Payment Nerds Review 2025

Payment Nerds Merchant Services Plans & Pricing

Payment Nerds Comparison

Expert Review

Pros

Cons

Payment Nerds Merchant Services's Offerings

The Payment Nerds merchant services pricing is transparent, with a pay-as-you-go pricing model and no installation charges, monthly fees, or contract obligations. I think this is a great way to offer affordable payment solutions to businesses just starting out or to SMBs.

You’re charged only for the services you use, ensuring flexibility and fairness. While there’s no free trial, the model eliminates unnecessary commitments. Additional charges include 0.5% for manually entered cards, 1.5% for international cards, and 1% for currency conversions.

- Low Risk: Ideal for stable industries like retail, education, and home goods. Domestic card transactions are charged at 1.59% + 3¢.

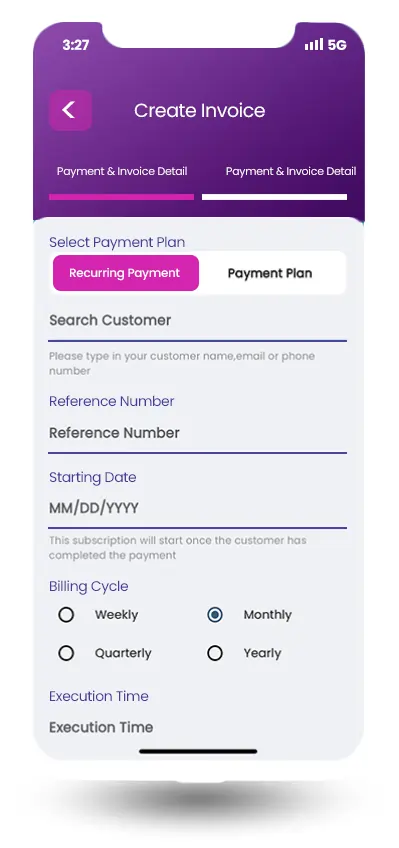

- Medium Risk: Designed for sectors like subscriptions, health, and wellness, which may face occasional chargebacks. Transactions cost 2.49% + 3¢ per card.

- High Risk: Tailored for industries like ticketing, firearms, and dating sites that face higher chargeback risks. Charges start at 2.99% + 3¢ per transaction.

- Start-Up: New businesses begin at 2.7% + 3¢ per card transaction, with potential reclassification as the business grows.

- Enterprise: Large companies can secure tailored rates based on payment volume and processing history by contacting Payment Nerds for a custom quote.

This flexible system ensures businesses of all sizes and risk levels can access secure, competitive payment solutions.

Customer Support

When I reached out to their customer support, I tried multiple channels. Phone and email support are the most reliable channels.

The phone support was quick, I got through to an agent within a couple of minutes, and they were professional and helpful in answering my questions.

Email support took a little longer, around a few hours. I received a thorough response and the agent was well-informed about her products and services. The agent was also transparent with pricing details, but for businesses inquiring about tailored solutions, you’ll need to connect with a sales representative for further clarification.

When I explored Payment Nerds’ blog, I found it packed with insightful articles covering payment processing trends, security tips, and e-commerce platform strategies. It’s a useful resource for business owners looking to sell online and optimize their inventory management. The blog also provides guidance on payment integrations, compliance, and industry updates.

Payment Nerds does not offer live chat support, but you can reach out through their social media channels. However, as a relatively new player in the market, their social media presence is still developing and lacks extensive content.

The company’s website lacks a comprehensive FAQ section or knowledge base, which could be beneficial for users seeking quick, self-service information.

Features & Functionality

General Features

The Payment Nerds merchant services software is designed to enhance payment processing and support businesses across many industries.

Here’s a list of the key features offered:

- All-around payment solutions

- Real-time payment processing

- Fraud monitoring and prevention

- Merchant accounts

- Chargeback mitigation tools

- Customizable reporting and analytics

- PCI DSS compliance for security

- Seamless integration with e-commerce platforms

- Support for credit and debit cards

- Digital wallet compatibility

- Mobile-friendly dashboard

- API for custom workflows

- Multi-currency support

- Tailored solutions for high-risk industries

- Customizable solutions for each industry

- Transparent and fast funding

- Integrations

All-Around Payment Solutions

Payment Nerds offers an integrated suite of payment solutions tailored for businesses of all sizes. From processing credit card transactions to supporting online payments, the merchant services software is designed to streamline financial operations efficiently.

Real-Time Payment Processing

Payment Nerds ensures instant transaction processing, reducing delays and improving the customer experience. When I tried it, payments were processed in real-time, helping businesses maintain steady cash flow and handle high transaction volumes. For companies looking for an affordable e-commerce solution, this feature keeps operations running smoothly.

