Worldpay Review 2025

Worldpay Merchant Services Plans & Pricing

Worldpay Comparison

Expert Review

Pros

Cons

Worldpay Merchant Services's Offerings

Worldpay doesn’t advertise fixed plans. It prefers to follow a customized approach based on your exact business needs. This means that you’re not paying for services you don’t use. However, this Worldpay pricing model does make it harder to compare it to other providers of merchant services software.

I found an example of a pricing plan on the Worldpay website. It uses an e-commerce SaaS company as an example, showcasing how it will pay $50 monthly, totaling $600 for the year, for basic features.

I found the process of getting set up very straightforward. You just have to tell Worldpay your typical turnover through merchant services, the average transaction size, and your industry.

* Merchant will receive either a $150, $225, $550, or $650 statement credit depending on the equipment selected (promotion only valid on Smart Terminal or Smart Terminal Flex devices), and by completing all applicable requirements listed below: Being a new client to Worldpay (i.e. has not processed a transaction with Worldpay in the last 90 days and does not have an active payment processing agreement); Signs a new 3-year Worldpay agreement by July 31, 2025; Activates device and processes $100 dollars within 60 days of contract approval and no later July 31, 2025. Early termination fees apply. Limited to one device credit per customer. Statement credit to be issued as a one-time payment within 60 days after verification that all required criteria has been met. If merchant does not receive the statement credit at the scheduled time, for any reason, it will not affect the terminal lease terms. This promotion supersedes any and all prior or concurrent promotions and may be amended or discontinued by Worldpay without notice. Additional terms and limitations may apply. Not valid with other offers. Promotion runs January 1, 2025 – July 31, 2025.

Customer Support

Worldpay focuses on looking after its customers in every way possible. My first point of call was the knowledge management center, which provides extensive guides for various types of merchant service needs.

The FAQ page also gave me a solid overview of Worldpay and how its systems work. You can constantly upskill by checking out the insights area, which is full of articles by experts in the merchant services software space.

You can explore case studies of existing customers that showcase how other companies in your industry successfully leverage Worldpay’s systems.

If you want to stay updated with the latest news about Worldpay, you can follow one of its social media accounts.

If you want to talk with the Worldpay sales team, you can do so Monday to Friday between 8:30am and 7:30pm EST. If you’re outside these hours, you can request a callback.

Once you sign up for a Worldpay plan, you can access 24/7 telephone support. This means you can get instant help if you encounter an issue with your merchant services software.

I was really impressed by this level of service, as even saving a few hours in response time can be significant for a business’s operations. There’s also a live chat tool that is ideal for simple matters.

Features & Functionality

General Features

Worldpay offers some of the most comprehensive features and functionalities I’ve seen when reviewing merchant services software providers. There’s something for almost every business need. I’ll highlight some of the most relevant ones and walk you through what they could do for your business.

- Payment Processing

- Point of Sale Software

- Next-Day Funding

- Third-Party App Integration

- Custom Reporting

- Extensive Analytics

- Loyalty Program Integration

- Batch Processing

- Recurring Billing

- Management of Chargebacks

- Fraud Detection

- Credit Card Surcharging

- 24/7 Customer Support

- Fast Replacement of Devices

Payment Processing

Worldpay cuts out intermediaries and takes care of all your payment processing needs cheaply, whether it’s in-person or an e-commerce payment, as it’s its own payment getaway.

You can accept various customer payment options, including credit cards, ACH bank transfers, electronic check processing, gift cards, and online payment platforms like PayPal.

