The best time to start an LLC and why timing matters

TL;DR: The best time to form your LLC is often right around January 1. Filing early in the year can save you from paying taxes and annual fees for two calendar years at once, while still giving you a full year of protection and operation.

When is the best time to form an LLC?

Deciding when to form an LLC is not just about picking a date. It is about setting your business up for success from day one. The right timing can lower your tax bill, keep you compliant, and protect your assets when needed.

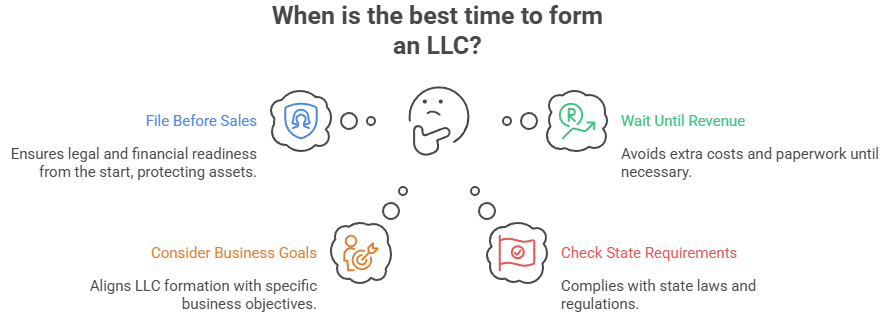

Some entrepreneurs file before making a single sale to ensure their legal and financial foundation is ready. Others wait until the first signs of revenue to avoid extra costs and paperwork. The truth is, there is no one-size-fits-all answer. The best time to start an LLC depends on your business goals, state requirements, and even your work type.

In this guide, we will walk you through all the LLC timing considerations from tax year planning and state filing windows to seasonal business factors and investor readiness so you can confidently file and get the most out of your LLC from day one.

Pre-business launch filing vs Post-revenue filing strategies

The decision to file your LLC before launch or after you start making money can impact your legal protection and costs.

Filing before launching gives you immediate liability protection, letting you sign contracts, open a business bank account, and secure funding in the LLC’s name. According to the SBA, 36% of small businesses face legal issues in their first year, often related to contracts or vendor disputes. Protection from day one can be a smart move.

Filing after you start earning can help you avoid paying annual state fees before you have revenue. Since most states require a yearly report (costing anywhere from $50 to $500), delaying formation by even a few months can save you money. The tradeoff is that any agreements or liabilities remain tied to you personally before filing.

If your business will sign contracts or incur expenses before making sales, file first. If your pre-revenue activities are minimal, filing closer to your launch date may be more cost-effective.

|

Timing Strategy |

Pros |

Cons |

Average Cost Impact |

Best For |

|

File Before Launch |

Immediate liability protection, ability to open bank accounts and sign contracts in LLC name, and build business credit early |

Pay state annual fees before earning revenue |

Annual state fees: $50–$500 (varies by state) |

Businesses with contracts, vendors, or funding needs pre-launch |

|

File After Revenue |

Avoids paying annual fees before revenue starts, and has more time to prepare |

No liability shield until formation date; pre-filing liabilities are personal |

Potential savings: 1 year of yearly state fees ($50–$500) |

Low-risk businesses with minimal pre-launch activities |

Source: State fee ranges from the SBA and the state Secretary of State filings database.

Tax year implications and calendar considerations

Timing your LLC formation can significantly impact your tax obligations. By default, the IRS assigns most LLCs a calendar tax year ending on December 31. According to IRS data, over 90% of small businesses operate on this calendar year because it simplifies accounting and aligns with personal tax filings.

Filing early in the year

Forming your LLC in January or early in the year gives you a clean 12-month tax period. You’ll have more time to generate revenue before taxes are due, and you can maximize deductible startup costs for the entire year. For businesses expecting consistent income, early filing often means smoother bookkeeping and a longer runway to optimize deductions.

Filing late in the year

If you form your LLC in November or December, you may only need to file a partial-year tax return. This can reduce immediate tax liability if you plan to operate minimally until the following year. However, California still charges the full $800 annual franchise tax, even for a few weeks of operation, while states like New York prorate specific fees.

State-specific calendar rules

Many states have unique fiscal year considerations. For instance:

|

State |

Annual LLC Fee |

Prorated? |

Key Note |

|

California |

$800 franchise tax |

No |

Charged for any part of the year your LLC is active |

|

Texas |

No franchise tax if under $2.47M revenue |

N/A |

Annual report due May 15 |

|

New York |

$25–$4,500 (based on income) |

Yes |

Prorated for partial-year activity |

|

Florida |

$138.75 annual report |

No |

Due May 1 each year, regardless of start date |

Sources: https://www.ftb.ca.gov/forms/2024/2024-568-booklet.html, https://www.tax.ny.gov/pit/efile/annual_filing_fee.htm?