Fraud Monitoring and Prevention

I explored the fraud prevention tools, and Payment Nerds uses real-time monitoring and AI-powered detection to flag suspicious activities. The merchant service provider employs advanced fraud detection tools that actively monitor transactions for suspicious activities, ensuring real-time identification and prevention of fraudulent behavior.

Their system includes algorithms designed to detect patterns that could indicate fraud, reducing the risk of chargebacks and unauthorized transactions.

Additionally, the platform integrates with enhanced chargeback management solutions, helping businesses resolve disputes effectively and minimize financial losses associated with fraudulent claims.

Merchant Accounts

Payment Nerds offers secure merchant accounts that are tailored to meet the specific needs of businesses across various industries.

These accounts provide the foundation for accepting credit and debit card payments, ensuring fast and reliable transaction processing.

The merchant services software is designed to comply with industry regulations, giving businesses peace of mind about data security and legal standards. With features like multi-currency support and seamless integration with e-commerce platforms, their merchant accounts enable businesses to operate efficiently both locally and globally.

Chargeback Mitigation Tools

When I tested Payment Nerds’ merchant services platform, I found its chargeback mitigation tools effective in reducing financial losses from disputes. The system detects potential chargebacks early, giving businesses time to resolve issues before they escalate.

The platform provides detailed tracking, documentation, and communication tools, making it easier to dispute claims efficiently. By minimizing chargeback rates and fees, businesses can maintain strong relationships with payment processors while protecting their revenue. This feature is particularly beneficial for companies handling high transaction volumes in an e-commerce platform.

Customizable Reporting and Analytics

Payment Nerds offers real-time reporting and analytics, allowing businesses to track sales trends, transaction data, and performance metrics. I could customize reports to focus on inventory management, revenue patterns, and fraud detection.

These tools make Payment Nerds a strong choice for businesses looking for e-commerce platforms with SEO features and data-driven insights to sell online more effectively.

PCI DSS compliance for security

The merchant services platform complies with PCI DSS standards, ensuring all transactions and data storage meet stringent security requirements to protect sensitive information.

Seamless Integration With E-commerce Platforms

Payment Nerds easily integrates with popular e-commerce platforms, allowing businesses to connect their payment systems with existing online stores.

Support for Credit and Debit Cards

Payment Nerds enables you to accept a broad range of credit and debit card payments, providing customers with flexibility and convenience.

The merchant service platform supports major card networks, ensuring widespread compatibility for both domestic and international transactions.

By facilitating seamless card payments, you can enhance the checkout experience and reduce barriers to completing sales. This feature is integral to accommodating diverse customer preferences and increasing overall transaction success rates.

Digital Wallet Compatibility

I found it supports digital wallets, providing a convenient payment option for customers who prefer contactless transactions. Businesses using this e-commerce platform can accept payments through Apple Pay, Google Pay, and other mobile wallet services, making selling online more accessible. This feature enhances the checkout experience and caters to modern consumer preferences.

Mobile-Friendly Dashboard

Payment Nerds offers a mobile-responsive design, allowing business owners to manage payments from any device. When I accessed the dashboard on a smartphone, I could track real-time transactions, generate reports, and monitor payment activity without any lag. This makes it an affordable e-commerce solution for businesses needing flexibility on the go.

API for Custom Workflows

I played with Payment Nerds’ API integration, and it allows businesses to create custom workflows that fit their needs. The merchant services platform integrates smoothly with e-commerce website builders, CMS platforms, and other third-party tools, providing a tailored payment processing experience.

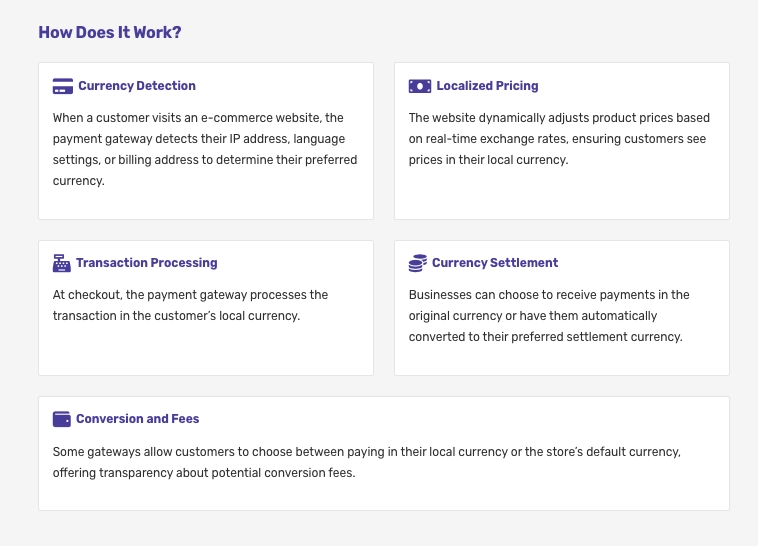

Multi-Currency Support

Payment Nerds offers multi-currency transaction capabilities, allowing businesses to accept payments from customers worldwide in their local currencies. This feature simplifies international commerce by automatically handling currency conversions and ensuring a seamless payment experience for global customers.

