Paylocity Payroll Services Review 2025

Paylocity Payroll Services Plans & Pricing

Paylocity Comparison

Expert Review

Pros

Cons

Paylocity Payroll Services's Offerings

Paylocity offers a range of pricing plans based on the customer’s needs. Their pricing is not publicly available on their website, as it is tailored to each individual business. It is based on a variety of factors, such as the number of employees, the complexity of the HR processes required, and any additional features or modules that the business may require.

Paylocity does offer a free demo that provides an overview of the platform’s capabilities and how it can help businesses achieve their HR and payroll goals.

Customer Support

Paylocity customer support is by phone or via chat 7:00 am to 7:00 pm CST, Monday through Friday. They also have offices in multiple states.

Chatbot

There is a customer support chatbot on the Paylocity site with limited capabilities during non-business hours.

Email Support

I found an unlisted customer support email address and placed a service request. I received a reply within 12 hours directing me to contact sales.

Live Phone Conversation

My phone consultation with the Paylocity support team was pleasant. My call was answered on the 3rd ring with no holding time. The representative was helpful and directed me to schedule a demo. A second call was placed for direct support regarding importing old employee records via CSV. The representative was helpful and did not attempt an upsell when it was revealed that I am not a current customer.

Online Resources

Paylocity has an extensive Resources page that includes a resource library with e-books and blog posts, product training courses, an event calendar for webinars, tax resources, and year-end resources.

Paylocity also has a dedicated YouTube Channel and podcast.

Overall Experience

My overall experience with their support was positive though limited to business hours. The Paylocity staff was helpful during the call, but there are very limited support options for prospective customers.

