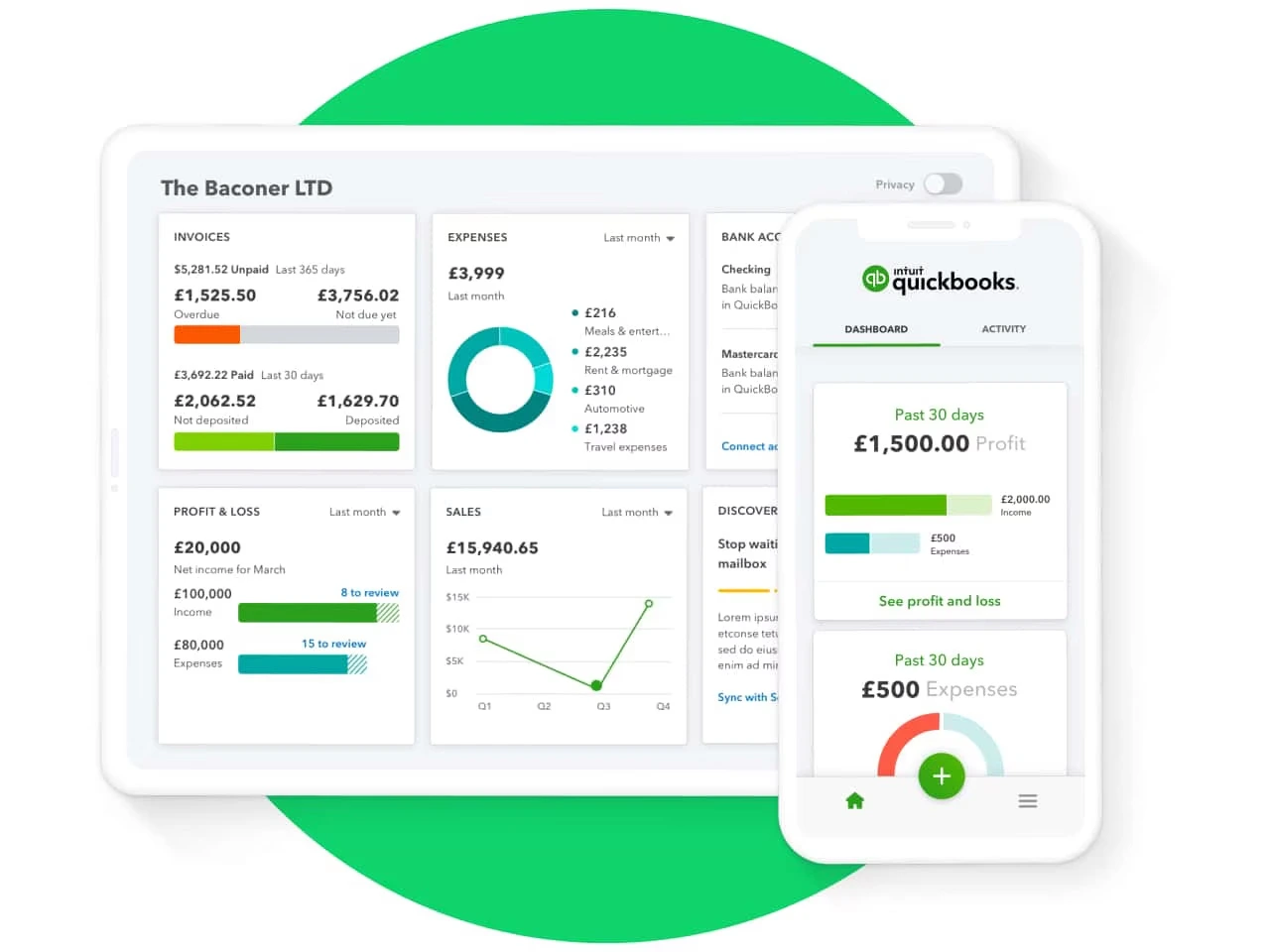

Quickbooks Cash Business Banking

Quickbooks Payments users who want to further aggregate their operations into one place might consider opening a Quickbooks Cash account. Quickbooks Cash is a high-yield business savings account provided by Quickbooks. It offers an impressive 1% APY, no monthly fees, and access to 19,000 AllPoint ATMs. Of course, Quickbooks Payments users who open a Quickbooks Cash account can access their money paid from invoices within 30 minutes regardless of date or time since everything is happening in Quickbooks. Quickbooks Cash also offers cash flow projections and insights (one of the main ones being Cash Flow), free ACH transfers, and a savings helper tool called Quickbooks Envelopes.

Quickbooks Point of Sale

For Quickbooks Desktop users, there’s Quickbooks Point of Sale. This is an excellent choice if you use Quickbooks to run your brick-and-mortar business. Everything syncs flawlessly with your Quickbooks account, and you can obtain a variety of hardware through Quickbooks for your POS needs.

Add-Ons & Integrations

- Quickbooks supports integrations with numerous third-party products, many of them payment processors:

- PayPal, Square, or your financial institution (for transaction importing)

- Sales and sales tax tracking for Shopify/other major e-commerce platforms

- Payment processing for PoS or mobile card readers

- Bill.com accounts payable automation

Many of these work well in conjunction with Quickbooks Payments, while others are simply nice extras. Quickbooks also can connect you to a Quickbooks-certified bookkeeper if you need it.

Hardware & Software

Hardware needs vary depending on what features you’re using. For example, brick-and-mortar companies will need POS hardware to run Quickbooks Point of Sale. Card readers may also be helpful.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Ease Of Use:

Quickbooks’ interface is a bit overwhelming at first, but Intuit provides a large video tutorial library to get you started. Plus, there is an endless number of tutorials created by third parties due to Quickbooks’ popularity. Alternatively, you can pay Quickbooks $50, and they’ll set up your account. Once you familiarize yourself with the interface, it becomes pretty easy to navigate.

Verdict:

Quickbooks Payments is definitely a good payment processing and merchant services solution. However, you do need a full Quickbooks subscription to get it. If you’re not keen on Quickbooks or enjoy your current accounting/bookkeeping solution, then Quickbooks Payments isn’t really worth it. But if you’re a Quickbooks user (or soon to be one), you really can’t go wrong with Quickbooks Payments. If the wealth of features doesn’t persuade you, the seamless integration with your Quickbooks data streamlines your business’s financial side will.