Melio Review 2025

Melio Accounts Receivable Plans & Pricing

Melio Comparison

Expert Review

Pros

Cons

Melio Accounts Receivable's Offerings

Melio is a cost-free solution that does not require any subscription fees. Sending and receiving ACH bank transfers incurs no charges.

However, if you opt for paying via card, sending an international bank transfer, or requesting a check to be sent to your vendor, additional fees will apply. Expedited payment options such as same-day or faster payments also entail fees.

Customer Support

Melio offers limited live resources to assist customers. However, they provide support options such as a Help Center with detailed articles, an email request form for direct assistance, as well as community support through features like accountant blogs, guides, and customer stories.

Live Chat

On Melio’s website, you can access the live chat feature throughout the site’s interface during weekdays from 9 a.m. to 8 p.m. EST.

Overall Experience

Melio is very effective at providing answers to commonly asked user questions. The Help Center articles are detailed, helpful and easy to navigate. It would be beneficial for Melio to have more live support options in case of queries that aren’t addressed in the help center or need to be answered quickly. From that perspective their customer support could definitely be improved.

Features & Functionality

General Features

Melio offers various automated payment features such as ACH processing, online payment processing, fraud detection, and more. It is an affordable and user-friendly online payment platform catering to small businesses. Melio focuses on automating Accounts Receivable, simplifying payment processes, and empowering small businesses with its transparent and collaborative environment. Its low fees and commitment to the local small business community make it an excellent option for those who value simplicity and efficiency.

Automation Features

By integrating Melio with Quickbooks, business owners can manage their entire client base from a single platform and automate invoice and payment processes. Additionally, Melio handles tax forms, making it easier for businesses to keep track of their payments, whether they are one-time or recurring. This is particularly useful for those who struggle with managing their payments.