Features & Functionality

Payroll Features

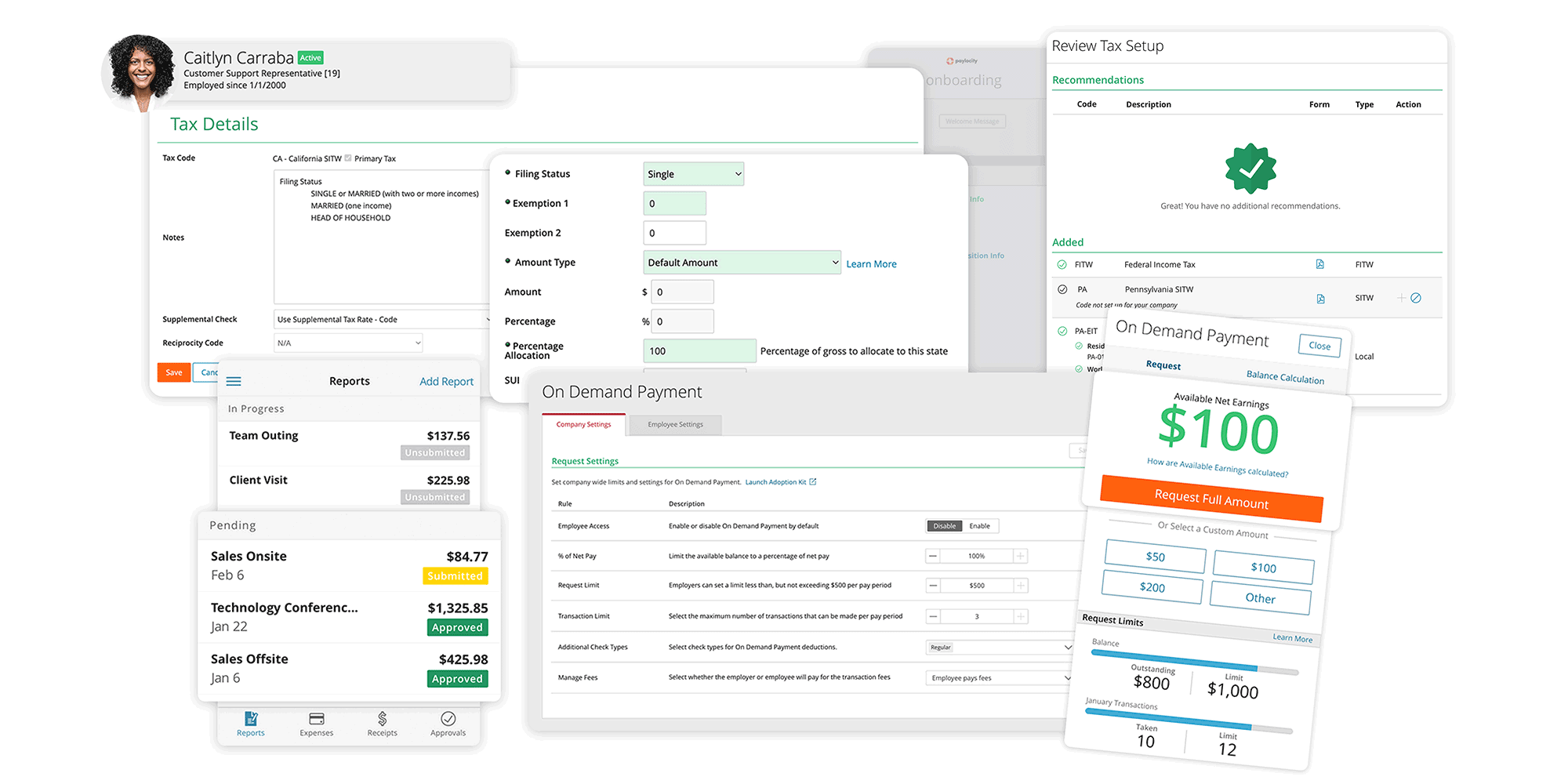

Paylocity payroll software provides full-service payroll with customizable pay schedules, wage and hour tracking, and automated calculations for salaried and hourly employees.

Automation Features

Paylocity automates payroll runs, tax filings, and benefit deductions, reducing manual errors and improving efficiency for businesses of all sizes.

HR Features

Human Resource Management

Organizing, tracking, and providing instant access to critical employee data, job profiles, transfers, promotions, and benefits information.

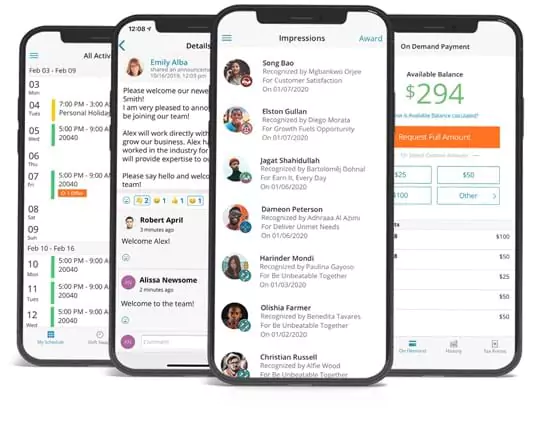

There is also a mobile app for managing payroll and tasks on the go.

Time and Attendance Management

Streamlines communication between HR and employees and facilitates efficient management of employee leave including requisitions, approvals, balance calculation, and annual carry-forward.

Succession Planning

Succession planning is the identification and development of internal employees with the potential to fill key business leadership positions in the company.

Recruiting & Talent Management

Recruiting or Applicant Tracking Software is software used to manage the recruitment process electronically by handling job postings, applicant status, resume management, etc.

Tax Features

Paylocity automates tax filings, ensuring accurate calculation and timely filing of federal, state, and local taxes, as well as year-end W-2 and 1099 forms.

Integrations

Paylocity integrates seamlessly with various accounting software, time-tracking systems, and other HR solutions to provide a unified, efficient workflow across platforms.

Performance:

Paylocity’s cloud-based platform delivers real-time payroll data, improving payroll accuracy and ensuring timely payment processing.

Ease Of Use:

The Paylocity page is intuitive and easy to navigate. Information for each product is easy to find despite their long list of available features.

Sign-Up

I found that signing up for Paylocity’s payroll software was a user-friendly experience. The company provides a simple and intuitive platform for businesses to sign up and begin using the software quickly.

