SurePayroll Payroll Services Review 2025

SurePayroll Payroll Services Plans & Pricing

SurePayroll Comparison

Expert Review

Pros

Cons

SurePayroll Payroll Services's Offerings

SurePayroll primarily provides two types of payroll services – the “No Tax Filing” and the “Full Service” options. Both of these services include features such as unlimited payroll executions, AutoPayroll, new employee reporting, direct deposits, and live support. The pricing of SurePayroll, which is based on quotes, may pose a challenge for growing businesses in terms of cost forecasting. As the business scales, costs may fluctuate and new functionalities could be incorporated.

Customer Support

SurePayroll support team is available to assist with inquiries via phone or chat. The chat option is available on the right side of the screen and can be used to send a message during off-hours, with the team responding the following day.

Phone Support

SurePayroll offers extended business hour email support at their phone number: 877-956-7873. The customer service line instructions were very clear and I was able to speak to a representative during their business hours in under three minutes.

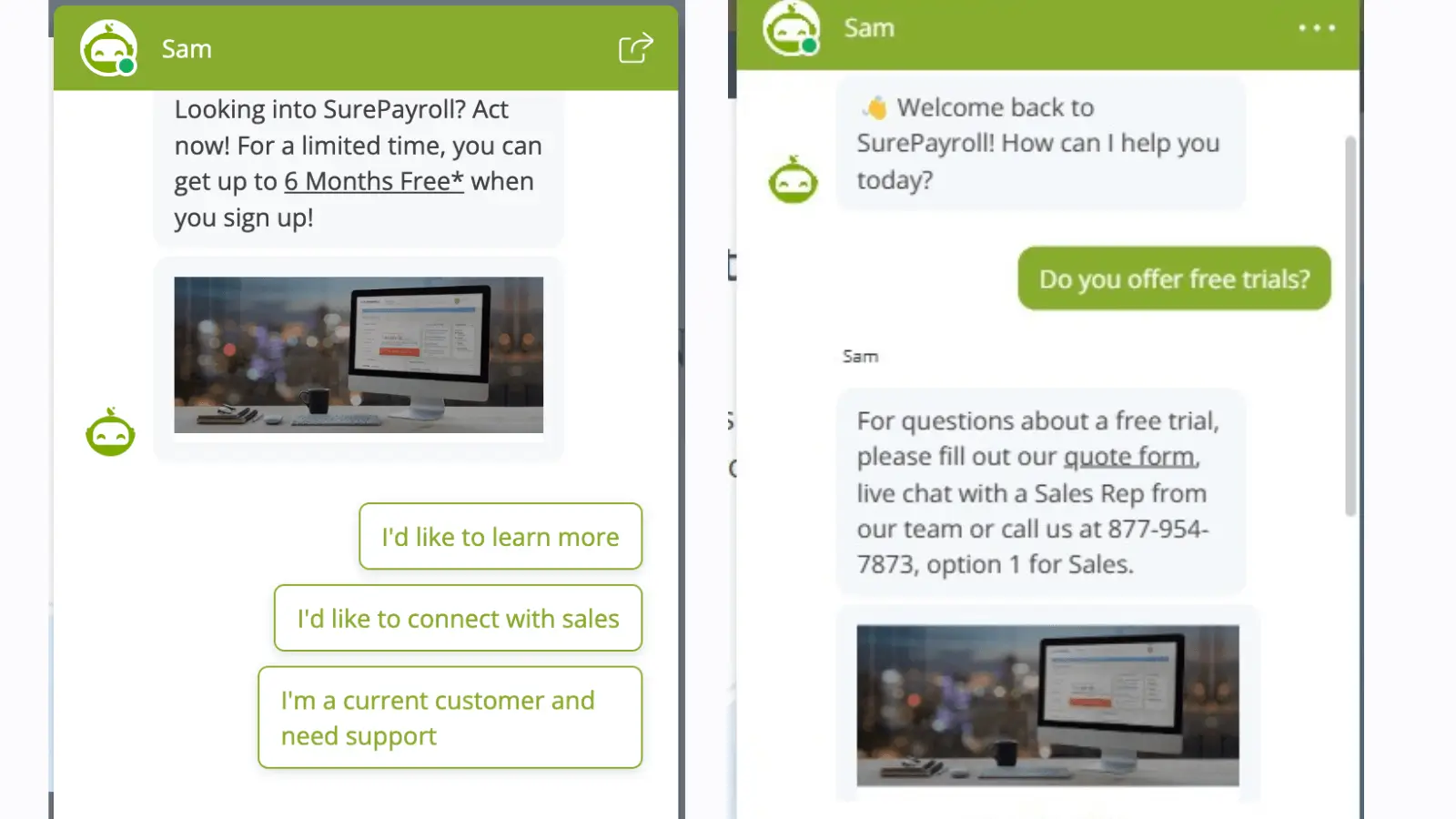

Online Chat

SurePayroll has an online chat feature that provides accurate information in seconds. Once I asked a question, I received a response immediately which indicated how to receive the information I inquired about.

Email Support

SurePayroll offers extended business hour email support at help@surepayroll.com. Similarly to their phone support, assistance is not available on Sundays. Before I had the chance to email the support email I had received a friendly welcome message detailing all the support options SurePayroll offers. Once I had signed up, I received an email from an account specialist for further assistance in my enrollment process.

Video Tutorials

Informative video tutorials are available on SurePayroll’s YouTube channel, and include podcasts featuring industry experts, tours and overviews of products, as well as business tips and explanations of key concepts. The podcasts are particularly useful for business owners, and cover timely topics in an accessible manner.

Features & Functionality

Payroll Features

Offers payroll for all employees, multiple pay rates, custom pay schedules, contractor payments, and off-cycle payments.

Automation Features

Time Tracking

SurePayroll’s time clock integration allows businesses to log employee hours and import this data directly into the payroll system. Through its alliance with Stratustime, employees can log their time through web punch, online timesheet entry, or a mobile web app. This automated system ensures accuracy and reduces manual effort. Moreover, SurePayroll is compatible with third-party time clock companies such as Redcort, Homebase, OnTheClock, and Time Wolf.

HR Features

Includes online employee onboarding/offboarding, PTO management, basic timecards, and a mobile-friendly interface for employees.