Point-of-Sale Hardware

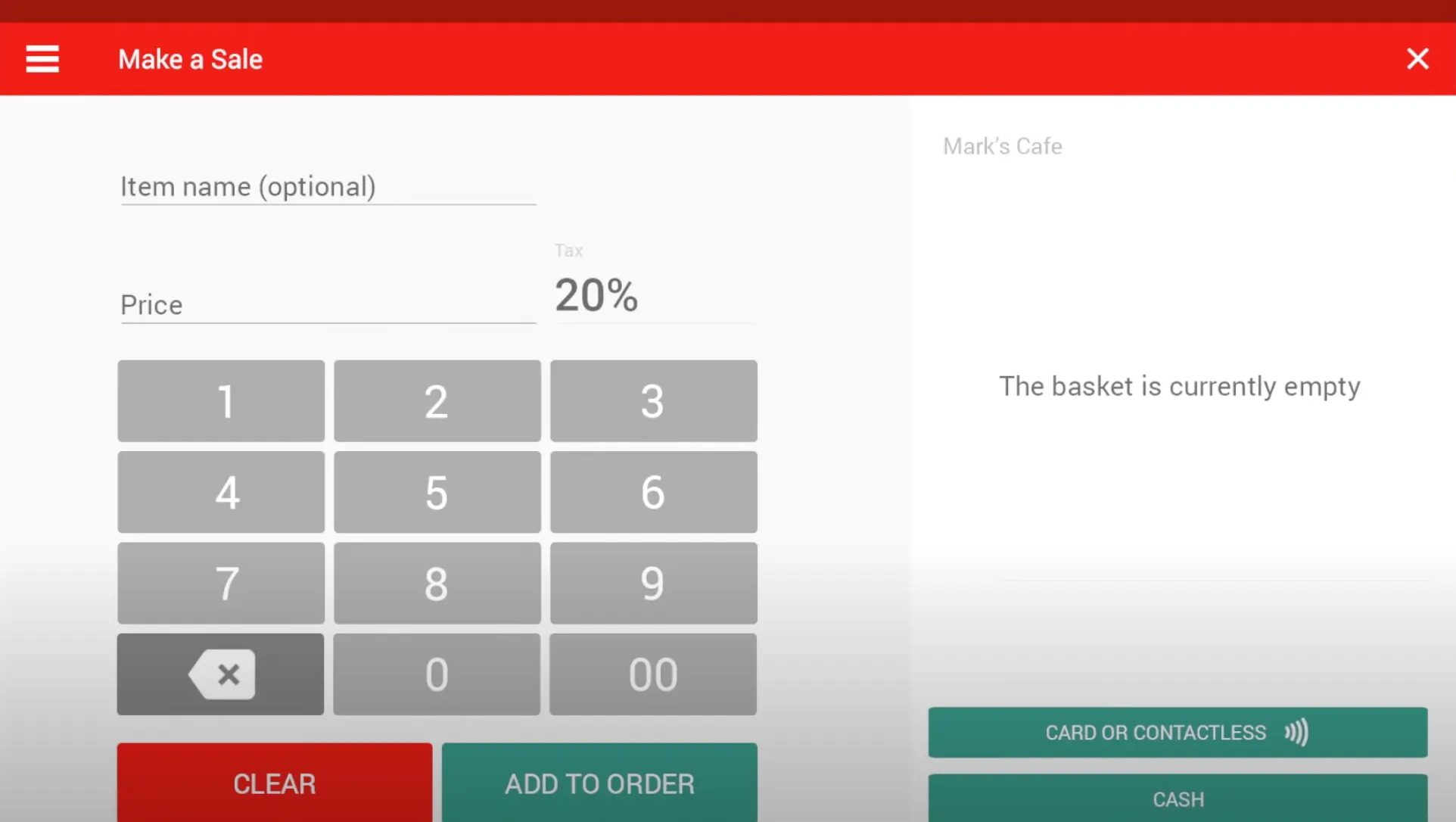

Worldpay offers several different point-of-sale hardware devices, such as a Smart Terminal. These allow you to accept payments in a retail setting. Some are fixed-point devices, while others are easily transportable so that you can accept payments from anywhere.

Point of Sale Software

All of Worldpay’s hardware links seamlessly into its software. You can also integrate third-party POS devices if you’re not using Worldpay for your physical terminals.