If your LLC elects S Corporation tax status, filing early in the year maximizes the time you can strategically allocate owner salaries and dividends. The IRS generally requires this election within 75 days of formation or the start of the tax year, so forming in January gives you maximum flexibility.

State-specific filing requirements and processing times

Each state sets its LLC filing requirements and processing timelines, significantly influencing the best time to start your business. In some states, you can form an LLC online in a single day, while others may take weeks — especially during peak filing season in late December and early January.

Certain states, like Nevada and Wyoming, offer same-day expedited filing for an additional fee. Others, such as New York and Maryland, can take up to six weeks if you choose standard processing. These timelines matter if you need your LLC operational for a specific business launch date, investor meeting, or seasonal market window.

Below is a snapshot of average LLC processing times by state as of 2025, based on Secretary of State data:

|

State |

Standard Processing |

Expedited Processing |

Expedited Fee |

|

California |

10–15 business days |

1 business day |

$350 |

|

Delaware |

5–10 business days |

Same day |

$100 |

|

Florida |

5–7 business days |

1–2 business days |

$100 |

|

New York |

4–6 weeks |

1–2 business days |

$25 |

|

Texas |

5–7 business days |

1–2 business days |

$25 |

|

Wyoming |

1–2 business days |

Same day |

$50 |

If your state allows delayed effective dates, you can file early, secure your LLC name, and have your company officially start on your preferred date — avoiding last-minute rushes or missed opportunities.

Seasonal business considerations and timing advantages

Timing your LLC formation can be essential if your business has a seasonal revenue cycle. Many seasonal businesses — such as landscaping, tax preparation, tourism, or holiday retail — choose to form their LLC just before their busiest season begins. This approach ensures your business is ready to operate legally, open bank accounts, and sign contracts when demand is highest, without incurring extra costs during slow months.

Historically, LLC filings spike in January as entrepreneurs align with the start of the calendar year for tax and organizational purposes. Another smaller surge happens in late spring, often tied to business launches planned for summer. State fee structures also influence filing patterns, as some states don’t prorate annual fees — meaning filing in December could cost the same as filing in January, but with far fewer months of coverage.

Below is an example of average monthly LLC filing trends based on aggregated data from multiple Secretary of State offices:

|

Month |

Filing Volume Index (100 = peak) |

|

January |

100 |

|

February |

85 |

|

March |

78 |

|

April |

82 |

|

May |

88 |

|

June |

92 |

|

July |

75 |

|

August |

73 |

|

September |

80 |

|

October |

84 |

|

November |

89 |

|

December |

97 |

If you plan to start selling or providing services in January, consider filing in December and setting a delayed effective date for January 1. This allows you to hit the ground running at the start of the year while maximizing tax efficiency.

Final thoughts

The best time to file an LLC depends on your launch plans, state filing rules, and tax and liability priorities. For many entrepreneurs, filing in December for a January 1 effective date offers a clean start to the tax year and immediate operational readiness. Seasonal businesses might form their LLC just before their peak period, while others file early to secure personal liability protection and start building business credit.

Whether you file now or later, the key is aligning your LLC formation with your strategic goals and ensuring you understand the financial and legal implications of your timing.

Our recommended formation services can help you file quickly, correctly, and in line with your ideal launch date.

Frequently Asked Questions

Q. Is it smart to form an LLC before I start earning revenue?

A. Yes. Forming an LLC early—before you generate income—can offer strong protection, let you lock in your business name, and begin building business credit.

Q. Should I form my LLC just before January 1?

A. Absolutely. Filing in December with an effective January 1 date helps you avoid filing a partial-year return and cleanly aligns your LLC with the new tax year.

Q. Do most new LLCs get registered around year-end?

A. Yep—there’s a noticeable spike in LLC filings between mid-December and mid-January, especially from entrepreneurs aiming for clean tax and financial planning for the year ahead.

Q. Is there a downside to filing my LLC late in the year?

A. It can trigger short-year filings and early annual fees. In places like California, you’ll owe full-year franchise taxes even if your LLC only existed for a few weeks.

Q. When are the slowest months to file an LLC?

A. Filing tends to dip in July through September. If you’re flexible, these quieter months may offer faster processing and more one-on-one attention from state agencies.