The following business information is required to create an account:

●Business Tax ID/EIN – This will be verified by Paylocity

●Business Banking Information – This will be verified by Paylocity

●Business Mailing Address

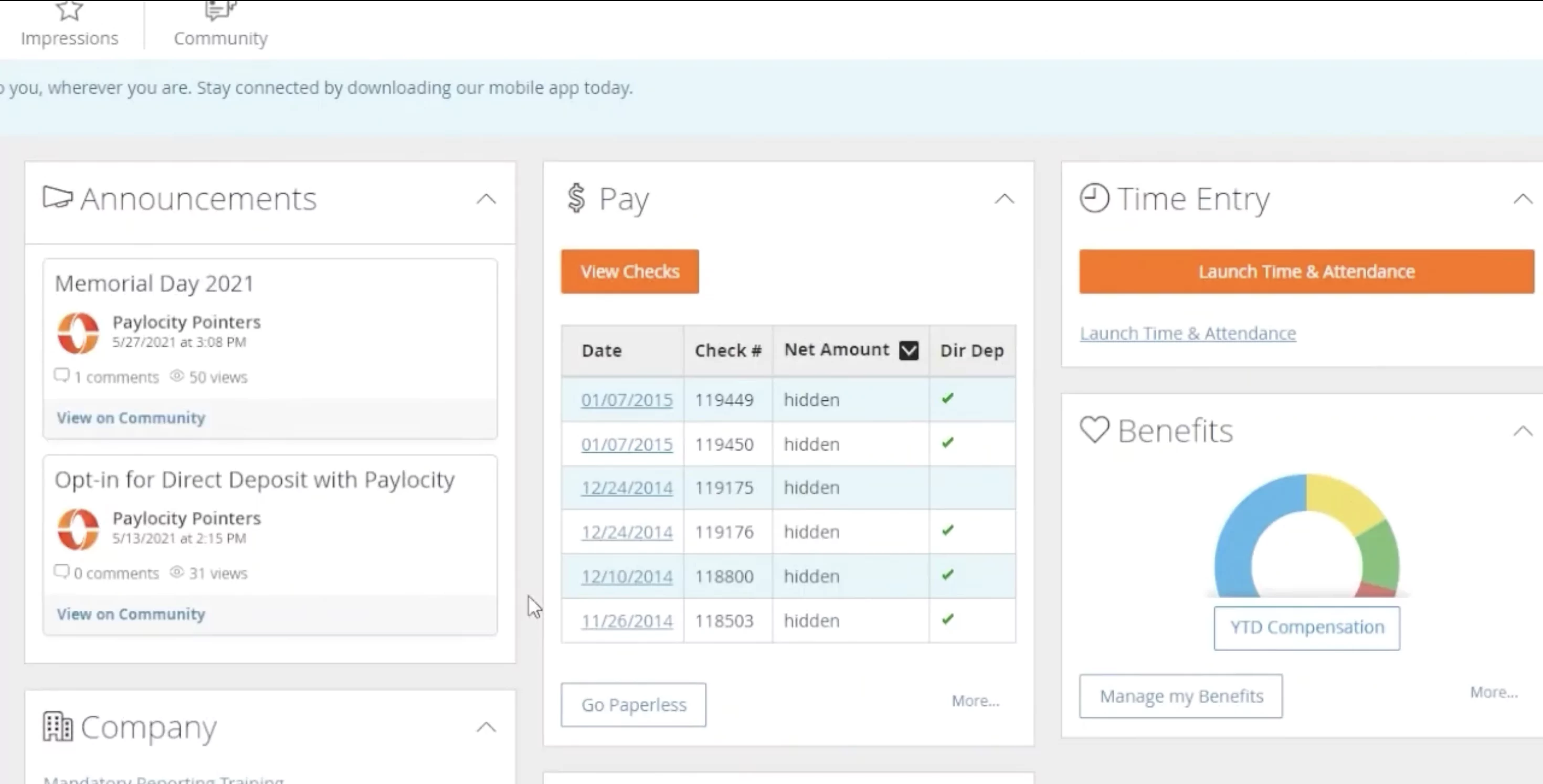

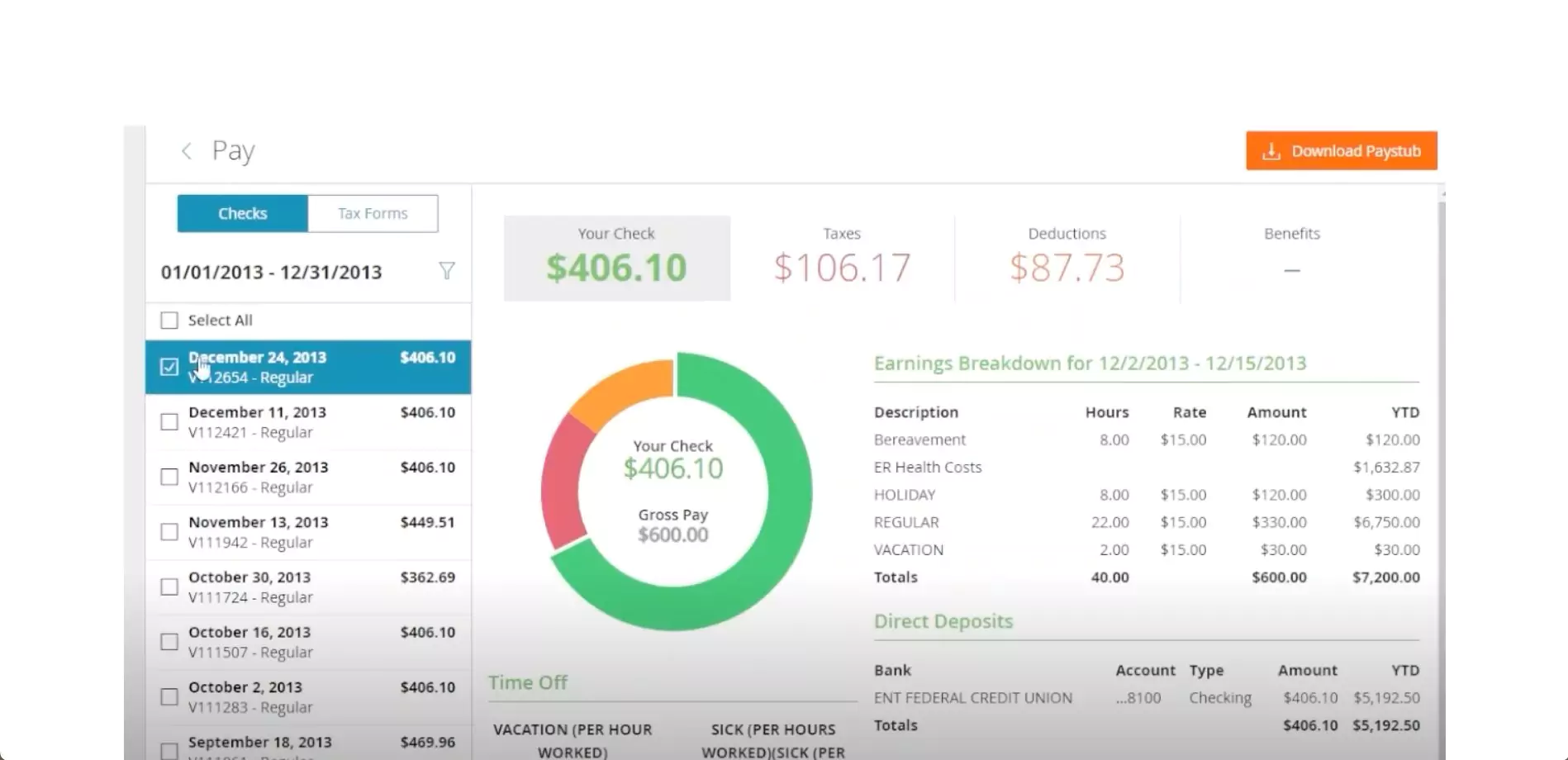

Once signed up, I found the Paylocity dashboard to be easy to use and navigate. Payroll processing seemed to be efficient and error-free, providing accurate calculations and deductions.

To run Payroll, employee/contractor address, SSN, and banking information is also needed. *Only address and SSN are needed if payment will be via paper check.

Run Payroll

Paylocity’s interface is intuitive and easy to navigate, making it simple for users to input employee data and generate payroll reports. The software’s automated processing system helps to reduce errors and streamline the payroll process, freeing up valuable time for businesses.

Uniqueness:

Paylocity’s cloud-based payroll service delivers real-time payroll data, improving payroll accuracy and ensuring timely payment processing.

Verdict:

Paylocity is a human resources management software that is best suited for medium to large-sized businesses. Their pricing is based on the number of employees you have, and they do not charge a setup fee. You’ll need to speak to a representative to get an exact quote, and customer service is limited to business hours. Overall, Paylocity is an excellent solution for medium to large-sized businesses looking for a user-friendly and feature-rich platform.

Click the video to see my closing thoughts: