How Long Does an International Wire Transfer Take?

Businesses increasingly rely on cross-border transactions and need payments to go through as quickly as possible, while consumers are used to having their demands fulfilled instantly. How long do international bank transfers take? Unfortunately, there isn’t a definitive answer, although we can give you a good indication.

Whether you’re helping out family members overseas, paying an international vendor, or moving money abroad for an investment, international wire transfers are a go-to solution. But let’s be honest — waiting for your funds to land can feel like watching paint dry.

The truth is that most international transfers go through multiple banks, checks, and processes before reaching the final destination. Depending on factors like bank policies, time zones, and processing steps, your transfer could take anywhere from a few hours to several business days.

Understanding what affects the timing can help you plan ahead and avoid those “where’s my money?” moments.

In this article we’ll go over:

- How international wire transfers work

- The fees involved

- Average international wire transfer times

- Reasons for delayed international wire transfers

- How to send international wire transfers

How Do International Wire Transfers Work?

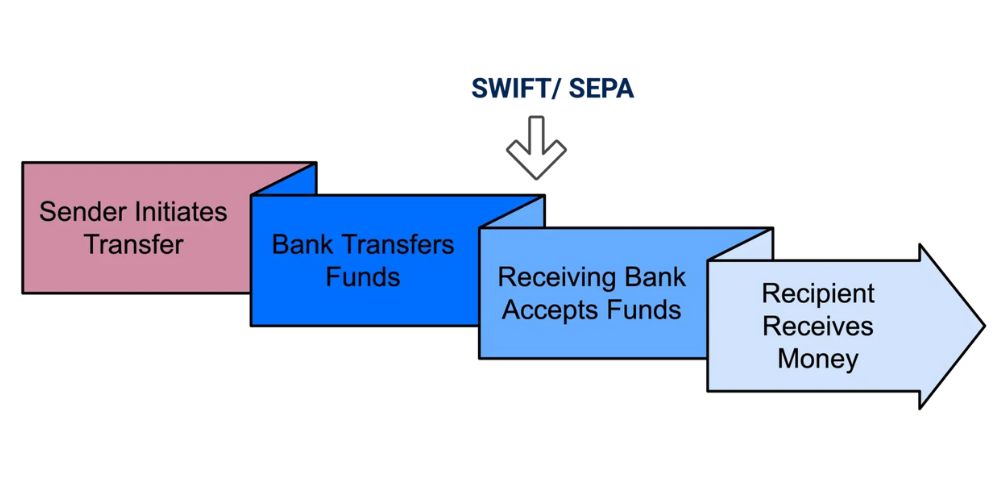

International wire transfers move money between banks in different countries electronically.

When you send a transfer, your bank routes the funds through an international payment network, such as the Society for Worldwide Interbank Financial Telecommunication (SWIFT) or Single Euro Payments Area (SEPA), before they reach the recipient’s account.

International bank transfer time varies depending on factors such as local laws, processing times, and the number of banks involved. Typically, transfers go through intermediary banks before arriving at their final destination.

How long it takes depends on a few things, including:

- Currency exchange

- Time zones and banking hours

- Local laws and bank processing times

- Security and compliance checks

The Fund Transfer Process

Here’s a look at the process of an international fund transfer:

- Initiation: You start the wire transfer through your bank (online, via mobile app, or in-person) by providing the following:

- Recipient’s full name and address

- Recipient’s bank name, address, and country

- Recipient’s account number and type (savings/checking)

- Recipient’s routing number (US) or BIC/SWIFT code

- Reason for transfer (optional)

- Interbank communication: Your bank securely sends transaction details using the SWIFT network, which assigns banks unique codes for secure communication.

- Intermediary banks (optional): Some transfers pass through intermediary banks, which help route funds but may charge additional fees.

- Currency exchange: You might use a different currency with an international fund transfer. Your bank converts the funds at their exchange rate, which may include a markup. Always check the rate before confirming.

- Completion: The recipient’s bank receives and credits the funds to their account, finalizing the transfer.