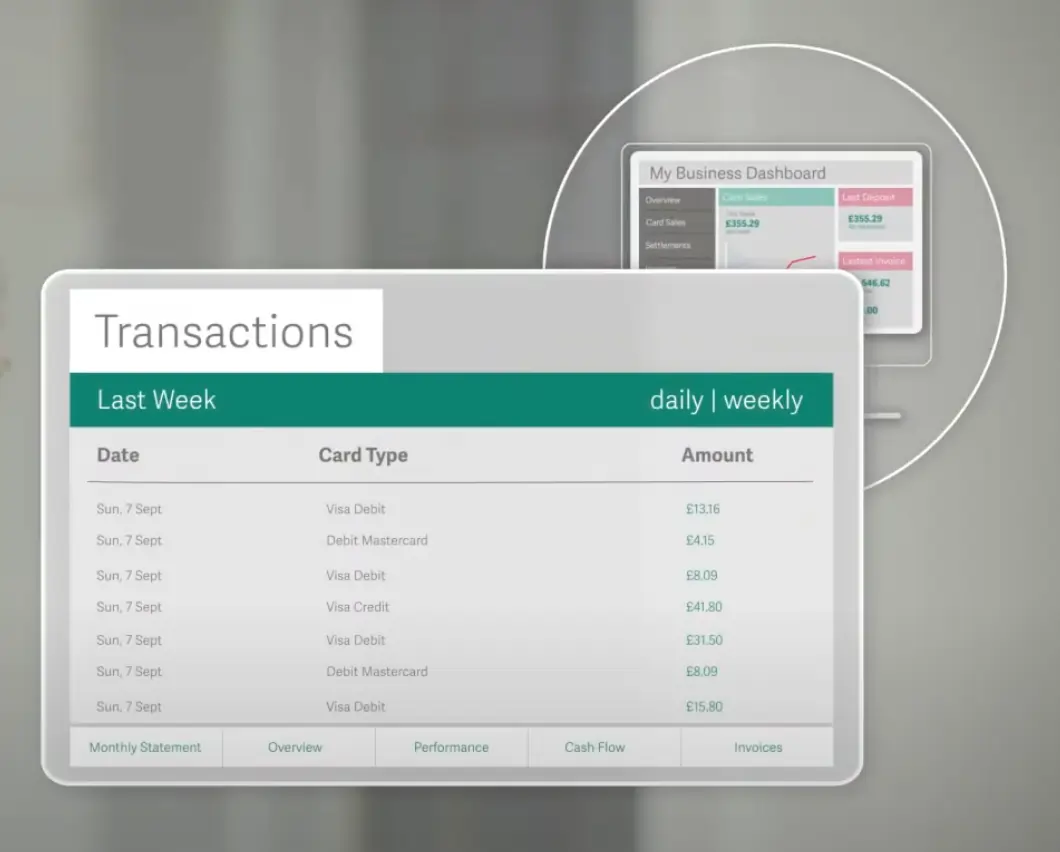

I was pleased with how a dashboard allows you to access real-time insights into your business performance, track inventory, see the latest sales, and manage refunds.

Next-Day Funding

Worldpay aims to almost always send payments to your bank account the next day after you make a sale. This means that you’ll bolster your cash flow. I’ve seen competitors who can take days or weeks to pay business owners.

Third-Party App Integration

Worldpay ensures that all of its hardware and software is compatible with hundreds of popular third-party apps and services, including CRM systems, booking software, and marketing tools. This allows you to leverage these other tools to help boost the performance of your online payment solutions.

Custom Reporting

You can create customizable reports highlighting the information relevant to your business needs. This can be done in seconds, so you no longer need to compile reports that can take days manually.

Extensive Analytics

The Worldplay tool for analytics provides extensive insights into your sales and inventory. You can track customer behavior, forecast revenue based on your historical data, and analyze the performance of specific promotions.

I found the analytics dashboard’s intuitive nature ideal for even total beginners in the business world.

You can also see a currency report to understand where your sales are coming from, which can help in targeting audiences in your marketing efforts.

Loyalty Program Integration

All of Worldpay’s systems integrate with loyalty programs, which I thought was a critical feature for growing businesses. You can tailor rewards to specific customers, track their history, and keep them happy with relevant gifts. The same goes for gift cards, including if someone is using a virtual card for online payment.

