Pay.com Review 2025

Pay.com Merchant Services Plans & Pricing

Pay.com Comparison

Expert Review

Pros

Cons

Pay.com Merchant Services's Offerings

Pay.com has two service options if your business processes less than $800k per year, their package for 2.9% + $0.29 per transaction is standard.

You have to contact their sales team for businesses processing more than $800k per year.

Both plans come with a user dashboard and customer insights.

Customer Support

Customer Support

When I explored Pay.com’s customer support, I found that assistance is primarily available through a Help Center request window within the user dashboard. This means that direct contact with an agent via phone, chat, or email isn’t currently offered. However, the platform compensates with comprehensive online resources.

Help Center

The Help Center is accessible directly from the dashboard, allowing users to submit requests or find answers to common questions. While testing, I found the response time to be prompt, and the support team provided detailed solutions to my inquiries.

Website Resources

Pay.com’s website features an extensive collection of articles and guides covering various topics related to their online payment solutions. These resources are well-organized, making it easy to find information on specific features or troubleshooting steps.

Blog

The platform maintains a regularly updated blog that offers insights into the latest trends in online payment platforms and e-commerce payment methods. The content is informative and can be a valuable resource for businesses looking to stay current with industry developments.

FAQ Section

An FAQ section addresses common questions about Pay.com’s services, including payment gateway integration, virtual card usage for online payments, and electronic check processing. This section is particularly helpful for new users seeking quick answers without navigating through extensive documentation.

So, while direct contact options are limited, Pay.com provides a robust support system through its Help Center and comprehensive online resources, ensuring users have access to the information they need to effectively utilize the platform’s merchant services software.

Features & Functionality

General Features

Pay.com offers Integrated Payment Methods, Checkout Page, Card Authentication, and Payment Requests. In addition to these standard merchant services, it also offers:

- Multiple Payment Methods

- Global Payment Processing

- Virtual terminals

- Online Payments

- Mobile payment solutions

- Point-of-sale (POS) systems

- Merchant account services

- Customer Insights

- Customizable checkout pages

- Payment requests

- Support for multiple payment methods

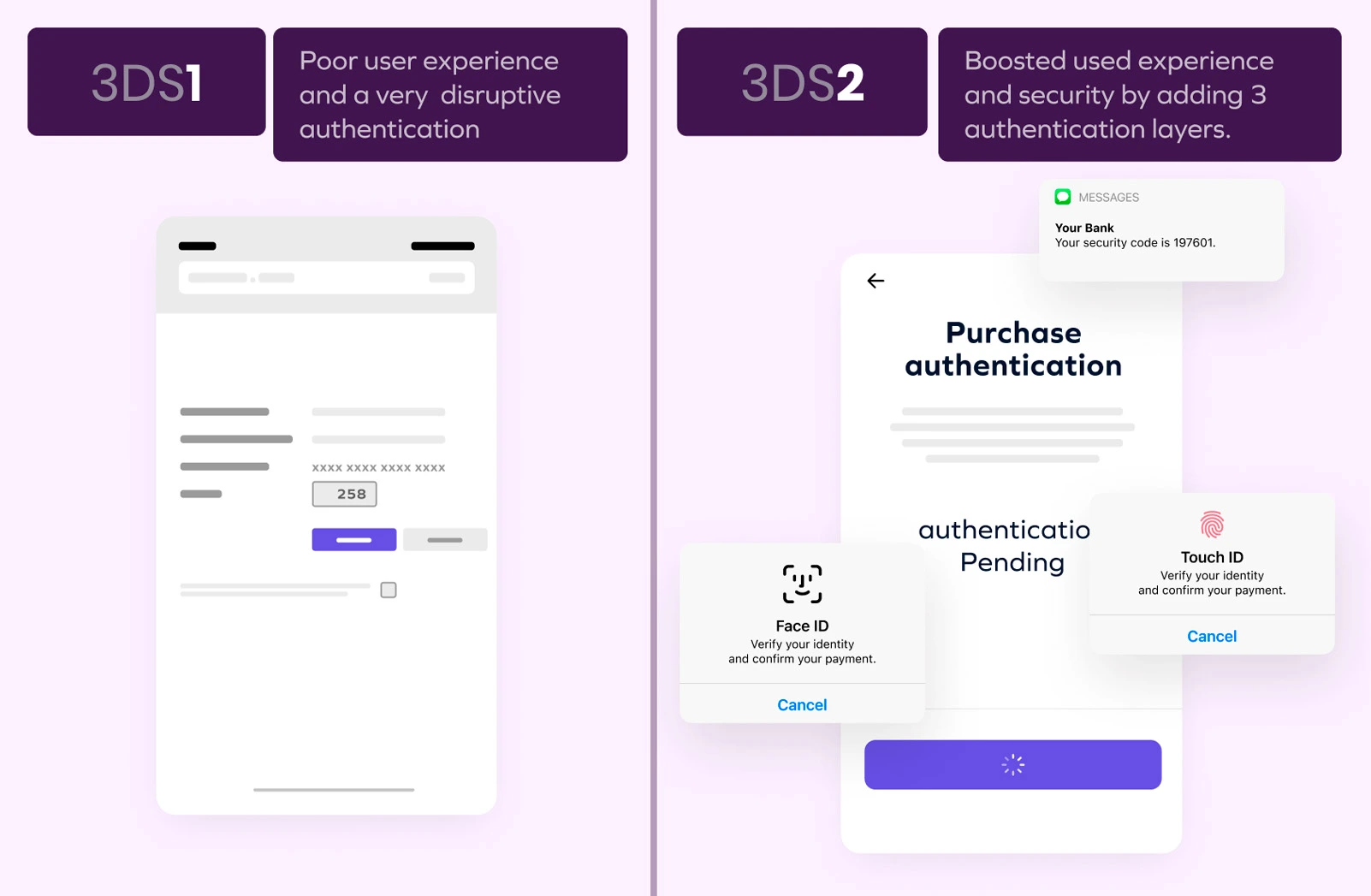

- 3D Secure 2.0 authentication

- Fraud detection and prevention

- Recurring billing and subscriptions

- Integration with major e-commerce platforms

- Developer-friendly API

- PCI compliance

- Real-time reporting

- Multi-currency support