It is especially beneficial for businesses looking to expand their reach into international markets, as it minimizes the complexity of cross-border transactions and enhances customer satisfaction.

Tailored Solutions for High-Risk Industries

Payment Nerds specializes in serving high-risk industries by offering fraud prevention, compliance tools, and secure payment systems.

Customizable Solutions for Each Industry

Payment Nerds provides industry-specific customization, ensuring businesses in diverse sectors receive solutions that fit their unique operational needs.

Transparent and Fast Funding

The platform emphasizes quick payouts with no hidden fees, ensuring businesses can access your funds promptly and maintain operational liquidity.

Integrations

When I tested Payment Nerds, I found its seamless integration capabilities useful for businesses using multiple tools. It connects with top e-commerce platforms, CMS solutions, and accounting software. The API for custom workflows allows businesses to tailor payment processing to their needs. While the setup is straightforward, some open-source platforms may require additional configuration to fully integrate Payment Nerds into their online store builder.

Hardware & Software

Integrated tools for efficient merchant operations.

Sales Channels

The platform’s capabilities perform on the following sales channels:

Performance:

Transaction Speed and Reliability

When I tested Payment Nerds’ e-commerce platform, I found its real-time payment processing efficient for businesses of all sizes. Transactions process quickly, ensuring seamless selling online. The system is designed for reliability, handling high transaction volumes without performance issues, making it one of the top e-commerce platforms for businesses prioritizing speed.

Payment Methods Supported

Payment Nerds supports credit and debit cards along with digital wallets, covering essential payment options for an online store. While mobile and contactless payments aren’t explicitly mentioned, the platform ensures secure transactions for businesses looking for an affordable e-commerce solution with broad payment support.

Security and Fraud Prevention

I found that Payment Nerds emphasizes PCI DSS compliance to protect customer data. The platform includes fraud monitoring and chargeback mitigation tools, particularly useful for high-risk businesses. These features help merchants sell online securely while minimizing risks.

Ease of Integration

I played with the integration tools and found that Payment Nerds connects seamlessly with e-commerce website builders and supports customization through APIs. Businesses can link it with their CMS and existing workflows, making setup quick and efficient.

User Experience

The user-friendly dashboard makes payment management easy. When I tested it, I could monitor transactions, generate reports, and manage payments effortlessly. The platform’s mobile-responsive design ensures smooth navigation on any device, providing convenience for business owners who need access on the go.

Reporting and Analytics

Payment Nerds offers real-time reporting and analytics, helping businesses track trends and make informed decisions. I tested the customization options, which allow users to tailor reports to their needs, making it a strong tool for businesses looking for e-commerce platforms with SEO features and data-driven insights.

Scalability

The platform is built to scale with growing businesses. Whether you’re a startup or an enterprise, Payment Nerds supports increasing transaction volumes and offers solutions across industries. I found it to be a reliable e-commerce website builder for businesses that need flexibility as they expand.

Ease Of Use:

When I tested Payment Nerds, I found its e-commerce platform to be highly intuitive and well-organized. The dashboard simplifies payment management, making it accessible for both beginners and experienced users.

Seamless Onboarding

I tried out the onboarding process and found it smooth, with clear instructions guiding me through setup. The platform integrates quickly with e-commerce website builders like Shopify and accounting tools like QuickBooks, making it easy to get started.

Mobile Optimization

Payment Nerds is a mobile-responsive e-commerce platform, allowing businesses to manage transactions, track payments, and access real-time reports from any device. When I tested it on a smartphone, navigation was seamless, and key data remained easily accessible.

Customization & Flexibility

The platform offers customizable reporting and branding options, helping businesses tailor the system to their needs. While it focuses on payment processing rather than e-commerce website design, it complements top e-commerce platforms well, providing an affordable e-commerce solution with minimal setup effort.

Verdict:

Payment Nerds is a newcomer to the payment processing industry, but it has made a strong impression. The company offers a variety of packages tailored to your processing volume and business needs. Their all-in-one payment solutions support online, in-person, and mobile payments, making them versatile for businesses of all types. Key benefits include detailed transaction statistics and transparent funding with no hidden fees.

Pricing is competitive, offering good value for the features provided. While the platform is secure and reliable, the website could benefit from additional resources, such as a comprehensive FAQ section. Payment Nerds is a solid choice for businesses seeking a dependable payment processor.