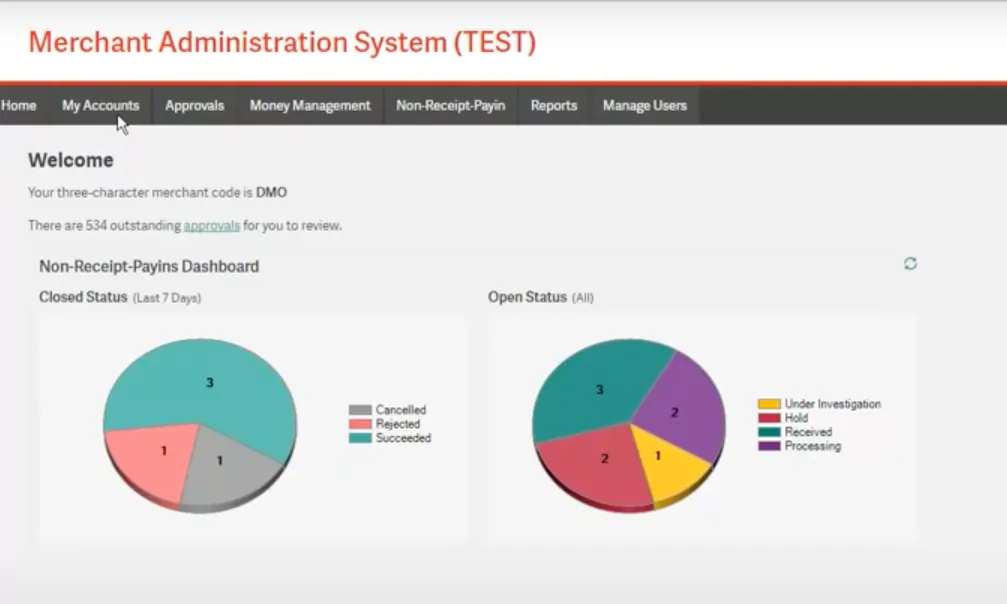

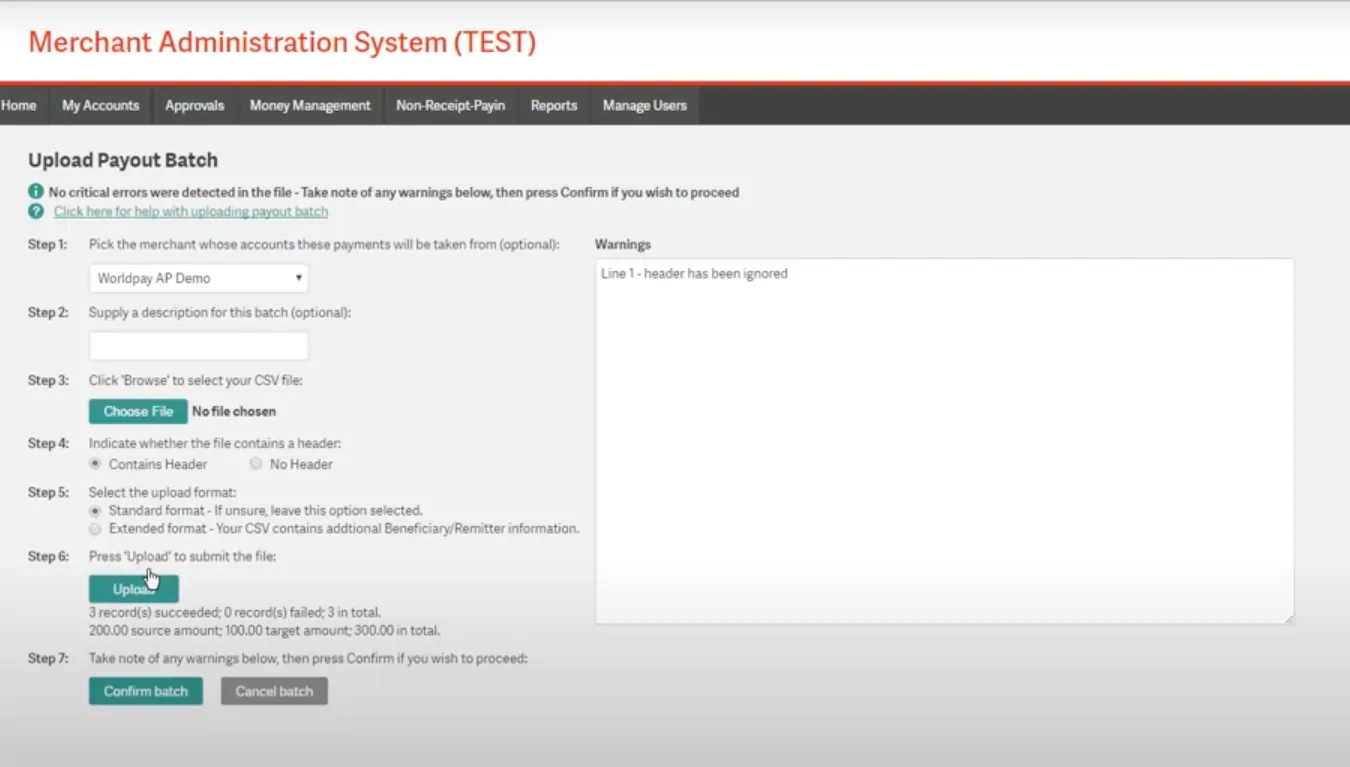

Batch Processing

Worldpay’s Batch Processing feature enables merchants to process multiple credit card and electronic check (ACH) transactions by uploading a single file. This method streamlines transaction handling, reduces manual entry time, and integrates seamlessly with existing accounting or POS systems.

Merchants can submit batch files 24/7, and transactions are processed through the same secure payment engine as online transactions, with results accessible via the Online Merchant Center. Batch processing is recommended for most transaction types, excluding authorizations and voids, which are better suited for real-time processing.

Recurring Billing

Many businesses find it time-consuming to send out the same invoice repeatedly. Worldpay supports recurring billing, so you can set up these payments once without worrying about them again. This can be a game-changer for many owners.

Management of Chargebacks

One of the most frustrating parts of accepting payments from customers is chargebacks. Chargebacks can dampen an owner’s spirits, which is why Worldpay handles these disputes for you. This allows you to focus on what matters most to your business.

Fraud Detection

Worldpay’s systems are some of the most secure I’ve encountered. The company leverages many years of data to make informed decisions about whether a payment is legitimate.

A similar system is in place to prevent data breaches, which can save business owners a lot of headaches.

Credit Card Surcharging

While credit cards are one of the most popular e-commerce payment methods, the fees can really eat into your bottom line. I was impressed with how easy it is to set up credit card surcharging. You can pass on these costs to the customer with the click of a button.

24/7 Customer Support

One of the most important features for me is the availability of 24/7 tech support. Time is of the essence for businesses, and having issues accepted can be very costly. The support team is always on hand to quickly resolve any issues that arise.

Fast Replacement of Devices

If you ever encounter an issue with your hardware device, Worldpay aims to send a replacement within 24 hours to minimize any potential downtime. This once again reflects Worldpay’s commitment to keeping customers happy.