Reporting & Analytics

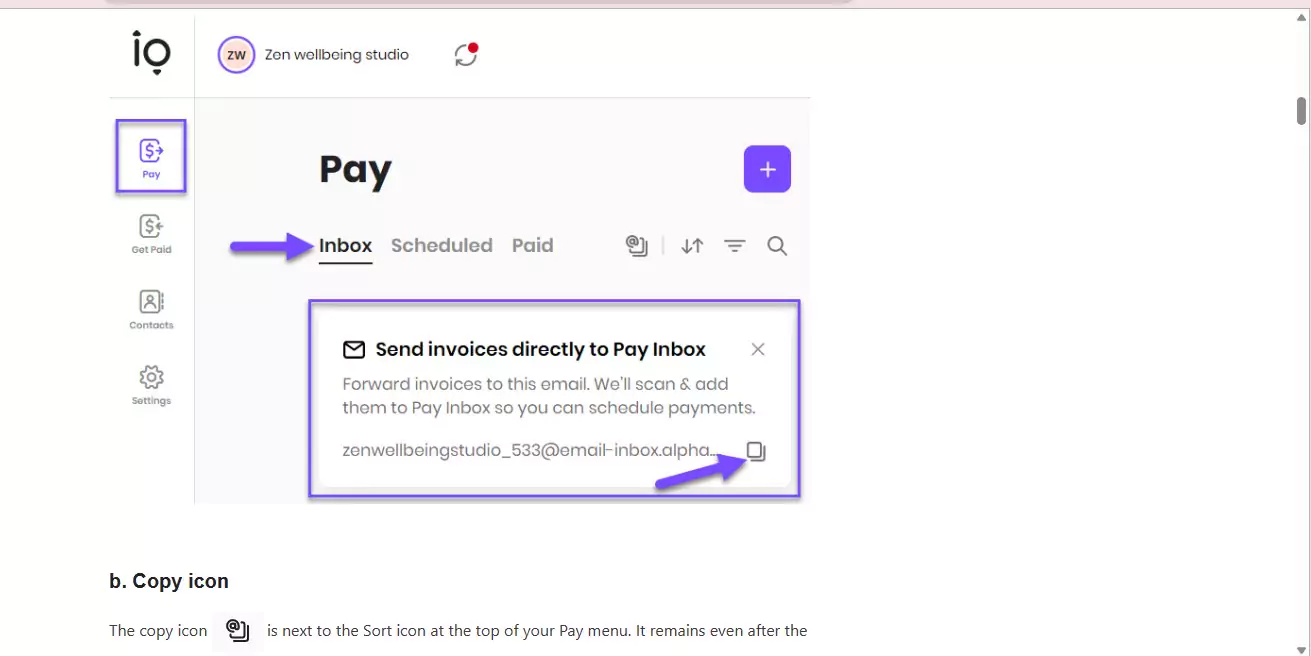

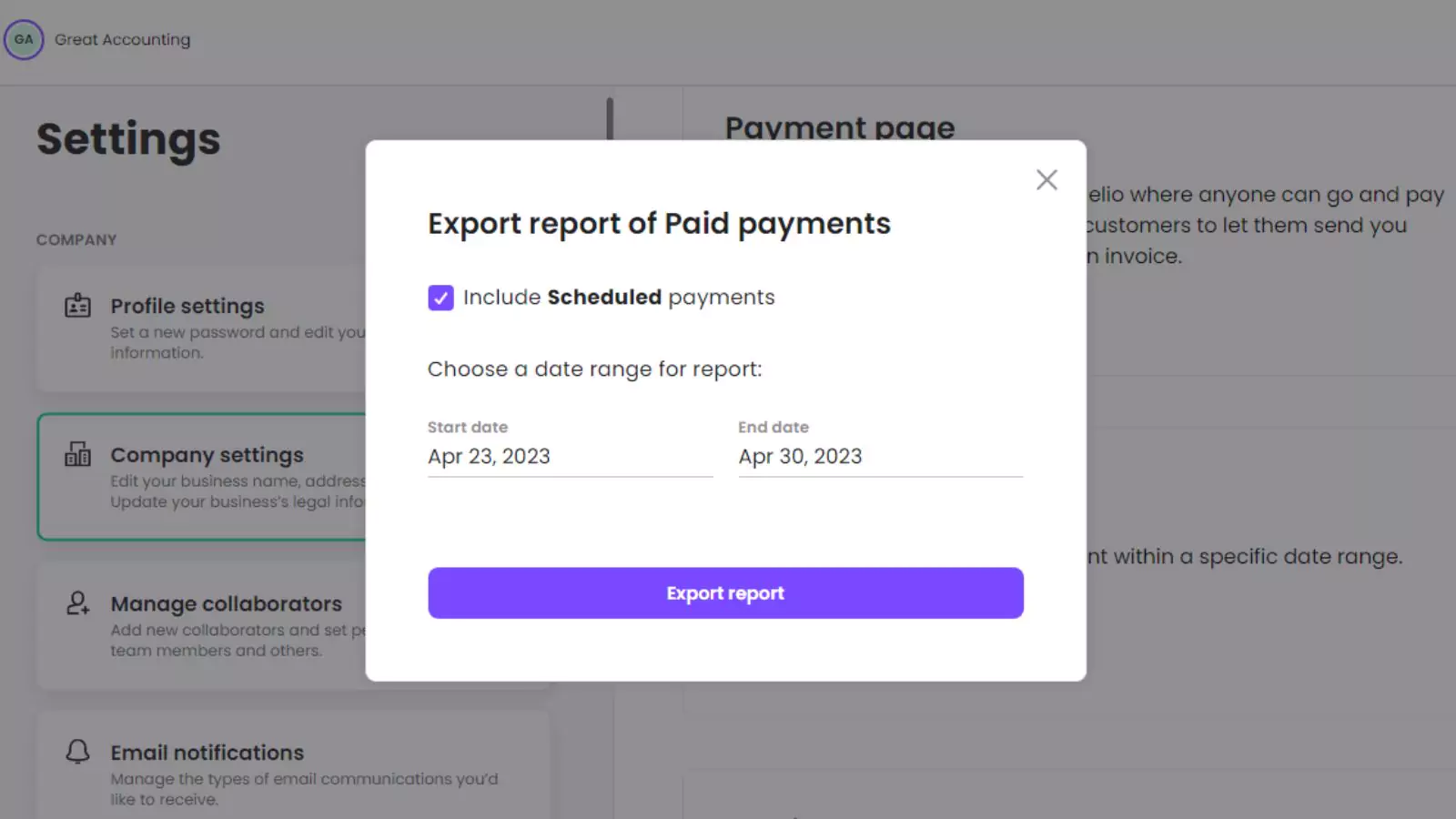

vCita is a platform that enables users to manage their financial transactions, including electronically managing all payments and receipts. As part of its features,{{brand name}} provides users with the ability to export data in CSV format. Once a user has set their preferences on the platform, they can easily extract data on payments and transactions and convert it into a CSV file format, which can be useful for accounting and financial analysis.