- Secure payment links

- Invoicing tools

Dashboard

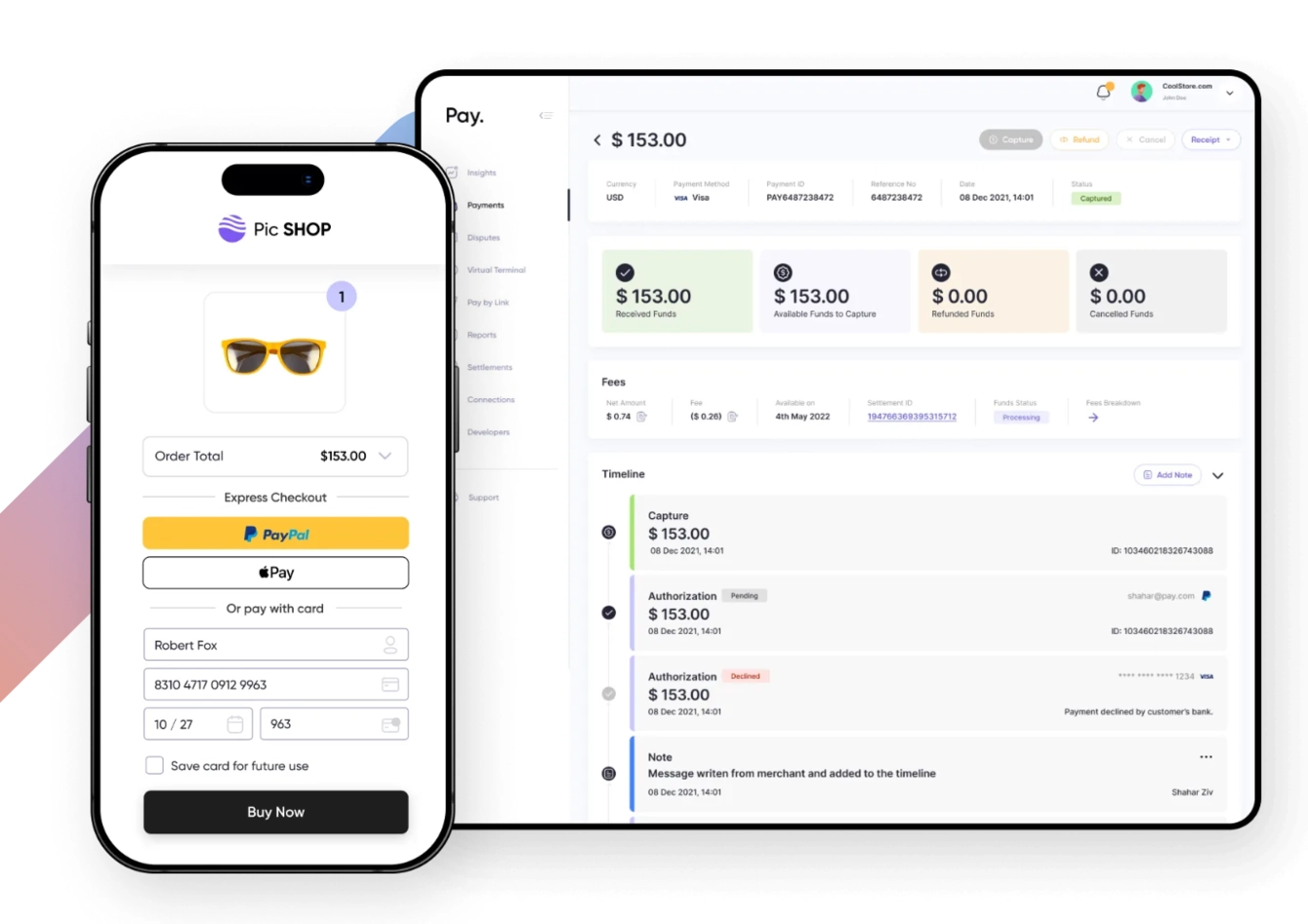

Multiple Payment Methods

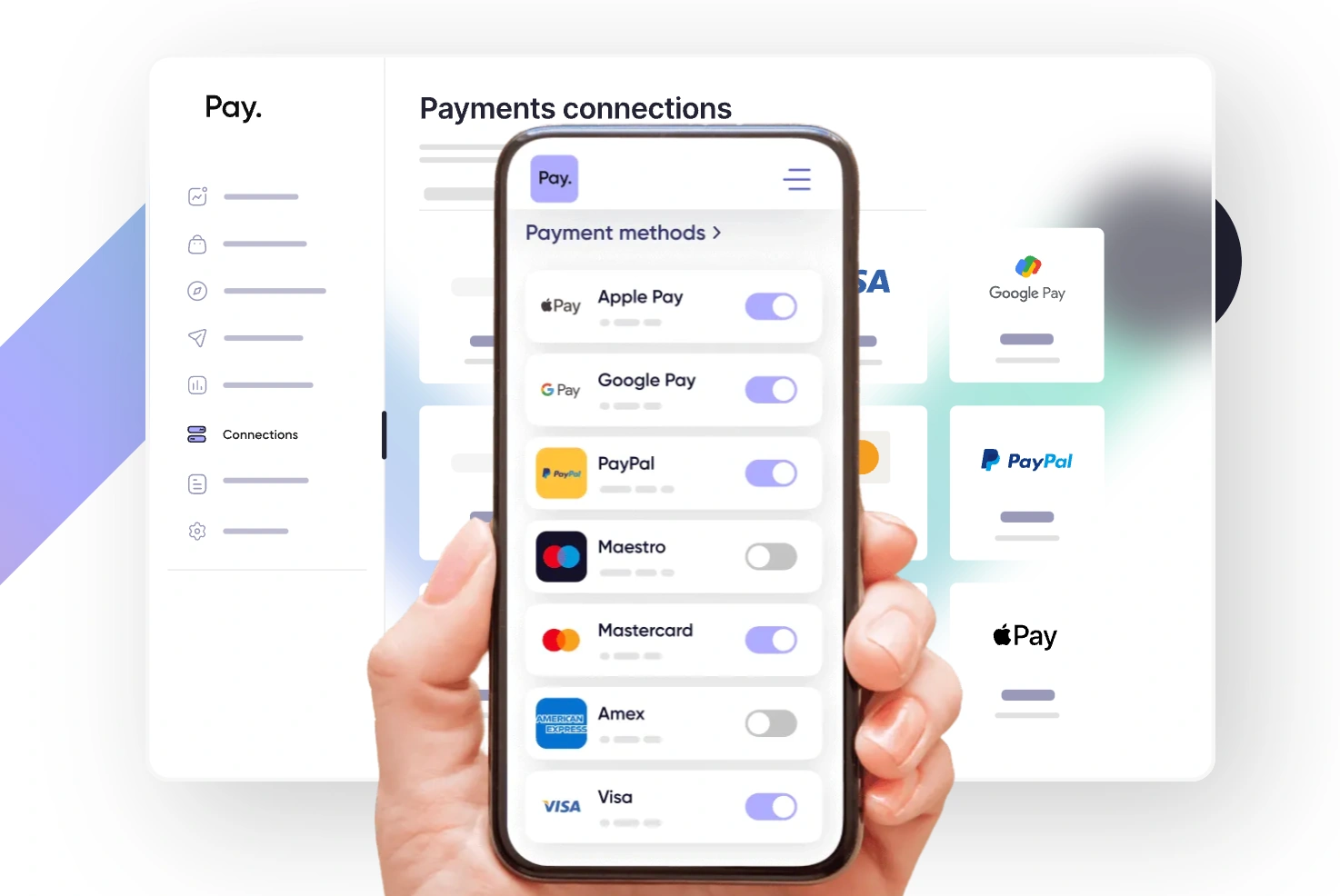

When I tested Pay.com, I found it supports a wide array of payment options, including major credit and debit cards, ACH transfers, and digital wallets like Apple Pay, Google Pay, and PayPal. Managing these options was straightforward through the Pay.com Dashboard, allowing me to easily add or remove payment methods to align with customer preferences. This flexibility enhanced the checkout experience, catering to diverse customer needs.