What is SWIFT

SWIFT is a global messaging network that banks and financial institutions use to securely send and receive transaction details. It doesn’t transfer money itself but provides a standardized way for banks to communicate about international payments.

Each bank in the SWIFT network has a unique code, also known as a Bank Identification Code (BIC) code, which helps identify the correct financial institution during a transfer. Most international wire transfers rely on SWIFT to ensure secure and accurate processing.

Additional Details You May Need

It’s always good to be prepared with important details like the amount you’re sending, the currencies involved (e.g., USD to EUR), and the reason for the transfer.

- ABA routing number: A nine-digit code used to identify U.S. banks. Some banks have special routing numbers just for wire transfers.

- IBAN (International Bank Account Number): Up to 34 letters and numbers that help pinpoint the recipient’s country and bank branch.

- SWIFT/ BIC code: An 8–11 character identifier that ensures your money reaches the right international bank.

Having this info handy can help your transfer go smoothly and avoid delays.

Are Wire Transfers Safe?

Yes, wire transfers are secure as long as you verify the recipient. Since they require your authorization, no one can withdraw funds from your account without your approval.

However, wire transfers are hard to reverse, so mistakes can be costly. Retrieving funds can be difficult if you send money to the wrong account or fall for a scam. Because transfers process quickly, always double-check recipient details before confirming.

To stay safe, only send money to trusted recipients, use secure banking channels, and be cautious of unexpected payment requests to avoid fraud.

How to Cancel a Wire Transfer

Once you hit send, a wire transfer is pretty much final — but there’s a small window to cancel. If your bank sends a cancellation request before the receiving bank processes the transfer, you might be able to stop it.

If the transfer has already gone through, there’s no undo button. The only exception is if the bank makes a mistake, like sending the wrong amount or duplicating a transfer. In such very rare cases, they’re responsible for fixing it.

If you think something went wrong, call your bank ASAP — the sooner, the better!

Average International Wire Transfer Times

So the question is, how long do international wire transfers take?

International wire transfers typically take 1 to 5 business days, depending on numerous factors.

The timeframes in the table below are approximate and can vary based on the specific banks and countries involved. But here’s an average overlook:

|

Transfer Type |

Estimated Time | Notes |

| Standard international transfer | 1–5 business days | Most common timeframe: Depends on banks, countries involved, and processing times. |

| Same-bank international transfer | 1–3 business days | Faster if both the sender and recipient use the same bank. |

| SWIFT network transfer | 1–5 business days | Common for most international banks: May involve intermediary banks, potentially causing delays. |

| SEPA transfer (Eurozone) | 1 business day | Applicable for Euro transactions within SEPA countries: Typically processed within one business day. |

| Expedited international transfer | Within 24 hours | Some banks offer expedited services for an additional fee. Availability and speed depend on specific bank policies. |

| Intermediary bank involvement | +1–2 business days | Transfers passing through intermediary banks can experience additional delays. |

| Currency conversion required | +1–2 business days | Currency exchange processes may add extra time to the transfer. |

| Weekends & holidays | Delayed | Banks typically process transfers only on business days. Initiating a transfer before weekends or holidays can help avoid delays. |

Wire Transfers vs. ACH Transfers

Wire transfers are typically faster than ACH transfers for international transactions — taking 1–5 business days. Domestic wire transfers can even arrive on the same day.

ACH transfers can take 1–3 business days but are batch-processed, meaning they aren’t instant like some wire transfers. So, while ACH can sometimes be quicker for domestic payments, wire transfers are preferred for urgent, high-value, and international transactions.

Reasons for Delayed International Wire Transfers

Several factors can slow down the process, and knowing what they are can help you plan ahead. Here’s what might cause a delay and how it can impact you.

Common Causes of Delays

-

- Time of day: Some banks have cut-off times for transfers. If the cut-off time is 4 p.m., and you initiate the transfer at 4:10 p.m., it will be recorded the next day.

- Incorrect recipient details: Mistakes in account numbers, SWIFT codes, or IBANs can lead to rejections or delays.