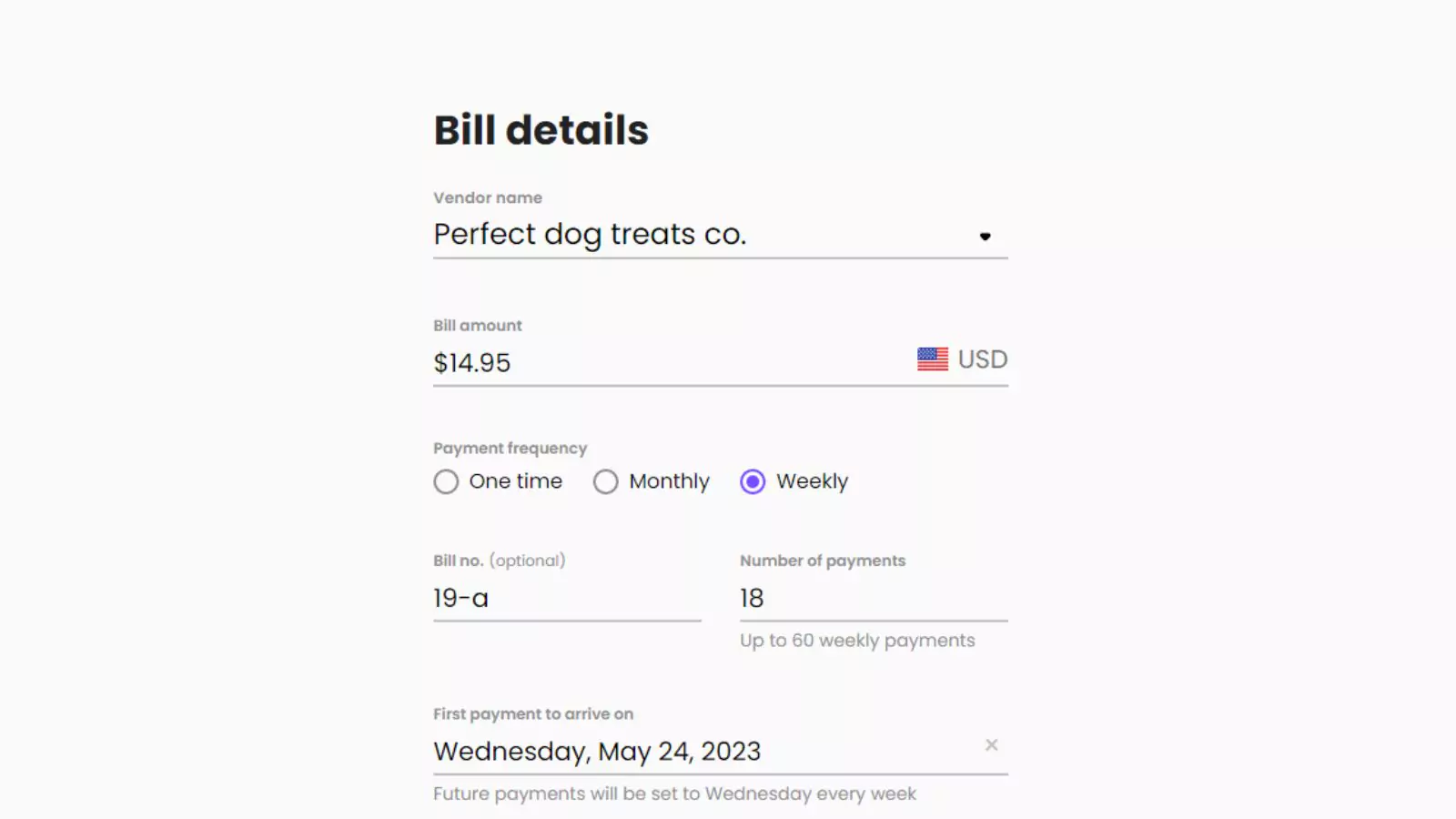

Cash Flow Features

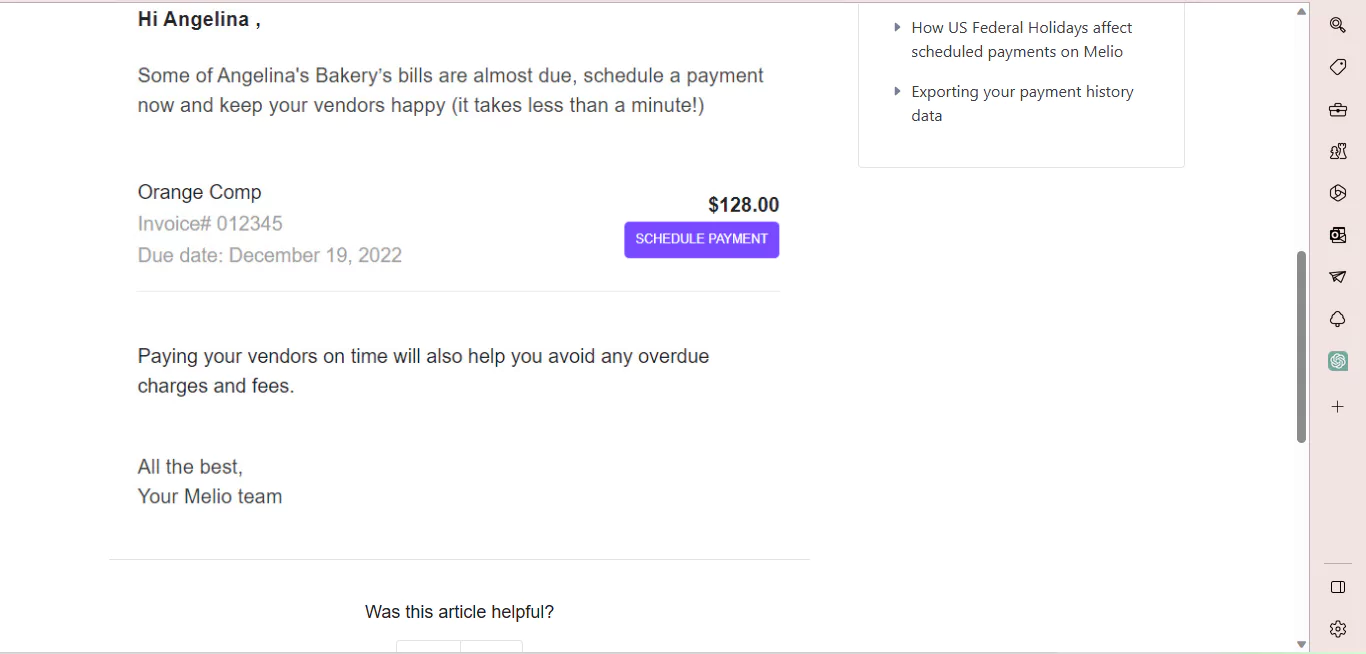

With Melio, users have the flexibility to choose the most convenient payment method,and set a schedule for when your payment will be deducted from an account. This ensures timely payments, which Melio will handle on the user’s behalf and without requiring a vendor to sign up for their services, making the process simple and quick.

Melio’s services are also free, with only transaction fees charged when sending or receiving money. By using your credit card for payments, you can track payments in real-time and make decisions based on current information, improving your cash flow.