Global Payment Processing

I tried out Pay.com’s global payment processing feature and was impressed by its efficiency in handling international transactions. The platform connects to local payment methods and card schemes, enabling businesses to accept payments from customers worldwide. This capability simplifies expanding into global markets without the hassle of managing multiple payment gateways.

Virtual Terminals

I found that Pay.com’s virtual terminal enabled me to process payments without physical card readers. By entering customer payment details directly into a secure online portal, I could handle transactions remotely, which was ideal for phone or mail orders. This flexibility ensured I could accept payments in various scenarios, enhancing customer service and expanding sales opportunities.

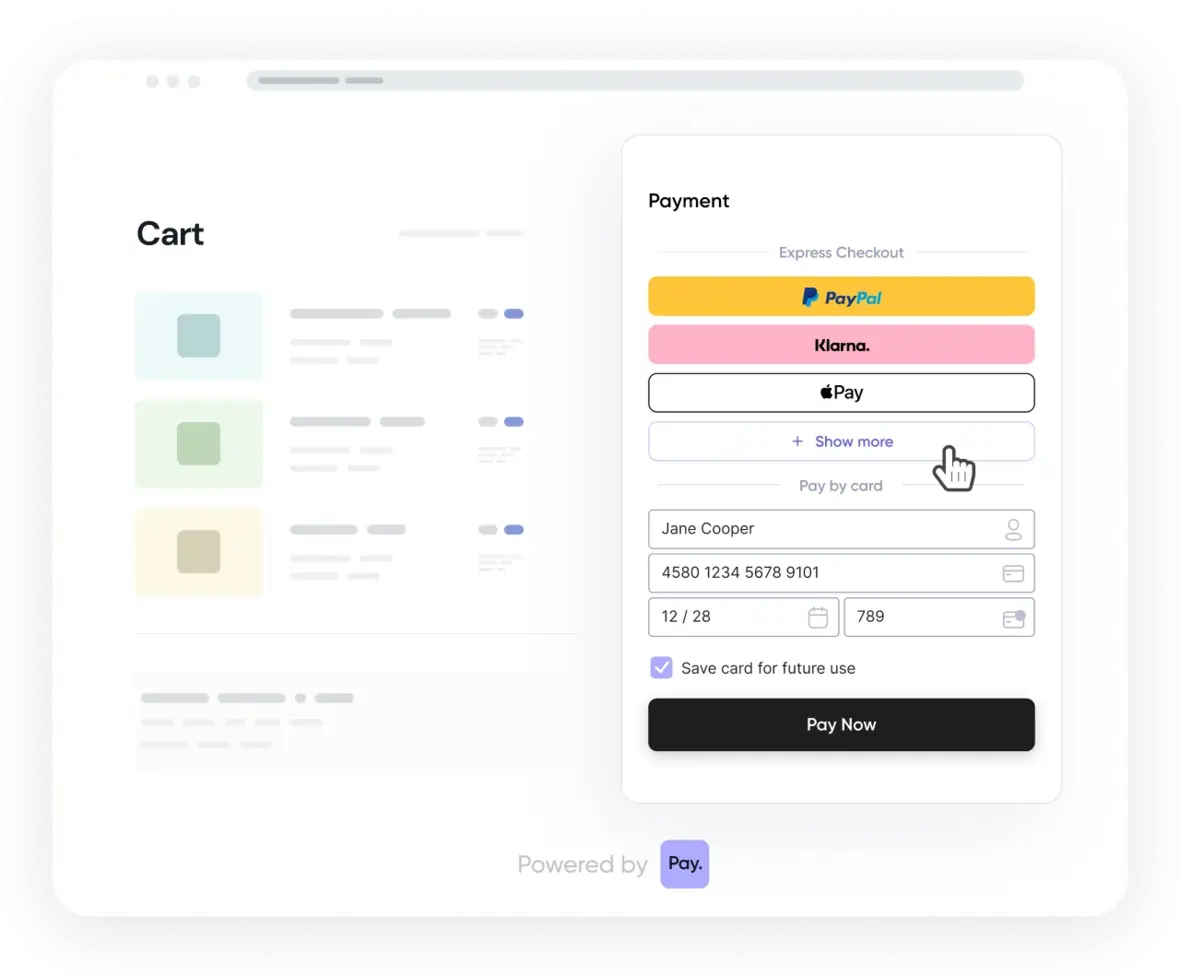

Online Payments

When I tested Pay.com’s online payment processing services, accepting payments was seamless. The payment gateway supports credit cards, digital wallets, and multiple e-commerce payment methods, ensuring smooth transactions. The merchant services software integrates with online payment platforms, making it ideal for businesses needing secure, fast, and flexible online payment solutions.

