QuickBooks Payroll Services Review 2025

QuickBooks Payroll Services Plans & Pricing

QuickBooks Comparison

Expert Review

Pros

Cons

QuickBooks Payroll Services's Offerings

Memorial Day Sale: 70% OFF Payroll & QuickBooks Online for 3 months* Ends May 31.

Please refer to the QuickBooks website for the terms and conditions.

QuickBooks Payroll is available in 3 pricing tiers as a standalone product, but you have to do some deeper searching on the site to find the packages that aren’t bundled with their other services.

There is an option for a 30-day free trial, however, the following monthly prices double when the trial ends.

Customer Support

QuickBooks Support staff Monday – Friday, 5 AM to 6 PM PT.

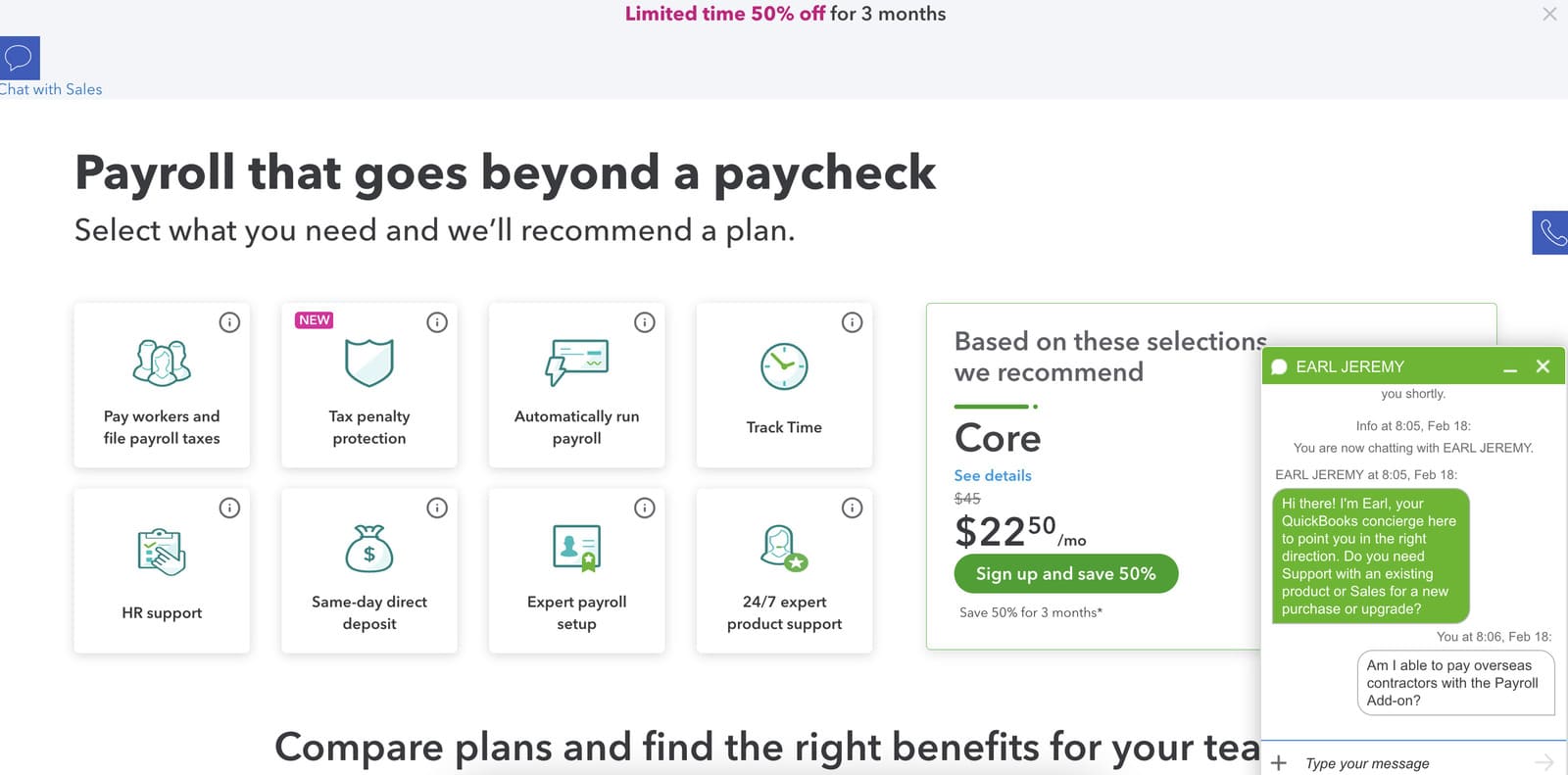

Chatbot

The QuickBooks website has an onscreen icon that resembles a chatbot but serves as a portal to schedule a call or redirect to the support page. It accepts limited information for a return call. Once inside the account, I was able to get a live agent on the chat.

Live Phone Conversation

I requested a callback and received one within 3 minutes, and my conversation with QuickBooks sales was pleasant and informative.

Online Resources

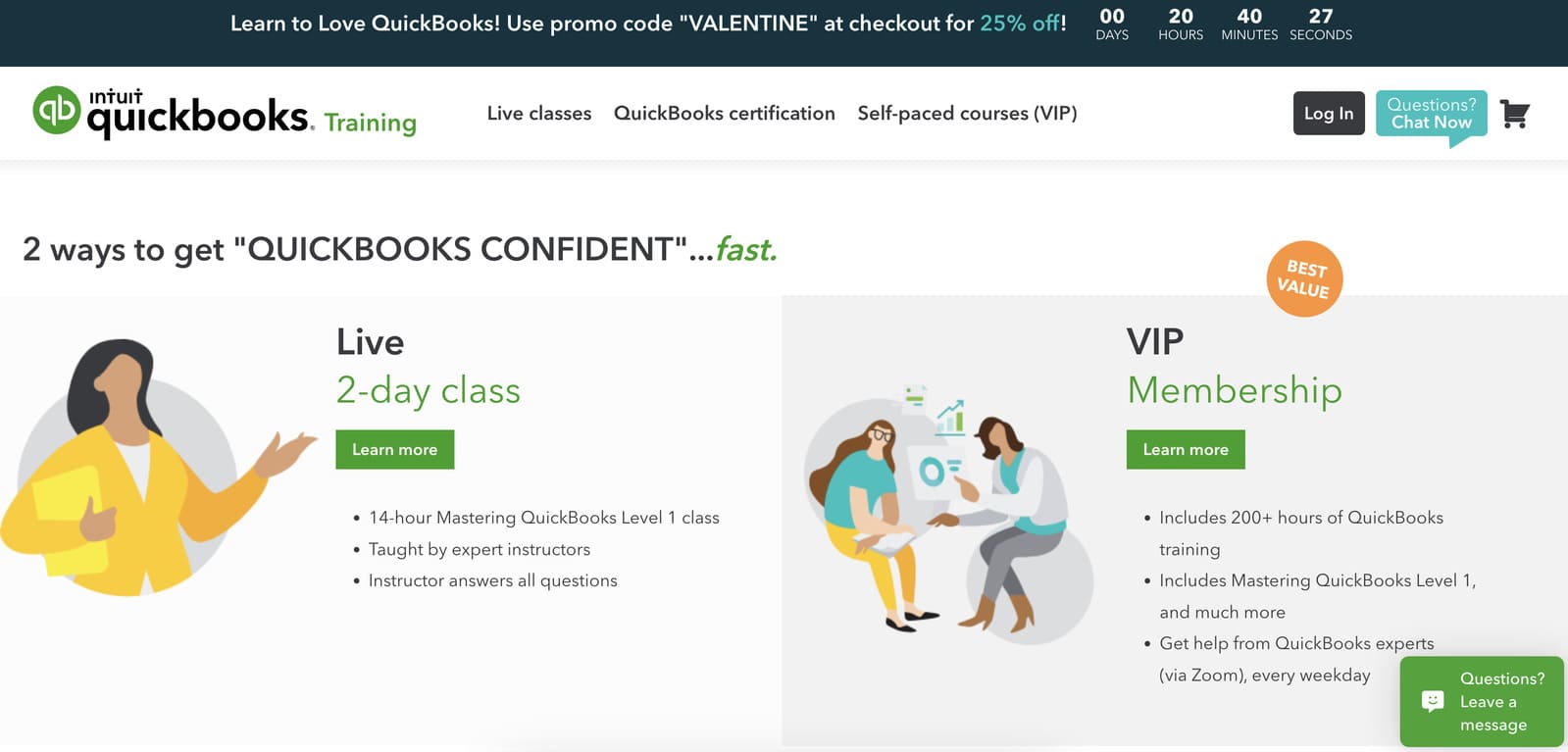

QuickBooks has extensive online learning resources including a Community Forum, tutorials, certification courses, and literature. There are also webinars and options to work with certified QuickBooks users.

QuickBooks also has a dedicated YouTube Channel.

Overall Experience

My overall experience with their support was very positive. As with most payroll platforms, options are limited until the user completes the account setup process.

Features & Functionality

Payroll Features

QuickBooks’ payroll is an add-on but is packed with features to include same-day direct deposit, employee self-service, tax compliance, time and attendance tracking, and benefits deductions.

Multiple Interface Options

The QuickBooks mobile app is intuitive and allows complete control across all devices which connect to a user’s Online Account. There is also a QuickBooks Desktop version available for those wanting to keep their payroll on a local server.

Learn Payroll

No matter what stage of business a user is at, QuickBooks has a collection of articles, videos, and tools to help you hire employees and learn payroll fast.

Features & Live Chat

Click the video to see a quick tour of payroll features and a live agent chat:

Automation Features

Automate repetitive payroll tasks to save time.

HR Features

QuickBooks Payroll goes beyond payroll processing by offering a range of human resources (HR) features designed to help small and medium-sized businesses manage their employees more effectively. These HR tools simplify tasks such as employee management, benefits administration, compliance, and more. Here’s a detailed look at the HR features available with QuickBooks Payroll:

1. Employee Benefits Management

QuickBooks Payroll integrates with benefits providers to help businesses offer and manage employee benefits:

- Health Insurance: QuickBooks Payroll allows businesses to offer health insurance through partner providers. The system simplifies the enrollment process and automatically deducts premiums from employee paychecks.

- Retirement Plans (401(k)): The platform integrates with retirement plan providers to manage 401(k) contributions. Employees can easily set up their contributions, and QuickBooks handles the payroll deductions.

- Other Benefits: You can also manage additional benefits such as dental, vision, life insurance, and flexible spending accounts (FSAs).

2. HR Support Center

QuickBooks Payroll offers access to HR resources through its HR support center (available with higher-tier plans):

- Employee Handbook Builder: The HR support center includes tools to help you create and customize an employee handbook, ensuring it aligns with labor laws and your business’s policies.

- HR Document Templates: Provides a library of essential HR forms, such as job descriptions, offer letters, and disciplinary action forms.

- HR Compliance Alerts: Receive notifications and updates regarding labor law changes that may affect your business, helping you stay compliant.

3. Employee Onboarding

QuickBooks Payroll streamlines the employee onboarding process:

- Self-Onboarding: New employees can enter their own information directly into the system, such as tax withholding (W-4), personal details, and bank information for direct deposit. This reduces administrative work for HR and payroll staff.

- New Hire Reporting: QuickBooks automatically files required new hire reporting forms with the appropriate state agencies, ensuring compliance with legal requirements.

4. Employee Self-Service Portal

The employee self-service portal empowers employees by giving them access to their personal payroll and HR information:

- Pay Stubs and Tax Forms: Employees can view and download pay stubs, W-2s, and 1099s directly from the portal.

- Update Personal Information: Employees can update their personal details, such as address, contact information, and direct deposit details, reducing the burden on HR staff.

- Benefits Enrollment: Employees can review and manage their benefit options, such as health insurance and retirement contributions, through the portal.

5. HR Compliance and Legal Guidance

QuickBooks Payroll helps businesses stay compliant with federal, state, and local labor laws:

- Compliance Alerts: The platform notifies you of upcoming compliance deadlines and changes in labor regulations, such as minimum wage updates or new workplace safety laws.

- HR Expert Support (Premium and Elite Plans): Access to HR professionals for guidance on employee relations, legal issues, and best practices in human resources. This can help businesses navigate complex HR situations, such as handling disputes or terminations.

6. Time and Attendance Tracking

QuickBooks Payroll integrates with QuickBooks Time (formerly TSheets) to track employee hours:

- Time Tracking: Employees can clock in and out using the mobile app, desktop, or time clocks. The system automatically syncs with payroll, ensuring accurate wage calculations.

- Overtime Management: The system tracks overtime hours, ensuring employees are compensated correctly based on applicable overtime laws.

- PTO and Sick Leave Tracking: QuickBooks Payroll tracks paid time off (PTO), vacation days, and sick leave balances, automatically updating these records as employees take time off.

7. Performance Management

Although QuickBooks Payroll focuses primarily on payroll and compliance, it offers basic tools for tracking employee performance:

- Employee Information Storage: Maintain detailed records of employee performance reviews, job descriptions, and disciplinary actions within the system.

- Employee Notes: Managers can add notes related to employee performance, helping with future reviews and decision-making.

8. Employee Management Tools

QuickBooks Payroll helps businesses manage their employees through a centralized platform:

- Organizational Charts: Provides a visual representation of your company’s structure, helping managers track reporting relationships and team composition.

- Employee Records: Stores comprehensive employee information, including job titles, wages, hire dates, and work history, all in one place.

9. HR Reports and Analytics

QuickBooks Payroll provides various reports to help businesses monitor their HR activities:

- Employee Turnover Reports: Track employee turnover rates and reasons for separation, helping you identify potential retention issues.

- Labor Cost Reports: Analyze the total cost of wages, taxes, and benefits to understand how labor expenses impact your bottom line.

- Compliance Reports: Generate reports that detail employee eligibility for benefits, tax withholding summaries, and more, helping with regulatory compliance.

10. Paid Family Leave (PFL) and Paid Time Off (PTO) Management

QuickBooks Payroll allows businesses to track and manage paid leave:

- Leave Accrual Tracking: Automatically calculates and tracks leave accrual for employees, including vacation, sick days, and paid family leave (PFL).

- PTO Requests: Employees can submit PTO requests through the self-service portal, and managers can approve or deny them with just a few clicks.

Tax Features

QuickBooks Payroll is designed to automatically stay up-to-date with the latest tax laws and regulations at the federal, state, and local levels. Here’s how QuickBooks Payroll manages tax updates to ensure compliance and accuracy:

1. Automatic Tax Rate Updates

QuickBooks Payroll automatically updates the tax rates for federal, state, and local taxes. These updates include:

- Federal Tax Rates: Social Security, Medicare, federal income tax withholding, and unemployment taxes (FUTA) are automatically updated.

- State Tax Rates: State income taxes, unemployment taxes, and any state-specific payroll taxes are also automatically updated within the system.

- Local Taxes: If your business is in a location that requires local payroll taxes (e.g., city taxes), QuickBooks Payroll will automatically apply the correct local tax rates.

The system continuously monitors tax law changes and applies them to your payroll calculations as soon as they take effect.

2. Compliance with Tax Law Changes

QuickBooks Payroll is regularly updated to comply with new tax laws, such as changes to withholding formulas, thresholds, or deductions. This ensures that:

- New Tax Laws: Any changes to tax laws (such as updates from the IRS or state governments) are applied automatically, without requiring you to manually adjust settings.

- Year-End Updates: At the end of the tax year, QuickBooks Payroll ensures compliance with new tax regulations, including updates to W-2s, 1099s, and other required forms.