Integrations & Add-Ons

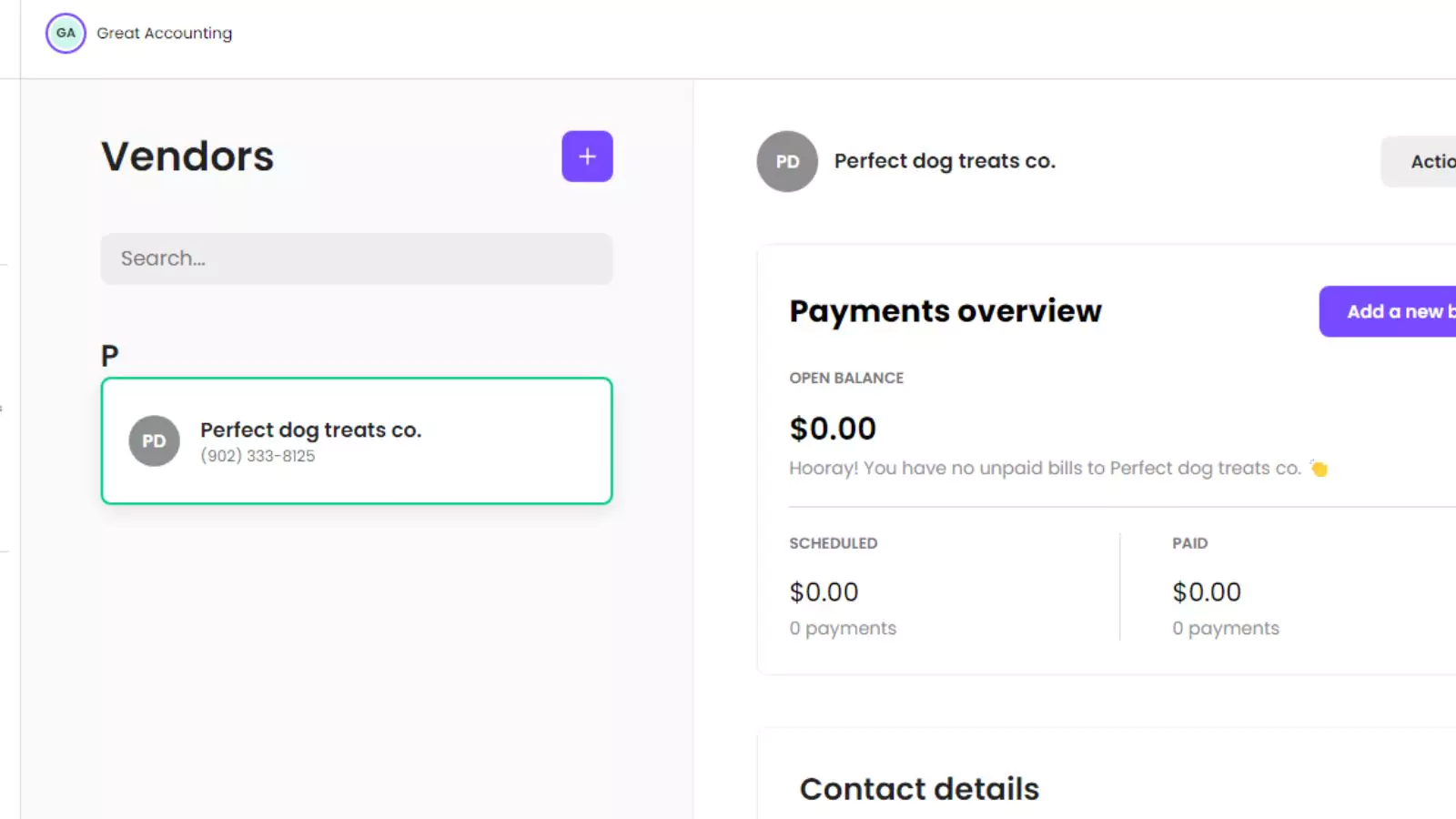

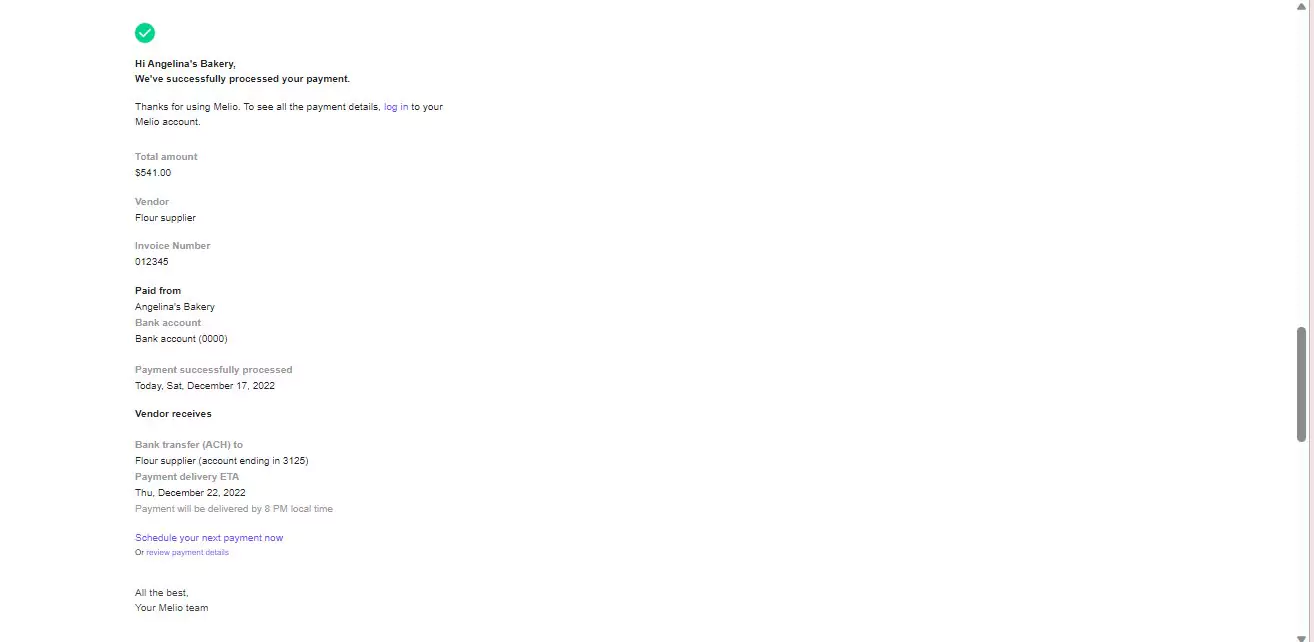

One of the impressive features is Melio’s integration with several US banks and QuickBooks. After integrating Melio and QuickBooks, the platform automatically extracts vendor information from QuickBooks, making your workflow more efficient by eliminating the need to enter vendor details manually. Instead, you can simply choose a vendor from the list or type their name to have vendor’s information auto-completed. Once a bill payment has been made in Melio, your QuickBooks account will be automatically updated with the payment details.