Mobile Payment Solutions

I tried out Pay.com’s mobile payment solutions and was able to accept payments on-the-go using my smartphone. This feature was particularly beneficial for providing flexibility in payment locations. The mobile interface was user-friendly, ensuring quick and efficient transactions, which led to improved customer satisfaction and increased sales.

Point-of-Sale (POS) Systems

When I used Pay.com’s integrated POS system, it streamlined my in-store payment processing. The system supported various payment methods, including credit/debit cards and digital wallets, providing customers with multiple options. The seamless integration with inventory and sales tracking tools helped me manage operations more effectively, leading to better decision-making and operational efficiency.

Merchant Account Services

By utilizing Pay.com’s merchant account services, I was able to accept and process credit card and electronic payments efficiently. This service acted as an intermediary between my customers’ banks and my business bank account, ensuring secure and swift fund transfers. Having a dedicated merchant account led to faster transaction approvals and settlements, improving my cash flow and financial management.

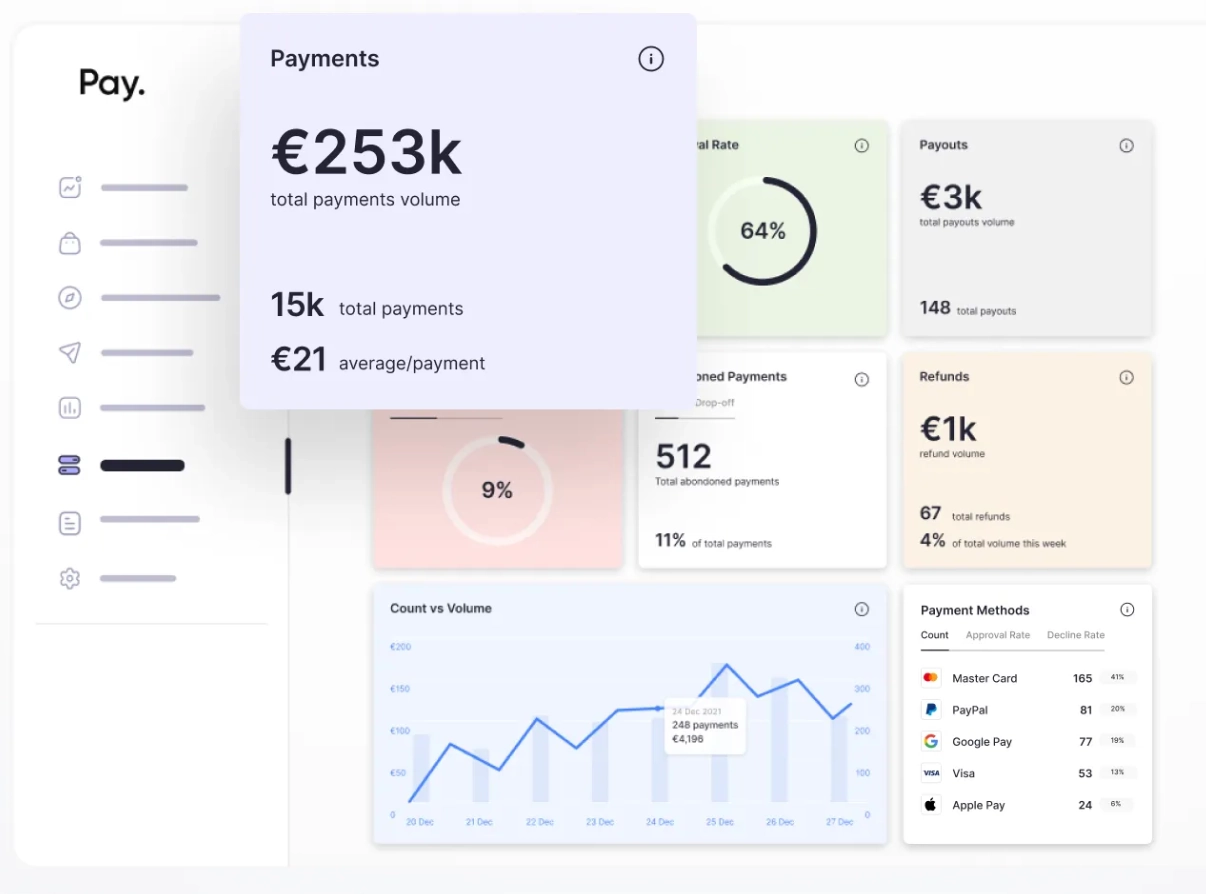

Customer Insights

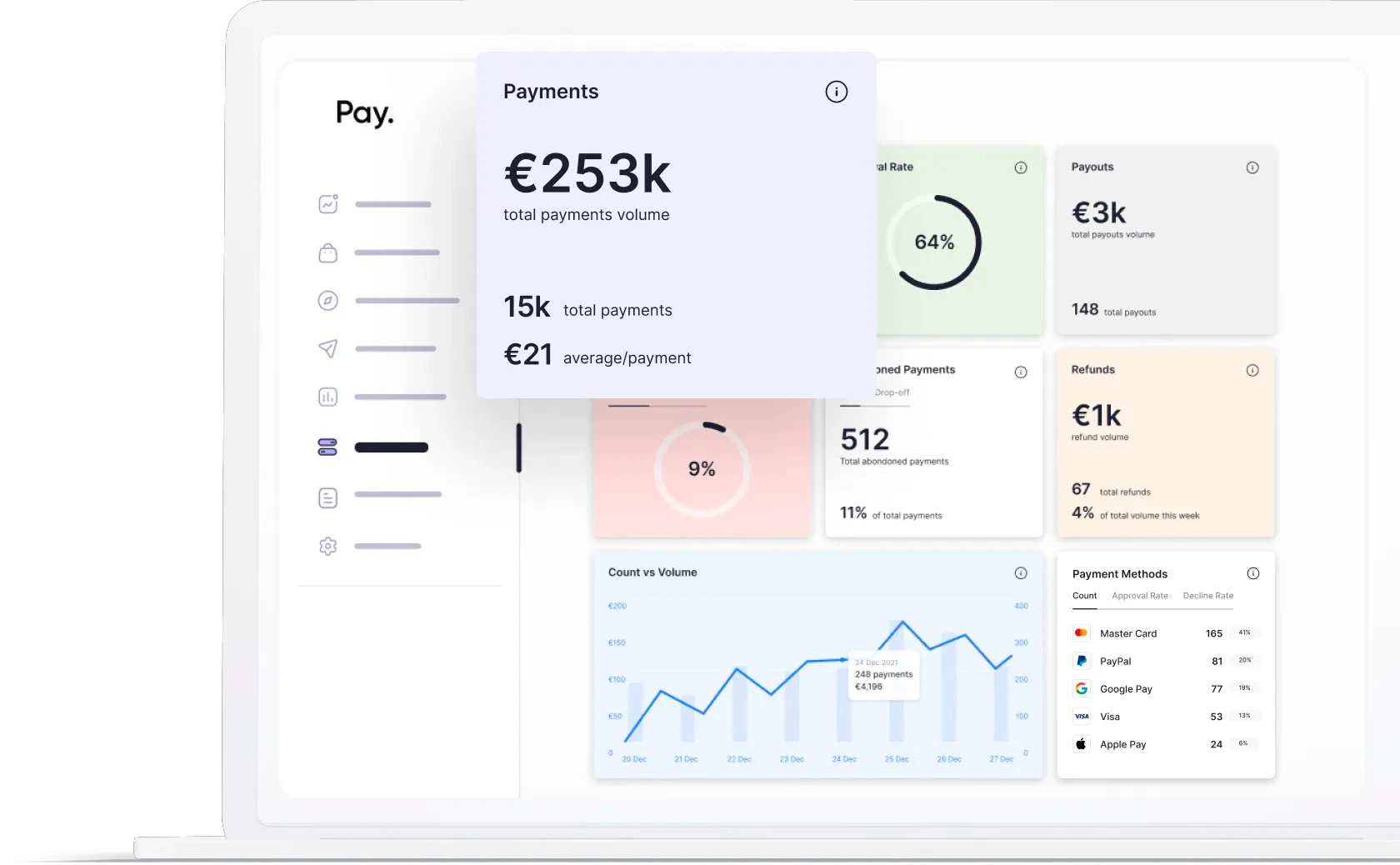

Pay.com’s admin tools provided me with valuable insights into customer spending habits. The platform offers functionalities such as real-time transaction viewing, quick report generation, and intuitive visuals like charts and graphs. These tools helped me spot patterns and trends, allowing for data-driven decisions to enhance customer service and optimize operations.