- Compliance & fraud checks: Banks must verify international transactions to prevent fraud, scams, or money laundering.

- Bank processing times: Some banks take longer to process transfers, especially on weekends or holidays.

- Intermediary banks: If your transfer passes through multiple banks, each one may add processing time.

- Currency Conversion: Banks may take extra time to exchange currencies, especially for less common ones.

- Time zone differences: Transfers initiated late in the day may not be processed until the next business day in another country.

- Slow-to-pay countries: Some countries take up to three weeks to process transfers. Before sending a transfer, check with your bank for a list of slow-to-pay countries.

- Destination country: This is due to regulations, documentation requirements, or slower banking infrastructure in less developed financial systems.

- Transfer methods: Automated wire transfers are faster, but they can take longer if manual intervention is needed.

The Impact of Transfer Delays

- For individuals: Delays can mean late rent payments, missed financial support for family, or extra stress when making urgent transactions.

- For businesses: Late payments to suppliers or employees can damage relationships, delay shipments, or cause cash flow issues.

International Wire Transfer Fees

International fund transfers aren’t always straightforward, and unfortunately, wire transfer fees can add up quickly, so it’s important to know your budget ahead of time.

Banks and financial institutions charge fees at different stages of the process, and understanding these costs can help you avoid surprises. Fees vary based on the bank, transfer method, and whether intermediary banks are involved.

Here’s what you can expect:

- Outgoing international transfer fees: Most banks charge around $25 to $50 for sending an international wire.

- Intermediary bank fees: If the transfer passes through additional banks, they may deduct their own fees, which are typically $10 to $30 per bank.

- Recipient bank fees: The receiving bank may charge a fee, which is usually between $10 and $20.

- International incoming wire transfer fees: If you’re receiving funds, you’ll usually pay around $15, depending on your bank.

- Currency exchange markups: If converting currencies, banks may apply a markup to the exchange rate, reducing the final amount received.

| Bank | Incoming domestic | Outgoing Domestic | Incoming international | Outgoing international |

| Industry average* | $13 | $27 | $14 | $44 |

| Bank of America | $0-$15 | $30 | $15 | $0-$45 |

| Chase | $0-$15 | $0-$35 | $0-$15 | $0-$50 |

| Citi | $0-$15 | $0-$35 | $0-$15 | $0-$35 |

| Fidelity | $0 | $0 | $0 | $0** |

| Huntington | $15 | $25 | $15 | $75 |

| PNC | $0-$15 | $0-$30 | $15 | $5-$50 |

| State Employees’ Credit Union | $0 | $10 | $0 | $25 |

| TD Bank | $0-$15 | $30 | $0-$15 | $50 |

| Truist | $15 | $30 | $20 | $65 |

| U.S. Bank | $20 | $30 | $25 | $50*** |

| Wells Fargo | $0-$15 | $0-$40 | $0-$15 | $0-$40 |

Before you send a transfer, it’s a good idea to check with your bank to know exactly how much it will cost and how much your recipient will actually receive.

How to Send an International Wire Transfer: Step-by-Step

Sending money internationally is easier when you know the process. Here’s an easy step-by-step guide to help you get going:

1. Choose Your Bank or Transfer Service

- Decide whether to use your bank, an online payment service (like Wise or PayPal), or a money transfer provider.

- Compare fees, exchange rates, and transfer speeds.

2. Gather Recipient Information

- Full name and address

- Bank name, address, and country

- Account number or IBAN (for international accounts)

- SWIFT/BIC code (for international routing)

- Reason for transfer (optional but may be required by some banks)

3. Verify Compliance Requirements

- KYC (Know Your Customer) checks: Banks may require identity verification for both the sender and recipient, including government-issued IDs and proof of address.

- AML (Anti-Money Laundering) regulations: Transfers that are unusually large or occur frequently may be flagged for additional review to prevent fraud and illegal activities.

- Sanctions & restricted countries: Some countries have stricter regulations or sanctions that require extra documentation and approvals before processing international transfers.