Performance:

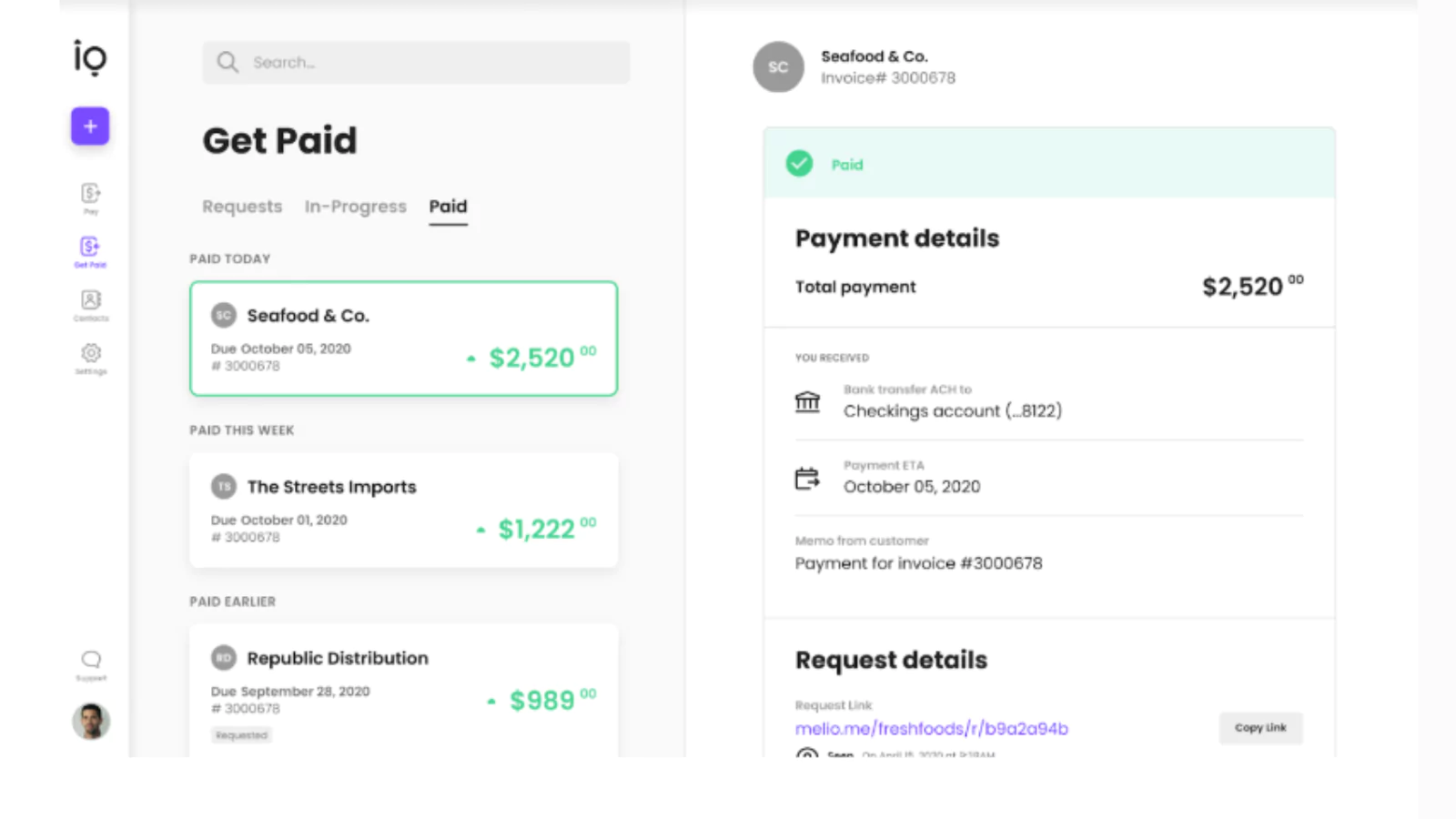

Payment Notifications

Melio allows users to turn notifications on and off for different modules, such as payment notifications, invoice reminders, and more. Payment notifications are alerts that users receive when a payment is made or received through Melio. This feature allows users to manage their transactions in real-time and stay up-to-date on their payment status. Users can customize the types of payment notifications they want to receive, depending on their preferences and needs.

Reminders (For receiving payments)

Melio provides users with the option to set reminders for receiving payments, which can help them avoid missing any deadlines or oversights. With this feature, users can create custom reminders for each invoice or payment, ensuring that they are notified when it is due. Users can set reminders to be sent via email, SMS, or push notifications. Melio also allows users to schedule recurring payments or invoices, saving them time and hassle in the long run.

Sending Emails

Melio allows users to send invoices via email, which makes the payment process easy and seamless. This feature eliminates the need for users to send invoices manually, saving them time and effort. Users can customize the email templates and include their branding or logos. Melio also tracks when the invoice is viewed or paid, providing users with real-time updates on the payment status.