3. Real-Time Updates During Payroll Runs

When you run payroll, QuickBooks Payroll automatically checks for any tax updates that need to be applied:

- Instant Calculations: The system automatically recalculates payroll based on the latest tax rates and withholding requirements, ensuring that payroll is accurate and up to date.

- Error Prevention: If there are any discrepancies or updates needed before you submit payroll, QuickBooks will notify you and guide you through the necessary changes.

4. Filing Updates and Notifications

- Automatic Filing Adjustments: QuickBooks Payroll will automatically adjust your payroll filings to reflect updated tax laws. This includes submitting the correct amounts for federal, state, and local taxes.

- Tax Filing Reminders: If a tax law changes or requires your action (such as new forms or additional filings), QuickBooks Payroll sends notifications and reminders to ensure compliance.

5. Self-Adjusting Based on Employee Location

If your business has employees in multiple states or localities, QuickBooks Payroll will:

- Adjust for Multi-State Taxes: The system tracks employee work locations and applies the correct state and local tax rates accordingly.

- Automatically Handle Relocation: If an employee moves to a new location with different tax requirements, QuickBooks will automatically apply the updated tax rates and withholding requirements based on the new address.

6. Payroll Tax Support

QuickBooks Payroll provides support and guidance on tax issues:

- Support for Tax Questions: If you have questions about tax updates, QuickBooks Payroll’s customer support team is available to assist with specific payroll tax issues.

- HR and Tax Guidance (Higher Tiers): Some plans offer access to HR and tax experts who can provide insights into compliance and assist with more complex tax scenarios.

Integrations

Expand payroll functionality with third-party integrations.

Performance:

QuickBooks Payroll is designed to provide small and medium-sized businesses with an efficient, reliable, and easy-to-use payroll solution. The platform’s performance is characterized by its speed, accuracy, automation, and integration capabilities, making payroll processing simpler and more efficient. Here’s a breakdown of how QuickBooks Payroll performs across various aspects:

1. Speed and Efficiency

- Automated Payroll Processing: QuickBooks Payroll automates repetitive tasks such as wage calculations, tax withholdings, and benefits deductions, significantly reducing the time spent on payroll. Once set up, payroll can be run in just a few clicks.

- Same-Day and Next-Day Direct Deposit: Depending on your plan, QuickBooks Payroll offers same-day or next-day direct deposit, allowing you to pay employees quickly. This feature enhances payroll efficiency and helps meet tight payment deadlines.

2. Accuracy in Payroll Calculations

- Automated Calculations: QuickBooks Payroll automates wage calculations, tax withholdings, and benefit deductions, ensuring that payments are accurate. This reduces the risk of costly errors commonly associated with manual payroll.

- Real-Time Updates: The platform stays up-to-date with the latest tax laws, automatically adjusting payroll calculations based on the latest federal, state, and local tax regulations. This helps ensure compliance and accurate tax filings.

3. Tax Filing and Compliance

- Automatic Tax Filing: QuickBooks Payroll automatically calculates and files federal, state, and local payroll taxes on your behalf. The platform also handles tax payments, ensuring they are submitted on time.

- Year-End Reporting: QuickBooks Payroll simplifies year-end tasks by generating W-2 and 1099 forms for employees and contractors. The system files these forms electronically, ensuring timely and accurate reporting.

4. Seamless Integration with QuickBooks Accounting

- Accounting Integration: QuickBooks Payroll integrates seamlessly with QuickBooks Online and QuickBooks Desktop. This integration ensures that payroll data is automatically synced with your financial records, eliminating the need for manual data entry and reducing errors.

- Real-Time Syncing: Payroll expenses, including wages, taxes, and benefits, are automatically updated in QuickBooks, giving you accurate financial insights without additional effort.

5. User Experience

- Intuitive Interface: QuickBooks Payroll is known for its user-friendly interface, making it accessible even for users without extensive payroll experience. The dashboard is easy to navigate, and the step-by-step instructions make running payroll straightforward.