- Purpose of transfer: Certain banks may ask for the reason behind the transfer, especially for high-value transactions.

- Business vs. personal transfers: Businesses may need to provide invoices or contracts to comply with international trade regulations.

4. Initiate the Transfer

- Log into your bank’s website or visit a branch.

- Enter the recipient’s details and double-check for accuracy.

- Select the amount and currency for the transfer.

Related Articles

5. Review Fees & Exchange Rates

- Be aware of international wire transfer fees and any currency conversion charges.

- Some banks offer a choice between paying fees upfront or having them deducted from the recipient’s amount.

6. Confirm & Send

- Review all details to avoid errors.

- Approve the transfer and keep the transaction receipt or confirmation number for tracking.

- Make sure to notify the recipients and provide them with any additional information they might need.

7. Track Your Transfer

- Use your bank’s tracking system or SWIFT reference number to monitor the transfer status.

- Transfers usually take 1–5 business days, but delays can occur due to bank processing times or compliance checks.

International Wire Transfer Services for Businesses

For businesses operating globally — which is the hope of many business owners — finding the right international wire transfer service is crucial for smooth transactions and managing cross-border payroll.

Different providers offer various benefits, from faster processing to lower fees and multi-currency support.

Here are some leading services that can help small businesses streamline international payments.

1. Chase Payment Solutions

- Overview: Chase Payment Solutions, a division of JPMorgan Chase, provides comprehensive payment processing services, including international wire transfers.

- International Wire Transfers: As part of JPMorgan Chase, they facilitate international wire transfers, allowing businesses to send and receive funds globally.

- Additional Features:

- Merchant accounts with integrated payment processing.

- Point-of-sale systems and online payment gateways.

2. Paysafe

- Overview: Paysafe specializes in global payment processing solutions, catering to businesses that require international transaction capabilities.

- International Wire Transfers: Paysafe supports international transactions, making it suitable for businesses selling high-ticket items globally.

- Additional Features:

- Multi-currency processing in over 120 markets.

- Tailored solutions for various industries.

3. U.S. Bank Merchant Services

- Overview: U.S. Bank provides comprehensive merchant services integrated with their banking solutions.

- International Wire Transfers: As a full-service bank, U.S. Bank offers international wire transfer services.

- Additional Features:

- Multi-currency processing in 48 currencies to over 195 countries, facilitating global transactions.

- Flexible initiation channels through U.S. Bank’s treasury management platform, SinglePoint®, or by visiting a branch.

- Real-time foreign exchange rates ensure transparency in currency conversions.

- Leverage the SWIFT network for secure and efficient international payment instructions and notifications.

The Bottom Line on International Transfers

International wire transfers typically take 1 to 5 business days, depending on the countries, banks, and currencies involved. Delays can happen due to time zones, currency conversion, intermediary banks, or security checks.

To help your transfer go smoothly:

- Double-check recipient details (name, account number, bank code)

- Ask your bank about expected delivery times and any fees

- Consider banking hours and holidays in both countries

- Track your transfer if your bank offers updates

Planning ahead and being accurate with the details can help avoid delays and ensure your money gets where it needs to go—on time and securely.

FAQ

Q: How long does it take to transfer money internationally?

A: International wire transfers typically take 1 to 5 business days to complete. Factors such as the banks involved, intermediary banks, and currency conversion can influence the transfer time.

Q: Are there limits on the amount I can send internationally?

A: While there’s no legal maximum for international wire transfers, individual banks and service providers may impose their own limits. Transfers over $10,000 are reported to the IRS to prevent money laundering and fraud.

Q: What details are required to send an international wire transfer?

A: You’ll typically need the recipient’s full name, bank account number or IBAN, the bank’s SWIFT/BIC code, and the bank’s name and address.

Q: What fees are associated with international wire transfers?

A: Fees vary by institution but often include outgoing transfer fees, intermediary bank fees, and currency conversion charges. It’s best to check with your bank for specific costs.