Hardware & Software

Integrated tools for efficient merchant operations.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Performance:

Business owners want merchant services software that is always reliable, as any outage or downtime can be very costly. Worldpay delivers reliable transactions around the clock, even if you’re dealing with especially high volumes. This would give me great peace of mind as a business owner.

The speed at which you can receive the funds from a payment into your bank account was also a highlight for me. The next day, funding means that you can always maintain a strong level of cash flow when sales come in.

I was happy with the range of payment methods available, including debit cards, credit cards, ACH transfers, payment systems like Google Pay, and gift cards.

I was also impressed with Worldpay’s efforts to protect business owners from fraud, data breaches, and chargebacks. They go above and beyond with their services to keep you well-protected. It’s also fully PCI compliant, which means that regulatory issues aren’t going to be a concern.

I found that there’s support for an almost endless list of third-party integrations, whether you want to link payment systems, customer relationship management (CRM) tools, or booking services.

Accepting payments from anywhere, anytime, is a massive advantage. Worldpay’s user-friendly software also makes it stand out from the other merchant services software providers I’ve reviewed.

The in-depth analytics and reporting capabilities can provide powerful insights in real-time, allowing you to be flexible and change your approach to reflect changing conditions.

Finally, Worldpay provides plenty of support for businesses looking to scale, whether you need help with marketing, expanding globally, or dealing with higher volumes.

Verdict:

Worldpay is one of those rare companies that is a good fit for business owners regardless of the size of their operations or industry.

The customizable pricing plans mean that you only pay for what you need. Then there’s the abundance of useful features, with Worldpay acting as a one-stop shop for all your merchant services software needs.

I’d recommend Worldpay to anyone looking for a low-cost and easy-to-use online merchant servicess provider.