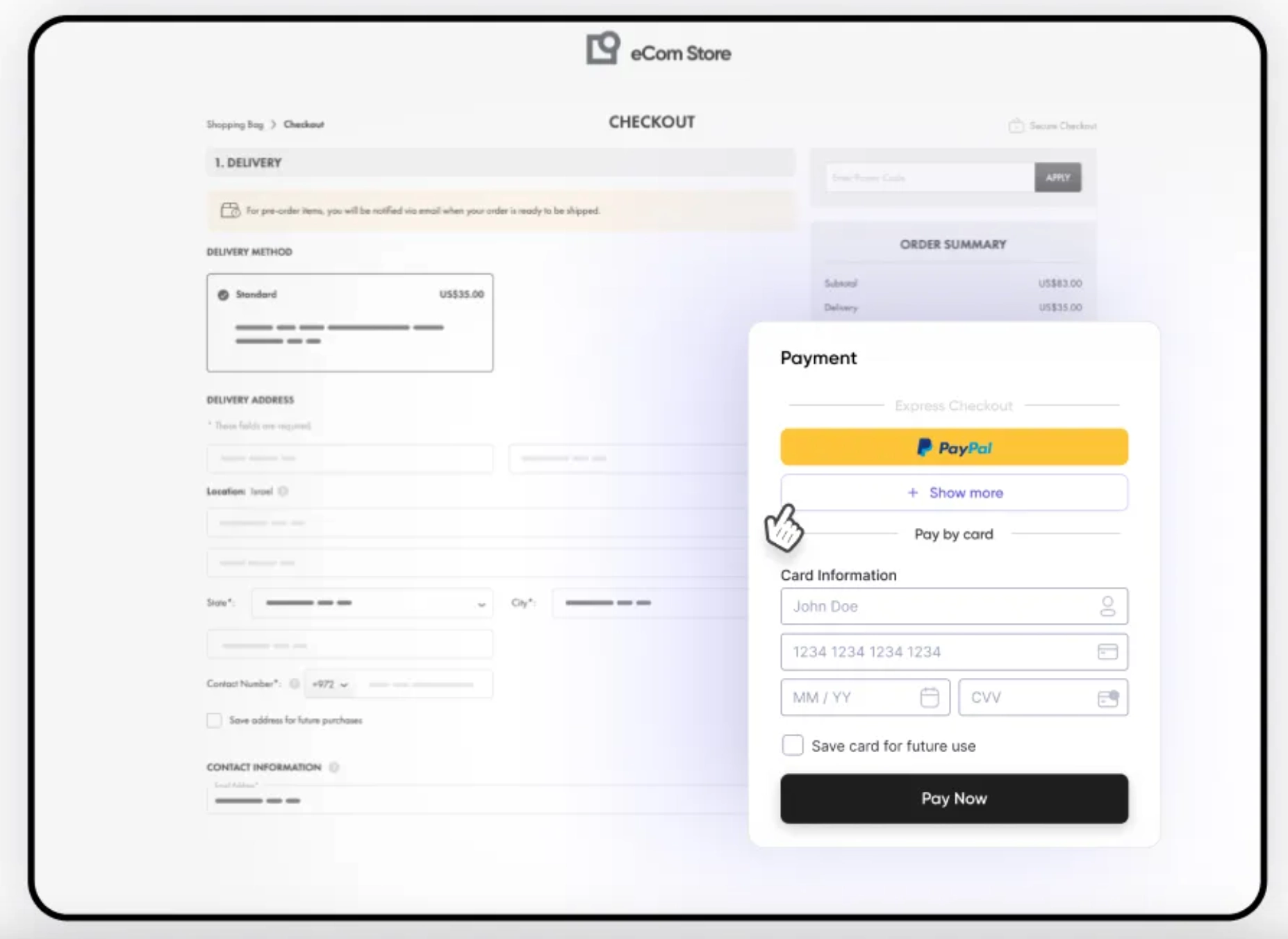

Customizable Checkout Page

When I played with Pay.com’s customizable checkout page, I was able to create a design that matched my brand seamlessly. The platform allows for the inclusion of branding elements, use of a custom domain name, and setting specific terms, policies, returns, and refunds. This customization not only reinforces brand identity but also fosters customer trust during the payment process.

Support for Multiple Payment Methods

Pay.com supports a wide range of payment options, including major credit/debit cards, ACH transfers, and digital wallets like Apple Pay and Google Pay. Managing these options was straightforward through the Pay.com Dashboard, where I could easily add or remove payment methods to align with my customers’ preferences. During checkout, customers could select their preferred payment method, enhancing their experience and potentially boosting conversion rates.

3D Secure 2.0 Authentication

Implementing 3D Secure 2.0, Pay.com added an extra layer of security for online transactions. This authentication protocol required customers to verify their identity during the payment process, reducing the risk of fraudulent activities. Enhanced security measures not only protected my business from chargebacks but also built customer trust, encouraging repeat business.

Payment Requests

I experimented with Pay.com’s payment request feature, which allowed me to send invoices or payment links directly to customers via email or SMS. This facilitated prompt payments without requiring customers to navigate to a separate payment portal. The convenience of this feature accelerated the payment cycle, reduced outstanding receivables, and enhanced the overall customer experience.

Fraud Detection and Prevention

Pay.com employs advanced fraud detection tools to monitor transactions for suspicious activities. By analyzing patterns and utilizing machine learning algorithms, the system could identify and prevent potential fraud before it affected my business. Proactive fraud prevention safeguarded my revenue and maintained the company’s reputation.

Recurring Billing and Subscriptions

For offering subscription-based services, Pay.com’s recurring billing feature automated payment collection at specified intervals. This automation reduced administrative tasks and ensured timely payments, providing a steady revenue stream. Customers also benefited from the convenience of automatic renewals, enhancing satisfaction and loyalty.