- Employee Self-Service: Employees can access pay stubs, tax forms, and update personal information through a self-service portal, reducing administrative work for business owners.

6. Mobile Accessibility

- Mobile App: QuickBooks Payroll offers a mobile app that allows business owners to manage payroll on the go. The app provides access to key payroll functions, including running payroll, viewing reports, and managing direct deposit.

- Performance on Mobile: The app is responsive and performs well, providing business owners with the flexibility to process payroll from anywhere, improving overall efficiency.

7. Scalability

- For Growing Businesses: QuickBooks Payroll is designed to scale with your business. Whether you have a few employees or a growing workforce, the platform can handle increased complexity without performance issues.

- Multi-State Payroll: For businesses operating across multiple states, QuickBooks Payroll manages the specific tax and compliance requirements of each state. It automatically adjusts for different tax rates and ensures compliance with state laws.

8. Automation and Customization

- Automatic Payroll Runs: QuickBooks Payroll allows you to automate payroll runs, reducing manual intervention. Once set up, payroll can run on a schedule you set, ensuring timely payment without the need for constant monitoring.

- Customizable Reports: The platform provides customizable reports, allowing you to track specific metrics like labor costs, tax liabilities, and benefits. These reports help business owners gain insights into their payroll expenses and make informed financial decisions.

9. Customer Support and Reliability

- Customer Support Performance: QuickBooks Payroll offers robust customer support options, including phone, chat, and email support. Some plans even offer 24/7 support. The response times are generally fast, and the support staff is knowledgeable in handling payroll-related issues.

- Reliability: QuickBooks Payroll is a reliable platform, with minimal downtime. It has built a reputation for consistent performance and dependability, ensuring that payroll is processed on time without disruptions.

10. Security

- Data Security: QuickBooks Payroll employs industry-standard encryption and security protocols to protect sensitive payroll data. The platform also offers multi-factor authentication (MFA) and regularly updates its security features to protect against data breaches.

- Compliance Certifications: QuickBooks Payroll complies with various security standards, including SOC 1 and SOC 2, ensuring that sensitive financial and payroll data is stored and processed securely.

11. Cost and Value

- Cost-Effectiveness: QuickBooks Payroll offers various pricing tiers, allowing businesses to choose a plan that fits their budget and needs. While the cost may be higher than some competitors, the range of features and seamless integration with QuickBooks accounting software make it a valuable investment for businesses that want an all-in-one payroll and accounting solution.

- Return on Investment (ROI): By automating payroll, minimizing errors, and ensuring compliance, QuickBooks Payroll saves businesses time and reduces the risk of penalties, leading to a high ROI.

Ease Of Use:

The QuickBooks site is user-friendly and easy to navigate. Because the platform is so feature-rich, it takes some searching to find the standalone Payroll option.

Setup

To utilize Payroll, the user must create a QuickBooks account and have the following information on hand:

●Business Tax ID/EIN – This will be verified by QuickBooks

●Business Banking Information – This will be verified by QuickBooks

●Business Mailing Address

To run Payroll, employee/contractor address, SSN, and banking information is also needed. *Only address and SSN are needed if payment will be via paper check. The entire sign-up process takes less than 15 minutes.

Run Payroll

In this video, we take a look at the employer dashboard and run payroll:

Verdict:

QuickBooks Payroll is cloud-based and ideal for small to medium-sized businesses. The mobile app, allows users to manage their payroll on the go, and users can also integrate QuickBooks Payroll with other QuickBooks products. As part of the QuickBooks family, QuickBooks payroll has extensive learning and customer support resources to include experts and certifications. If you’re looking for a payroll solution that can help you save time and reduce errors, QuickBooks Payroll is an excellent choice.

Click the video to see my closing thoughts:

User Review

- - Quickbooks mobile app could be better

- This might not be the right solution for larger companies

- I like that there is an app so we can access our account even when we are working on the road. It is a very user friendly program

- Sometimes takes a while to get a representative on the phone.

- No negative comments