Invoice Creation

Melio makes it easy for users to create professional invoices quickly and easily. Users can create custom invoices with their branding and logo, choose from different payment methods, and add payment terms or notes. The invoice creation feature allows users to create invoices on-the-go, reducing the need for manual paperwork. Once an invoice is created, users can send it directly to the vendor or customer via email, making the payment process fast and efficient.

Ease Of Use:

Registering for Melio was very simple, and only took a few minutes. I was able to use an existing email address to sign up, and Melio didn’t necessitate any credit card or financial details. The dashboard’s user-friendly design allows for seamless navigation, and the features are both easily accessible and uncomplicated. Furthermore, there are a plethora of informative articles and blogs accessible to offer guidance on any feature or function.

Create Invoice

Creating invoices is very intuitive, thanks to the user-friendly interface. The fields are laid out in a logical manner.

Find Client

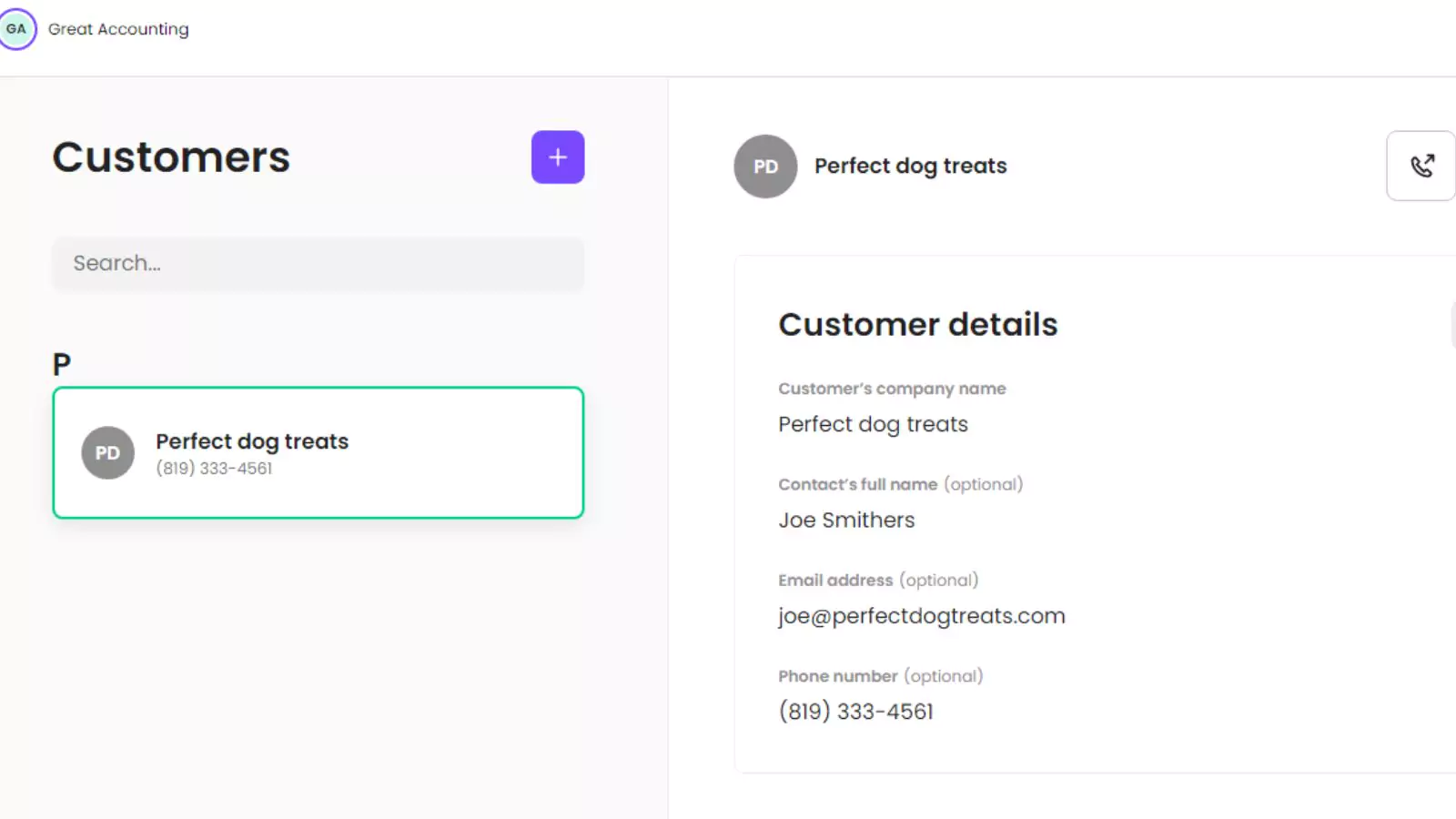

Melio users can create detailed customer records, which can be organized according to active and inactive.