Integrations

I explored Pay.com’s integration capabilities and found it compatible with major platforms, including Apple Pay, Google Pay, PayPal, Maestro, American Express, Visa, and Mastercard. This extensive integration ensures that businesses can offer customers their preferred payment methods, enhancing the overall payment experience. You can also integrate it into your e-commerce platform for easy sales and checkouts.

PCI Compliance

I tried out Pay.com’s platform and appreciated its adherence to Level 1 PCI DSS compliance. This commitment to data security ensures that sensitive payment information is handled with the highest standards, reducing the risk of breaches. For businesses, this means enhanced trust from customers and a reduced burden of managing compliance independently.

Real-Time Reporting

Pay.com’s real-time reporting feature provided me with immediate insights into transactions and sales performance. The intuitive dashboard displayed data clearly, facilitating quick decision-making and effective financial management. Access to up-to-date information is crucial for businesses aiming to monitor their operations closely and respond promptly to emerging trends.

Multi-Currency Support

When I explored Pay.com’s multi-currency support, I found it enabled acceptance of payments in various currencies, catering to a global customer base. This feature simplifies international transactions, allowing businesses to expand their reach without the complexities of currency conversion. It enhances the customer experience by displaying prices in their local currency, potentially increasing conversion rates.

Secure Payment Links

I played with Pay.com’s secure payment links and found them to be a convenient way to request payments. By generating unique, secure URLs, I could send them directly to customers via email or SMS. This method streamlines the payment process, making it easier for customers to complete transactions promptly, which can improve cash flow and customer satisfaction.

Invoicing Tools

Pay.com’s invoicing tools allowed me to create and send professional invoices directly from the platform. The customizable templates and automated reminders reduced manual effort and improved accuracy. Efficient invoicing can lead to faster payments and better cash flow management, essential for business sustainability.

Developer-Friendly API

When I tested Pay.com, I found its developer-friendly API allowed seamless integration of its payment gateway into existing systems. The comprehensive documentation and customizable options made the process straightforward, enabling businesses to tailor the payment experience to their specific needs. This flexibility is invaluable for adapting to unique operational requirements.

Hardware & Software

Pay.com offers hardware and software flexibility, supporting iOS, Android, Windows, and Mac for seamless transactions across devices. Its cloud-based system ensures remote access, while on-place installation provides stability for in-store payments. This versatility makes it a strong merchant services software for diverse online payment platforms and businesses.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

When I tested Pay.com, I found its online payment processing services to be fast and seamless. Transactions process quickly, ensuring smooth checkouts for customers. The platform also includes a payment request feature, allowing businesses to send secure payment links through multiple channels, speeding up payments.

Reliability

Pay.com maintains high reliability by working with multiple payment acquirers. If one system encounters issues, transactions are automatically rerouted to another, ensuring uninterrupted service. This is essential for businesses that need consistent and dependable merchant services software to handle payments without downtime.

Features

Pay.com offers a range of e-commerce payment methods, including credit and debit cards, electronic check processing, and digital wallets like PayPal, Apple Pay, and Google Pay. I also tested its customizable checkout pages, which allow businesses to align their payment process with their brand. Real-time analytics and reporting provide insights into transactions and sales trends, helping business owners make informed decisions.

Overall, Pay.com delivers fast, reliable, and feature-rich online payment solutions, making it a strong choice for businesses looking for a payment gateway that prioritizes efficiency and security.

Ease Of Use:

Simple Sign-Up Process

When I tested Pay.com, I found the sign-up process to be quick and straightforward. After entering basic details, I was able to access the user dashboard within minutes. However, to activate the account and start using its online merchant services, additional business and banking details were required—standard for merchant services software.

User-Friendly Dashboard

Navigating the Pay.com tool was easy. The dashboard is well-organized, with clearly labeled tabs at the top of the homepage, making it simple to explore Pay.com’s online payment solutions. Whether setting up a payment gateway, managing virtual card for online payment options, or configuring electronic check processing, everything was intuitive.

Optimized for Business Owners

Pay.com is designed for business owners who need reliable online payment platforms. The combination of smooth navigation, clear e-commerce payment options, and responsive design makes online payment processing services simple to manage.

Verdict:

Pay.com is a reliable merchant services software that covers all online payment processing services for any business—whether online or offline, B2B or B2C, freelancing, or outsourcing. During my testing, I found that it supports all e-commerce payment methods, including credit cards, digital wallets, and electronic check processing, making it a strong payment gateway for global transactions. Its fraud detection system effectively minimizes fake payments and bot attacks, ensuring security. While customer support options are limited, the platform’s intuitive dashboard and online payment solutions make it a solid choice. In this Pay.com review, I’ve covered features, performance, and Pay.com pricing.