Onboarding

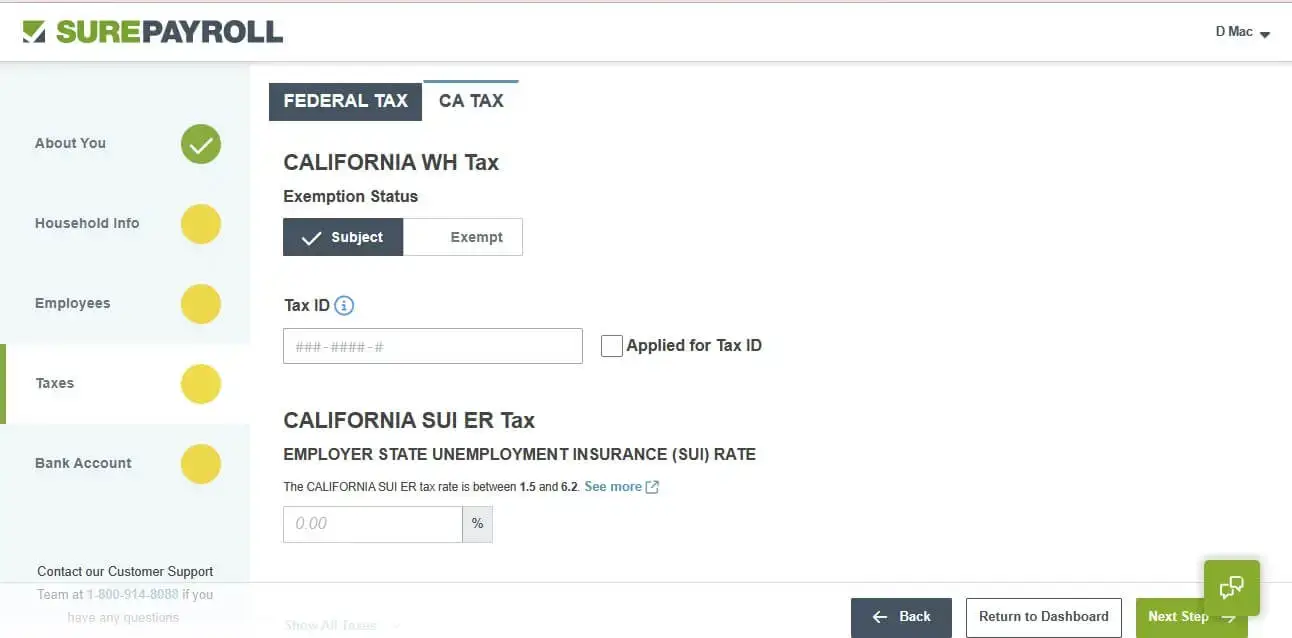

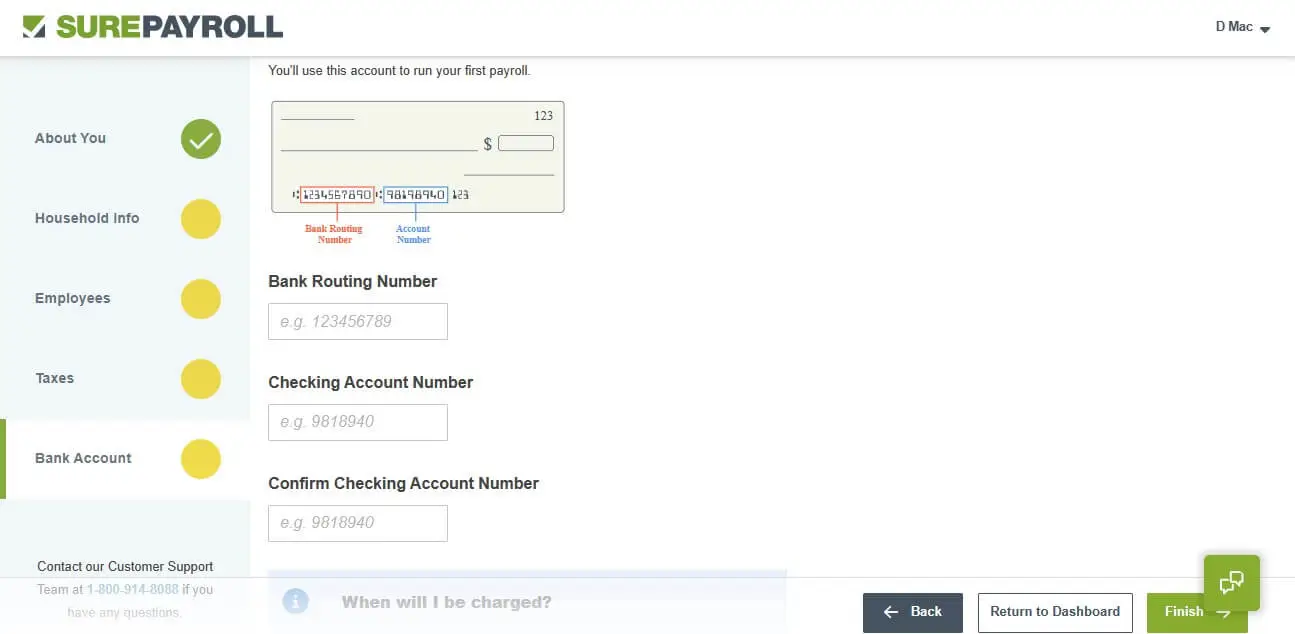

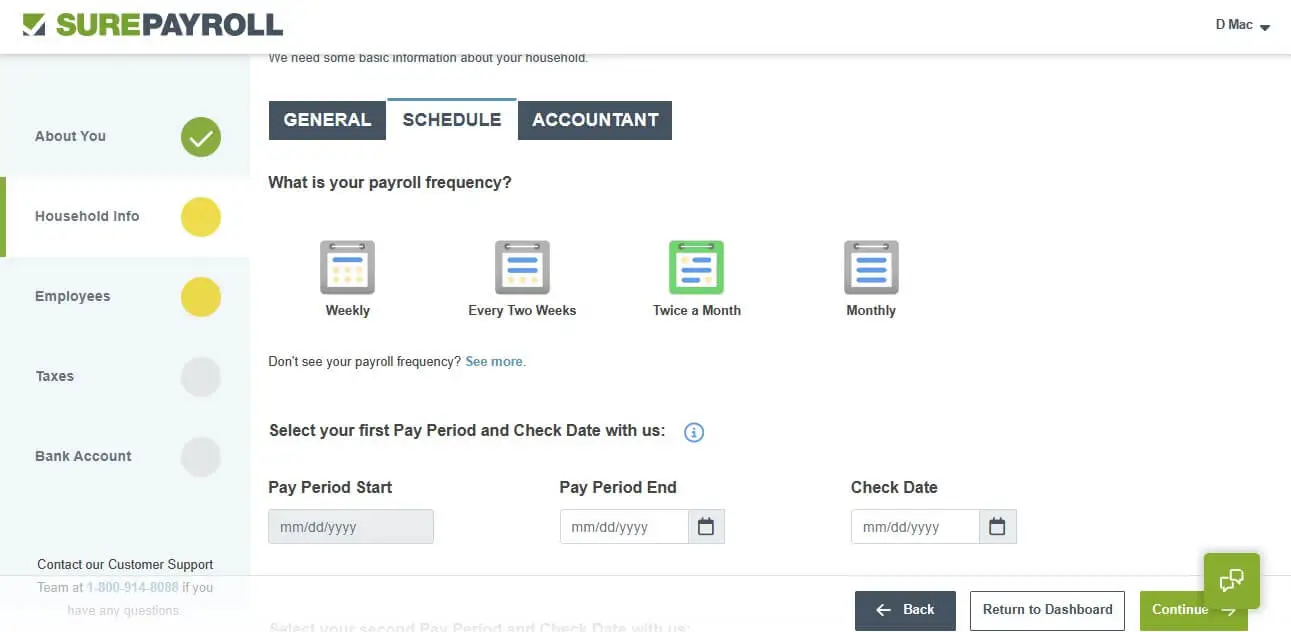

SurePayroll’s onboarding wizard ensures a seamless user experience when creating an account. Users are guided through the required paperwork in the setup process, which is segmented into five sections: personal information, business details, employees, federal and state taxes, and details of the payroll bank account.

Tax Features

Tax Filing

SurePayroll simplifies the calculation, payment, and filing of payroll taxes. The Full Service plan extends its services to local and multi-state tax filing for an extra $9.99 per month. While some states have intricate tax laws, SurePayroll assists businesses in deciphering these regulations. The platform supports over 6,000 active taxes across the US.

Integrations

Integrates with accounting software, allowing seamless syncing of payroll data for better financial management.

Performance:

Includes features like state unemployment insurance administration and workers’ compensation to enhance payroll efficiency.

Ease Of Use:

Setup

SurePayroll is easy to install and straightforward to understand. It offers the capability to automate regular payroll cycles, make essential changes, and sends reminders prior to processing.

Run Payroll

The software provides thorough, sequential guidance during the payroll procedure, and customer service representatives stand ready to help new users. These representatives can assist with tasks like inputting employee hours, examining payroll reports, and making any required modifications.

Uniqueness:

Mobile-friendly interface for employees and comprehensive tools like the document center and directory make team management easier.

Verdict:

Accuracy and punctuality in payments are essential for small business owners who handle employee management. However, payroll processing can be intricate and divert attention from other critical business operations. SurePayroll, an online entity, presents an economical and uncomplicated solution for managing payroll in small businesses. SurePayroll has a significant number of useful features, such as unlimited payroll executions and payroll tax computations.