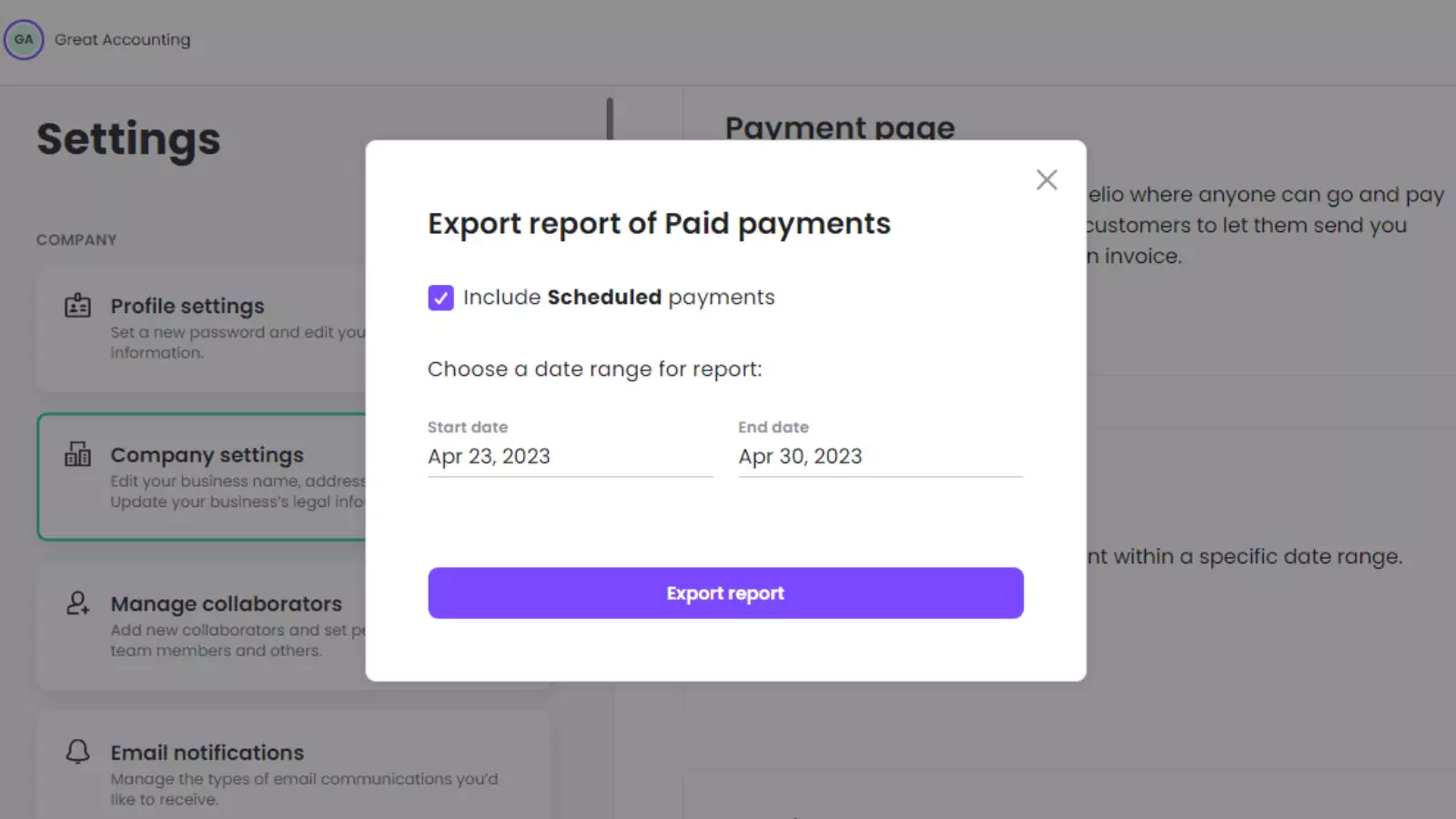

Customize Reports

Melio does allow users to export data into a report format (such as payment history) but doesn’t appear to have additional functionality.

Verdict:

Melio is a payment platform that helps small businesses pay and get paid online, without the hassle of paper checks. It’s perfect for mom and pop shops that may not be savvy in accounting. Unlike some competitors, Melio charges a 1% fee for same-day payment and a 2.9% fee for credit card payment.

The best part is, Melio simplifies the payment process for your small business customers, making it easy and frictionless. They offer intuitive technology, flexible payment options, tracking, and an online collaborative environment, all for free. This can help your small business customers facilitate speedy and efficient payments, while automating their accounts receivable.